U.S. Next-generation Sequencing Library Preparation Market Size and Trends

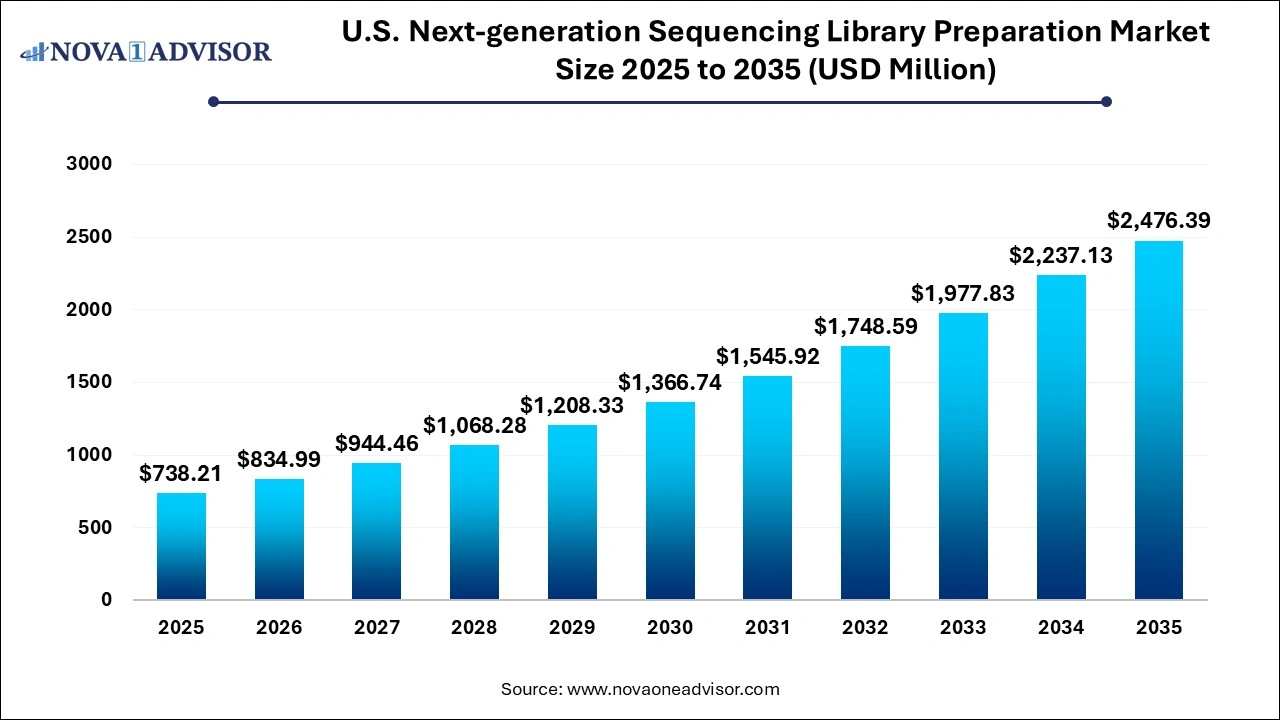

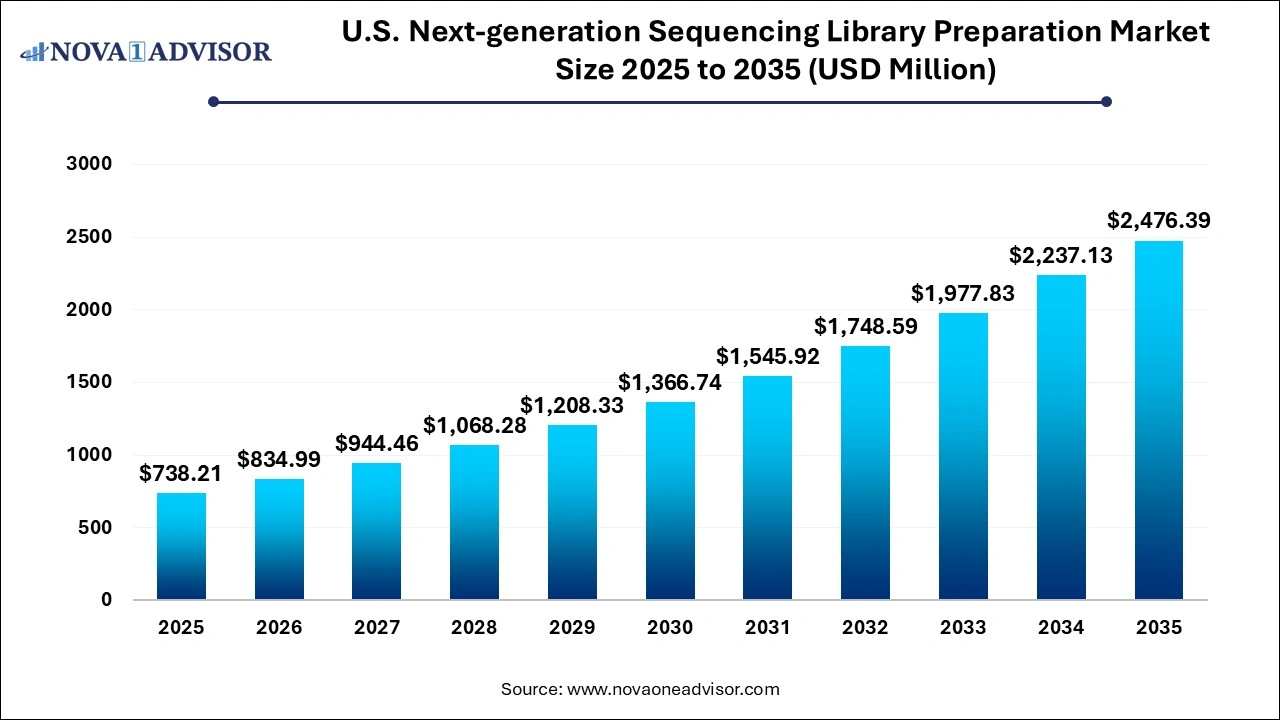

The U.S. next-generation sequencing library preparation market size is calculated at USD 738.21 million in 2025, grows to USD 834.99 million in 2026, and is projected to reach around USD 2,237.13 million by 2035, growing at a CAGR of 12.87% from 2026 to 2035. The U.S. next-generation sequencing library preparation market growth can be linked to the clinical adoption of NGS workflows, cost-effectiveness and automation of library preparation systems.

U.S. Next-generation Sequencing Library Preparation Market Key Takeaways

- By sequencing type, the targeted genome sequencing segment dominated the market with the largest share in 2025.

- By sequencing type, the whole genome sequencing segment is expected to show the fastest growth over the forecast period.

- By product, the reagents and consumables segment held the largest market share in 2025.

- By product, the instruments segment is expected to register fastest growth during the forecast period.

- By application, the drug and biomarker discovery segment captured the largest market share in 2025.

- By application, the disease diagnostics segment is expected to show the fastest growth during the forecast period.

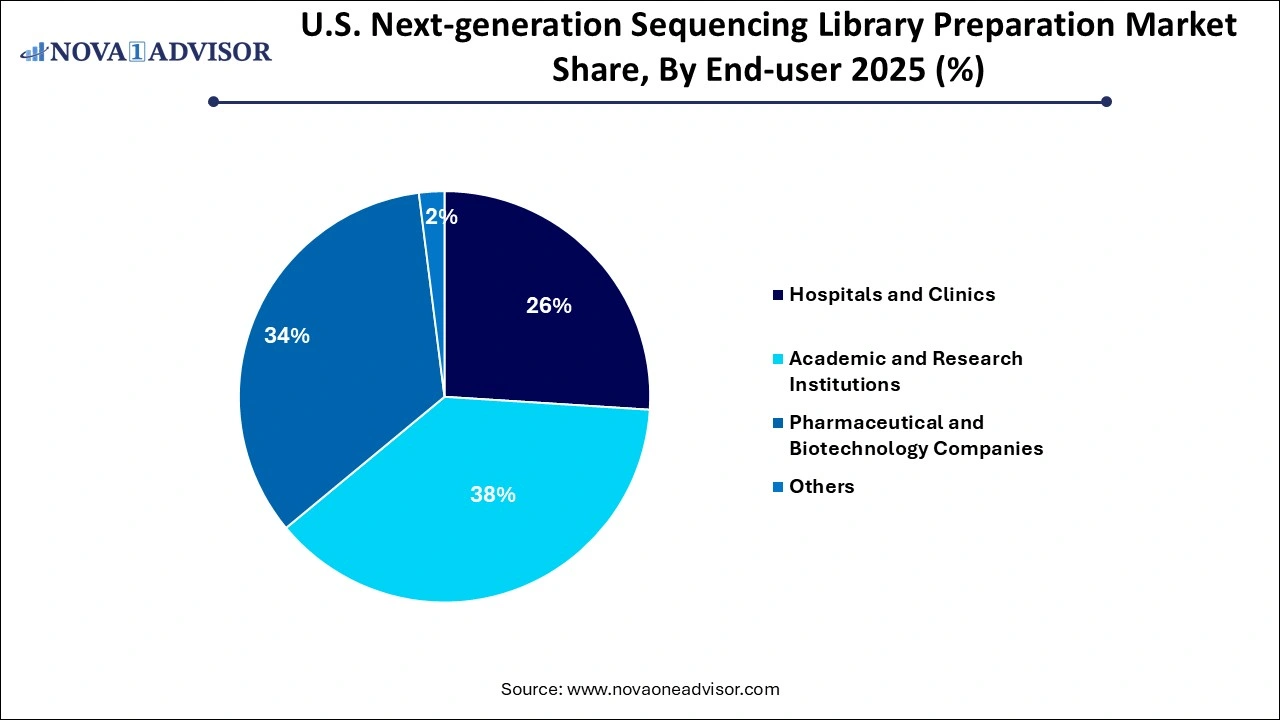

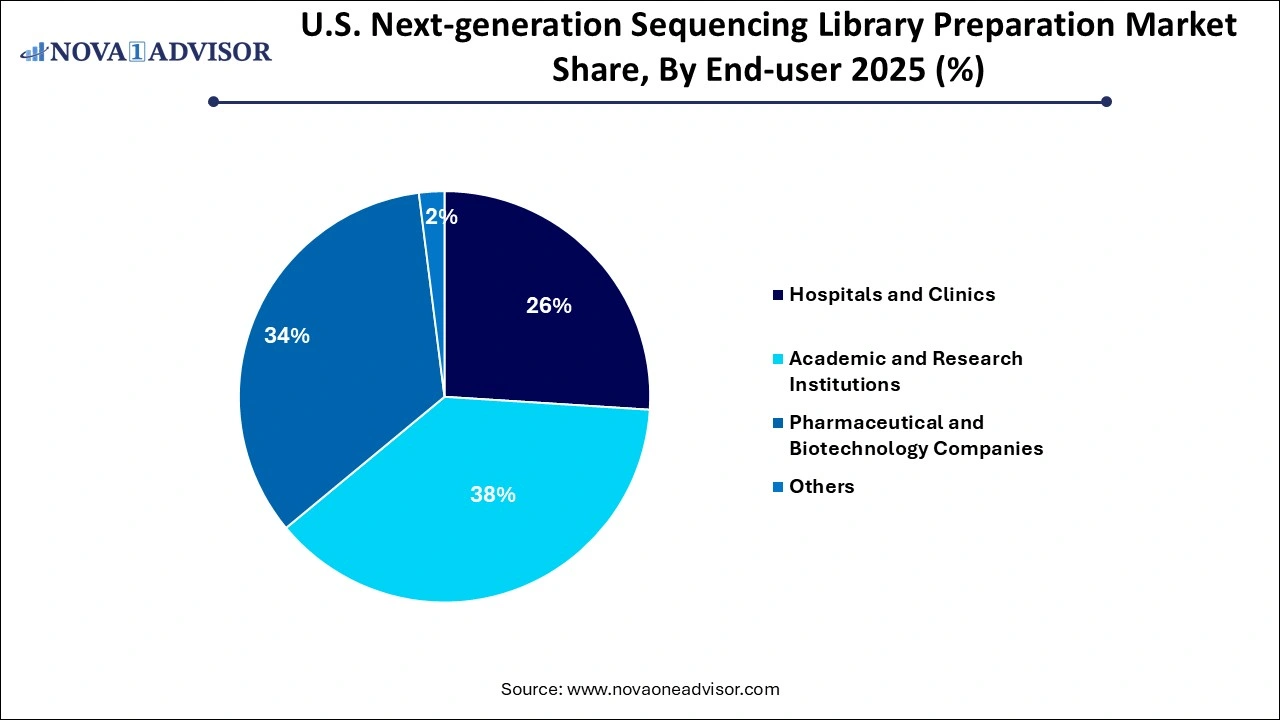

- By end use, the academic and research institutions segment generated the highest market revenue in 2025.

- By end use, the pharmaceutical and biotechnology companies segment is expected register the fastest CAGR during the predicted timeframe.

How is the U.S. Next-generation Sequencing Library Preparation Market Expanding?

Next-generation sequencing (NGS) library preparation refers to the preliminary step in the NGS workflow which involves converting DNA or RNA samples into a compatible format for sequencing machines. Types of library preparation includes ligation-based library prep and tagmentation-based library prep. Rising prevalence of rare and genetic disorders, increased focus of pharmaceutical companies on strengthening drug discovery and development pipelines through NGS, surging demand for NGS-based diagnostic tests and decentralization of NGS workflows are expanding the U.S. next-generation sequencing library preparation market.

What Are the Key Trends in the U.S. Next-generation Sequencing Library Preparation Market in 2025?

- In June 2025, Zymo Research officially launched its MultiOmiX Workstation which stole spotlight at the American Society for Microbiology (ASM) Microbe 2025 conference. The next-generation fully automated platform delivers high-throughput microbiome workflows – from sample through NGS-ready libraries.

- In May 2025, Twist Bioscience Corporation formed an expanded collaboration with Element Biosciences, Inc., for offering end-to-end workflow from library prep through sequencing by enabling Element’s AVITI systems and Trinity flowcells with additional Twist library preparation and target enrichment workflows. The partnership will enhance customer access to new NGS tools.

What Influence Does AI Have on the U.S. Next-generation Sequencing Library Preparation Market?

Artificial intelligence (AI) algorithms can be applied for analyzing sequencing data for identifying and correcting biases occurred during next-generation sequencing library preparation. Prediction and prevention of common errors such as adapter contamination and insufficient amplification in library preparation by deploying machine learning models can potentially enhance the overall quality of sequencing data. AI-powered liquid handling systems can mitigate human error and manual labor by automating library preparation steps such as fragmentation, end-repair, adapter ligation and PCR (Polymerase Chain Reaction) amplification. Optimization of library preparation protocols such as cycling conditions, incubation times and reagent concentrations by leveraging AI tools for inspecting large datasets of NGS experiments, leading to increased sequencing yields, improved library quality and decreased costs. Integration of AI in the U.S. next-generation sequencing library preparation is essential for advancing genomic research and translating it into clinical applications.

Report Scope of U.S. Next-generation Sequencing Library Preparation Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 834.99 Million |

| Market Size by 2035 |

USD 2,476.39 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 12.87% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Product, By Sequencing By Type, By Application, By End use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Agilent Technologies, Inc., BD, F. Hoffmann-La Roche AG, Inc., Illumina, Inc., New England Biolabs Inc., Oxford Nanopore Technologies, Pacific Biosciences of California, Inc., QIAGEN N.V., Revvity, Inc., Thermo Fisher Scientific Inc. |

U.S. Next-generation Sequencing Library Preparation Market Dynamics

Drivers

Increased Adoption of Personalized and Precision Medicine

Next-generation sequencing (NGS) provides detailed insights into an individual’s genetic profile, further enabling tailored treatments, especially in areas such as oncology, pharmacogenomics and rare disease diagnostics. An increasing emphasis on personalized medicine in the U.S. is creating the demand for comprehensive genomic data requiring streamlined NGS library preparation to ensure the accuracy and reliability of sequencing data. Precision medicine is utilizing NGS for identification of biomarkers and to develop targeted therapies, particularly in oncology which drives the need for efficient library preparation kits.

Restraints

High Capital Expenditure

Procurement of advanced NGS instruments, setting up an NGS facility, installation of high-performance computing systems for data analysis, need for data storage as well as integration of specialized lab automation tools requires substantial upfront investments which is not affordable for all companies, especially for small companies, emerging start-ups and academic institutions with limited budgets. Furthermore, ongoing costs associated with purchase of high-quality reagents and consumables used in library preparation as well as need for trained personnel such as bioinformaticians, molecular biologists and genetic counsellors can significantly restrain the market growth.

Opportunities

Expanding Applications

Although oncology is a dominant area of NGS technology, ongoing advancements in routine clinical diagnostics are driving the adoption of this technology in various clinical applications. Expanding applications such as in infectious disease diagnostics for tracing outbreaks and understanding antimicrobial resistance, for rare disease diagnosis for identification of causative genetic mutations in undiagnosed or rare genetic disorders, in pharmacogenomics for gaining better comprehension of individual genetic makeup as well as in reproductive health for non-invasive prenatal testing (NIPT), preimplantation genetic testing (PGT) and carrier screening. Advancements in liquid biopsies, adoption of single-cell sequencing technologies, automation and integration of AI for workflow optimization is creating opportunities for market growth.

U.S. Next-generation Sequencing Library Preparation Market Segmental Insights

By Sequencing Type Insights

What Made Targeted Genome Sequencing the Dominant Segment in 2025?

The targeted genome sequencing segment captured the biggest market share in 2025.Targeted genome sequencing offers a more concentrated and cost-effective for analyzing specific regions on interest within a genome which is useful for identification of disease-causing mutations, studying known genetic variations and to perform follow-up studies after initial genome sequencing. Less sequencing data, accelerated turnaround times facilitating rapid diagnosis and reduced computational burden allowing streamlined data analysis are driving the adoption of targeted genome sequencing for clinical diagnostics and research. Clinical relevance of targeted sequencing in various applications such in oncology for identifying actionable mutations in cancer, in hereditary disease testing, in pharmacogenomics for predicting drug response as well as for infectious diseases surveillance for rapid detection of specific pathogens or resistant genes is boosting the dominance of this segment.

The whole genome sequencing segment is expected to register the fastest growth during the forecast period. Whole genome sequencing involves identification of the complete DNA sequence of an organism’s genome for application in various fields such as medicine, research and agriculture. Rising investments by the U.S. government through large-scale initiatives such as the “All of Us” Research Program by the National Institutes of Health (NIH) focused on sequencing hundreds of thousands or even millions of genomes by utilizing whole genome sequencing to gain better understanding of health and disease across diverse populations is creating massive demand for efficient and high-throughput library preparation systems.

- For instance, in May 2025, Volta Labs, Inc., and Hartwig Medical Foundation entered into a multi-year collaboration focused on advancing oncological discoveries with the Callisto Sample Prep Systems used for cancer diagnostic sequencing applications. The system involves advancement in the next-generation of sample prep “apps” comprising whole genome sequencing, targeted sequencing, ctDNA and RNA profiling throughout various sequencing technologies.

By Product Insights

How Reagents and Consumables Segments Dominated the Market in 2025?

The reagents and consumables segment accounted for the largest market share in 2025. Rising volume of NGS experiments and testing in both clinical and research settings in creating huge need of reagents and consumables such as buffers, adapters, enzymes, magnetic beads, reaction tubes and pipette tips for library preparation. Growing adoption of personalized medicine approaches, increasing investments by pharmaceutical and biotech companies in drug discovery and development as well as rise in academic and genomic research activities across various fields such as agriculture, infectious diseases, population genomics are driving the demand for high-quality reagents and consumables required NGS workflows.

The instruments segment is expected to show the fastest growth over the forecast period. The market growth of this segment is driven by continuous advancements in NGS instruments, increasing R&D investments and diverse applications of instruments in various NGS workflows. Automated systems in NGS library preparation are leading to reduced manual errors, improved reproducibility, high-throughput processing, reduced labor costs, minimum reagent waste as well as freeing up skilled personnel allowing them to focus on complex tasks such as data analysis, experimental design and interpreting results.

By Application Insights

Why Did the Drug & Biomarker Discovery Segment Dominate in 2025?

The drug and biomarker discovery segment generated the highest market revenue in 2025. Next-generation sequencing (NGS) allows researchers to rapidly and accurately analyze genetic variations, gene expression profiles and epigenetic modifications throughout a huge number of samples, further enabling the detection and validation of novel drug targets for therapeutic interventions as well as in better understanding of disease pathogenesis.

Increasing emphasis on personalized medicine is driving the adoption of various biomarkers, such as predictive biomarkers, prognostic biomarkers, diagnostic biomarkers and monitoring biomarkers, which are necessary for patient stratification, prediction of treatment response and disease monitoring. Furthermore, integration with multi-omics approaches, reduced development costs and streamlined patient selection in clinical trials are the factors driving the market growth of this segment.

- For instance, in May 2025, Cellecta, Inc., launched the ultra-sensitive DriverMap EXP Human Genome-Wide 19K Dried Blood Microsample Profiling kit which is a targeted RNA expression profiling assay delivering a molecular snapshot of all 19,000 human protein-coding genes from as little as 30 microliters of dried whole blood, further simplifying discovery of clinically relevant transcriptome biomarkers.

The disease diagnostics segment is expected to expand rapidly during the predicted timeframe. The market growth of this segment can be linked to increased adoption of NGS workflows in clinical oncology for precision cancer diagnostics, for development of targeted therapies, in companion diagnostics as well as in non-invasive cancer detection, monitoring and recurrence surveillance through liquid biopsies. Whole exome sequencing (WES) and whole genome sequencing (WGS) methodologies are enhancing diagnostic yield of patients with rare and undiagnosed diseases. Advancements in infectious disease diagnostics and surveillance by leveraging NGS is enabling pathogen identification and characterization, antimicrobial resistance monitoring and for tracking outbreaks.

By End Use Insights

What Drives Academic & Research Institutions Segment’s Dominance in 2025?

The academic & research institutions segment dominated the market with the largest share in 2025. Increased R&D activities by various academic and research institutions across various fields such as agriculture and environmental genomics, disease mechanisms, drug target identification, fundamental biology and populations genomics are driving the demand for NGS library preparation. Significant funding and grants provided by the U.S. government through agencies such as the National Institutes of Health (NIH) and National Science Foundation (NSF) as well as industrial collaborations and investments by private foundations for advancing research activities and development of innovative sequencing technologies are fuelling the market growth.

The pharmaceutical and biotechnology companies segment is expected to show the fastest growth over the forecast period. Pharmaceutical and biotechnology companies are actively deploying NGS technologies in their workflows for accelerating drug discovery and development processes, and to advance personalized and precision medicine approaches. Rising investments in genomics research, focus on strategic collaborations for conducting large-scale genomic studies and development of innovative NGS-based assays as well as for advancing cell and gene therapies to treat complex diseases such as autoimmune disorders and cancer are driving the market expansion.

Country-Level Analysis

U.S. next-generation sequencing library preparation market is booming owing to factors such as growing emphasis on genomic research, focus on developing tailored treatment strategies, and increased utilization for cancer diagnosis and treatment management. Declining sequencing costs and increased accessibility to NGS technologies is driving their adoption across several institutions such as from large research centers to small clinical laboratories as well as by direct-to-consumer genetic testing companies. Continuous innovations in library preparation kits and reagents such as advancements in bead-based purification, barcoding, enzymatic fragmentation and high-fidelity enzymes are contributing to the market growth. Additionally, presence of major market players, well-established healthcare infrastructure, government and private funding and shift towards automation are bolstering the market growth.

Some of the Prominent Players in the U.S. Next-generation Sequencing Library Preparation Market

- Agilent Technologies, Inc.

- BD

- F. Hoffmann-La Roche AG, Inc.

- Illumina, Inc.

- New England Biolabs Inc.

- Oxford Nanopore Technologies

- Pacific Biosciences of California, Inc.

- QIAGEN .

- Revvity, Inc.

- Thermo Fisher Scientific Inc.

Recent Developments

- In January 2025, New England Biolabs (NEB), launched an updates kit, EM-seq v2 which offers a high-performance enzyme-based alternative to bisulfite sequencing enabling more sensitive detection of 5-methylcytosine (5mC) and 5-hydroxymethylcytosine (5hmC).

- In October 2024, seqWell, a globally leading provider of genomic library and multiplexing solutions, declared the full-scale market release of its LongPlex Long Fragment Multiplexing Kit which is a first-in-class tagmentation product designed to deal with the scalability and multiplexing challenges related to long-read sequencing library preparation workflows.

- In October 2024, BD (Becton, Dickinson and Company), declared the commercial launch of its first-of-a-kind high-throughput, automation-ready reagent kits leveraging the Hamilton robotics liquid-handler, further streamlining and accelerating lab work leading to genomic sequencing. The new robotics solution will increase efficiency and ensure greater consistency in large-scale, single-cell discovery studies.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Next-generation Sequencing Library Preparation Market.

By Sequencing Type

- Targeted Genome Sequencing

- Whole Genome Sequencing

- Whole Exome Sequencing

- Other Sequencing Types

By Product

-

- DNA Library Preparation Kits

- RNA Library Preparation Kits

- Other Reagents & Consumables

By Application

- Drug & Biomarker Discovery

- Disease Diagnostics

-

- Cancer Diagnostics

- Reproductive Health Diagnostics

- Infectious Disease Diagnostics

- Other Disease Diagnostic Applications

By End Use

- Hospitals and Clinics

- Academic and Research Institutions

- Pharmaceutical and Biotechnology Companies

- Others