U.S. Next-generation Sequencing Services Market Size and Growth

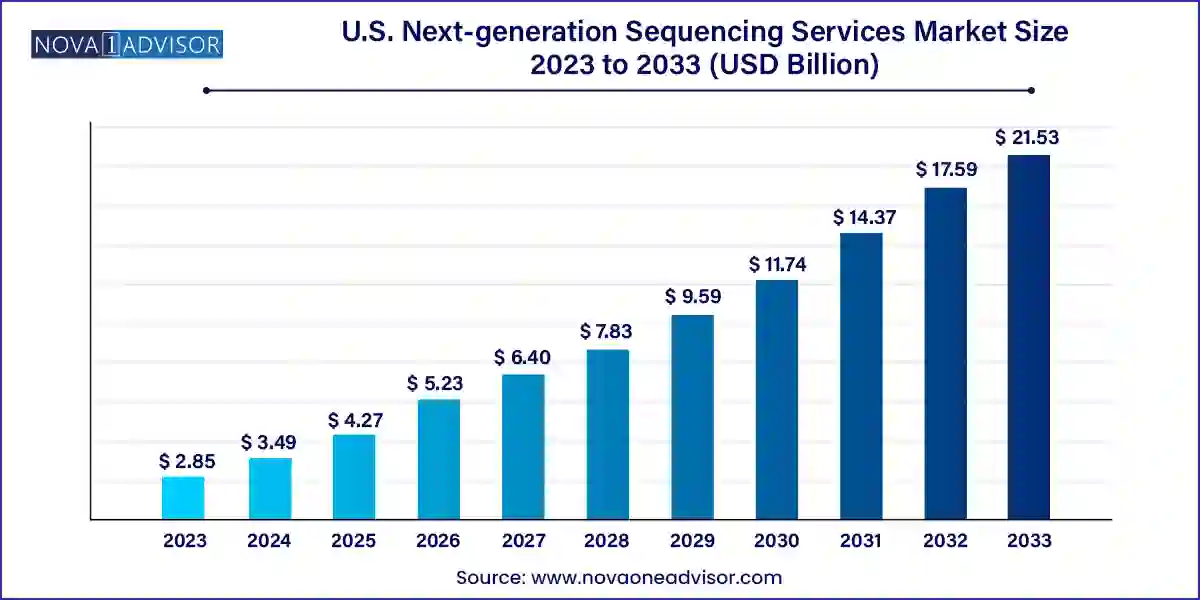

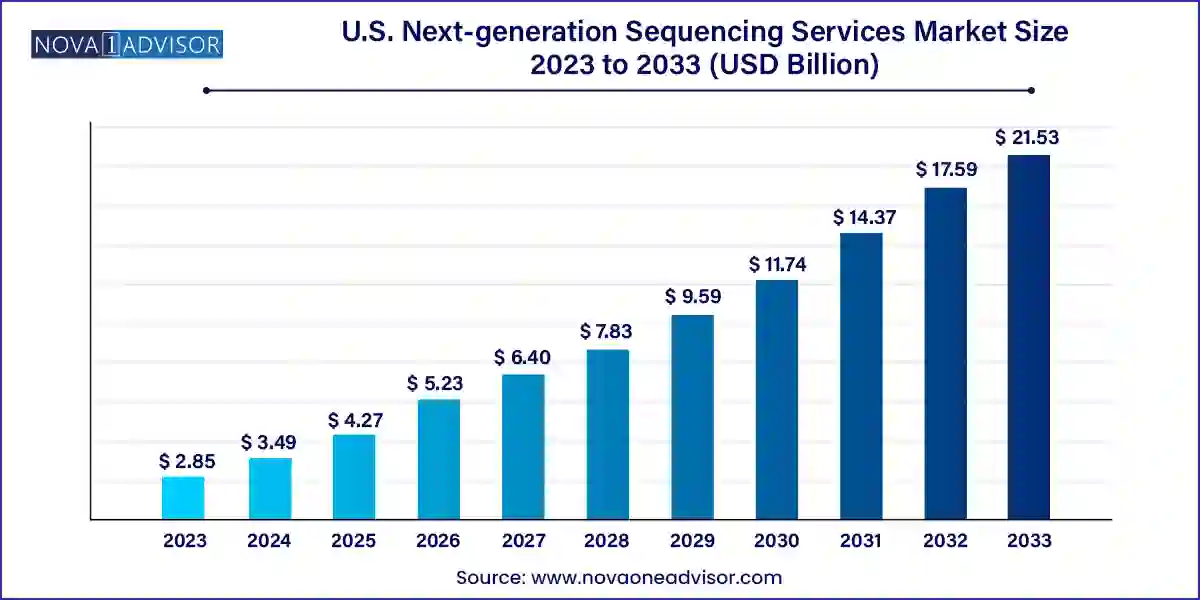

The U.S. next-generation sequencing services market size was valued at USD 2.85 billion in 2023 and is anticipated to reach around USD 21.53 billion by 2033, growing at a CAGR of 22.41% from 2024 to 2033.

U.S. Next-generation Sequencing Services Market Key Takeaways

- Human genome sequencing services dominated the market in 2023, generating nearly 32.19% of the total revenue share.

- Human genome sequencing services dominated the market in 2023, generating nearly 32.19% of the total revenue share.

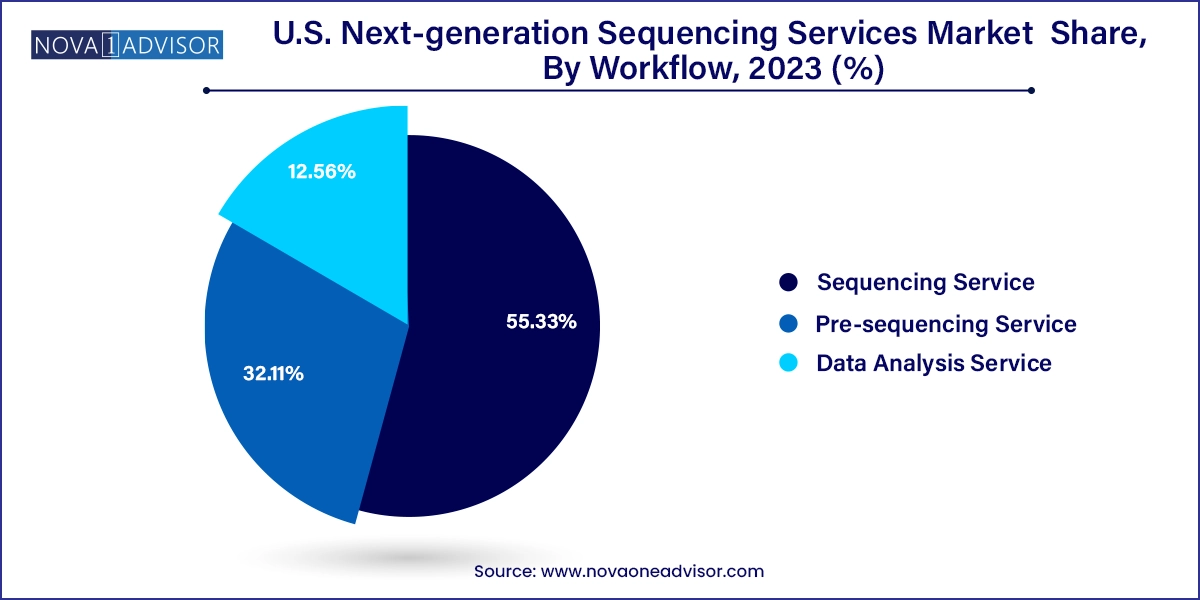

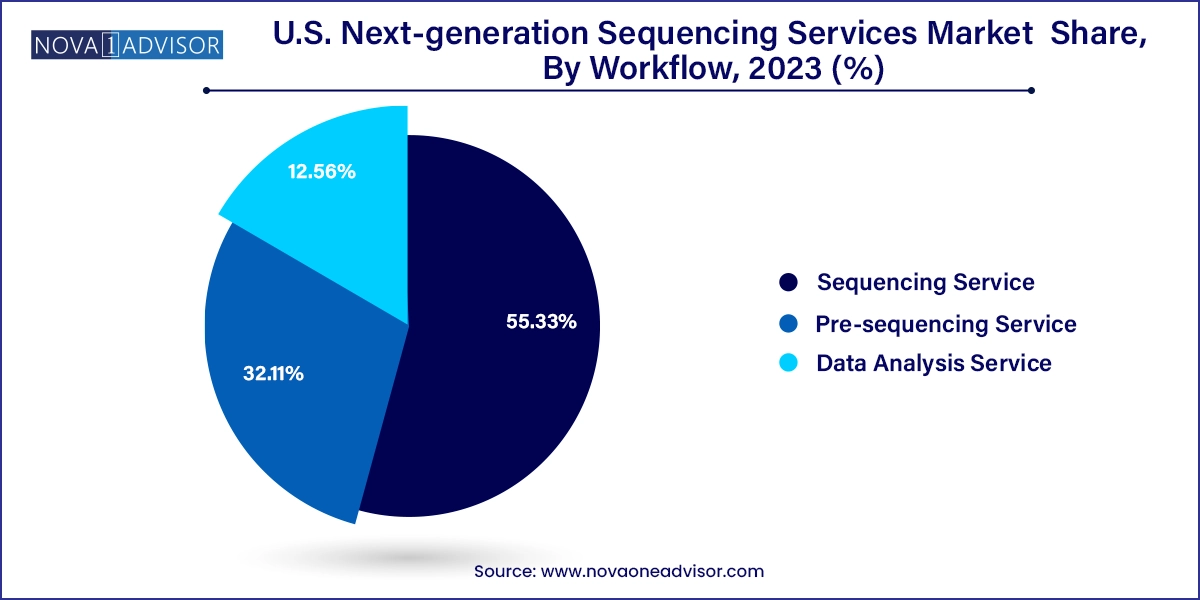

- Sequencing services dominated the market in 2023, with a share of 55.33% of the total revenue.

- Pre-sequencing services are estimated to experience lucrative growth from 2024 to 2033.

- In 2023, universities and other research entities held the largest market share, accounting for nearly 53.23% of the total revenue.

- Hospitals & clinics are expected to grow at the fastest rate over the forecast period

Market Overview

The U.S. Next-generation Sequencing (NGS) services market stands at the forefront of modern genomic research and precision healthcare, reshaping diagnostics, drug discovery, and disease prevention. NGS, a high-throughput technology enabling the sequencing of DNA and RNA much faster and more accurately than traditional methods, has transformed life sciences research and clinical applications alike. In recent years, the service-based arm of this market where laboratories and service providers offer NGS as an outsourced, turnkey solution has surged in demand, driven by the complexity, cost, and expertise required for in-house sequencing.

Within the United States, the NGS services sector has become essential for academic research, hospital diagnostics, biotech innovation, and agricultural genomics. Service providers deliver everything from genome and exome sequencing to single-cell analysis and microbiome profiling, often including library preparation, bioinformatics pipelines, and data interpretation. The democratization of genomic analysis once limited to elite research institutions is now accessible to smaller research groups, hospitals, and private companies through these services.

A convergence of enabling factors including falling sequencing costs, expanded clinical use of genomics, rising investment in oncology diagnostics, and the U.S. government's focus on initiatives like the All of Us Research Program continues to accelerate the market's evolution. The rise of cloud-based genomic analysis, machine learning in bioinformatics, and the emergence of integrated service platforms are setting new benchmarks in speed, scale, and accuracy of sequencing workflows.

Major Trends in the Market

-

Growing adoption of NGS in clinical diagnostics, particularly in oncology, rare diseases, and reproductive health.

-

Rise in demand for single-cell sequencing services, enabling highly granular views of cellular heterogeneity.

-

Integration of AI and machine learning in NGS data analysis pipelines for enhanced interpretation and predictive modeling.

-

Cloud-based sequencing platforms enabling remote, collaborative, and large-scale genomic studies.

-

Increasing collaborations between pharma companies and NGS service providers to streamline biomarker discovery and companion diagnostics.

-

Emergence of third-party clinical sequencing services for hospitals lacking in-house genomic labs.

-

Microbiome sequencing gaining traction in nutrition, dermatology, and mental health studies.

-

Shift toward customizable, modular sequencing packages catering to diverse client needs from academic to commercial entities.

U.S. Next-generation Sequencing Services Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 3.49 Billion |

| Market Size by 2033 |

USD 21.53 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 22.41% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Service type, workflow, end-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Illumina, Inc.; Thermo Fisher Scientific Inc.; Eurofins Scientific SE; PerkinElmer, Inc.; QIAGEN; Quest Diagnostics Incorporated; Azenta Life Sciences (GENEWIZ); NanoString; PacBio; bioMérieux; BGI Group; F. Hoffmann-La Roche Ltd; ARUP Laboratories; Novogene Co, Ltd.; Gene by Gene Ltd.; Lucigen Corporation |

U.S. Next-generation Sequencing Services Market By Service Type Insights

Human genome sequencing services dominated the market in 2024, driven by growing demand for personalized medicine and population-level genomics projects. Whole genome and exome sequencing are now routine tools in identifying monogenic diseases, cancer mutations, and pharmacogenomic markers. Hospitals, research centers, and biopharmaceutical firms increasingly rely on outsourced genome sequencing services for pilot studies, diagnostic confirmation, and clinical trials. With the NIH and other federal agencies supporting national genomic health programs, this segment’s dominance is expected to continue.

Meanwhile, single-cell sequencing services are the fastest-growing segment due to their revolutionary applications in developmental biology, cancer research, and immunology. Single-cell RNA-seq, for example, reveals transcriptional heterogeneity across tissues, helping uncover mechanisms of disease progression and drug resistance. Service providers are expanding single-cell offerings through partnerships with tech innovators like 10x Genomics and Fluidigm, enabling researchers to access high-resolution, cell-level data without managing complicated protocols. As single-cell analysis becomes more cost-effective and standardized, demand for outsourced expertise will grow across academic and commercial sectors.

U.S. Next-generation Sequencing Services Market By Workflow Insights

Sequencing services remained the dominant workflow component in the U.S. NGS services market, as they involve the actual execution of genomic sequencing across varied technologies. Whether it’s Illumina’s short-read platforms or Oxford Nanopore’s long-read sequencing, the core sequencing process remains central to service offerings. Many clients prefer outsourcing this stage to avoid costly instrument procurement and maintenance. Large contract research organizations (CROs) and clinical sequencing labs often perform bulk sequencing for academic centers and biopharma trials, maintaining their leading position in the workflow hierarchy.

However, data analysis services represent the fastest-growing workflow segment as the volume and complexity of sequencing data continues to balloon. Interpretation pipelines, variant annotation, pathway enrichment, and AI-based analytics are increasingly being offered as value-added services by sequencing providers. Some service providers now specialize exclusively in bioinformatics, offering cloud-based dashboards, clinical report generation, and decision support for oncologists and genetic counselors. This surge is further fueled by demand for integrated solutions that reduce time from sequencing to clinical actionability, especially in time-sensitive applications like cancer diagnostics.

U.S. Next-generation Sequencing Services Market By End-use Insights

Universities and other research entities dominated the end-use segment in 2024 due to their broad involvement in basic and translational genomics research. From plant genomics and microbiome studies to cancer biology and evolutionary genetics, academic institutions drive significant sequencing volume. Federal funding, particularly from agencies like the NIH and NSF, fuels their ability to outsource high-throughput sequencing projects. Research consortiums often turn to commercial providers for rapid turnaround times and advanced services like long-read sequencing or epigenomic profiling.

Hospitals and clinics are emerging as the fastest-growing end-use segment, reflecting the clinical transition of genomics. More U.S. hospitals are establishing precision medicine programs and leveraging NGS to identify somatic mutations, screen for hereditary diseases, and guide treatment decisions. Outsourcing sequencing to certified clinical labs ensures compliance with CLIA and CAP regulations while reducing the burden of internal lab maintenance. Additionally, regional healthcare networks and community hospitals are beginning to adopt NGS through service partnerships, widening access to genomic diagnostics.

Country-level Analysis

The United States serves as both a global innovation hub and a major consumer of NGS services, supported by a robust ecosystem of academic institutions, biopharma companies, clinical labs, and technology providers. States like California, Massachusetts, and Texas host clusters of genomic research centers, sequencing service companies, and bioinformatics startups. Silicon Valley and Boston, in particular, are incubators of genomics innovation, housing companies like Illumina, Thermo Fisher, and numerous AI-genomics platforms.

Federal initiatives such as the All of Us Research Program, aiming to sequence one million American genomes, and investments in pandemic preparedness, have elevated NGS as a national healthcare priority. Meanwhile, private sector initiatives, such as health-tech startups offering DTC (direct-to-consumer) sequencing and employer genomics programs, are driving consumer awareness. Educational initiatives, reimbursement expansions, and interoperability standards (such as HL7 and FHIR genomics) are aligning to make NGS a routine part of U.S. healthcare delivery.

U.S. Next-generation Sequencing Services Market Recent Developments

-

March 2025 – Illumina announced a strategic partnership with the U.S. Department of Veterans Affairs to expand access to whole genome sequencing for veterans with rare diseases, marking a major milestone in public-private healthcare genomics collaboration.

-

February 2025 – Thermo Fisher Scientific launched a new turnkey sequencing service platform targeting oncology clinics and CROs, providing rapid sequencing-to-report solutions under CLIA certification.

-

January 2025 – Personalis, Inc. entered into a multi-year agreement with a U.S.-based biopharma company to provide tumor sequencing services for immuno-oncology trials.

-

December 2024 – Ginkgo Bioworks unveiled an AI-driven microbial genome sequencing service, tailored for biotech and synthetic biology firms.

-

November 2024 – Guardant Health expanded its NGS-based liquid biopsy service in the U.S. through hospital partnerships across six new states, offering blood-based cancer genomic profiling.

U.S. Next-generation Sequencing Services Market Top Key Companies:

- Illumina, Inc.

- Thermo Fisher Scientific Inc.

- Eurofins Scientific SE

- PerkinElmer, Inc.

- QIAGEN

- Quest Diagnostics Incorporated

- Azenta Life Sciences (GENEWIZ)

- NanoString

- PacBio

- bioMérieux

- BGI Group

- F. Hoffmann-La Roche Ltd

- ARUP Laboratories

- Novogene Co, Ltd.

- Gene by Gene Ltd.

- Lucigen Corporation

U.S. Next-generation Sequencing Services Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Next-generation Sequencing Services market.

By Service Type

- Human Genome Sequencing Services

- Single Cell Sequencing Services

- Microbial Genome-based Sequencing Services

- Gene Regulation Services

- ChIP Sequencing Service

- Small RNA Sequencing Service

- Other Gene Regulation-based Service

- Animal & Plant Sequencing Services

- Other Sequencing Services

By Workflow

- Pre-sequencing Service

- Sequencing Service

- Data Analysis Service

By End-use

- Universities & Other Research Entities

- Hospitals & Clinics

- Pharma & Biotech Entities

- Other End-uses

- By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)