U.S. Non-alcoholic Steatohepatitis Biomarkers Market Size and Growth

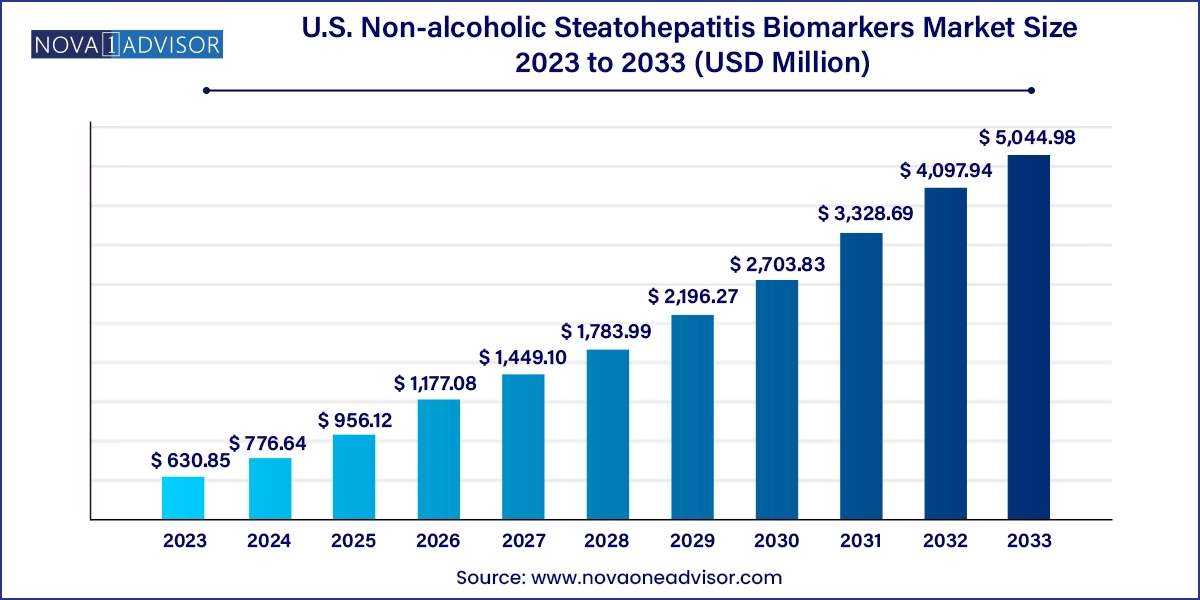

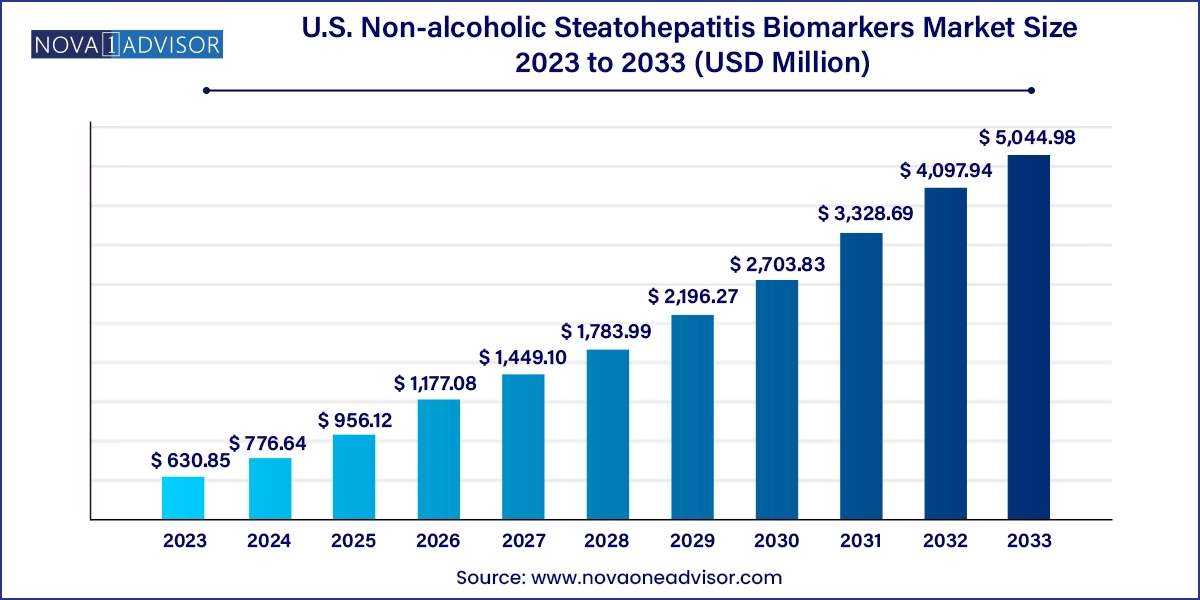

The U.S. non-alcoholic steatohepatitis biomarkers market size was exhibited at USD 630.85 million in 2023 and is projected to hit around USD 5,044.98 million by 2033, growing at a CAGR of 23.11% during the forecast period 2024 to 2033.

U.S. Non-alcoholic Steatohepatitis Biomarkers Market Key Takeaways:

- The serum biomarker segment dominated the market with a revenue share of 32.55% in 2023.

- The hepatic fibrosis biomarkers segment is expected to grow at the fastest CAGR during the forecast period.

- The pharma & CRO industry segment dominated the market in 2023 and is expected to grow with the fastest CAGR over the forecast period from 2024 to 2033.

Market Overview

Non-alcoholic Steatohepatitis (NASH) is emerging as one of the most critical liver diseases in the United States, closely tied to rising obesity, diabetes, and metabolic dysfunction. Unlike alcoholic liver disease, NASH develops without significant alcohol consumption, making it insidious and harder to detect without specific diagnostic tools. It is marked by inflammation, fat accumulation in the liver, and in severe cases, fibrosis or cirrhosis. This slow-progressing disease often remains asymptomatic until significant liver damage has occurred.

Against this backdrop, biomarkers have become indispensable for early detection and effective monitoring of disease progression. Biomarkers offer a non-invasive or minimally invasive approach to diagnose NASH, assess its severity, predict progression, and guide therapeutic decisions. Traditionally, diagnosis relied heavily on liver biopsy, a method that, despite being the gold standard, is invasive, costly, and prone to sampling variability. The push toward non-invasive solutions has resulted in a fertile market for biomarker development and implementation.

In the United States, the convergence of academic research excellence, cutting-edge biotech startups, and a favorable regulatory environment provides fertile ground for biomarker innovation. Clinical trials increasingly include biomarker endpoints, and drug development pipelines for NASH therapies are deeply interwoven with diagnostic companion biomarkers. As the healthcare industry moves toward precision and preventative medicine, the NASH biomarkers market is poised to grow not only in volume but also in complexity, with multi-modal biomarker panels, machine-learning-based interpretations, and real-time tracking tools likely to become standard in the near future.

Major Trends in the Market

-

Shift from Invasive to Non-invasive Diagnostics

Liver biopsies are being replaced or supplemented by blood-based, imaging-based, and proteomic biomarkers that can reduce patient risk while improving diagnostic accessibility.

-

Growth of Multi-biomarker Panels

Instead of relying on a single metric, clinical practice is moving toward using panels that combine serum, inflammatory, fibrotic, and metabolic markers for more comprehensive assessment.

-

Integration with AI and Machine Learning

Algorithms are being developed to analyze large volumes of biomarker data, enabling faster and more accurate diagnosis and risk prediction models for NASH.

-

Rising Investment from Biotech and Pharma

Many companies developing NASH drugs are also investing in or partnering with diagnostic firms to create biomarker-based screening tools for trial recruitment and therapeutic monitoring.

-

Expansion of Companion Diagnostics

Biomarkers are becoming integrated with therapeutic development, guiding not only diagnosis but also matching patients with specific drugs or treatment regimens.

-

Focus on Early-stage Disease Detection

Research is increasingly focusing on identifying biomarkers that can detect the disease before irreversible liver damage, allowing for timely lifestyle or pharmaceutical interventions.

-

Standardization of Assay Techniques

Laboratories and diagnostic companies are working to develop standardized assay kits for widespread clinical adoption of certain biomarker tests.

-

Exploration of Microbiome and Genetic Markers

Novel research is expanding the definition of biomarkers to include microbiome profiles and genetic variants linked to NASH susceptibility and progression.

Report Scope of U.S. Non-alcoholic Steatohepatitis Biomarkers Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 776.64 Million |

| Market Size by 2033 |

USD 5,044.98 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 23.11% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

GENFIT; Prometheus Laboratories; Siemens Medical Solutions USA, Inc.; Quest Diagnostics; AstraZeneca; Laboratory Corporation of America Holdings; Pfizer, Inc.; Bristol-Myers Squibb Company |

The primary force driving the U.S. NASH biomarkers market is the explosion of metabolic health issues. The United States has seen an alarming increase in obesity and type 2 diabetes over the past two decades. These conditions are directly associated with the onset of Non-alcoholic Fatty Liver Disease (NAFLD), which can advance to NASH in a significant subset of patients. As more individuals develop metabolic syndrome a condition characterized by high blood pressure, insulin resistance, and lipid abnormalities the pool of patients at risk for NASH continues to expand.

The healthcare system is under increasing pressure to identify these patients early to avoid the high costs and health consequences of late-stage liver disease, including liver transplantations and hepatocellular carcinoma. Biomarkers provide a practical and cost-effective method of screening at-risk populations. Primary care physicians, endocrinologists, and hepatologists can incorporate biomarker tests into routine exams, especially for patients already managing obesity or diabetes. This demand for early detection tools fuels the continued expansion and investment in the biomarker space.

Key Market Restraint: Clinical Uncertainty and Validation Challenges

Despite scientific excitement around NASH biomarkers, a major restraint persists: clinical uncertainty due to a lack of universally validated biomarkers. Unlike diseases like cancer where biomarker validation is well-established, NASH diagnostics is still in an evolving phase. Many of the biomarkers in use today, such as ALT (alanine aminotransferase) or AST (aspartate aminotransferase), lack the specificity needed to clearly distinguish between benign fatty liver, active NASH, and fibrotic progression.

Moreover, the absence of a standardized, FDA-approved panel of biomarkers limits adoption in routine clinical settings. Variability in lab methodologies, inconsistent definitions of disease severity, and population-specific performance of biomarkers all hinder reproducibility and large-scale clinical validation. This issue becomes even more pronounced in diverse patient groups, as comorbid conditions like cardiovascular disease can skew results. Until a consensus framework for biomarker validation is achieved, the market will remain fragmented and underutilized in day-to-day clinical settings.

Key Market Opportunity: Biomarkers as Enablers of Personalized NASH Therapies

The rise of personalized medicine is generating new opportunities for biomarker integration in NASH. With no FDA-approved drugs specifically for NASH on the market as of now, drug development efforts are intense and ongoing. Biomarkers are not only aiding in diagnosis but are increasingly seen as key enablers for drug development, particularly in defining subgroups of patients who are more likely to benefit from particular therapies.

For example, a patient whose NASH is driven predominantly by oxidative stress might respond differently to a therapeutic than one whose disease is more inflammation-driven. Biomarkers can help identify these distinctions, making them invaluable in both clinical trial design and future real-world treatment paradigms. Once therapeutic options for NASH hit the market, companion diagnostics based on validated biomarkers will likely become a regulatory requirement, opening a profitable niche for diagnostics developers.

U.S. Non-alcoholic Steatohepatitis Biomarkers Market By Type Insights

Serum biomarkers dominate the current market, largely due to their accessibility and relative affordability. These biomarkers include widely used enzymes and proteins such as ALT, AST, and CK-18 fragments, which are typically measured using blood tests. They are easy to implement across healthcare settings from specialist clinics to community hospitals and allow for longitudinal monitoring without the need for invasive procedures. Their role is particularly prominent in risk stratification and ongoing disease management. Healthcare providers often rely on these markers as a first-line assessment tool before considering more specialized testing or imaging.

On the other hand, oxidative stress biomarkers are emerging as the fastest-growing segment. These markers provide insight into the underlying cellular processes contributing to hepatocyte injury and fibrosis. As understanding of disease mechanisms deepens, more sophisticated markers such as malondialdehyde (MDA), glutathione ratios, and 4-HNE are being explored for their predictive value. Research indicates that these biomarkers can reveal more about the disease's active progression and may even help in predicting outcomes. Startups and academic labs alike are channeling significant research efforts into developing reliable oxidative stress marker panels that can be commercialized for diagnostic and therapeutic purposes.

U.S. Non-alcoholic Steatohepatitis Biomarkers Market By End-use Insights

Pharma and CRO industries dominate the end-use landscape due to their heavy involvement in NASH drug development. Biomarkers are crucial tools in clinical trials, allowing sponsors to identify eligible participants, assess response to therapy, and satisfy regulatory requirements for efficacy and safety data. These organizations invest significantly in both in-house and partnered biomarker technologies to improve patient selection and accelerate trial timelines. With over a hundred NASH-related compounds under investigation, the demand for biomarkers in this segment is expected to remain high over the next decade.

Academic research institutes represent the fastest-growing end-use segment. Fueled by NIH grants and institutional funding, universities and medical schools are at the forefront of biomarker discovery. Unlike industry players who may focus on biomarkers with immediate commercial potential, academic centers explore novel and sometimes risky areas, such as gene expression profiles, microbiome signatures, and epigenetic changes. These institutions act as the breeding ground for next-generation biomarker technologies that may later be licensed or spun out into commercial ventures.

Country-Level Analysis

The U.S. is uniquely positioned to lead the global NASH biomarkers market due to a combination of demographic, institutional, and technological advantages. The nation’s growing burden of chronic disease, particularly obesity and type 2 diabetes, has created a vast potential patient pool requiring liver health screening. More than any other country, the U.S. is equipped with the infrastructure to support advanced diagnostic innovation—from clinical trials to regulatory oversight and reimbursement pathways.

Federal agencies like the NIH and CDC actively fund liver disease research, and the FDA has shown increasing openness to surrogate endpoints and companion diagnostics in hepatology. Moreover, the ecosystem of innovation in the U.S.—from Silicon Valley health tech startups to leading university hospitals—enables rapid prototyping, validation, and market introduction of novel biomarker technologies.

The commercial health insurance system in the U.S. also creates incentives for early disease detection, particularly for diseases with high future treatment costs. As such, payers are showing increasing interest in covering biomarker-based diagnostics that can prevent progression to costly advanced liver disease or liver cancer.

Some of the prominent players in the U.S. non-alcoholic steatohepatitis biomarkers market include:

- GENFIT

- Prometheus Laboratories.

- Siemens Medical Solutions USA, Inc.

- Quest Diagnostics

- AstraZeneca

- Laboratory Corporation of America Holdings.

- Pfizer, Inc.

- Bristol-Myers Squibb Company

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. non-alcoholic steatohepatitis biomarkers market

Type

- Serum Biomarkers

- Hepatic Fibrosis Biomarkers

- Apoptosis Biomarkers

- Oxidative Stress Biomarkers

- Others

End-use

- Pharma & CRO Industry

- Hospitals

- Diagnostic Labs

- Academic Research Institutes