U.S. Nutritional Supplements Market Size and Research

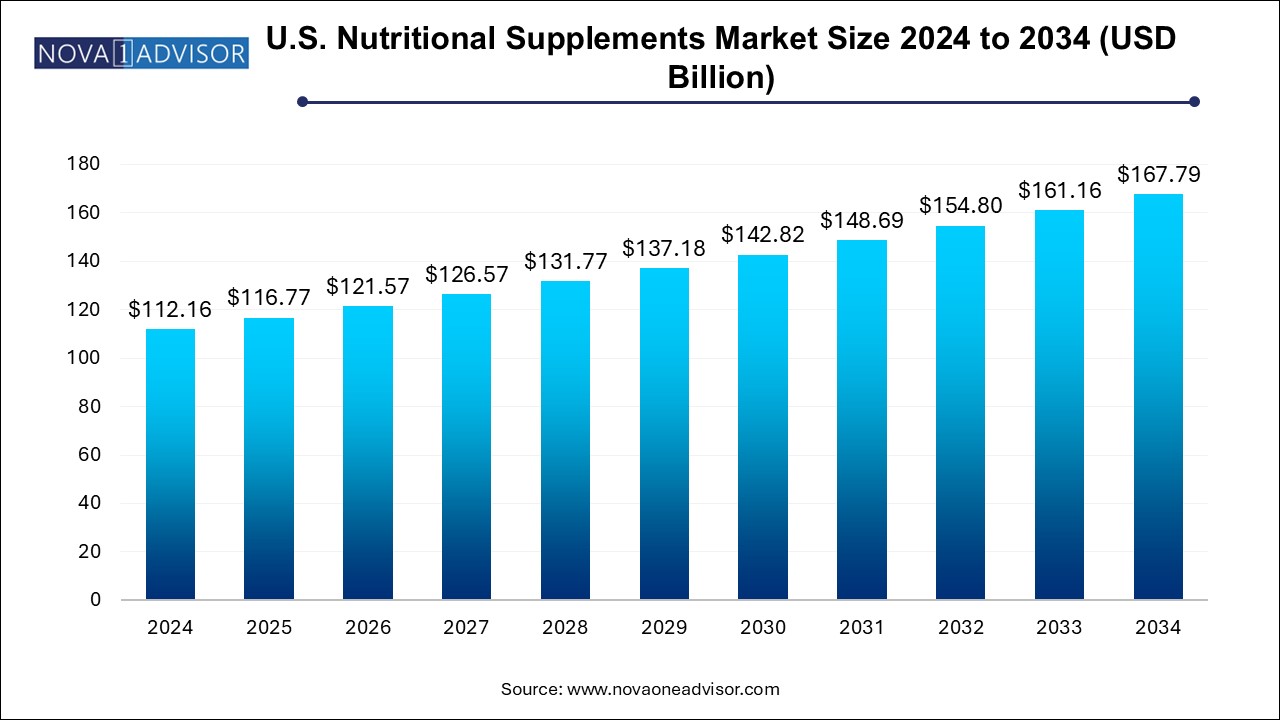

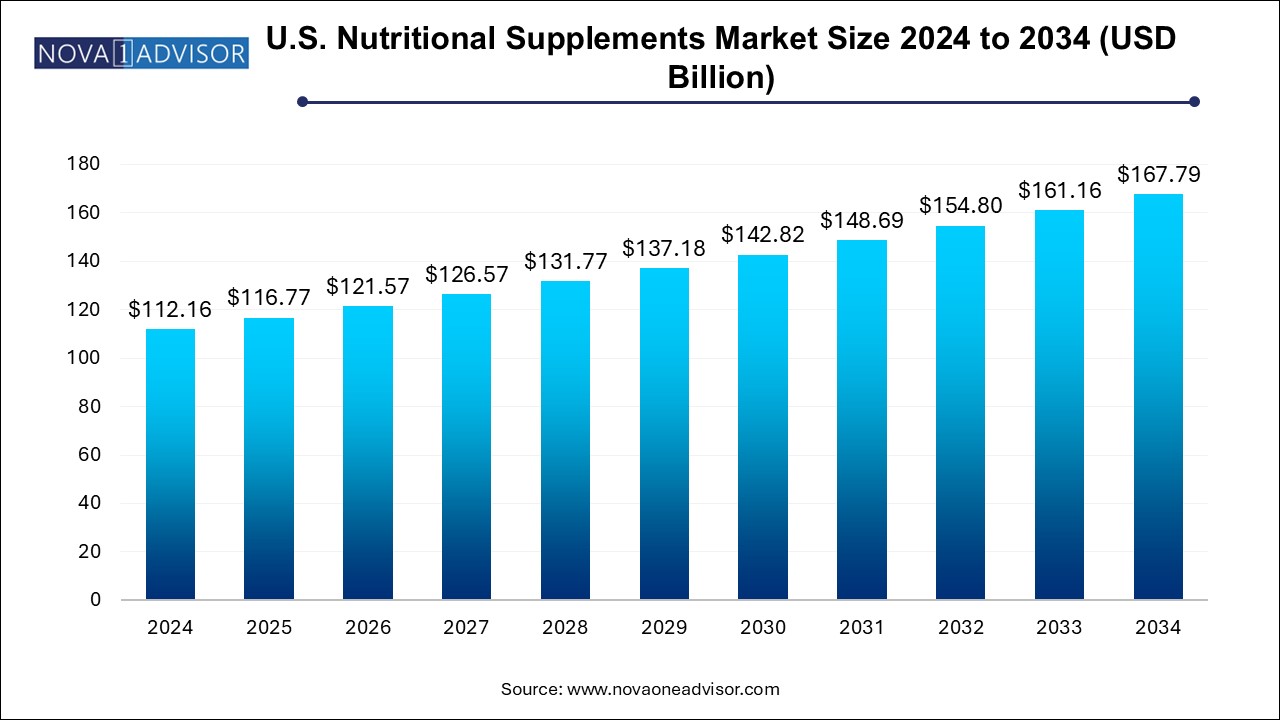

The U.S. nutritional supplements market size was exhibited at USD 112.16 billion in 2024 and is projected to hit around USD 167.79 billion by 2034, growing at a CAGR of 4.11% during the forecast period 2024 to 2034. The growth of the U.S. nutritional supplements market can be linked to the rising health and wellness awareness among consumers, emergence of e-commerce platforms and clean-label trends. Focus on preventive healthcare among individuals, especially in the geriatric population is driving the demand for personalized nutrition.

U.S. Nutritional Supplements Market Key Takeaways:

- The functional foods and beverages segment dominated the market with a share of 49.5% in 2024.

- The sports nutrition segment is expected to grow at the fastest CAGR of 6.2% over the forecast period.

- The adult segment dominated the market with a share of 51.3% in 2024.

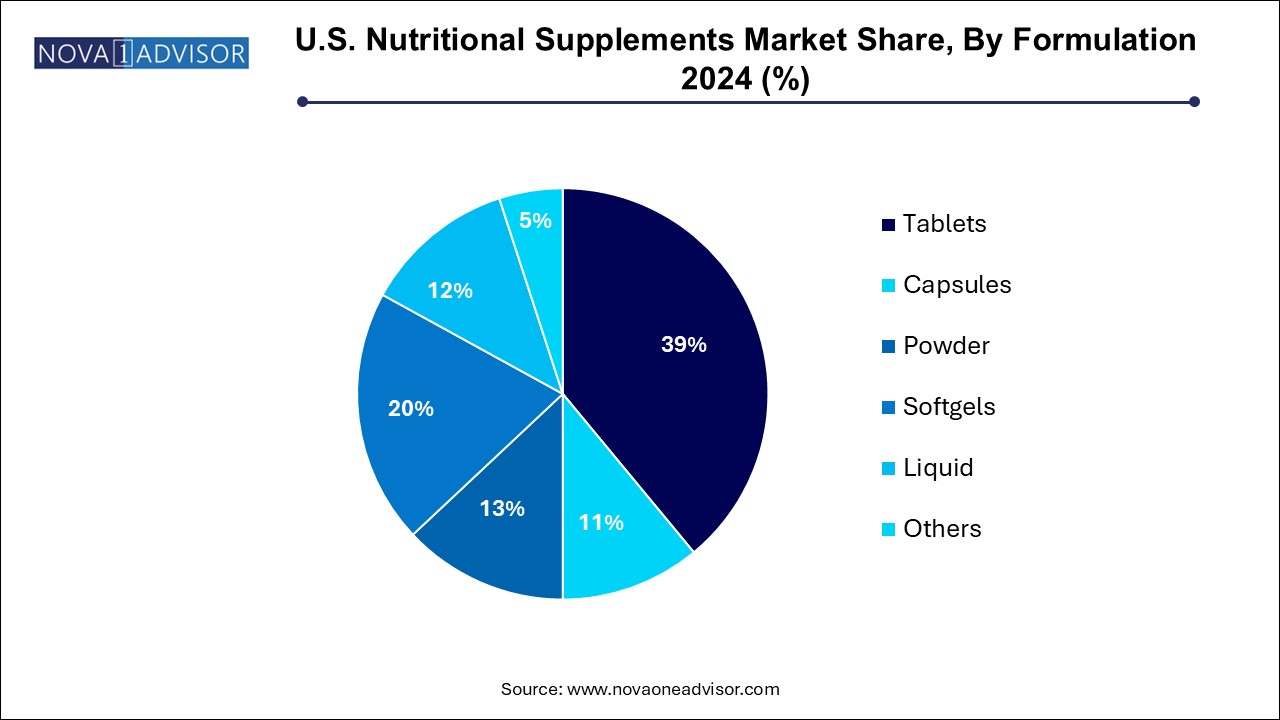

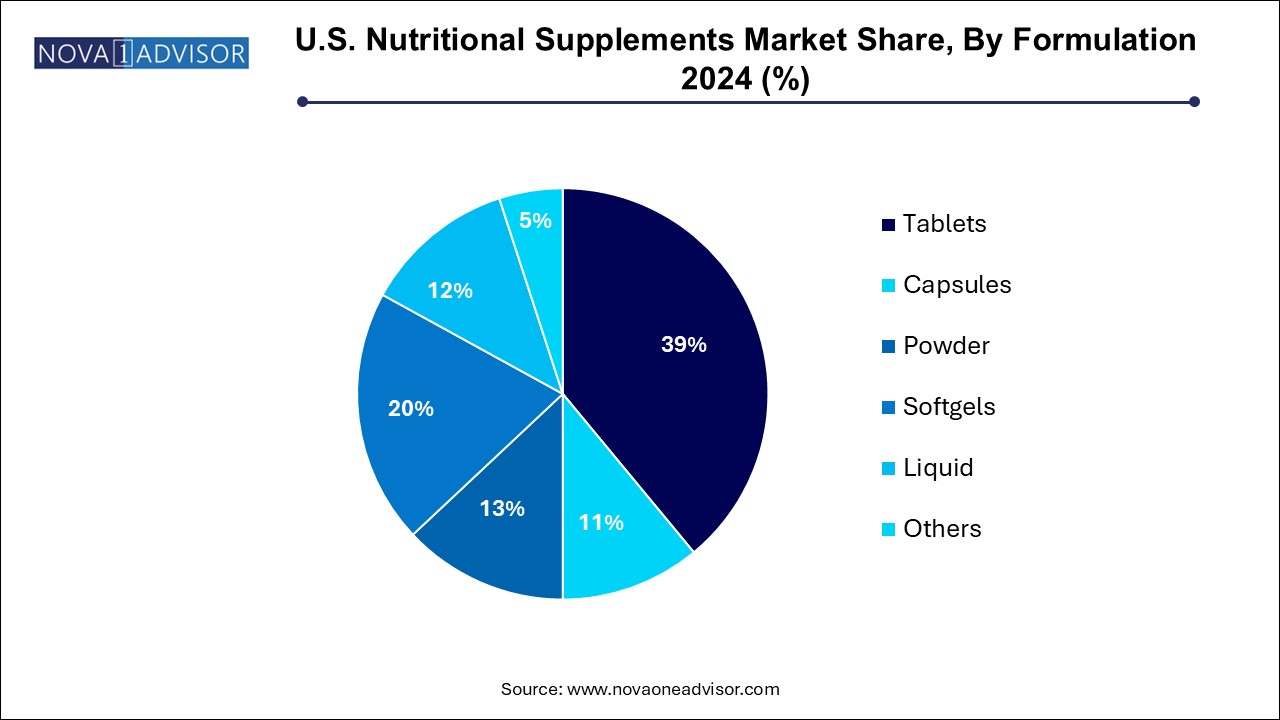

- The powder segment dominated the market with a share of 39.0% in 2024.

- The capsules segment is expected to grow at the fastest CAGR of 7.2% over the forecast period.

- The brick-and-mortar segment dominated the market with a share of 58.2% in 2024.

- The e-commerce segment is expected to grow at the fastest CAGR of 6.4% over the forecast period.

- The weight management segment dominated the market with a share of 58.2% in 2024.

- The sports & athletics segment is expected to grow at the fastest CAGR of 9.9% over the forecast period.

Market Overview

The U.S. nutritional supplements market stands as one of the most mature and dynamic segments within the broader health and wellness economy. Fueled by a growing consumer focus on proactive health management, preventive healthcare, fitness culture, and personalized nutrition, the market continues to experience robust demand across all demographics. From sports enthusiasts and aging adults to pregnant women and health-conscious millennials, nutritional supplements have become mainstream staples in American households, driving sustained expansion across product categories and sales channels.

The convergence of technology and health, coupled with increasing awareness of lifestyle-related chronic diseases, has pushed consumers toward supplementation for a variety of wellness goals, including immunity enhancement, cardiovascular support, weight management, digestive health, and mental performance. Moreover, the COVID-19 pandemic has accelerated this shift, heightening interest in immune-boosting and general wellness supplements like multivitamins, probiotics, omega-3 fatty acids, and zinc.

In the U.S., market players range from legacy pharmaceutical and food companies to DTC (direct-to-consumer) startups that harness digital marketing, AI-driven personalization, and subscription-based business models. The regulatory framework under the Dietary Supplement Health and Education Act (DSHEA) allows significant product diversity, although it necessitates stringent labeling, transparency, and compliance practices.

Formulations have evolved significantly from conventional tablets and capsules to on-the-go powders, gummies, and liquids—enhancing palatability and user experience. E-commerce is playing a pivotal role in shaping the market, allowing niche brands to build loyal customer bases and deliver personalized wellness solutions via data analytics and behavioral insights. As healthcare costs continue to rise in the U.S., nutritional supplements offer a cost-effective route to disease prevention and wellness optimization, supporting long-term market momentum.

U.S. Government’s Role in Supplement Safety and Regulation

The Dietary Supplement Health and Education Act of 1994 (DSHEA) significantly influences the nutritional supplements market in the U.S. The regulatory frameworks established for nutritional supplements don’t need the FDA’s pre-market approval. Labelling requirements set by the FDA imposes addition of Supplement Facts panel along with allergen information, ingredient lists and serving size. The Federal Trade Commission (FTC) overlooks the advertising regulation of dietary supplements, ensuring the deployment of truthful and not misleading advertising claims backed by reliable and competent scientific proof.

Additionally, the FDA’s education initiatives like “Supplement Your Knowledge” are focused on broadening public understanding of dietary and nutritional supplements. The nutritional supplements market in U.S. is characterized by a post-market regulatory approach actively monitored and regulated by the FDA and FTC.

Major Trends in the Market

-

Rising demand for personalized supplements based on genetics, lifestyle, and health goals, driven by AI, microbiome analysis, and wearable integration.

-

Surge in clean-label and plant-based products, with consumers seeking organic, vegan, non-GMO, and allergen-free formulations.

-

Expansion of e-commerce and DTC brands, emphasizing subscription models, targeted marketing, and consumer engagement platforms.

-

Integration of sports nutrition into lifestyle segments, blurring lines between athletes, gym-goers, and wellness-focused consumers.

-

Increasing popularity of gummy, powder, and liquid formulations among children, older adults, and pill-fatigued users.

-

Focus on women’s health and hormonal balance, including prenatal vitamins, menopause support, and fertility supplements.

-

Incorporation of nootropics and adaptogens in brain health and anti-aging supplements targeting cognitive performance and stress.

-

Growing physician-endorsed supplement programs, often co-branded with clinics or integrated into wellness packages.

-

Heightened scrutiny over transparency and labeling, with consumers demanding clinically supported claims, third-party testing, and traceability.

-

Nutraceutical convergence with functional foods and beverages, especially in fortified drinks and health-focused snacks.

Report Scope of U.S. Nutritional Supplements Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 116.77 Billion |

| Market Size by 2034 |

USD 167.79 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 4.11% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Consumer Group, Formulation, Sales Channel, Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Glanbia PLC; Abbott; Nestlé Health Science; Herbalife International of America, Inc.; Amway Corp.; PepsiCo; Mondelez International group (Clif Bar & Company); SiS (Science in Sport) PLC; THG PLC; CSN |

Market Driver: Growing Preventive Health Awareness Among U.S. Consumers

The leading driver of the U.S. nutritional supplements market is the increasing consumer focus on preventive health and wellness. Rising healthcare costs, coupled with heightened awareness of chronic disease risks, are prompting individuals to take proactive measures to maintain physical and mental well-being. According to the CDC, over 60% of American adults live with at least one chronic condition such as heart disease, obesity, or diabetes—conditions largely influenced by lifestyle and diet.

In this context, nutritional supplements are perceived as accessible, affordable tools to fill dietary gaps, manage symptoms, and support overall vitality. Popular products such as omega-3s, magnesium, probiotics, and vitamin D are linked to immune resilience, mental clarity, heart health, and inflammation control. The shift toward self-care, especially post-pandemic, has amplified daily supplementation routines across age groups. The mainstreaming of these habits, along with increasing integration into digital health ecosystems, is fueling sustained market growth.

Market Restraint: Regulatory and Quality Control Challenges

One of the core restraints in the market is quality control inconsistency and regulatory limitations in ensuring product safety and efficacy. The U.S. FDA classifies dietary supplements as food, not drugs, under DSHEA. As a result, manufacturers are not required to prove efficacy before marketing their products. While this regulatory structure allows for innovation and rapid commercialization, it also opens the door to misleading claims, mislabeling, and substandard formulations.

Reports of supplements with incorrect dosages, undisclosed ingredients, or contamination—especially from lesser-known online brands—have led to increased consumer skepticism. These issues are particularly concerning in high-demand segments such as weight loss, testosterone boosters, and brain enhancers. The lack of mandatory pre-market approval may undermine consumer trust and create friction for new entrants. To address this, many established brands voluntarily pursue third-party certifications (e.g., NSF, USP) to enhance transparency and credibility.

A transformative opportunity for the U.S. nutritional supplements market lies in the personalization of nutrition via digital technologies and precision health platforms. With advancements in genomics, microbiome profiling, wearable integration, and AI-driven health assessments, supplement companies are delivering hyper-personalized regimens based on individual biomarkers, diet patterns, sleep quality, and fitness data.

For example, companies like Care/of, Persona Nutrition, and Rootine offer online quizzes, blood tests, or DNA kits to tailor supplement packs delivered directly to consumers. These platforms also provide real-time tracking, dosage adjustments, and wellness coaching—creating high levels of user engagement and brand loyalty. As consumers become more data-savvy and expect personalization in every aspect of their lifestyle, digital health personalization offers immense growth potential, particularly among millennials and Gen Z.

U.S. Nutritional Supplements Market By Product Insights

Dietary supplements continue to dominate the U.S. nutritional supplements market, with a broad consumer base encompassing adults, children, geriatrics, and pregnant women. Multivitamins, vitamin D, calcium, magnesium, and omega-3s lead the charge, addressing common nutritional deficiencies and preventive health needs. The growing trend of combining vitamins with functional botanicals—such as turmeric, elderberry, and ashwagandha—is expanding the product landscape. Dietary supplements are widely available across all retail formats and enjoy high consumer trust due to legacy brand presence and extensive clinical backing.

Sports nutrition is the fastest growing segment, rapidly evolving from an athlete-focused niche into a broader lifestyle category. Protein powders, BCAAs, electrolytes, and pre-workout blends are increasingly consumed by recreational gym-goers, endurance athletes, and health-focused adults. Whey protein isolate and plant-based proteins like pea and lentil are in high demand, with clean-label and vegan variants gaining traction. The segment is also seeing innovation in delivery forms such as energy gels, performance gummies, and infused beverages, attracting a younger, active demographic.

U.S. Nutritional Supplements Market By Consumer Group Insights

The adult segment dominated the market with a share of 51.3% in 2024 Accounting for a large portion of multivitamin, protein, and lifestyle supplement consumption. This group seeks wellness maintenance, energy, cognitive support, and immunity, often combining dietary supplements with fitness and nutrition goals. As they juggle work, parenting, and aging concerns, their supplement choices reflect a preventive and performance-focused mindset.

The geriatric segment is expected to witness considerable growth over the forecast period. With tailored products for bone health, hormonal balance, menopause support, and cardiovascular wellness. Older adults increasingly adopt calcium, vitamin D, and joint health supplements to support mobility and independence. Meanwhile, the women’s health category is flourishing with targeted SKUs for fertility, PMS relief, prenatal/postnatal care, and mood support, reflecting an era of personalized, life-stage-specific supplementation.

The powder segment dominated the market with a share of 39.0% in 2024. This traditional format offers cost efficiency, convenience, and extended shelf life, making it the preferred choice for multivitamins, minerals, and herbal blends. Tablets are particularly common in mass-market and private label offerings, as they support bulk packaging and long-term supplementation regimens. Despite competition from newer formats, their affordability and brand trust keep them widely adopted.

The capsules segment is expected to grow at the fastest CAGR of 7.2% over the forecast period Gummies offer a flavorful, easy-to-consume format with increasing inclusion of vitamins, omega-3s, and even functional mushrooms. Powders are highly favored in sports nutrition and wellness beverages, allowing for flexible dosing and fast absorption. Protein, collagen, and greens powders dominate this space, with mix-in formats expanding across lifestyle categories like beauty, sleep, and digestion.

U.S. Nutritional Supplements Market By Sales Channel Insights

The brick-and-mortar segment dominated the market with a share of 58.2% in 2024. Consumers prefer shopping in physical stores where they can seek advice from familiar staff, especially when navigating the wide range of supplement options available. In-store experiences provide a sense of trust and reliability that online shopping may not offer, as consumers can directly evaluate product quality through labeling and packaging. In addition, physical stores often provide convenience for those who wish to make spontaneous purchases without waiting for delivery times.

The e-commerce segment is expected to grow at the fastest CAGR of 6.4% over the forecast period. Online shopping allows consumers to browse various nutritional supplements from various brands and compare prices easily without leaving home. E-commerce platforms also provide detailed product information, reviews, and ratings that help consumers make informed purchasing decisions. In addition, the rise of subscription-based services and targeted marketing, such as personalized supplement recommendations based on health goals, is further driving online sales.

U.S. Nutritional Supplements Market By Application Insights

The weight management segment dominated the market with a share of 58.2% in 2024. As more people become aware of the health risks associated with excess weight, including heart disease, diabetes, and joint problems, there is a growing interest in products that support healthy weight loss and maintenance. Supplements such as fat burners, appetite suppressants, and metabolism boosters are becoming popular as individuals seek additional ways to manage their weight alongside diet and exercise. The increasing focus on fitness and body image and the desire for quick and convenient solutions have also driven demand for weight management products.

The sports & athletics segment is expected to grow at the fastest CAGR of 9.9% over the forecast period. With the growing number of individuals engaging in physical activities, from recreational fitness enthusiasts to competitive athletes, there is an increasing need for supplements that aid in muscle recovery, endurance, and overall performance. Products such as protein powders, amino acids, creatine, and electrolytes are sought after to improve strength, energy, and hydration. The growing emphasis on healthy living and sports participation, combined with the desire to optimize athletic performance, is contributing to this trend. With greater awareness of the role nutrition plays in performance, the sports and athletics application segment in the nutritional supplements market is expected to continue growing.

Country-Level Analysis

Within the U.S., consumer behavior and purchasing trends vary by geography, lifestyle, and healthcare accessibility. Urban centers such as New York, Los Angeles, San Francisco, and Chicago exhibit a high penetration of premium, organic, and niche supplement brands. These markets often favor plant-based, sustainable, and personalized formulations. Coastal cities also show higher adoption of wellness platforms and app-integrated supplementation.

Midwestern and Southern states contribute heavily to mass-market supplement consumption, with leading sales in multivitamins, weight loss products, and sports nutrition. Retail pharmacies dominate these markets, supported by extensive shelf availability and promotional pricing. Meanwhile, digital-first states like California and Texas have seen strong uptake of subscription services and tele-nutrition brands, reflecting a growing demand for accessible, tech-driven health solutions.

Some of the prominent players in the U.S. nutritional supplements market include:

- Glanbia PLC

- Abbott.

- Nestlé Health Science

- Herbalife International of America, Inc.

- Amway Corp.

- PepsiCo

- Mondelez International group (Clif Bar & Company)

- SiS (Science in Sport) PLC

- THG PLC

- CSN

U.S. Nutritional Supplements Market Recent Developments

- In May 2025, Pharmavite LLC, a nutrition-powered wellness company and creator of Nature Made vitamins, launched its new manufacturing and research & development facility in New Albany, Ohio. The opening of the new 225,000 square-foot facility fuels the production of Nature Made vitamin gummies and also strengthens the product research & development section with Pharmavite’s Gummies Innovation Center of Excellence.

- In November 2024, Persona Nutrition, a pioneering subscription-based personalized vitamins and supplements supplying company, launched its white-labelling service for new or well-established businesses and personalities seeking expansion in the personalized nutrition subscription market through tailored business-to-business (B2B) offering.

- In October 2024, Ultisana, a popular nutraceutical brand tried-and-true among healthcare professionals across Central America, declared its launch in the U.S. market with the introduction of its three breakthrough supplement products, namely COGNIFORTE, DIABERINE, and STAMINA. These products are scientifically formulated solutions for metabolic balance, cognitive enhancements and stress relief.

- In September 2024, Factor, the leading ready-to-eat (RTE) meal delivery service, launched Factor Form, a new supplements brand which features a line-up of greens powder, protein powder and hydration packs approved by dietitians supporting on-the-go nutrition.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. nutritional supplements market

By Product Type

-

-

-

- Egg Protein

- Soy Protein

- Pea Protein

- Lentin Protein

- Hemp Protein

- Casein

- Quinoa Protein

- Whey Protein

-

-

-

-

- Whey Protein Isolate

- Whey Protein Concentrate

-

-

-

- Calcium

- Potassium

- Magnesium

- Iron

- Zinc

-

-

-

- BCAA

- Arginine

- Aspartate

- Glutamine

- Beta Alanine

- Creatine

- L-carnitine

-

-

- Probiotics

- Omega-3 Fatty Acids

- Carbohydrates

-

-

-

- Maltodextrin

- Dextrose

- Waxy Maize

- Karbolyn

-

-

- Detox Supplements

- Electrolytes

- Others

-

-

- Isotonic

- Hypotonic

- Hypertonic

-

-

- Protein Bars

- Energy Bars

- Protein Gel

-

- Meal Replacement Products

- Weight Loss Product

-

- Green Tea

- Fiber

- Protein

- Green Coffee

- Others

-

-

- Multivitamin

- Vitamin A

- Vitamin B

- Vitamin C

- Vitamin D

- Vitamin E

-

- Minerals

- Enzymes

- Amino Acids

- Conjugated Linoleic Acids

- Others

- Functional Foods and Beverages

-

- Probiotics

- Omega-3

- Others

By Formulation

- Tablets

- Capsules

- Powder

- Softgels

- Liquid

- Others

By Sales Channel

-

- Direct Selling

- Chemist/ Pharmacies

- Health Food Shops

- Hyper Markets

- Super Markets

By Consumer Group

-

- Age Group 21 to 30

- Age Group 31 to 40

- Age Group 41 to 50

- Age Group 51 to 65

By Application

- Sports & Athletics

- General Health

- Bone & Joint Health

- Brain Health

- Gastrointestinal Health

- Immune Health

- Cardiovascular Health

- Skin/ Hair/ Nails

- Sexual Health

- Women Health

- Anti-Aging

- Weight Management

- Others