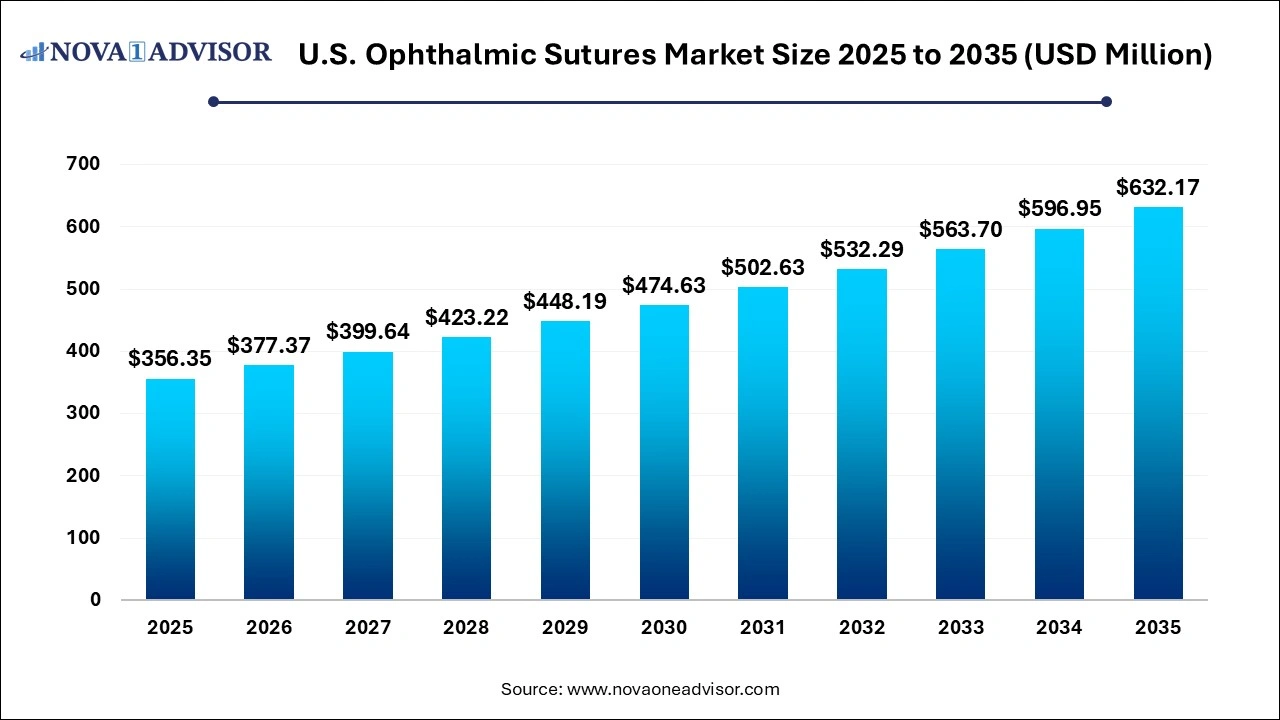

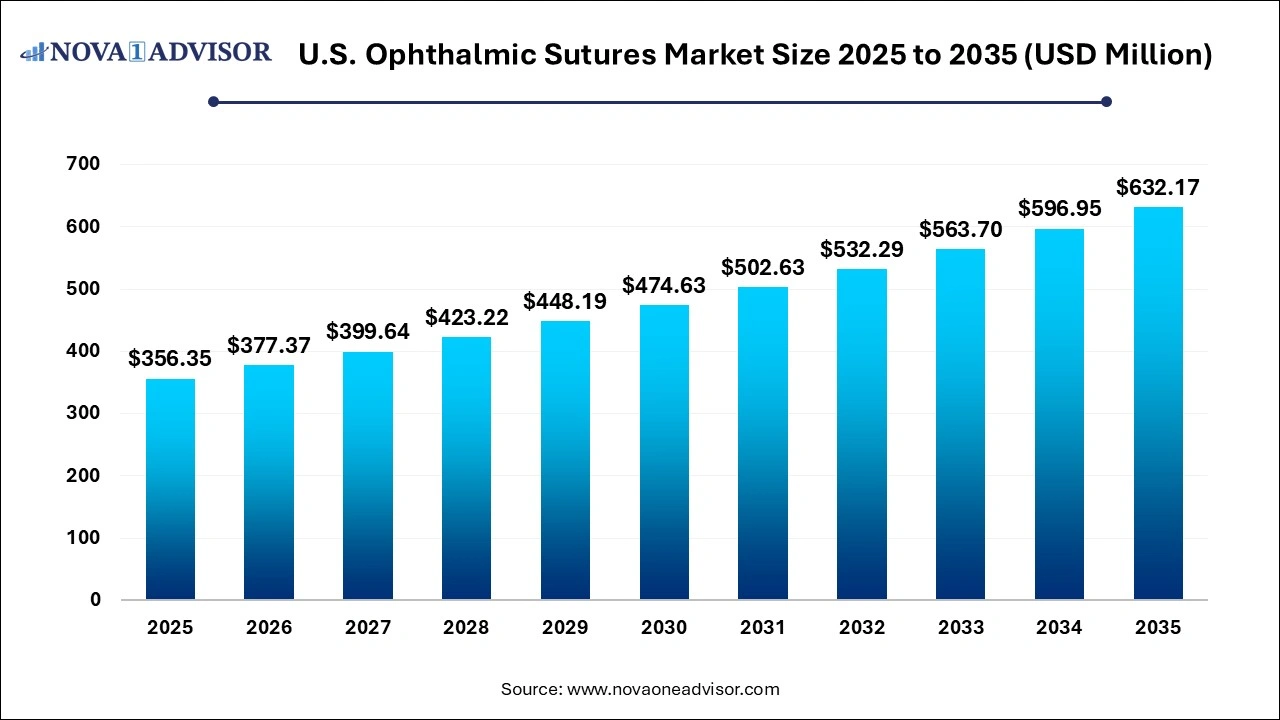

U.S. Ophthalmic Sutures Market Size and Growth 2026 to 2035

The U.S. ophthalmic sutures market size was exhibited at USD 356.35 million in 2025 and is projected to hit around USD 632.17 million by 2035, growing at a CAGR of 5.9% during the forecast period 2026 to 2035.

U.S. Ophthalmic Sutures Market Key Takeaways

- The U.S. natural ophthalmic sutures market share is expected to reach around USD 170 million through 2035.

- The synthetic segment is the fastest growing in the U.S. Ophthalmic Sutures Market

- The uncoated segment leads in the U.S. ophthalmic sutures market

- U.S. ophthalmic sutures market share from the coated segment is expected to grow with more than 5.4% CAGR by 2035.

- The corneal transplantation surgery segment dominated the market share in the U.S. ophthalmic sutures market in 2025.

- The industry size from the cataract surgery segment is anticipated to record more than 5.6% CAGR through 2035.

- The U.S. ophthalmic sutures market share from the hospital segment held a dominant market share in 2025 and is projected to touch USD 300 million through 2035.

- The ambulatory surgical centers segment fastest growing in the U.S. ophthalmic sutures market.

U.S. Ophthalmic Sutures Market Outlook

- Market Growth Overview: The U.S. ophthalmic sutures market is expected to grow significantly between 2025 and 2034, driven by the rising aging population, rise in eye conditions, and trends towards outpatient surgeries in ASCs and hospitals, and rising demand for efficient wound closure.

- Sustainability Trends: Sustainability trends involve focusing on rising biodegradable and bio-based materials, eco-friendly alternatives, and eco-friendly packaging and production.

- Major Investors: Major investors in the market include Johnson & Johnson, Medtronic, B. Braun, Alcon, Smith & Nephew, Teleflex, Mani Inc., DemeTECH, and Aurolab.

Artificial Intelligence: The Next Growth Catalyst in U.S. Ophthalmic Sutures

AI is transforming the U.S. ophthalmic sutures industry by enhancing surgical precision through AI-powered, robotic-assisted, and image-guided procedures that optimize wound closure accuracy. The integration of AI algorithms allows for real-time tissue recognition during complex, delicate eye surgeries, which in turn drives demand for advanced, specialized suture materials compatible with these modern, minimally invasive techniques. Furthermore, AI facilitates the development of "smart" or bioengineered sutures designed to monitor healing through sensors or release therapeutic agents, signaling a shift toward more personalized, tech-enabled postoperative care.

U.S. Ophthalmic Sutures Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 377.37 Million |

| Market Size by 2035 |

USD 632.17 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 5.9% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Type, By Material, By Coating, By Material Structure, By Absorptio, By Application, By End-use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Medtronic, Mani, Corza Medical, Teleflex Incorporated, Ethicon (Johnson & Johnson), B. Braun Melsungen AG |

Segment Analysis

By Type Analysis

How did the synthetic segment grow the fastest in the U.S. Ophthalmic Sutures Market?

The synthetic segments have superior tensile strength and reduced immunogenicity, which are critical for minimizing inflammation in delicate eye tissues. The shift toward these advanced polymers is accelerated by predictable absorption rates and enhanced handling characteristics that allow for greater precision in complex procedures like vitrectomies. Furthermore, the integration of antimicrobial coatings and ultra-fine diameters addresses the rising demand for better infection control and faster patient recovery times.

By Coating Analysis

How did the uncoated segment lead in the U.S. ophthalmic sutures market?

The uncoated segments' growth is driven by their superior knot security and minimal risk of foreign body reactions in sensitive ocular tissues. Their inherent reliability and high versatility make them an indispensable staple for high-volume procedures such as cataract removal and corneal transplantations. Ultimately, the absence of complex coatings ensures predictable performance and long-term wound closure stability, sustaining their widespread adoption among ophthalmic surgeons.

By Application Analysis

How did the corneal transplantation surgery segment dominate the market share in the U.S. ophthalmic sutures market?

The corneal transplantation surgery segment is dominated by the rising prevalence of conditions like Fuchs' dystrophy and keratoconus. This demand is sustained by a robust healthcare infrastructure that enables advanced, high-precision surgical techniques such as DMEK, which require specialized, micro-diameter synthetic sutures for optimal graft stability. Furthermore, favorable reimbursement policies and increased awareness of vision-restoring procedures have significantly expanded patient access to these life-changing interventions.

By End-Use Analysis

How did the ambulatory surgical centers segment fastest growing in the U.S. ophthalmic sutures market?

The ambulatory surgical centers are driven by the operational efficiency and cost-effectiveness of ASCs, which allow for rapid turnaround times in high-volume surgeries such as cataract removals and glaucoma treatments. Consequently, the rising demand for minimally invasive techniques within these centers necessitates a steady supply of high-precision, specialized sutures to accommodate an aging population requiring vision-restoring interventions.

U.S. Ophthalmic Sutures Market Companies

- Medtronic: As a top-tier player, Medtronic provides a wide range of specialized, high-performance absorbable and non-absorbable sutures designed for delicate, minimally invasive eye surgeries.

- Mani: Known for superior sharpness, Mani contributes to the U.S. market by offering specialized, high-quality needles and sutures tailored for precise ocular tissue approximation.

- Corza Medical: As a dedicated leader, Corza Medical provides a comprehensive portfolio of ophthalmic sutures, including the high-end Sharpoint and Onatec lines specialized for ocular, oculoplastic, and cataract surgeries.

- Teleflex Incorporated: Teleflex contributes to the U.S. ophthalmic market by offering specialized, high-precision surgical instruments and suture products designed for delicate ophthalmic procedures.

- Ethicon (Johnson & Johnson): As the leading global suture manufacturer, Ethicon dominates the U.S. market with a broad portfolio of innovative, high-quality absorbable and non-absorbable products, such as Ethilon.

- B. Braun Melsungen AG: B. Braun enhances the U.S. ophthalmic sutures market by focusing on high-quality, biocompatible solutions with excellent, surgeon-friendly handling properties.

Value Chain Analysis of the U.S. Ophthalmic Sutures Market

- Raw Material Sourcing & Development: This upstream stage involves procuring high-grade raw materials for both natural and synthetic sutures, including polyglycolic acid (PGA), polydioxanone, nylon, and silk.

Key Players: Evonik, DSM Biomedical

- Manufacturing and Quality Control (R&D & Production): This stage transforms raw materials into finished ophthalmic sutures, including needle attachment and coating. Key Players: Johnson & Johnson (Ethicon), Alcon Inc., B. Braun Melsungen AG, Medtronic, Corza Medical, Surgical Specialties Corporation, and Kono Seisakusho Co., Ltd.

- Distribution and Logistics: Finished sutures are transported through a complex network, including direct sales to hospitals, medical distributors, and e-commerce platforms.

Segments Covered in the Report

This report forecasts the volume and revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2035. For this study, Nova one advisor has segmented the U.S. ophthalmic sutures market.

By Type

- Natural

- Synthetic

- By Material

- Nylon

- Polyproplene

- Silk

- PGA

- Others

By Coating

By Material Structure

- Monofilament

- Multifilament/Braided

By Absorption

- Absorbable

- Non-absorbable

By Application

- Cataract Surgery

- Corneal Transplantation Surgery

- Glucoma Surgery

- Vitrectomy

- Oculoplastic surgery

- Others

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Others