U.S. Over-the-Counter Hearing Aids Market Size and Trends

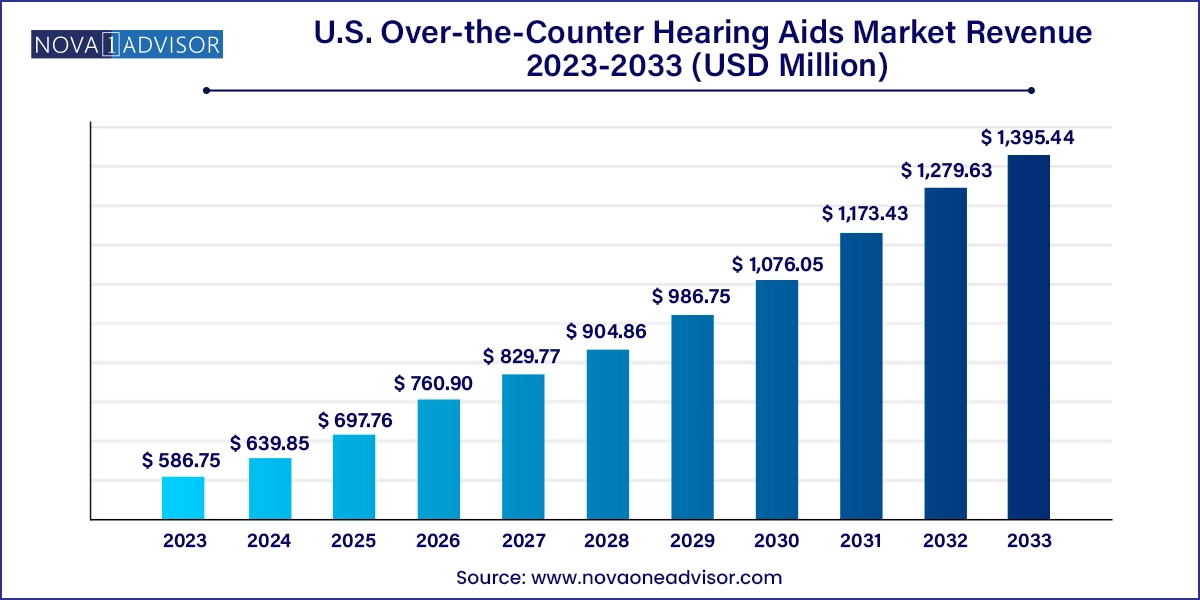

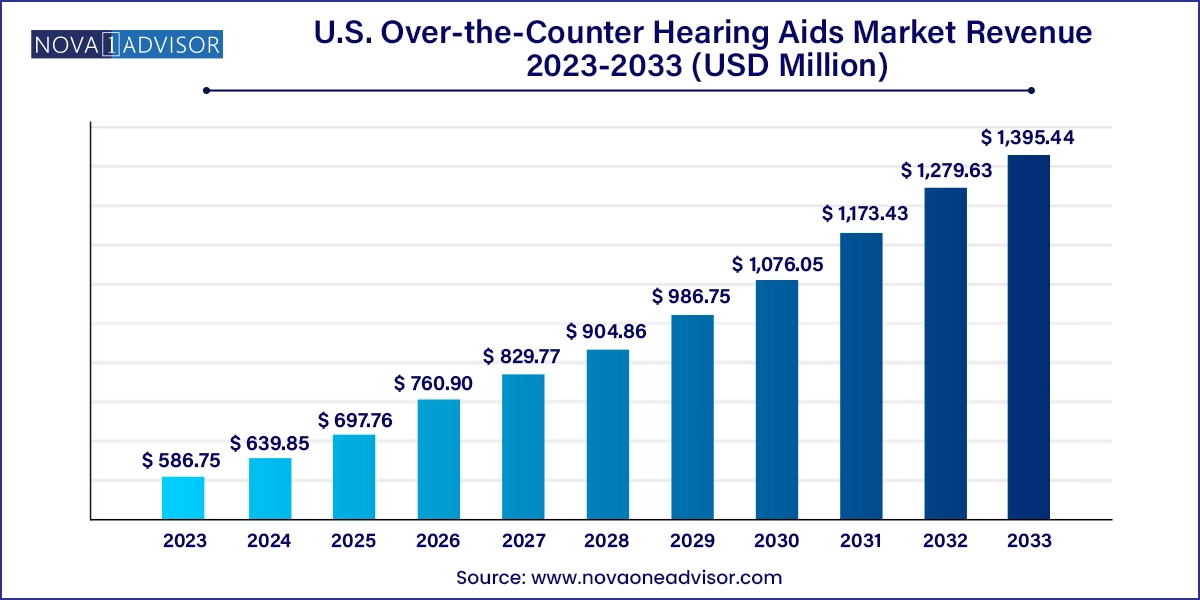

The U.S. Over-the-Counter hearing aids market size was exhibited at USD 586.75 million in 2023 and is projected to hit around USD 1,395.44 million by 2033, growing at a CAGR of 9.05% during the forecast period 2024 to 2033.

U.S. Over-the-Counter Hearing Aids Market Key Takeaways:

- The canal hearing aids segment dominated the market, accounting for the largest share of 33.05% in 2023.

- The retail stores segment dominated the market, with a share of 48.90% in 2023.

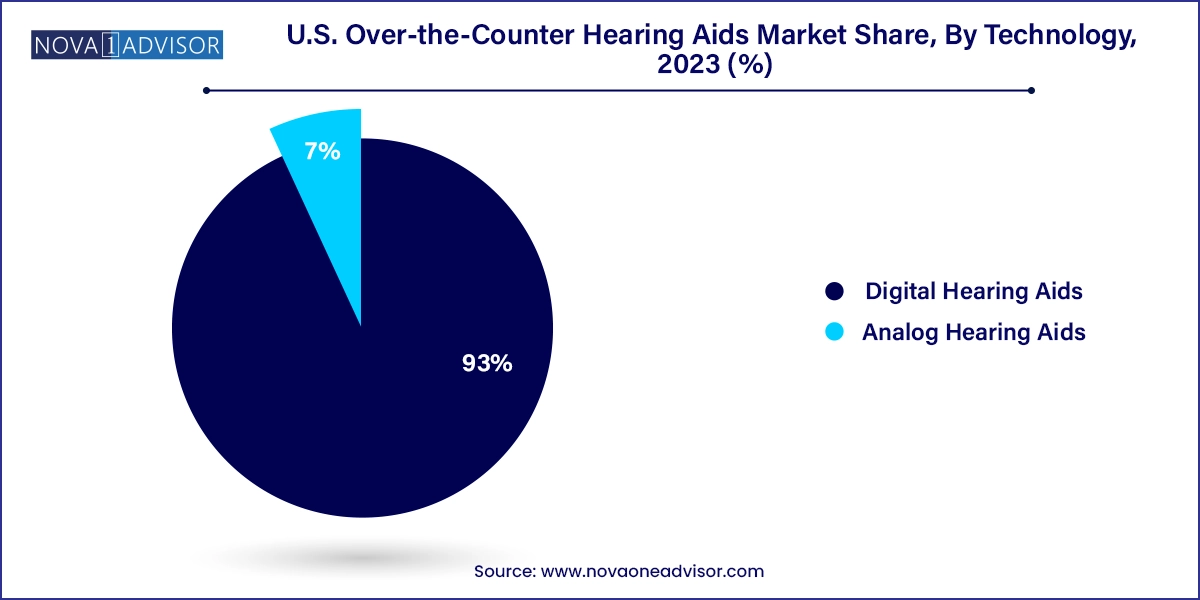

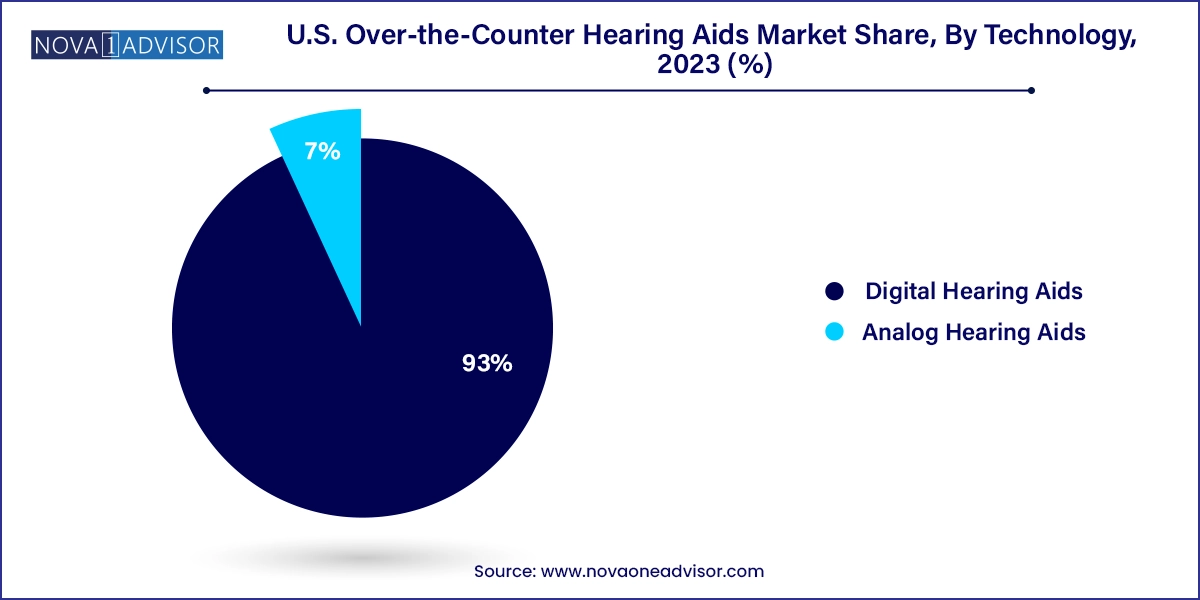

- Based on technology, the digital hearing aids segment dominated the market with a share of 93.0% in 2023.

- The analog segment is expected to witness substantial growth over the forecast period.

Market Overview

The U.S. Over-the-Counter (OTC) hearing aids market is undergoing a paradigm shift, marked by expanding accessibility, increasing technological innovation, and evolving consumer behavior. Traditionally dominated by prescription-based models and audiologist-controlled distribution, the market began a new chapter following the FDA’s final ruling in October 2022 to establish a regulatory category for OTC hearing aids. This ruling permitted adults with perceived mild to moderate hearing loss to purchase hearing aids directly, without needing a prescription, medical exam, or fitting from a licensed provider.

This regulatory change unlocked a previously underserved and often overlooked segment of the population. According to the National Institute on Deafness and Other Communication Disorders (NIDCD), approximately 28.8 million U.S. adults could benefit from hearing aids, yet only about 16% of those aged 20–69 who need them actually use them. High costs, limited access to specialists, and social stigma have historically been barriers. OTC hearing aids aim to break down these barriers, offering affordable, user-friendly, and technologically sophisticated options across mainstream retail and online channels.

Today’s OTC devices feature advanced audio processing, Bluetooth connectivity, rechargeable batteries, and smartphone compatibility—bringing them closer to consumer electronics than traditional medical devices. Tech giants like Bose, Sony, and Jabra have entered the market, leveraging their expertise in sound engineering and user experience. This intersection of healthcare and consumer electronics is not only disrupting the traditional hearing care model but also democratizing access to hearing solutions in a way previously unimagined.

Major Trends in the Market

-

Mainstream Consumer Electronics Brands Entering the Market: Companies like Sony, Jabra, and Bose are launching OTC hearing aids, leveraging brand recognition and expertise in audio technologies.

-

Rise of Self-Fitting and App-Based Personalization: OTC hearing aids now often include mobile apps allowing users to self-administer hearing tests and customize sound profiles.

-

Growth in Online and Subscription-Based Distribution Models: Consumers are increasingly purchasing devices online, with some companies offering monthly subscription services and bundled care plans.

-

Increased Focus on Aesthetics and Discreet Design: Sleek, nearly invisible form factors are gaining traction among image-conscious consumers.

-

Digital Marketing and Influencer Promotion: Brands are using influencer campaigns, digital tutorials, and testimonials to educate and build trust with first-time users.

-

Dual-Use Devices (Hearing Aids + Earbuds): Hybrid devices that function as both hearing aids and wireless earbuds for music/phone calls are becoming increasingly popular.

-

AI and Noise Cancellation Capabilities: High-end OTC models are integrating machine learning to differentiate between speech and background noise, enhancing clarity.

-

Insurance Reimbursement and HSA/FSA Eligibility Expansion: Some insurers and benefit providers are now beginning to include partial coverage for OTC hearing devices.

Report Scope of U.S. Over-the-Counter Hearing Aids Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 639.85 Million |

| Market Size by 2033 |

USD 1,395.44 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 9.05% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Technology, Distribution Channel |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

Eargo Inc.; GN Store Nord A/S (Jabra); Bose Corporation; MDHearing; Audicus; Sony Corporation; Starkey Laboratories, Inc. (Starkey); hearX IP (Pty) Ltd. (Lexie); Sonova; WSAudiology; NUHEARA LIMITED; Audien Hearing; Novidan. |

A major driver for the OTC hearing aids market in the U.S. is the rising prevalence of mild to moderate hearing loss among aging adults and younger populations exposed to prolonged loud noises. Hearing loss is not only a natural consequence of aging but also a growing concern among young adults due to headphone overuse, exposure to loud work environments, and recreational activities. According to the CDC, about 1 in 8 people in the U.S. aged 12 or older have hearing loss in both ears, based on standard hearing examinations.

What makes this statistic particularly critical for the OTC market is that most of these individuals experience mild to moderate hearing loss—the precise category eligible for OTC devices. These individuals often delay or avoid seeking professional help due to cost or inconvenience, making the OTC option especially attractive. Additionally, as public awareness increases regarding the correlation between untreated hearing loss and cognitive decline, depression, and social isolation, there is growing urgency to provide accessible, affordable interventions. OTC hearing aids fulfill this need by enabling early adoption and encouraging proactive hearing care.

Key Market Restraint – Limited Consumer Education and Device Misuse

One of the most significant challenges in the U.S. OTC hearing aids market is consumer unfamiliarity with self-fitting devices and a lack of clinical oversight, which can result in improper use, dissatisfaction, or even worsened hearing issues. While these devices are designed to be self-administered, the reality is that hearing loss can be complex. Users often struggle to determine the severity of their hearing impairment, interpret sound configuration settings, or differentiate between device malfunctions and personal adaptation issues.

Moreover, without professional counseling or fitting, users may have unrealistic expectations or abandon the device due to discomfort or perceived ineffectiveness. This has implications for return rates, brand loyalty, and overall trust in OTC hearing solutions. Although mobile apps and virtual support aim to address this, the learning curve remains steep for elderly users or those not digitally literate. This challenge underscores the importance of user-friendly interfaces, clear educational content, and potential hybrid models that blend digital convenience with occasional professional guidance.

Key Market Opportunity – Integration of OTC Hearing Aids with Smart Health Ecosystems

A promising opportunity lies in the integration of OTC hearing aids into broader smart health ecosystems, where hearing devices become part of the digital wellness landscape. As wearables, fitness trackers, and health-monitoring apps become standard, the potential for hearing aids to join this network is immense. New-generation OTC hearing aids can track hearing health metrics, alert users to environmental noise hazards, and even sync with smartwatches or health apps for real-time adjustments and monitoring.

Tech companies entering this space are uniquely positioned to pioneer this integration. Imagine a scenario where a user’s hearing aid automatically adapts to noisy environments detected via a smartphone’s location services, or where AI-driven analytics suggest hearing care adjustments based on sleep patterns and activity levels. By aligning with health trends and empowering users through data, OTC hearing aid manufacturers can not only improve user satisfaction but also tap into the rapidly growing market of health-conscious consumers seeking holistic care solutions.

U.S. Over-the-Counter Hearing Aids Market By Product Insights

Behind-the-Ear (BTE) hearing aids dominated the U.S. OTC hearing aids market in 2023, largely due to their universal fit, comfort, and versatility for users across a broad range of hearing loss levels. BTE devices are known for their larger size, which allows for stronger amplification and longer battery life. For first-time users seeking ease of use and reliability, BTE options provide a comfortable entry point. Furthermore, many of the popular OTC devices from leading brands such as Eargo and Lexie offer compact BTE-style designs that discreetly sit behind the ear while housing advanced technological components.

On the other hand, Receiver-in-the-Ear (RITE) devices are emerging as the fastest-growing product segment. These hearing aids offer a blend of comfort, aesthetics, and superior sound quality. Their receiver sits inside the ear canal while the rest of the device rests behind the ear, offering a more natural hearing experience and clearer sound fidelity. Their discreet profile makes them a favorite among younger users and tech-forward consumers. Additionally, the customizable nature of RITE devices, often enhanced via smartphone apps, appeals to users who value self-managed hearing solutions and enhanced personalization.

U.S. Over-the-Counter Hearing Aids Market By Distribution Channel Insights

Retail stores continue to dominate the distribution landscape, particularly large pharmacy and electronics chains like Walgreens, CVS, Best Buy, and Walmart. These retailers have embraced the OTC hearing aid category by dedicating shelf space, offering in-store trials, and training staff to assist first-time buyers. The trust and familiarity consumers have with these retail brands play a crucial role in reducing hesitation around first-time purchases. In addition, these locations enable impulse purchases and allow customers to physically inspect products—a major plus for users still skeptical about device comfort and performance.

Online sales, however, are the fastest-growing channel, spurred by e-commerce convenience, broader product variety, and better pricing transparency. The ability to browse reviews, access expert consultations via chat or video, and purchase subscription bundles appeals to digitally savvy consumers. Brands like Lexie and Eargo have built strong DTC models, offering at-home hearing tests, app-guided setup, and remote customer support. As consumers continue to prioritize convenience and self-directed health decisions, online distribution will play a central role in expanding market penetration.

U.S. Over-the-Counter Hearing Aids Market By Technology Insights

Digital hearing aids dominate the market due to their superior audio processing, programmability, and compatibility with smartphones and Bluetooth-enabled devices. Digital technology enables real-time sound analysis, background noise reduction, and speech enhancement—all essential for delivering a tailored user experience. With modern OTC devices relying heavily on app-based adjustments, digital processing becomes non-negotiable. Brands like Jabra Enhance and Sony’s CRE-C10 have set benchmarks by offering premium digital features at accessible price points.

Analog hearing aids, though still present, represent a shrinking share, yet continue to serve niche markets. However, they are being rapidly outpaced by digital alternatives as the latter become more affordable and user-friendly. That said, some consumers who prioritize simplicity, especially elderly individuals unfamiliar with digital interfaces, may still opt for analog devices. Despite this, the overall trajectory clearly favors digital advancement as the standard for OTC offerings.

Country-Level Analysis

In the U.S., the market is being reshaped by regulatory reform, changing consumer perceptions, and increasing tech adoption. Suburban and urban areas show the highest demand due to access to retail outlets and higher awareness about hearing health. Meanwhile, rural regions are seeing rising interest in online purchases, helping bridge geographic access gaps. Educational initiatives by the FDA and health organizations are improving understanding and trust in OTC options across age groups.

Generational preferences are also shaping the landscape. Baby Boomers—many now entering their 70s—are actively seeking affordable, easy-to-use hearing solutions to maintain social engagement and quality of life. Millennials and Gen Xers, increasingly experiencing early-onset hearing loss due to lifestyle factors, are opting for hybrid earbud-hearing devices with dual functionality. Across all age groups, the growing normalization of hearing aids—akin to wearing glasses—is reducing stigma and encouraging early adoption.

Some of the prominent players in the U.S. Over-the-Counter hearing aids market include:

- Eargo Inc.

- GN Store Nord A/S (Jabra)

- Bose Corporation

- MDHearing

- Audicus

- Sony Corporation

- Starkey Laboratories, Inc. (Start Hearing)

- hearX IP (Pty) Ltd. (Lexie)

- Sonova

- WSAudiology

- NUHEARA LIMITED

- Audien Hearing

- Novidan

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Over-the-Counter hearing aids market

Product

- In-the-Ear Hearing Aids

- Receiver-in-the-Ear Hearing Aids

- Behind-the-Ear Hearing Aids

- Canal Hearing Aids

Technology

- Digital Hearing Aids

- Analog Hearing Aids

Distribution Channel

- Retail Stores

- Audiology Offices

- Online