U.S. Packaged Salads Market Size and Trends

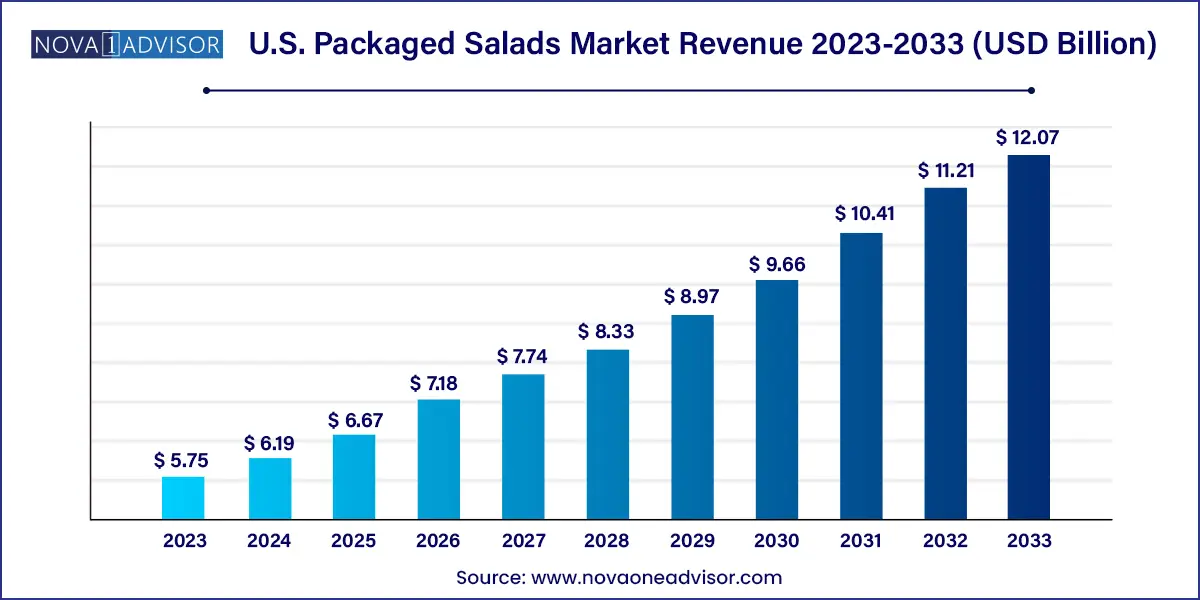

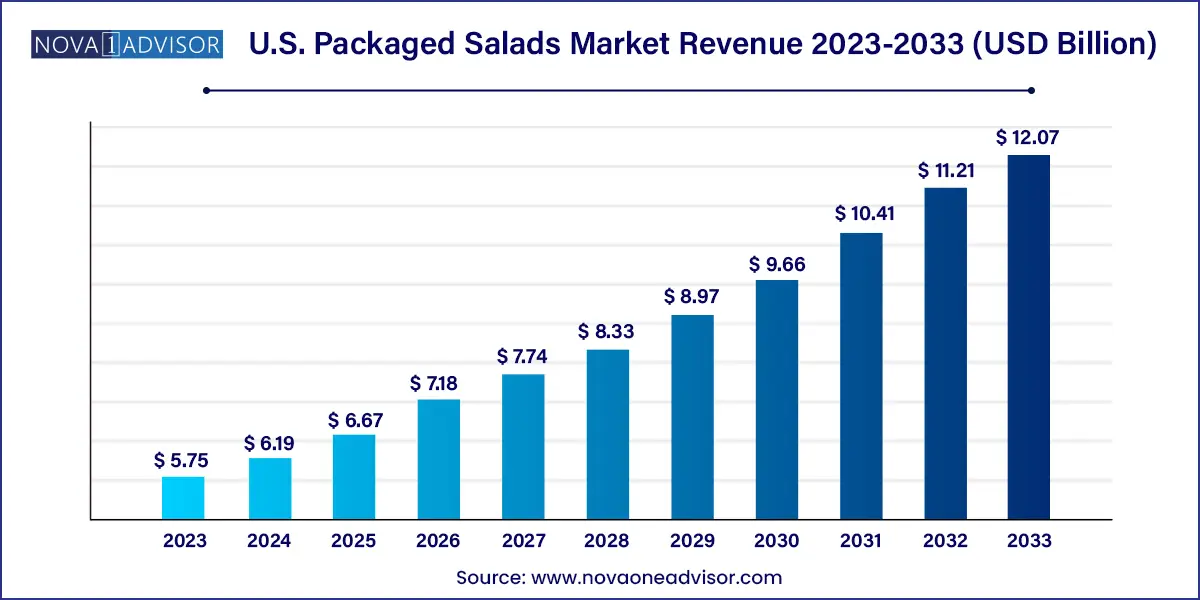

The U.S. packaged salads market size was exhibited at USD 5.75 billion in 2023 and is projected to hit around USD 12.07 billion by 2033, growing at a CAGR of 7.7% during the forecast period 2024 to 2033.

U.S. Packaged Salads Market Key Takeaways:

- The vegetarian packaged salads market segment accounted for a revenue share of 67% in 2023.

- The non-vegetarian packaged salad market is projected to grow at a CAGR of 8.2% from 2024 to 2033.

- The conventional packaged salads market segment accounted for a revenue share of 74.56% in 2023.

- The organic packaged salad market is projected to grow at a CAGR of 8.8% from 2024 to 2033.

- The packaged greens market segment accounted for a revenue share of 63.56% in 2023.

- The packaged kits market segment is projected to grow at a CAGR of 8.5% from 2024 to 2033.

- The branded packaged salads market segment accounted for a revenue share of 77.40% in 2023.

- The in-store/ private label market segment is projected to grow at a CAGR of 9.6% from 2024 to 2033.

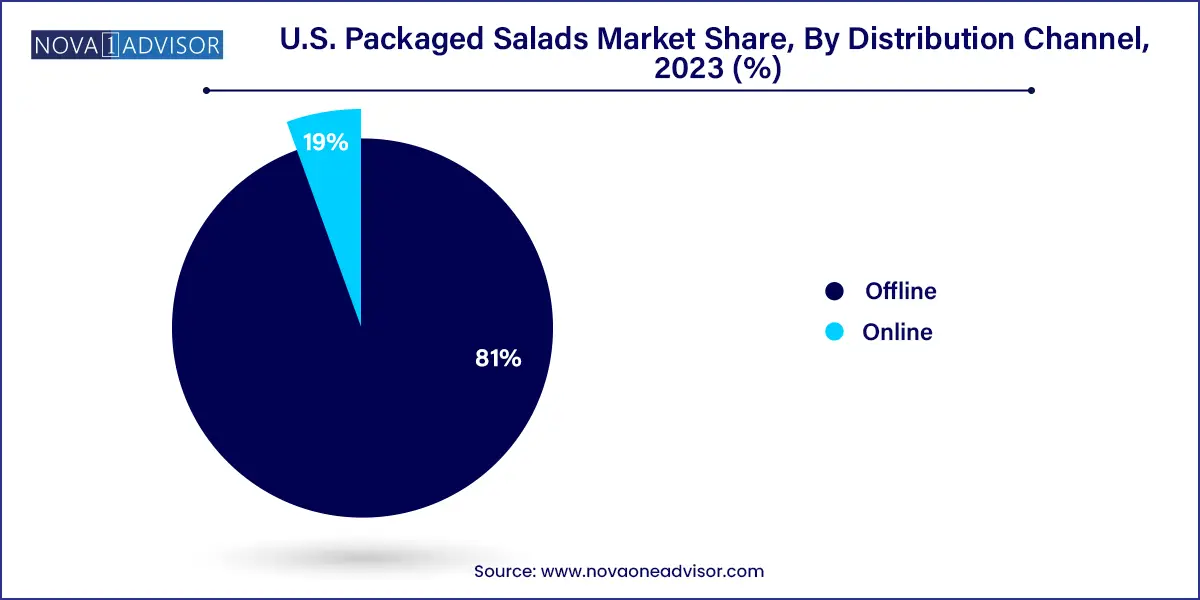

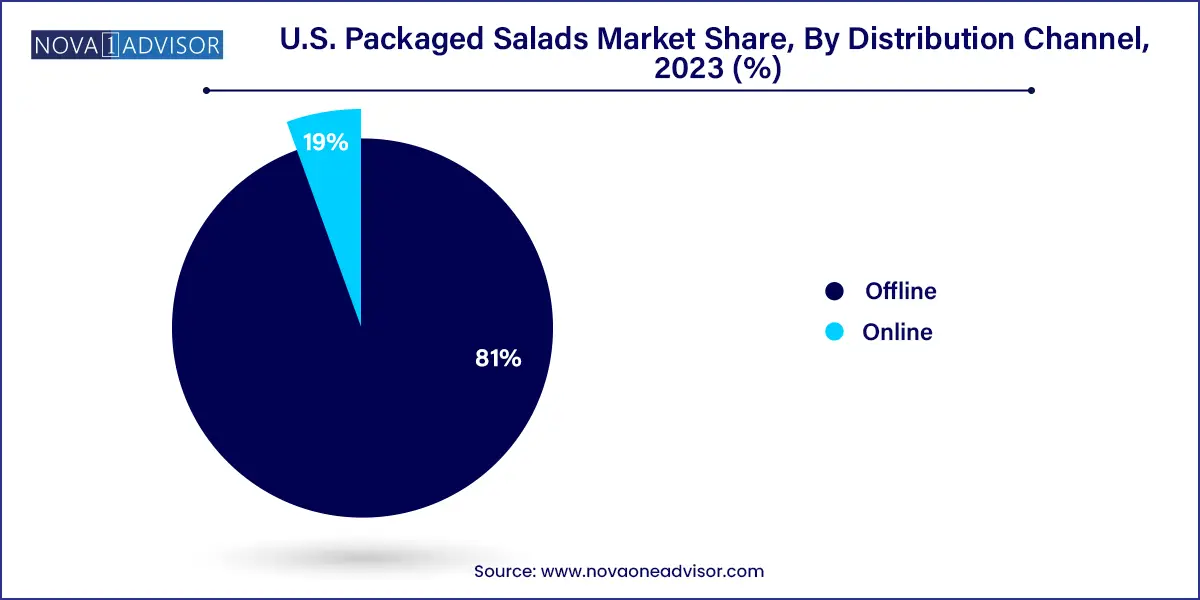

- The sales of packaged salads through offline accounted for a revenue share of 81.0% in 2023.

- The sales of packaged salads through online distribution channels are projected to grow at a CAGR of 10.7% from 2024 to 2033.

Market Overview

The U.S. packaged salads market has experienced significant growth in recent years, becoming a critical component of the country’s ready-to-eat food ecosystem. As consumers increasingly prioritize convenience, health, and sustainability, packaged salads have evolved from a niche offering to a mainstream staple in grocery carts across all income brackets. These salads cater to a range of dietary needs, from plant-based eaters to protein seekers, and are now a popular choice for on-the-go meals, office lunches, and quick dinners.

The market’s momentum is largely fueled by shifting consumer behaviors, notably the rise of the health-conscious millennial and Gen Z segments, and the post-pandemic acceleration of clean eating habits. With more Americans cooking less and relying on meal solutions that are fast, fresh, and nutritious, packaged salads are uniquely positioned to deliver value. From simple greens to chef-inspired kits that include dressings, proteins, and toppings, these products combine the health benefits of raw vegetables with the ease of pre-preparation.

Major retailers have expanded their refrigerated sections to accommodate a growing variety of salad kits, blends, and bowls. The industry is also seeing greater product innovation, including ethnic flavor profiles, organic certifications, sustainable packaging, and protein-rich options using alternative sources like lentils and tofu. Meanwhile, technology-driven supply chain optimization ensures product freshness and extended shelf life, reducing food waste and maintaining consumer trust. As the U.S. continues to navigate trends in health, convenience, and sustainability, the packaged salad market is expected to remain one of the fastest-growing categories within fresh food.

-

Rise of Meal Kit Salads: Packaged salad kits that include greens, proteins, dressing, and toppings offer a full meal solution and have surged in popularity.

-

Plant-Based Protein Integration: Chickpeas, tofu, edamame, lentils, and other plant-based proteins are increasingly used in vegetarian salad kits to boost nutritional appeal.

-

Expansion of Organic Options: Consumers are leaning toward USDA-certified organic salads as concerns grow around pesticide exposure and sustainable agriculture.

-

Global and Gourmet Flavors: Salads inspired by Mediterranean, Southwest, Asian, and Middle Eastern cuisines are attracting adventurous and health-conscious eaters.

-

Transparent and Eco-Friendly Packaging: Consumers favor packaging that is recyclable, compostable, or made from recycled materials, alongside clear visibility of product contents.

-

In-Store Private Labels Competing with National Brands: Supermarkets are investing in branded-quality private label salad lines at competitive price points.

-

Online Grocery and Direct Delivery Growth: Digital platforms, including e-commerce grocers and third-party apps, are increasing access to packaged salads.

-

Functional Nutrition Focus: Salads marketed for gut health, immunity, or weight management—incorporating superfoods and probiotics—are gaining traction.

Report Scope of U.S. Packaged Salads Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 6.19 Billion |

| Market Size by 2033 |

USD 12.07 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Processing, Type, Category, Distribution Channel, State |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

BrightFarms, Inc.; Dole Food Company, Inc.; Earthbound Farm; Eat Smart (Curation Foods); Missionero; Gotham Greens Holdings; PBC; Mann Packaging Co., Inc.; Bonduelle; Fresh Express, Inc.; VegPro Intenational, Inc.; ORGANICGIRL, LLC |

Market Driver: Consumer Shift Toward Health and Convenience

A major driver propelling the U.S. packaged salads market is the rising demand for healthier yet convenient food solutions. In today’s fast-paced lifestyles, consumers are seeking ready-to-eat meals that align with their health goals without compromising on time or taste. Packaged salads fit this niche perfectly, offering nutrient-dense, low-calorie, and fiber-rich alternatives to fast food or heavily processed snacks. According to consumer behavior data, nearly 70% of Americans aim to eat more fruits and vegetables, yet fewer than 10% actually meet daily intake recommendations. Packaged salads bridge this gap by providing pre-washed, chopped, and portioned vegetables in a convenient format.

This behavior is especially prevalent among millennials and Gen Z consumers, who are more likely to read nutrition labels, avoid artificial ingredients, and experiment with plant-based eating. Additionally, rising rates of obesity, diabetes, and cardiovascular diseases have spurred demand for functional foods, reinforcing packaged salads as part of a balanced diet. As awareness continues to grow through public health campaigns and media coverage, more consumers are integrating packaged salads into daily routines—whether at work, school, or home.

Market Restraint: Short Shelf Life and Cold Chain Dependency

One key restraint that continues to challenge the packaged salads market is the limited shelf life of fresh produce and the reliance on cold chain logistics. Unlike canned or frozen products, packaged salads have a short window for consumption, often just five to seven days from packaging. This creates significant pressure on inventory turnover, supply chain coordination, and forecasting accuracy. Retailers must ensure quick restocking, temperature consistency, and appealing in-store presentation to prevent spoilage and product loss.

Moreover, any breach in the cold chain—from production to transportation to retail display—can result in rapid deterioration of quality. The risk of spoilage also extends to consumers, who may avoid purchasing packaged salads if they perceive signs of wilting, browning, or moisture buildup. These issues contribute to food waste, erode brand trust, and place financial burdens on both manufacturers and retailers. Innovations in modified atmosphere packaging (MAP), improved logistics, and transparent “best before” labeling are helping to mitigate these challenges, but cold chain dependency remains a persistent barrier to broader adoption, particularly in rural areas or small-format stores.

Market Opportunity: Premiumization Through Culinary Innovation

A promising opportunity in the U.S. packaged salads market lies in premiumization via culinary-driven innovation. While the category initially grew around basic green blends, today’s consumers are seeking elevated taste experiences, exotic ingredients, and chef-inspired combinations. Brands that offer globally inspired salad kits—such as Thai peanut crunch, Greek feta lemon, or Southwest chipotle black bean—are tapping into the demand for adventurous eating without the effort of cooking.

There is also untapped potential in aligning salad products with functional health goals, such as “power bowls” infused with superfoods (like quinoa, goji berries, or kale), anti-inflammatory dressings, or high-fiber ingredients aimed at digestion and satiety. Collaborations with celebrity chefs, nutritionists, or wellness influencers can add brand value and differentiate premium offerings. Furthermore, the integration of reusable containers, QR-code-based sourcing information, and climate impact scores can enhance brand loyalty among ethically driven consumers. Premiumization not only increases profit margins but also expands the consumer base beyond budget-driven buyers into wellness, foodie, and lifestyle segments.

U.S. Packaged Salads Market By Product Insights

Vegetarian packaged salads dominated the market, aligning with the strong consumer shift toward plant-based diets. These products cater to a wide range of dietary preferences and are widely perceived as healthier, lighter, and more sustainable. Most vegetarian options are either simple leafy greens or full salad kits that include toppings like seeds, nuts, dried fruits, and legumes. Major brands such as Fresh Express and Earthbound Farm have seen robust growth by introducing vegetarian kits with creative combinations and functional nutrients. Moreover, these salads tend to have longer shelf lives than those with meat or dairy, making them logistically advantageous.

Non-vegetarian salads are the fastest-growing product category, propelled by consumer interest in protein-packed, meal-replacement options. These salads typically include grilled chicken, turkey, bacon, tuna, or hard-boiled eggs and are often marketed as “ready-to-eat meals” rather than sides. They are popular among working professionals, gym-goers, and travelers seeking a complete meal with minimal prep. Innovations in vacuum-sealed proteins and safe packaging technologies have improved their shelf life and quality, helping this category expand rapidly. Retailers are also experimenting with hot-cold hybrid meals that combine pre-cooked proteins with crisp greens.

U.S. Packaged Salads Market By Processing Insights

Conventional packaged salads dominate the processing category due to wider accessibility and affordability. These salads are available across all major supermarket chains, often in multiple flavors and formats. Although not organic, many still adhere to high-quality standards and transparency in sourcing. Their price advantage makes them attractive for large households, schools, and cost-conscious consumers.

Organic packaged salads are the fastest-growing, benefiting from rising consumer awareness around pesticide exposure and environmental sustainability. With USDA-certified organic labels gaining trust, consumers are more likely to choose organic salad options when available, especially in urban areas and natural food stores. Brands like Organicgirl and Taylor Farms Organic have significantly expanded their shelf space in stores like Whole Foods, Sprouts, and even Walmart.

U.S. Packaged Salads Market By Type Insights

Packaged kits dominate the segment, as they offer a complete solution with greens, toppings, and dressings included. These kits are popular among consumers looking for grab-and-go meal options that are both satisfying and flavorful. They remove the hassle of assembling a salad from scratch and come in diverse flavor profiles—from Caesar and Greek to Asian sesame and Tex-Mex.

Packaged greens are the fastest-growing, as they appeal to consumers seeking customization. Pre-washed and pre-chopped, these products serve as versatile bases for homemade salads, smoothies, or cooking. Their expansion is also tied to the growing interest in cooking at home and meal prepping, where consumers want clean ingredients but with convenience.

U.S. Packaged Salads Market By Category Insights

Branded salads dominate, especially those from companies like Fresh Express, Dole, and Eat Smart. These brands have earned consumer trust through consistent quality, flavor innovation, and wide availability. They also invest heavily in marketing, sustainability initiatives, and food safety certifications, boosting their market penetration.

In-store/private label brands are the fastest-growing, largely due to affordability and competitive quality. Grocery chains like Kroger, Publix, and Trader Joe’s have developed strong private label salad lines, often priced 15–30% lower than branded counterparts. These products are now comparable in variety and freshness, making them appealing to a broader demographic.

U.S. Packaged Salads Market By Distribution Channel Insights

Offline channels dominate, encompassing supermarkets, convenience stores, and big-box retailers. These outlets allow consumers to evaluate freshness firsthand and often have dedicated refrigerated sections for meal kits and salads. Impulse purchases are common in this channel, particularly during lunchtime or dinner rushes.

Online sales are the fastest-growing, particularly through grocery delivery services such as Instacart, Amazon Fresh, and retailer-specific platforms. Busy professionals, homebound individuals, and urban dwellers are using these platforms for weekly salad restocks. Subscription-based salad kits are also emerging, with companies offering customized blends and recurring deliveries.

U.S. Packaged Salads Market By State Insights

The U.S. packaged salads market demonstrates significant diversity at the state level, influenced by demographics, dietary habits, climate, and retail infrastructure. States with higher urban populations and higher health awareness tend to lead in both consumption and innovation.

-

Florida: With its warm climate and focus on active lifestyles, Florida sees strong demand for light, refreshing salads year-round. Supermarkets like Publix are key players in driving in-store private label growth.

-

New York: Urban consumers in New York prioritize convenience and trend-forward eating. Gourmet and premium packaged salads—particularly organic and chef-inspired kits—perform strongly here.

-

Pennsylvania and Ohio: These states exhibit growing interest in value-oriented options, especially in suburban areas. Grocery chains like Giant Eagle and Meijer are promoting store-brand salads aggressively.

-

Illinois: Chicago is a key urban market for ready-to-eat salad kits. Consumers here are responsive to health messaging and plant-based options.

-

Georgia: With rising urbanization and a youthful population in Atlanta, Georgia shows strong potential for premium and ethnic-inspired salad varieties.

U.S. Packaged Salads Market Recent Developments

-

January 2025: Fresh Express launched a new line of chopped salad kits infused with international flavors, including Korean BBQ and Moroccan spice blends, catering to adventurous eaters.

-

February 2025: Taylor Farms introduced a zero-waste packaging initiative for select organic salads, with compostable containers tested in Whole Foods locations.

-

March 2025: Dole partnered with a leading nutritionist to roll out its “Gut Health” salad line, incorporating prebiotics, fermented vegetables, and fiber-rich greens.

-

January 2025: Walmart expanded its in-house Marketside salad range, launching more than a dozen new private-label kits priced below national brand equivalents.

-

February 2025: Earthbound Farm unveiled its “Greens for Kids” program, featuring fun packaging and kid-friendly greens to support healthy eating in schools.

Some of the prominent players in the U.S. packaged salads market include:

- BrightFarms, Inc.

- Dole Food Company, Inc.

- Earthbound Farm

- Eat Smart (Curation Foods)

- Missionero

- Gotham Greens Holdings, PBC

- Mann Packaging Co., Inc.

- Bonduelle

- Fresh Express, Inc.

- VegPro Intenational, Inc.

- ORGANICGIRL, LLC

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. packaged salads market

Product

- Vegetarian

- Non-vegetarian

Processing

Type

- Packaged Greens

- Packaged Kits

Category

- Branded

- In-Store/ Private Label

Distribution Channel

State

-

- Florida

- New York

- Pennsylvania

- Illinois

- Ohio

- Georgia