U.S. Patient Engagement Solutions Market Size and Research

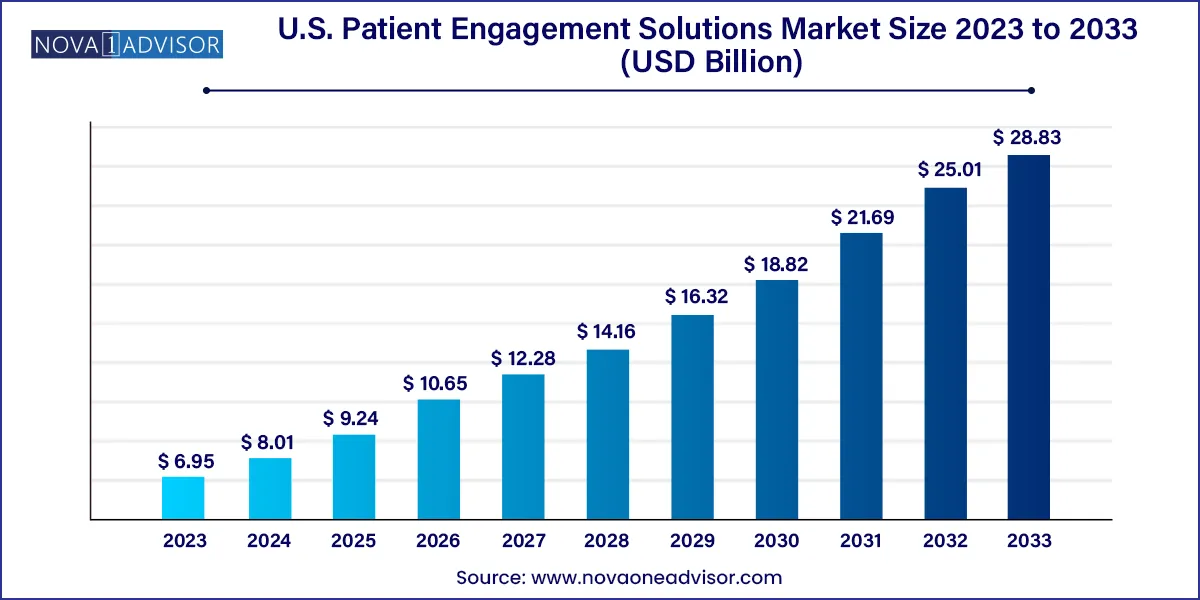

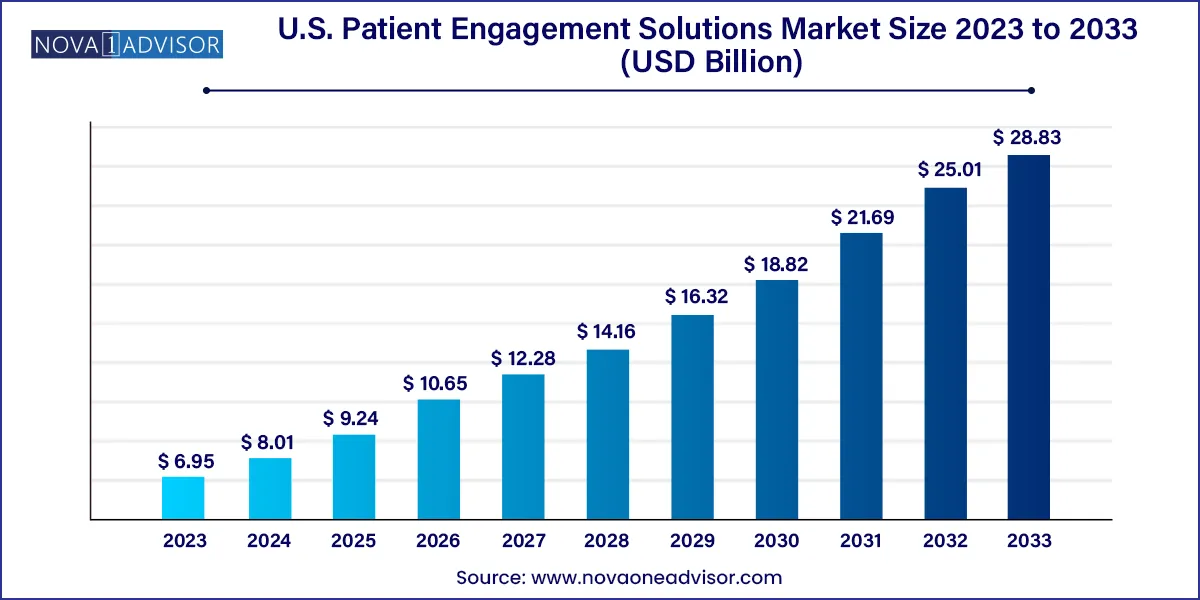

The U.S. patient engagement solutions market size was exhibited at USD 6.95 billion in 2023 and is projected to hit around USD 28.83 billion by 2033, growing at a CAGR of 15.29% during the forecast period 2024 to 2033.

Key Takeaways:

- The web & cloud-based solutions segment dominated the U.S. patient engagement solutions market by delivery type in 2023 and is also anticipated to expand at the fastest CAGR of over 15%.

- The software & hardware segment contributed to the largest share of the market by component in 2023 and is also estimated to grow at a CAGR of 15.5% during the forecast period.

- The communication segment held over 30% of the market in 2023, while the health tracking & insights segment is anticipated to progress at the fastest rate of over 16% in the coming years..

- The others segment, comprising patient engagement for clinical studies and preventive care, is projected to expand at the fastest rate of more than 15% during the forecast period.

- Chronic disease management represented the largest share of over 40% of the U.S. patient engagement solutions industry in 2023.

- The payers segment, on the other hand, is expected to register the highest growth of over 15% in the coming years.

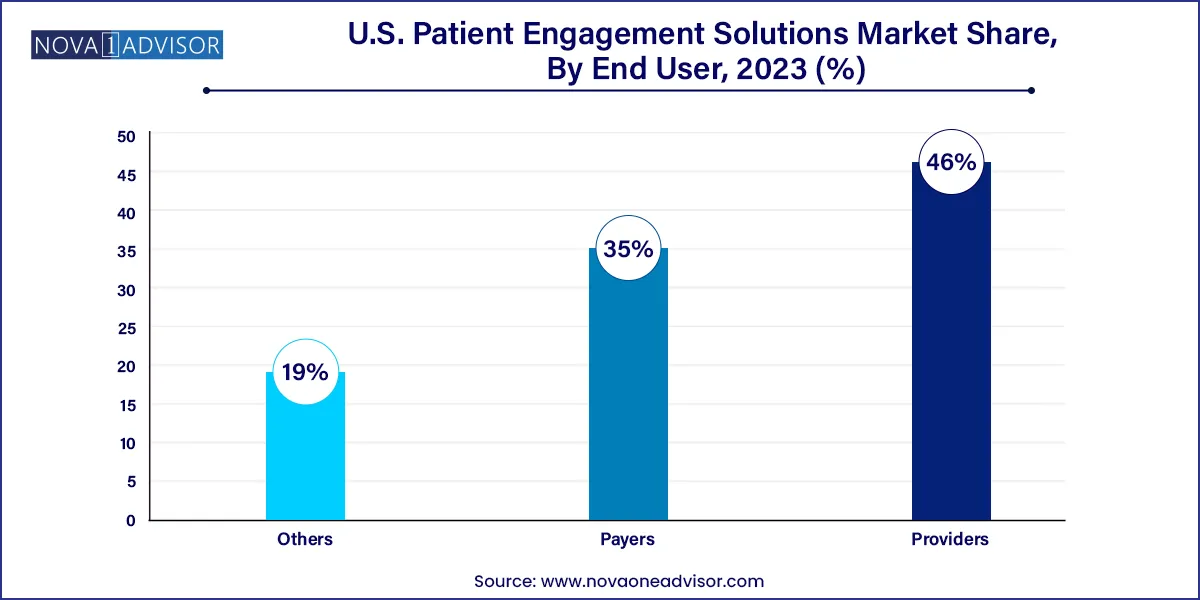

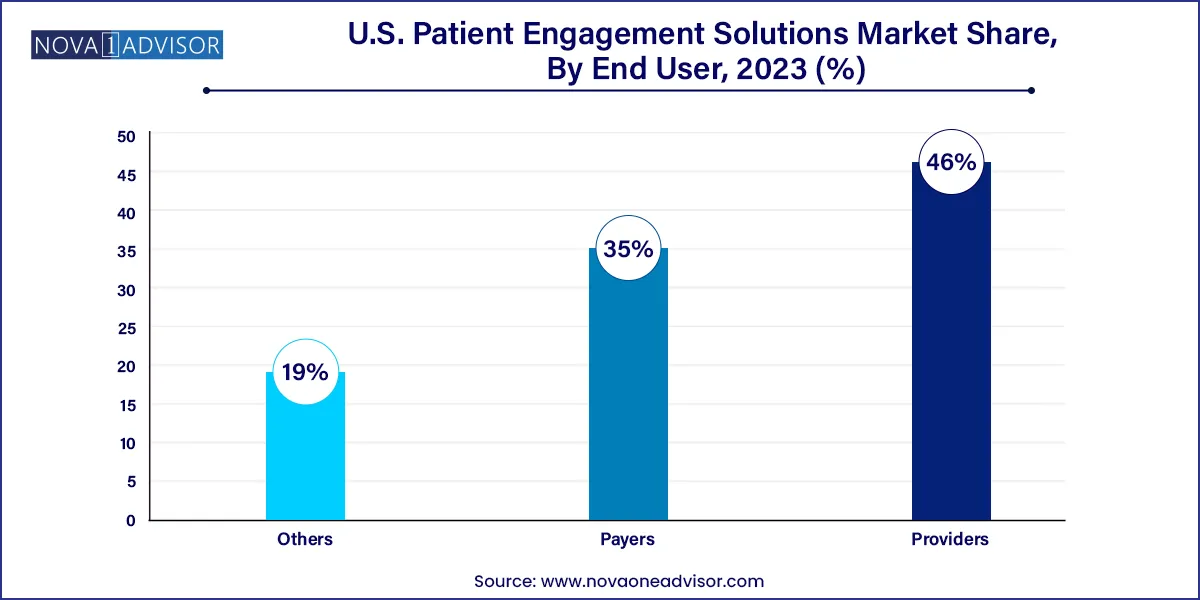

- Providers contributed over 46% of the market share by end-user in 2023.

Market Overview

The U.S. Patient Engagement Solutions Market has witnessed a transformative evolution over the last decade, driven by digitization across the healthcare ecosystem and a mounting emphasis on value-based care. Patient engagement solutions refer to tools, platforms, and technologies designed to enhance patient involvement in their own health and treatment plans. These solutions are critical in fostering improved health outcomes, reducing healthcare costs, and encouraging proactive patient behavior.

The increasing burden of chronic diseases, an aging population, and an evolving regulatory framework emphasizing patient-centric care are contributing significantly to the market's growth. In a post-pandemic environment, virtual health solutions such as telemedicine and digital engagement tools have seen widespread adoption, redefining patient-provider interactions.

According to industry estimates, the U.S. Patient Engagement Solutions Market is expected to continue its upward trajectory, supported by robust healthcare IT infrastructure and growing investments in digital health. Moreover, favorable government initiatives, such as the Centers for Medicare & Medicaid Services' (CMS) encouragement of patient engagement under the Meaningful Use Program and value-based reimbursement models, further bolster the market.

Major Trends in the Market

-

Expansion of Remote Monitoring Tools: With chronic disease prevalence on the rise, remote patient monitoring tools integrated with engagement platforms are gaining traction for continuous health tracking.

-

Adoption of AI and Machine Learning: These technologies are being incorporated to enhance personalized patient experiences, provide predictive analytics, and facilitate real-time decision-making.

-

Mobile-first Engagement Platforms: Smartphones and mobile applications are increasingly used for appointment scheduling, medication reminders, health education, and virtual consultations.

-

Rise of Interoperability Solutions: Seamless integration of engagement platforms with Electronic Health Records (EHR) and other hospital systems is becoming a priority.

-

Gamification and Behavioral Nudges: Gamified platforms are being used to boost adherence and patient participation in wellness programs.

-

Social Determinants of Health (SDoH): Engagement solutions are increasingly incorporating features to address SDoH, offering targeted support to underserved communities.

Report Scope of The U.S. Patient Engagement Solutions Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 8.01 Billion |

| Market Size by 2033 |

USD 28.83 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 15.29% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Delivery Type, Component, Type, Service Type, Functionality, Therapeutic Area, Application, End-user |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Cerner Corporation (Oracle); NextGen Healthcare, Inc.; Epic Systems Corporation; Allscripts Healthcare, LLC; McKesson Corporation; ResMed; Koninklijke Philips N.V.; Klara Technologies, Inc.; CPSI; Experian Information Solutions, Inc.; athenahealth, Inc. |

U.S. Patient Engagement Solutions Market By Delivery Type Insights

Web & Cloud-based solutions dominated the delivery type segment in the U.S. Patient Engagement Solutions Market. These platforms offer superior scalability, lower upfront costs, and easier maintenance, making them highly attractive to healthcare providers. In addition, cloud-based platforms facilitate remote access to data, support interoperability, and are more adaptable to the growing telehealth trend. Major healthcare systems are adopting these solutions for their ability to integrate with existing hospital systems and their readiness for future upgrades.

On the other hand, the on-premise segment is witnessing slower growth due to high infrastructure costs and limited flexibility. However, for providers with strict data control needs, on-premise systems remain relevant. Cloud-based models are expected to retain their lead owing to rising demand for flexible, subscription-based services.

U.S. Patient Engagement Solutions Market By Component Insights

Services accounted for the largest share in the component segment. Services like implementation, training, and support are essential for ensuring that hospitals and healthcare organizations successfully adopt and optimize patient engagement platforms. These services address the technological complexity of integrating new platforms with legacy systems, offering hands-on assistance during and after deployment.

However, software & hardware is the fastest-growing segment, propelled by innovations in app development, wearable integration, and artificial intelligence. As providers aim for automation and predictive analytics, investments in smart software solutions are expected to accelerate. Additionally, patient portals, mobile apps, and kiosk-based engagement tools are reshaping front-end patient interactions.

U.S. Patient Engagement Solutions Market By Functionality Insights

Communication tools emerged as the leading segment under functionality. Patient engagement begins with effective communication channels, such as secure messaging, video consultations, and automated notifications. These tools ensure that patients remain informed and connected with their care teams.

Health Tracking & Insights tools are witnessing the fastest growth, thanks to the widespread use of wearable devices and health apps. Real-time tracking of vitals, integration with EHR systems, and data-driven insights empower patients to take control of their health while allowing providers to intervene promptly.

U.S. Patient Engagement Solutions Market By Application Insights

Population Health Management leads this segment, as healthcare systems seek macro-level tools to assess and manage the health of specific populations. These platforms provide data analytics, risk stratification, and community outreach tools crucial for addressing large-scale health challenges.

Outpatient Health Management is expanding swiftly, especially as more care shifts from hospitals to outpatient settings. Engagement tools tailored for pre- and post-procedure communication, appointment scheduling, and remote follow-ups are essential in improving care outcomes in outpatient settings.

U.S. Patient Engagement Solutions Market By Therapeutic Area Insights

Chronic Disease Management dominates the therapeutic area segment, with conditions like diabetes, hypertension, COPD, and cardiovascular disease requiring long-term engagement strategies. Patient portals, personalized dashboards, and lifestyle coaching tools play a vital role in disease control and medication adherence.

Conversely, Health & Wellness applications are rapidly growing, driven by increasing consumer interest in preventive health and wellness. Wellness platforms offering stress management, diet tracking, and fitness integration appeal to a broad user base, supporting overall population health goals.

U.S. Patient Engagement Solutions Market By End User Insights

Providers constitute the largest end-user segment, as hospitals, physicians, and clinics are the primary adopters of patient engagement tools to improve workflow efficiency and patient satisfaction. Provider adoption is being fueled by government mandates and the promise of better health outcomes.

Payers are rapidly increasing their use of these solutions to improve member engagement, promote wellness programs, and reduce claims by encouraging preventive care. Insurance companies use engagement platforms to track patient behaviors and incentivize healthy living through rewards and reminders.

Country-Level Analysis

In the United States, the healthcare landscape is evolving rapidly with a push toward digitization and value-based care. The U.S. government has been instrumental in promoting patient-centric models through initiatives such as the Medicare Access and CHIP Reauthorization Act (MACRA) and the 21st Century Cures Act. These policies mandate the use of interoperable digital systems and reward organizations that achieve high levels of patient engagement and satisfaction.

Furthermore, private sector investment in health tech startups is accelerating. Venture capital funding for digital health companies has surged in the last few years, with many focusing on patient engagement tools. Urban healthcare systems are rapidly adopting these technologies, while rural areas are gradually catching up with the help of telehealth expansion and mobile health units. Companies are also targeting the growing senior population with user-friendly interfaces and multilingual platforms.

Some of the prominent players in the U.S. patient engagement solutions market include:

- Cerner Corporation (Oracle)

- NextGen Healthcare, Inc.

- Epic Systems Corporation

- Allscripts Healthcare, LLC

- McKesson Corporation

- ResMed

- Koninklijke Philips N.V.

- Klara Technologies, Inc.

- CPSI

- Experian Information Solutions, Inc.

- athenahealth, Inc.

- Solutionreach, Inc.

- IBM

- MEDHOST

- Nuance Communications, Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. patient engagement solutions market.

Delivery Type

- Web & Cloud-based

- On-premise

Component

- Software & Hardware

- Services

Type

Service Type

- Consulting

- Implementation & Training

- Support & Maintenance

- Others

Functionality

- Communication

- Health Tracking & Insights

- Billing & Payments

- Administrative

- Patient Education

- Others

Therapeutic Area

- Health & Wellness

- Chronic Disease Management

- Others

Application

- Population Health Management

- Outpatient Health Management

- In-Patient Health Management

- Others

End-user