U.S. Patient Positioning Systems Market Size and Trends

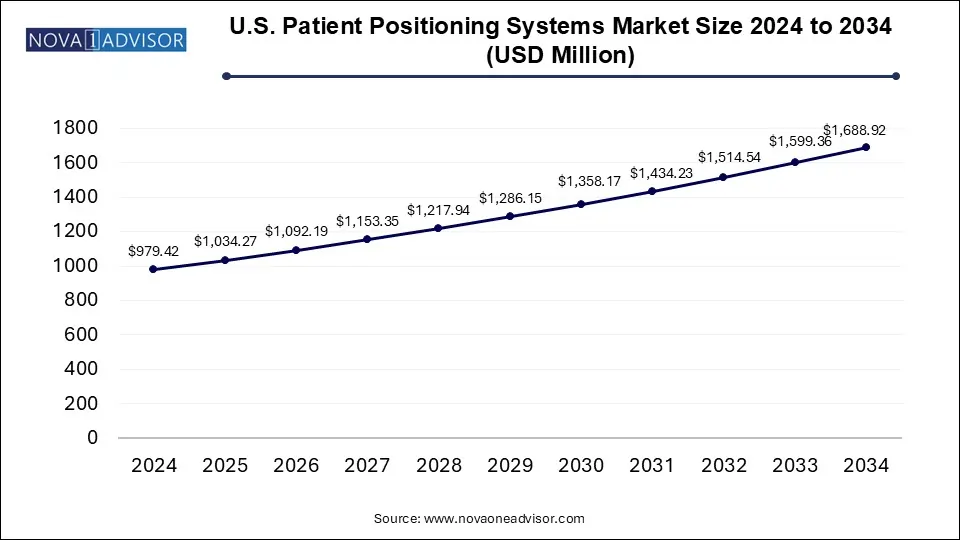

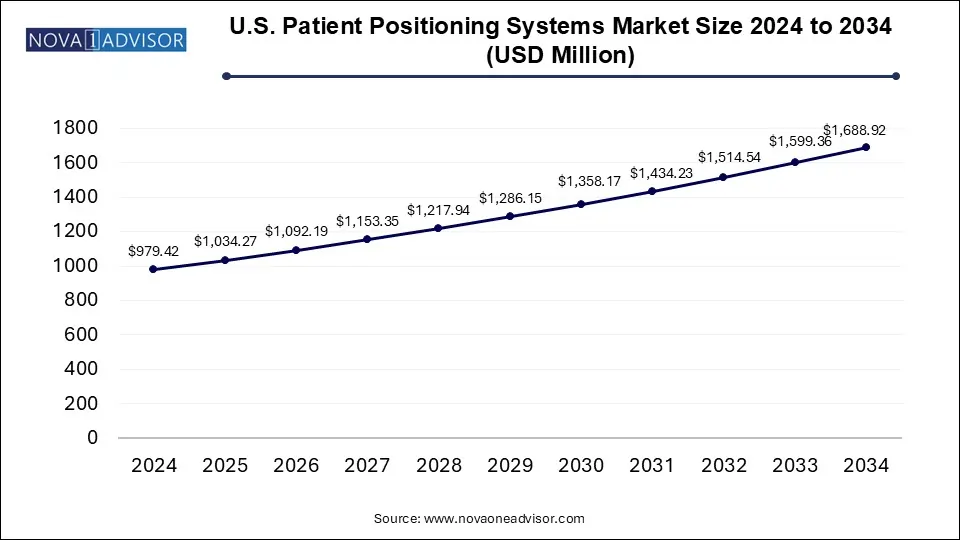

The U.S. patient positioning systems market size was exhibited at USD 979.42 million in 2024 and is projected to hit around USD 1688.92 million by 2034, growing at a CAGR of 5.6% during the forecast period 2025 to 2034.

Report Scope of U.S. Patient Positioning Systems Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1034.27 Million |

| Market Size by 2034 |

USD 1688.92 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 5.6% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Application, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Medtronic; Stryker; Steris; Hill-Rom Services, Inc.; SchureMed; Skytron LLC; Smith & Nephew; Leoni AG; Schaerer Medical AG; Mizuho OSI |

Market Overview

The U.S. patient positioning systems market is a critical component of the healthcare industry, focused on providing optimal positioning of patients during medical procedures, particularly surgeries, to improve treatment outcomes and ensure patient safety. These systems include various equipment and tools designed to help healthcare professionals place patients in the correct position for diagnostic and therapeutic procedures, minimizing discomfort, enhancing surgical accuracy, and reducing the risk of injury.

The market for patient positioning systems in the U.S. has grown significantly in recent years due to advancements in technology, the increasing prevalence of chronic diseases requiring surgical interventions, and an aging population that demands more medical procedures. The rise of minimally invasive surgeries, which often require precise patient positioning, has further bolstered the demand for high-quality patient positioning systems. As healthcare facilities continue to adopt cutting-edge technologies, the U.S. market for patient positioning systems is expected to expand, driven by innovations in design and functionality, as well as growing healthcare infrastructure investments.

Growth Factors

Increasing Surgical Procedures: With a rising number of surgeries, especially in the elderly population, the demand for reliable and effective patient positioning systems is on the rise. The prevalence of chronic diseases such as cardiovascular disorders, diabetes, and orthopedic conditions is increasing, leading to more surgical interventions.

Technological Advancements: Innovations in patient positioning systems, such as the development of more ergonomic and precise tables, adjustable supports, and integration with imaging technologies, are driving market growth. These technological advancements improve surgical outcomes and minimize the risk of patient injuries.

Aging Population: The growing elderly population in the U.S. is contributing to a higher demand for healthcare services, including surgeries and diagnostic imaging, which in turn fuels the need for patient positioning systems. The elderly are more prone to conditions that require surgical interventions, which boosts the demand for specialized positioning equipment.

Market Dynamics

Driver

One of the main drivers of the U.S. patient positioning systems market is the increasing number of surgeries performed annually, particularly those required by the aging population. As healthcare services evolve, the demand for specialized equipment such as patient positioning systems grows. The need for patient comfort, safety, and optimal alignment during medical procedures is pushing healthcare institutions to invest in high-quality positioning systems that improve surgical precision and reduce complications.

The rise in minimally invasive surgeries (MIS) is another critical driver of the market. MIS techniques, which rely on small incisions and precision instruments, require accurate patient positioning to ensure the success of the procedure. Patient positioning systems tailored to these procedures, such as adjustable tables and specialized supports, are therefore in high demand. These innovations help enhance the effectiveness of these surgeries, making them more attractive to both patients and healthcare providers.

Restraint

Despite the positive growth drivers, several factors are inhibiting the widespread adoption and growth of the U.S. patient positioning systems market. One of the primary restraints is the high cost associated with advanced patient positioning systems. While these systems offer significant benefits in terms of patient safety, comfort, and precision, their high purchase and maintenance costs make them less accessible for smaller healthcare facilities, particularly in underserved or rural areas.

Another challenge lies in the complexity of some patient positioning systems, which may require specialized training for medical staff to operate effectively. Healthcare providers may be reluctant to invest in such systems if they believe the technology will require extensive training or lead to operational inefficiencies.

Opportunity

The U.S. patient positioning systems market holds several growth opportunities, particularly in the areas of technological innovation, healthcare infrastructure development, and the increasing demand for specialized surgical procedures.

Technological Advancements: There is significant opportunity for the development of more advanced, customizable, and ergonomic patient positioning systems. For example, incorporating features such as automated positioning, integration with robotic surgery systems, and the use of materials that offer enhanced comfort and durability could further drive adoption. Innovations in 3D imaging and augmented reality for precise positioning are also likely to impact the market positively.

Segment

U.S. Patient Positioning Systems Market By Product Segment:

In 2024, tables were the dominant product segment in the U.S. patient positioning systems market. These specialized positioning tables are designed to offer the necessary support and adjustability required during various medical procedures. Tables are an essential tool for ensuring patients are correctly positioned during surgeries, diagnostic imaging, and other procedures. Their ability to provide ergonomic support while accommodating a wide range of patient sizes and medical needs is a key reason for their dominance in the market.

U.S. Patient Positioning Systems Market By Application Insights

The surgery application segment accounted for the largest revenue share in the market in 2024. Surgical procedures, particularly those that require precise positioning of patients, rely heavily on positioning systems. With the increasing number of surgeries performed annually, especially in the areas of orthopedics, neurology, and cardiovascular treatments, the demand for positioning systems that ensure optimal positioning during surgeries is expected to remain strong.

U.S. Patient Positioning Systems Market By End-use Insights

In 2024, the hospitals segment held the largest market share in the U.S. patient positioning systems market. Hospitals are the primary end-users of these systems, as they house the most advanced surgical suites and diagnostic imaging departments. The significant number of surgeries and medical procedures conducted in hospitals makes them the largest consumers of patient positioning systems.

Some of the prominent players in the U.S. patient positioning systems market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. patient positioning systems market

By Product

- Tables

- Surgical Tables

- Examination Tables

- Radiolucent Imaging Tables

- Accessories

By Application

- Surgery

- Diagnostics

- Others

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Others (Diagnostic Centers, Clinics)