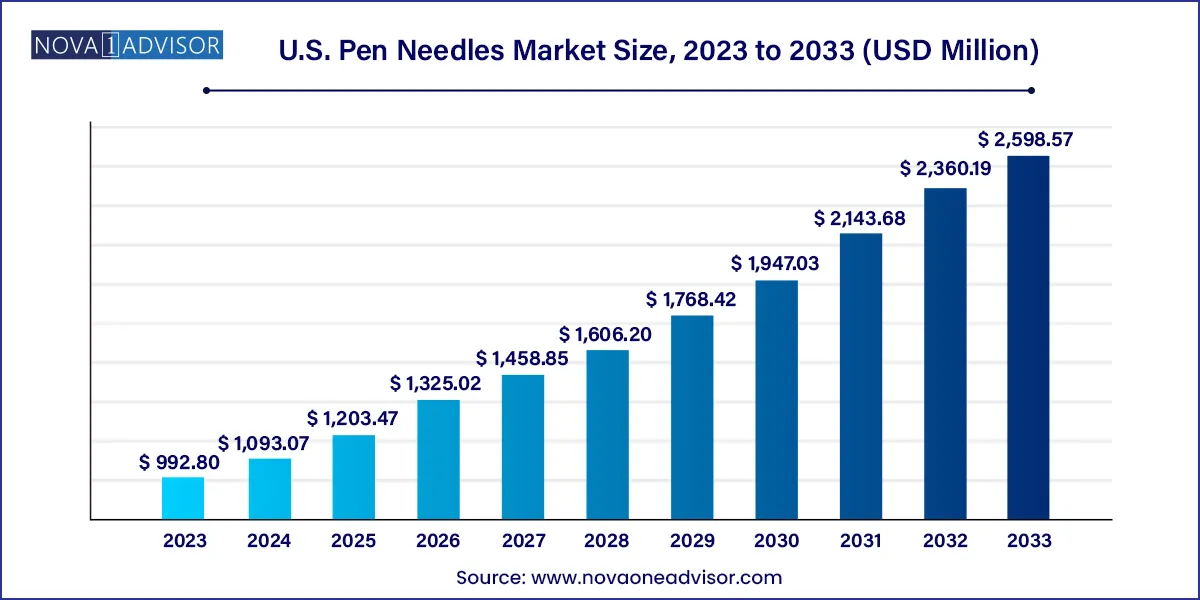

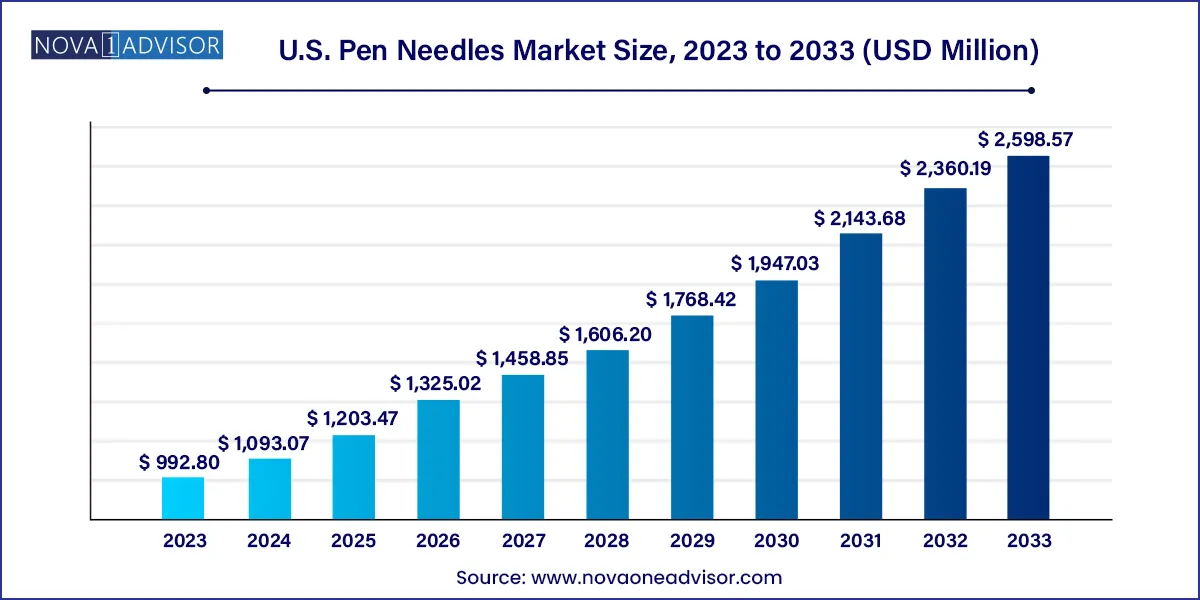

The U.S. pen needles market size was valued at USD 992.80 million in 2023 and is projected to surpass around USD 2,598.57 million by 2033, registering a CAGR of 10.1% over the forecast period of 2024 to 2033.

Key Takeaways:

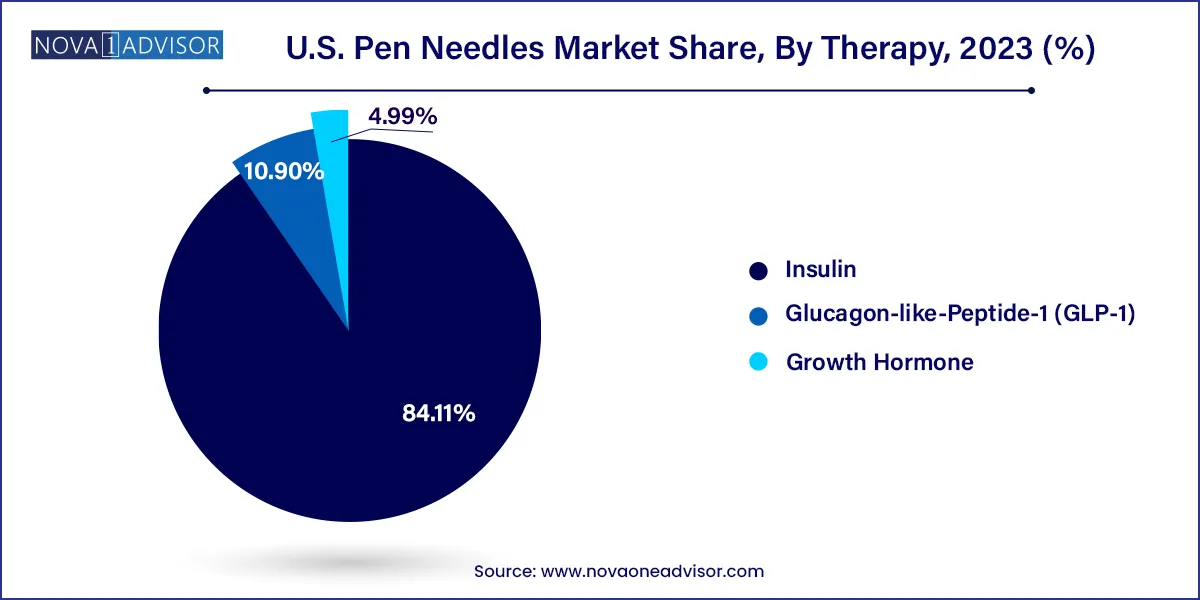

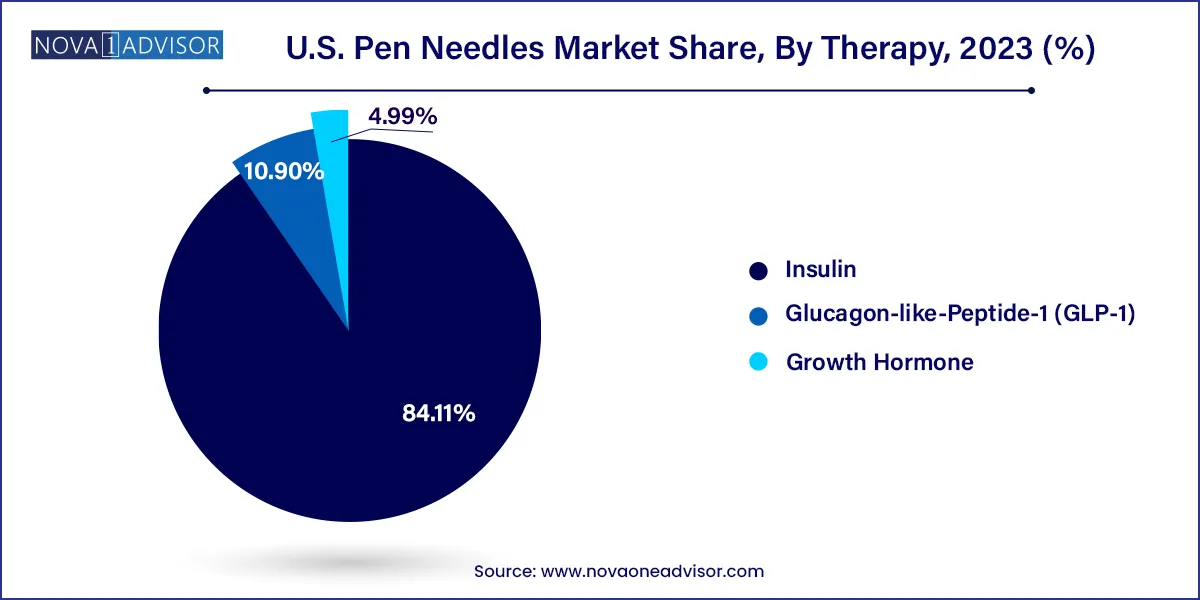

- Insulin dominated the market with the highest revenue market share in 2023 of 84.11% and is also expected to grow at the fastest CAGR over the forecast period.

- Glucagon-like-Peptide-1 (GLP-1) is expected to witness lucrative growth during the forecast period.

- Standard pen needles dominated the market with the largest revenue share in 2023.

- Safety pen needles are expected to grow at the fastest CAGR of 11.9% during the forecast period.

- 5mm dominated the market and accounted for the largest revenue market share of over 20.19% in 2023.

- 4mm is anticipated to witness the fastest CAGR during the forecast period.

Market Overview

The U.S. pen needles market plays a vital role in the delivery of injectable therapies, particularly for chronic conditions like diabetes, which require frequent self-administration of medication. Pen needles are small, disposable needles that are attached to injection pens used to administer drugs such as insulin, GLP-1 receptor agonists, and human growth hormones. These devices are designed to be easy to use, less painful, and safer, contributing to better adherence to treatment regimens.

In the United States, where diabetes remains a significant public health concern affecting over 38 million people according to the CDC (2024 data) the importance of pen needles in therapeutic management is enormous. Insulin-dependent diabetes patients often require multiple injections per day, which has driven the demand for pen needles that offer comfort, ease of use, and minimal invasiveness. Over the years, technological improvements have led to thinner and shorter needles, improving user experience and minimizing discomfort.

The market is characterized by continuous innovation, regulatory oversight by agencies like the FDA, and the strong presence of key players including Becton, Dickinson and Company, Novo Nordisk, and Ypsomed. Market dynamics are shaped by a growing patient population, increasing preference for home-based care, and rising awareness around the availability of safe injection devices. Additionally, the trend toward integrated care and digital monitoring devices is driving convergence between traditional injection systems and smart technologies.

The penetration of safety pen needles, aimed at reducing needlestick injuries among healthcare workers and patients, is gaining ground due to increasing regulatory pressures and safety protocols in hospitals and clinics. Moreover, expanding therapeutic applications of injectable drugs, such as GLP-1s for weight management and metabolic syndromes, is broadening the potential customer base beyond traditional insulin users.

Major Trends in the Market

-

Shift Toward Safety-Engineered Devices: A growing focus on occupational safety is encouraging the adoption of safety pen needles to prevent accidental needlestick injuries in healthcare environments.

-

Miniaturization of Needles: Manufacturers are developing shorter and thinner needles (e.g., 4 mm and 5 mm) to enhance comfort and compliance, especially among pediatric and elderly populations.

-

Rising GLP-1 Therapy Adoption: The increasing use of GLP-1 receptor agonists like semaglutide (Ozempic, Wegovy) is expanding the addressable market for pen needles.

-

Home Healthcare Boom: With a rising preference for at-home treatments, demand for user-friendly injection systems has surged, bolstering pen needle sales.

-

Sustainability Initiatives: Manufacturers are exploring recyclable and biodegradable pen needle materials to align with environmental and regulatory expectations.

-

Integration with Digital Platforms: Some pen injection systems are being paired with mobile apps and digital monitoring tools to enhance adherence and real-time feedback.

-

Customization for Patient Segments: Pen needles are now being designed with personalized lengths and gauge sizes for sub-groups such as children, geriatric patients, or those with obesity.

U.S. Pen Needles Market Report Scope

Key Market Driver: Rising Diabetes Prevalence and Insulin Dependency

One of the most compelling drivers propelling the U.S. pen needles market is the surging prevalence of diabetes and the expanding population of insulin-dependent patients. According to the Centers for Disease Control and Prevention, approximately 1.5 million Americans are diagnosed with diabetes each year, and an estimated 8.4 million individuals currently use insulin as part of their diabetes treatment.

This growing user base creates a consistent demand for injection tools such as pen needles. The shift from vials and syringes to pen devices is particularly notable, as pen injectors offer greater convenience, accuracy, and lower pain perception. For example, insulin pens combined with short (e.g., 4 mm) needles provide a user-friendly interface for patients who self-administer insulin multiple times daily. Additionally, with the launch of basal-bolus regimens that require both long-acting and rapid-acting insulin, the need for reliable and easy-to-use injection devices has expanded.

The trend is also reinforced by public and private health programs that subsidize or reimburse diabetes supplies, including pen needles, making them more accessible to patients. Pharmaceutical companies and device manufacturers are aligning product development with these needs, leading to higher adoption rates across healthcare settings.

Key Market Restraint: Reimbursement Challenges and Cost Sensitivity

Despite increasing demand, reimbursement and cost issues remain a significant barrier to the widespread adoption of advanced pen needle systems, especially safety-engineered ones. While insurance often covers insulin pens and needles, reimbursement policies vary between providers, states, and insurance plans, creating inconsistencies in accessibility.

For patients without comprehensive health insurance or under high-deductible plans, out-of-pocket costs for pen needles can accumulate quickly, especially considering the daily frequency of use. This economic burden may force some users to reuse needles, a practice that can compromise safety and efficacy. Moreover, premium products like safety pen needles or ultra-thin designs, though more user-friendly, are priced higher than standard variants, limiting their adoption among cost-sensitive patient groups.

From a healthcare system perspective, hospitals and clinics may also be hesitant to transition to costlier safety pen needles despite their safety advantages, due to budget constraints. These challenges can slow market growth and hinder equitable access to the latest innovations in pen needle technology.

Key Market Opportunity: Expanding Applications in GLP-1 Therapies

Beyond insulin, GLP-1 receptor agonists represent a significant growth opportunity for the U.S. pen needles market. Originally developed for type 2 diabetes management, drugs like liraglutide (Victoza) and semaglutide (Ozempic, Wegovy) have gained widespread popularity for weight management and obesity treatment due to their appetite-suppressing and metabolic benefits.

These medications are administered via subcutaneous injections, often using the same pen injector platforms as insulin. With obesity affecting over 40% of the U.S. adult population (CDC, 2024), and GLP-1s being increasingly prescribed for off-label uses, the potential user base for pen needles is rapidly expanding. Moreover, the launch of new formulations that require weekly injections rather than daily ones is expected to drive adoption among patients seeking simpler treatment regimens.

This presents a unique opportunity for manufacturers to diversify their offerings, develop therapy-specific needles, and collaborate with pharmaceutical firms for bundled pen-needle packs. The rising popularity of GLP-1 therapies in both endocrinology and bariatric medicine signals a promising new frontier for market expansion.

U.S. Pen Needles Market By Therapy Insights

Insulin therapy continues to dominate the U.S. pen needles market, accounting for the largest share due to the sheer volume of patients who require multiple daily injections. Whether for type 1 or type 2 diabetes, insulin is a mainstay of treatment, and pen needles serve as the primary delivery mechanism. With new insulin analogs being developed and a continued rise in diabetes prevalence, this segment is expected to maintain its lead for the foreseeable future. Manufacturers often optimize needle design specifically for insulin delivery, focusing on factors such as flow rate, pain reduction, and reliability.

However, GLP-1 therapy is emerging as the fastest-growing segment, driven by rapid uptake of drugs like Ozempic and Wegovy not only for diabetes, but also for obesity. With celebrity endorsements and increased public interest, GLP-1s have entered mainstream awareness, fueling demand for compatible pen needles. Weekly dosing schedules and expanding indications—such as cardiovascular risk reduction—are likely to increase the frequency of prescriptions. This growth trajectory offers opportunities for companies to innovate needles tailored to GLP-1 delivery and potentially integrate them with smart tracking features.

U.S. Pen Needles Market By Product Insights

Standard pen needles dominated the U.S. pen needles market due to their wide availability, affordability, and compatibility with most pen injection systems in use today. These needles are generally used in home care and outpatient settings, making them the default choice for self-administration. With decades of use, standard pen needles have become synonymous with insulin therapy in non-institutional settings. Their economic viability also makes them popular among budget-conscious healthcare systems and patients. Despite the emergence of advanced alternatives, the entrenched market presence of standard variants continues to sustain demand.

On the other hand, safety pen needles are projected to witness the fastest growth over the forecast period, especially within hospital and clinical environments. Designed with built-in safety mechanisms such as retractable or shielded tips, these needles significantly reduce the risk of accidental needlestick injuries. Regulatory bodies including OSHA have recommended the use of safety-engineered devices in medical practice, and this compliance drive is pushing their adoption. Manufacturers like BD and Terumo are leading innovation in this space, creating devices that enhance both safety and user comfort without compromising on performance.

U.S. Pen Needles Market By Needle Length Insights

The 4 mm needle length segment has emerged as the most dominant in recent years, owing to its minimal invasiveness and reduced risk of intramuscular injection. Studies have shown that shorter needles are as effective as longer ones in delivering subcutaneous medication, even in obese individuals, provided the injection technique is appropriate. Their increased comfort and reduced anxiety factor make 4 mm needles particularly suitable for pediatric and geriatric populations. Healthcare providers also prefer recommending shorter needles to promote adherence and reduce the likelihood of complications such as bruising or lipohypertrophy.

Meanwhile, the 6 mm and 5 mm segments are showing strong growth, largely driven by a transition from traditional 8 mm or 10 mm needles to more patient-friendly options. These lengths strike a balance between penetration depth and comfort, making them ideal for adults with varying levels of body fat. The introduction of thin-gauge, high-precision needles in this size category is further encouraging adoption. As patient education around injection techniques improves, preference is shifting toward mid-length options that offer versatility across different body types and therapeutic needs.

Country-Level Analysis

The U.S. healthcare landscape provides a unique backdrop for the growth of the pen needles market. With robust pharmaceutical infrastructure, a high prevalence of chronic diseases, and advanced health IT systems, the U.S. supports widespread adoption of injection-based therapies. Government agencies like the FDA ensure strict oversight of pen needle manufacturing, safety, and labeling, helping maintain high standards across the industry.

Public health campaigns to combat diabetes and obesity have led to an increased focus on early diagnosis and proactive treatment, which includes injectable drugs administered via pens. In addition, the culture of home-based care in the U.S. aligns well with pen needles’ user-friendly design, enabling patients to self-administer without requiring frequent hospital visits. This trend is further supported by telemedicine, which often relies on patient-managed therapies.

Another unique aspect of the U.S. market is the presence of major R&D hubs and biotech clusters that support innovation in medical devices. Collaborations between device makers and pharmaceutical companies foster co-development of drugs and delivery systems, accelerating the commercialization of novel pen needle products. Insurance coverage and reimbursement mechanisms though fragmented do offer partial support for most essential diabetic supplies, enhancing access in insured populations.

U.S. Pen Needles Market Recent Developments

-

March 2025: BD (Becton, Dickinson and Company) announced FDA clearance for its next-gen Nano Ultra pen needle featuring a 32G x 4 mm profile and new lubrication technology aimed at reducing insertion pain.

-

January 2025: Novo Nordisk launched an initiative to bundle pen needles with its semaglutide-based drug Wegovy, targeting obesity patients newly introduced to self-injection therapy.

-

November 2024: Ypsomed introduced a connected pen injector platform compatible with third-party pen needles, enabling real-time data sharing for patients using GLP-1 therapy.

-

October 2024: Owen Mumford launched its new Unifine SafeControl safety pen needles across the U.S. market, designed to improve needle safety for healthcare professionals.

-

August 2024: Terumo Medical Systems USA expanded its safety product portfolio with the SurGuard 4 pen needle, emphasizing ergonomics and user protection.

Key U.S. Pen Needles Company Insights

Leading companies in the U.S. pen needles market are employing various strategic measures such as partnerships, expansion of products and services, mergers and acquisitions, and R&D investments to gain a competitive edge through advanced applications. The market is dominated by key players like Novo Nordisk A/S, Becton, Dickinson and Company, TERUMO CORPORATION, Owen Mumford Ltd., Ypsomed, B. Braun Melsungen AG, HTL-STREFA, UltiMed, Inc., Allison Medical, Inc., and Artsana S.p.a. These major firms are undertaking initiatives like mergers and acquisitions, new product developments, and geographical expansions to meet the growing patient needs. For instance, in February 2023, Montmed Inc. announced the issuance of a second U.S. patent for the Sitesmart Pen Needles.

U.S. Pen Needles Market Top Key Companies:

- Novo Nordisk A/S

- Becton

- Dickinson and Company

- Terumo Corp.

- Owen Mumford Ltd.

- Ypsomed

- B. Braun Melsungen AG

- HTL-STREFA

- UltiMed, Inc.

- Allison Medical, Inc.

- Artsana S.p.A.

U.S. Pen Needles Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Pen Needles market.

By Product

- Standard Pen Needles

- Safety Pen Needles

By Needle Length

- 4 mm

- 5 mm

- 6 mm

- 8 mm

- 10 mm

- 12 mm

By Therapy

- Insulin

- Glucagon-like-Peptide-1 (GLP-1)

- Growth Hormone