U.S. Pet Dental Health Market Size and Trends

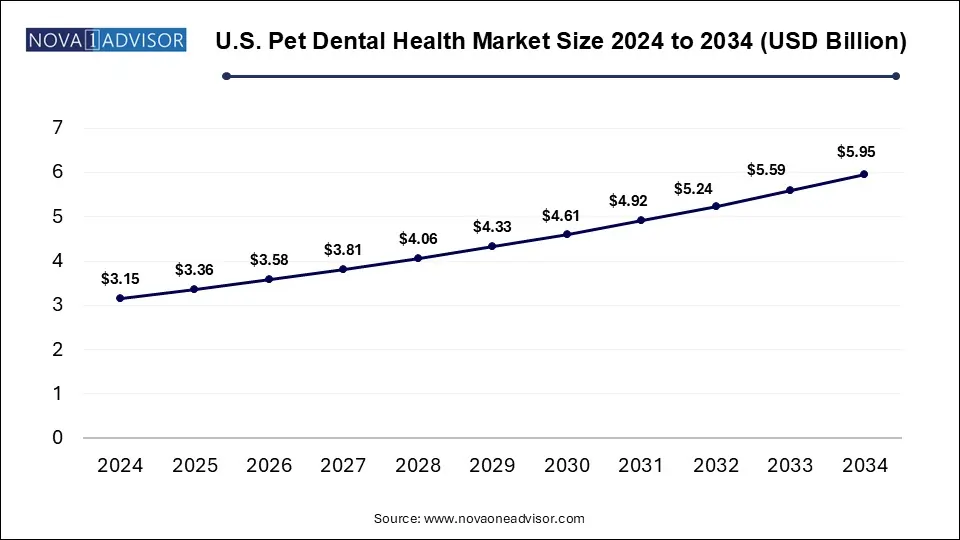

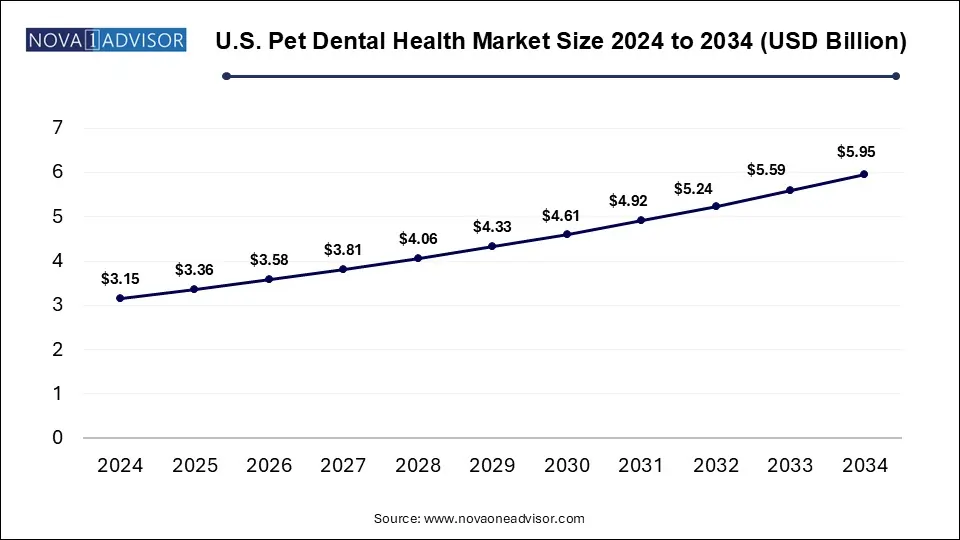

The U.S. pet dental health market size was exhibited at USD 3.15 billion in 2024 and is projected to hit around USD 5.95 billion by 2034, growing at a CAGR of 6.57% during the forecast period 2025 to 2034. Rising prevalence of dental issues like periodontal disease in cats and dogs, increased pet ownership and expanding veterinary care services are driving the growth of the U.S. pet dental health market.

U.S. Pet Dental Health Market Key Takeaways:

- In 2024, the services segment accounted for the largest revenue share in the U.S. pet dental health market, capturing over 70% of the total market.

- The dogs category led the U.S. pet dental health market in 2024, contributing more than 60% of the overall revenue.

- Gum diseases emerged as the dominant indication segment in 2024, holding a revenue share exceeding 39% of the market.

- Veterinary hospitals and clinics were the leading distribution channel in the U.S. pet dental health industry in 2024, with a market share of approximately 40%.

Market Overview

The U.S. pet dental health market is emerging as a critical segment of the veterinary industry, driven by growing pet ownership, heightened awareness of pet oral hygiene, and increasing expenditure on pet healthcare. With approximately 70% of U.S. households owning at least one pet, the demand for preventive and therapeutic dental solutions is escalating. Periodontal disease remains the most prevalent dental condition affecting dogs and cats, with studies estimating that over 80% of pets aged three years and older suffer from some form of dental issue.

The market encompasses a wide array of products, medicines, equipment, and services aimed at preventing, diagnosing, and treating dental ailments in pets. From toothpastes, oral care solutions, and dental chews to advanced treatments like root canal therapy and oral surgeries, the sector caters to both routine and complex dental needs.

Market players are increasingly adopting innovation-driven approaches. For instance, companies are investing in developing enzymatic toothpastes and water additives that simplify oral hygiene for pet owners. Meanwhile, e-commerce platforms are bolstering the accessibility of pet dental products, especially in post-pandemic America where online purchasing behaviors have surged.

Major Trends in the Market

-

Rising Popularity of Preventive Oral Care Products: Pet owners are increasingly investing in dental chews, water additives, and toothpastes to prevent dental disease rather than treat it.

-

Expansion of Veterinary Dentistry Services: More clinics are offering specialized dental services including extractions, radiographs, and advanced oral surgeries.

-

E-commerce and Subscription Models for Oral Care Products: Online platforms are gaining momentum with monthly dental kits, automatic refills, and personalized product recommendations.

-

Growth in Functional Foods and Treats: Pet food and treat manufacturers are launching products that promote dental health while offering complete nutrition.

-

Increased Focus on Senior Pet Dentistry: As pets live longer, demand is rising for age-specific dental care, including root canal therapies and pain management.

-

Integration of Digital Dental Records and Imaging: Veterinary clinics are adopting intraoral radiography and digital dental charting for improved diagnostics and continuity of care.

-

Humanization Driving Demand for Advanced Procedures: Pet parents are increasingly opting for dental surgeries and aesthetic care similar to human standards, such as orthodontics and cosmetic tooth restorations.

How is AI Influencing the U.S. Pet Dental Health Market?

Pet care product developers in the U.S. are actively utilizing artificial intelligence (AI) tools for improving pet dental health. AI-powered tools are being deployed for at-home monitoring pets’ oral health, facilitating early detection of issues. Enhanced diagnostic efficiency for in interpretation of dental radiographs with AI such as SignalPET company’s specialized program, SignalSMILE which leverages AI and deep machine learning for comprehensive scanning of pet X-rays leading to early detection diseases like periodontal bone loss and root canal issues. Furthermore, AI algorithms can be applied for improving treatment planning and efficiency by assisting veterinarians in developing personalized treatment strategies.

- For instance, in May 2025, Mars, Incorporated, a globally leading provider of pet care products and services, introduced its global portfolio of artificial intelligence (AI) powered digital health tools for pet wellbeing with the launch of GREENIES Canine Dental Check which is now available in the U.S. The new digital AI tool is trained on more than 53,000 images for analyzing dogs’ teeth and gums for detection of signs of gum irritation and tartar build up, just from a smartphone photo.

Report Scope of U.S. Pet Dental Health Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 3.36 Billion |

| Market Size by 2034 |

USD 5.95 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 6.57% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Animal Type, Indication, Distribution Channel |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

U.S. |

| Key Companies Profiled |

Virbac; Colgate- Palmolive Company; Dechra Pharmaceuticals plc; Nestlé Purina Pet Care; Vetoquinol SA; Nylabone (Central Garden & Pet Company); Barkbox; imRex Inc.; Basepaws, Inc.; Dentalaire, International.; Pedigree (Mars Incorporate); PetIQ, LLC. |

Market Driver: Increased Awareness of Pet Oral Health

One of the primary drivers for the U.S. pet dental health market is the growing awareness among pet owners about the importance of maintaining oral hygiene in animals. Veterinary associations, such as the American Veterinary Medical Association (AVMA), have launched nationwide campaigns like “National Pet Dental Health Month” to educate pet owners about the consequences of neglecting oral health. Poor dental hygiene is linked to systemic conditions like heart, liver, and kidney diseases in pets, prompting owners to adopt preventive measures. As a result, demand for regular professional cleaning services and home-use products like dental treats and brushes is on the rise. This proactive attitude is not only expanding product consumption but also driving the uptake of advanced veterinary dental services.

Market Restraint: High Cost of Advanced Dental Treatments

Despite the increasing emphasis on pet oral health, the high cost of veterinary dental treatments acts as a significant barrier. Advanced procedures such as root canals, tooth extractions, and oral tumor surgeries can range from $500 to over $3,000 per treatment, making them unaffordable for many pet owners. Additionally, pet insurance often provides limited coverage for dental procedures, further deterring pet owners from seeking professional dental care. This has resulted in a gap between the rising awareness and the actual uptake of advanced dental services. Small animal clinics in rural areas may also lack access to specialized dental equipment, restricting service availability.

Market Opportunity: Integration of AI and Telehealth in Veterinary Dentistry

An emerging opportunity lies in integrating AI-driven diagnostics and telehealth platforms into veterinary dentistry. Technologies like AI-based dental imaging software can assist veterinarians in early detection of gum disease, tooth fractures, or oral tumors. Telehealth platforms also offer virtual consultations, helping pet owners monitor their pet’s oral health from home. This is particularly beneficial in underserved regions with limited access to veterinary specialists. Companies investing in digital dental care solutions stand to gain competitive advantage, tapping into the growing segment of tech-savvy pet owners seeking convenience and proactive care.

U.S. Pet Dental Health Market By Type Insights

The products segment holds the largest share of the U.S. pet dental health market, driven by the widespread adoption of home-care oral hygiene products. Among these, dental chews and oral care solutions have gained immense popularity due to their ease of use and pet-friendly flavors. Pet owners prefer these products as they allow for regular dental care without the stress of brushing. In addition, manufacturers are innovating with enzymatic formulations and natural ingredients to attract health-conscious pet owners. Toothpastes & brushes, although traditional, remain essential for pet owners committed to routine brushing. The rising trend of customized dental kits tailored to different breeds further supports this segment.

The services segment is anticipated to witness the highest growth rate over the forecast period. Increasing demand for professional dental cleaning, preventive check-ups, and advanced procedures like root canal therapy is driving this trend. Veterinary clinics and hospitals are increasingly offering bundled dental care packages, including scaling, polishing, and post-operative care. The availability of specialized veterinary dentists in urban areas enables complex treatments, boosting the adoption of professional services. Moreover, pet owners are increasingly opting for annual dental wellness plans as part of preventive healthcare.

U.S. Pet Dental Health Market By Animal Type Insights

Dogs dominate the animal type segment, largely due to their higher prevalence of dental diseases compared to cats and other pets. Breeds with crowded teeth, like bulldogs and pugs, are especially prone to periodontal disease, necessitating regular professional care.

Cats are projected to be the fastest growing segment. Increasing awareness of feline dental diseases such as gingivostomatitis and the development of cat-specific oral care products are contributing to this growth. Companies are also innovating with palatable oral care solutions designed specifically for felines.

U.S. Pet Dental Health Market By Indication Insights

Gum disease is the most commonly treated indication, accounting for a significant portion of veterinary dental visits. Early-stage gingivitis and advanced periodontitis are widespread among aging pets, driving demand for both preventive and therapeutic solutions.

Endodontic diseases such as tooth fractures and pulpitis are gaining attention as pet owners increasingly seek treatment for traumatic injuries and infections. Advanced imaging tools and specialized endodontic procedures are supporting the growth of this segment.

U.S. Pet Dental Health Market By Distribution Channel Insights

Veterinary hospitals and clinics are the leading distribution channel, reflecting their role in both product sales and provision of professional dental services. Pet owners prefer clinics for trusted recommendations on dental care products and access to diagnostic and treatment services.

E-commerce platforms are experiencing rapid growth, driven by convenience and a wide variety of oral care products. Subscription-based delivery models for dental chews and toothpastes are particularly appealing to busy pet owners. Major online retailers and specialized pet health websites have expanded their offerings to cater to the rising demand.

Country-Level Analysis

The U.S. market for pet dental health exhibits significant growth potential, with urban areas leading in terms of veterinary infrastructure and product availability. States such as California, Texas, and New York are key markets due to high pet ownership rates and strong presence of veterinary service providers. Rural areas, however, face challenges like limited access to specialized dental care, creating an opportunity for mobile veterinary clinics and telehealth services.

U.S. Pet Dental Health Market Recent Developments

-

In June 2025, Spot & Tango, launched its first-of-a-kind dental chew made with a patent-pending postbiotic, PupGum which is clinically proven for reducing bad breath in dogs in just seven days.

-

In May 2025, Other Half Pet, launched its first-ever product featuring Canine Oral Health Postbiotic (COHP), Doggie Dental which is a new human-grade powder targeting bad breath, oral biofilms and plaque at their root cause.

-

In February 2025, Fera Pets launched Dental Support which is an easy-to-use powder offering comprehensive dental care. The first-of-a-kind dental product focuses on improving pets’ oral health by balancing the oral microbiome with just one scoop of powder.

-

In July 2024, Pet Honesty, launched a breakthrough meal-time supplement topper, Fresh Breath Dental Powder which is designed for freshening the breath and keeping the teeth and gums of dogs’ healthy.

Some of the prominent players in the U.S. pet dental health market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. pet dental health market

By Type

-

-

- Toothpastes & Brushes

- Oral Care Solutions

- Foods & Treats

- Dental Chews

- Dental Powder

- Others

-

-

- Dental Cleaning

- Surgery

- Root Canal Therapy

- Others

By Animal Type

By Indication

- Gum Disease

- Endodontic Diseases

- Dental calculus

- Oral tumor

- Others

By Distribution Channel

- Veterinary Hospitals & Clinics

- Retail Pharmacies

- E-commerce

- Others