U.S. Platelet Rich Plasma Market Size and Growth

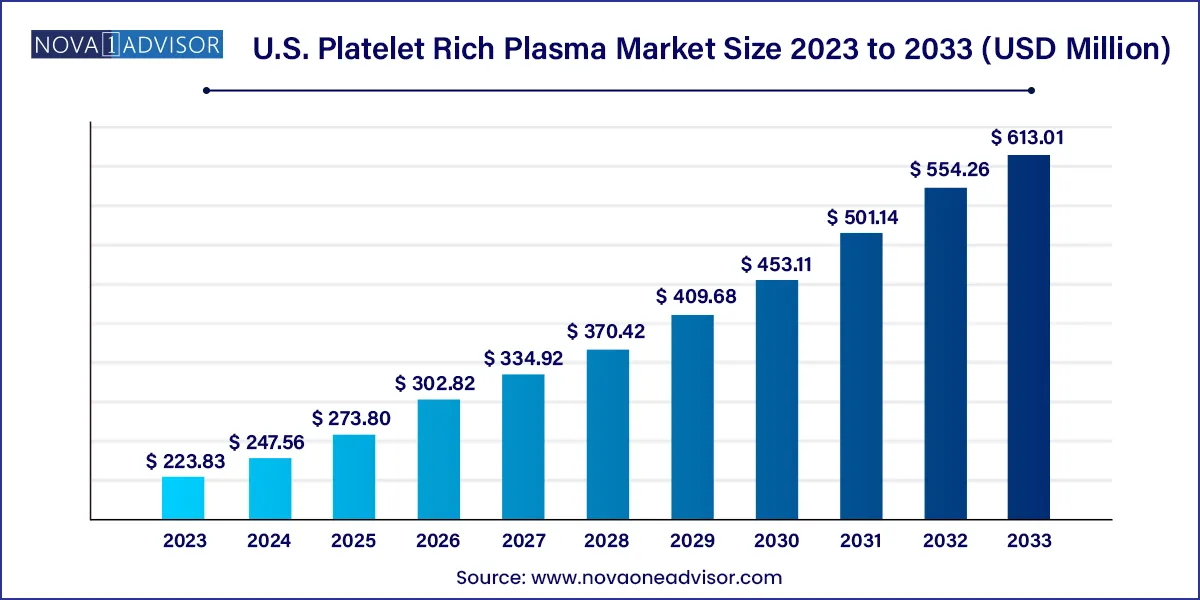

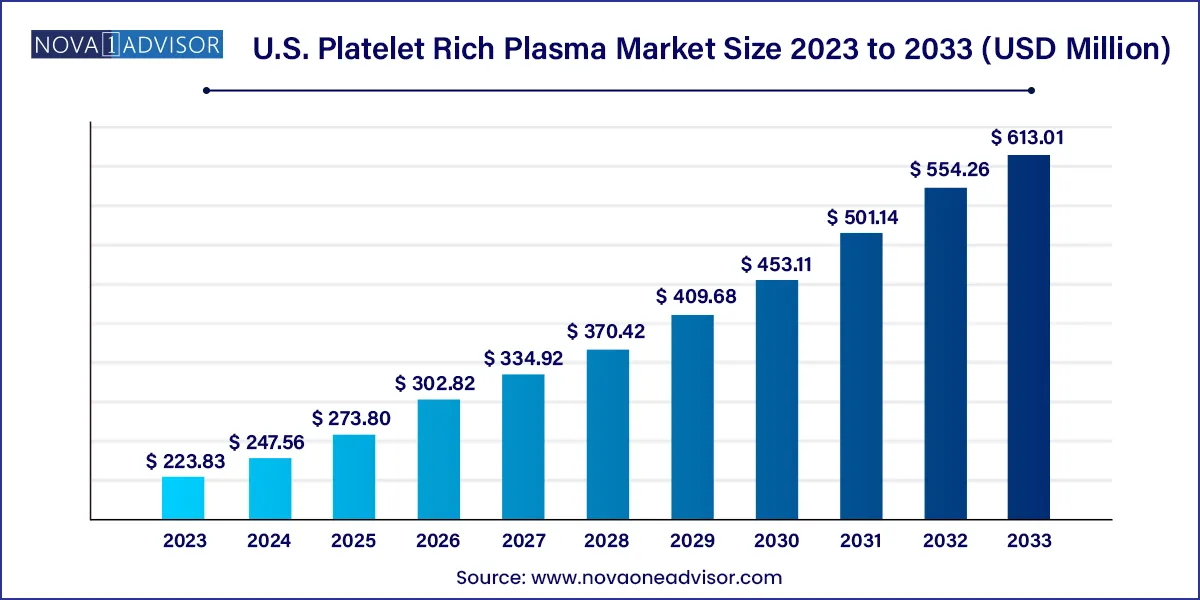

The U.S. platelet rich plasma market size was exhibited at USD 223.83 million in 2023 and is projected to hit around USD 613.01 million by 2033, growing at a CAGR of 10.6% during the forecast period 2024 to 2033.

Key Takeaways:

- Pure platelet rich plasma dominated the market with a revenue share of 51.8% in 2023

- Leukocyte-rich PRP (LR-PRP) is anticipated to grow at a CAGR of around 11% during the forecast period.

- In terms of revenue, the orthopedics held the maximum share of 26.7% in 2023

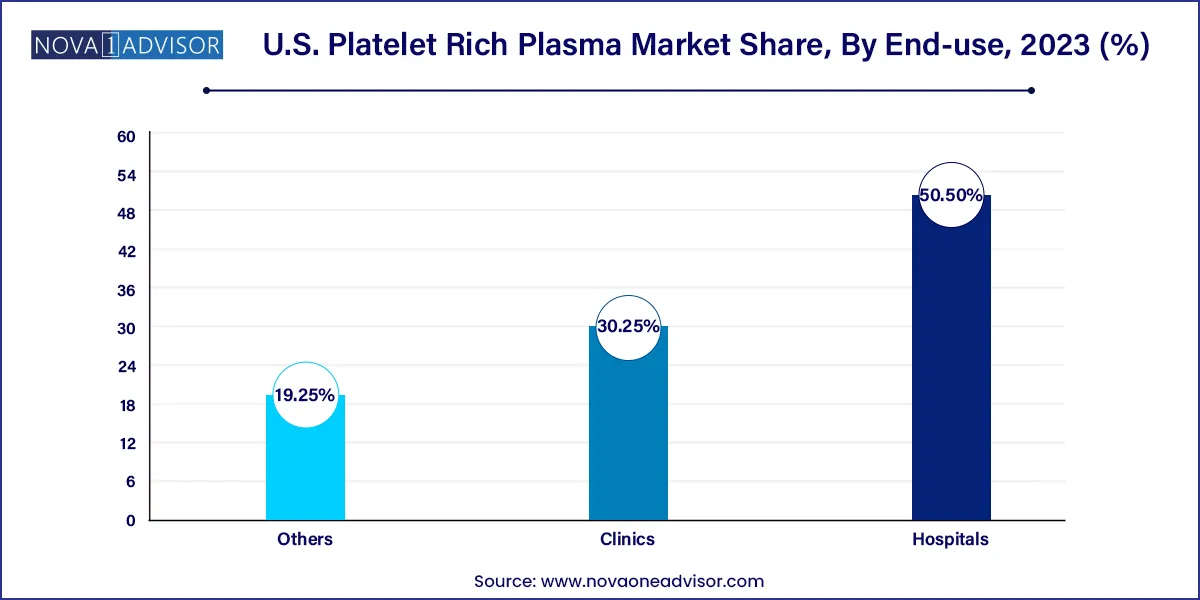

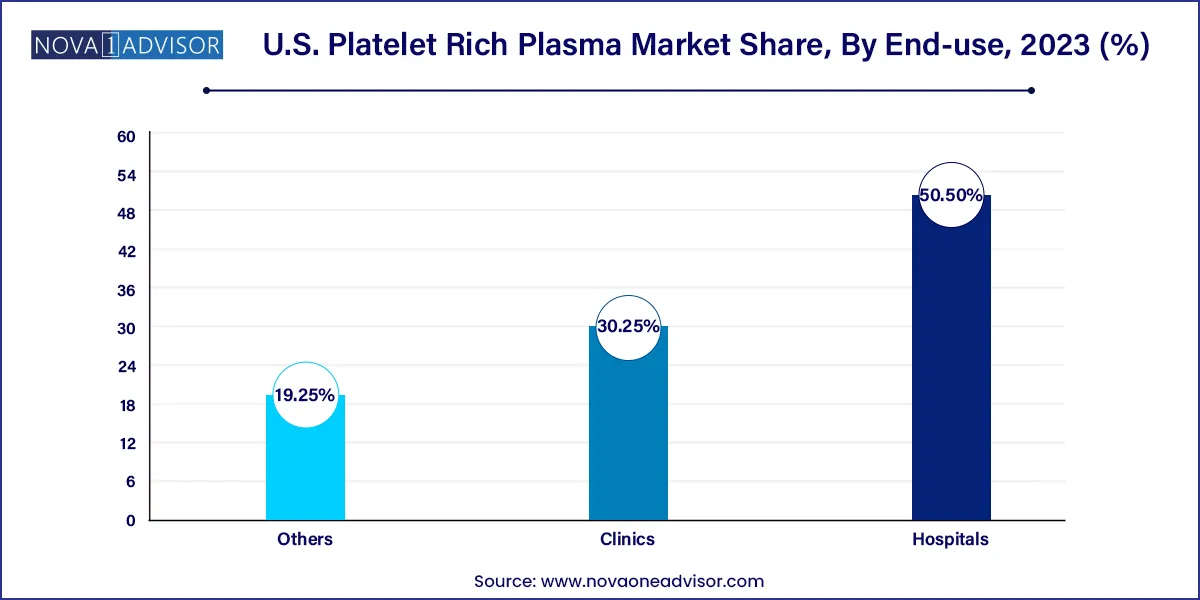

- The hospital segment accounted for the largest revenue share of 50.5% in 2023.

Market Overview

The U.S. Platelet Rich Plasma (PRP) market is undergoing a significant transformation, driven by the convergence of regenerative medicine, sports injury management, dermatological innovation, and orthopedic advancements. PRP is a concentration of autologous platelets in a small volume of plasma. It is rich in growth factors and has gained recognition as a viable therapeutic solution for tissue repair, inflammation control, and aesthetic rejuvenation.

The market has benefited from increased public and clinical awareness of minimally invasive therapies. From elite athletes and celebrities endorsing PRP for joint injuries and hair loss to surgeons employing it in advanced wound care and musculoskeletal therapies, the technique has moved from experimental to semi-mainstream across many clinical applications. The U.S., being a leader in healthcare innovation, regulatory clarity, and private investment in biotech, remains at the forefront of this market.

Moreover, the aging U.S. population, with its growing demand for non-surgical pain relief and cosmetic maintenance, has provided fertile ground for the expansion of PRP therapies. The technique’s low immunogenicity and minimal downtime compared to surgical procedures also contribute to its rising popularity. Regulatory considerations remain relatively lenient for autologous PRP procedures, encouraging clinicians to incorporate these therapies in outpatient settings.

Major Trends in the Market

-

Increased Application in Aesthetic Dermatology: Use of PRP for facial rejuvenation, hair restoration, and scar treatment is growing rapidly across med-spas and cosmetic clinics.

-

Bundling of PRP with Other Regenerative Therapies: PRP is increasingly combined with stem cell therapy, hyaluronic acid injections, or microneedling for synergistic outcomes.

-

Technological Advances in PRP Kits: Innovations in centrifuge systems and separation kits are allowing for faster and more consistent PRP preparation, reducing human error.

-

Rise of Orthobiologics in Sports Medicine: PRP is now routinely recommended for tendon injuries, ligament sprains, and post-operative healing in sports medicine.

-

Insurance Reimbursement Expansion: Some orthopedic and dermatologic indications are beginning to qualify for partial insurance coverage, improving affordability.

-

Adoption in Chronic Ulcer Management: Hospitals and wound care centers are increasingly adopting PRP therapy for non-healing ulcers, especially diabetic foot ulcers.

-

Regulatory Scrutiny on Commercial Claims: FDA warnings on unsubstantiated PRP claims are pushing companies toward evidence-based marketing and product labeling.

Report Scope of The U.S. Platelet Rich Plasma Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 247.56 Million |

| Market Size by 2033 |

USD 613.01 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 10.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Application, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Johnson & Johnson Services, Inc; Arthrex, Inc.; EmCyte Corporation; Dr PRP USA LLC; Juventix Regenerative Medical, LLC; Terumo Corporation; Zimmer Biomet; Stryker; Apex Biologix; Celling Biosciences |

Market Driver: Rising Demand for Minimally Invasive Regenerative Therapies

One of the strongest growth drivers in the U.S. PRP market is the increasing preference for minimally invasive and regenerative therapies among patients and providers. Traditional surgical interventions often come with prolonged recovery times, higher risks, and significant costs. PRP, by contrast, can be administered via injection in an outpatient setting, with little to no recovery time and reduced risk of infection or rejection, since it utilizes the patient's own blood.

In orthopedics, for instance, PRP is being used to treat conditions like tennis elbow, rotator cuff tears, and knee osteoarthritis—either as a stand-alone solution or adjunct to surgery. Similarly, in aesthetic medicine, PRP-based "vampire facials" and hair restoration therapies have gained celebrity endorsement and wide consumer appeal. The common thread is patient preference for natural, low-risk, and effective treatments that don't require extensive downtime. This shift toward non-invasive care is expected to fuel PRP’s adoption in both medical and cosmetic disciplines.

Market Restraint: Lack of Standardization and Clinical Evidence

Despite its promise, the PRP market in the U.S. is constrained by a lack of standardized preparation protocols and variability in clinical efficacy. PRP is not a single product—there are many variations based on platelet concentration, inclusion or exclusion of leukocytes, and preparation methods. This inconsistency makes it difficult to draw broad clinical conclusions or conduct large-scale randomized controlled trials, which are crucial for gaining FDA approvals and insurance reimbursement.

Additionally, skepticism among physicians who prioritize evidence-based medicine can limit broader adoption. While patient testimonials and early studies are promising, more rigorous data is needed across applications. The ambiguity around classification whether PRP is a biologic, a drug, or a device also creates regulatory grey zones, potentially deterring investors or smaller clinics from adopting or offering it at scale.

Market Opportunity: Integration into Chronic Wound Care Programs

A notable opportunity in the U.S. PRP market lies in chronic wound management, particularly for diabetic foot ulcers, venous leg ulcers, and pressure sores. These conditions are notoriously difficult to treat, with high recurrence rates and significant healthcare costs. PRP’s ability to promote angiogenesis, collagen synthesis, and epithelialization makes it a strong candidate for inclusion in advanced wound care regimens.

Hospitals and outpatient wound care centers are already experimenting with PRP gel and injections as part of multidisciplinary care plans. The increasing prevalence of diabetes and obesity in the U.S., both of which contribute to poor wound healing, ensures a growing patient base. As more clinical data emerges, PRP could become a reimbursable therapy for ulcers, offering commercial opportunities for device makers and service providers alike.

U.S. Platelet Rich Plasma Market By Type Insights

Pure Platelet Rich Plasma dominated the market in 2024 due to its widespread use in dermatology and cosmetic procedures where minimal inflammation is preferred. This type of PRP is characterized by the absence of leukocytes, reducing post-injection discomfort and improving compatibility with facial or sensitive tissue applications. Dermatologists and cosmetic surgeons frequently opt for pure PRP in facial rejuvenation procedures, including wrinkle reduction, scar fading, and volume enhancement, thanks to its smoother formulation and better patient tolerance.

Conversely, Leukocyte-Rich Platelet Rich Plasma is the fastest-growing segment, particularly in orthopedics and sports medicine. The inclusion of leukocytes is beneficial in managing musculoskeletal injuries due to its enhanced inflammatory response, promoting faster tissue regeneration and healing. Athletic trainers and orthopedic clinics are increasingly using LR-PRP for tendonitis, ligament injuries, and joint pain management, supported by emerging clinical data and endorsements from professional sports organizations.

U.S. Platelet Rich Plasma Market By Application Insights

Orthopedics remained the dominant application area in the U.S. PRP market, driven by its increasing use in the treatment of joint disorders, tendon injuries, and cartilage repair. The rise of outpatient orthopedic centers and ambulatory surgery facilities has made PRP injections a popular conservative treatment before surgery is considered. Institutions like the Mayo Clinic and Cleveland Clinic have integrated PRP into care plans for joint pain, ACL tears, and spinal degeneration, validating its clinical utility.

Cosmetic surgery and dermatology are among the fastest-growing applications, especially for facial aesthetics, acne scars, and alopecia. PRP is being incorporated into hair regrowth protocols, often combined with microneedling or laser treatments. Celebrities and social media influencers have further driven demand, making procedures like "PRP facials" mainstream. Clinics in urban centers such as Los Angeles and New York now offer bundled PRP treatments that combine anti-aging and regenerative benefits in a single session.

U.S. Platelet Rich Plasma Market By End-use Insights

Hospitals represented the leading end-use segment, particularly due to their advanced infrastructure, access to comprehensive pathology labs for PRP preparation, and ability to integrate PRP into post-surgical recovery programs. Large hospitals in metropolitan areas are also establishing specialized regenerative medicine departments, where PRP is offered as a pain management or wound healing adjunct.

Clinics, however, are emerging as the fastest-growing segment, owing to their flexibility, lower cost structures, and consumer-friendly environment. Dermatology and sports medicine clinics are especially agile in adopting new technologies and procedures. Many clinics now offer same-day PRP treatments, using compact centrifuge kits that require minimal space and staff training. The democratization of PRP therapy at the clinic level is enhancing accessibility and driving rapid market expansion.

Country-Level Analysis – United States

In the United States, the adoption of PRP therapy varies significantly by region, specialty, and healthcare setting. Urban areas such as California, Texas, Florida, and New York lead in cosmetic applications due to higher consumer income and aesthetic awareness. States with strong sports medicine ecosystems, such as Colorado and Arizona, have seen growth in orthopedic and athletic-focused PRP clinics.

Institutions like Johns Hopkins and the Hospital for Special Surgery are actively involved in clinical research on PRP efficacy, helping legitimize its use in mainstream medicine. The U.S. also benefits from a thriving private sector of device makers producing PRP kits, centrifuge systems, and adjunct delivery tools. Additionally, the relatively relaxed regulatory framework for autologous use (under FDA Section 361) allows physicians to use PRP without extensive product registration, provided the preparation is minimally manipulated and used in the same surgical procedure.

Reimbursement remains limited but is slowly improving. Private insurers are beginning to cover PRP for select indications, particularly when alternative treatments have failed. This shift may soon expand accessibility to a wider demographic beyond elective cash-paying patients.

Some of the prominent players in the U.S. platelet rich plasma market include:

- Johnson & Johnson Services, Inc.

- Arthrex, Inc.

- EmCyte Corporation

- Dr PRP USA LLC

- Juventix Regenerative Medical, LLC.

- Terumo Corporation

- Zimmer Biomet

- Stryker

- Apex Biologix

- Celling Biosciences, Inc.

Recent Developments

-

In February 2025, Arthrex Inc. launched a new dual-spin PRP preparation system designed for enhanced platelet yield and faster processing, targeting orthopedic clinics and surgical centers across the U.S.

-

In January 2025, EmCyte Corporation partnered with a group of regenerative medicine clinics to pilot an AI-powered outcome tracking platform, enabling real-time analysis of PRP therapy efficacy.

-

In December 2024, Zimmer Biomet announced the expansion of its biologics segment to include next-generation PRP devices for post-surgical recovery in knee and shoulder procedures.

-

In November 2024, Dr. PRP USA launched a mobile PRP therapy unit in Los Angeles aimed at delivering in-home aesthetic PRP treatments, an innovation targeting affluent urban consumers.

-

In October 2024, RegenLab USA received conditional FDA clearance for a hybrid PRP and hyaluronic acid gel formulation designed for joint degeneration therapy.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. platelet rich plasma market.

Type

- Pure Platelet Rich Plasma

- Leukocyte Rich Platelet Rich Plasma

- Others

Application

- Orthopedics

- Sports Medicine

- Cosmetic Surgery

- Dermatology

-

-

- Venous Ulcer

- Traumatic Ulcer

- Diabetic Ulcer

- Pyoderma Gangrenosum Ulcer

- Trophic Ulcer

- Vasculitic Ulcer

- Others

- Ophthalmic Surgery

- Neurosurgery

- General Surgery

- Others

End-use