U.S. Practice Management System Market Size and Trends

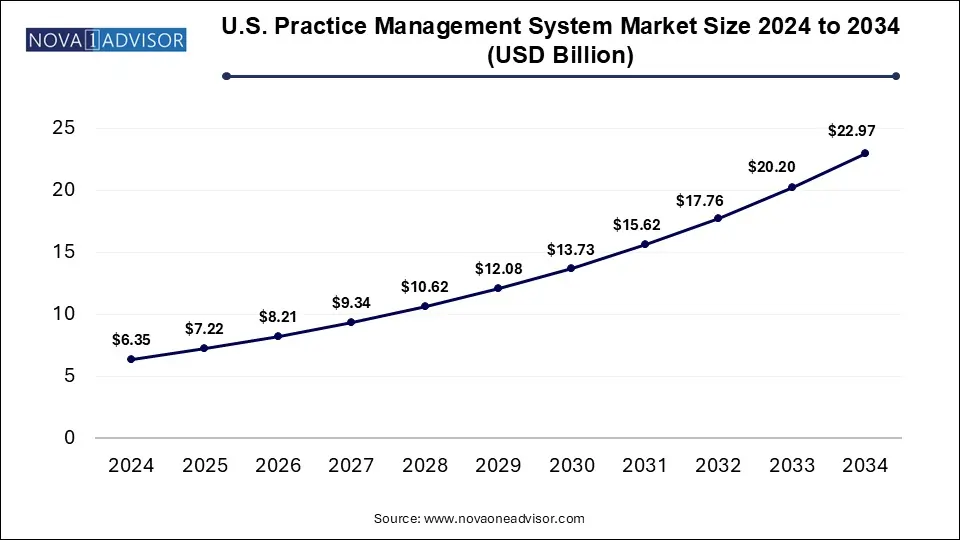

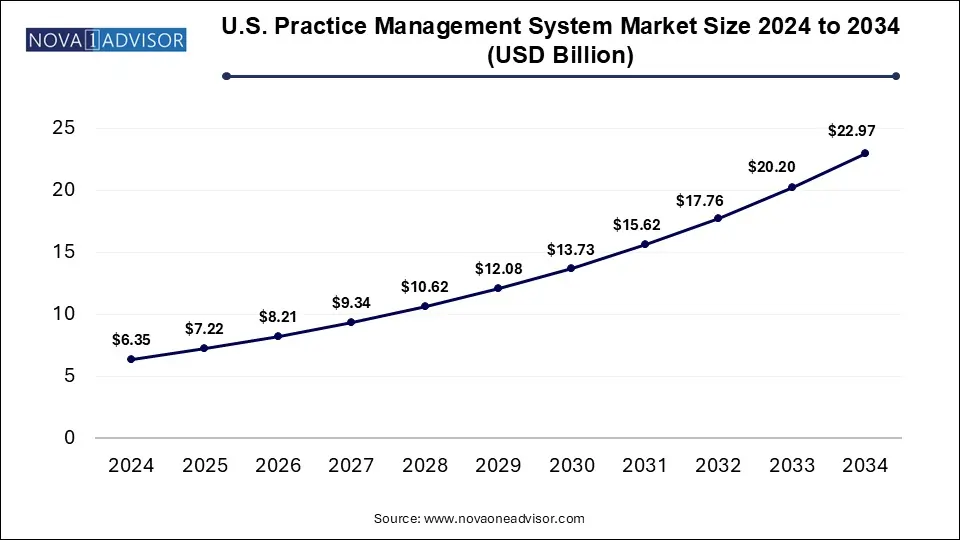

The U.S. Practice Management System Market size was exhibited at USD 6.35 billion in 2024 and is projected to hit around USD 22.97 billion by 2034, growing at a CAGR of 13.72% during the forecast period 2025 to 2034.

U.S. Practice Management System Market Key Takeaways:

- In 2024, the integrated segment dominated the market, accounting for a substantial revenue share of 76%.

- The software segment held the largest portion of the market in 2024, contributing 67% of the total revenue.

- Web-based solutions emerged as the leading delivery mode in 2024, securing a revenue share of 48%.

- The physician back office segment captured the highest market share in 2024, representing 57% of total revenues.

Market Overview

The U.S. Practice Management System (PMS) market has emerged as a crucial pillar within the healthcare IT landscape, enabling healthcare providers to streamline administrative, financial, and clinical workflows. With the rising complexities of medical billing, patient scheduling, regulatory compliance, and electronic health record (EHR) integration, practice management systems have become indispensable tools for modern healthcare facilities. The market encompasses a wide array of solutions, including integrated platforms and standalone applications designed to cater to diverse healthcare settings, from physician back offices to diagnostic laboratories and pharmacies.

In recent years, the demand for PMS solutions in the U.S. has been bolstered by the push for value-based care and interoperability across healthcare systems. Cloud-based delivery models, in particular, are reshaping how healthcare providers adopt technology, allowing for scalable, cost-effective, and secure access to patient data and administrative tools. For instance, the shift from on-premise to cloud PMS solutions has enabled small and mid-sized practices to access enterprise-level functionalities without substantial capital expenditure.

Moreover, regulatory initiatives like the Centers for Medicare & Medicaid Services (CMS) promoting the adoption of electronic health records (EHRs) and Meaningful Use criteria have further amplified the need for PMS platforms that can integrate seamlessly with EHR systems. Large healthcare systems are increasingly leveraging integrated solutions that combine billing, patient engagement, and e-prescription modules within a unified framework.

Major Trends in the Market

-

Transition Toward Cloud-Based Solutions: Cloud deployment is rapidly becoming the preferred delivery mode, enabling remote access, scalability, and cost efficiency.

-

Integration with Telehealth Platforms: PMS vendors are adding telehealth capabilities to meet the growing demand for virtual care post-pandemic.

-

AI-Powered Automation: Artificial intelligence is being integrated into PMS to enhance revenue cycle management, predictive analytics, and workflow automation.

-

Growing Adoption of Patient Engagement Tools: Features like online appointment scheduling, automated reminders, and patient portals are becoming standard in PMS offerings.

-

Regulatory Compliance Driving Upgrades: The need to comply with HIPAA, ICD-10 coding, and interoperability standards is prompting providers to invest in advanced PMS solutions.

-

Shift Toward Subscription-Based Pricing Models: Software-as-a-Service (SaaS) PMS offerings are attracting small practices with their pay-as-you-go pricing structures.

Report Scope of U.S. Practice Management System Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 7.22 Billion |

| Market Size by 2034 |

USD 22.97 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 13.72% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Component, Delivery Mode, End use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Henry Schein, Inc.; Veradigm LLC (Allscripts Healthcare, LLC); AdvantEdge Healthcare Solutions; Athenahealth, Inc.; Cerner Corporation (Oracle); GE Healthcare; McKesson Corporation; EPIC Systems Corporation; NXGN Management, LLC. (Thoma Bravo); eClinicalWorks; CareCloud, Inc.; Kareo, Inc.; AdvancedMD, Inc. (Global Payments Inc.); DrChrono, Inc.; CollaborateMD Inc.; OfficeAlly Inc. |

Market Driver: Rising Focus on Healthcare Digitalization

A key driver accelerating the growth of the U.S. PMS market is the ongoing digital transformation in healthcare. Healthcare organizations are under increasing pressure to improve operational efficiency, reduce administrative burdens, and enhance patient outcomes. Practice management systems address these needs by automating billing, claims management, and scheduling, significantly reducing manual errors and administrative costs. For instance, practices using cloud-based PMS have reported up to a 30% reduction in claim denials due to built-in coding assistance and real-time verification tools. Moreover, the U.S. government’s financial incentives for adopting healthcare IT, coupled with penalties for non-compliance with EHR mandates, are driving healthcare providers across the country to adopt advanced PMS platforms.

Market Restraint: Data Security and Privacy Concerns

While the adoption of PMS solutions continues to rise, concerns regarding data security and patient privacy remain a significant barrier. The healthcare industry has witnessed a surge in cyberattacks and ransomware incidents, with healthcare data breaches in the U.S. rising by over 30% in the past two years. Cloud-based PMS solutions, despite their advantages, have heightened apprehensions around unauthorized access and data leaks. Compliance with HIPAA regulations requires vendors and providers to implement robust security measures, often increasing the cost of adoption. These challenges particularly impact smaller practices with limited IT infrastructure and budget for cybersecurity enhancements.

Market Opportunity: Integration of AI and Predictive Analytics in PMS

An emerging opportunity lies in the integration of artificial intelligence and predictive analytics within practice management systems. AI can automate complex tasks like prior authorization, claims scrubbing, and predictive scheduling, allowing healthcare providers to optimize workflows and focus on patient care. Predictive analytics, meanwhile, can provide actionable insights into patient no-show risks, revenue trends, and population health management. For example, predictive models can alert practices to potential bottlenecks in appointment scheduling or flag billing errors before submission, improving financial performance. Vendors investing in AI-driven PMS platforms are likely to capture significant market share as providers increasingly seek smarter and more intuitive systems.

Segmental Analysis

By Product

Integrated practice management systems held the largest revenue share in the U.S. market in 2024, as healthcare organizations prefer comprehensive platforms that unify scheduling, billing, e-prescriptions, and patient engagement. These systems eliminate the need for multiple standalone applications, ensuring seamless interoperability across administrative and clinical workflows. The integrated EHR/EMR modules are particularly in demand, supporting regulatory compliance and improving care coordination. Large hospital networks and multi-specialty practices are the primary adopters, driven by the need for scalable and interoperable solutions.

Standalone PMS solutions, while smaller in market share, are witnessing growing adoption among small and medium-sized practices. These systems appeal to providers seeking cost-effective solutions for specific functions like billing or appointment scheduling without overhauling their entire IT infrastructure. Innovations such as standalone patient engagement apps and telehealth add-ons are making this segment increasingly attractive to niche players.

By Component

The software component accounted for the majority share of the U.S. PMS market, reflecting the high demand for advanced functionalities like electronic billing, claims management, and analytics dashboards. Cloud-hosted software offerings have surged in popularity, with vendors introducing intuitive interfaces and mobile-accessible platforms to cater to busy healthcare providers.

Services are projected to grow at the fastest rate, driven by rising demand for implementation support, training, and maintenance services. As practices transition from legacy systems to modern PMS platforms, professional services are critical to ensure smooth migration and user adoption. Managed services, offering round-the-clock support and system monitoring, are gaining traction among resource-constrained practices.

By Delivery Mode

Web-based PMS solutions remained dominant in 2024, offering cost efficiency and ease of deployment for a wide range of healthcare facilities. These solutions are especially popular in small to mid-sized practices due to their minimal IT infrastructure requirements.

Cloud-based PMS solutions are the fastest-growing segment, fueled by the growing preference for subscription-based models and the ability to access systems remotely. Providers are increasingly migrating from on-premise systems to cloud environments, drawn by lower upfront costs and enhanced scalability.

By End Use

Physician back offices dominated the U.S. PMS market, with widespread adoption of systems to manage patient appointments, billing, and workflow automation. The integration of PMS with clinical systems allows for efficient practice operations and better patient management.

Diagnostic laboratories represent a fast-growing end-use segment, driven by the need for efficient test scheduling, result management, and billing automation. As diagnostic services expand in the U.S., labs are increasingly turning to PMS solutions to handle high patient volumes and streamline administrative tasks.

Country-Level Analysis: United States

In the U.S., the PMS market is experiencing rapid growth across both urban and rural settings. Urban centers like California, New York, and Texas are leading in adoption due to their dense network of healthcare facilities and higher concentration of large hospital systems. In rural areas, smaller practices and clinics are adopting web-based and cloud PMS solutions to enhance care delivery despite limited IT resources. Government initiatives, such as the Medicare Access and CHIP Reauthorization Act (MACRA), are further incentivizing U.S. providers to embrace PMS solutions to improve reporting and reimbursement processes.

Some of The Prominent Players in The U.S. Practice Management System Market Include:

- Henry Schein, Inc.

- Veradigm LLC (Allscripts Healthcare, LLC)

- AdvantEdge Healthcare Solutions

- Athenahealth, Inc.

- Cerner Corporation (Oracle)

- GE Healthcare

- McKesson Corporation

- EPIC Systems Corporation

- NXGN Management, LLC.

- eClinicalWorks

- CareCloud, Inc.

- Kareo, Inc.

- AdvancedMD, Inc.

- DrChrono, Inc. (EverCommerce)

- CollaborateMD Inc. (EverCommerce)

- OfficeAlly Inc.

Recent Developments

-

June 2025: Athenahealth launched a next-generation cloud-based PMS with embedded AI tools for claims management and patient engagement.

-

April 2025: Epic Systems announced a partnership with a leading cybersecurity firm to enhance data protection features across its PMS solutions.

-

February 2025: Allscripts unveiled an upgraded version of its PMS platform with telehealth integration and enhanced interoperability with third-party applications.

-

January 2025: eClinicalWorks introduced a mobile-first PMS solution targeted at small practices, enabling remote management of scheduling and billing.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Practice Management System Market.

By Product

-

- Integrating Software

- EHR/EMR

- e-Rx

- Patient Engagement

- Others

By Component

By Delivery Mode

- On Premise

- Web-Based

- Cloud-Based

By End Use

- Physician Back Office

- Pharmacies

- Diagnostic Laboratories

- Other Settings