U.S. Regulatory Affairs Market Size and Research

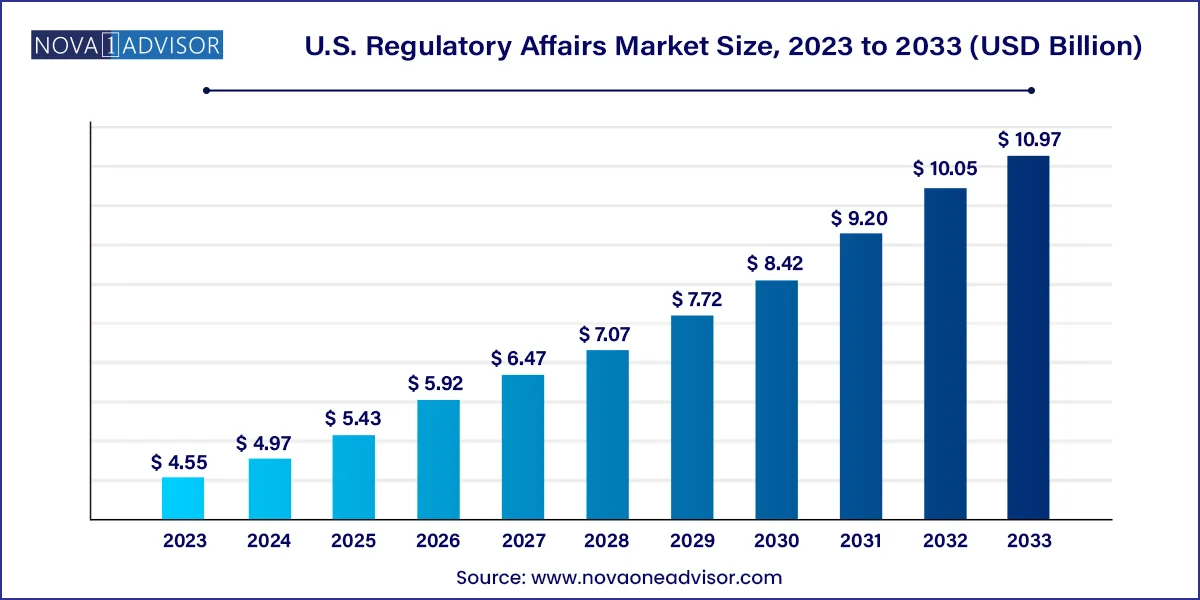

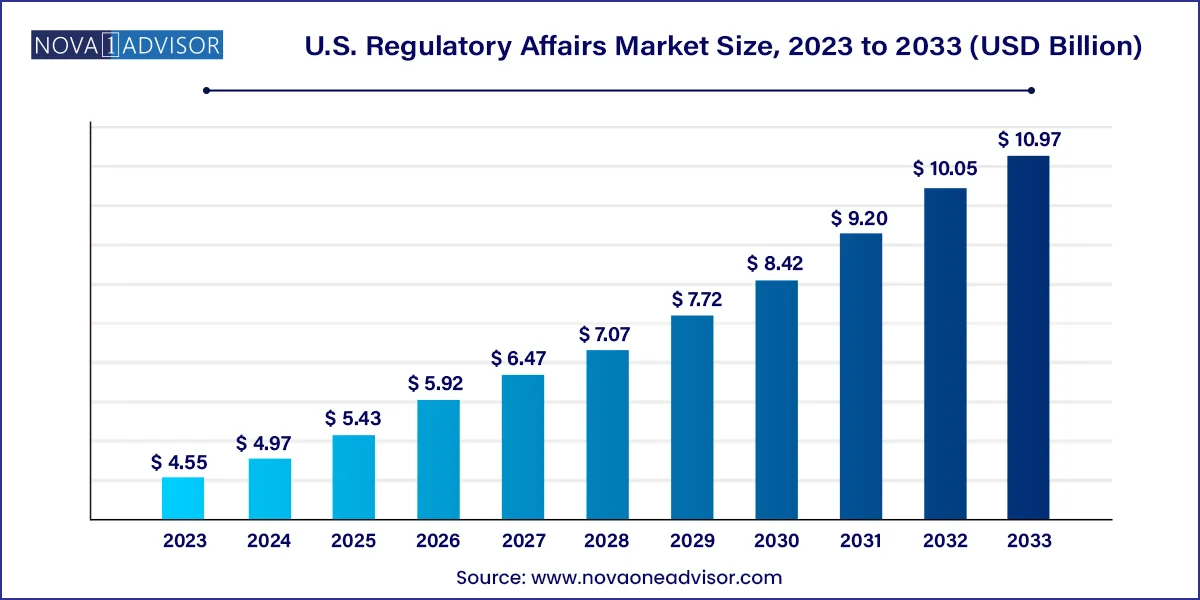

The U.S. regulatory affairs market size was exhibited at USD 4.55 billion in 2023 and is projected to hit around USD 10.97 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2024 to 2033.

U.S. Regulatory Affairs Market Key Takeaways:

- The regulatory writing & publishing segment dominated the market and accounted for a share of over 16% in 2023.

- Thelegal representation segment is expected to rise with the fastest CAGR over the forecast period.

- Medical devices accounted for the largest market revenue share in 2023 and are anticipated to grow at the fastest CAGR over the forecast period.

- Oncology accounted for the largest market revenue share in 2023.

- The immunology segment is expected to grow at the fastest CAGR during the forecast period.

- Clinical studies accounted for the largest market revenue share in 2023.

- Outsourced service providers accounted for the largest market revenue share in 2023 and are anticipated to grow at the fastest CAGR over the forecast period.

- The medium-sized companies accounted for the largest market revenue share in 2023.

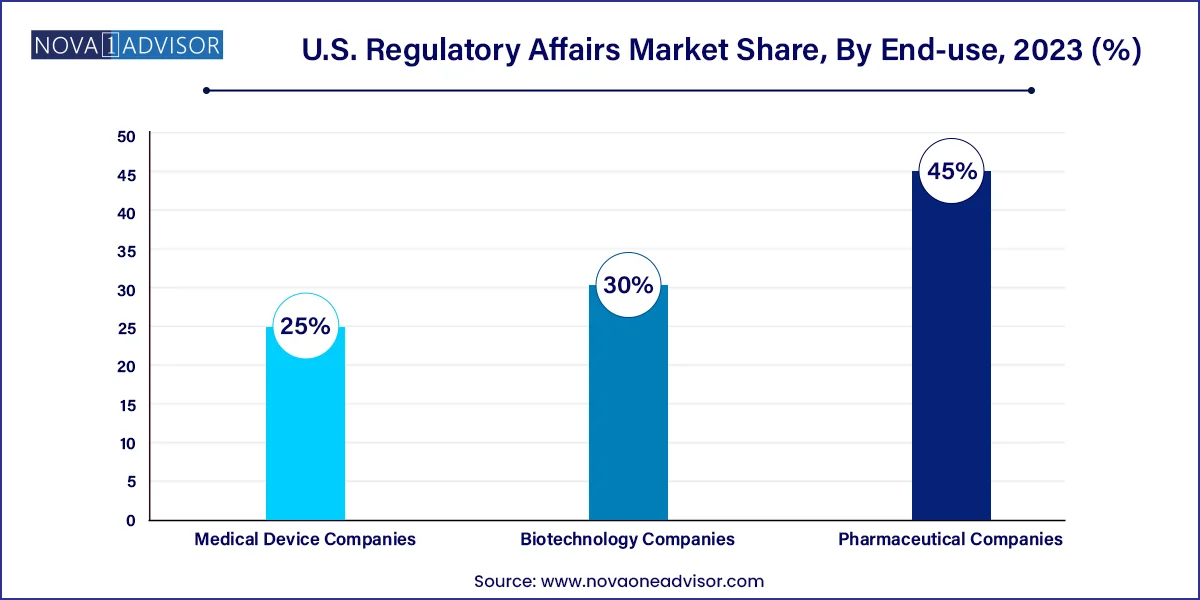

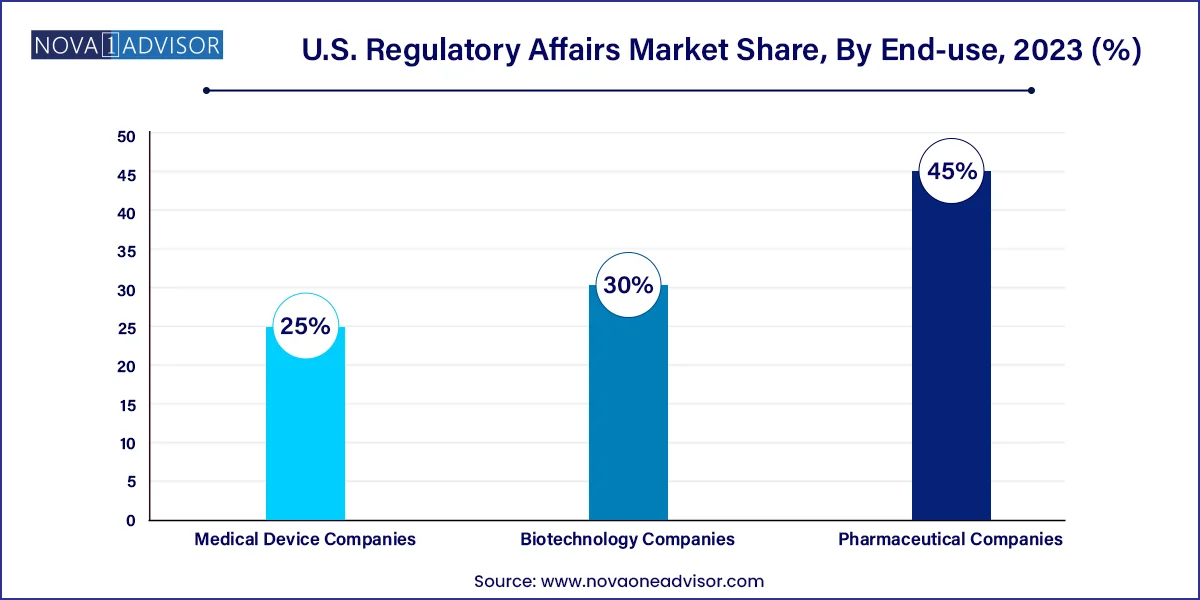

- The pharmaceutical companies segment dominated the market share of 45.0% in 2023.

Market Overview

The U.S. regulatory affairs market plays a vital role in ensuring that healthcare innovations spanning pharmaceuticals, biologics, biosimilars, and medical devices comply with federal standards for safety, efficacy, and quality. As a critical interface between regulatory agencies such as the U.S. Food and Drug Administration (FDA) and life sciences companies, regulatory affairs professionals and service providers are central to bringing medical products to market efficiently and ethically.

The complexity of U.S. healthcare regulations and the growing pipeline of new drug entities, combination therapies, cell and gene therapies, and novel medical devices are fueling the demand for regulatory expertise. Regulatory affairs services not only assist in preparing documentation and navigating submission processes but also provide strategic consulting during preclinical and clinical phases to ensure alignment with compliance protocols. Additionally, increased outsourcing trends among small to mid-sized firms and the emergence of digital regulatory tools are reshaping the landscape of this industry.

As biotechnology, pharmaceutical, and medtech firms strive to expedite product development while meeting stringent regulatory frameworks, the regulatory affairs ecosystem is evolving into a multifaceted service sector encompassing consulting, legal guidance, publishing, and lifecycle management. In the U.S., where the innovation-to-commercialization pipeline is more dynamic than ever, the regulatory affairs market is poised to witness consistent growth.

Major Trends in the Market

-

Surge in outsourcing regulatory affairs services, especially by early-stage and small biotech firms.

-

Increased emphasis on digital transformation and eCTD (electronic Common Technical Document) submissions.

-

Rising complexity of biologics and cell/gene therapies leading to demand for niche regulatory expertise.

-

Integration of AI in regulatory operations to optimize document review and submission timelines.

-

FDA’s evolving guidance on expedited approvals, such as Fast Track and Breakthrough Therapy designations.

-

Greater demand for regulatory consulting during the preclinical and clinical trial phases.

-

Consolidation of regulatory affairs services into centralized regulatory hubs for multi-product firms.

-

Heightened focus on post-market surveillance and real-world evidence (RWE) compliance requirements.

Report Scope of U.S. Regulatory Affairs Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 4.97 Billion |

| Market Size by 2033 |

USD 10.97 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Services, Category, Indication, Product Stage, Service Provider, Company Size, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

Accell Clinical Research, LLC; Genpact; CRITERIUM, INC.; ICON plc; Promedica International; WuXi AppTec; Medpace; Charles River Laboratories; Labcorp Drug Development; Parexel International (MA) Corporation; Freyr; Pharmalex GmbH; NDA Group AB; Qvigilance; BlueReg; Cambridge Regulatory Services; VCLS |

Market Driver: Expanding Biopharma and MedTech Pipelines

A primary driver of the U.S. regulatory affairs market is the expanding pipeline of pharmaceuticals, biologics, and medical devices, particularly in areas such as oncology, immunology, and rare diseases. According to the FDA, new drug applications (NDAs) and biologics license applications (BLAs) have reached record numbers in recent years. This growth reflects a surge in innovation driven by advancements in genomics, targeted therapies, and personalized medicine.

Every product that enters the development pipeline requires extensive regulatory documentation, strategic planning, and communication with authorities to obtain approval. Regulatory affairs services guide companies through Investigational New Drug (IND) applications, New Drug Applications (NDAs), Biologic License Applications (BLAs), and Pre-Market Approvals (PMAs) for devices. With increasingly sophisticated products, companies are seeking external expertise to navigate regulatory complexity, making regulatory affairs an indispensable component of the product development lifecycle.

Market Restraint: Evolving and Complex Regulatory Frameworks

The ever-changing regulatory environment in the U.S. presents a major restraint for companies operating in this market. Frequent updates to FDA guidance, increased emphasis on pharmacovigilance, and the introduction of new data requirements—such as for digital health tools and software-as-a-medical-device (SaMD)—can create uncertainty and compliance risks.

For companies without deep in-house expertise, this evolving landscape increases the chance of delays, rejections, or post-market complications. Regulatory ambiguity, particularly for combination products or novel biologics, may extend the approval timeline and inflate development costs. Furthermore, misinterpretation of regulatory pathways can lead to strategic missteps, resulting in non-compliance penalties or additional clinical work.

Market Opportunity: Acceleration of Digital Health and Combination Products

The emergence of digital health technologies, AI-integrated devices, and combination products presents a major opportunity for regulatory affairs professionals in the U.S. With more companies developing software-driven diagnostics, wearables, and drug-device combinations, there is a growing need for expertise that spans multiple regulatory categories.

Regulatory professionals who understand both traditional therapeutic regulations and novel digital frameworks (such as FDA’s Digital Health Software Precertification Program) are in high demand. This opportunity is especially relevant for regulatory consultancies that can provide hybrid expertise across medical devices, therapeutics, and digital health. Furthermore, combination products require integrated submission strategies involving both CDER (Center for Drug Evaluation and Research) and CDRH (Center for Devices and Radiological Health), increasing the value of specialized regulatory knowledge.

U.S. Regulatory Affairs Market By Service Insights

Regulatory consulting services dominated the U.S. regulatory affairs market due to their critical role in guiding product development teams through strategy formulation, regulatory classification, and communication with agencies. These services are particularly in demand during early-stage development, IND meetings, and FDA submission planning. Many biopharmaceutical firms, especially startups and those entering new therapeutic areas, rely on consultants for initial assessments, pre-IND meetings, and risk mitigation planning. Consulting firms offer tailored strategies for each product type and regulatory pathway, positioning them as the backbone of the regulatory planning process.

Regulatory writing and publishing services are witnessing the fastest growth, propelled by the increasing volume of documentation required by the FDA and other stakeholders. Within this segment, writing services lead in demand due to the complexity of INDs, NDAs, and BLA submissions, requiring high-quality summaries and consistent formatting. Publishing, especially eCTD submissions, is gaining traction with the FDA mandating electronic formats for almost all product types. Advanced software tools, AI-enabled writing assistants, and document management platforms are enhancing the efficiency and scalability of regulatory publishing.

U.S. Regulatory Affairs Market By Category Insights

Drugs, particularly innovator drugs, represent the dominant category within the U.S. regulatory affairs landscape. These products require comprehensive documentation from preclinical through post-marketing phases and involve strategic decisions regarding orphan drug designation, fast track, and breakthrough therapy approvals. Innovator drug companies often maintain large regulatory departments or partner with specialized consultancies to manage ongoing submissions and FDA interactions.

Biologics, specifically ATMPs (advanced therapy medicinal products), are the fastest-growing category, as they include cutting-edge therapies such as gene therapy, cell therapy, and tissue-engineered products. These treatments pose unique challenges in terms of manufacturing controls, trial design, and regulatory classification. ATMP developers are increasingly outsourcing regulatory tasks due to the specialized knowledge required. Moreover, the FDA’s Office of Tissues and Advanced Therapies (OTAT) has streamlined pathways like RMAT (Regenerative Medicine Advanced Therapy) designation, further expanding regulatory activities in this category.

U.S. Regulatory Affairs Market By Indication Insights

Oncology dominated the indication segment, due to the sheer volume of oncology drugs and devices being developed, as well as their complexity and urgency. The FDA’s commitment to accelerated oncology approvals, such as priority review and accelerated approval, places a heavy burden on regulatory teams to manage ongoing clinical submissions, data analysis, and fast turnaround times. Regulatory professionals in oncology must be adept in managing orphan drug status, breakthrough designations, and REMS (Risk Evaluation and Mitigation Strategies) programs.

Neurology is one of the fastest-growing indications, driven by an increase in neurodegenerative diseases, epilepsy treatments, and CNS-focused biologics. Many of these therapies involve complex delivery systems or novel mechanisms of action, necessitating strategic regulatory planning. Given the challenge of designing clinical endpoints for neurological conditions, regulatory experts are crucial in defining acceptable trial designs and endpoints that satisfy FDA expectations.

U.S. Regulatory Affairs Market By Product Stage Insights

Clinical studies stage dominated, as this phase encompasses the bulk of regulatory submission work, including Investigational New Drug applications, protocol amendments, and safety reporting. Regulatory affairs teams are heavily involved in compiling study data, communicating with the FDA, and preparing for Phase II/III transitions. This stage also includes interactions with Institutional Review Boards (IRBs) and Data Safety Monitoring Boards (DSMBs), requiring deep regulatory knowledge.

PMA (Pre-Market Approval) is emerging as the fastest-growing segment, particularly for high-risk medical devices and combination products. Companies submitting PMAs must present comprehensive clinical and manufacturing data, often requiring coordinated efforts between internal regulatory affairs, clinical, and quality teams. Outsourced regulatory providers with PMA specialization are increasingly in demand for streamlining submissions and managing advisory panel interactions.

U.S. Regulatory Affairs Market By Service Provider Insights

In-house service providers remain dominant, particularly among large pharmaceutical and medical device companies. These firms typically maintain extensive regulatory departments that oversee global regulatory strategy, health authority engagement, and lifecycle management. In-house teams allow for greater continuity and integration with R&D and commercial teams, facilitating faster responses and decision-making.

However, outsourced regulatory services are growing faster, particularly among small and mid-sized biotech and medtech firms that lack the resources to build internal teams. Regulatory affairs consultancies offer scalable expertise, access to former FDA officials, and flexible project-based support, making them ideal for emerging innovators. The rise of virtual biotech companies has further fueled this segment, as these companies often operate without physical headquarters and rely entirely on external partnerships.

U.S. Regulatory Affairs Market By Company Size Insights

Large companies dominate the market, accounting for the majority of regulatory spending and submission volume. These companies manage global product portfolios and require sophisticated regulatory planning to support ongoing clinical programs, label updates, and post-marketing surveillance. They also invest heavily in regulatory intelligence, automation, and data integration platforms.

Small companies are growing rapidly in their regulatory footprint, particularly those developing niche therapies or breakthrough technologies. While they contribute fewer overall submissions, the complexity of their products demands high regulatory precision. Small companies often seek modular service offerings from CROs and consultants, enabling them to manage INDs or PMAs without building full internal teams.

U.S. Regulatory Affairs Market By End-use Insights

Pharmaceutical companies led the end-use segment, driven by their expansive development pipelines and broad regulatory needs. These firms require constant engagement with the FDA, including label expansions, REMS management, and manufacturing changes. They also invest in lifecycle management services and post-approval compliance, making them long-term clients for regulatory service providers.

Biotechnology companies are the fastest-growing end-use segment, fueled by innovations in gene editing, RNA therapies, and monoclonal antibodies. These companies face complex regulatory pathways and often target rare diseases or conditions with no prior precedent. As such, they depend heavily on consulting firms for pre-IND support, orphan drug designation strategy, and accelerated approval planning.

Country-Level Analysis

As the most regulated healthcare market in the world, the United States stands as a cornerstone for global regulatory affairs, with the FDA setting standards followed by other regions. The country hosts over 3,000 biotech and pharma companies, making it the largest consumer of regulatory affairs services. U.S.-based firms often lead first-in-class approvals, requiring innovative regulatory strategies. The FDA’s continued modernization e.g., Project Orbis, Real-Time Oncology Review (RTOR), and digital health frameworks adds to the evolving regulatory landscape.

Additionally, major innovation hubs like Boston, San Diego, and the San Francisco Bay Area contribute significantly to market demand. These regions house venture-backed startups, academic spinoffs, and large R&D clusters, creating fertile ground for regulatory outsourcing. In 2024, the FDA approved over 55 new molecular entities, highlighting the market's maturity and constant demand for regulatory support.

U.S. Regulatory Affairs Market Recent Developments

-

IQVIA announced in February 2025 the launch of its enhanced regulatory intelligence platform that combines AI with global submission tracking, aiming to assist U.S.-based clients with real-time compliance updates.

-

Parexel in January 2025 expanded its regulatory consulting team in the U.S., focusing on supporting ATMP and biosimilar submissions.

-

PharmaLex, a global provider of regulatory services, announced in December 2024 a new U.S.-based Regulatory Strategy Center to support expedited drug approval pathways.

-

ProPharma Group was acquired by Odyssey Investment Partners in November 2024, with the new leadership indicating plans to scale U.S.-focused regulatory operations..

Some of the prominent players in the U.S. regulatory affairs market include:

- Accell Clinical Research, LLC

- Genpact

- CRITERIUM, INC.

- ICON plc

- Promedica International

- WuXi AppTec

- Medpace

- Charles River Laboratories

- Labcorp Drug Development

- Parexel International (MA) Corporation

- Freyr

- Pharmalex GmbH

- NDA Group AB

- Qvigilance

- BlueReg

- Cambridge Regulatory Services

- VCLS

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. regulatory affairs market

Service

- Services Regulatory consulting

- Legal Representation

- Regulatory Writing & Publishing

- Product registration & Clinical Trial Applications

- Other Services

Category

-

-

- Preclinical

- Clinical

- Pre-Market Approval (PMA)

-

-

- Preclinical

- Clinical

- Pre-Market Approval (PMA)

-

-

- Preclinical

- Clinical

- Pre-Maker Approval (PMA)

-

-

- Preclinical

- Clinical

- Pre-Maker Approval (PMA)

-

- Preclinical

- Clinical

- Pre-Market Approval (PMA)

-

-

- Preclinical

- Clinical

- Pre-Market Approval (PMA)

-

-

- Preclinical

- Clinical

- Pre-Market Approval (PMA)

Indication

- Oncology

- Neurology

- Cardiology

- Immunology

- Others

Product Stage

- Preclinical

- Clinical studies

- PMA

Service Provider

Company Size

End-use

- Medical Device Companies

- Pharmaceutical Companies

- Biotechnology Companies