U.S. Revenue Cycle Management for Oncology And Urology Market Size and Trends

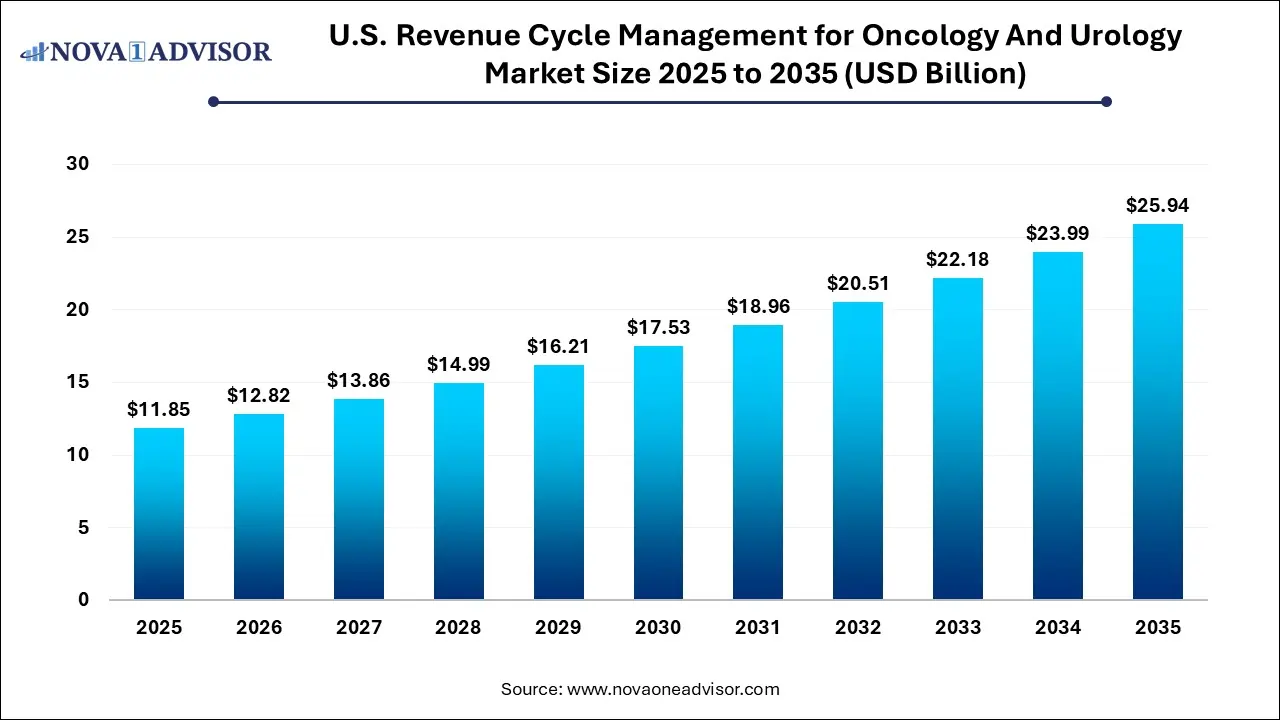

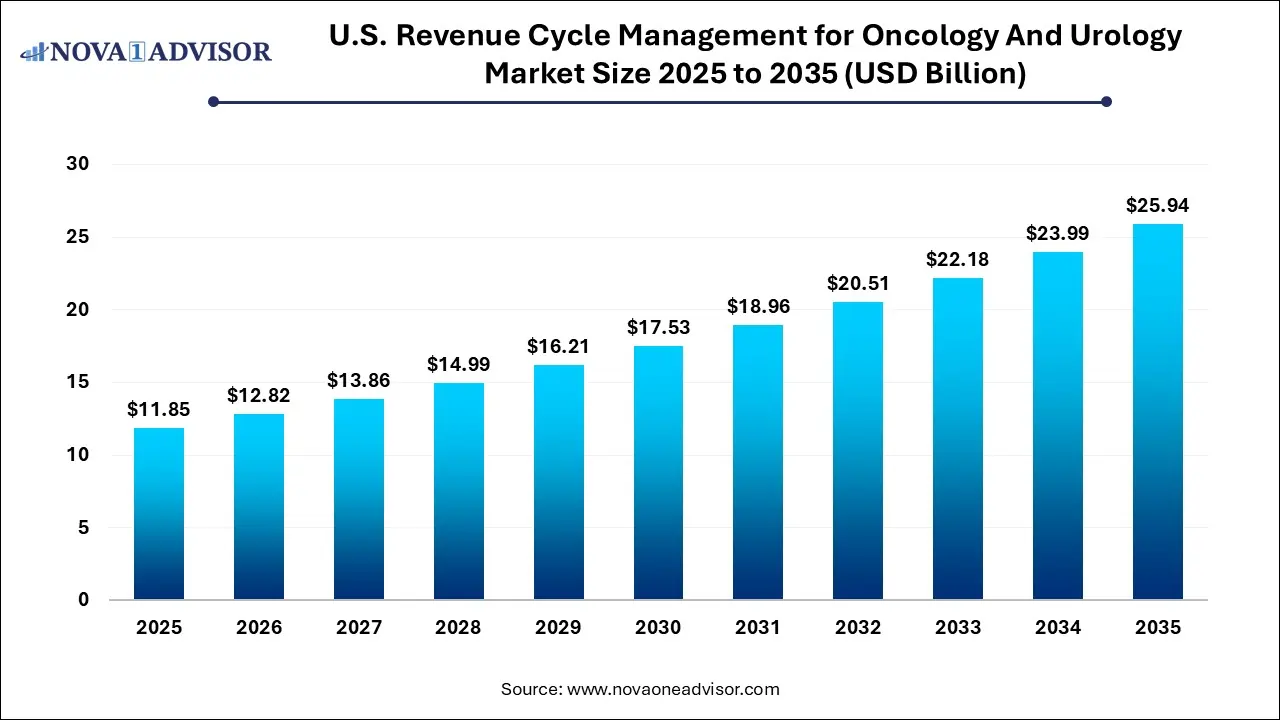

The U.S. revenue cycle management for oncology and urology market size was exhibited at USD 11.85 billion in 2025 and is projected to hit around USD 25.94 billion by 2035, growing at a CAGR of 8.15% during the forecast period 2026 to 2035.

Key Takeaways:

- The in-house segment held the largest share of 72.9% in 2025.

- The outsourced RCM services segment is anticipated to witness lucrative growth during the forecast period.

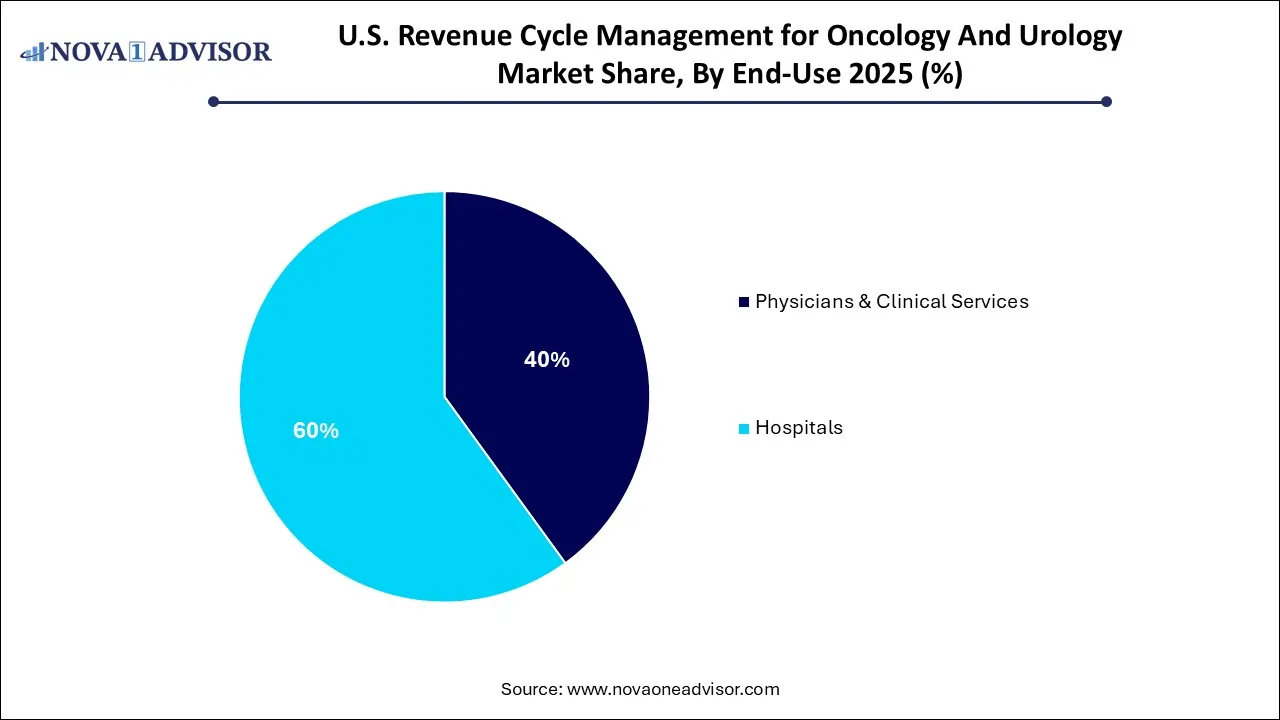

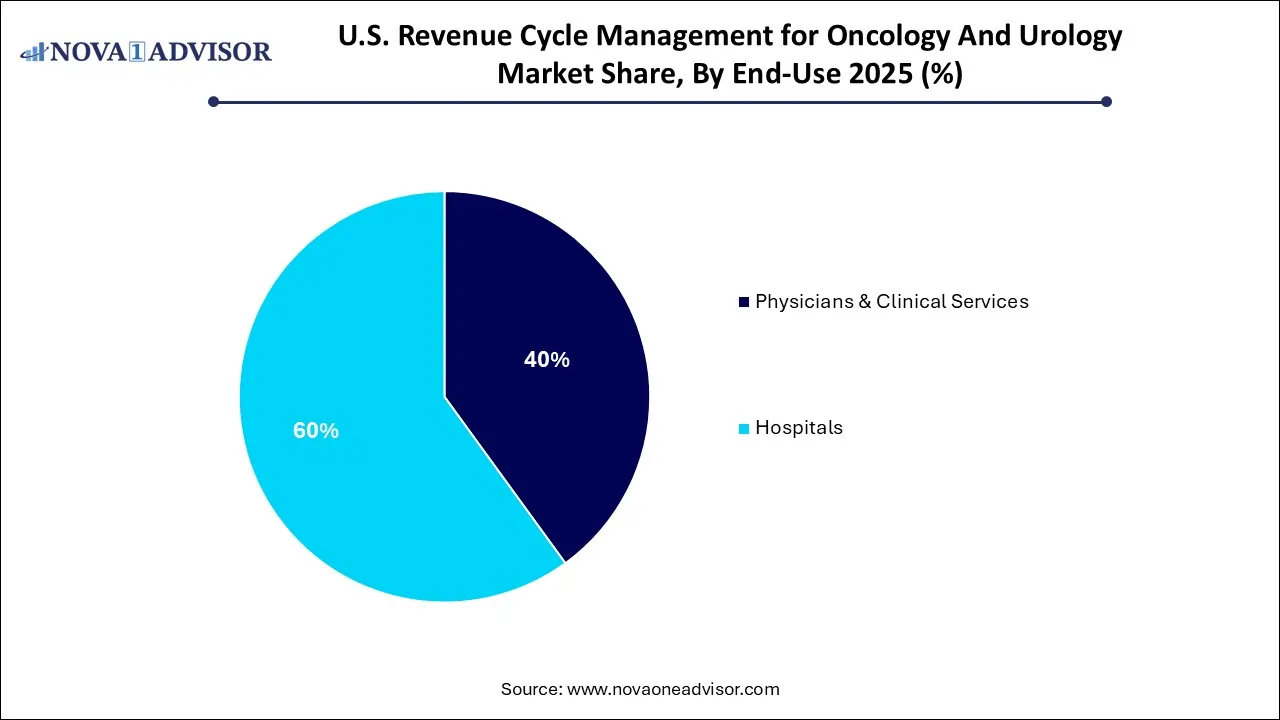

- The hospitals segment accounted for the largest share of 60.0% in 2025.

- The physicians and clinical services segment is anticipated to witness the fastest growth during the forecast period.

Market Overview

The U.S. Revenue Cycle Management (RCM) for Oncology and Urology Market represents a vital intersection of clinical complexity and financial necessity. Revenue cycle management, the backbone of healthcare reimbursement, encompasses the full spectrum of administrative and clinical functions involved in capturing, managing, and collecting revenue from patient services. In highly specialized fields such as oncology and urology, where treatment plans are sophisticated, multi-modal, and often long-term, RCM solutions must be equally specialized to ensure accurate, timely, and compliant billing.

In oncology, patients may receive radiation therapy, chemotherapy, immunotherapy, and targeted diagnostics—all of which require coordination with payers, prior authorization, and nuanced coding. Similarly, urology involves a wide variety of surgical and non-surgical treatments ranging from prostate cancer care to complex urinary tract procedures. These fields are not only clinically intensive but also subject to intricate payer regulations and evolving billing guidelines, making effective RCM solutions critical to financial sustainability.

The U.S. healthcare system, with its mixed reimbursement model of public and private payers, demands high operational efficiency and rigorous compliance. Small oncology or urology practices often lack the infrastructure to manage revenue processes in-house, leading to increased reliance on RCM vendors or software platforms. At the same time, hospitals and physician groups managing cancer or urology centers face growing pressures to optimize cash flow, avoid claim denials, and maintain regulatory compliance.

As value-based care models expand and patient volume grows due to an aging population and increasing cancer prevalence, revenue cycle modernization is not optional—it is imperative. This market is witnessing a wave of digital transformation through automation, AI, analytics, and cloud-based platforms that allow providers to streamline workflows and reduce administrative burdens.

Major Trends in the Market

-

Specialization of RCM Platforms for Oncology and Urology: Vendors are tailoring modules to address unique codes, authorization requirements, and payment models in these disciplines.

-

Rise in Outsourced RCM Services: Clinics and smaller practices increasingly outsource billing, coding, and denial management to third-party experts.

-

Integration with Electronic Health Records (EHR): Seamless integration with EHR systems is now a core requirement to reduce duplicate entries and enable real-time billing.

-

Adoption of AI for Claims Processing and Predictive Denial Management: Artificial intelligence is improving revenue capture by identifying high-risk claims and reducing errors.

-

Growth of Cloud-Based RCM Applications: Remote accessibility and data security are driving the popularity of SaaS-based solutions, particularly in multi-site oncology networks.

-

Focus on Patient Financial Experience: Providers are investing in pre-authorization tools, upfront eligibility checks, and patient-facing payment portals.

-

Regulatory Alignment with Medicare and CMS Oncology Care Models: RCM platforms are evolving to support bundled payment programs and value-based oncology care initiatives.

Report Scope of The U.S. Revenue Cycle Management for Oncology And Urology Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 12.82 Billion |

| Market Size by 2035 |

USD 25.94 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 8.15% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Sourcing, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

United Urology Group; Cardinal Health; Flatiron; Oncospark.com; Fedora Solutions; BillingParadise; Gentem; Integra Connect LLC; R1 RCM Inc. |

Market Driver: Increasing Complexity of Oncology and Urology Billing Workflows

One of the primary drivers fueling growth in this market is the increasing complexity of billing workflows and documentation in oncology and urology practices. These specialties involve multi-stage treatment pathways, frequent use of biologics and medical devices, and coordination among multiple care teams. Each service must be meticulously documented and coded for insurance reimbursement, and many services require prior authorization, especially in cancer care where chemotherapy and immunotherapy involve high-cost drugs.

Coding errors, missed modifiers, and incorrect use of CPT and HCPCS codes can lead to costly denials or delays. For example, in urology, coding for advanced procedures like robotic-assisted prostatectomy must be precisely linked to diagnosis codes and operative reports. In oncology, timing of drug administration relative to diagnosis codes can affect reimbursement eligibility. These nuances are beyond the capabilities of generalized billing systems, requiring specialty-specific RCM workflows, pre-programmed with specialty-focused rules and flags.

By implementing targeted RCM systems or services, providers reduce claim rework, increase clean claim rates, and improve revenue predictability—making RCM a mission-critical investment in both independent practices and integrated care networks.

Market Restraint: Data Security and Integration Challenges

Despite growing demand, the U.S. market for oncology and urology RCM solutions faces a significant restraint in the form of data security concerns and integration complexities. As providers adopt third-party platforms or outsource billing operations, they must ensure secure transmission of sensitive patient and financial information, in compliance with the Health Insurance Portability and Accountability Act (HIPAA).

Integration between practice management systems, EHRs, and RCM tools can be technically difficult, especially in legacy environments or institutions with homegrown IT systems. Without seamless integration, data silos can cause delays in billing, duplicate entries, and compliance risks. Additionally, transitioning to a new RCM system can disrupt operations if not carefully planned, especially in high-volume environments like cancer centers where even minor disruptions can result in cascading claim issues.

Furthermore, the frequent changes in payer requirements, documentation rules, and Medicare updates require ongoing maintenance, which can be burdensome for smaller vendors or practices without dedicated IT staff. This complexity may deter adoption, particularly among small urology clinics or oncology providers with tight margins.

Market Opportunity: Expansion of Value-Based Oncology Payment Models

A significant opportunity lies in the growing alignment of revenue cycle processes with value-based care initiatives, particularly in oncology. Programs like the CMS Oncology Care Model (OCM), Oncology Care First (OCF), and various bundled payment pilots incentivize providers to deliver high-quality care at reduced cost. Participation requires not just clinical excellence but also advanced financial tracking, outcome-based billing, and real-time analytics—capabilities only available through sophisticated RCM systems.

RCM vendors have an opportunity to create specialized value-based modules that align with performance metrics, manage shared savings tracking, and monitor patient attribution. As the healthcare system shifts away from fee-for-service, oncology providers will increasingly depend on RCM platforms that can manage risk contracts, measure episode-of-care costs, and optimize utilization patterns.

Vendors that can combine financial and clinical data into a unified platform will find strong demand among hospitals and private oncology networks participating in federal and commercial value-based programs. By supporting the administrative backbone of value-based care, RCM firms can transition from a back-office role to a strategic partner in practice transformation.

U.S. Revenue Cycle Management for Oncology And Urology Market By Sourcing Insights

Outsourced RCM services dominated the U.S. oncology and urology revenue cycle market, particularly among small to mid-sized practices that lack the internal resources to manage complex billing operations. These services include end-to-end revenue cycle solutions encompassing coding, claims submission, denial management, and patient collections. Outsourcing enables providers to offload administrative burdens while gaining access to specialized staff trained in oncology and urology coding requirements. Firms like GeBBS Healthcare Solutions, R1 RCM, and Omega Healthcare offer scalable solutions tailored to these verticals, enabling high claims accuracy and rapid reimbursements.

External RCM apps/software are the fastest-growing sourcing category, especially in larger hospitals and integrated practices that seek to retain billing control but want automation and decision support. Cloud-based RCM platforms such as those from Waystar, Kareo, and AdvancedMD are being adopted to improve claims visibility, reduce coding errors, and shorten days in accounts receivable. These platforms often integrate with EHR systems and offer analytics dashboards that help providers spot trends, predict denials, and optimize staff productivity. Their flexibility, scalability, and cost-effectiveness make them attractive to multi-site oncology networks and urology practices transitioning to digital operations.

U.S. Revenue Cycle Management for Oncology And Urology Market By End-Use Insights

Hospitals led the market by end-use, primarily due to their extensive patient volume, multidisciplinary treatment modalities, and complex oncology/urology care pathways. In these settings, RCM is essential for maintaining financial health amid strict regulatory oversight and shifting payer models. Hospitals managing cancer centers or urology departments handle hundreds of procedures and drug administrations daily, necessitating robust platforms that integrate clinical documentation with billing workflows. Many hospitals now adopt enterprise-wide RCM platforms with embedded specialty modules that address the specific requirements of oncology drug billing, infusion coding, and procedure-based care in urology.

Physicians and clinical services are the fastest-growing end-use segment, particularly among outpatient providers and ambulatory surgery centers (ASCs) focused on oncology or urology. These practices are adopting modern RCM platforms to increase revenue realization, reduce administrative overhead, and gain competitive advantage. In the face of narrowing margins and rising patient deductibles, clinics rely on automated eligibility verification, real-time coding suggestions, and patient portals for billing transparency. Additionally, consolidation among physician groups is leading to shared RCM infrastructure, where scalable software allows multiple practices to operate under a unified financial framework.

Country-Level Analysis – United States

In the United States, the revenue cycle management landscape is shaped by a fragmented payer environment, rising regulatory scrutiny, and growing patient financial responsibility. Oncology and urology are among the most impacted specialties, given their reliance on expensive treatments, intricate documentation, and frequent payer audits. Medicare and private insurers alike are instituting stricter rules around medical necessity, drug dosing, and procedural justification, increasing the stakes for effective RCM.

Urban centers such as Houston, Boston, Los Angeles, and Chicago home to major cancer institutes and urology research hubs are hotbeds for RCM innovation, where providers partner with technology firms to create custom platforms. Meanwhile, rural and mid-sized markets are increasingly relying on outsourced RCM providers due to staffing shortages and limited local expertise. The shift toward outpatient oncology care and tele-urology services is also changing revenue cycle needs, requiring more nimble, patient-centric financial processes.

As CMS introduces new models and private payers experiment with bundled payments, providers across the U.S. are prioritizing RCM modernization. Regulatory alignment, payer negotiation, and revenue protection are now strategic imperatives not just billing tasks making this a high-growth, innovation-rich segment of the U.S. healthcare IT and services industry.

Some of the prominent players in the U.S. revenue cycle management for oncology and urology market include:

Recent Developments

-

In February 2025, Waystar announced the launch of its specialty-specific RCM toolkit for oncology and urology, integrating prior authorization automation, drug billing rules, and real-time denial alerts into its cloud-based platform.

-

In January 2025, R1 RCM signed a multi-year partnership with a U.S.-based oncology care network to deliver end-to-end revenue cycle services and value-based care tracking across 45 clinics nationwide.

-

In December 2024, GeBBS Healthcare Solutions expanded its oncology coding support services in response to increased demand for certified oncology coders across ambulatory care settings.

-

In November 2024, Omega Healthcare introduced an AI-powered denial prediction module specifically trained on oncology and urology claim data, enabling proactive appeal workflows and improved first-pass rates.

-

In October 2024, AdvancedMD rolled out a urology-focused enhancement to its RCM platform, enabling bundled claims management for cystoscopies, lithotripsy, and robotic-assisted procedures.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. revenue cycle management for oncology and urology market

Sourcing

- In-house

- External RCM Apps/ Software

- Outsourced RCM Services

End-use

- Physicians & Clinical Services

- Hospitals