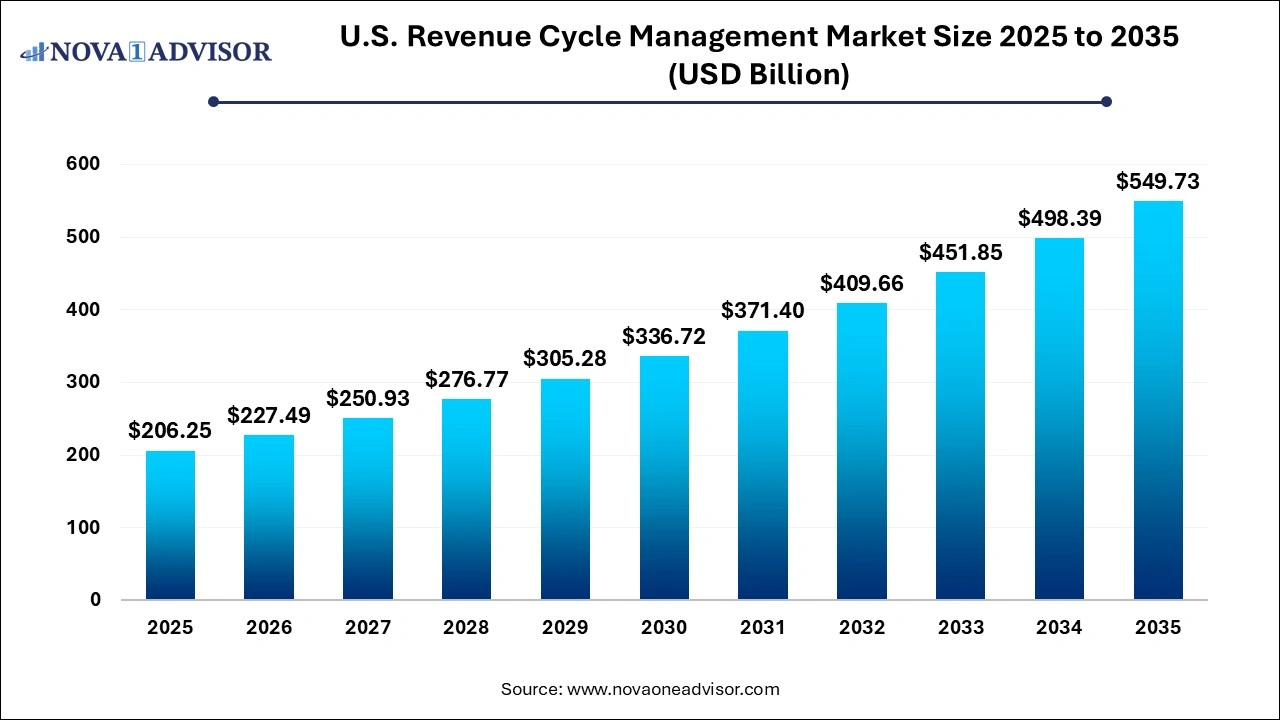

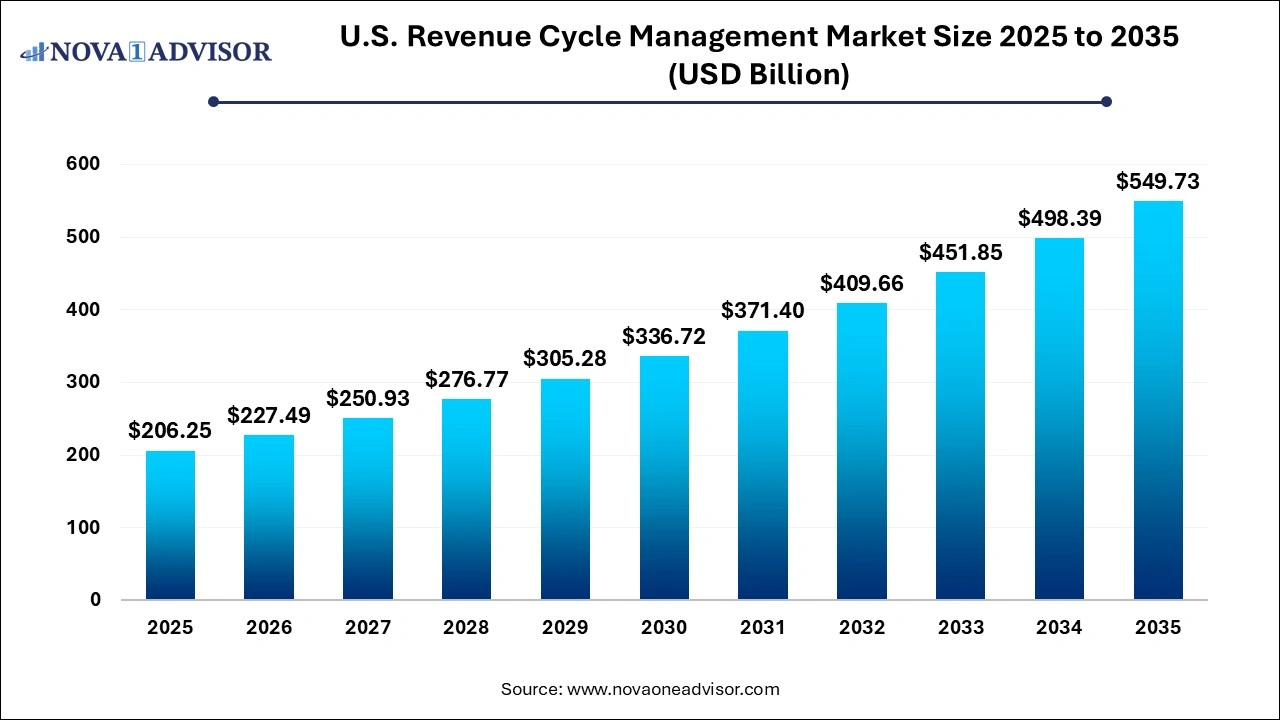

U.S. Revenue Cycle Management Market Size and Growth 2026 to 2035

The U.S. revenue cycle management market size was valued at USD 206.25 billion in 2025 and is projected to surpass around USD 549.73 billion by 2035, registering a CAGR of 10.3% over the forecast period of 2026 to 2035.

Key Takeaways:

- The services segment dominated the market in 2025 and accounted for a revenue share of over 68.14%.

- The services segment is anticipated to register the fastest growth rate 11.3% over the forthcoming years.

- The integrated system segment dominated the market in 2025 and accounted for a revenue share of over 73.14%.

- Web-based delivery mode dominated the market in 2025 and accounted for a revenue share of over 58.1%.

- The cloud-based segment is anticipated to register the fastest growth rate 11.9% over the forthcoming years.

- The hospitals segment dominated the market in 2025 and accounted for a revenue share of over 57.9%.

- The physician and clinical services segment is anticipated to register the fastest growth rate over the forecast period.

- The others segment dominated the U.S. market in 2025 and accounted for a revenue share of over 73.9%.

- The cardiology segment is anticipated to register the fastest growth rate over the forthcoming years.

- The in-house segment dominated the U.S. market in 2025 and accounted for a revenue share of over 73.19%.

- The outsourced RCM services segment is anticipated to register the fastest growth rate over the forecast period.

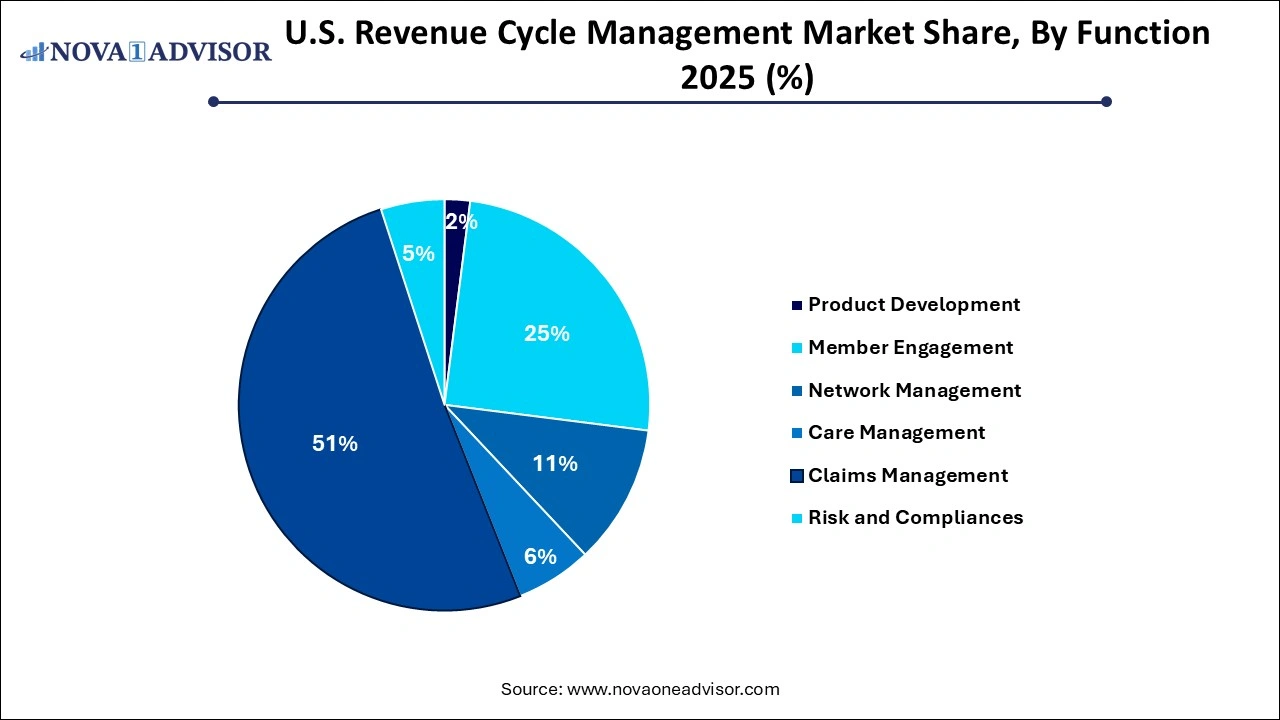

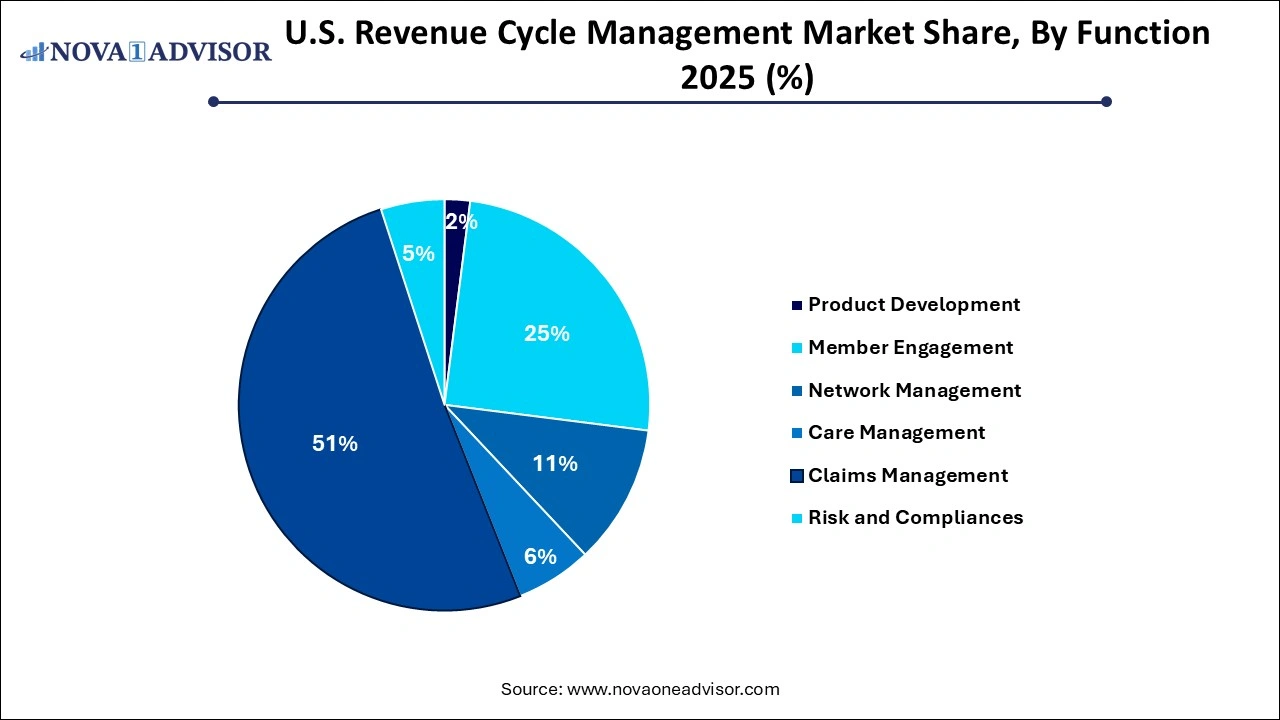

- The care management segment is anticipated to register the fastest growth rate over the forecast period.

U.S. Revenue Cycle Management Market Overview

The U.S. revenue cycle management (RCM) market plays a pivotal role in streamlining the financial processes of healthcare organizations, encompassing the entire spectrum from patient registration to final payment of balances. As the U.S. healthcare system increasingly leans on digitization and value-based care, RCM solutions have become indispensable. These systems help mitigate the complexities associated with billing, coding, compliance, and reimbursement. The growing demand for efficient billing systems, the necessity to reduce operational costs, and the need for seamless interoperability are propelling the adoption of RCM platforms across diverse healthcare settings.

With healthcare providers facing increasing pressure to enhance patient experiences and ensure operational efficiency, RCM systems offer a lifeline through automation and integration. Moreover, the U.S. regulatory environment, marked by policies such as the Affordable Care Act (ACA) and the transition towards ICD-11 coding, adds another layer of urgency for healthcare providers to invest in robust RCM tools. Private payers and federal health programs alike require accuracy in claim processing and compliance, pushing the market forward.

The market has also benefited from heightened demand following the COVID-19 pandemic, as providers had to adapt to virtual care environments while maintaining financial stability. This created a surge in the deployment of cloud-based and web-based RCM systems, leading to increased investment from healthcare entities.

Major Trends in the U.S. Revenue Cycle Management Market

-

Integration of Artificial Intelligence (AI) and Machine Learning (ML): AI is being utilized to automate coding, predictive analytics, and real-time denial management.

-

Shift Towards Cloud-Based Solutions: Healthcare providers are increasingly favoring cloud infrastructure to enhance data access and scalability.

-

Consumer-Centric RCM Models: Solutions are being tailored to improve patient engagement and transparency in billing.

-

Growth in Outsourced RCM Services: Hospitals and physician practices are outsourcing RCM functions to reduce costs and improve focus on core healthcare delivery.

-

Emphasis on Data Security and Compliance: With rising cyber threats, RCM providers are enhancing cybersecurity measures and HIPAA compliance.

-

Adoption of Blockchain for Secure Transactions: A growing number of providers are exploring blockchain to manage patient data and financial records securely.

-

Expansion of Telehealth Billing Support: The rise in telemedicine has created a demand for specialized billing codes and RCM processes.

U.S. Revenue Cycle Management Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 227.49 Billion |

| Market Size by 2035 |

USD 549.73 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 10.3% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

End user, product type, component, delivery mode, physician specialty, sourcing, function |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

The SSI Group, Inc.; AllScripts Healthcare, LLC; McKesson Corporation; athenahealth, Inc.; Epic Systems Corporation; NXGN Management, LLC; eClinicalWorks; Oncospark, Inc. |

Key Market Driver

Increasing Administrative Complexity in U.S. Healthcare

One of the primary drivers of the U.S. RCM market is the rising complexity of healthcare administration. In a healthcare ecosystem characterized by multi-payer systems, differing regulations by state, and frequent changes in billing codes and reimbursement policies, providers are under significant strain. Revenue cycle management systems help alleviate this burden by automating claim submissions, monitoring denials, and enhancing documentation accuracy.

For instance, with the transition from ICD-10 to ICD-11 and more stringent requirements from Medicare and Medicaid, healthcare providers are compelled to upgrade their revenue cycle technologies to remain compliant and efficient. A robust RCM system ensures that medical coding aligns with the services rendered, reducing claim denials and delays in reimbursements. Additionally, features like eligibility verification, prior authorization, and claims analytics help in minimizing manual errors and enhancing financial outcomes.

Key Market Restraint

High Implementation Costs for Small and Medium Providers

Despite the advantages offered by revenue cycle management solutions, the high upfront investment required remains a significant restraint, particularly for small to mid-sized practices. Licensing fees, infrastructure upgrades, staff training, and system maintenance can strain limited budgets.

A standalone RCM software solution can cost thousands of dollars per year, excluding periodic maintenance and updates. Moreover, integrating RCM with existing Electronic Health Records (EHR) systems adds complexity and further expense. In rural or underfunded healthcare facilities, where IT budgets are already constrained, such investments often seem unfeasible. This cost barrier is limiting the penetration of advanced RCM tools in certain healthcare segments, stalling overall market growth.

Key Market Opportunity

Rising Demand for Value-Based Reimbursement Models

The transition from fee-for-service to value-based care presents a significant opportunity for the U.S. RCM market. In value-based models, providers are reimbursed based on the quality rather than the quantity of care, necessitating advanced analytics and reporting capabilities to track performance outcomes.

RCM solutions with integrated data analytics, population health management, and care coordination functionalities are well-positioned to capitalize on this shift. Providers require RCM platforms that can link financial outcomes with clinical data, enabling holistic performance tracking. Companies that offer comprehensive value-based billing modules stand to gain from the evolving reimbursement landscape. For example, CMS's continued push towards Accountable Care Organizations (ACOs) further validates the need for sophisticated RCM infrastructure.

By Function Insights

Claims management constitutes the dominant function within the RCM market. Accurate and timely claims submission is critical to healthcare organizations' financial health. RCM tools that support automated claims processing, error checking, and real-time tracking are widely adopted. These systems help reduce claim denials, shorten reimbursement cycles, and improve cash flow.

Care management is a rapidly growing segment. As the focus shifts toward value-based care, providers are integrating care management into their financial workflows. These solutions enable better coordination among care teams and facilitate improved patient outcomes, both of which are essential for value-based reimbursement.

By Component Insights

Software solutions represent the largest share within this segment, largely due to their direct application in automating and streamlining the revenue cycle. Hospitals and private practices invest heavily in proprietary or third-party RCM software to manage coding, billing, and reporting efficiently. These software solutions reduce administrative overhead, lower error rates, and provide real-time performance insights.

Services, however, are the fastest-growing component, driven by the increasing trend of outsourcing RCM functions. Outsourced services offer scalability, access to expert teams, and reduced internal resource burdens. Particularly for organizations struggling with staffing shortages or compliance complexities, RCM service providers offer a cost-effective and efficient alternative.

By Product Type Insights

Integrated RCM systems dominate the U.S. market, primarily because they offer a comprehensive solution that links all stages of the revenue cycle, from scheduling and registration to final payment. These systems reduce redundancy and facilitate seamless communication between departments. Hospitals and large healthcare systems prefer integrated RCM platforms due to their ability to centralize functions such as billing, claims management, coding, and analytics under a single platform. This not only improves data visibility but also enhances decision-making and speeds up revenue realization.

On the other hand, standalone systems are witnessing modest growth, particularly among specialty clinics and smaller practices that may not require full-suite solutions. These systems are favored for specific functions such as coding or claims management. However, their limited scalability and integration capabilities often restrict their long-term utility.

By Delivery Mode Insights

Web-based RCM systems hold a significant market share due to their accessibility and ease of integration. Many hospitals adopt web-based platforms to streamline claims processing and financial tracking without investing in extensive on-site infrastructure. These systems offer a balance between functionality and cost.

Cloud-based RCM systems, however, are the fastest growing due to their superior scalability, lower upfront costs, and real-time data access. In an era where healthcare providers are embracing digital transformation, cloud platforms support remote access, robust data security, and seamless updates. The flexibility offered by cloud-based models aligns well with both small practices and large hospitals.

By Physician Specialty Insights

Radiology dominates this segment because of the high volume of procedures and billing complexity involved. Imaging centers and radiology departments require specialized RCM tools that can handle frequent insurance verifications, pre-authorizations, and varied CPT codes. As imaging services are often outsourced or referred, having a dedicated RCM process ensures accurate and timely reimbursements.

Oncology is one of the fastest-growing specialties due to the rise in cancer prevalence and the associated treatment costs. Oncology RCM systems need to manage long treatment cycles, clinical trials, and a mix of private and public insurance reimbursements. With an increased focus on personalized medicine, oncology practices demand tailored RCM solutions for optimal financial performance.

By Sourcing Insights

In-house RCM continues to dominate, particularly among large healthcare institutions with the infrastructure to manage billing, compliance, and claims internally. These organizations prefer in-house teams to maintain control, ensure data confidentiality, and align RCM strategies with broader organizational goals.

Conversely, outsourced RCM services are witnessing accelerated growth. As reimbursement rules evolve and administrative burdens mount, more healthcare providers are choosing to outsource their RCM needs to third-party vendors. This model offers advantages in terms of cost efficiency, compliance expertise, and operational flexibility.

By End-user Insights

The hospitals segment dominated the market in 2025 and accounted for a revenue share of over 57.9%. The growing presence of renowned and well-established hospitals in the U.S. and a growing number of patient care regulatory reforms and guidelines introduced by regulatory agencies are driving the hospitals segment. Hospitals are focusing on implementing innovative revenue cycle management solutions by collaborating with vendors to transform the reimbursement scenario, which is anticipated to boost segment growth. Moreover, the growing demand to optimize hospitals’ workflow to improve efficiency and productivity is driving the adoption of integrated RCM systems in hospitals.

The physician and clinical services segment is anticipated to register the fastest growth rate over the forecast period owing to the growing number of physicians in the U.S. In physician offices and clinical services, revenue cycle management systems are used by nursing staff, office managers, and consultants to ensure the smooth functioning of the healthcare facility. Moreover, the Covid-19 pandemic increased the demand for remote monitoring and physician consultations, which is anticipated to contribute to the segment growth. Private physician offices and clinical services are readily outsourcing RCM systems and services to address their unmet financial needs.

Country-Level Insights United States

The U.S. stands as the most lucrative market for revenue cycle management globally. A complex healthcare reimbursement framework, a high volume of insured patients, and stringent federal regulations drive the need for advanced RCM solutions. The United States spends more on healthcare than any other country, and administrative costs form a significant portion of that expenditure.

Private health insurance companies, Medicare, and Medicaid all have different reimbursement requirements, making claim submission and follow-up a daunting task. Hospitals and private practices in the U.S. are increasingly investing in AI-enabled RCM solutions to handle this complexity. Moreover, government initiatives promoting digital health infrastructure further support market expansion. As U.S. healthcare continues its transition to value-based care, RCM systems will become even more vital.

U.S. Revenue Cycle Management Market Top Key Companies:

Recent Developments

-

March 2025: R1 RCM Inc. announced its acquisition of Cloudmed, an analytics-driven revenue intelligence platform, enhancing its capabilities in predictive analytics and automation.

-

January 2025: Change Healthcare launched a next-generation claims management platform integrating real-time analytics to assist providers in reducing denials and improving revenue capture.

-

November 2024: Optum (a part of UnitedHealth Group) partnered with a leading hospital chain in Texas to deploy AI-powered RCM solutions focused on reducing administrative burden and enhancing compliance.

-

September 2024: Cerner Corporation introduced a new module to its RCM suite, enabling integration with telehealth platforms to support accurate billing of virtual care visits.

U.S. Revenue Cycle Management Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. Revenue Cycle Management market.

By Product Type

- Integrated System

- Standalone System

By Component

- Software Solution

- Services

By Delivery Mode

- On-premise

- Web-based

- Cloud-based

By Physician Specialty

- Oncology

- Cardiology

- Anesthesia

- Radiology

- Pathology

- Pain Management

- Emergency Service

- Others

By Sourcing

- In-house

- External RCM Apps/ Software

- Outsourced RCM Services

By Function

- Product Development

- Member Engagement

- Network Management

- Care Management

- Claims Management

- Risk and Compliances

By End-user

- Hospitals

- Physician & Clinical Services

- Diagnostic Laboratories

- Other