U.S. RFID in Healthcare Market Size and Research

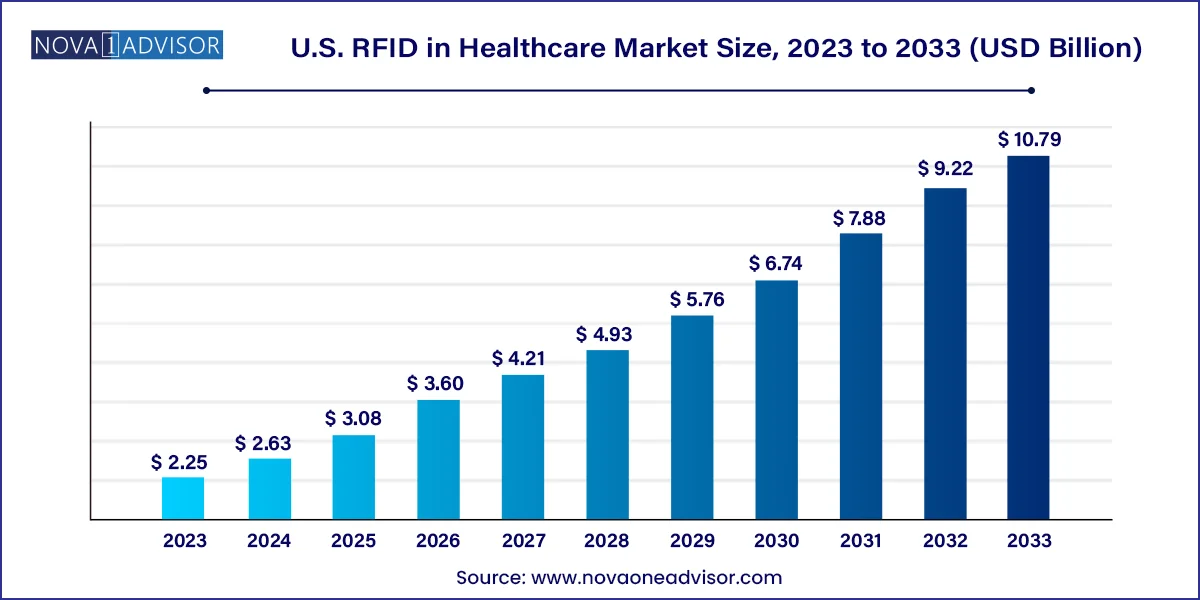

The U.S. RFID in healthcare market size was exhibited at USD 2.25 billion in 2023 and is projected to hit around USD 10.79 billion by 2033, growing at a CAGR of 16.97% during the forecast period 2024 to 2033.

U.S. RFID In Healthcare Market Key Takeaways:

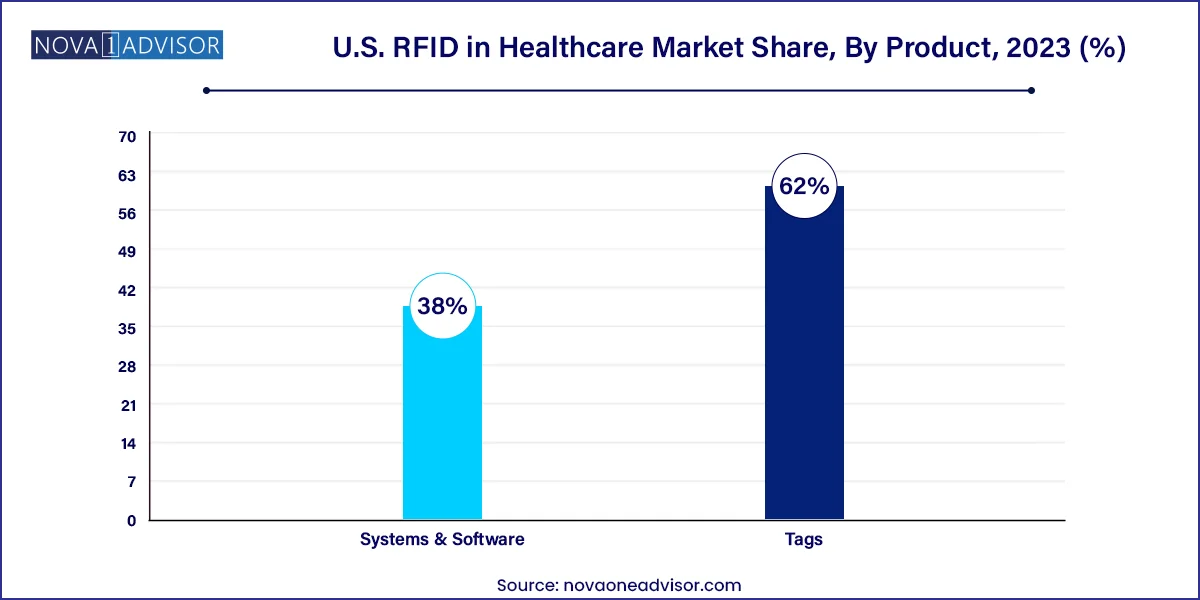

- The tags segment dominated the market with a share of 62.0% in 2023 and is expected to grow at the fastest CAGR of 17.06% over the forecast period.

- The asset tracking segment held the largest revenue share in 2023

- The pharmaceutical tracking market segment is anticipated to register the fastest CAGR from 2024 to 2033.

Market Overview

The U.S. RFID in healthcare market has witnessed remarkable growth over the past decade, reflecting an increased emphasis on digitization, inventory automation, and patient safety within healthcare ecosystems. Radio-Frequency Identification (RFID) technology, which uses electromagnetic fields to automatically identify and track tags attached to objects or individuals, has become a cornerstone of operational excellence and compliance in U.S. hospitals, clinics, pharmaceutical supply chains, and blood banks.

RFID’s versatility in healthcare has allowed it to go far beyond basic inventory control. It now plays a vital role in tracking surgical instruments, monitoring cold chain pharmaceuticals, preventing theft or counterfeiting, verifying blood product authenticity, and enhancing patient identification protocols. With a healthcare system as complex as that of the U.S., the ability to streamline workflows, ensure real-time visibility, and eliminate human error has made RFID a strategic necessity.

Furthermore, healthcare reforms, the growing prevalence of chronic diseases, and increased regulatory scrutiny particularly by the FDA and The Joint Commission have pushed hospitals and healthcare providers to seek technological solutions that can ensure safety, traceability, and data accuracy. The COVID-19 pandemic further emphasized the need for contactless and trackable healthcare operations, with RFID being pivotal in PPE inventory tracking, patient movement tracing, and vaccine cold chain logistics.

Private and public investments in healthcare IT, paired with continuous technological innovation, make the U.S. an innovation hub for RFID in healthcare. From robust RFID-enabled EHR integration to AI-powered asset monitoring platforms, the market continues to evolve rapidly, opening avenues for providers, suppliers, and IT vendors.

Major Trends in the Market

- Rising Adoption of RFID for Pharmaceutical Serialization and Anti-Counterfeiting

- Expansion of RFID-enabled Patient Monitoring and Tracking Systems

- Growth in Smart Inventory Management for High-Value Medical Assets

- Cloud-based RFID Systems Integration with EHR and Hospital Management Platforms

- Increased Utilization in Blood Product Tracking to Ensure Chain of Custody

- Miniaturization and Cost Reduction of RFID Tags

- Strategic Partnerships Between Tech Companies and Health Systems

- RFID in Emergency Response and Disaster Readiness Systems

- Regulatory Push Toward Track-and-Trace in Drug Supply Chain Security Act (DSCSA)

- RFID Adoption in Long-Term Care Facilities and Remote Clinics

Report Scope of U.S. RFID In Healthcare Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.63 Billion |

| Market Size by 2033 |

USD 10.79 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 16.97% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

Impinj, Inc.; Zebra Technologies Corporation; Siemens Healthineers AG; International Business Machines Corporation (IBM); GE Healthcare; Honeywell International Inc.; CenTrak, Inc.; Savi Technology; AVERY DENNISON CORPORATION; SMARTRAC N.V.; Texas Instruments Incorporated; ThingMagic (A Motorola Solutions Company); Invengo Information Technology Co., Ltd.; Confidex Ltd.; Nedap N.V.; SML Group; RF Controls LLC |

Key Market Driver

Increasing Regulatory Mandates for Drug Traceability and Inventory Transparency

A significant driver of the U.S. RFID in healthcare market is the escalating demand for traceability and compliance, particularly in the pharmaceutical and medical device sectors. The Drug Supply Chain Security Act (DSCSA) enacted by the U.S. Food and Drug Administration (FDA) has mandated end-to-end product serialization and track-and-trace capabilities by 2024. This has triggered an accelerated demand for RFID-based solutions to ensure transparency, prevent diversion, and combat counterfeit drugs.

Hospitals, distributors, and manufacturers are turning to RFID for real-time drug tracking from production to point-of-care. Unlike barcoding, RFID offers continuous monitoring without line-of-sight, which is crucial for managing thousands of drug SKUs in high-throughput environments like hospital pharmacies and central distribution centers. RFID tags can be embedded into drug packages or IV bags, enabling accurate inventory counts, real-time location mapping, and immediate alerts on expiration or recalls. These capabilities have positioned RFID not just as a logistical tool but as a critical compliance enabler in the evolving healthcare regulatory landscape.

Key Market Restraint

High Implementation Costs and Integration Complexity

Despite its transformative potential, one of the key restraints limiting RFID adoption in healthcare is the high upfront cost of system deployment and integration complexity. Unlike traditional barcoding, RFID systems require the installation of readers, antennas, middleware, and specialized software platforms that must integrate seamlessly with existing Hospital Information Systems (HIS), Electronic Health Records (EHR), and Enterprise Resource Planning (ERP) systems.

Smaller hospitals and independent clinics often lack the IT infrastructure or budgets to deploy end-to-end RFID ecosystems. Additionally, customization needs, staff training, and regulatory documentation add to the implementation timeline and cost. While RFID tags themselves have become more affordable, the total cost of ownership—including hardware, software, and support—can remain prohibitive for under-resourced healthcare providers. This challenge underscores the need for scalable, cloud-based RFID platforms and flexible pricing models to widen adoption.

Key Market Opportunity

Surging Demand for RFID in Real-time Location Systems (RTLS) and Smart Hospitals

An emerging opportunity lies in the integration of RFID with Real-Time Location Systems (RTLS) in the burgeoning “smart hospital” landscape. Healthcare providers are increasingly leveraging RFID-powered RTLS for asset tracking, patient safety, and workflow optimization. These systems provide continuous visibility into the movement of critical equipment, high-value consumables, and patients across complex facilities.

Smart hospitals in the U.S. particularly large academic medical centers and multihospital systems are investing in RFID to automate preventive maintenance of biomedical equipment, reduce time wasted in asset searching, and prevent surgical kit misplacement. RTLS integrated with RFID enables time-stamped location data, which supports infection control, contact tracing, and even fall prevention in elderly care settings. With smart infrastructure funding from both federal programs and private equity, this opportunity is poised for exponential growth.

U.S. RFID In Healthcare Market By Product Insights

RFID tags emerged as the dominating product category in the U.S. RFID healthcare market due to their widespread deployment in applications like medication tracking, asset labeling, and specimen identification. These tags can be embedded or attached to virtually any healthcare asset, from surgical tools to patient wristbands. The demand for passive UHF tags, in particular, is significant due to their cost-effectiveness and compatibility with long-range applications. Tags also provide granularity in inventory management, enabling hospitals to monitor high-usage items in real time.

Systems and software, however, represent the fastest-growing segment. As healthcare providers seek integrated solutions that interface with EHRs, pharmacy automation, and clinical decision systems, the value proposition of intelligent software layers is increasing. Middleware platforms that aggregate, analyze, and visualize data collected from RFID tags are gaining traction. These systems support analytics dashboards, predictive maintenance models, and utilization benchmarking, turning raw RFID data into actionable insights. Cloud-based, AI-enabled platforms are expected to lead the next wave of adoption.

U.S. RFID In Healthcare Market By Application Insights

Asset tracking continues to dominate the RFID application landscape in U.S. healthcare, driven by the need to monitor the movement and availability of high-value assets like infusion pumps, wheelchairs, surgical tools, and diagnostic equipment. Hospitals lose millions annually due to equipment misplacement or underutilization. RFID allows healthcare staff to locate, retrieve, and manage assets efficiently, ensuring they are available when needed, thereby reducing delays and improving patient throughput. Preventive maintenance and calibration schedules are also streamlined through RFID tagging.

Pharmaceutical tracking is the fastest-growing segment, underpinned by increasing compliance requirements under DSCSA and rising drug theft concerns. RFID tags are used to trace pharmaceuticals from manufacturers to hospital shelves, reducing errors, counterfeit risk, and drug wastage. RFID is also gaining traction in blood tracking, where maintaining a sterile, secure, and time-sensitive chain of custody is essential. Automated tagging and temperature-sensitive RFID chips ensure that blood bags meet storage requirements, improving safety and traceability.

Country-Level Analysis

The United States stands as the global leader in the adoption of RFID in healthcare due to its advanced digital infrastructure, large hospital networks, regulatory mandates, and an innovation-friendly ecosystem. Major hospital systems such as Kaiser Permanente, Mayo Clinic, Cleveland Clinic, and HCA Healthcare have adopted RFID across multiple touchpoints, including medication tracking, surgical suite automation, and patient flow optimization.

The country’s strong tech-health convergence, led by Silicon Valley startups and partnerships with global RFID hardware leaders, fosters constant innovation. Additionally, mandates from CMS, HIPAA requirements, and standards set by the Association for Healthcare Resource & Materials Management (AHRMM) push facilities toward traceability and real-time documentation—areas where RFID excels. Urban centers with large tertiary hospitals, especially in California, Texas, New York, and Massachusetts, are early adopters. Meanwhile, RFID pilot programs in rural health networks and long-term care are expanding due to funding under federal digital transformation grants.

Some of the prominent players in the U.S. RFID in healthcare market include:

- Impinj, Inc.

- Zebra Technologies Corporation

- Siemens Healthineers AG

- International Business Machines Corporation (IBM)

- GE Healthcare

- Honeywell International Inc.

- CenTrak, Inc.

- Savi Technology

- AVERY DENNISON CORPORATION

- SMARTRAC N.V.

- Texas Instruments Incorporated

- ThingMagic (A Motorola Solutions Company)

- Invengo Information Technology Co., Ltd.

- Confidex Ltd.

- Nedap N.V.

- SML Group

- RF Controls LLC

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. RFID in healthcare market

Product

Application

- Asset Tracking

- Patient Tracking

- Pharmaceutical Tracking

- Blood Tracking

- Others