U.S. Roadside Drug Testing Market Size and Trends 2026 to 2035

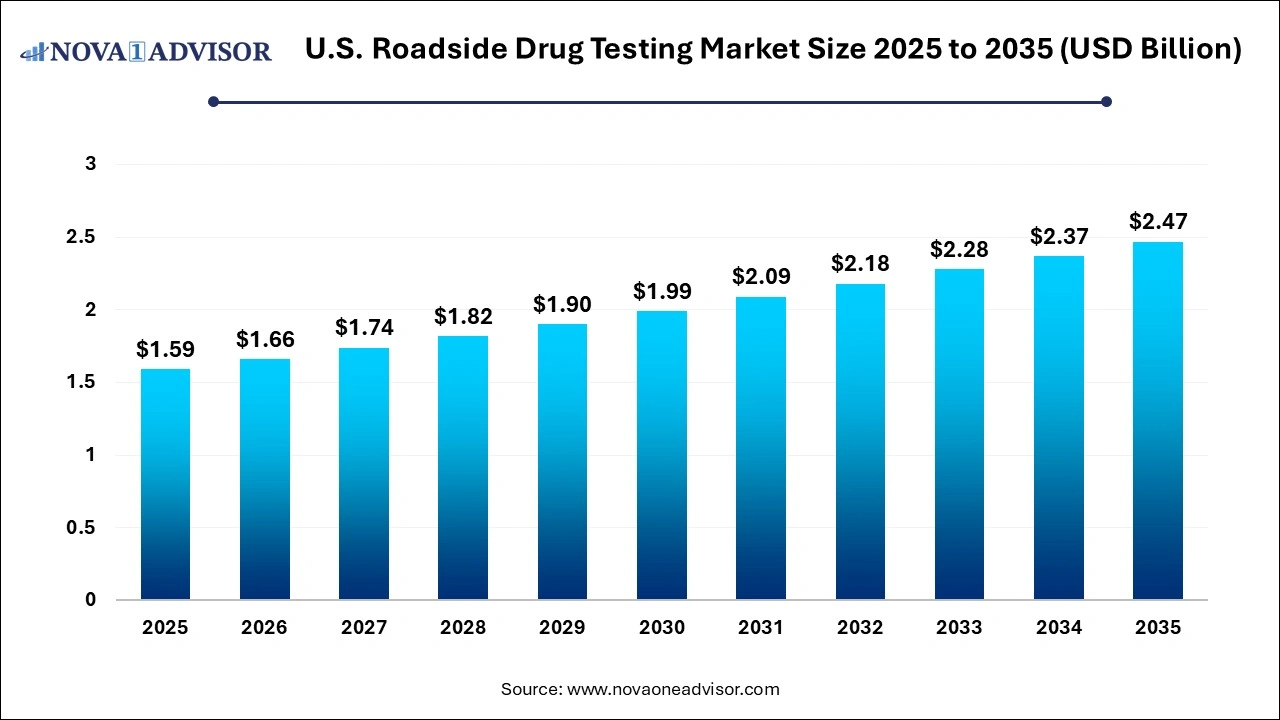

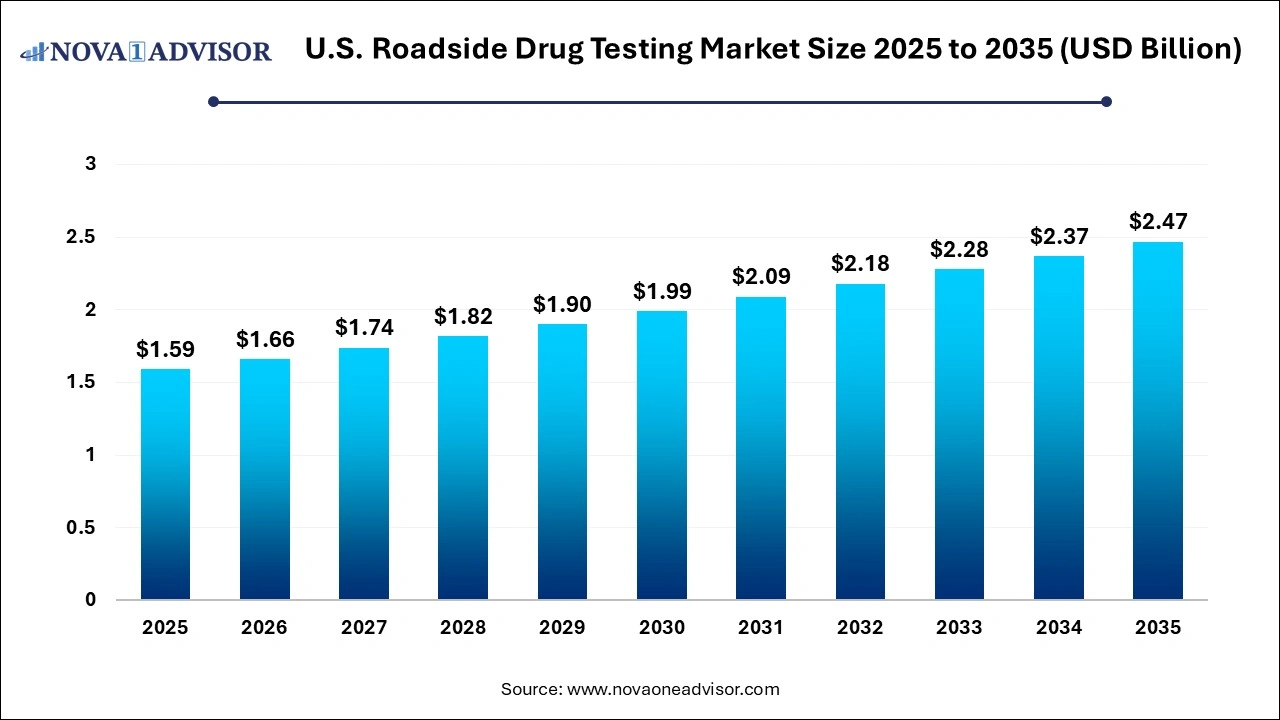

The U.S. roadside drug testing market size was exhibited at USD 1.59 billion in 2025 and is projected to hit around USD 2.47 billion by 2035, growing at a CAGR of 4.5% during the forecast period 2026 to 2035.

U.S. Roadside Drug Testing Market Key Takeaways:

- Alcohol segment dominated the market with a share of 31.96% in 2025.

- On the other hand, cannabis/marijuana segment is expected to grow at the highest CAGR of 5.50% over the forecast period.

- Breath segment dominated the market with a share of 44.44% in 2025.

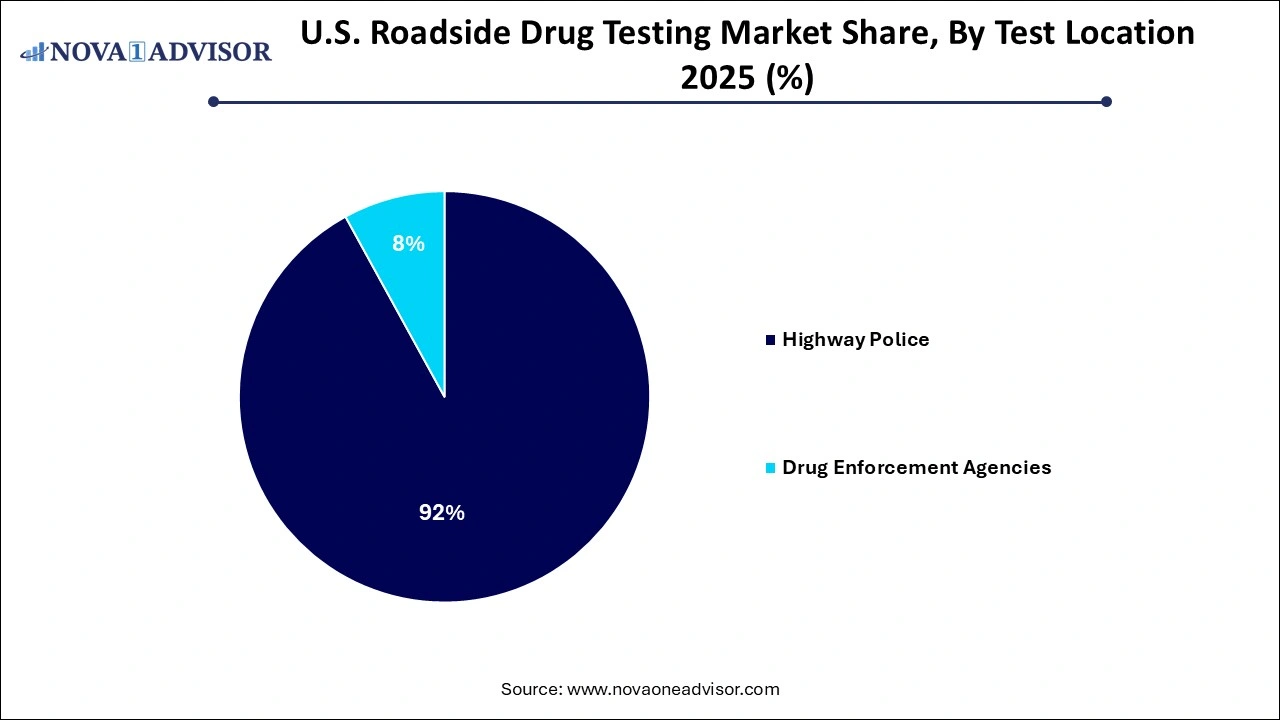

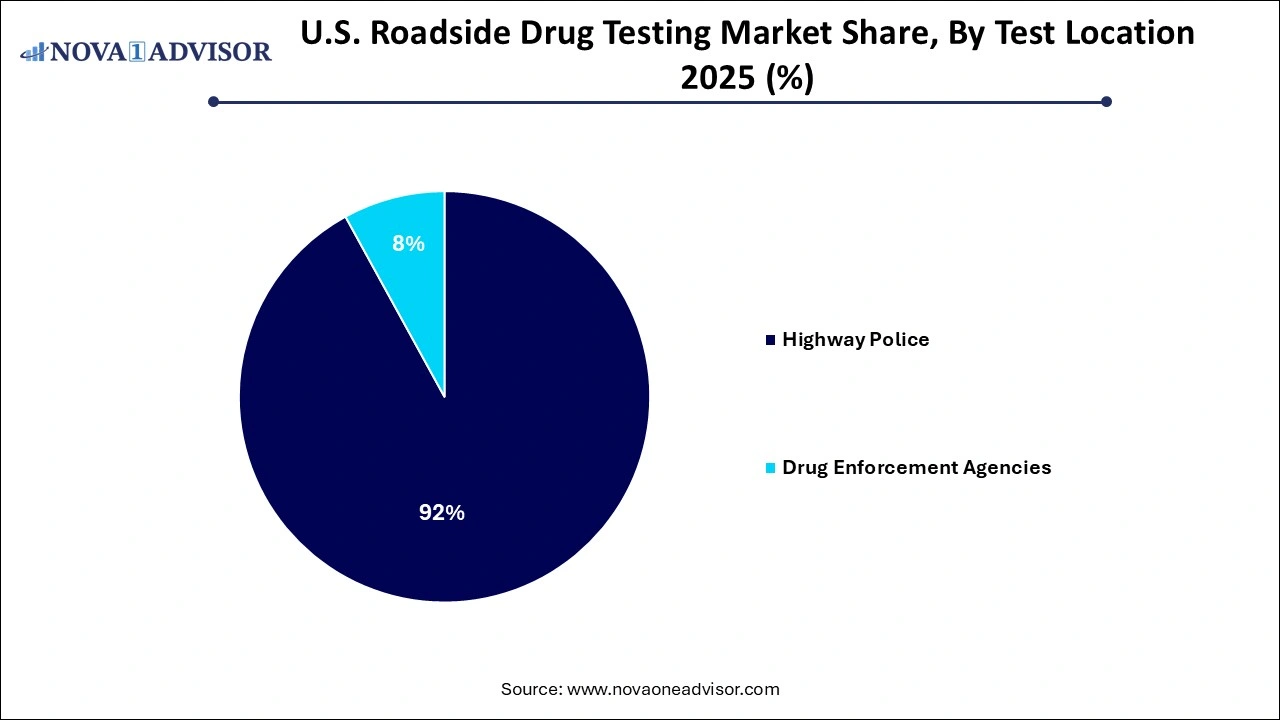

- Highway police segment dominated the market with a share of 92% in 2025.

U.S. Roadside Drug Testing Market Overview

The U.S. roadside drug testing market is an increasingly critical component of the country’s law enforcement, public health, and traffic safety ecosystem. Roadside drug testing refers to the on-site assessment of drivers for the presence of intoxicating substances such as alcohol, cannabis, opioids, cocaine, amphetamines, and other controlled or illicit drugs. With the growing societal concerns over impaired driving and substance abuse, these tests serve as front-line tools to deter, detect, and remove impaired drivers from public roadways.

Impaired driving remains one of the leading causes of motor vehicle accidents and fatalities in the U.S. According to the National Highway Traffic Safety Administration (NHTSA), nearly 56% of drivers involved in serious injury or fatal crashes tested positive for at least one drug in 2023. While alcohol has traditionally been the focus of roadside testing, the increased legalization of recreational and medical marijuana in many states, coupled with rising prescription opioid use and the resurgence of synthetic stimulants, has made drug testing broader and more complex.

The roadside drug testing market in the U.S. encompasses an array of technologies, from simple breathalyzers for alcohol to advanced saliva and blood analyzers capable of detecting multiple drug classes within minutes. Law enforcement agencies across all 50 states rely on these tests to assess impairment, often in combination with field sobriety testing or behavioral evaluations. Recent innovations have led to the deployment of rapid, non-invasive, and portable testing kits with high accuracy and minimal invasiveness.

As substance-related traffic enforcement evolves, this market is seeing rising investments from federal and state governments, increased adoption by highway patrol and drug enforcement agencies, and continuous innovation from diagnostic companies. The future of roadside drug testing lies not only in expanding the scope of substances detected but also in ensuring judicial defensibility, real-time data capture, and integration with public health surveillance systems.

Major Trends in the U.S. Roadside Drug Testing Market

-

Expansion of Saliva-Based Testing: Saliva tests are gaining ground due to their non-invasive nature and rapid detection of multiple substances.

-

Cannabis Legalization Driving Marijuana Detection Tools: Growing legalization has pushed demand for accurate roadside THC impairment testing, particularly in states like California and Colorado.

-

Shift Toward Multi-Panel Drug Screening Devices: Agencies are increasingly adopting devices capable of detecting multiple drug classes simultaneously, improving testing efficiency.

-

Integration with Digital Evidence Systems: Devices now include Bluetooth and cloud connectivity, enabling automatic syncing with police records and chain-of-custody documentation.

-

Federal Funding Boosts for Drugged Driving Programs: Recent federal initiatives like the FAST Act and Infrastructure Investment programs are channeling more resources into impaired driving detection.

-

Pilot Programs for THC Impairment Detection: Several states are experimenting with THC-specific roadside tests to establish correlation with impairment.

-

Push for Real-Time Drug Analytics and AI-Enhanced Devices: Companies are developing systems that use AI for real-time behavior analysis alongside chemical detection.

Report Scope of U.S. Roadside Drug Testing Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 1.66 Billion |

| Market Size by 2035 |

USD 2.47 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 4.5% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Drug, Sample, Test Location, State |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Drägerwerk AG & Co. KGaA; Abbott; Intoximeters; Lifeloc Technologies, Inc.; Hound Labs, Inc.; Immunalysis Corporation; CMI Inc.; Alcohol Countermeasure Systems Corp.; AK GlobalTech Corp.; PAS Systems International, Inc |

Market Driver: Rise in Drug-Impaired Driving Incidents

The primary driver for the U.S. roadside drug testing market is the significant rise in drug-impaired driving incidents across the country. As prescription drug use increases and states continue to legalize recreational cannabis, the threat posed by drivers under the influence of substances has escalated dramatically. A 2023 NHTSA study found that the number of weekend nighttime drivers testing positive for cannabis had nearly doubled over the previous decade.

Moreover, opioids such as fentanyl, benzodiazepines like Xanax, and stimulants including methamphetamine are now frequently implicated in impaired driving cases. Unlike alcohol, for which clear legal limits and standardized testing protocols exist, the lack of uniform drug impairment thresholds has increased the need for advanced detection technologies. Roadside drug tests help officers make timely decisions and provide preliminary evidence for further lab confirmation and legal proceedings.

As traffic fatalities linked to drugged driving increase, the adoption of these testing tools by highway patrols, local police departments, and drug enforcement agencies continues to expand, reinforcing their importance in public safety strategies.

Market Restraint: Lack of Standardized Impairment Thresholds for Drugs

A major restraint in the U.S. roadside drug testing market is the lack of federally accepted impairment thresholds for most drugs, unlike the 0.08% blood alcohol concentration (BAC) standard for alcohol. For substances like THC (the psychoactive component of cannabis), the correlation between concentration levels and actual impairment varies significantly among individuals, making it difficult to set enforceable limits.

This regulatory ambiguity creates challenges for law enforcement officers and prosecutors. A driver may test positive for a drug days after use, even if they are no longer impaired. This makes it difficult to differentiate between recent use and actual impairment, potentially leading to legal challenges and false positives. Additionally, some testing technologies are not yet admissible in court due to questions about accuracy, calibration, or procedural errors.

These factors create hesitation among law enforcement agencies to fully deploy newer drug detection tools and can hinder wider adoption of sophisticated devices, especially if the legal framework does not evolve in tandem with technology.

Market Opportunity: Technology Innovation for On-Site Drug Detection

One of the most promising opportunities in the U.S. roadside drug testing market lies in the development of advanced, real-time drug detection technologies that are accurate, portable, and legally defensible. There is a growing need for devices that can rapidly detect multiple drugs at nanogram levels with high specificity and low error rates.

Saliva-based devices that can detect recent use within minutes and provide results admissible in court are in high demand. Emerging startups and established companies are also investing in miniaturized spectrometry, biosensors, and microfluidic lab-on-a-chip solutions that bring lab-level precision to the roadside. Additionally, AI-enhanced platforms capable of analyzing eye movements, facial cues, and speech to detect intoxication are being tested in parallel with chemical assays.

By combining behavioral analytics with chemical detection, future roadside drug testing may evolve into a holistic assessment of impairment. Federal and state funding for research, pilot programs, and technology procurement is expected to fuel these innovations, creating a lucrative opportunity for diagnostic technology providers.

U.S. Roadside Drug Testing Market Segmental Insights

By Drug Insights

Alcohol segment dominated the market with a share of 31.96% in 2025. The U.S., supported by decades of regulatory frameworks, technological maturity, and standardized enforcement protocols. Breathalyzer devices capable of delivering real-time results with legal backing are ubiquitous among police departments and highway patrols. These tests are fast, inexpensive, and widely accepted in courts.

Despite the growing use of drugs, alcohol remains the most common substance involved in impaired driving incidents. It is also the easiest to detect with high accuracy using breath-based tools. Routine alcohol checkpoints, combined with zero-tolerance laws for underage drinking and driving, ensure the continued dominance of alcohol testing devices in the market.

On the other hand, cannabis/marijuana segment is expected to grow at the highest CAGR of 5.50% over the forecast period. As of 2025, 24 states have legalized recreational marijuana, while over 35 have approved it for medicinal use. This has led to an increase in THC-related driving offenses and a growing demand for accurate roadside cannabis detection tools.

Unlike alcohol, THC is not easily detected through breath, and blood or saliva tests must be used instead. New portable saliva test kits that can detect THC within minutes are being trialed by law enforcement in states like California, Colorado, and Oregon. However, due to lack of consensus on impairment thresholds, these tests are often used as preliminary evidence. Ongoing technological innovation and regulatory evolution are expected to solidify this segment’s rapid growth.

By Sample Insights

Breath segment dominated the market with a share of 44.44% in 2025. Primarily because of its effectiveness in detecting alcohol and its widespread use in law enforcement. Devices such as breathalyzers are compact, accurate, and legally standardized. The technology is mature, easy to administer, and delivers immediate results with minimal invasion of personal space.

Most U.S. law enforcement agencies are equipped with breath analyzers, and their use is well-supported by courts and traffic safety protocols. The simplicity of the breath test, coupled with its effectiveness in measuring blood alcohol concentration (BAC), ensures that this segment continues to lead in terms of deployment and volume.

Saliva testing is gaining traction as the fastest growing method, particularly for detecting drugs like THC, cocaine, opioids, and amphetamines. These tests are less invasive than blood or urine collection, can be conducted at the roadside, and provide quick results. They are especially effective in identifying recent use, which is critical for assessing impairment.

Several U.S. states have launched pilot programs using saliva-based multi-panel drug tests that detect multiple substances in under 10 minutes. As accuracy improves and legal frameworks begin to accept saliva-based evidence in court, this segment is expected to grow rapidly and possibly rival breath tests in the future.

By Test Location Insights

Highway police segment dominated the market with a share of 92% in 2025. given their responsibility for patrolling interstate highways, monitoring high-speed traffic, and responding to road accidents. They are often the first to identify impaired drivers and use on-the-spot testing to assess the level of intoxication.

The widespread deployment of DUI checkpoints and highway patrol operations has led to high adoption of breath and saliva testing kits among highway law enforcement officers. Their mobility, jurisdiction, and ability to stop vehicles at random enable them to conduct more roadside tests than other agencies.

Drug enforcement agencies are rapidly expanding their use of roadside drug testing devices, particularly in cities and states grappling with the opioid crisis and synthetic drug proliferation. These agencies often conduct special operations targeting drug trafficking routes and impaired driving hot spots, requiring multi-substance testing capabilities.

In addition to traditional tests, drug enforcement officers are adopting advanced handheld analyzers capable of detecting narcotics, synthetic opioids, and designer drugs. Their operations are more targeted and data-driven, and they are often early adopters of new technologies. As the drug landscape evolves, the role of specialized enforcement agencies in roadside testing is growing in both volume and complexity.

By State Insights

California is the leading state in the U.S. roadside drug testing market, thanks to its large population, high vehicle density, and progressive stance on drug legalization and public safety. The California Highway Patrol (CHP) is one of the best-funded state patrol agencies and has launched several programs for impaired driving detection, including saliva-based THC testing pilots.

The state’s legalization of recreational marijuana has created both opportunities and challenges for law enforcement, prompting significant investments in drug detection tools. Urban centers like Los Angeles and San Francisco also face high rates of drug-related vehicular incidents, making California a leader in both deployment and innovation within this market.

Texas is Among the Fastest Growing States

Texas is one of the fastest growing markets for roadside drug testing, driven by its large highway network, rising drug trafficking routes, and increased drug-impaired driving incidents. The Texas Department of Public Safety and local sheriff’s departments are actively deploying multi-drug testing kits and initiating partnerships with diagnostic companies.

As the state expands its fight against synthetic opioids and illegal drug transport along the Mexico border, demand for roadside drug testing tools is rising sharply. Moreover, legislative interest in zero-tolerance and impairment detection laws is fostering a regulatory environment conducive to market expansion.

U.S. Roadside Drug Testing Market Recent Developments

-

In February 2025, Dräger launched a next-generation saliva-based roadside drug testing device, DrugTest 6000, approved for THC, cocaine, and opioid detection with results in under 8 minutes.

-

In November 2024, Abbott announced the deployment of its SoToxa Mobile Test System across six U.S. states, including Ohio and New York, as part of a statewide drug-impaired driving pilot program.

-

In September 2024, Intoximeters Inc. released a Bluetooth-enabled breathalyzer that automatically uploads results to police evidence management systems.

-

In July 2024, the California Highway Patrol partnered with a startup to test new eye-tracking devices for roadside THC impairment detection, integrating AI and biometric data.

-

In May 2024, the U.S. Department of Transportation awarded $35 million in grants to state police departments for impaired driving countermeasures, including the purchase of advanced roadside drug testing equipment.

Some of the prominent players in the U.S. roadside drug testing market include:

- Drägerwerk AG & Co. KGaA

- Abbott.

- Intoximeters

- Lifeloc Technologies, Inc.

- Hound Labs, Inc.

- Immunalysis Corporation

- CMI Inc.

- Alcohol Countermeasure Systems Corp.

- AK GlobalTech Corp.

- PAS Systems International, Inc

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. roadside drug testing market

Drug

- Alcohol

- Cannabis/Marijuana

- Cocaine

- Opioids

- Amphetamine & Methamphetamine

- LSD

- Others

Sample

- Saliva

- Breath

- Urine

- Blood

Test Location

- Highway Police

- Drug Enforcement Agencies

States

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming