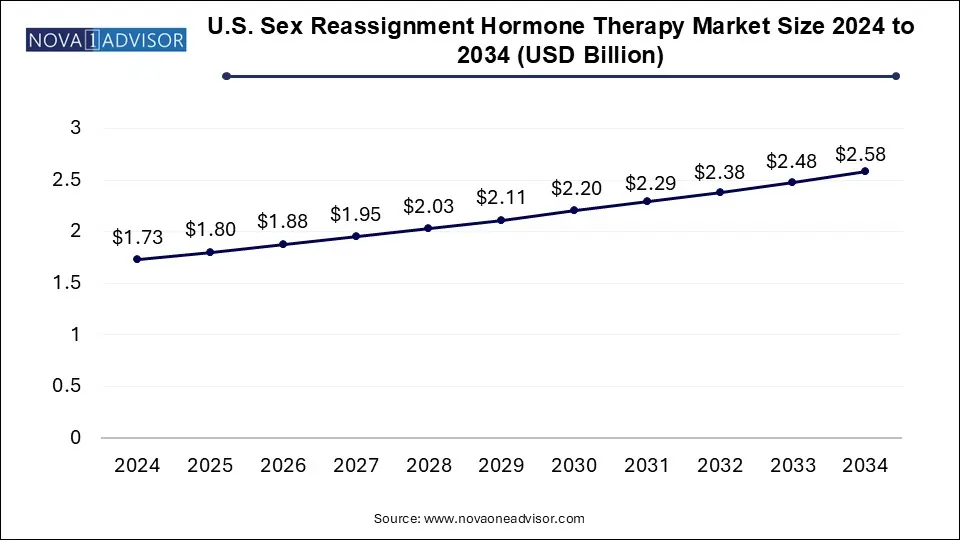

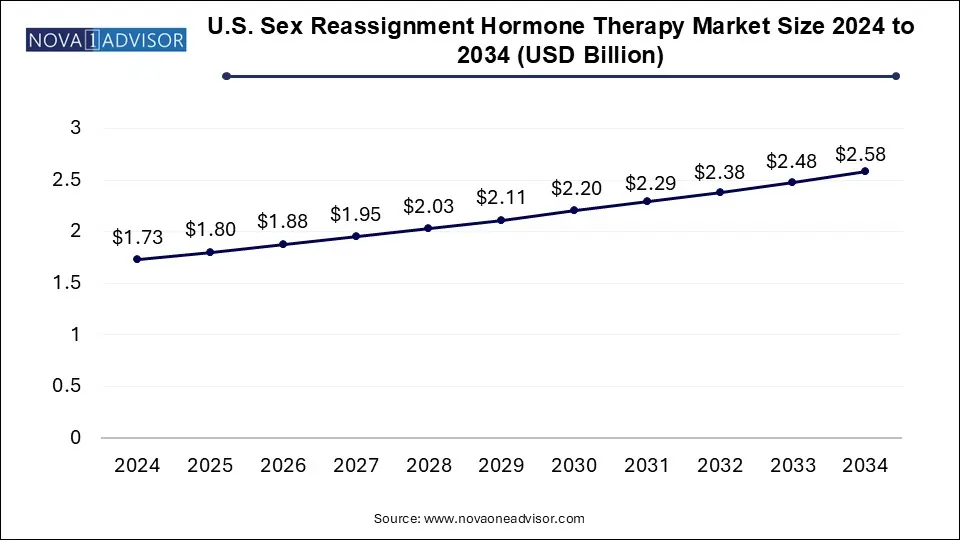

U.S. Sex Reassignment Hormone Therapy Market Size and Growth

The U.S. sex reassignment hormone therapy market size was exhibited at USD 1.73 billion in 2024 and is projected to hit around USD 2.58 billion by 2034, growing at a CAGR of 4.06% during the forecast period 2025 to 2034.

U.S. Sex Reassignment Hormone Therapy Market Key Takeaways:

- The male-to-female segment dominated the market in 2024 with a share of 52.28% and is anticipated to witness the fastest growth over the forecast period.

- The population-based gender incongruence range for birth-assigned males is between 0.5% to 1.3%.

- The estrogen segment dominated the market in 2024 with a revenue share of 41.6%.

- The retail pharmacies segment dominated with a revenue share of 57.0% in 2024.

- The other segment comprises online platforms offering online distribution of sex reassignment hormone therapy products and is anticipated to grow fastest at a CAGR of 5.83% from 2025 to 2034

Market Overview

The U.S. Sex Reassignment Hormone Therapy Market is undergoing a substantial evolution, driven by rising societal acceptance of gender diversity, expanding access to gender-affirming healthcare, and increasing visibility of transgender and non-binary individuals in public life. Hormone therapy, a vital component of medical transition for many transgender people, involves the use of pharmacologic agents such as estrogen, testosterone, and puberty blockers to induce physical changes aligned with an individual’s gender identity.

In recent years, the U.S. has seen an upsurge in the number of individuals identifying as transgender or gender diverse. According to data from the Williams Institute at UCLA, over 1.6 million people in the United States identify as transgender, and many of them either seek or currently undergo gender-affirming hormone therapy. Medical transition through hormone therapy has been shown to significantly improve mental health outcomes, reduce gender dysphoria, and enhance quality of life.

Supportive policies, increasing insurance coverage, and evolving standards of care from professional bodies such as the World Professional Association for Transgender Health (WPATH) are fostering broader availability of hormone therapy services. While certain sociopolitical and legislative challenges remain, particularly at the state level, the overarching trajectory of the market is towards expansion and normalization. In this evolving context, pharmaceutical manufacturers, compounding pharmacies, endocrinologists, and community health clinics are all playing a pivotal role in meeting growing patient demand.

Major Trends in the Market

-

Mainstreaming of Transgender Healthcare: Gender-affirming hormone therapy is becoming part of standard care protocols in major hospital systems and community clinics.

-

Growth in Telehealth for Hormone Prescriptions: Digital health platforms now facilitate remote consultations and home delivery of hormones, expanding access, particularly in underserved regions.

-

Increased Inclusion in Insurance Policies: Medicaid and many private insurers have expanded coverage for hormone therapy under gender-affirming care.

-

Development of Long-Acting Injectable Formulations: Companies are investing in depot formulations for testosterone and estrogen, reducing dosing frequency and improving adherence.

-

Rising Demand for Youth-Oriented Care: The use of puberty blockers in transgender adolescents is becoming more prevalent, alongside ethical and political debates.

-

Expansion of Compounding Pharmacies: Personalized hormone regimens offered by compounding pharmacies are gaining popularity among patients seeking individualized care.

-

Medical Training and Education Initiatives: Universities and healthcare systems are increasingly incorporating transgender care into their curricula, helping build a more inclusive provider workforce.

Report Scope of U.S. Sex Reassignment Hormone Therapy Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.8 Billion |

| Market Size by 2034 |

USD 2.58 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 4.06% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Gender Transition, Type, Distribution Channel |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Viatris Inc.; AbbVie Inc.; ASCEND Therapeutics US, LLC.; Pfizer Inc.; Eli Lilly and Company; Novartis AG; Endo International plc |

Key Market Driver: Growing Transgender Population and Increased Access to Gender-Affirming Healthcare

A major driver for the U.S. Sex Reassignment Hormone Therapy Market is the growing number of individuals openly identifying as transgender and non-binary, coupled with expanded access to gender-affirming healthcare. Cultural shifts, increased visibility of transgender individuals in media, and changing social attitudes have empowered more people to seek medically supervised gender transition.

Moreover, institutional support is strengthening. The WPATH Standards of Care Version 8, released in 2022, offers detailed clinical guidance and has accelerated the medical community’s adoption of evidence-based practices. Major healthcare networks, including Kaiser Permanente and Planned Parenthood, now offer integrated gender-affirming care, including hormone therapy. The expansion of Medicaid coverage in numerous states and growing private insurer support have further lowered financial barriers.

Telemedicine services have also emerged as a game-changer, enabling people in rural or conservative regions to receive care discreetly and safely. Digital clinics like Folx Health, Plume, and QueerDoc specialize in trans health and have streamlined the process of starting and managing hormone therapy. These systemic shifts are contributing to a steadily rising demand for hormone therapy services in the U.S.

Key Market Restraint: Political and Regulatory Uncertainty

Despite broad progress, political and regulatory instability poses a substantial challenge to the U.S. hormone therapy market. Over the past few years, a wave of state-level legislation has emerged aimed at restricting or banning access to gender-affirming care, especially for minors. By mid-2025, more than 20 U.S. states had introduced or passed laws limiting the use of puberty blockers and cross-sex hormones in adolescents, with some states threatening criminal penalties for providers.

These legislative actions create a chilling effect—not only for healthcare providers, who may be reluctant to offer services due to legal risks, but also for patients who fear losing access to ongoing care. Inconsistent policies between states can disrupt continuity of treatment, especially for those forced to travel across state lines. Additionally, misinformation campaigns and social stigma continue to impact both access and public perceptions of hormone therapy. Until clearer and more stable federal-level protections are established, these uncertainties will continue to hinder the full potential of market growth.

Key Opportunity: Innovation in Long-Acting and Personalized Hormonal Therapies

A major opportunity in the U.S. market lies in the innovation and commercialization of long-acting and personalized hormone delivery systems. Traditional hormone therapy often requires daily oral medications, weekly injections, or bi-weekly transdermal applications. For many patients, these frequent regimens can be burdensome, leading to inconsistent adherence and fluctuating hormone levels.

To address this, pharmaceutical companies are developing long-acting injectable forms of testosterone and estrogen. For instance, long-acting testosterone undecanoate and estradiol valerate injections allow for monthly or quarterly dosing schedules, improving compliance and minimizing hormonal fluctuations. Compounded slow-release implants, while currently less common, are also being explored as a solution for stable, long-term hormone delivery.

Furthermore, compounding pharmacies are playing an expanding role by offering customized hormone preparations tailored to individual hormone profiles, dosage needs, and delivery preferences. These innovations not only improve patient experience but also position the market for premium pricing and greater product differentiation. As research in this area advances and regulatory pathways become clearer, long-acting and personalized hormone therapies are expected to unlock significant market growth.

U.S. Sex Reassignment Hormone Therapy Market By Gender Transition Insights

Male-to-Female (MTF) therapies dominated the market, reflecting a larger patient base and earlier historical access to estrogen therapy compared to testosterone. MTF hormone therapy typically involves a combination of estrogen and anti-androgens to promote feminizing changes such as breast development, softer skin, and fat redistribution. Estrogen options include oral estradiol, transdermal patches, and injectable estradiol valerate, while anti-androgens like spironolactone or bicalutamide help suppress testosterone levels. MTF patients are more likely to engage in long-term hormone therapy, sometimes spanning decades, thereby contributing to sustained pharmaceutical demand.

Female-to-Male (FTM) therapies are the fastest-growing segment, driven by increasing visibility and acceptance of transmasculine individuals, particularly among younger age groups. Testosterone therapy for FTM transitions is commonly administered via injections, gels, or patches, with the goal of inducing masculinizing effects such as deepening of the voice, facial hair growth, and increased muscle mass. New formulations, such as subcutaneous testosterone and longer-acting injectables, are gaining popularity among patients seeking greater convenience. The growth of telemedicine and social media-based peer education has significantly accelerated FTM therapy adoption, particularly in underrepresented and rural populations.

U.S. Sex Reassignment Hormone Therapy Market By Type Insights

Estrogen therapy emerged as the dominant category, owing to its critical role in male-to-female transitions and broad availability in multiple delivery forms. Oral estradiol remains the most commonly prescribed due to its ease of use and low cost, but transdermal patches and injectables are increasingly preferred for their lower risk of blood clots and more stable hormone levels. Estrogen therapy is also often used in combination with anti-androgens, which, although not standalone hormone therapies, complement estrogen's effectiveness by minimizing testosterone activity. The large and enduring base of MTF patients ensures consistent demand in this category.

Puberty blockers represent the fastest-growing type, particularly among transgender and non-binary youth. These agents, such as GnRH agonists like leuprolide or histrelin, are used to delay the physical changes associated with puberty, allowing adolescents more time to explore their gender identity. Puberty blockers offer a reversible intervention and are often viewed as a gateway to further medical transition. Clinics and pediatric endocrinologists across the U.S., especially in urban centers, have reported increased uptake of these treatments. Despite political pushback in some states, the clinical demand and ethical support for puberty blockers continue to grow, especially in states with protective legislation.

U.S. Sex Reassignment Hormone Therapy Market By Distribution Channel Insights

Retail pharmacies accounted for the largest share of distribution, reflecting widespread availability of hormone therapies through commercial pharmacy chains like CVS, Walgreens, and independent outlets. Many hormone prescriptions are filled monthly through retail stores, supported by insurance plans or out-of-pocket payments. The accessibility, competitive pricing, and pharmacist support make retail pharmacies a critical node in the delivery of transgender healthcare.

Hospital pharmacies and specialty clinics are the fastest-growing distribution channels, particularly in academic medical centers and gender clinics that integrate hormone therapy with other gender-affirming services. Hospital systems such as the University of California Health, Mount Sinai, and Fenway Health offer full-spectrum gender care, including on-site pharmacy services tailored to trans patients. These pharmacies often carry specialized formulations, such as long-acting injectables or compounded hormone blends, which are not available through retail chains. The clinical oversight provided in these settings also facilitates better dosing and adherence, making them preferred choices for many patients initiating hormone therapy.

Country-Level Analysis

In the U.S., the demand for sex reassignment hormone therapy is growing across diverse demographic, geographic, and socio-economic lines. States like California, New York, Illinois, and Massachusetts have become national hubs for gender-affirming care, supported by robust healthcare systems, protective legislation, and inclusive medical training. These states offer Medicaid coverage for hormone therapy and host leading gender clinics that set best practices nationwide.

Conversely, southern and midwestern states have seen legal and ideological battles over transgender healthcare access. Nevertheless, telehealth platforms have played a transformative role in bridging these gaps, allowing patients in restrictive environments to consult providers in more progressive states and receive prescriptions via mail-order pharmacies. As federal health authorities and professional organizations continue to standardize care practices and expand provider training, nationwide access to hormone therapy is expected to improve further. The U.S. market, although segmented by policy differences, represents one of the most dynamic and innovative spaces globally for gender-affirming hormone therapy.

Some of the prominent players in the U.S. sex reassignment hormone therapy market include:

Recent Developments

-

Folx Health, a digital health startup specializing in LGBTQ+ care, announced in April 2025 the expansion of its hormone therapy services to all 50 U.S. states, including rural and underserved areas.

-

In March 2025, GoodRx partnered with a network of trans-affirming providers to offer discounts on hormone therapy medications, expanding affordability for uninsured and underinsured individuals.

-

Plume, a telehealth platform focused on gender-affirming care, raised $24 million in a Series B funding round in February 2025 to develop proprietary hormone management tools and expand its national presence.

-

WPATH released updated training modules in January 2025 to equip healthcare providers with clinical and cultural competency in administering puberty blockers and hormone therapy for transgender youth.

-

Endo Pharmaceuticals announced a pilot program in May 2025 for a quarterly injectable testosterone formulation aimed at transgender men and non-binary individuals, currently under FDA review.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. sex reassignment hormone therapy market

By Gender Transition

- Male-To-Female (MTF)

- Female-To-Male (FTM)

By Type

- Puberty Blockers

- Estrogen

- Testosterone

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Others