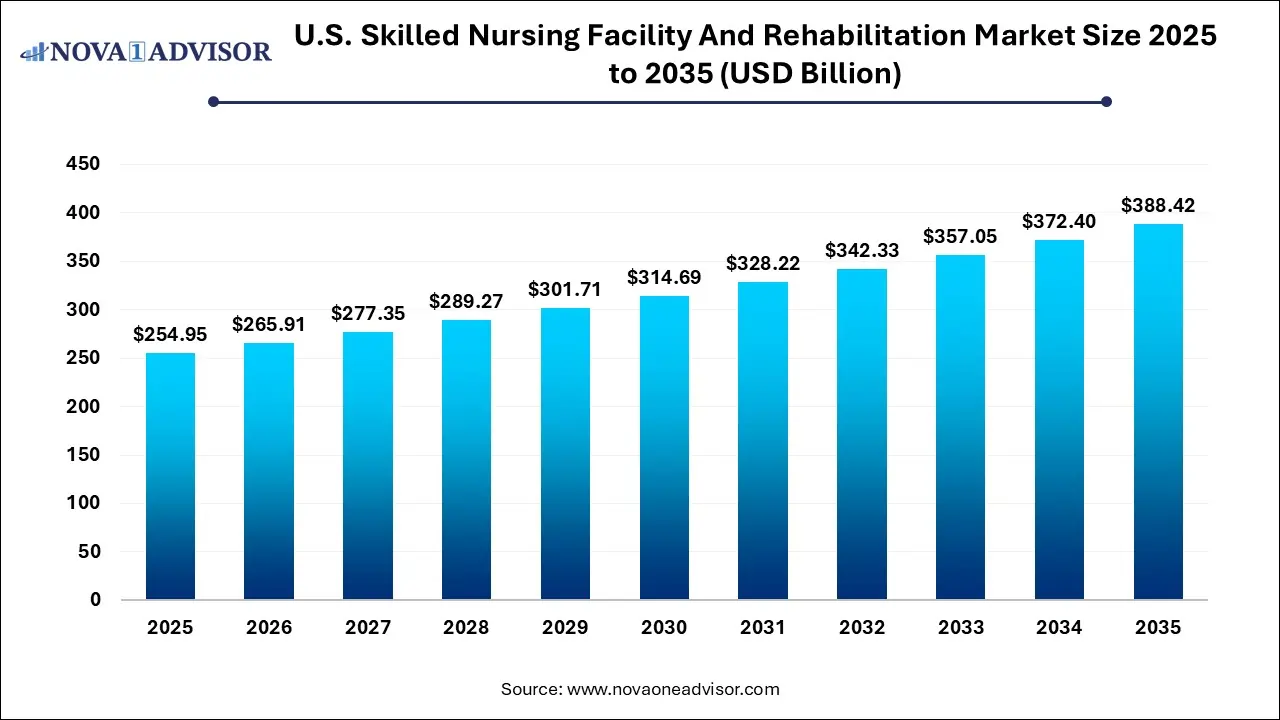

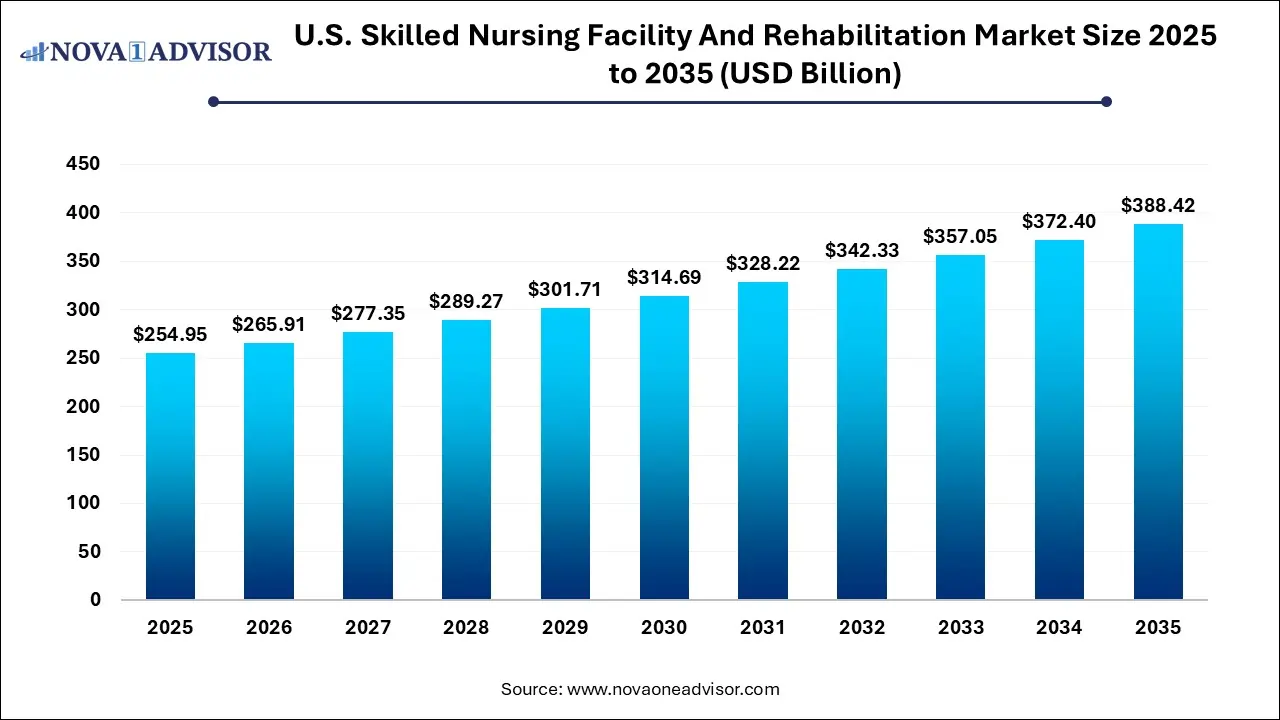

U.S. Skilled Nursing Facility And Rehabilitation Market Size and Growth

The U.S. skilled nursing facility and rehabilitation market size was exhibited at USD 254.95 billion in 2025 and is projected to hit around USD 388.42 billion by 2035, growing at a CAGR of 4.3% during the forecast period 2026 to 2035.

Market Overview

The U.S. skilled nursing facility (SNF) and rehabilitation market is an integral component of the post-acute care continuum, catering to patients who require continuous medical supervision and rehabilitation following hospitalization. These facilities bridge the gap between intensive hospital care and the return to home, offering round-the-clock nursing care, therapy services, wound management, and other forms of rehabilitation for patients recovering from surgeries, strokes, fractures, or chronic disease complications.

In the wake of an aging U.S. population and a rising prevalence of complex health conditions, the demand for skilled nursing and rehabilitation services has grown significantly. Medicare and Medicaid continue to be the primary payers in this market, influencing care delivery models and reimbursement dynamics. Recent trends show a clear shift toward value-based care, with greater scrutiny on length of stay, rehospitalization rates, and patient outcomes.

SNFs and rehab centers have also faced operational challenges post-COVID-19, including staffing shortages, infection control standards, and occupancy volatility. Nevertheless, they remain critical infrastructure for healthcare systems managing an increasing volume of elderly patients and post-surgical cases. Investment in staff training, facility upgrades, and integrated care coordination has become paramount for players aiming to remain competitive in this evolving landscape.

Major Trends in the Market

-

Growth of Short-Term Rehabilitation Over Long-Term Custodial Care: Facilities are increasingly focusing on higher turnover, rehab-driven services rather than long-stay housing models.

-

Increased Adoption of Electronic Health Records (EHR) and Tele-rehab Tools: Technology is improving care documentation, outcomes tracking, and remote therapy delivery.

-

Post-Acute Value-Based Reimbursement Models: Payers are tying reimbursements to patient recovery outcomes, encouraging providers to improve coordination and efficiency.

-

Expansion of Freestanding SNFs Near Hospitals and Urban Centers: These purpose-built centers are designed to handle rapid patient inflow from hospitals while reducing readmissions.

-

Rising Workforce Challenges and Labor Cost Pressures: The need for licensed nurses, physical therapists, and geriatricians is driving staffing shortages and wage inflation.

Report Scope of U.S. Skilled Nursing Facility And Rehabilitation Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 265.91 Billion |

| Market Size by 2035 |

USD 388.42 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 4.3% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Type of Facility |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

The Ensign Group, Inc; Brookdale Senior Living, Inc; Genesis Healthcare, Inc; Extendicare; Sunrise Senior Living, LLC; ProMedica; Golden Living Centers; Life Care Centers of America |

Key Market Driver: Aging Population and Increasing Post-Acute Demand

A principal driver of the U.S. skilled nursing facility and rehabilitation market is the aging demographic profile of the country. The U.S. Census Bureau estimates that by 2030, one in every five Americans will be over the age of 65. This population cohort experiences a higher incidence of surgeries, falls, strokes, and chronic illnesses such as diabetes, heart disease, and arthritis all conditions that often require skilled nursing and rehab services post-discharge.

As hospital stays become shorter due to cost and policy constraints, SNFs and rehab centers are assuming greater responsibility for post-acute recovery. For example, a patient recovering from hip replacement surgery may be discharged after two or three days but still require several weeks of physical therapy and skilled nursing—services that these facilities are best positioned to deliver. The increase in bundled payments and hospital readmission penalties is further accelerating hospital partnerships with SNFs that demonstrate quality outcomes and cost efficiency.

Key Market Restraint: Staffing Shortages and Regulatory Compliance Burden

Despite growing demand, staffing shortages present a formidable challenge to the growth of SNFs and rehabilitation centers. These facilities rely on a skilled workforce including registered nurses, licensed practical nurses, physical and occupational therapists, and certified nursing assistants to deliver care. According to industry data, turnover rates in the sector often exceed 50%, exacerbated by low wage scales, physical and emotional job demands, and burnout intensified during the pandemic.

In addition, SNFs must comply with a wide range of federal and state regulations, including those set by the Centers for Medicare & Medicaid Services (CMS). Regulations cover everything from patient rights and infection control to staffing ratios and reporting standards. While these are crucial for maintaining care quality, compliance often requires significant administrative effort and cost. For smaller or rural facilities, the combined burden of staffing and regulatory demands can threaten operational viability.

Key Market Opportunity: Integration with Hospitals and ACOs for Seamless Care Continuum

A major opportunity lies in the closer integration of skilled nursing facilities with hospitals and Accountable Care Organizations (ACOs) to create a seamless continuum of care. Hospitals are increasingly looking to partner with SNFs that can deliver consistent, high-quality rehab services while minimizing readmissions. These preferred SNF networks often receive priority referrals, access to shared patient data, and participation in care pathway planning.

Such partnerships are being reinforced through value-based care models like the CMS’s Skilled Nursing Facility Value-Based Purchasing (SNF VBP) Program. SNFs that demonstrate lower readmission rates and better functional improvement are financially rewarded. By investing in case management, care coordination teams, and interoperable electronic medical records, SNFs can align more closely with hospital systems, securing both patient volume and reimbursement bonuses.

U.S. Skilled Nursing Facility And Rehabilitation Market By Type Of Facility Insights

Freestanding skilled nursing facilities dominate the U.S. market, comprising the majority of beds and admissions across the country. These standalone centers are purpose-built for rehabilitation and nursing care and are not physically integrated into hospital campuses. They provide a wide range of services including physical, occupational, and speech therapy; IV medication administration; wound care; and more. Freestanding facilities often serve both post-surgical patients and those needing extended recuperation, offering flexible admission policies and dedicated care programs. Their prevalence in both urban and rural areas ensures broad geographic coverage and accessibility.

Freestanding centers have also been at the forefront of innovation. Many are transitioning toward short-stay rehab models and investing in post-acute recovery suites that resemble hotel rooms more than hospital wards. This environment appeals to patients seeking a comfortable yet medically equipped space for recovery. Operators such as Genesis Healthcare and Encompass Health are enhancing service offerings, integrating tech solutions, and building partnerships with hospital discharge planners to secure patient inflow.

Hospital-based skilled nursing and rehab units are the fastest-growing segment, driven by hospitals’ need to improve patient flow and reduce avoidable readmissions. These units provide continuity of care for patients transitioning from acute care to subacute recovery within the same health system. They benefit from direct access to hospital specialists, diagnostics, and lab services, which can improve patient outcomes and shorten lengths of stay.

Additionally, hospital-affiliated SNFs are often preferred in bundled payment programs and gain-sharing arrangements under Medicare. As hospitals face increasing pressure to manage total cost of care under ACO contracts, integrating post-acute care into their own delivery models becomes a strategic move. Health systems are now retrofitting hospital wings or building on-site rehab centers to retain patients within their ecosystem, thus making hospital-based facilities a growth hotspot.

Country-Level Analysis: United States

The U.S. skilled nursing and rehabilitation sector is shaped by complex regulatory frameworks, public-private funding models, and shifting patient demographics. According to CMS, more than 15,000 certified skilled nursing facilities operate across the country, with the majority accepting Medicare and Medicaid payments. State-level regulations determine facility licensing, staffing ratios, and quality assurance programs, leading to variability in standards across regions.

Reimbursement plays a central role in market dynamics. Medicare typically covers up to 100 days of SNF care post-hospitalization if certain conditions are met, while Medicaid covers long-term care for low-income elderly populations. Recent reforms in payment systems—including the shift to the Patient Driven Payment Model (PDPM)—have changed how facilities are reimbursed, incentivizing more individualized, outcome-driven care.

The U.S. market is also seeing demographic shifts. An increasing number of younger patients are entering SNFs for short-term rehab following trauma or elective procedures, altering traditional assumptions about patient profiles. Meanwhile, rural SNFs face closure threats due to low margins, while urban centers are experiencing saturation and greater competition. Workforce shortages remain a nationwide concern, prompting federal and state initiatives to subsidize nursing education, immigration programs, and wage enhancements.

Some of the prominent players in the U.S. skilled nursing facility and rehabilitation market include:

Recent Developments

-

Genesis HealthCare (April 2025) launched a strategic collaboration with a major health system in Pennsylvania to build a post-acute care network using freestanding SNFs and technology-enabled rehab services.

-

Encompass Health (March 2025) announced the opening of a new 80-bed inpatient rehabilitation hospital in Dallas, Texas, designed to serve complex orthopedic and neurological cases.

-

Brookdale Senior Living (February 2025) expanded its transitional care units in partnership with local hospitals, incorporating tele-rehab and remote patient monitoring for better post-discharge outcomes.

-

ProMedica Health System (January 2025) implemented AI-based fall prediction systems across its skilled nursing network, reducing fall-related incidents by 22% in pilot sites.

-

Select Medical (December 2024) began integrating EHR interoperability across its rehabilitation hospitals and long-term acute care facilities to streamline care transitions and billing.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. skilled nursing facility and rehabilitation market

By Type of Facility