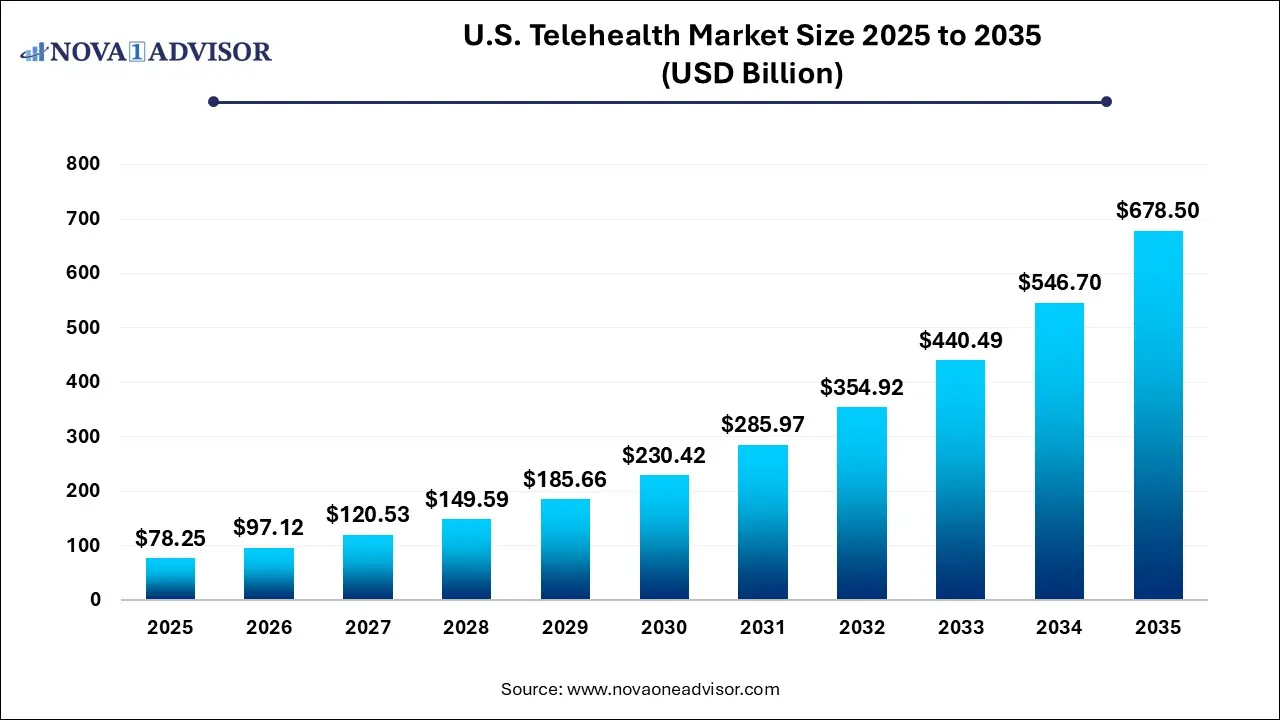

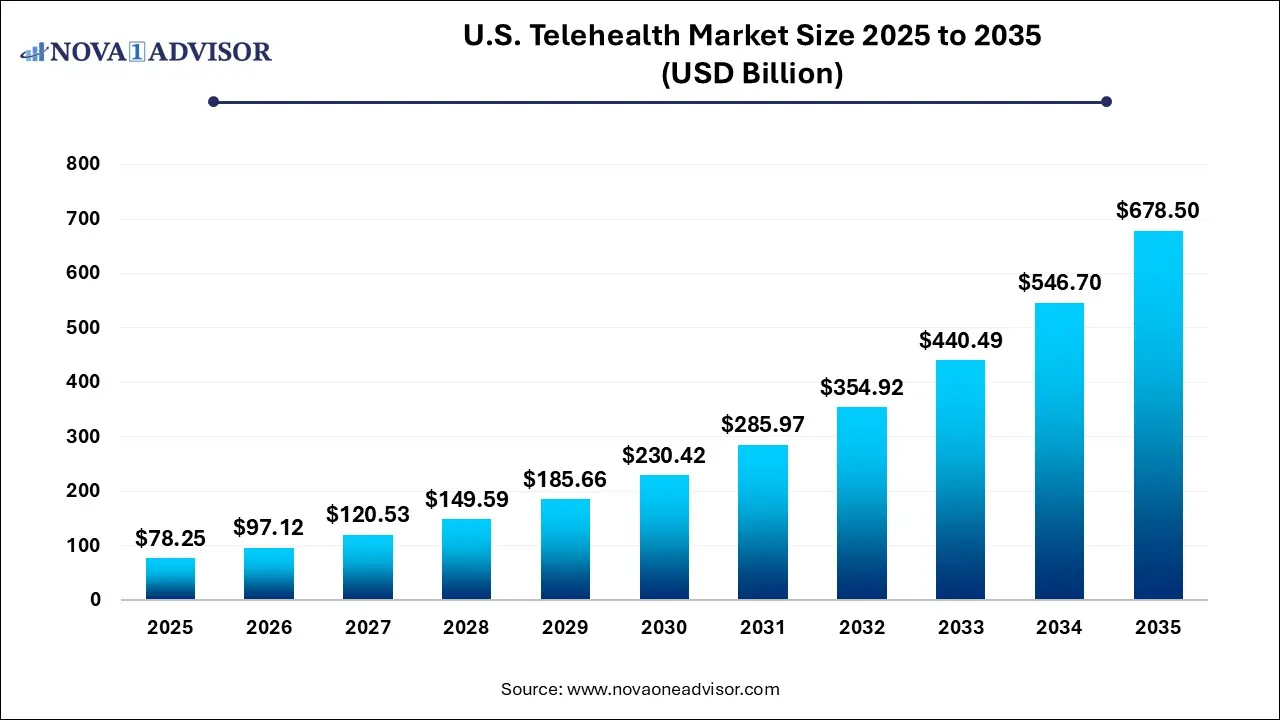

U.S. Telehealth Market Size and Growth

The U.S. telehealth market size was valued at USD 78.25 billion in 2025 and is projected to surpass around USD 678.50 billion by 2035, registering a CAGR of 24.11% over the forecast period of 2026 to 2035.

U.S. Telehealth Market Key Takeaways

- The services segment dominated the overall industry in 2025 and accounted for the largest share of 49.4% of the overall revenue.

- The web-based delivery segment accounted for the largest revenue share of 47.1% in 2025.

- The providers segment held the largest revenue share of 55.0% in 2025.

- The patients segment is expected to register the fastest growth rate during the forecast period.

Market Overview

The U.S. telehealth market has emerged as a transformative force in the healthcare industry, bridging the gap between patients and providers through digital platforms. The market witnessed exponential growth post-2020, spurred by the COVID-19 pandemic, which served as a catalyst for widespread adoption. Since then, telehealth has evolved from a contingency solution to a mainstream healthcare modality, supported by a changing regulatory landscape, technological advancement, and increasing consumer acceptance.

Telehealth encompasses a broad spectrum of services including remote consultations, diagnostics, chronic disease management, mental health services, and post-acute care. It leverages audio-visual communication, mobile health applications, wearable devices, and cloud-based solutions to deliver real-time healthcare. As of 2025, the U.S. telehealth market remains robust, driven by the demand for healthcare accessibility, provider shortages in rural regions, and a strategic pivot towards value-based care.

Government support through policies like the CARES Act, along with the Centers for Medicare & Medicaid Services (CMS) expanding reimbursement coverage for telehealth services, has significantly contributed to the market’s viability. Major hospitals, private clinics, and independent practitioners alike have integrated virtual care into their patient engagement strategies, ensuring continuity of care beyond traditional clinical settings.

Market Outlook

- Market Growth Overview: The U.S. telehealth market is expected to grow significantly between 2025 and 2034, driven by the growing deficits in primary care and specialists, which propel virtual solutions, technological advancement, and supportive policies.

- Sustainability Trends: Sustainability trends involve reduced transportation emissions, minimized material emissions, and green ICT and energy efficiency.

- Major Investors: Major investors in the market include a shift to hybrid models, speciality focus, and strategic partnerships.

- Startup Economy: The startup economy is focused on integration in AI and machine learning, behavioral and mental health, and remote patient monitoring.

Impact of AI on the U.S. Telehealth Market?

Artificial Intelligence: The Next Growth Catalyst in U.S. Telehealth

AI is a transformative force in the U.S. telehealth market, significantly enhancing accessibility, efficiency, and the quality of patient care. AI-powered tools are streamlining operations by automating administrative tasks like documentation and scheduling, which helps reduce physician burnout and allows healthcare professionals to focus more on direct patient interaction. Clinically, AI algorithms enable more accurate remote diagnostics (especially in medical imaging), personalize treatment plans based on vast datasets, and facilitate real-time remote patient monitoring through connected devices.

Major Trends in the Market

-

Integration of AI and Machine Learning: AI-driven diagnostic tools, virtual health assistants, and predictive analytics are increasingly incorporated into telehealth platforms.

-

Growth in Behavioral and Mental Health Services: Virtual mental health consultations have seen a dramatic rise, especially among adolescents and working professionals.

-

Rise in Remote Patient Monitoring (RPM): Wearable and connected devices for continuous health monitoring are becoming standard, especially for chronic condition management.

-

Expansion of Telehealth in Rural America: Infrastructure investments and regulatory allowances have expanded telehealth services into underserved rural regions.

-

Telehealth Interoperability with EHRs: Seamless integration of telehealth platforms with Electronic Health Records is becoming a norm to streamline care delivery.

-

Direct-to-Consumer (DTC) Telemedicine Models: More startups and healthcare brands are offering on-demand consultations directly to consumers without intermediary institutions.

-

Regulatory Evolution and Policy Reforms: Continued legislative developments are fostering greater reimbursement parity and licensure portability across states.

-

Increased Venture Capital Funding: The telehealth segment has seen a surge in venture investments, fueling innovation and market competition.

U.S. Telehealth Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 97.12 Billion |

| Market Size by 2035 |

USD 678.50 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 24.11% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Product type, Delivery Mode, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Koninklijke Philips N. V.; Siemens Healthineers; Cerner Corp.; GE Healthcare; Medtronic PLC; Teladoc Health Inc.; American Well; Doctor on Demand; U.S.Med; MDLive |

Market Driver: Rising Demand for Healthcare Accessibility and Convenience

A significant driver for the U.S. telehealth market is the increasing consumer preference for accessible, convenient healthcare. Traditional healthcare systems are often constrained by long wait times, geographical barriers, and high costs. Telehealth resolves many of these issues by providing on-demand access to medical services, eliminating the need for travel, and reducing operational expenses.

For instance, during the peak of the COVID-19 crisis, over 60% of outpatient visits in certain states were conducted virtually. Since then, consumer surveys indicate that over 75% of patients who used telehealth during the pandemic are likely to continue using it. Moreover, patients with chronic diseases such as diabetes and hypertension benefit from regular virtual monitoring, which minimizes complications and hospitalizations. Telehealth has effectively democratized healthcare access, making it indispensable in a post-pandemic world.

Market Restraint: Concerns over Data Security and Privacy

Despite its rapid adoption, data security and privacy concerns represent a formidable barrier in the U.S. telehealth landscape. The digital nature of telehealth makes it vulnerable to cyber threats, including data breaches, ransomware attacks, and unauthorized access. Healthcare data is among the most sensitive information types, and any compromise can result in severe legal and financial consequences.

High-profile cases such as the 2023 ransomware attack on a major telehealth provider, which exposed data of over 3 million patients, have heightened public concern. Regulatory compliance with HIPAA (Health Insurance Portability and Accountability Act) and the implementation of secure platforms are essential, but many smaller providers lack the technical capacity to maintain robust cybersecurity measures. These challenges could hinder telehealth adoption, particularly among privacy-conscious demographics and organizations with limited IT infrastructure.

Market Opportunity: Expansion of Telehealth Services for Chronic Disease Management

The U.S. telehealth market is poised to benefit immensely from the growing need for chronic disease management services. Nearly half of the U.S. adult population suffers from at least one chronic condition, such as diabetes, heart disease, or COPD. Managing these conditions traditionally involves frequent clinic visits, laboratory tests, and lifestyle monitoring.

Telehealth offers a more sustainable and cost-effective approach by enabling continuous, remote patient engagement through connected devices. For example, glucose monitoring devices that sync with telehealth apps can provide real-time blood sugar levels to healthcare providers. This not only allows for timely interventions but also empowers patients with better disease control. As health systems continue to transition towards value-based care, chronic disease telemanagement represents a significant growth avenue.

U.S. Telehealth Market By Product Type Insights

Services dominated the U.S. telehealth market, accounting for the largest share in terms of revenue and utilization. Services such as remote consultations, real-time interactions, and remote patient monitoring are the core of telehealth delivery. Real-time video communication between doctors and patients became the most common use-case during the pandemic, especially for primary care, mental health consultations, and follow-up visits. Remote Patient Monitoring (RPM), in particular, has gained traction for managing cardiovascular and diabetic conditions. The flexibility of these services, along with their ability to generate recurring revenue, makes them the backbone of the telehealth ecosystem.

Software is expected to grow at the fastest pace in the product type segment, driven by increased demand for integrated and user-friendly telehealth platforms. Software solutions enable scheduling, patient portals, data analytics, and EHR integration, streamlining the entire patient journey. Standalone telehealth software is commonly adopted by small and mid-sized clinics, while larger hospitals prefer integrated solutions that combine patient data, communication tools, and administrative functionalities. With increasing interest in AI-enabled platforms and predictive analytics, software innovation will continue to propel this segment forward.

U.S. Telehealth Market By Delivery Mode Insights

Web-based delivery dominated the U.S. telehealth market due to its ease of access, cost-effectiveness, and compatibility with various hardware devices. Many hospitals and clinics use browser-based portals that allow patients to log in for consultations without installing dedicated applications. This delivery model also supports scalability for providers operating in multiple states and is favored in community health programs due to its low technological barrier. Especially during the early pandemic period, web-based platforms played a pivotal role in ensuring continuity of care.

Cloud-based solutions are growing the fastest, fueled by their scalability, data security, and multi-location access. Cloud platforms enable real-time updates, centralized storage, and easy sharing of patient records among authorized personnel. In April 2024, a major U.S. health system transitioned all telehealth operations to a cloud-based architecture, reducing IT costs by 30% and improving service uptime. Cloud platforms also facilitate advanced analytics and integration with wearable devices, further enhancing the value proposition of telehealth delivery.

U.S. Telehealth Market By End-use Insights

Providers currently dominate the end-use segment of the U.S. telehealth market. Hospitals, specialty clinics, and independent physicians are the primary drivers of telehealth services, especially in urban and suburban settings. Many providers have incorporated telehealth into their standard operating procedures, using it for pre-surgical consultations, post-discharge monitoring, and behavioral therapy. The trend is evident across institutions like Kaiser Permanente and Cleveland Clinic, both of which report a significant proportion of appointments being conducted virtually. Providers also benefit from telehealth by reducing readmission rates and enhancing patient satisfaction.

Patients are projected to be the fastest-growing end-users, as healthcare consumerism continues to rise. With increasing smartphone penetration and health literacy, patients are actively seeking virtual care options that fit into their daily lives. Direct-to-consumer telehealth services offered by platforms like Teladoc and MDLIVE are empowering patients to choose healthcare on their terms. From mental health counseling to dermatology consults, the accessibility and affordability of telehealth are driving its popularity among patients, particularly millennials and Gen Z.

Country-Level Analysis

The U.S. telehealth landscape is diverse, with varying adoption rates across states depending on factors like broadband penetration, licensure laws, and state-level reimbursement policies. States like California, New York, and Texas lead in telehealth implementation due to their large healthcare systems and supportive regulatory frameworks. In contrast, states in the Midwest and South are rapidly catching up through federal grants and private investment in digital infrastructure.

Notably, the Health Resources and Services Administration (HRSA) has launched initiatives to expand telehealth access in rural and underserved regions. For instance, the HRSA’s 2024 Telehealth Network Grant Program funded over 100 rural clinics to implement cloud-based telehealth platforms. Additionally, cross-state licensure compacts such as the Interstate Medical Licensure Compact (IMLC) are enabling physicians to serve patients across multiple states, promoting market growth.

U.S. Telehealth Market Companies

- Koninklijke Philips N.V.: Philips provides advanced telehealth hardware and software, focusing on high-acuity remote monitoring and eICU programs that allow clinicians to oversee patients from a centralized hub.

- Siemens Healthineers: Siemens contributes through its teamplay digital health platform, which facilitates secure data sharing and remote imaging collaboration across healthcare networks.

- Cerner Corporation (Oracle Health): Cerner integrates telehealth capabilities directly into its Electronic Health Record (EHR) systems, ensuring that remote visit data flows seamlessly into a patient’s permanent medical history.

- GE Healthcare: GE Healthcare offers the Mural Virtual Care Continuum, a software solution that aggregates data from multiple sources to give clinicians a comprehensive view of patients across a hospital system.

- Medtronic PLC: Medtronic specializes in remote patient monitoring (RPM) for chronic conditions, providing connected devices like pacemakers and insulin pumps that transmit real-time data to physicians.

- Teladoc Health Inc.: As a market leader, Teladoc provides a comprehensive, whole-person virtual care platform that covers everything from general medical visits to mental health and chronic condition management.

- American Well (Amwell): Amwell offers a modular, scalable telehealth platform that enables health systems and insurers to launch their own branded virtual care programs.

- Doctor on Demand (Included Health): Following its merger into Included Health, the company focuses on providing integrated virtual primary care and behavioral health services to employees of large corporations.

- U.S. Med: U.S. Med acts as a specialized provider of medical supplies and coaching for chronic disease management, particularly for diabetes patients who require consistent monitoring.

- MDLive (Evernorth/Cigna): Owned by Cigna’s Evernorth, MDLive provides 24/7 access to board-certified doctors and therapists through a user-friendly digital interface.

Recent Developments

-

Teladoc Health (March 2025): Announced a partnership with a leading employer group to provide chronic condition telemanagement for over 500,000 employees across the U.S.

-

Amwell (January 2025): Launched a behavioral health platform in collaboration with CVS Health, focusing on adolescent mental wellness.

-

Hims & Hers Health (February 2025): Expanded its teledermatology offerings with AI-based diagnostic tools to improve accuracy in skin condition assessments.

-

MDLIVE (December 2024): Introduced voice-enabled teleconsultations integrated with smart home assistants for seniors.

-

Amazon Clinic (November 2024): Expanded nationwide virtual care services through its app, now including contraception, skin conditions, and sinus infections.

U.S. Telehealth Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. telehealth market.

By Product Type

- Hardware

- Monitors

- Medical Peripheral Devices

- Blood Pressure Meters

- Blood Glucose Meters

- Weighing Scales

- Pulse Oximeters

- Peak Flow Meters

- ECG Monitors

- Others

- Software

- Standalone Software

- Integrated Software

- Services

- Remote Patient Monitoring

- Real-time Interactions

- Store and Forward

- Others

By Delivery Mode

- Web-based

- Cloud-based

- On-premises

By End-use

- Providers

- Payers

- Patients