U.S. Telemedicine Market Size and Trends 2026 to 2035

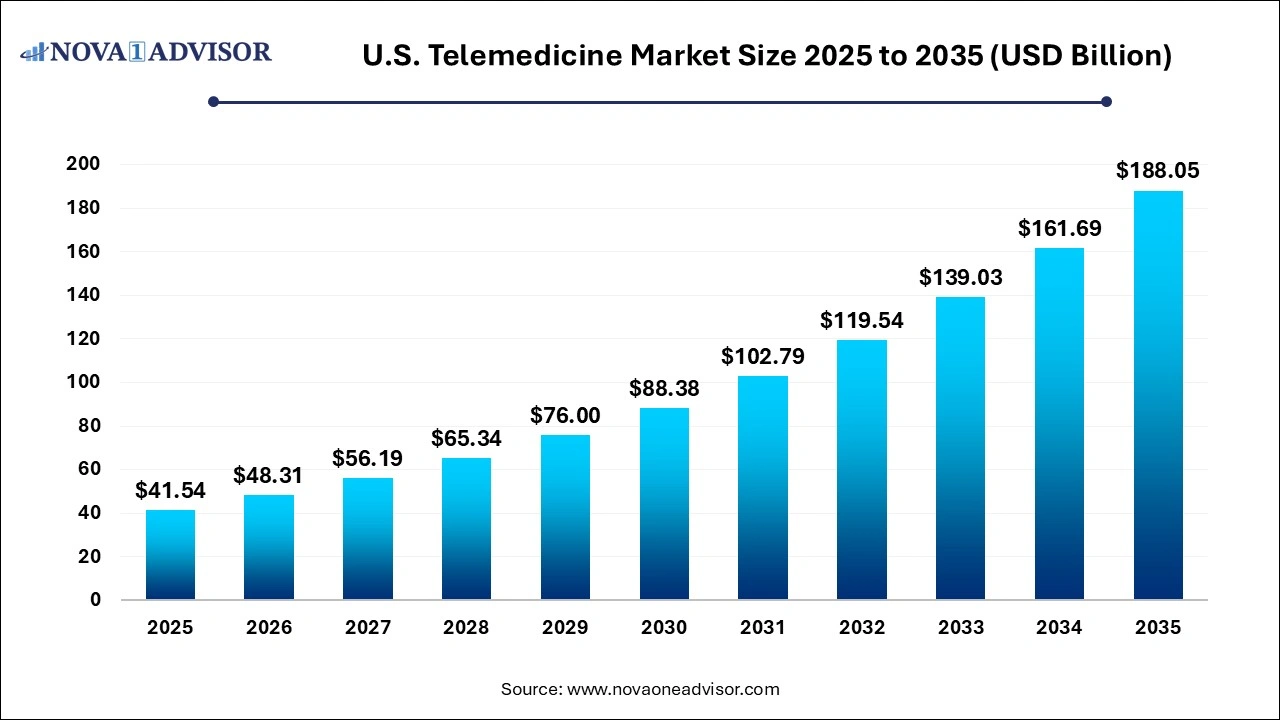

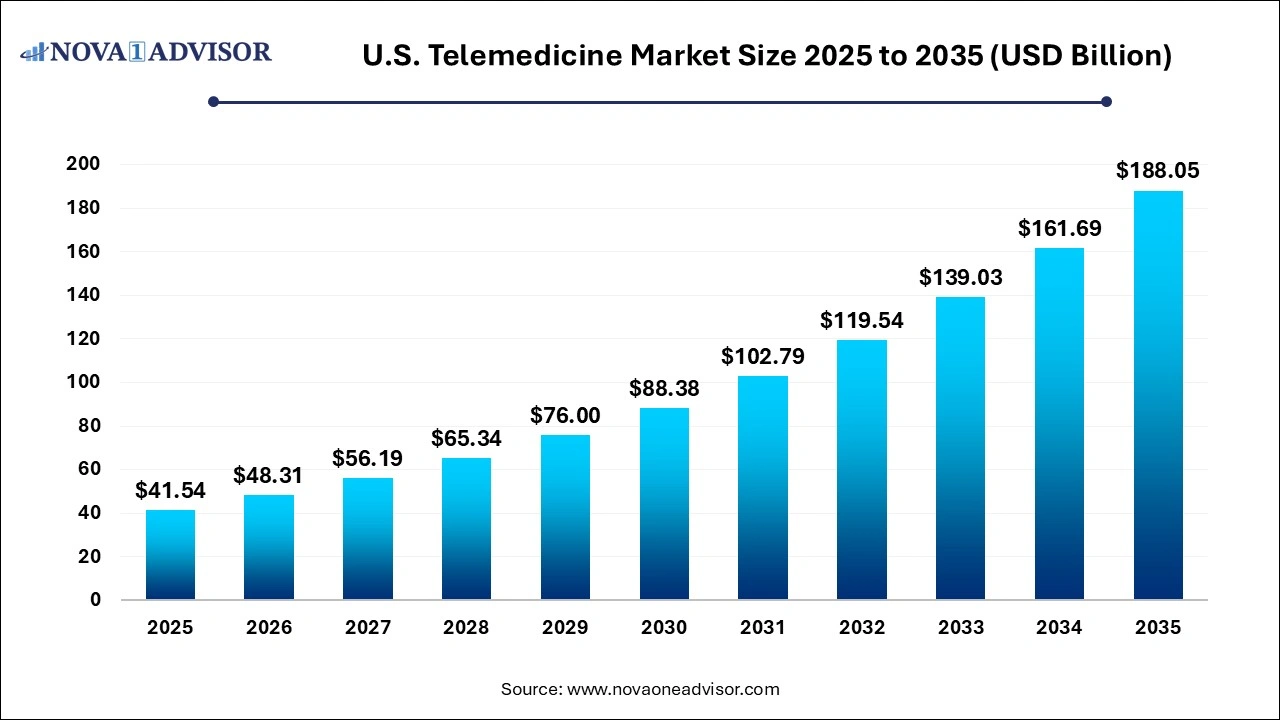

The U.S. telemedicine market size was exhibited at USD 41.54 billion in 2025 and is projected to hit around USD 188.05 billion by 2035, growing at a CAGR of 16.3% during the forecast period 2026 to 2035.

U.S. Telemedicine Market Key Takeaways:

- By component, the product segment dominated the market in 2025 and is anticipated to witness significant growth during the forecast period.

- The services segment in the telemedicine market is anticipated to witness the fastest growth with a CAGR of 17.1% over the forecast period.

- By modality, the real-time segment dominated the market with a revenue share of 38.3% in 2025.

- The store and forward segment in the telemedicine market is anticipated to witness the fastest CAGR growth over the forecast period.

- By application, the teleradiology segment dominated the market with a share of 24.3% in 2025.

- The telepsychiatry segment in the telemedicine market is anticipated to witness the fastest CAGR growth over the forecast period.

- By delivery model, the web/mobile segment dominated the market in 2024 and is anticipated to witness the fastest growth of 16.3% during the forecast period.

- The call centers segment in the telemedicine market is anticipated to witness significant CAGR growth over the forecast period.

- By facility, the tele-home segment dominated the market in 2025 and is anticipated to witness significant growth of 16.6% during the forecast period.

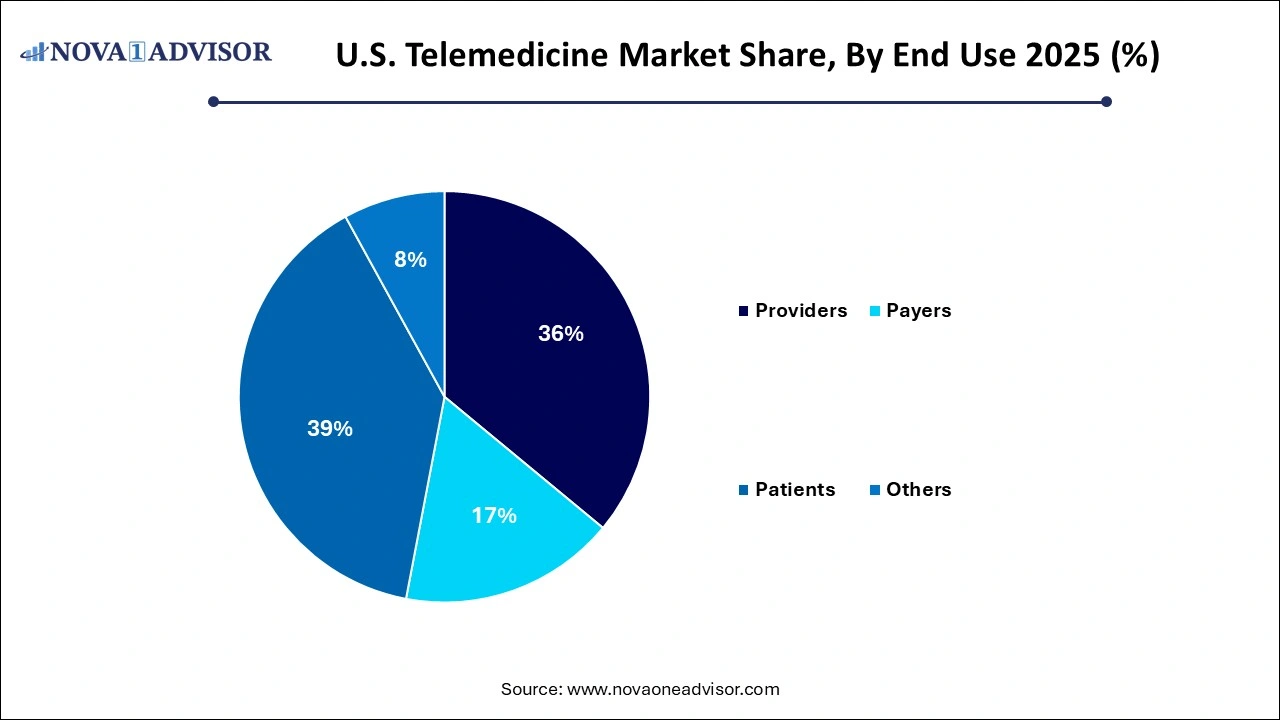

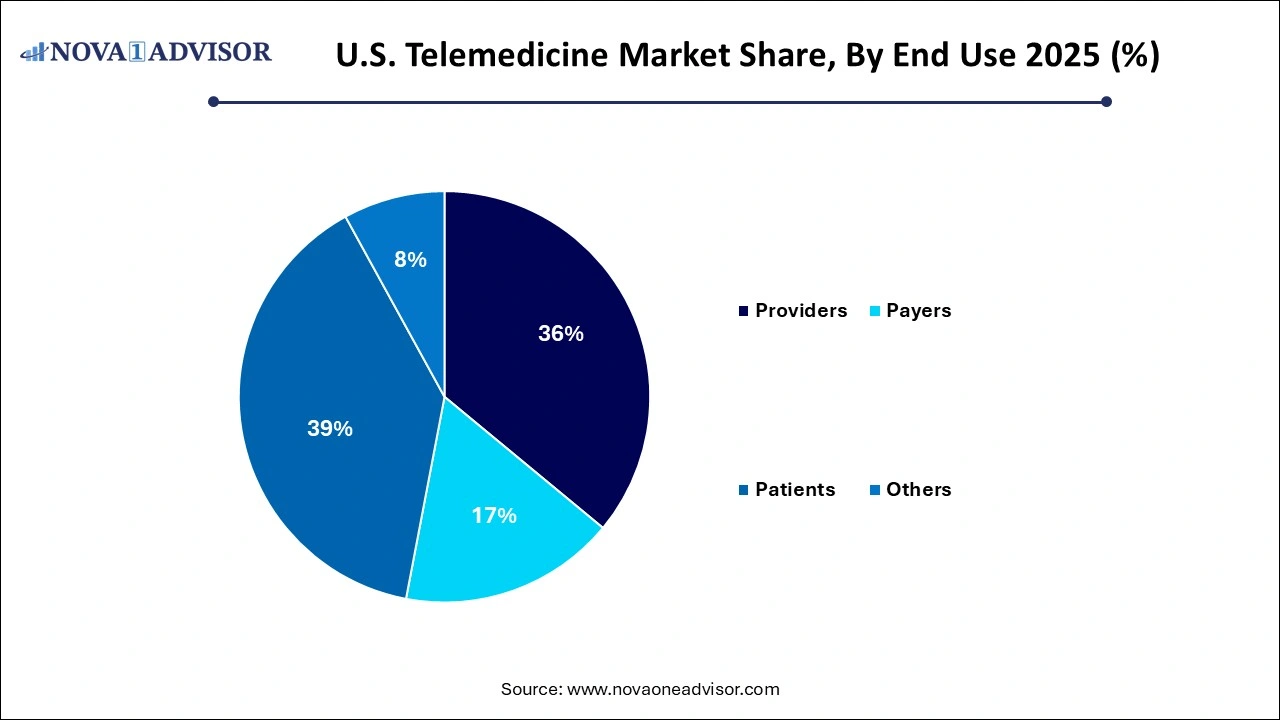

- By end use, the patients segment dominated the market with a revenue share of 38.0% in 2025.

U.S. Telemedicine Market Overview

The U.S. telemedicine market has transformed from a supplementary healthcare service into a fundamental pillar of the national healthcare delivery system. Telemedicine defined as the remote diagnosis and treatment of patients via telecommunications technology has evolved into a strategic healthcare solution addressing accessibility, affordability, and efficiency concerns.

The COVID-19 pandemic acted as a catalyst, propelling the U.S. telemedicine market into mainstream acceptance. However, its growth trajectory predates the pandemic, rooted in persistent challenges like rural healthcare access, physician shortages, aging populations, and chronic disease prevalence. With telemedicine, patients can consult physicians in real-time, access specialist opinions, receive prescriptions, and even undergo post-operative monitoring from the comfort of their homes.

Today, telemedicine is not limited to general care. Its applications span psychiatry, dermatology, cardiology, radiology, pathology, and more. Moreover, a hybrid healthcare model is emerging, wherein digital-first consultations, remote monitoring, and tele-ICU systems coexist with in-person care. Reimbursement support from Medicare and private insurers, favorable regulatory changes, and technological advancements have made the U.S. a global leader in telemedicine implementation.

U.S. Telemedicine Market Outlook

- Market Growth Overview: The U.S. telemedicine market is expected to grow significantly between 2025 and 2034, driven by the growing consumer demand and convenience, expanded medical coverage for various services boosting adoption, and integration of employer adoption.

- Sustainability Trends: Sustainability trends involve reduced carbon footprint, trends towards remote patient monitoring and chronic care, and regularity and payment stability.

- Major Investors: Major investors in the market include Oracle, Cisco, Philips, Medtronic, GE Healthcare, Teladoc Health, Amwell, and MDLIVE.

Artificial Intelligence: The Next Growth Catalyst in U.S. Telemedicine

AI is revolutionizing the U.S. telemedicine industry by shifting virtual care from simple video consultations to a proactive, data-driven ecosystem. AI is heavily impacting diagnostics through machine learning algorithms that analyze imaging and patient data for faster, more accurate remote assessments. Additionally, AI-driven tools are enhancing operational efficiency and reducing physician burnout by automating administrative workflows like documentation, triage, and scheduling. Furthermore, the integration of AI with wearable devices for remote patient monitoring (RPM) is enabling continuous, real-time tracking of chronic conditions.

Major Trends in the U.S. Telemedicine Market

-

Integration of AI and Predictive Analytics: Platforms are now offering AI-enabled diagnostic suggestions and patient triage capabilities.

-

Telepsychiatry and Mental Health Boom: Rising awareness of mental health post-COVID has led to high demand for remote behavioral health services.

-

Interoperable and EHR-Integrated Platforms: Seamless data exchange and health record integration are becoming standard for telemedicine software.

-

Home-Based Chronic Care Management (CCM): Tele-monitoring devices are enabling real-time management of hypertension, diabetes, and COPD.

-

Shift Toward Visualized and Mobile Telehealth: App-based video consultation platforms are outperforming text-based call centers.

-

Tele-home Models Replacing Routine Hospital Follow-ups: Remote patient monitoring is reducing hospital readmission rates.

-

Direct-to-Consumer (DTC) Virtual Clinics: Players like Hims & Hers, Ro, and Teladoc are reshaping consumer health access.

-

Rise of Virtual Primary Care Plans: Employers and insurers are offering digital-first primary care as part of health plans.

Report Scope of U.S. Telemedicine Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 48.31 Billion |

| Market Size by 2035 |

USD 188.05 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 16.2% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Component, Modality, Application, Delivery Model, Facility, End user |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

MDlive, Inc. (Evernorth); American Well Corporation; Twilio Inc.; Teladoc Health, Inc.; Doctor On Demand, Inc. (Included Health); Zoom Video Communications, Inc.; SOC Telemed, Inc.; NXGN Management, LLC; HP Development Company, L.P.; Practo; VSee |

Market Driver – Rapid Digitization of Healthcare and Favorable Reimbursement

A principal driver of the U.S. telemedicine market is the rapid digitization of healthcare coupled with reimbursement reform by both public and private payers. Prior to the pandemic, Medicare coverage for telemedicine was limited to rural patients. However, the Centers for Medicare & Medicaid Services (CMS) quickly expanded telehealth access under emergency declarations, allowing reimbursement for over 80 telehealth services, including mental health, emergency care, and chronic condition management.

This momentum has carried into post-pandemic policy frameworks, with bipartisan support for permanent telehealth coverage in many cases. Additionally, private insurers and large employers are expanding coverage for digital consultations, often incentivizing telehealth as a cost-saving, high-convenience option. From AI-assisted triage to connected devices enabling virtual visits, digital health innovation has found fertile ground due to both reimbursement certainty and clinical integration.

Market Restraint – Regulatory Fragmentation and Data Privacy Concerns

Despite its growth, the U.S. telemedicine market faces critical barriers in the form of regulatory fragmentation and data privacy concerns. Healthcare regulations vary significantly by state, particularly in terms of licensing, prescribing laws, and cross-border virtual care delivery. Physicians must often be licensed in the state where the patient resides, limiting the scalability of telemedicine platforms.

Additionally, data security remains a central concern. The use of cloud storage, mobile health apps, and third-party communication tools raises risks of HIPAA violations, unauthorized access, and cybersecurity breaches. While the Department of Health and Human Services temporarily relaxed enforcement of HIPAA rules during the pandemic, permanent legal clarity and robust end-to-end encryption are now essential to building trust in virtual care models.

Market Opportunity – Expansion of Tele-home and Remote Monitoring Models

A major opportunity lies in the expansion of tele-home care, including chronic care management, post-acute monitoring, and eldercare services. As more patients seek to avoid prolonged hospital stays or travel to clinics, tele-home models offer comprehensive virtual care often backed by remote diagnostic tools such as digital stethoscopes, pulse oximeters, ECG patches, and glucometers.

Remote patient monitoring (RPM) allows physicians to track vital signs, medication adherence, and symptom changes in real-time. This is especially impactful for patients with chronic diseases like heart failure, diabetes, and COPD, reducing emergency visits and improving long-term outcomes. With Medicare expanding coverage for RPM and telehealth, and aging populations demanding continuity of care at home, this segment presents a scalable, high-impact opportunity for providers and tech innovators alike.

U.S. Telemedicine Market Segmental Insights

By Component Insights

Services dominate the telemedicine market by component, accounting for the largest revenue share. This includes tele-consulting, tele-monitoring, and tele-education services. These models are used by hospitals, private practices, and virtual care providers to deliver synchronous and asynchronous care. Tele-consulting services are widely adopted across primary care, psychiatry, and specialty referrals. Many providers now operate hybrid practices, combining in-office visits with tele-consults to maximize patient access.

Software is the fastest-growing segment, especially cloud-based, interoperable, and AI-integrated platforms. Telemedicine software now includes appointment scheduling, EHR integration, billing, and automated documentation. Platforms such as Amwell, Teladoc Health, and Doxy.me are investing in advanced features like clinical decision support, voice recognition, and patient triage bots. The demand for highly secure, customizable, and mobile-friendly solutions is pushing software innovation rapidly forward.

By Modality Insights

Real-time (synchronous) telemedicine dominates the market, driven by video consultations between patients and providers. Platforms like MDLIVE, Doctor on Demand, and Amwell specialize in on-demand video consultations, offering convenience for general practice, urgent care, and behavioral health. These platforms have seen high consumer uptake due to immediacy, personalized interaction, and wide physician networks.

Store-and-forward is the fastest-growing modality, especially in fields like teleradiology, teledermatology, and telepathology. These services allow specialists to review diagnostic images and records asynchronously, providing greater flexibility and operational efficiency. For instance, primary care doctors upload images of skin lesions for review by dermatologists, reducing the need for in-person referrals. This model is especially useful in rural and resource-limited settings and is gaining favor among specialists who wish to optimize their work schedules.

By Application Insights

Teleradiology leads in terms of telemedicine application, reflecting its established use in both urban and rural hospitals. Radiologists can interpret diagnostic images remotely, ensuring round-the-clock service in emergency care settings. Hospitals are outsourcing imaging to teleradiology providers to address staff shortages and improve turnaround times. Regulatory standards and reimbursement frameworks are well-established in this segment, contributing to its dominance.

Telepsychiatry is the fastest-growing application, driven by mental health awareness, post-pandemic stress disorders, and psychiatrist shortages. Video-based therapy sessions, medication management, and behavioral assessments are now widely accepted by insurers and patients. Companies like Talkspace, BetterHelp, and Teladoc’s mental health division are expanding rapidly, offering direct-to-consumer therapy services through app-based models. This application has proven to be one of the most resilient and scalable in the post-COVID healthcare economy.

By Delivery Model Insights

Web/mobile-based visualized telemedicine dominates the delivery mode segment, as patients increasingly prefer smartphone-based video consultations. With mobile penetration exceeding 90% in the U.S., app-based platforms are the primary interface for accessing digital care. Providers are using video consultations not only for urgent care but also for post-surgical follow-ups, chronic disease check-ins, and wellness counseling.

Audio/text-based platforms are growing in niche segments, particularly for rural patients with limited broadband access or those preferring asynchronous interactions. Chronic disease coaching and medication reminders are often delivered via SMS or secure messaging platforms. Meanwhile, call centers remain important for health system triage, especially for elderly populations. However, their growth is slower compared to interactive digital platforms.

By Facility Insights

Tele-hospitals dominate the market by facility, as hospitals integrate telemedicine into emergency rooms, ICUs, and specialty departments. From tele-stroke services to tele-ICU monitoring, hospitals are leveraging telehealth to deliver fast, expert care, especially in rural branches. Large hospital systems like Cleveland Clinic and Mayo Clinic operate full-scale telemedicine wings to improve patient outreach.

Tele-home is the fastest-growing facility segment, fueled by consumerization of healthcare, rising chronic care needs, and payer support for at-home care. The proliferation of home health devices, digital coaching programs, and virtual visits is transforming the living room into a healthcare access point. Startups and hospital-at-home models are expanding this frontier, offering full-spectrum care without the patient ever stepping into a clinical facility.

By End Use Insights

Providers are the dominant end-users, including physicians, clinics, hospitals, and health systems. As telemedicine becomes embedded in routine workflows, provider groups are using it to extend working hours, expand reach, and reduce patient no-shows. Primary care, pediatrics, and dermatology practices are increasingly relying on hybrid care models that blend in-office visits with virtual touchpoints.

Payers and patients are the fastest-growing end-use segments. Payers are integrating telemedicine into value-based care models, creating digital-first health plans with virtual primary care and mental health. Patients, empowered by tech familiarity and digital literacy, are initiating virtual visits directly, often bypassing traditional gatekeepers. As retail and consumer-facing brands enter the market, patient-initiated care is expected to become a primary driver of telehealth volume.

Country-Level Insights – United States

The United States is the largest and most mature telemedicine market globally, owing to its dynamic mix of private and public healthcare, strong technology infrastructure, and favorable reimbursement policies. States like California, New York, Texas, and Florida are hotspots for telehealth adoption due to urbanization, diverse populations, and dense provider networks. Meanwhile, rural states like Wyoming, Montana, and Mississippi benefit from telemedicine’s ability to bridge care gaps.

The U.S. is also unique in its direct-to-consumer virtual care landscape, with telemedicine platforms operating independently of hospitals. The presence of multiple payers, including Medicare, Medicaid, and private insurers, has enabled competitive telehealth offerings tailored to various populations. Continued regulatory modernization, such as interstate licensure compacts and permanent Medicare telehealth policies, is expected to reinforce the U.S. leadership position in digital health.

Some of the prominent players in the U.S. telemedicine market include:

- MDlive, Inc. (Evernorth): MDlive provides 24/7 virtual access to board-certified doctors, dermatologists, and licensed therapists to over 60 million members, focusing on urgent care and behavioral health.

- American Well Corporation (Amwell): Amwell offers a comprehensive, flexible telehealth platform connecting providers, payers, and employers to patients through video, phone, and secure messaging.

- Twilio Inc.: Twilio provides the underlying, secure cloud communications infrastructure (API and SDKs) that enables other healthcare providers and platforms to build HIPAA-compliant video and messaging services.

- Teladoc Health, Inc.: Teladoc is a leading virtual healthcare provider in the U.S., offering a wide range of services from primary care to complex, chronic condition management.

- Doctor On Demand, Inc. (Included Health): Doctor On Demand provides immediate, direct-to-consumer video consultations for medical, mental health, and chronic care, and is highly active in the behavioral health sector.

- Zoom Video Communications, Inc.: Zoom enables telemedicine by providing a secure, reliable, and user-friendly video communication platform, specifically designed to meet HIPAA compliance requirements for healthcare providers.

- SOC Telemed, Inc. (Avel eCare): SOC Telemed specializes in acute, specialized care, specifically using telehealth to connect specialists, such as neurologists or psychiatrists, to hospitals in rural or underserved areas.

U.S. Telemedicine Market Recent Developments

-

April 2025 – Teladoc Health introduced an AI-powered virtual assistant to triage patients, offering initial clinical guidance before connecting with providers.

-

March 2025 – Amwell announced a partnership with Cerner to integrate telehealth directly into hospital EMRs, improving workflow efficiency.

-

February 2025 – Amazon Clinic expanded its virtual care offering to all 50 states, covering over 30 conditions through asynchronous consultation.

-

January 2025 – UnitedHealthcare launched a virtual-first health plan with 24/7 access to physicians, mental health providers, and wellness coaches.

-

November 2024 – Talkspace announced new partnerships with major employers to provide enterprise-level mental health support through telepsychiatry.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. telemedicine market

By Component

-

- Tele-consulting

- Tele-monitoring

- Tele-education

By Modality

- Store and forward

- Real time

- Others

By Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

By Delivery Mode

-

- Audio/Text-based

- Visualized

By Facility

By End Use

- Providers

- Payers

- Patients

- Others