U.S. Ultrasound Devices Market Size and Trends

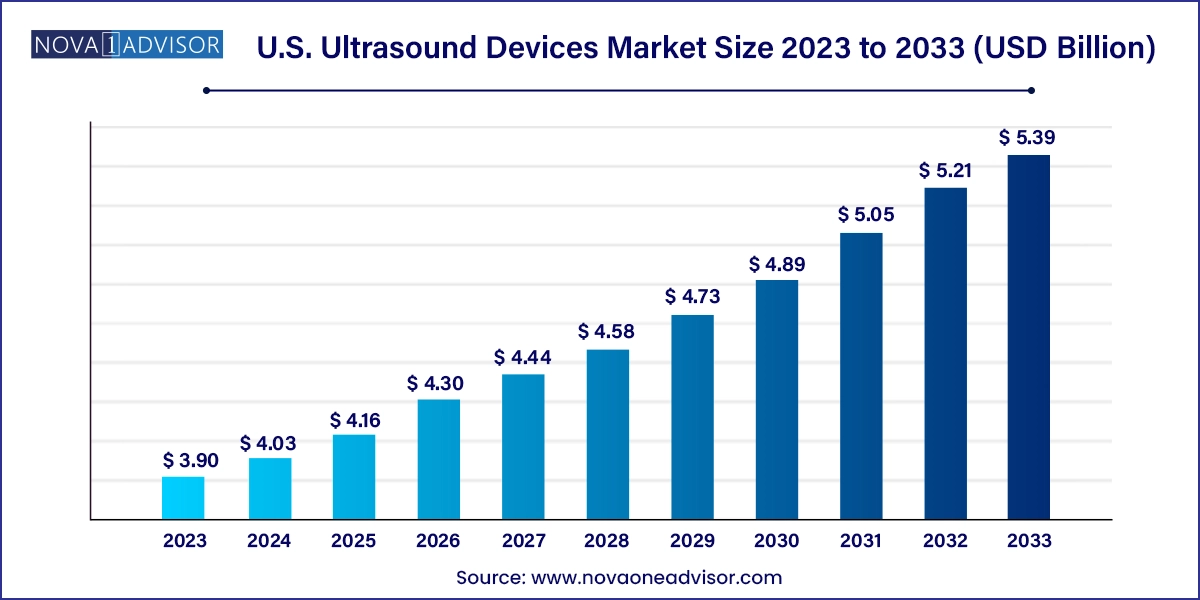

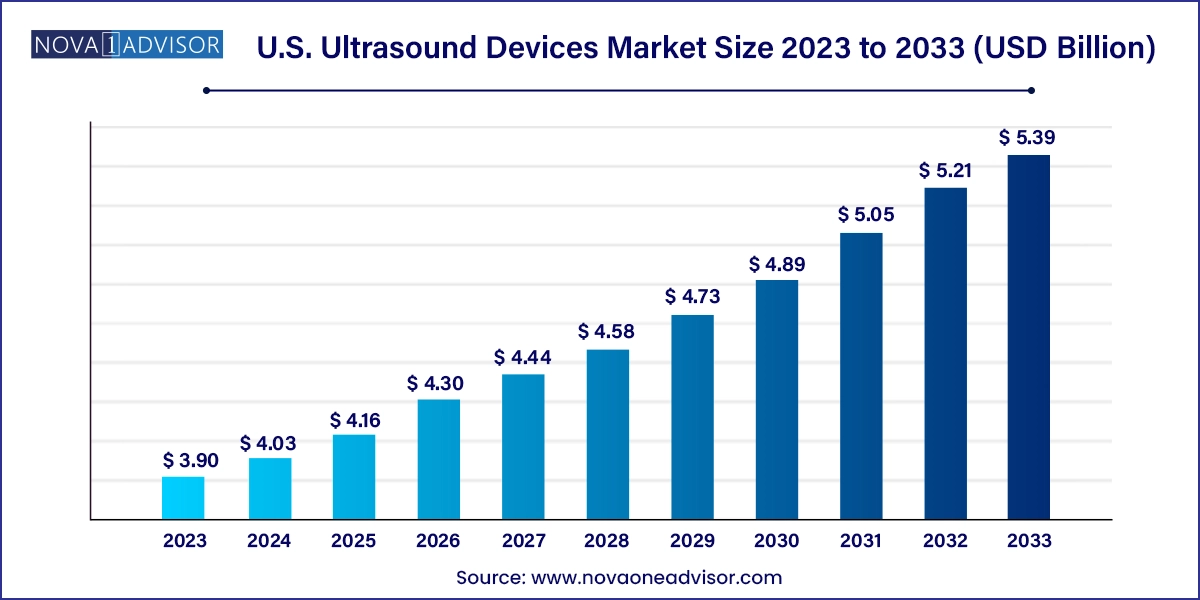

The U.S. ultrasound devices market size was exhibited at USD 3.90 billion in 2023 and is projected to hit around USD 5.39 billion by 2033, growing at a CAGR of 3.28% during the forecast period 2024 to 2033.

U.S. Ultrasound Devices Market Key Takeaways:

- The cart/trolley segment dominated the market with a share of 67.95% in 2023.

- The diagnostic ultrasound devices segment dominated the market with a share of 84.85% in 2023

- The radiology segment dominated the market with a share of 22.25% in 2023.

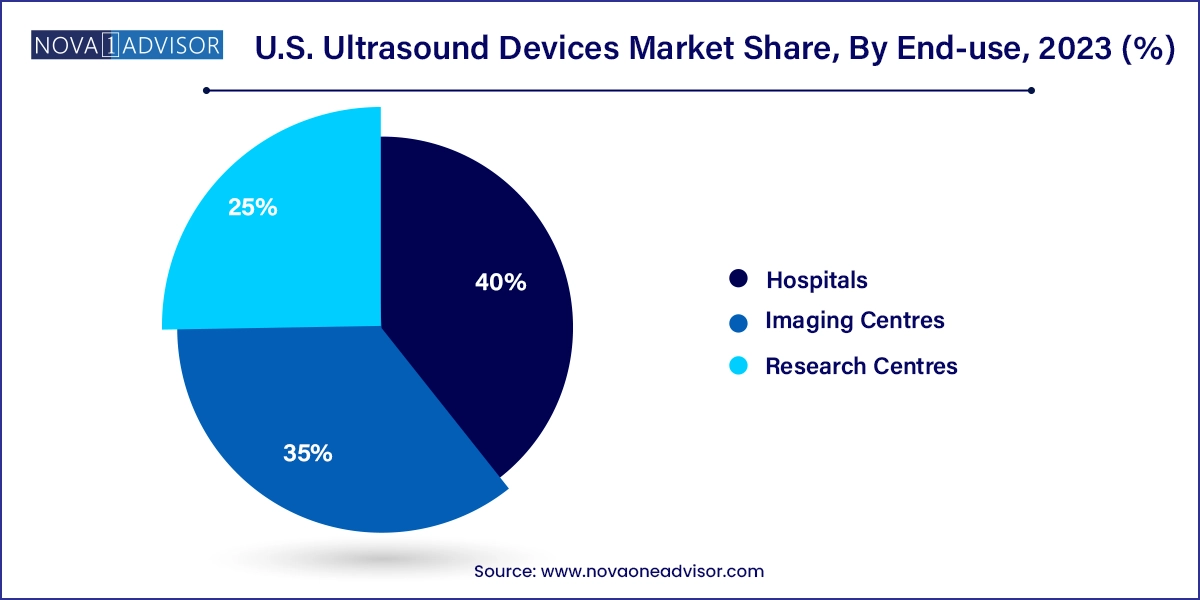

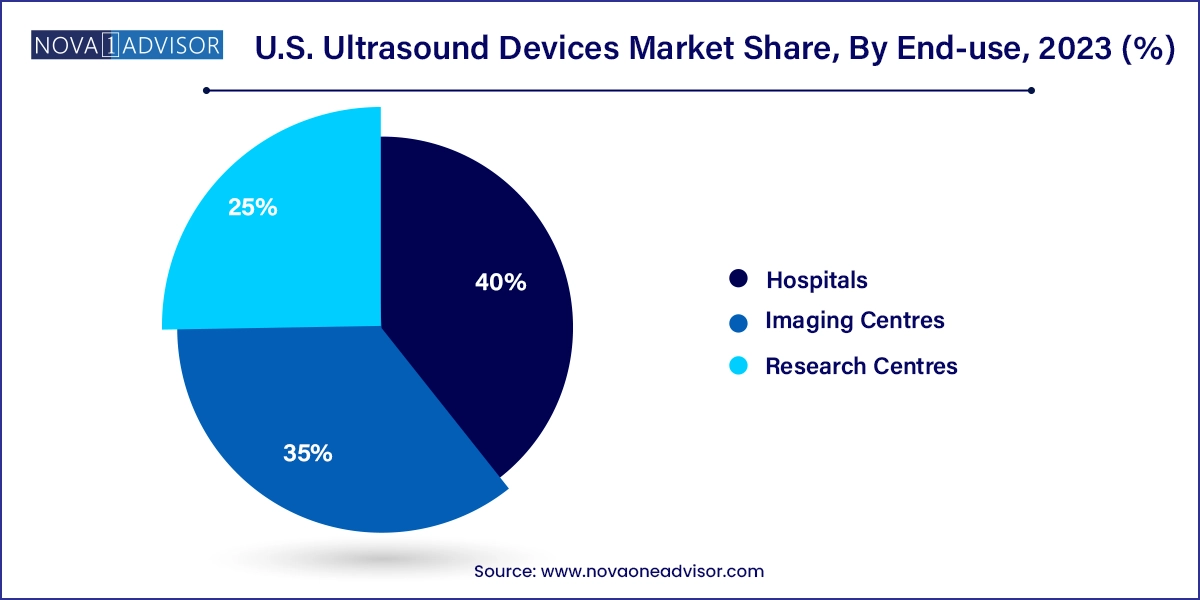

- The hospitals segment dominated the market with a share of 40.0% in 2023.

- The imaging centers segment is expected to witness highest growth over the forecast period.

Market Overview

The U.S. ultrasound devices market represents a pivotal sector in the medical imaging industry, combining diagnostic precision, safety, and versatility. Ultrasound technology, which relies on high-frequency sound waves to create real-time images of internal body structures, is widely used across a multitude of clinical applications including obstetrics and gynecology, cardiology, radiology, musculoskeletal assessments, emergency medicine, and anesthesia.

With its non-invasive nature, lack of ionizing radiation, and affordability compared to modalities like CT and MRI, ultrasound has become a cornerstone of point-of-care imaging. In the U.S., a country with high healthcare expenditure and a well-developed diagnostic infrastructure, ultrasound technology plays a significant role in both hospital and outpatient settings. Furthermore, its application has broadened beyond traditional imaging into therapeutic interventions, such as high-intensity focused ultrasound (HIFU) and extracorporeal shockwave lithotripsy (ESWL) for targeted therapy delivery and tissue ablation.

The market is currently benefiting from technological innovation, including AI-powered image analysis, wireless probes, portable systems, and cloud-integrated imaging platforms. Demand for handheld and compact ultrasound devices is rising, particularly in emergency departments and rural areas, driven by portability, affordability, and remote connectivity.

With a growing focus on early disease detection, value-based healthcare, and increased use of ultrasound in ambulatory settings, the U.S. ultrasound devices market is poised for sustained growth. Government programs promoting maternal and fetal health, rising cardiovascular disease burden, and expanding applications in chronic disease management further strengthen its relevance in the broader healthcare landscape.

Major Trends in the Market

-

Proliferation of Handheld and Point-of-Care Ultrasound (POCUS): Clinicians increasingly use compact and handheld systems in emergency, critical care, and primary care settings for real-time bedside assessments.

-

AI Integration for Image Interpretation: Artificial intelligence is being incorporated for automated measurement, anatomical recognition, and diagnostic decision support.

-

Growing Preference for 3D/4D Imaging: Obstetrics and gynecology are seeing increased demand for advanced 3D and 4D imaging systems, improving fetal anomaly detection and parental engagement.

-

Expansion of Therapeutic Ultrasound Applications: High-intensity focused ultrasound (HIFU) is gaining acceptance in oncology and pain management for non-invasive tumor ablation.

-

Rise in Wireless and App-Based Probes: Portable, wireless probes that sync with smartphones and tablets are transforming access in remote clinics and emergency transport.

-

Bundled Equipment-Software Services: Vendors are offering ultrasound devices with integrated cloud storage, AI add-ons, and software licensing for predictive analytics and tele-ultrasound.

-

Remote and Home-Based Imaging Services: Especially during and after the COVID-19 pandemic, ultrasound is increasingly used in mobile clinics and home care setups for elderly and chronic patients.

Report Scope of U.S. Ultrasound Devices Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 4.03 Billion |

| Market Size by 2033 |

USD 5.39 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 3.28% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Portability, Applications, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Koninklijke Philips N.V.; GE Healthcare; Siemens Healthineers AG; Canon Medical Systems; Mindray Medical International Limited; Samsung Medison Co., Ltd.; FUJIFILM SonoSite, Inc.; Konica Minolta Inc.; Esaote |

Market Driver: Increasing Demand for Point-of-Care Imaging

A major driver behind the U.S. ultrasound devices market's growth is the expanding adoption of point-of-care ultrasound (POCUS). POCUS enables healthcare providers to conduct real-time diagnostic assessments at the bedside or in field settings, reducing reliance on centralized imaging services and accelerating clinical decisions. Its utility spans multiple specialties, including emergency medicine, critical care, anesthesiology, and even general practice.

For example, emergency physicians can use portable ultrasound devices to assess internal bleeding, cardiac function, or lung status within minutes of a trauma patient’s arrival. In anesthesiology, real-time ultrasound guides regional nerve blocks with greater precision. The rise of handheld ultrasound systems from companies like Butterfly Network and Philips Lumify, which can connect to mobile devices, has dramatically expanded the reach and convenience of POCUS. As hospitals and clinics aim for quicker turnaround and personalized care delivery, POCUS remains a core enabler of streamlined and accurate diagnostics.

Market Restraint: Shortage of Skilled Sonographers and Training Gaps

Despite the advantages, the market faces a significant restraint in the form of a limited pool of trained sonographers and clinicians who can effectively operate and interpret ultrasound scans. While POCUS is democratizing access, its effectiveness hinges on proper training to ensure image accuracy and diagnostic reliability. Misinterpretation or poor image acquisition can lead to false positives or missed diagnoses.

This shortage is particularly acute in rural and underserved regions, where access to certified professionals and advanced training programs is limited. While some companies offer integrated training modules and simulations, the learning curve can still pose a barrier to wide adoption. Moreover, inconsistent credentialing and regulation across states contribute to variations in clinical quality. Until robust training infrastructure and certification programs are more widely implemented, these limitations may slow adoption in certain segments of the healthcare system.

Market Opportunity: Expanding Use in Primary and Preventive Care

One of the most promising opportunities in the U.S. ultrasound devices market lies in expanding the use of ultrasound in primary care and preventive medicine. Traditionally considered a hospital-based tool, ultrasound is now increasingly used by primary care physicians to detect conditions like abdominal aortic aneurysms, early-stage liver disease, kidney stones, and thyroid nodules during routine checkups.

With the rise of value-based care models and reimbursement incentives for early detection, family practices and community clinics are integrating compact ultrasound systems into their diagnostic toolkits. Companies are also introducing AI-driven automation that simplifies image acquisition and interpretation, enabling primary care providers to use ultrasound with minimal training. As chronic diseases such as diabetes and cardiovascular disorders continue to surge, ultrasound’s role in risk stratification, screening, and preventive interventions is set to grow significantly.

U.S. Ultrasound Devices Market By Portability Insights

Cart/trolley-based ultrasound systems remain dominant in terms of total revenue and hospital usage, especially in large imaging departments and tertiary care centers. These devices offer advanced features, multi-probe compatibility, and high-end resolution suitable for complex applications in radiology, cardiology, and gynecology. Sub-segmentation reveals that higher-end trolley systems are prevalent in academic and high-throughput hospitals due to their adaptability and integration with PACS systems.

However, handheld ultrasound systems are the fastest-growing segment, driven by affordability, ease of use, and demand for mobility. Devices like Butterfly iQ+, Clarius, and Philips Lumify connect directly to smartphones or tablets and are used by a growing number of emergency medicine physicians, primary care providers, and paramedics. These devices are expanding access to ultrasound in rural and home care environments and are transforming bedside care in intensive care units (ICUs) and emergency departments.

U.S. Ultrasound Devices Market By Product Insights

Diagnostic ultrasound devices dominated the product segment, accounting for the majority of installations across hospitals, imaging centers, and clinics. Within this category, 2D ultrasound remains the most widely used format, especially for routine exams in obstetrics, abdominal, and vascular imaging. However, 3D/4D ultrasound is gaining significant momentum, particularly in gynecologic applications and fetal diagnostics, due to its ability to provide volumetric visualization and dynamic motion tracking. Doppler ultrasound, known for its real-time blood flow assessment, is essential in cardiology and vascular assessments, making it a staple in cardiovascular diagnostic practices.

On the other hand, therapeutic ultrasound devices represent the fastest-growing product category, led by applications such as high-intensity focused ultrasound (HIFU) in oncology and extracorporeal shockwave lithotripsy (ESWL) in urology. HIFU is being increasingly used for non-invasive ablation of tumors, especially in prostate cancer, as well as for uterine fibroid management. ESWL remains a popular solution for kidney stone fragmentation, offering an outpatient, non-invasive alternative to surgery. As therapeutic ultrasound garners FDA approvals for new indications, its market share is expected to expand rapidly across outpatient centers and specialized clinics.

U.S. Ultrasound Devices Market By Application Insights

Obstetrics and gynecology dominated the application segment, continuing its long-standing use for fetal assessment, placental evaluation, and monitoring of gynecologic conditions. Routine prenatal ultrasounds using 2D, Doppler, and increasingly 3D/4D imaging are widely practiced. The emotional appeal and clinical precision of 4D fetal imaging have made it a standard of care in many practices, contributing significantly to device sales and upgrades.

Cardiology is the fastest-growing application area, driven by increased prevalence of heart disease and the demand for echocardiography in both outpatient and inpatient settings. Doppler and tissue harmonic imaging technologies allow real-time visualization of cardiac structures and flow dynamics. Portable echocardiography is also becoming more common in ERs and ICUs, particularly with handheld devices that facilitate rapid bedside assessment of heart function, fluid status, and shock causes.

U.S. Ultrasound Devices Market By End-use Insights

Hospitals dominate the end-use landscape, driven by their infrastructure, high procedural volumes, and demand for both diagnostic and therapeutic ultrasound applications. In high-acuity hospital settings, ultrasound is indispensable for a range of specialties including anesthesia, cardiology, emergency medicine, and maternal-fetal medicine. Hospitals also benefit from bundled equipment procurement and staff expertise.

Imaging centers are witnessing the fastest growth, especially among outpatient and ambulatory diagnostic service providers. With growing demand for cost-effective diagnostic solutions and shorter patient wait times, imaging centers are increasingly adopting mid-range and portable ultrasound units for fast-turnaround services. These centers are also adopting ultrasound as an alternative to MRI and CT for certain indications to reduce cost and increase accessibility.

Country-Level Analysis

Across the United States, the ultrasound devices market is characterized by high technological adoption and a diverse set of users—from large academic hospitals to solo practitioners. The Northeast region, encompassing New York, Massachusetts, and Pennsylvania, leads in device installations due to its concentration of academic medical centers and robust healthcare funding. Advanced cardiovascular and prenatal care facilities further fuel demand in this region.

Meanwhile, Southern and Midwestern states such as Texas, Florida, and Ohio are experiencing rapid growth, largely due to population aging, chronic disease prevalence, and expansion of outpatient clinics and mobile diagnostic services. The U.S. Department of Veterans Affairs and state-funded telemedicine programs are also incorporating portable ultrasound devices in rural health centers, further boosting market reach across underserved regions.

Some of the prominent players in the U.S. ultrasound devices market include:

- Koninklijke Philips N.V.

- GE Healthcare

- Siemens Healthineers AG

- Canon Medical Systems

- Mindray Medical International Limited

- Samsung Medison Co., Ltd.

- FUJIFILM SonoSite, Inc.,

- Konica Minolta Inc.

- Esaote

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. ultrasound devices market

Product

- Diagnostic Ultrasound Devices

- Therapeutic Ultrasound Devices

-

- High-intensity Focused Ultrasound

- Extracorporeal Shockwave Lithotripsy

Portability

- Handheld

- Compact

- Cart/Trolley

-

- Point-of-Care Cart/Trolley Based Ultrasound

- Higher-end Cart/Trolley Based Ultrasound

Application

- Cardiology

- Obstetrics/Gynaecology

- Radiology

- Orthopaedic

- Anaesthesia

- Emergency Medicine

- Primary Care

- Critical Care

End-use

- Hospitals

- Imaging Centres

- Research Centres