U.S. Urgent Care Center Software Market Size and Growth

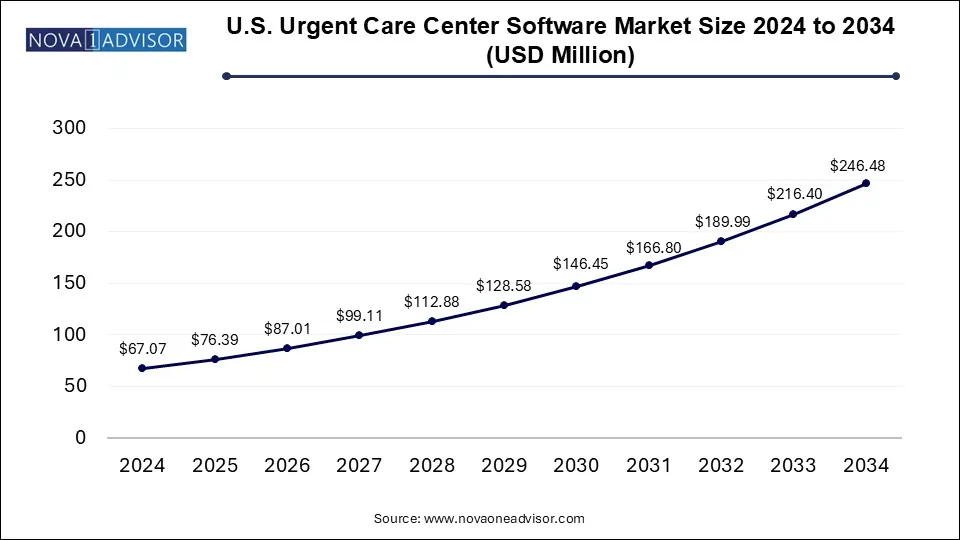

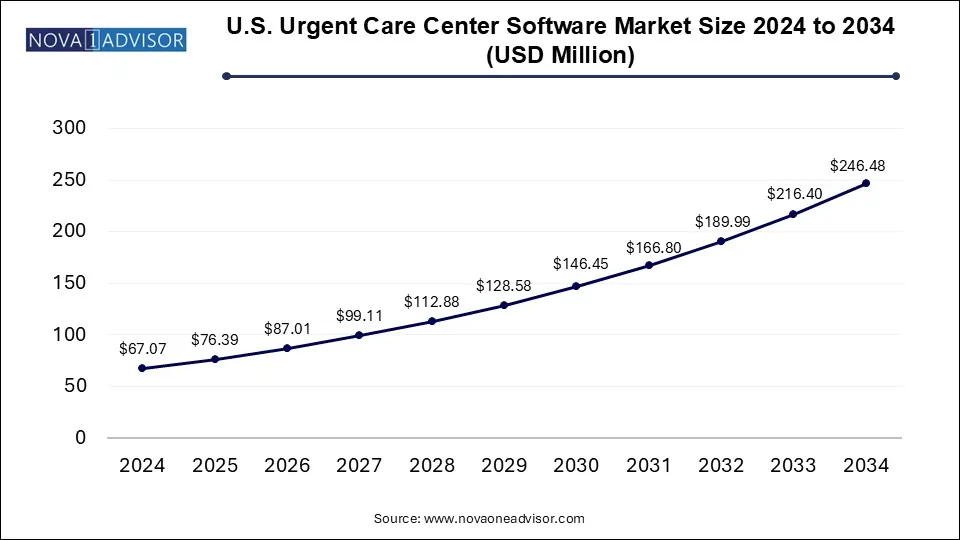

The U.S. urgent care center software market size was exhibited at USD 67.07 million in 2024 and is projected to hit around USD 246.48 million by 2034, growing at a CAGR of 13.9% during the forecast period 2025 to 2034.

U.S. Urgent Care Center Software Market Key Takeaways:

- The cloud-based segment held the largest market share of 65.27% in 2024.

- The EHR/EMR segment dominated the market with the largest share of 37.71% in 2024 and is expected to witness the fastest growth over the forecast period.

- The standalone segment dominated the market with the largest share of 58.0% in 2024.

- However, integrated software is expected to witness the fastest growth rate over the forecast period.

Market Overview

The U.S. Urgent Care Center Software Market is experiencing robust growth driven by increasing demand for efficient, scalable, and user-friendly healthcare IT solutions tailored to urgent care environments. Urgent care centers (UCCs) operate in a fast-paced, high-throughput clinical setting where accurate, real-time information management is essential. As these centers become a preferred option for non-life-threatening medical needs thanks to lower costs and shorter wait times compared to emergency rooms—the need for specialized software systems is rising.

Urgent care center software encompasses a broad suite of digital tools, including Electronic Health Records (EHR), Revenue Cycle Management (RCM), Practice Management (PM), Patient Engagement platforms, and Telehealth modules. These systems streamline clinical and administrative workflows, enhance patient experience, improve billing accuracy, and support compliance with HIPAA and other healthcare regulations.

The U.S. urgent care ecosystem has expanded significantly, fueled by factors such as aging populations, rising healthcare consumerism, and the demand for value-based care. According to industry estimates, there are over 10,000 urgent care centers across the country, many of which are independently owned or operated by multi-location groups. As competition intensifies, software vendors are responding with integrated, cloud-based, and mobile-accessible platforms that ensure seamless care delivery, data interoperability, and real-time performance tracking.

Major Trends in the Market

-

Adoption of Cloud-Based Software Models: Cloud solutions are gaining favor due to their scalability, lower upfront costs, and ease of remote access.

-

Integration of Telehealth Features: Software systems are adding video consultations, remote triaging, and virtual waiting rooms as core functionalities.

-

AI-Driven Documentation and Analytics: Natural language processing (NLP) and machine learning are being used to automate charting and improve clinical decision support.

-

Focus on Patient Experience Tools: Portals for check-in, digital forms, real-time notifications, and feedback collection are enhancing engagement.

-

Interoperability and EHR Consolidation: UCCs are increasingly choosing platforms that integrate easily with hospital EHRs, pharmacies, and labs.

-

Value-Based Reimbursement Support: Software modules are being tailored to accommodate quality tracking and population health reporting.

-

Subscription-Based Pricing Models: Vendors are shifting from perpetual licensing to SaaS models that offer better cash flow and update flexibility.

Report Scope of U.S. Urgent Care Center Software Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 76.39 Million |

| Market Size by 2034 |

USD 246.48 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 13.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Application, Mode of Deployment, Type |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Experity, Inc.; NXGN Management, LLC; Veradigm LLC; DrChrono Inc.; CareCloud, Inc.; AdvancedMD, Inc.; eClinicalWorks; MicroFour, Inc.; PrognoCIS EHR (Bizmatics, Inc.); Medsphere Systems Corp.; AthenaHealth; 1st Provider's Choice |

Market Driver: Growth of On-Demand Healthcare and Retail Clinics

One of the primary drivers of the U.S. urgent care center software market is the rapid expansion of on-demand healthcare models, especially retail and walk-in clinics. Consumers increasingly value convenience, affordability, and immediate access to healthcare services without the need for appointments. Urgent care centers fulfill this demand by offering extended hours, same-day services, and treatment for a broad range of conditions—from minor injuries to diagnostic testing.

This surge in UCC traffic necessitates highly efficient digital infrastructure that minimizes administrative bottlenecks and supports real-time clinical documentation. Software platforms tailored to urgent care allow for rapid patient registration, automated coding and billing, and interoperability with imaging and lab systems. Moreover, the ability to generate real-time reports for operational metrics such as patient wait times, provider utilization, and reimbursement rates empowers UCCs to maintain profitability while delivering high-quality care.

Market Restraint: Data Security and Regulatory Compliance Challenges

Despite widespread digitization, one of the key restraints in the U.S. urgent care center software market is concern over data privacy, security, and compliance. With sensitive patient data being exchanged across multiple platforms ranging from patient portals to billing systems and third-party labs the risk of data breaches, ransomware attacks, and compliance violations is high.

Smaller urgent care operators, in particular, may lack the IT personnel and resources to fully secure their systems or monitor for vulnerabilities. Furthermore, adherence to constantly evolving regulations such as HIPAA, the 21st Century Cures Act, and CMS interoperability mandates places a significant burden on software developers and providers. Delays in patching, poor data encryption, and misconfigured access controls can expose both patients and providers to financial and reputational damage.

As a result, some centers hesitate to fully adopt cloud-based or third-party-hosted systems, which could limit innovation or delay modernization efforts.

Market Opportunity: Rise of AI and Workflow Automation

A promising opportunity lies in the application of artificial intelligence (AI) and automation tools in urgent care software systems. With patient volumes rising and workforce shortages persisting, UCCs are under pressure to maximize productivity while maintaining care quality. AI-enabled solutions can automate time-consuming tasks such as documentation, appointment scheduling, triage decision-making, and predictive analytics for patient flow.

For example, NLP tools can convert spoken provider notes into structured EHR entries, reducing charting time by over 40%. Predictive RCM tools can flag coding errors in real-time or forecast insurance claim denials. AI bots can also support administrative tasks like insurance verification or follow-up appointment reminders. These functionalities not only improve operational efficiency but also enhance clinical accuracy and financial outcomes.

Vendors that successfully embed AI and automation into their software platforms are likely to experience greater adoption, especially among multi-location UCC operators looking to scale efficiently.

U.S. Urgent Care Center Software Market By Mode Of Deployment Insights

Cloud-based software platforms dominate the U.S. urgent care center software market due to their scalability, remote accessibility, lower upfront costs, and seamless integration with third-party applications. As urgent care centers increasingly operate across multiple locations, cloud systems allow for centralized data management, multi-site reporting, and provider mobility. Cloud deployment also facilitates faster updates, better disaster recovery, and enhanced cybersecurity frameworks supported by specialized vendors.

In contrast, on-premise solutions are gradually declining but still hold relevance in certain enterprise-level health networks with stringent IT policies or infrastructure constraints. These setups offer greater control over data but require substantial capital investment and in-house technical expertise. Smaller clinics are increasingly migrating to hybrid or fully cloud-based ecosystems to minimize overhead and ensure continuity of service, especially after the operational disruptions experienced during the COVID-19 pandemic.

U.S. Urgent Care Center Software Market By Application Insights

Electronic Health Records (EHR) and Electronic Medical Records (EMR) remain the cornerstone of software adoption in urgent care centers. These systems serve as the digital backbone for patient charting, medication management, diagnostic result documentation, and regulatory compliance. Advanced EHRs tailored to urgent care include rapid visit templates, integrated billing codes, and lab/imaging interfaces. Vendors such as Epic, Athenahealth, and eClinicalWorks offer customized modules for high-throughput environments.

Telehealth, however, is the fastest-growing application segment. Accelerated by the pandemic and supported by permanent reimbursement policies from CMS and private payers, telehealth capabilities are now considered essential. UCCs are integrating video consults, virtual triage, and remote follow-ups into their core service models. Platforms like Mend, Doxy.me, and Updox are offering turnkey solutions compatible with urgent care workflows. The hybrid model—combining physical walk-ins with virtual care—is shaping the future of urgent care service delivery in the U.S.

U.S. Urgent Care Center Software Market By Type Insights

Integrated software platforms, which combine EHR, RCM, PM, and patient engagement modules into a unified system, dominate the U.S. market. These platforms offer a seamless user experience, reduce duplication of data entry, and ensure consistency across clinical and billing functions. They are particularly favored by growing urgent care chains that require standardized operations across multiple sites.

Standalone software, though more niche, is gaining traction among smaller practices or niche use cases. For instance, a UCC may adopt a standalone telehealth module or advanced analytics dashboard that integrates via APIs with their main EHR. The ability to choose best-of-breed solutions and customize functionality appeals to tech-savvy providers aiming for innovation without overhauling their entire IT infrastructure.

Country-Level Analysis

The U.S. market for urgent care center software reflects a unique convergence of healthcare decentralization, digital transformation, and consumer-driven expectations. With over 10,000 urgent care locations, spanning large corporate networks, hospital-affiliated centers, and independent operators, the country presents a diverse landscape for software adoption.

Federal and state-level reimbursement changes such as permanent telehealth CPT codes, value-based care incentives, and data interoperability mandates are shaping software requirements. States with higher population densities (e.g., California, Texas, Florida, New York) show accelerated adoption of integrated software platforms and cloud-based telemedicine systems. Conversely, rural and underserved areas benefit from affordable SaaS tools that extend virtual care access.

Private equity investment in multi-unit urgent care chains is also driving technology standardization and modernization, creating opportunities for software vendors offering scalable, interoperable, and analytics-driven platforms.

Some of the prominent players in the U.S. urgent care center software market include:

Recent Developments

-

March 2025: Experity, a leading urgent care software vendor, launched an AI-powered smart documentation feature in its EHR suite to reduce provider documentation time by 30%.

-

February 2025: Athenahealth announced a strategic partnership with a national urgent care network to integrate its cloud-based patient engagement platform across over 200 locations.

-

January 2025: Tebra (formerly Kareo and PatientPop) expanded its urgent care-focused revenue cycle management module, improving claim denial prediction with machine learning algorithms.

-

December 2024: AdvancedMD rolled out a virtual triage solution embedded within its existing EHR platform to support high-volume urgent care operations during flu season.

-

November 2024: DrChrono introduced a new telehealth workflow tailored to urgent care providers, featuring on-demand scheduling, virtual intake, and integrated billing.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. urgent care center software market

By Mode Of Deployment

By Application

- Electronic Health Records (EHR)/Electronic Medical Records (EMR)

- Practice Management

- Revenue Cycle Management

- Patient Engagement

- Telehealth

By Type

- Integrated Software

- Standalone Software