U.S. Value-based Healthcare Service Market Size and Trends

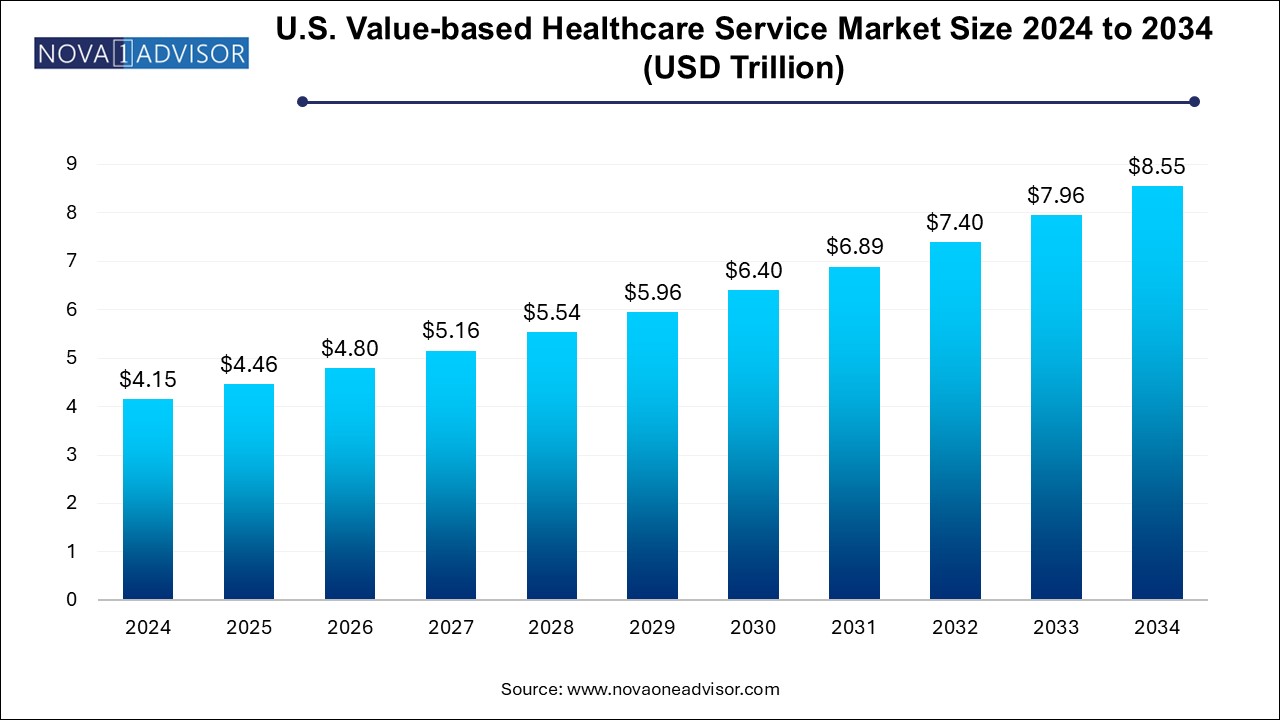

The U.S. value-based healthcare service market size was exhibited at USD 4.15 trillion in 2024 and is projected to hit around USD 8.55 trillion by 2034, growing at a CAGR of 7.5% during the forecast period 2024 to 2034.

U.S. Value-based Healthcare Service Market Key Takeaways:

- The basis of models, the patient-centred medical homes segment held the largest revenue share of 31.69% in 2024

- The shared savings segment is expected to grow at the lucrative rate over the forecast period.

- On the basis of payer category, the medicare and medicare advantage segment held the largest revenue share of 48.48% in 2024

- The Medicaid segment is expected to grow at the fastest CAGR over the forecast period.

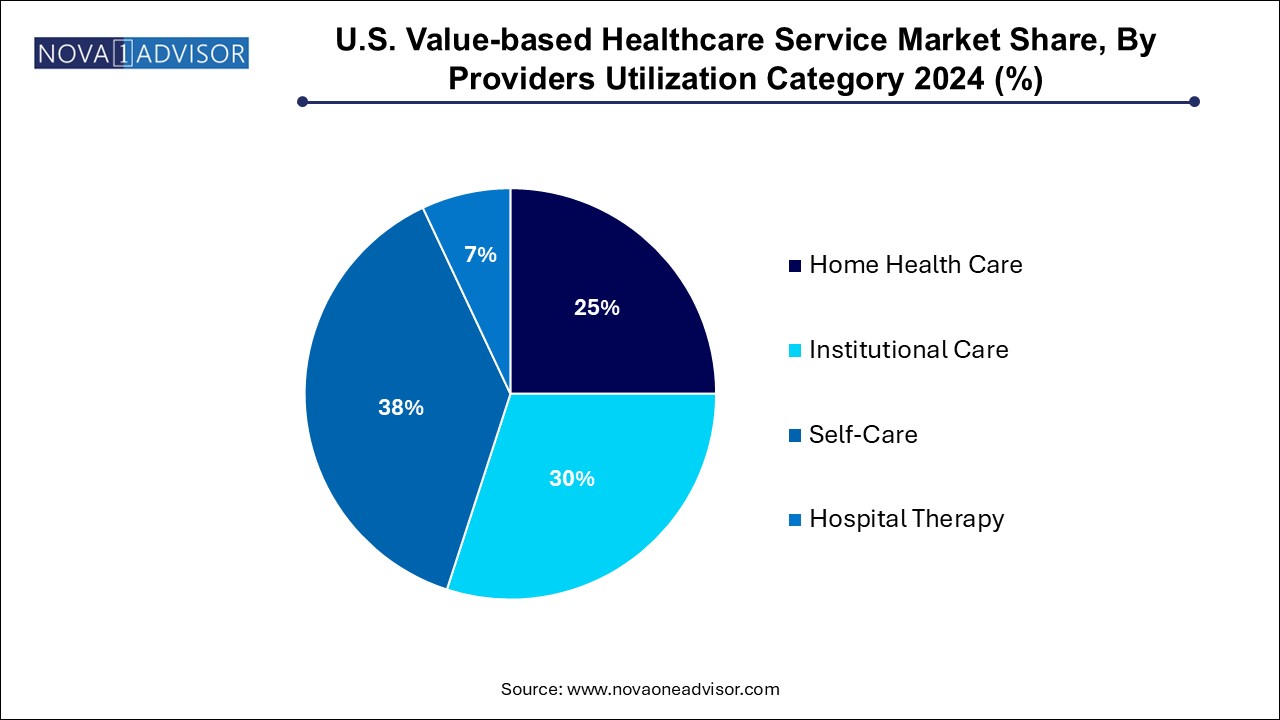

- On the basis of service, the self-care segment held the largest revenue share of 38.0% in 2024.

- The institutional care segment is expected to grow at the fastest CAGR over the forecast period.

Market Overview

The U.S. value-based healthcare service market marks a paradigm shift from volume-driven to outcome-driven healthcare delivery. Unlike the traditional fee-for-service model, value-based care (VBC) emphasizes better health outcomes, cost efficiency, and improved patient experiences. It links reimbursement to the quality of care provided, rather than the quantity of services delivered. As healthcare costs rise and chronic disease burdens grow, value-based models aim to create a more sustainable, patient-centric healthcare ecosystem.

Value-based healthcare incentivizes providers to coordinate care, reduce hospital readmissions, prevent complications, and focus on holistic well-being. With support from both public payers like Medicare and private insurers, adoption is steadily rising. The U.S. Centers for Medicare & Medicaid Services (CMS) has introduced several programs under the value-based umbrella, including bundled payment models, accountable care organizations (ACOs), and shared savings programs. These models are now being adopted by commercial insurers and provider networks nationwide.

As the U.S. healthcare industry evolves toward integrated, data-driven, and technology-enabled care, value-based services are becoming central to reform efforts. The focus is now shifting toward preventive medicine, coordinated chronic care, population health management, and risk-sharing agreements that align payer and provider incentives.

Major Trends in the Market

-

Rapid expansion of bundled payment models across chronic and elective procedures

-

Integration of electronic health records (EHRs), telehealth, and analytics in care coordination

-

Growth in shared-risk arrangements between payers and providers

-

Increased role of patient-reported outcomes in determining reimbursement

-

Shift toward home-based and community care delivery models

-

Rise of primary care-led medical homes and value-based specialty care

-

Emphasis on social determinants of health in care delivery strategies

-

Emergence of VBC-enabling startups focused on chronic disease management and behavioral health

Report Scope of U.S. Value-based Healthcare Service Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 4.46 Trillion |

| Market Size by 2034 |

USD 8.55 Trillion |

| Growth Rate From 2024 to 2034 |

CAGR of 7.5% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Models, Payer Category, Providers Utilization Category |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Baker Tilly US, LLP; Deloitte; Siemens Medical Solutions USA, Inc.; Boston Consulting Group; Change Healthcare; Athena Healthcare; Veritas Capital Fund Management, L.L.C.; UnitedHealth Group.; NXGN Management, LLC.; McKesson Corporation; Genpact; Unlimited Technology Systems, LLC; ForeSee Medical, Inc.; Signify Health, Inc. (Sentara Healthcare); Curation Health; Koninklijke Philips N.V.; Humana; The Commonwealth Fund.; Stellar Health; Privia Health. |

The biggest driver of the U.S. value-based healthcare market is the federal government’s long-standing push to shift from fee-for-service to performance-based reimbursement. CMS has implemented a wide array of programs under the Quality Payment Program (QPP), such as the Merit-based Incentive Payment System (MIPS) and Advanced Alternative Payment Models (AAPMs), to accelerate VBC adoption.

Programs like Medicare Shared Savings Program (MSSP), bundled payments for joint replacements, and accountable care organizations are changing provider behaviors by rewarding care quality and efficiency. State-level Medicaid reforms are also pushing for managed care models, integrating behavioral and physical health. These initiatives ensure long-term scalability of VBC frameworks across the nation.

Market Restraint: Operational Complexity and Provider Readiness

Despite its benefits, implementing value-based healthcare models presents operational challenges for many providers. Shifting from reactive care to proactive population management requires significant changes in care workflows, data infrastructure, reporting standards, and staff training. Small practices, rural hospitals, and safety-net providers often lack the resources to make these transitions smoothly.

Moreover, the administrative burden of participating in multiple VBC programs, each with unique metrics and compliance requirements, can lead to provider fatigue. Coordinating multidisciplinary care teams and integrating analytics platforms into daily operations remains difficult for many institutions. Until technical and training challenges are mitigated, provider engagement may remain uneven across the U.S.

Market Opportunity: Expansion of Home-Based and Virtual Value-Based Care Models

One of the most promising opportunities in the U.S. value-based healthcare market is the expansion of home-based and virtual care within the VBC framework. With the pandemic accelerating telehealth adoption, remote patient monitoring, and hospital-at-home models, many value-based providers are now able to manage chronic conditions more effectively and at lower costs.

Programs involving frontloading skilled nursing visits and specialized therapy within patients' homes have proven effective in reducing readmissions. Similarly, remote check-ins, medication adherence tools, and behavioral health interventions are expanding the scope of VBC into traditionally underserved areas. As regulatory and payer policies evolve to support these formats, the reach and ROI of value-based care will grow substantially.

U.S. Value-based Healthcare Service Market By Models Insights

Shared savings models dominate the value-based healthcare landscape in the U.S., primarily due to their early adoption and broad compatibility across provider types. Under this model, providers are rewarded for reducing healthcare spending for a defined patient population while maintaining or improving care quality. The model is widely used in the Medicare Shared Savings Program (MSSP) and among Accountable Care Organizations (ACOs). Shared savings reduce downside risk while fostering a performance culture.

Capitation and bundled payment models are the fastest-growing, especially as providers gain confidence in managing population risk. Capitation offers a per-member, per-month payment, incentivizing comprehensive care management and preventive care. Meanwhile, bundled payments are expanding across procedures such as cardiac surgeries, maternity care, and orthopedic interventions. These models are drawing interest from commercial insurers and self-insured employers alike.

U.S. Value-based Healthcare Service Market By Payer Category Insights

Medicare and Medicare Advantage lead the market, as federal programs have been the earliest and most aggressive adopters of value-based care. CMS initiatives such as Next Generation ACOs, ESRD Treatment Choices Model, and Primary Care First are transforming Medicare delivery and reimbursement. Medicare Advantage plans are increasingly tying provider bonuses and penalties to performance metrics such as hospital readmissions, patient satisfaction, and preventive screenings.

Commercial payers are the fastest-growing category, especially with self-funded employers and large insurers piloting shared risk arrangements and episode-based payment models. Health plans are using VBC frameworks to control costs and improve member retention, particularly in chronic care and mental health. Several Blue Cross Blue Shield (BCBS) affiliates and major insurers like UnitedHealth and Aetna are scaling their VBC networks across multiple states.

U.S. Value-based Healthcare Service Market By Providers Utilization Category Insights

Institutional care (especially inpatient and outpatient hospital services) remains dominant, due to the large number of VBC pilots embedded in hospital networks. These include bundled payments for surgical procedures, quality improvement incentives for inpatient care, and comprehensive stroke or cardiac care episodes. Hospitals are also forming partnerships with primary care groups to improve transitions of care and reduce unnecessary utilization.

Home health care is the fastest-growing utilization segment, especially frontloading skilled nursing and therapy visits. These strategies allow early intervention after discharge and have demonstrated significant reductions in readmissions and complications. Medicare Advantage plans and ACOs are increasingly contracting with home health agencies to execute VBC protocols. Virtual visits, mobile diagnostics, and connected devices are making it feasible to bring hospital-level care into the home.

Country-Level Analysis: United States

In the United States, value-based care has transitioned from pilot programs to mainstream healthcare strategy. Federal policies continue to incentivize risk-sharing, care coordination, and the use of patient-reported outcomes. Provider consolidation and vertical integration (e.g., insurers acquiring provider groups) are enabling better care alignment and data sharing.

States are also pursuing their own Medicaid transformation initiatives using 1115 waivers and managed care reforms. California’s CalAIM program and North Carolina’s Healthy Opportunities pilots are integrating social services into VBC. The presence of tech-forward provider networks and a maturing regulatory environment makes the U.S. an epicenter for global innovation in value-based healthcare delivery.

Some of the prominent players in the U.S. value-based healthcare service market include:

- Baker Tilly US, LLP

- Deloitte

- Siemens Medical Solutions USA, Inc.

- Boston Consulting Group

- Change Healthcare

- Athena Healthcare

- Veritas Capital Fund Management, L.L.C.

- UnitedHealth Group.

- NXGN Management, LLC.

- McKesson Corporation

- Genpact

- Unlimited Technology Systems, LLC

- ForeSee Medical, Inc.

- Signify Health, Inc. (Sentara Healthcare)

- Curation Health

- Koninklijke Philips N.V.

- Humana

- The Commonwealth Fund.

- Stellar Health

- Privia Health

U.S. Value-based Healthcare Service Market Recent Developments

-

In April 2025, Optum Health launched a new VBC platform for behavioral health integration, targeting employer-sponsored plans.

-

In February 2025, Humana expanded its Primary Care Organization (PCO) network to 17 additional markets to scale its value-based primary care model.

-

In December 2024, CVS Health/Aetna piloted a bundled payment model for maternity care in collaboration with major health systems.

-

In October 2024, Signify Health partnered with a national health plan to deliver in-home VBC assessments and care planning for seniors.

-

In August 2024, One Medical (Amazon Health) announced new analytics tools to support shared savings contracts across its clinics.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. value-based healthcare service market

Models

- Pay for performance

- Patient-centred

- medical home"

- Shared savings

- Shared risk

- Bundled payment

- Capitation models

Payer Category

- Medicare and Medicare Advantage

- Medicaid

- Commercial

Providers Utilization Category

-

- Frontloading Skilled Nursing Visits

- Specialized Frontloading Therapy Visits

- Institutional Care

- Self-Care

- Hospital Therapy