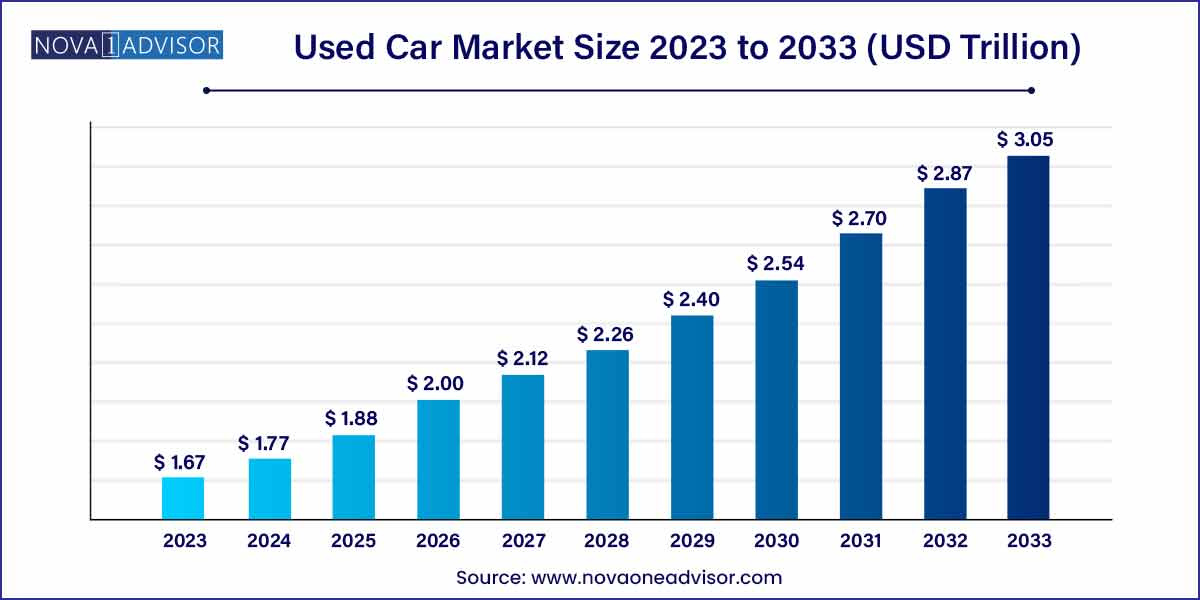

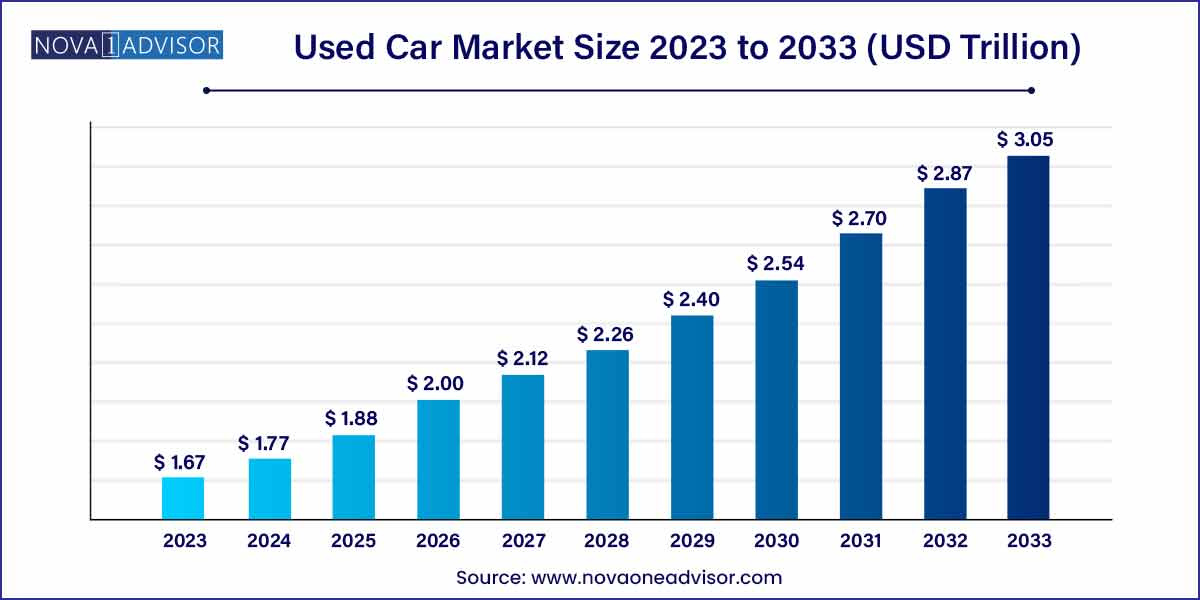

The global used car market size was exhibited at USD 1.67 trillion in 2023 and is projected to hit around USD 3.05 trillion by 2033, growing at a CAGR of 6.2% during the forecast period of 2024 to 2033.

Key Takeaways:

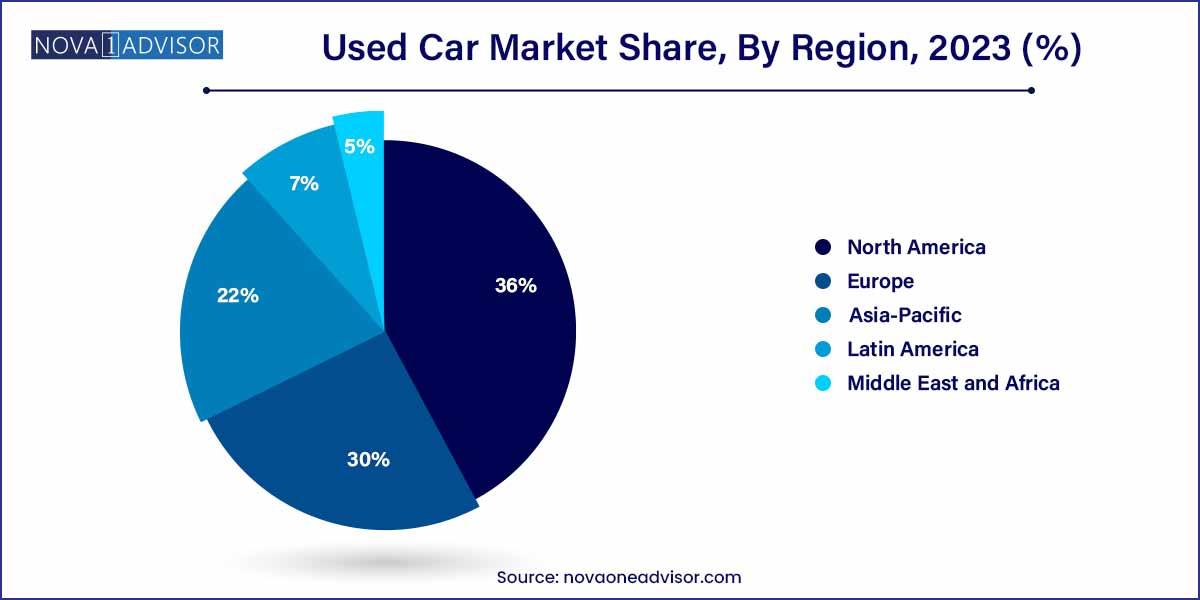

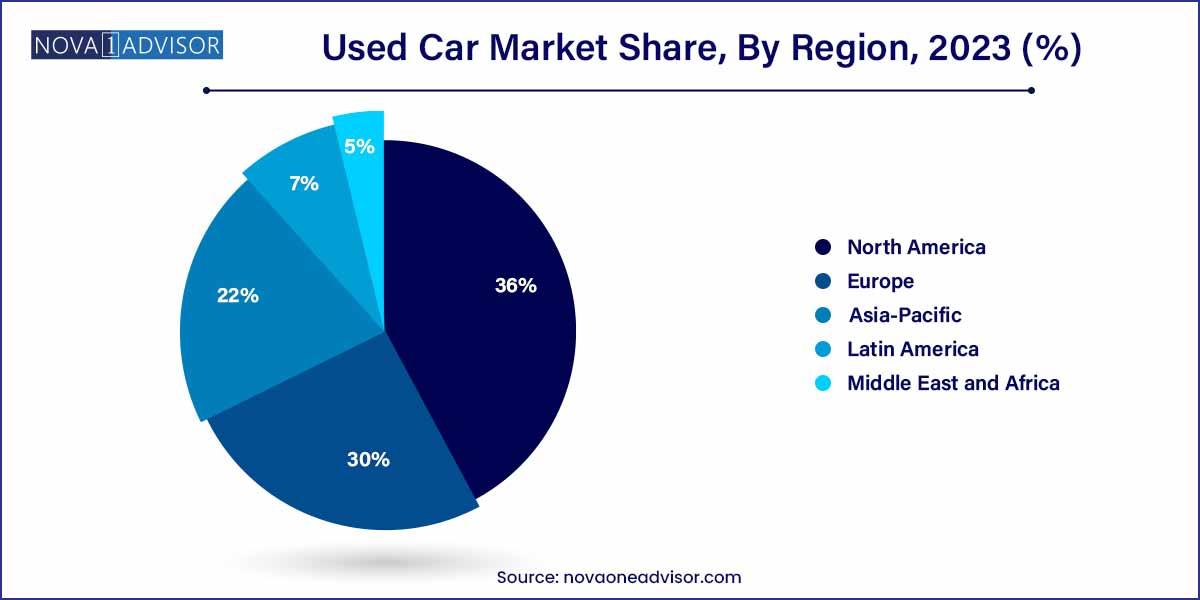

- North America dominated the market,with the largest revenue share of 36.0% in 2023.

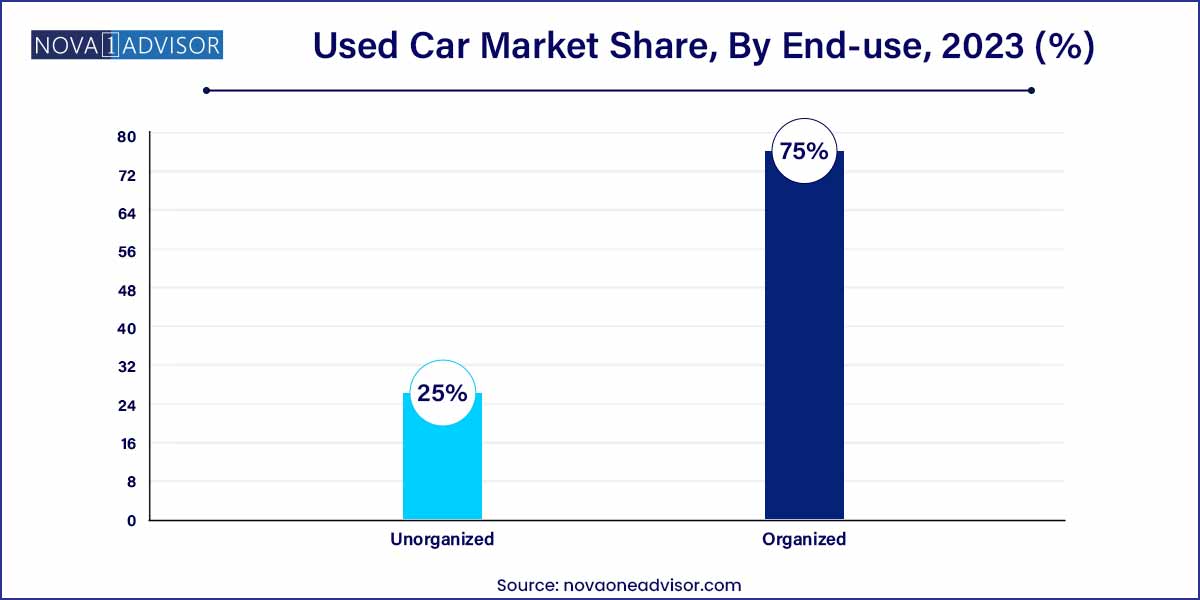

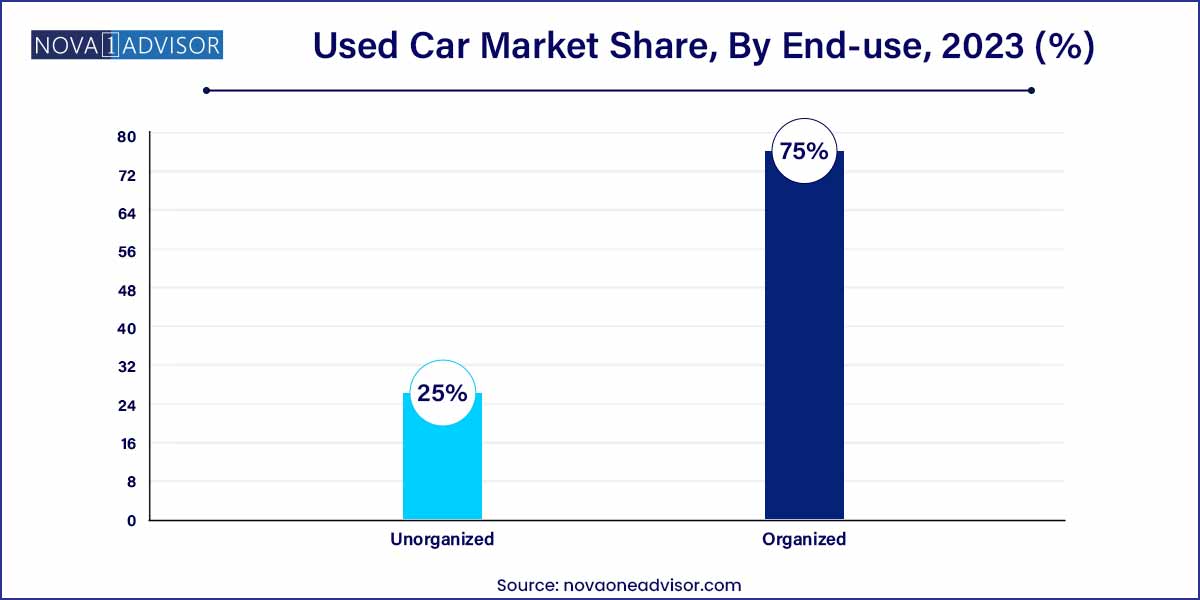

- The organized segment dominated the market with the highest revenue share of 75.0% in 2023.

- The conventional segment accounted for the largest revenue share of over 42.8%.

- The petrol segment held the largest market share of 42.5% in 2023.

- The SUV segment accounted for the largest market share of 37.6% of the market in 2023.

- The offline segment held a considerable market share of 74.8% in 2023.

Market Overview

The used car market represents a dynamic and expansive segment of the global automotive industry. As economic pressures, technological improvements, and sustainability concerns rise, consumers are increasingly turning toward pre-owned vehicles as viable alternatives to new car purchases. Used cars offer value for money, lower depreciation rates, and a broad selection across models, types, and price points, making them especially appealing to budget-conscious buyers, first-time car owners, and fleet operators.

Technological advancements, particularly in vehicle telematics, inspection services, and online retail platforms, have redefined transparency and trust within the used car market. Today, consumers can access comprehensive vehicle histories, certified inspections, and warranty options, significantly improving confidence in pre-owned purchases. Organized dealership networks, CPO (Certified Pre-Owned) programs, and the rise of digital marketplaces are further accelerating growth by professionalizing the buying experience.

Global socioeconomic shifts, such as urbanization, increasing car ownership aspirations in emerging economies, and growing environmental awareness, are influencing demand patterns. With consumers seeking reliable, affordable, and eco-friendly mobility solutions, the used car market is poised for robust expansion across regions and segments.

Used Car Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.67 trillion |

| Market Size by 2033 |

USD 3.05 trillion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Vehicle Type, Vendor Type, Fuel Type, Size, Sales Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Alibaba.com.; CarMax Enterprise Services, LLC; Asbury Automotive Group; TrueCar, Inc.; Scout24 SE; Lithia Motor Inc.; Group 1 Automotive, Inc.; eBay.com; Hendrick Automotive Group; AutoNation.com. |

Used Car Market Dynamics

The dynamics of the used car market are intricately shaped by two primary factors: economic realities and technological advancements. Firstly, economic realities play a pivotal role as consumers increasingly prioritize cost-effectiveness. The depreciation of new cars in their initial years makes used cars an attractive option, allowing buyers to acquire reliable vehicles at a fraction of the cost. This economic incentive is further accentuated by the variety of options available in the used car market, catering to diverse budgetary considerations and preferences.

Secondly, technological advancements significantly influence market dynamics, enhancing the overall customer experience. The rise of online platforms has revolutionized how buyers and sellers interact, providing a convenient and transparent marketplace. Additionally, innovations in vehicle manufacturing contribute to the extended longevity of used cars, ensuring they remain reliable and technologically competitive. Features such as advanced safety systems, connectivity options, and fuel efficiency are increasingly becoming key drivers in the decision-making process for used car buyers.

Used Car Market Restraint

Two notable restraints impacting the used car market are concerns about transparency and the need for comprehensive vehicle history reporting. Firstly, concerns about transparency pose a significant challenge. Buyers often face uncertainties regarding the accurate representation of a used vehicle's condition, mileage, and maintenance history. This lack of transparency can erode consumer trust, hindering the overall growth of the market. Addressing these concerns through standardized practices and regulations is essential to alleviating apprehensions among potential buyers.

Secondly, the need for comprehensive vehicle history reporting is a critical restraint. Inconsistent or incomplete information about a used car's history, including accidents, repairs, or title issues, can impede buyer confidence. To overcome this restraint, the industry needs to adopt and promote comprehensive reporting standards. Robust vehicle history reports, detailing the complete background of a used car, can enhance transparency and facilitate more informed purchasing decisions.

Used Car Market Opportunity

Two significant opportunities within the used car market include the embrace of online platforms and the growing demand for sustainable transportation. Firstly, the increasing reliance on online platforms presents a lucrative opportunity. The digital landscape has transformed how consumers buy and sell used cars, offering convenience, transparency, and a broader reach. Capitalizing on this trend through strategic investments in user-friendly online platforms and digital marketing initiatives can open up new avenues for market growth and customer engagement.

Secondly, there is a notable opportunity in cater to the growing demand for sustainable transportation. As environmental awareness rises, more consumers are seeking eco-friendly alternatives, including used electric or hybrid vehicles. Positioning the used car market as a viable option for sustainable transportation not only aligns with evolving consumer values but also expands the market to a segment of environmentally conscious buyers. Incorporating eco-friendly options and promoting sustainability in marketing strategies can tap into this growing demand and differentiate the used car market in a positive way.

Used Car Market Challenges

Two notable challenges confronting the used car market are fraud concerns and the impact of rapid technological evolution. Firstly, fraud concerns pose a significant challenge. The decentralized nature of the used car market, often involving individual sellers and varied inspection standards, can lead to instances of fraud. From misrepresented vehicle conditions to title discrepancies, these concerns undermine consumer trust. Implementing robust verification mechanisms, promoting standardized practices, and enhancing regulatory oversight can help mitigate the risks associated with fraud.

Secondly, the impact of rapid technological evolution presents a challenge for the used car market. As vehicles become more technologically advanced, there is a growing digital divide between newer models and their older counterparts. Buyers may encounter difficulties understanding and maintaining the technology embedded in used cars, impacting their overall satisfaction and confidence in the purchase. To address this challenge, the industry needs to invest in education and support systems, ensuring that both buyers and sellers are equipped to navigate the technological landscape of used vehicles effectively.

Segments Insights:

Vendor Type Insights

Conventional vehicles dominate the used car market, encompassing a vast inventory of petrol and diesel-powered sedans, hatchbacks, SUVs, and trucks. Their familiarity, availability, and wide service network make them a safe choice for most buyers. Used conventional cars continue to attract consumers looking for affordable ownership without concerns related to new technology adoption or charging infrastructure.

Electric vehicles are the fastest-growing segment, supported by early adopters upgrading their fleets and heightened environmental consciousness among buyers. The improving lifespan of EV batteries and falling resale prices are making them increasingly appealing. Urban centers with dense charging networks are particularly witnessing faster adoption of used electric vehicles.

By Vendor Type

Unorganized vendors currently dominate the used car market, particularly in emerging economies where informal dealers and direct seller-to-buyer transactions are prevalent. Lower prices, minimal documentation, and immediate availability make unorganized vendors an attractive option for budget-sensitive consumers.

Organized vendor channels are growing at the fastest pace, driven by consumer demand for trust, transparency, and value-added services. Certified dealers, branded used car programs, and online aggregators offering quality checks, financing, and return policies are reshaping buyer expectations and accelerating market formalization.

By Fuel Type

Petrol vehicles dominate the used car fuel segment, largely because of their lower maintenance costs, widespread availability, and favorable pricing in urban areas. Petrol cars are preferred for their smoother performance and lower upfront purchase cost compared to diesel alternatives.

Other fuel types, especially hybrid vehicles, are seeing rapid growth, as buyers seek more fuel-efficient and environmentally friendly options. Hybrid used cars are particularly gaining traction among urban commuters and eco-conscious consumers who want reduced carbon emissions without fully transitioning to electric vehicles.

By Size

Compact cars dominate the size segment of the used car market, due to their affordability, fuel efficiency, and ease of maneuverability in congested urban environments. They are often the first choice for first-time buyers, students, and small families.

SUVs represent the fastest-growing segment, reflecting a global consumer preference shift toward larger vehicles offering greater comfort, safety, and versatility. As new SUV prices rise, buyers are increasingly looking at the used market for more economical options to satisfy their aspirations for larger vehicles.

By Sales Channel

Offline sales channels still dominate, as traditional dealership visits, physical inspections, and personal negotiations remain important elements of the used car buying experience for many consumers. Trust-building and direct evaluation play critical roles, particularly in unorganized markets.

Online sales channels are growing rapidly, driven by digital transformation, tech-savvy consumers, and the COVID-19 pandemic’s influence on remote buying habits. Online platforms provide extensive vehicle inventories, financing options, home delivery, and return policies, redefining how used cars are bought and sold.

Regional Insights

North America dominates the global used car market, led by the United States, where used car sales volumes significantly outpace new car sales. A mature automotive ecosystem, robust financing options, strong online marketplaces, and the widespread popularity of Certified Pre-Owned (CPO) programs fuel this dominance.

Asia-Pacific is the fastest-growing region, with China, India, and Southeast Asia driving expansion. Rising middle-class aspirations, growing car ownership penetration, and increasing preference for value-for-money deals in emerging economies contribute to the surge. Rapid digitalization, improving quality assurance standards, and government policies encouraging organized used car sales are accelerating market development in the region.

Recent Developments

-

CarMax (March 2025): Announced an AI-based instant offer platform for online trade-ins and purchases, enhancing digital user experience.

-

Cazoo (February 2025): Expanded its operations into Italy and Spain, reinforcing its position as a leading European online used car retailer.

-

Cars24 (January 2025): Secured $400 million in funding to expand its certified used car refurbishment centers across India.

-

AutoNation (December 2024): Opened a chain of standalone used vehicle stores, focusing exclusively on online-to-offline customer journeys.

-

Vroom (November 2024): Launched a subscription-based vehicle ownership model aimed at flexible, short-term used car leasing.

Some of the prominent players in the used car market include:

- Alibaba.com.

- CarMax Enterprise Services, LLC

- Asbury Automotive Group

- TrueCar, Inc.

- Scout24 SE

- Lithia Motor Inc.

- Group 1 Automotive, Inc.

- eBay.com

- Hendrick Automotive Group

- AutoNation.com

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global used car market.

Vehicle Type

- Hybrid

- Conventional

- Electric

Vendor Type

Fuel Type

Size

- Compact Car

- Mid-Sized

- SUV

Sales Channel

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)