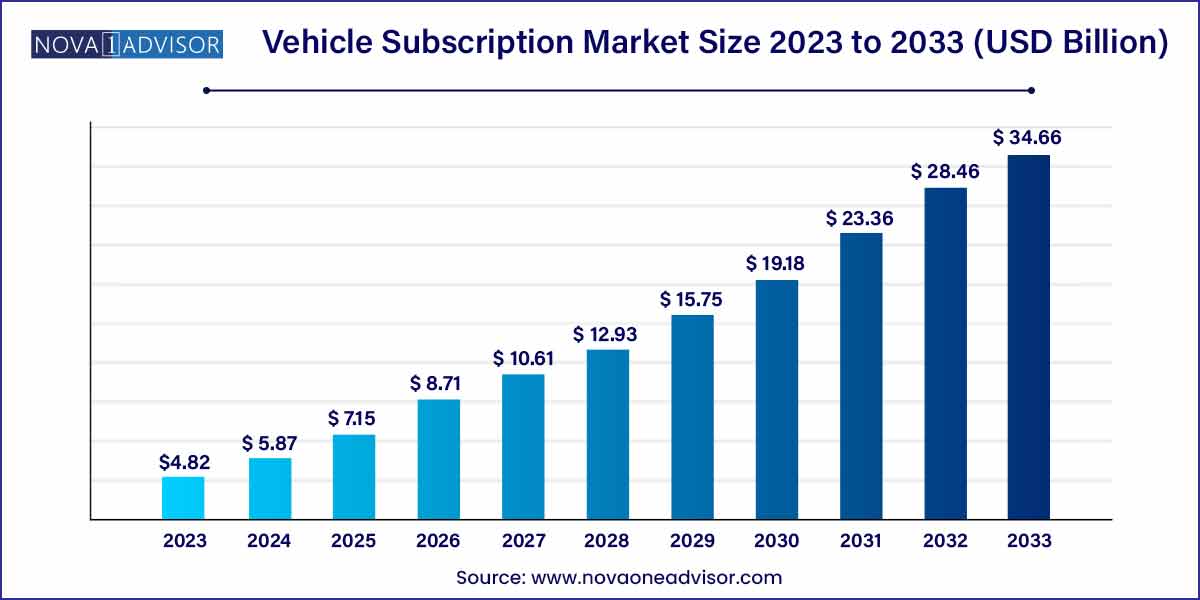

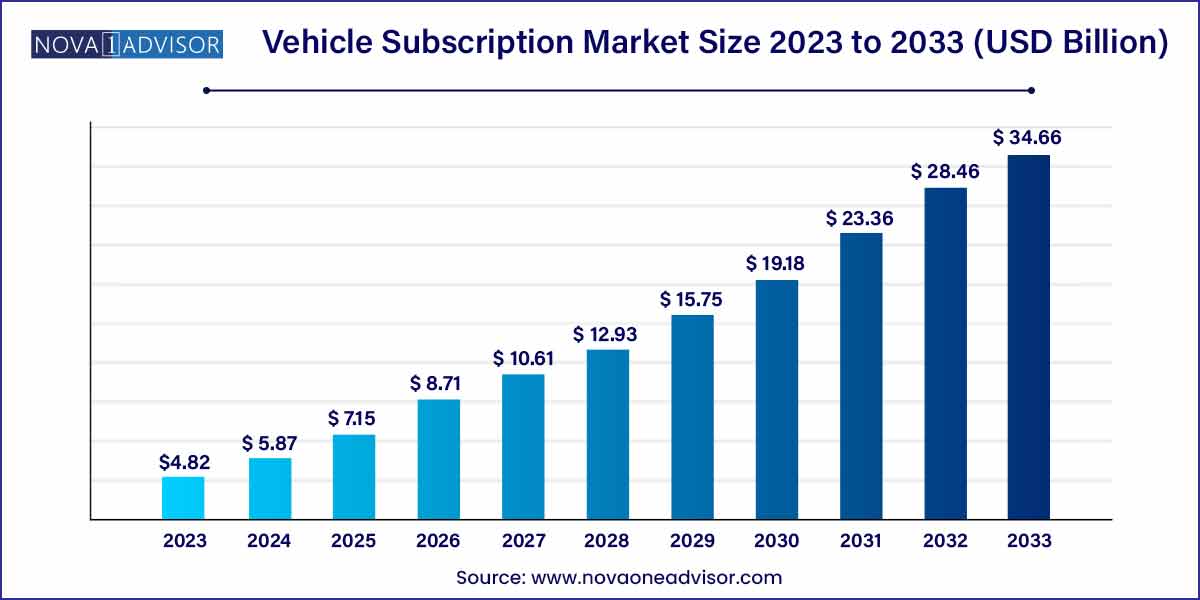

The global vehicle subscription market size was exhibited at USD 4.82 billion in 2023 and is projected to hit around USD 34.66 billion by 2033, growing at a CAGR of 21.81% during the forecast period of 2024 to 2033.

Key Takeaways:

- North America and Europe will dominate the during the forecast period and is expected to contribute more than 25% of the total revenue share in the upcoming years.

- The IC-powered vehicle segment leads the vehicle subscription market in terms of revenue share contributing more than 75% in 2023

Vehicle Subscription Market: Overview

The vehicle subscription market has emerged as a dynamic and innovative alternative to traditional car ownership, revolutionizing the automotive industry's landscape. Offering consumers greater flexibility, convenience, and access to a diverse range of vehicles, this burgeoning market segment has garnered significant attention and traction in recent years.

Growth Factors

The surge in the adoption of vehicle subscription model across the world owing to its cost-effectiveness and offering easy user access to vehicles is expected to drive the growth of the market. For instance, On 29th September 2021, General Motors announced the development of "Ultifi" software platform for its cars. This new software will facilitate in-car subscription services, over-the-air (OTA) updates and “new opportunities to increase customer loyalty. The automaker conceptualizes the new software powering everything starting from the mundane, such asweather apps, to potentially disputable features like the use of in-car cameras for facial recognition or to detect children to automatically activate the car’s child locks. The third partydevelopers will also be able to use this Linux-based system, who wishes to create apps and other features for GM customers.

The strategic partnership between the automakers and the subscription service providers are fostering the market growth. This partnership helps in catering the untapped markets. Owing to the Change in consumer sentiments toward vehicle subscription the vehicle subscription providers need to undergo strategic partnership with the auto manufacturers to attain the long-term business opportunities. These factors boost the market growth. For instance, On 6th July 2021, CarNext, one of Europe’s leading online B2C and B2B used car marketplaces, announced that it has entered into an exclusive Long-Term Service Agreement with LeasePlan, a largest car leasing companies in the world with over 1.8 million vehicles under management in 30 countries. This ensures CarNext a supply of close to 300,000 high-quality used cars annually to sell through its B2C and B2B marketplaces across Europe, giving the company an excellent base for future growth.

Vehicle Subscription Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 4.82 Billion |

| Market Size by 2033 |

USD 34.66 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 21.81% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Vehicle, Subscription Period, Service Providers, End Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Fair Financial Corp., Clutch Technologies, LLC, CarNext, FlexDrive, Cluno GmbH, DriveMyCar Rentals Pty Ltd, BMW AG, Daimler AG, General Motors, Hyundai Motor India, Tata Motors, Tesla, Volkswagen, Volvo Car Corporation, ZoomCar, Cox Automotive |

Vehicle Subscription Market Dynamics

- Shifting Consumer Preferences:

One of the primary dynamics propelling the vehicle subscription market is the significant shift in consumer preferences towards flexible mobility solutions. Increasingly, individuals are seeking alternatives to traditional car ownership that offer greater convenience, affordability, and simplicity. Vehicle subscription services cater to these evolving preferences by providing customers with access to a diverse range of vehicles on a subscription basis, eliminating the burdens associated with long-term ownership commitments. The appeal of subscription-based models lies in their ability to offer a hassle-free experience, allowing users to enjoy the benefits of driving without the financial and logistical constraints of ownership.

- Technological Advancements:

Another key dynamic driving the growth of the vehicle subscription market is the integration of advanced technologies and digital innovations. From mobile applications to IoT sensors and data analytics, technology plays a crucial role in enhancing the user experience and streamlining the subscription process. These technological advancements enable seamless vehicle management, customization, and access to additional services such as maintenance and insurance. Furthermore, digital platforms facilitate greater transparency and convenience for consumers, allowing them to easily compare subscription offerings, manage their accounts, and make changes to their vehicle preferences with just a few clicks.

Vehicle Subscription Market Restraint

A significant restraint facing the vehicle subscription market is the complex regulatory landscape governing automotive and insurance industries. The emergence of subscription-based models has raised questions and challenges regarding regulatory compliance, particularly regarding insurance requirements and liability issues. Different jurisdictions may have varying regulations and requirements for vehicle subscription services, creating a fragmented and often challenging operating environment for providers. Navigating these regulatory complexities requires substantial resources and expertise, potentially impeding the expansion and scalability of subscription offerings.

- Sustainability of Business Models:

Another notable restraint for the vehicle subscription market is the need to establish sustainable business models that ensure long-term viability and profitability. While subscription services offer consumers greater flexibility and convenience, they also entail significant operational costs for providers, including vehicle procurement, maintenance, insurance, and administrative overhead. Balancing these costs with subscription fees to achieve profitability poses a considerable challenge, especially in highly competitive markets with thin margins. Moreover, the subscription model's success relies on maintaining a stable and satisfied customer base, as churn rates can impact revenue streams and overall profitability.

Vehicle Subscription Market Opportunity

- Market Expansion and Diversification:

An outstanding opportunity within the vehicle subscription market lies in its potential for expansion and diversification. As consumer demand for flexible mobility solutions continues to grow, there is ample room for subscription services to expand into new geographic markets and demographic segments. Emerging economies, in particular, present untapped opportunities for subscription providers to introduce innovative mobility solutions and capture a burgeoning consumer base seeking affordable and convenient transportation options. Additionally, diversifying subscription offerings to cater to specific niches such as electric vehicles, luxury cars, or commercial fleets can further enhance market penetration and revenue generation.

- Partnership and Collaboration:

Another promising opportunity within the vehicle subscription market lies in fostering strategic partnerships and collaborations across the automotive ecosystem. By forging alliances with automotive manufacturers, dealerships, insurance companies, and technology providers, subscription services can access a broader range of resources, expertise, and distribution channels to enhance their value proposition and market reach. Collaborative efforts can facilitate access to exclusive vehicle models, streamline supply chain logistics, and optimize service delivery, ultimately enhancing the overall customer experience. Moreover, partnerships with complementary service providers such as ride-hailing companies, mobility platforms, and urban planners can enable subscription services to integrate seamlessly into evolving mobility ecosystems and address diverse transportation needs.

Vehicle Subscription Market Challenges

- Consumer Education and Awareness:

A significant challenge facing the vehicle subscription market is the need to educate and raise awareness among consumers about the concept and benefits of subscription-based mobility services. While traditional car ownership has long been the dominant model, many consumers may be unfamiliar with or skeptical about the advantages of subscribing to vehicles on a flexible basis. Educating consumers about the cost-effectiveness, convenience, and flexibility of subscription services requires targeted marketing campaigns, clear communication of value propositions, and transparent pricing structures. Moreover, addressing concerns related to vehicle maintenance, insurance coverage, and subscription terms can help build trust and confidence among potential subscribers.

- Regulatory and Legal Uncertainty:

Another significant challenge for the vehicle subscription market is navigating the complex and evolving regulatory landscape governing automotive and insurance industries. Subscription services may face regulatory hurdles and legal uncertainties related to vehicle registration, insurance requirements, liability issues, and consumer protection laws in different jurisdictions. Ensuring compliance with regulatory requirements and addressing potential legal risks can be time-consuming and resource-intensive for subscription providers, particularly when operating across multiple markets with varying regulations. Moreover, changes in legislation or regulatory frameworks can introduce additional compliance burdens and operational challenges, impacting the profitability and scalability of subscription offerings.

Segments Insights:

Mode of Vehicle Type

IC-powered vehicles dominated the vehicle subscription market in 2023, owing to their wide availability, lower initial costs, and consumer familiarity. Most early subscription services started by offering popular gasoline and diesel-powered models to attract a broad customer base. Vehicles like sedans, hatchbacks, and SUVs powered by internal combustion engines continue to fulfill everyday commuting and lifestyle needs for a vast segment of the market.

However, electric vehicles (EVs) are the fastest-growing vehicle type segment, driven by increasing government incentives, tightening emission regulations, and rising environmental consciousness among consumers. Subscription platforms are expanding their EV portfolios rapidly, featuring models from Tesla, Nissan, Chevrolet, and emerging brands like Rivian and Lucid Motors. The convenience of "try-before-you-buy" and the bundled charging solutions make EV subscriptions an attractive proposition for first-time EV adopters.

Subscription Period Insights

6 to 12 months subscriptions dominated the market, as they offer an ideal balance between flexibility and cost-effectiveness. Consumers who seek the benefits of short-term commitment without the expense of very brief rentals typically opt for 6- to 12-month periods. This duration appeals to individuals in transitional life stages (such as relocating for work or study) and corporate clients needing mobility solutions for temporary assignments.

Meanwhile, 1 to 6 months subscription plans are the fastest-growing segment, propelled by the need for ultra-flexible mobility, especially post-pandemic. Short-term subscriptions are popular among seasonal residents, tourists, and gig economy workers who require vehicle access only during specific months. Providers offering seamless digital onboarding, minimal paperwork, and immediate vehicle availability are capitalizing on this trend.

Service Providers Insights

OEMs and captives dominated the service provider landscape, leveraging their brand loyalty, direct manufacturing access, and dealership networks. Automakers like Volvo (Care by Volvo), Porsche (Porsche Drive), and Hyundai (Hyundai Mocean) have launched in-house subscription models, offering consumers access to a curated fleet of new vehicles, sometimes with options to purchase at the end of the term.

However, independent/third-party service providers are the fastest-growing segment, led by mobility startups and digital platforms such as Fair, Clutch, and Finn. These companies offer multi-brand subscriptions, giving users greater choice, flexible terms, and often lower monthly rates. Their technology-driven, customer-centric approach is reshaping consumer expectations around mobility.

End Use Insights

Private use dominated the vehicle subscription market, reflecting individual consumers' growing preference for flexible, all-inclusive mobility solutions without long-term ownership burdens. Private users primarily seek convenience, access to newer vehicle models, and the ability to switch cars based on lifestyle changes or seasonal needs.

Conversely, corporate subscriptions are the fastest-growing end-use segment, fueled by companies seeking scalable mobility solutions for employee fleets without the capital expenditure associated with traditional leasing or purchasing. Subscription services allow businesses to manage fleet sizes dynamically, adapting to project needs, remote work trends, and changing workforce mobility patterns.

By Region

North America dominated the vehicle subscription market in 2024, particularly the United States, where flexible mobility solutions are gaining traction among younger consumers and urban professionals. Leading providers like Hertz, Fair, and OEM programs have contributed to market maturity. High vehicle costs, growing urbanization, and consumers' desire to avoid long-term financial commitments reinforce North America's leadership.

Europe is the fastest-growing region, driven by strong EV adoption rates, regulatory support for sustainable transportation, and urban congestion policies that encourage flexible mobility. Countries like Germany, the UK, France, and the Nordics are witnessing a surge in subscription models, with OEMs like Volvo, BMW, and Mercedes-Benz rolling out subscription-based services tailored to regional mobility demands. Europe's commitment to green transportation aligns closely with subscription services promoting EV access.

Some of the prominent players in the vehicle subscription market include:

- Fair Financial Corp.,

- Clutch Technologies, LLC,

- CarNext

- FlexDrive

- Cluno GmbH,

- DriveMyCar Rentals Pty Ltd,

- BMW AG,

- Daimler AG,

- General Motors,

- Hyundai Motor India,

- Tata Motors,

- Tesla,

- Volkswagen,

- Volvo Car Corporation,

- ZoomCar,

- Cox Automotive,

- Wagonex Limited,

- LeasePlan,

- Drover Limited,

- Lyft Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global vehicle subscription market.

By Vehicle Type

- IC-Powered Vehicle

- Electric Vehicle

By Subscription Period

- 1 to 6 Months

- 6 to 12 Months

- More than 12 Months

By Service providers

- OEMs & Captives

- Independent/Third Party Service Provider

By End Use

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)