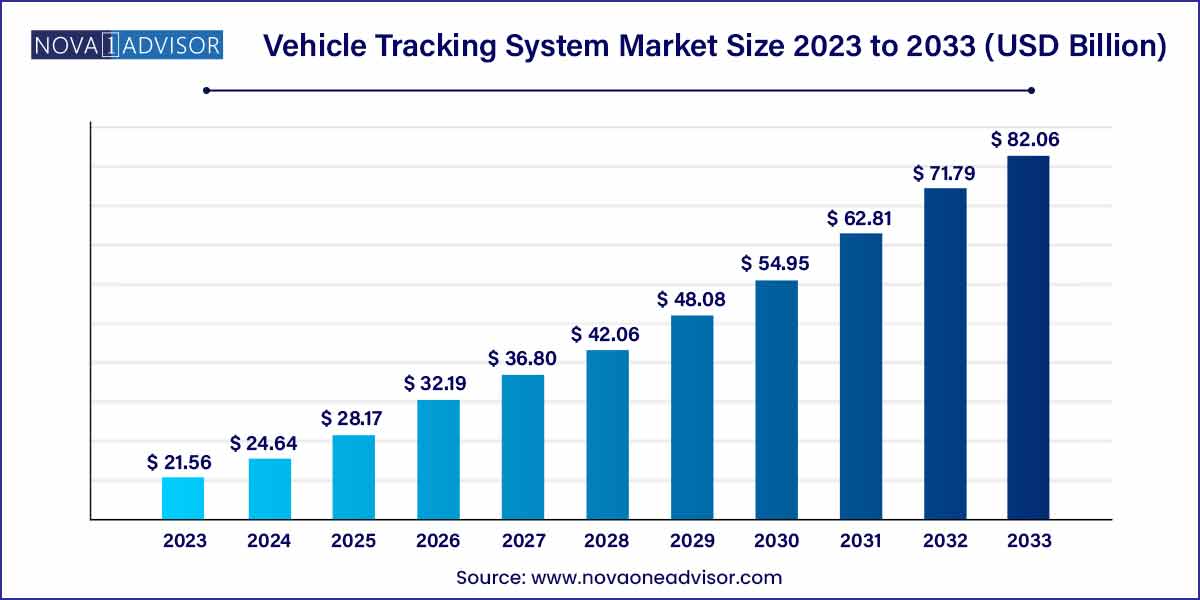

The global vehicle tracking system market size was exhibited at USD 21.56 billion in 2023 and is projected to hit around USD 82.06 billion by 2033, growing at a CAGR of 14.3% during the forecast period of 2024 to 2033.

Key Takeaways:

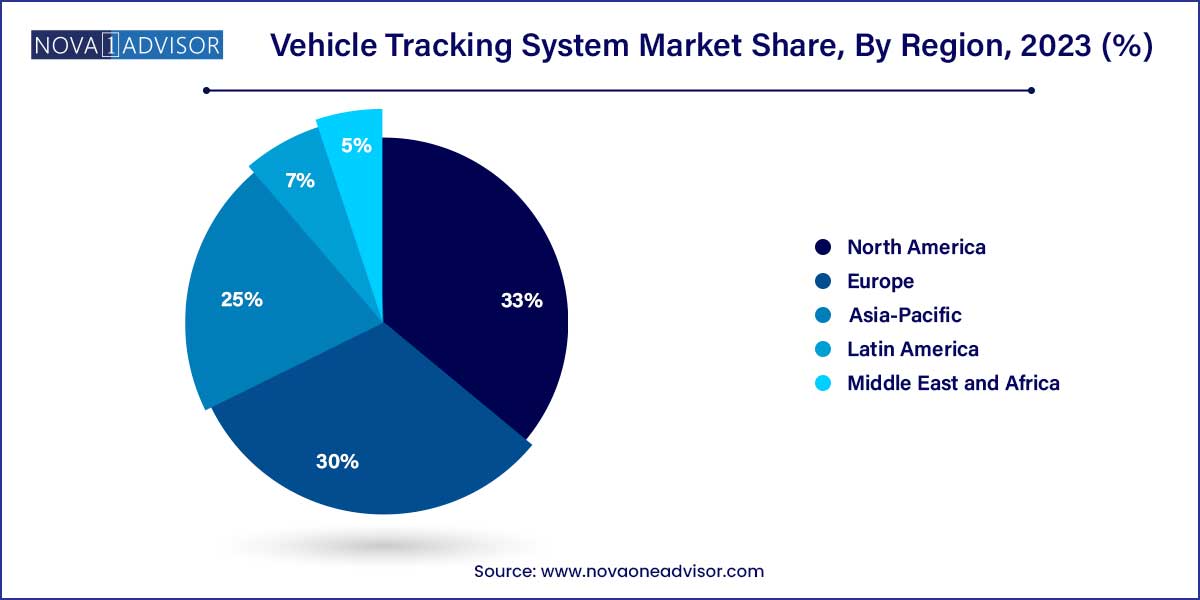

- North America dominated the market, with the largest revenue share of 33.0% in 2023.

- The transportation & logistics segment dominated the market, with the highest revenue share of 27.3% in 2023

- The GPS/satellite segment held the largest market share of 49.8% in 2023.

- The passenger vehicles segment accounted for the largest revenue share of over 43.1%.

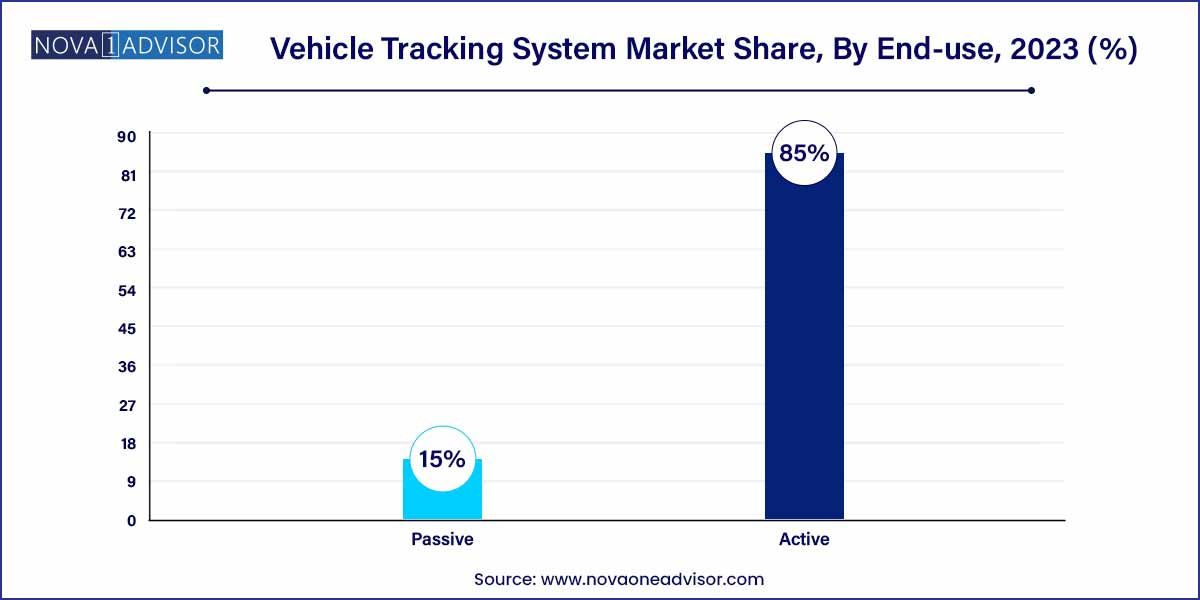

- The active segment accounted for the largest share of around 85.0% of the market in 2023.

Vehicle Tracking System Market by Overview

In the dynamic landscape of modern transportation, the Vehicle Tracking System (VTS) market has emerged as a pivotal technology, transforming the way businesses manage their fleets and optimize logistical operations. This overview delves into the fundamental aspects of the vehicle tracking system market, exploring its key components, growth drivers, challenges, and future prospects.

Vehicle Tracking System Market Growth

The robust growth of the Vehicle Tracking System (VTS) market can be attributed to several key factors. Firstly, the increasing emphasis on enhanced fleet management practices has driven widespread adoption of VTS, allowing businesses to optimize routes, minimize fuel consumption, and improve overall operational efficiency. Secondly, rising concerns regarding vehicle security have positioned VTS as a pivotal tool in tracking and recovering stolen vehicles, contributing significantly to its market expansion. Additionally, stringent government regulations mandating the use of tracking systems in commercial vehicles for safety and compliance have further fueled the market's growth trajectory. Despite challenges such as data security concerns and initial implementation costs, the tangible benefits offered by VTS in terms of operational optimization and compliance have positioned it as an indispensable technology in the contemporary transportation landscape.

Vehicle Tracking System Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 21.56 Billion |

| Market Size by 2033 |

USD 82.06 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 14.3% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Component, Vehicle Type, Technology, Type, End Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Cartrack; Verizon; Geotab Inc.; TomTom International BV.; CalAmp; TELTONIKA; ORBCOMM; Sensata Technologies Inc.; Laipac Technology Inc.; Trackimo. |

Vehicle Tracking System Market Dynamics

The Vehicle Tracking System (VTS) market is propelled by a set of compelling growth drivers. Chief among these is the increasing demand for enhanced fleet management solutions. VTS enables precise real-time monitoring of vehicle locations, empowering businesses to optimize routes, reduce fuel consumption, and enhance overall fleet efficiency. Moreover, the escalating concerns related to vehicle security have become a significant growth driver.

While the vehicle tracking system market experiences robust growth, it is not without its share of challenges. One prominent hurdle is the heightened concern over data security. Given that VTS involves the collection and transmission of sensitive location data, ensuring robust cybersecurity measures has become imperative. The protection of this data from unauthorized access and potential breaches is critical to maintaining user trust and meeting regulatory requirements.

Vehicle Tracking System Market Restraint

A primary restraint affecting the Vehicle Tracking System (VTS) market is the escalating concern over data privacy. As VTS involves the continuous collection and transmission of sensitive location data, businesses and consumers alike are becoming increasingly cautious about the potential misuse or unauthorized access to this information. Striking the right balance between effective tracking for operational purposes and safeguarding individuals' privacy is a complex challenge.

Initial Implementation Costs:

The upfront implementation costs associated with deploying vehicle tracking systems pose a significant restraint, especially for small and medium-sized enterprises (SMEs). The initial investment required for acquiring and installing the necessary hardware and software can be substantial, deterring some businesses from embracing VTS technology.

Vehicle Tracking System Market Opportunity

- Rising Demand for Advanced Analytics:

An opportunity that stands out in the Vehicle Tracking System (VTS) market is the increasing demand for advanced analytics capabilities. As VTS continues to evolve, there is a growing need for sophisticated analytics tools that can process the vast amount of data generated by tracking systems. Businesses can harness this opportunity by developing and offering analytics solutions integrated with VTS, providing actionable insights into vehicle performance, driver behavior, and overall fleet efficiency.

- Integration with IoT and Emerging Technologies:

The integration of vehicle tracking systems with the Internet of Things (IoT) and other emerging technologies presents a significant opportunity for market growth. By connecting VTS to IoT devices and leveraging technologies such as artificial intelligence and machine learning, businesses can unlock new levels of functionality and efficiency. This integration allows for real-time monitoring of vehicle health, predictive maintenance, and the development of smart transportation ecosystems.

Vehicle Tracking System Market Challenges

A primary challenge facing the Vehicle Tracking System (VTS) market is the heightened concern over data security. The continuous collection and transmission of sensitive location data makes VTS a potential target for cybersecurity threats. Unauthorized access, data breaches, and privacy violations are significant risks that businesses and consumers fear. Addressing these concerns requires robust encryption, secure access controls, and compliance with data protection regulations.

- Initial Implementation Costs:

The upfront costs associated with implementing vehicle tracking systems pose a notable challenge, particularly for small and medium-sized enterprises (SMEs). The investment required to acquire and install the necessary hardware and software can be a significant barrier to entry. Overcoming this challenge involves exploring cost-effective solutions, creating financial incentives for adoption, and educating businesses about the long-term benefits and cost savings associated with VTS, such as improved operational efficiency, fuel savings, and enhanced security.

Segments Insights

By Vehicle Type Insights

Passenger vehicles are the dominant category, largely due to the rising consumer interest in vehicle security, anti-theft systems, and parental tracking applications. Automakers are embedding trackers into premium car models, and aftermarket trackers are gaining popularity among owners of mid-range vehicles. For example, many urban car users install GPS trackers connected with mobile apps to monitor real-time movement or receive alerts during unauthorized use. Additionally, ridesharing and leasing firms extensively deploy VTS solutions for customer service and operational oversight.

Heavy commercial vehicles are emerging as the fastest-growing segment as logistics, mining, and construction industries realize the importance of asset monitoring and compliance. These vehicles, operating over long distances or under extreme conditions, require constant tracking to prevent misuse and ensure optimal performance. For instance, fuel theft in cross-border trucking and unmonitored overtime in heavy-duty machinery has led operators to adopt robust VTS hardware and behavior monitoring software. Advanced systems are now integrated with load sensors and route optimization tools, ensuring efficient fleet utilization.

By End-use Insights

Transportation and logistics dominate the end-use landscape, leveraging VTS for fleet optimization, driver accountability, fuel monitoring, and timely deliveries. Third-party logistics (3PL) providers and supply chain firms rely on tracking systems to improve customer satisfaction and reduce delays. For example, Amazon and UPS have deployed sophisticated VTS across their delivery networks to enable package traceability and ensure route efficiency.

The construction and manufacturing sector is the fastest-growing end-user segment. Companies are integrating VTS with heavy equipment to track usage hours, reduce idle time, and prevent unauthorized operations. Additionally, vehicle tracking helps with billing accuracy, job-site coordination, and fuel efficiency in massive infrastructure projects. For instance, Caterpillar’s "VisionLink" software offers real-time equipment tracking and predictive maintenance solutions to construction firms operating large machinery fleets.

By Type Insights

Active tracking systems dominate the market due to their ability to provide real-time location updates, route deviation alerts, and live vehicle status. Active systems are crucial in mission-critical applications such as emergency response, police patrols, and perishable goods transportation. The ability to send instant notifications, generate real-time dashboards, and integrate with control centers gives active tracking a distinct advantage in commercial and regulatory environments.

Passive systems are growing among cost-sensitive users, particularly small fleet operators or personal car owners who don't require real-time data. These systems store route, speed, and stop data, which can be downloaded later for analysis. Although lacking in immediacy, passive tracking offers affordability and simplicity, especially in educational institutions or leasing agencies looking for retrospective usage reports rather than live tracking.

By Component Insights

Hardware dominated the component segment, primarily driven by the deployment of OBD devices and standalone trackers in large-scale fleets and personal vehicles. These devices enable real-time location tracking, engine diagnostics, and theft recovery solutions. OBD trackers, for instance, plug into a vehicle’s diagnostic port and offer seamless installation for individual users and small fleets. Meanwhile, advanced trackers are preferred in commercial fleets for features like geofencing, fuel usage monitoring, and 3D accelerometers. Their demand is surging in logistics and delivery applications where precision and durability are paramount.

Software is the fastest-growing component segment, fueled by the rise of cloud platforms, mobile apps, and AI-driven analytics. Performance management modules are helping fleet operators monitor driver efficiency, reduce idling time, and optimize fuel consumption. Additionally, fleet analytics and reporting tools are becoming essential for real-time decision-making and compliance documentation. Driver behavior monitoring tools that analyze braking patterns, speeding, and fatigue indicators are gaining popularity, especially in regions with high road accident rates. As companies shift toward data-driven operations, software will play a central role in enabling smart fleet ecosystems.

By Regional Insights

North America, particularly the United States, dominates the global vehicle tracking system market, owing to its advanced telematics infrastructure, strict fleet regulations, and high penetration of connected vehicles. The region boasts well-established players like Verizon Connect, Geotab, and Trimble, offering comprehensive tracking solutions across transportation, emergency services, and retail delivery networks. The adoption of autonomous delivery vans and AI-based logistics tracking platforms further strengthens North America's lead. Government regulations such as the ELD mandate and vehicle inspection laws push commercial operators to invest in sophisticated VTS platforms for legal and operational compliance.

Asia-Pacific is witnessing explosive growth in the VTS market, driven by booming e-commerce, expanding transportation networks, and digital transformation in emerging economies like India, Indonesia, and Vietnam. In India, for instance, the government has mandated tracking systems in all commercial vehicles, while local startups like LocoNav and Fleetx are offering AI-driven fleet management tools at affordable prices. China, being the world's largest vehicle manufacturer, is embedding tracking and diagnostics in vehicles as part of its smart mobility vision. With rising demand from smart cities, infrastructure development, and logistics startups, APAC is set to outpace other regions in growth.

Recent Developments

- In April 2023, iTecknologi Group joined forces with Vehari Police to introduce Advanced Vehicle Tracking Services to enhance the safety and monitoring of the police fleet. This collaboration will provide real-time tracking capabilities, enabling the police to have up-to-date information about the location of their vehicles.

- In January 2023, West Bengal Chief Minister inaugurated a new system in Kolkata. The system aims to bring significant benefits to the transportation sector in the state. In its first phase, approximately 160,000 vehicles will be covered under this initiative. The inauguration of this system marks a significant step towards enhancing the efficiency and effectiveness of transportation in West Bengal.

- In August 2022, ineedatracker.com partnered with Global Telemetrics. This collaboration marks a significant transition for ineedatracker.com as it moves from its current position as a retailer to a provider of monitored vehicle tracking syst

Some of the prominent players in the vehicle tracking system market include:

- Verizon

- Geotab Inc.

- TomTom International BV.

- CalAmp

- TELTONIKA

- ORBCOMM

- Sensata Technologies Inc.

- Laipac Technology Inc.

- CompTrackimo9

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global vehicle tracking system market.

Component

-

- OBD Device/Tracker and Advance Tracker

- Standalone Tracker

-

- Performance Management

- Vehicle Diagnostics

- Fleet Analytics & Reporting

- Driver behavior Monitoring

- Others

Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Technology

- GPS/Satellite

- GPRS/Cellular Network

- Dual Mode

Type

End Use

- Transportation & Logistic

- Construction & Manufacturing

- Aviation

- Retail

- Government & Defense

- Other

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)