Veterinary Oncology Market Size and Research

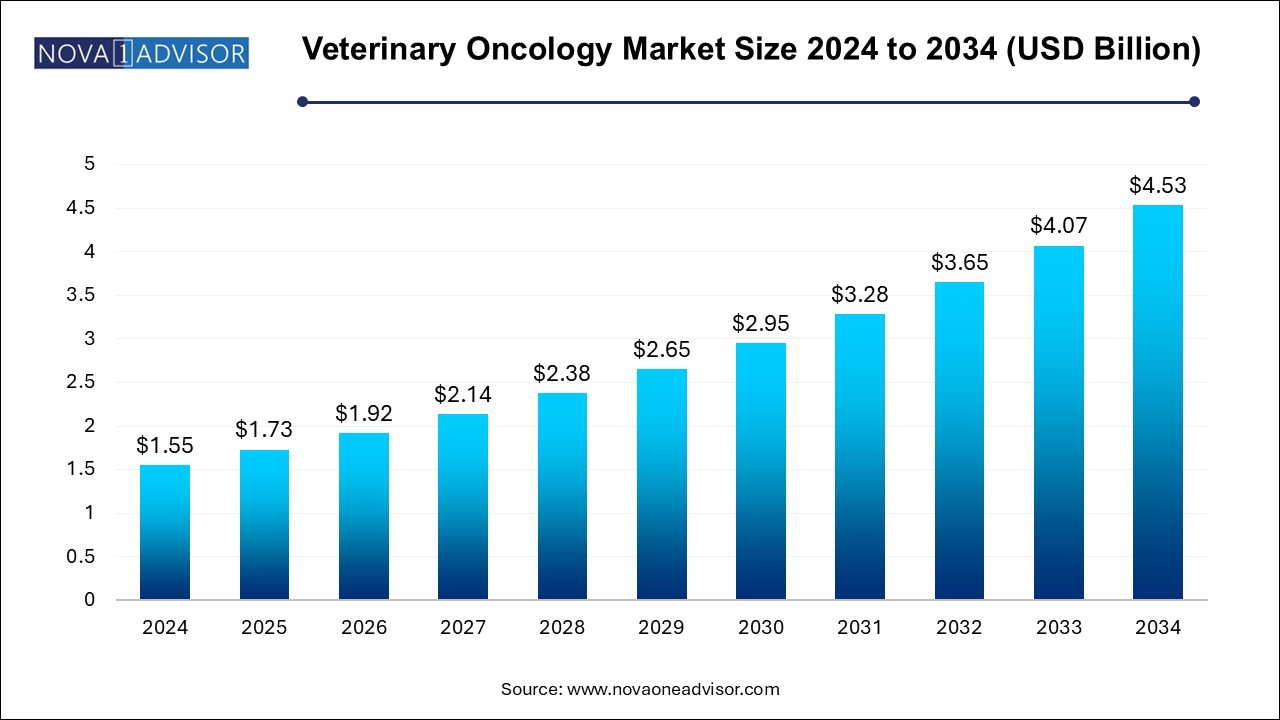

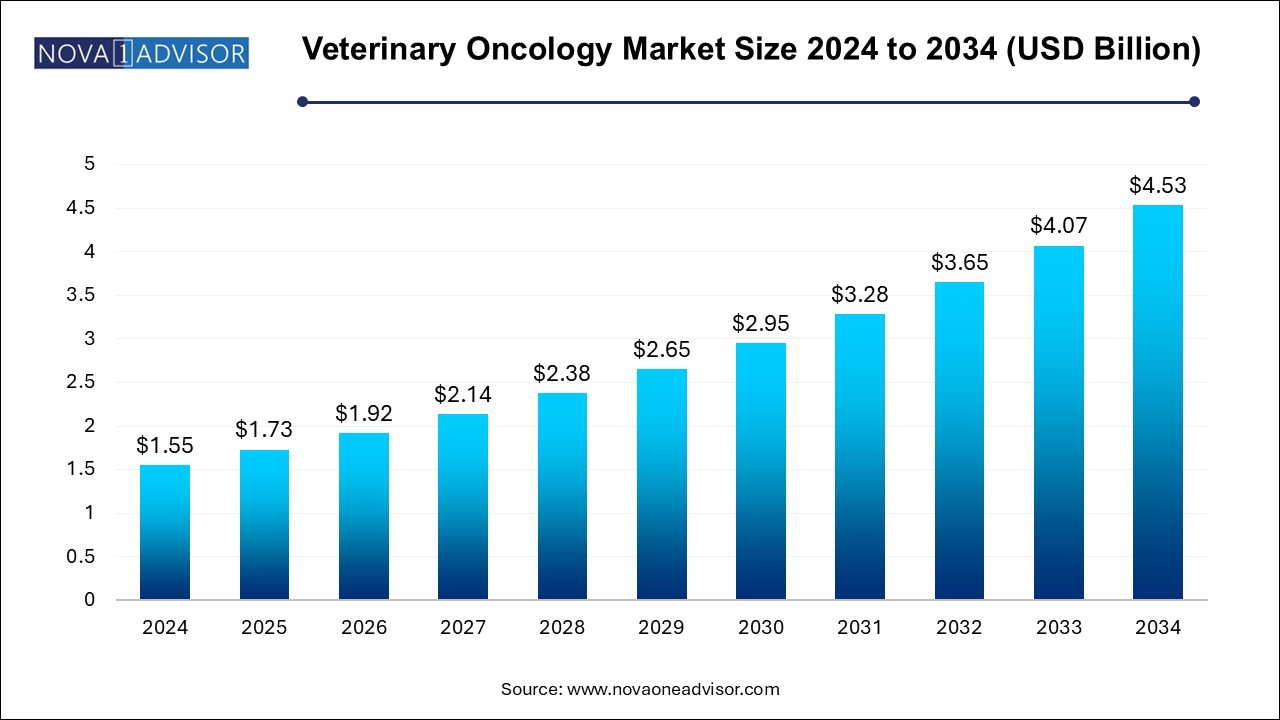

The veterinary oncology market size was exhibited at USD 1.55 billion in 2024 and is projected to hit around USD 4.53 billion by 2034, growing at a CAGR of 11.31% during the forecast period 2024 to 2034.

Veterinary Oncology Market Key Takeaways:

- North America dominated with a share of more than 45% in 2024.

- Based on therapy, the surgery segment dominated the market with a revenue share of over 36% in 2024.

- The immunotherapy segment is anticipated to witness the fastest CAGR over the forecast period.

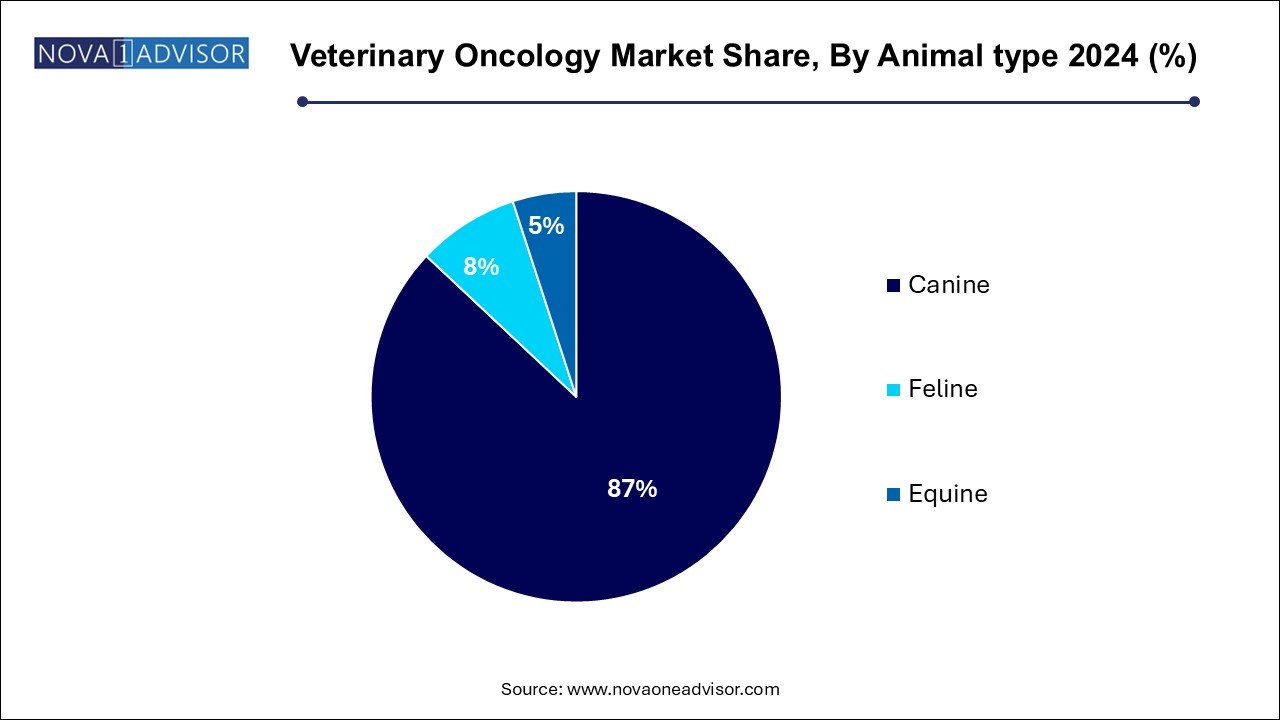

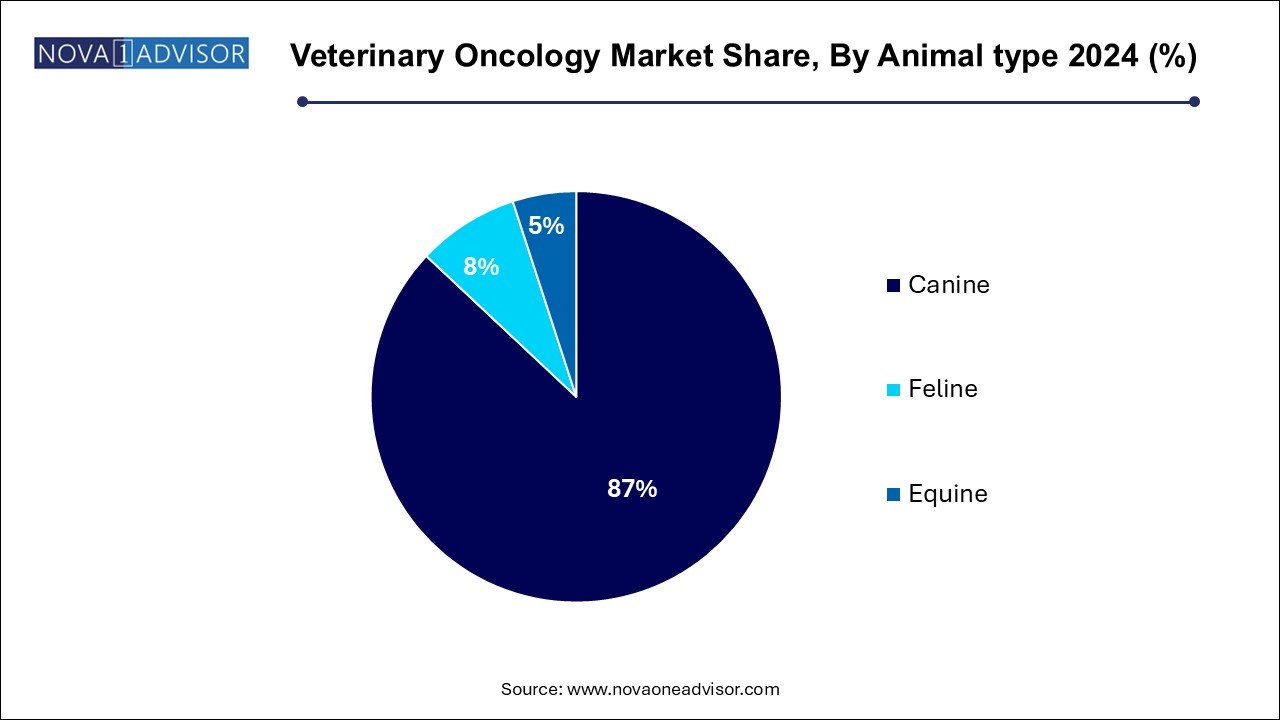

- The canine segment dominated the market with a revenue share of over 87.0% in 2024.

- Based on cancer, the skin cancers segment dominated the market with a revenue share of 39.1% in 2024.

- The other segment is estimated to grow at the fastest CAGR of 11.99% from 2024 to 2034.

Market Overview

The Veterinary Oncology Market represents a rapidly evolving field within veterinary medicine, emphasizing the diagnosis, treatment, and management of cancer in companion and livestock animals. As pets increasingly assume the role of family members, owners are willing to pursue advanced medical treatments, including oncology services, previously reserved for humans. Veterinary oncology encompasses several treatment modalities, such as chemotherapy, radiation therapy, immunotherapy, and surgical interventions, mirroring human oncology in both sophistication and innovation.

Cancer is one of the leading causes of death in pets, particularly in dogs and cats. According to the Veterinary Cancer Society, approximately 1 in 4 dogs will develop cancer at some stage, with almost 50% of dogs over the age of 10 affected. Feline cancers, although slightly less common, are often more aggressive. With the rising pet population, growing pet insurance coverage, and increasing pet healthcare spending, the veterinary oncology market has witnessed significant growth.

The market is being driven by technological advancements in diagnostic imaging, radiation equipment, and molecular diagnostics tailored for animals. Furthermore, collaborations between veterinary oncologists and pharmaceutical companies have accelerated the development of novel oncology drugs and minimally invasive treatment options. As awareness continues to expand among pet owners, veterinary clinics, specialty hospitals, and research centers are enhancing their oncology service offerings to meet the rising demand.

Major Trends in the Market

-

Personalized Veterinary Oncology: Tailored cancer therapies based on the animal's genetics, lifestyle, and tumor type are gaining momentum.

-

Growth in Veterinary Clinical Trials: Increasing number of clinical studies aimed at developing new oncology treatments for pets.

-

Rise of Immunotherapy: The application of cancer vaccines and monoclonal antibodies for animal cancer treatment is expanding.

-

Teleoncology Services: Remote consultation services by veterinary oncologists for diagnosis and treatment planning are becoming popular.

-

Minimally Invasive Surgical Techniques: Use of laparoscopic and robotic-assisted surgeries in oncology interventions is growing.

-

Targeted Chemotherapy Approaches: More precise chemotherapy regimens are being developed to minimize systemic toxicity in pets.

-

Expanding Use of Advanced Imaging: PET-CT, MRI, and digital radiography are becoming essential for early diagnosis and treatment planning.

-

Integration of Artificial Intelligence: AI algorithms are aiding in cancer diagnosis, staging, and even predicting treatment outcomes.

-

Veterinary-Specific Oncology Pharmaceuticals: Increasing focus by pharma companies on drugs developed specifically for animal physiology rather than repurposing human oncology drugs.

-

Holistic and Complementary Therapies: Interest in combining traditional oncology treatment with acupuncture, nutrition therapy, and herbal medicines for pets is rising.

Report Scope of Veterinary Oncology Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.73 Billion |

| Market Size by 2034 |

USD 4.53 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 11.31% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Therapy, Animal Type, Cancer Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

PetCure Oncology; Zoetis Inc.; Karyopharm Therapeutics, Inc.; Varian Medical Systems; Accuray Incorporated; Boehringer Ingelheim GmbH; Elanco; One Health; Regeneus Ltd. |

Key Market Driver: Rising Incidence of Cancer Among Companion Animals

A principal driver for the veterinary oncology market is the increasing prevalence of cancer among companion animals, particularly dogs and cats. As life expectancy for pets rises due to better nutrition, preventive care, and medical attention, age-related diseases such as cancer are becoming more common. Statistics show that about 50% of deaths in pets over the age of 10 are due to cancer.

This rising burden has prompted pet owners to seek advanced medical interventions for their pets, similar to treatments available for humans. The emotional bond between pet and owner drives the willingness to invest in costly therapies such as chemotherapy, radiotherapy, and even cutting-edge treatments like immunotherapy. Moreover, veterinary oncologists are expanding across both specialty clinics and university hospitals, improving accessibility and further encouraging pet owners to pursue aggressive cancer treatment options.

Key Market Restraint: High Cost of Oncology Treatments

Despite significant advances, the high cost associated with veterinary oncology treatments acts as a major restraint for the market. Oncology care for pets, particularly involving sophisticated interventions like radiation therapy or personalized chemotherapy, can cost thousands of dollars, often reaching up to $10,000–$15,000 for a full course of treatment.

While pet insurance is becoming more prevalent, coverage for oncology services remains variable and often inadequate to cover the entire expense. Many owners, especially in developing regions, find such treatments financially inaccessible. Additionally, the limited number of veterinary oncology specialists in certain areas restricts the reach of advanced services, making it difficult for rural and semi-urban pet owners to access comprehensive cancer care for their animals.

Key Market Opportunity: Expansion of Immuno-oncology for Pets

The emerging field of veterinary immuno-oncology presents a substantial growth opportunity for the market. Immunotherapies harness the animal's own immune system to fight cancer, offering a more targeted and potentially less toxic alternative to traditional therapies. Canine melanoma vaccines (such as Oncept, the first approved cancer vaccine for dogs) have opened the door for future research and product development in this domain.

Companies and research institutes are now investing in developing new monoclonal antibodies, cancer vaccines, and immune checkpoint inhibitors specifically for veterinary use. As clinical efficacy data accumulates and regulatory pathways for veterinary biologics become more established, immuno-oncology is poised to revolutionize cancer care in veterinary medicine. Owners looking for treatments with fewer side effects and improved outcomes are likely to drive demand for these innovative therapies.

Veterinary Oncology Market By Therapy Insights

Chemotherapy remained the dominant therapy segment in 2024. Chemotherapy remains a cornerstone in veterinary oncology treatment protocols, particularly for systemic cancers such as lymphomas and leukemias. It is preferred due to its ability to treat widespread disease and improve survival outcomes. Veterinary oncologists customize chemotherapy regimens to minimize side effects, making it more acceptable to pet owners. Additionally, the introduction of veterinary-specific chemotherapy drugs, lower toxicity regimens, and outpatient treatment models have supported the dominance of this segment.

Immunotherapy is projected to be the fastest-growing therapy segment. Immunotherapy is transforming the oncology landscape by offering treatments that stimulate the animal’s immune system to target and destroy cancer cells. Vaccines like Merial’s Oncept for canine melanoma and various clinical trials exploring new vaccine candidates and immune checkpoint inhibitors are reshaping expectations. Pet owners are increasingly leaning toward therapies that offer fewer side effects and potentially longer remissions, making immunotherapy an exciting and fast-expanding domain within veterinary oncology.

Veterinary Oncology Market By Animal type Insights

Canine segment dominated the veterinary oncology market in 2024. Dogs are more prone to developing various forms of cancer compared to other domestic animals. Studies show that approximately 25–30% of all dogs will develop some form of cancer during their lifetime. Canine cancers, such as lymphomas, mast cell tumors, and osteosarcomas, are commonly diagnosed, leading to a high demand for specialized oncology services. Additionally, the extensive availability of clinical trials, specialized drugs, and targeted therapies tailored for canine physiology has contributed to this segment’s dominance. Veterinary clinics often have greater experience treating canine oncology cases, thus enhancing diagnosis rates and treatment accessibility.

The feline segment is expected to grow at the fastest rate during the forecast period. Although cancer is slightly less prevalent in cats than dogs, feline cancers such as lymphoma, squamous cell carcinoma, and mammary gland tumors tend to be more aggressive. Recent advances in feline-specific diagnostic tools and treatment regimens, along with growing awareness among cat owners about preventive care, are propelling market growth. With the development of feline-specific oncology therapies and increasing participation of cats in veterinary clinical trials, this segment is poised for significant expansion in the coming years.

Veterinary Oncology Market By Cancer type Insights

Lymphomas dominated the cancer type segment in 2024. Lymphoma is one of the most commonly diagnosed cancers in both dogs and cats, often presenting in multicentric, gastrointestinal, or mediastinal forms. Its prevalence, coupled with the availability of relatively effective chemotherapy protocols that can induce remission, has ensured the dominance of this cancer type within the veterinary oncology landscape. Clinics and research centers focus heavily on lymphoma treatment models due to predictable disease progression and treatment responses.

Skin cancers are projected to witness the highest growth rate during the forecast period. Increasing exposure of pets to ultraviolet radiation, along with genetic predispositions, is driving the incidence of skin cancers, including melanomas and squamous cell carcinomas. Improved awareness about skin health in pets, coupled with advancements in diagnostic imaging and biopsy technologies, is resulting in earlier detection rates. Furthermore, the development of topical immunotherapies and surgical techniques is expanding the treatment options available for pet owners.

Veterinary Oncology Market By Regional Insights

North America, particularly the United States, has dominated the veterinary oncology market, accounting for the largest share in 2024. The region’s strong pet adoption rates, high per capita pet healthcare spending, and extensive network of veterinary specialty hospitals are major contributing factors. Moreover, the presence of leading veterinary oncology associations, such as the Veterinary Cancer Society, and active clinical trial ecosystems provide an environment conducive to innovation and adoption. Insurance coverage for pets, although not universal, is growing, further supporting market expansion. Advanced diagnostic imaging centers, oncology-specific veterinary practices, and public awareness campaigns have cemented North America's leadership position.

Asia Pacific is anticipated to register the fastest growth in the veterinary oncology market during the forecast period. Rising pet ownership, increasing disposable incomes, and changing cultural attitudes toward pet health are key drivers. Countries like Japan, Australia, China, and South Korea are witnessing a surge in pet humanization trends. Pet owners are seeking advanced healthcare services, including oncology treatments, for their companion animals. Additionally, governments and private players are investing in veterinary infrastructure, specialty clinics, and veterinary education. With an increasing number of international veterinary oncology conferences being held in the region, awareness and expertise are growing, positioning Asia Pacific as a burgeoning hotspot for veterinary cancer care.

Some of the prominent players in the veterinary oncology market include:

- PetCure Oncology

- Zoetis

- Karyopharm Therapeutics, Inc.

- Varian Medical Systems

- Accuray Incorporated

- Boehringer Ingelheim GmbH

- Elanco

- One Health

- Regeneus Ltd.

Veterinary Oncology Market Recent Developments

-

March 2025 – Elanco Animal Health announced a collaboration with a leading veterinary oncology research center to develop a novel immunotherapy for canine lymphomas, aiming for clinical trials by 2026.

-

January 2025 – Zoetis launched "OncoVet Diagnostics," a specialized division focused on early cancer detection assays for pets, initially rolled out in North America and Europe.

-

October 2024 – Veterinary Cancer Group, one of the largest veterinary oncology specialty practices in the U.S., opened a new state-of-the-art facility in Texas with advanced radiation therapy capabilities.

-

August 2024 – Anivive Lifesciences received conditional FDA approval for a new oncology drug aimed at treating canine mast cell tumors.

-

May 2024 – Merial (Boehringer Ingelheim Animal Health) expanded the availability of its Oncept vaccine for canine melanoma to key markets in Asia Pacific.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the veterinary oncology market

Animal type

Therapy

- Radiotherapy

- Surgery

- Chemotherapy

- Immunotherapy

- Other Therapies

Cancer Type

- Skin Cancers

- Lymphomas

- Sarcomas

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)