The global vitrectomy devices market size was exhibited at USD 1,037.50 million in 2023 and is projected to hit around USD 1,929.32 million by 2033, growing at a CAGR of 6.4% during the forecast period of 2024 to 2033.

.jpg)

Key Takeaways:

- The vitrectomy machines segment dominated the market and held the largest revenue share of 36.9% in 2023.

- The macular hole segment dominated the market and held the largest revenue share of 25.3% in 2023.

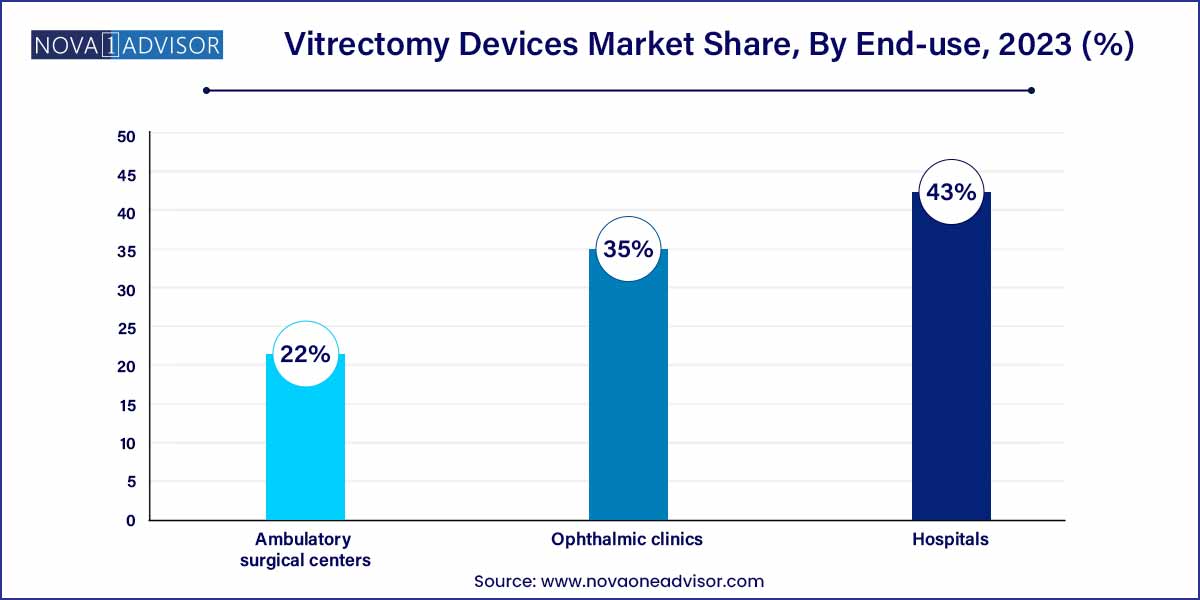

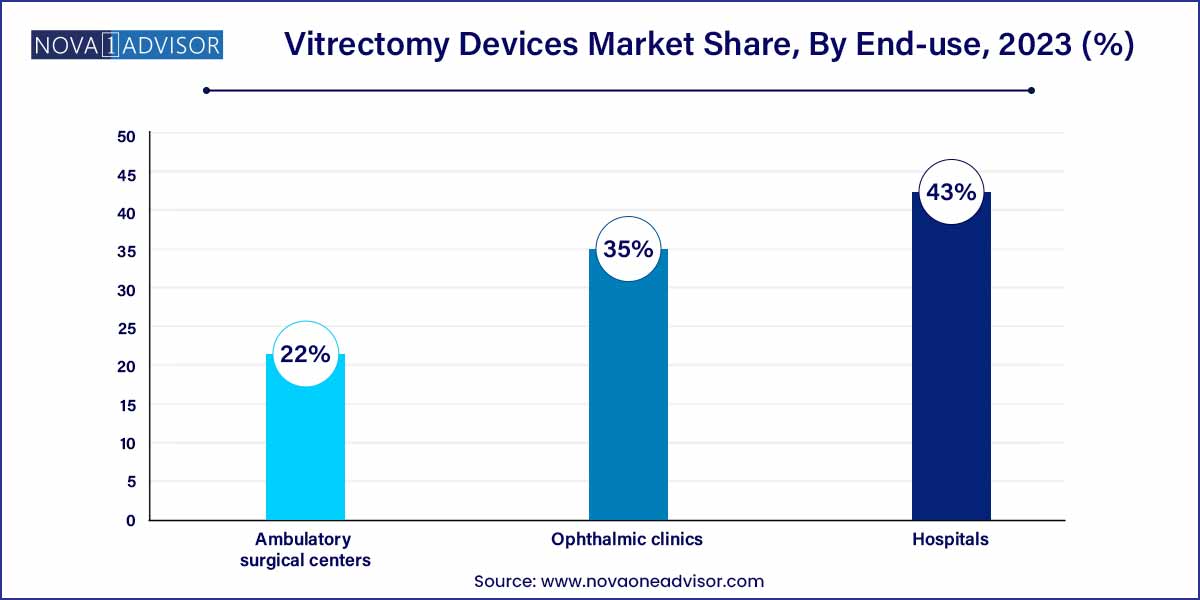

- The hospital segment dominated the market and held the largest revenue share of around 43.0% in 2023.

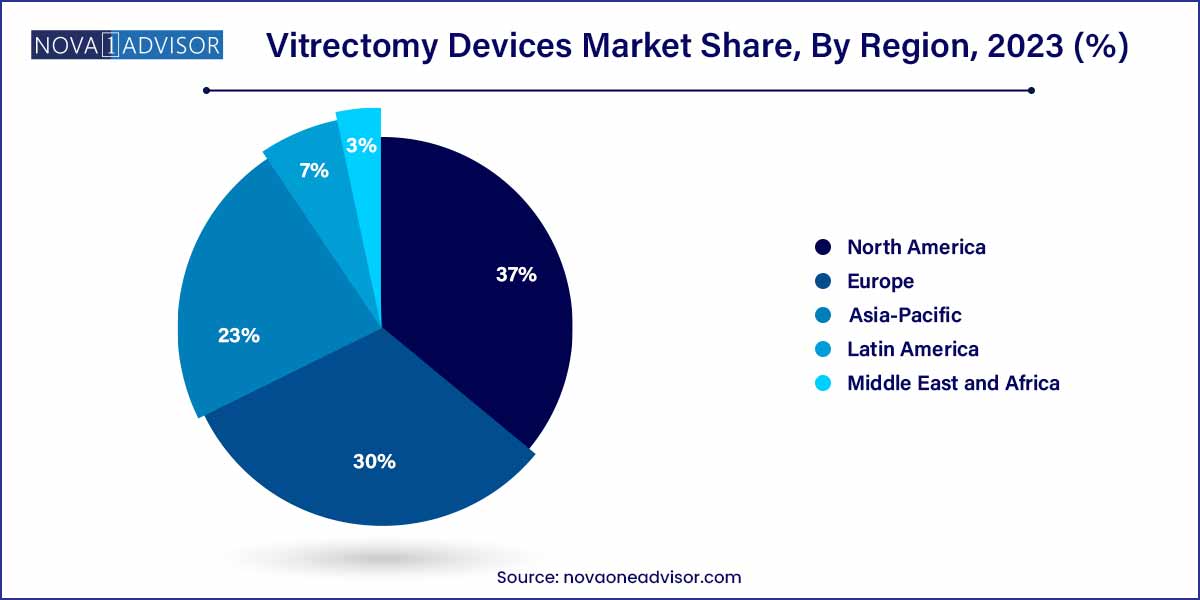

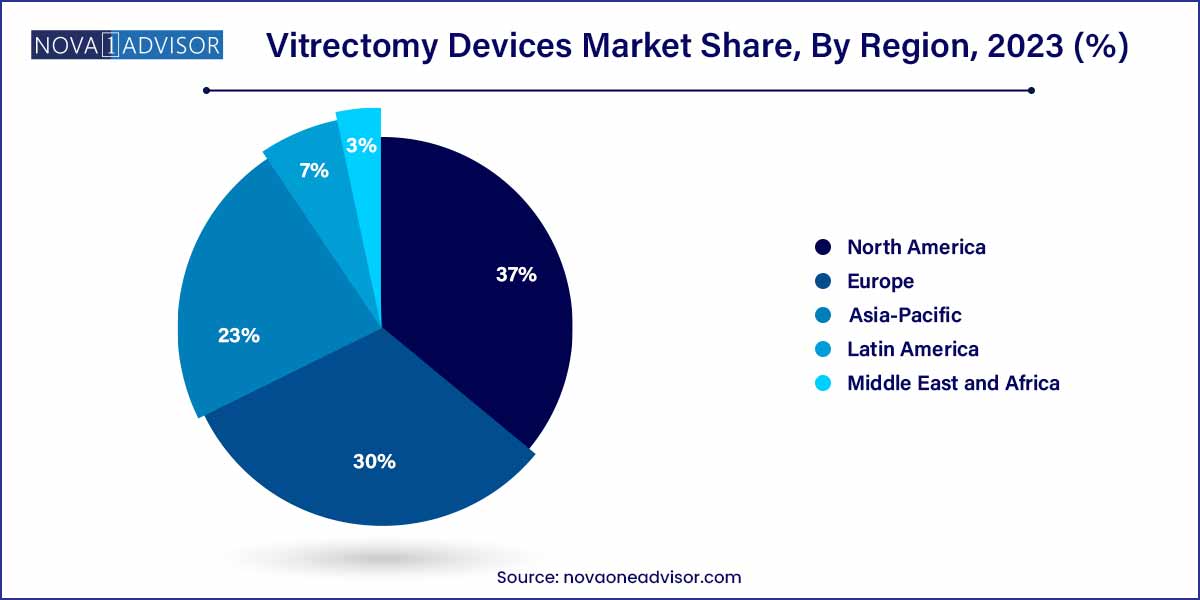

- North America dominated the market and accounted for the largest revenue share of 37.0% in 2023.

Market Overview

The vitrectomy devices market stands as a crucial pillar within the global ophthalmology landscape, driven by the growing incidence of retinal disorders and advances in minimally invasive surgical techniques. Vitrectomy is a surgical procedure that involves the removal of the vitreous humor from the eye, commonly performed to treat retinal detachment, diabetic retinopathy, macular holes, and vitreous hemorrhages. Over the past decade, technological innovations have transformed vitrectomy into a safer, faster, and more precise procedure, greatly enhancing patient outcomes and expanding treatment eligibility.

The demand for vitrectomy devices has surged as the global population ages and diabetes prevalence rises—both primary risk factors for retinal diseases. Additionally, improvements in vitrectomy machine design, the miniaturization of instruments, and the introduction of ultra-high-speed cutters have fueled market expansion. As awareness grows regarding early diagnosis and intervention for retinal diseases, ophthalmologists increasingly opt for vitrectomy to preserve vision and improve quality of life. Consequently, the market is poised for robust growth across diverse healthcare settings, from large hospitals to ambulatory surgical centers.

Major Trends in the Market

-

Adoption of small-gauge vitrectomy systems: 23-gauge, 25-gauge, and even 27-gauge vitrectomy instruments are gaining traction for their minimally invasive nature and faster recovery times.

-

Integration of intraoperative OCT (iOCT): Surgeons are increasingly using real-time imaging tools like iOCT to enhance visualization during vitrectomy procedures.

-

Expansion of multifunctional vitrectomy machines: Newer machines integrate vitrectomy, phacoemulsification, and illumination into one system, offering greater surgical efficiency.

-

Surge in diabetic-related retinal surgeries: Growing diabetic retinopathy and diabetic macular edema cases are creating substantial demand for vitrectomy interventions.

-

Technological innovation in illumination devices: The emergence of brighter, more focused, and safer light sources enhances surgical precision.

-

Growth of outpatient and ambulatory surgeries: The shift toward minimally invasive day surgeries boosts the adoption of portable and cost-effective vitrectomy systems.

-

Increasing preference for single-use vitrectomy packs: To minimize infection risks and enhance procedural efficiency, healthcare providers are shifting toward disposable vitrectomy consumables.

Vitrectomy Devices Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1,037.50 Million |

| Market Size by 2033 |

USD 1,929.32 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 6.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, End Use, And Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Alcon Inc.; Bausch & Lomb Incorporated; BVI; NIDEK CO., LTD.; Johnson & Johnson Vision Care, Inc.; Blink Medical; Topcon Corporation; Hoya Surgical Optics; Carl Zeiss Meditec AG. |

Product Insights

Vitrectomy machines dominated the product segment in 2024. Vitrectomy machines form the core of vitreoretinal surgeries, providing the essential functions of cutting, aspiration, and fluid management. Leading manufacturers have continually innovated to produce machines with faster cut rates, enhanced fluidics systems, and integrated visualization technologies. Brands like Alcon’s Constellation Vision System and Bausch + Lomb’s Stellaris Elite have set industry benchmarks, offering high-performance solutions for complex retinal procedures. Their pivotal role in every vitrectomy surgery cements their dominance in the market.

Illumination devices are expected to be the fastest-growing product segment. With improvements in endoilluminators and chandeliers, surgeons now have access to brighter and more focused intraocular lighting. Enhanced illumination directly impacts surgical visualization, critical for delicate retinal manipulations. As new light source technologies such as LED-based and laser-based systems continue to evolve, the demand for advanced illumination devices is anticipated to outpace other product categories, particularly in complex and minimally invasive vitrectomies.

Application Insights

Diabetic retinopathy dominated the application segment in 2024. Given the global diabetes epidemic, diabetic retinopathy has emerged as the leading cause of vision impairment requiring surgical intervention. Vitrectomy is commonly indicated for tractional retinal detachments, persistent vitreous hemorrhage, and proliferative diabetic retinopathy complications. Organizations like the American Diabetes Association have emphasized routine eye screenings, leading to early detection and timely surgical management.

Retinal detachment is poised to be the fastest-growing application segment. The rise in high myopia, trauma cases, and aging populations contributes to an increasing incidence of retinal detachment. Early vitrectomy intervention improves prognosis significantly, thereby propelling surgical volumes. Advances in tamponade agents, minimally invasive instruments, and surgical techniques further enhance outcomes, boosting the adoption of vitrectomy for retinal detachment repairs.

End-use Insights

Hospitals dominated the end-use segment in 2024. Hospitals house specialized ophthalmology departments capable of handling complex vitreoretinal surgeries, including trauma cases and urgent care scenarios. Their superior infrastructure, availability of multidisciplinary teams, and comprehensive post-operative care offerings make them the preferred choice for vitrectomy surgeries.

Ambulatory surgical centers are expected to be the fastest-growing end-use segment. With advancements in minimally invasive techniques and anesthesia practices, vitrectomy surgeries are increasingly being performed in outpatient settings. Ambulatory surgical centers offer cost-effective, efficient alternatives with shorter patient turnaround times. This trend aligns with healthcare systems' broader objective of reducing hospitalization costs while maintaining high-quality patient care.

Regional Insights

North America dominated the vitrectomy devices market in 2024. The region’s dominance stems from a combination of factors including a high prevalence of diabetes and age-related eye disorders, a technologically advanced healthcare system, and robust reimbursement structures. The United States, in particular, boasts a high density of trained retinal specialists and a strong pipeline of new device approvals by regulatory authorities such as the FDA. Furthermore, growing awareness about preventive eye care, coupled with increasing adoption of innovative technologies such as intraoperative OCT, fortifies North America's leadership position.

Asia-Pacific is projected to be the fastest-growing region. Rapid urbanization, aging populations, and rising diabetes prevalence are driving an increased burden of retinal diseases in countries like China, India, and Japan. However, limited access to advanced ophthalmic care has created substantial unmet needs. As healthcare infrastructure improves and awareness about diabetic eye disease and retinal health grows, demand for vitrectomy procedures is expected to surge. Government initiatives and private sector investments are further fueling the availability of cutting-edge surgical equipment across Asia-Pacific, stimulating remarkable market growth.

Some of the prominent players in the vitrectomy device market include:

- Alcon Inc.

- Bausch & Lomb Incorporated

- BVI

- NIDEK CO., LTD.

- Johnson & Johnson Vision Care, Inc.

- Blink Medical

- Topcon Corporation

- Carl Zeiss Meditec AG

- Hoya Surgical Optics

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global vitrectomy device market.

Product

- Vitrectomy machines

- Vitrectomy packs

- Photocoagulation lasers

- Illumination devices

Application

- Diabetic retinopathy

- Retinal detachment

- Macular hole

- Vitreous hemorrhage

- Others

End-use

- Hospitals

- Ophthalmic clinics

- Ambulatory surgical centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

.jpg)