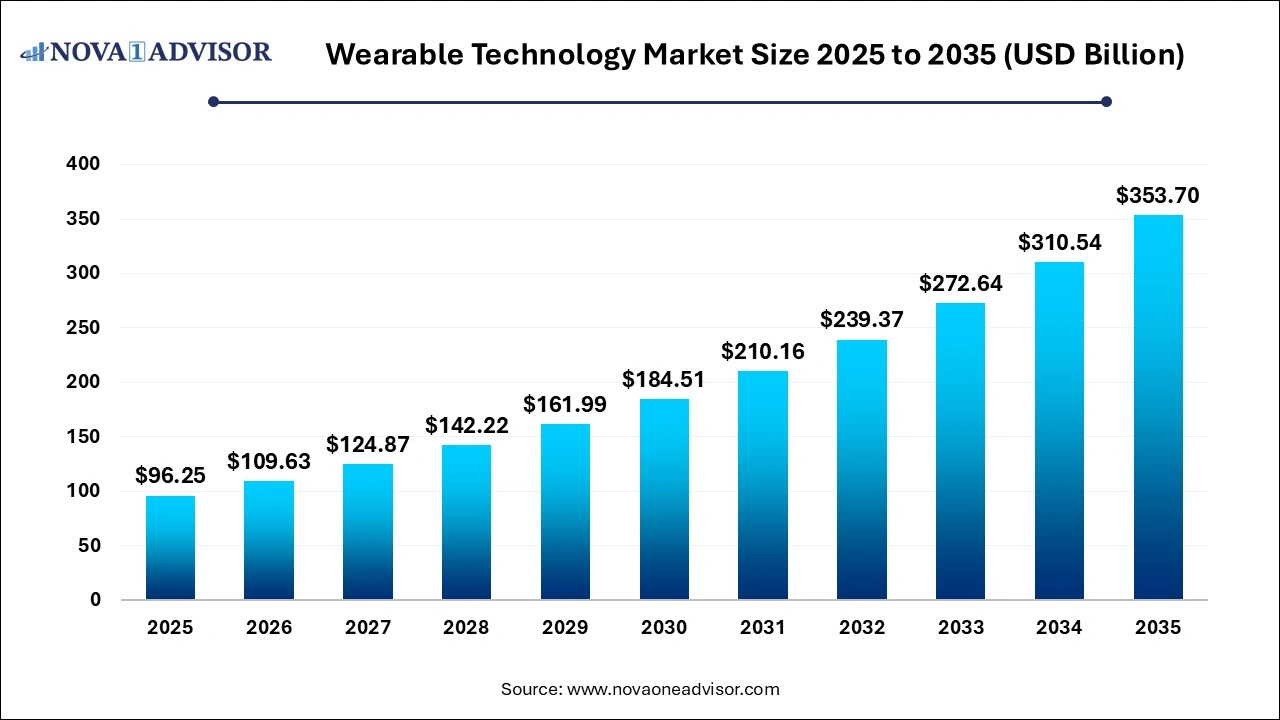

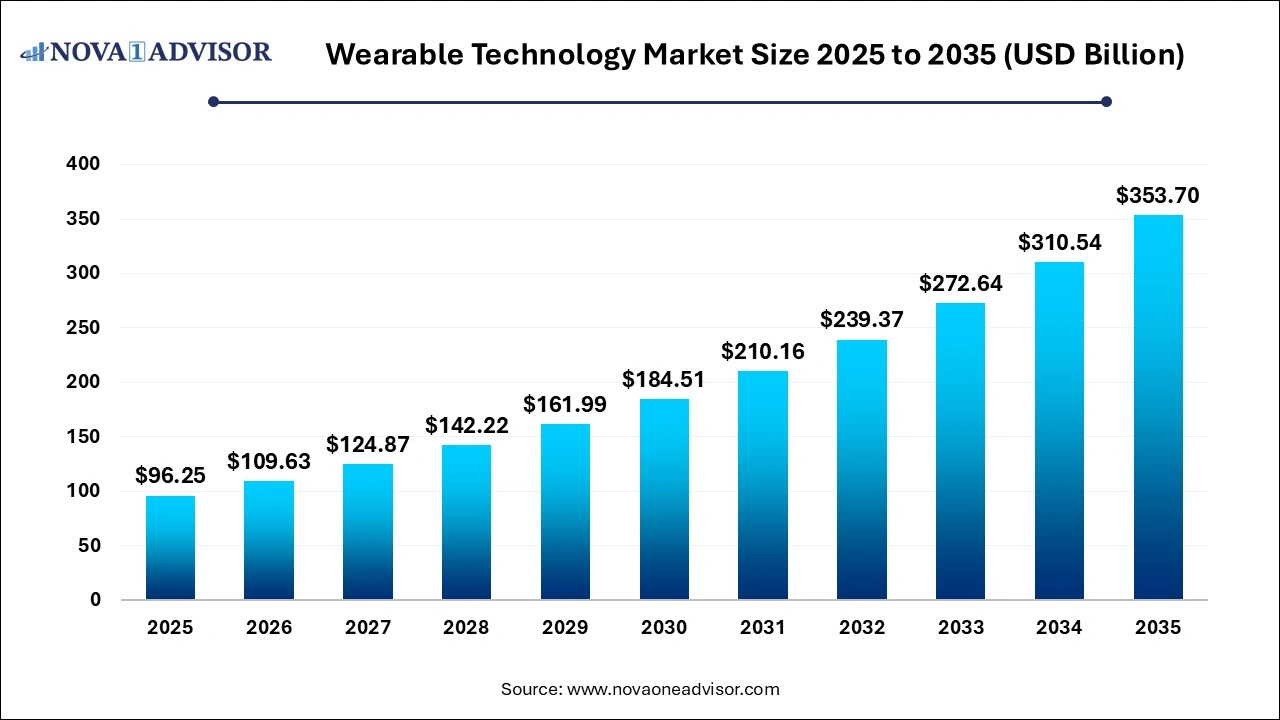

Wearable Technology Market Size and Growth

The wearable technology market size was exhibited at USD 96.25 billion in 2025 and is projected to hit around USD 353.70 billion by 2035, growing at a CAGR of 13.9% during the forecast period 2026 to 2035.

Wearable Technology Market Key Takeaways:

- The wrist-wear segment accounted for the largest revenue share of over 58% in 2025.

- The eyewear & headwear segment is expected to grow at a significant rate during the forecast period.

- The consumer electronics segment accounted for the largest revenue share of 50.0% in 2025

- The healthcare segment is expected to grow at a significant rate during the forecast period.

- North America wearable technology industry held the major revenue share of over 35.0% of the wearable technology market in 2025.

Market Overview

The Wearable Technology Market has emerged as one of the most dynamic sectors in the digital transformation landscape, integrating sensors, software, and connectivity into everyday apparel and accessories. Once limited to fitness bands and smartwatches, the category has now expanded to include smart eyewear, connected footwear, body-worn cameras, and textile-integrated sensors. Wearables are no longer just accessories they are becoming essential tools for health monitoring, communication, navigation, and immersive experiences.

Growth in this market is propelled by increasing consumer awareness, technological advancements in miniaturization and sensor efficiency, and the broader shift towards health and wellness. The pandemic catalyzed a wave of demand for non-invasive health monitoring devices, leading to broader adoption of smartwatches capable of tracking oxygen levels, ECG, and even stress. Furthermore, enterprise applications—particularly in manufacturing, logistics, and defense—have introduced ruggedized wearable platforms that enhance safety and operational efficiency.

As 5G, AI, and edge computing mature, wearables are evolving into highly contextual, intelligent systems. They are now capable of real-time data analysis, personalized feedback, and integration into broader Internet of Things (IoT) environments. With applications ranging from augmented reality (AR)-based remote collaboration to remote patient monitoring and biometric security, the future of wearables is both expansive and embedded into our daily digital fabric.

Major Trends in the Market

-

Integration of Health Diagnostics: Continuous glucose monitoring, ECG tracking, and blood pressure analysis are now key smartwatch features.

-

Growth of AR/VR Headsets: Wearables like Meta Quest and Microsoft HoloLens are powering immersive training, gaming, and industrial visualization.

-

Smart Apparel Expansion: Textile-based sensors are gaining traction in sports, rehabilitation, and military applications.

-

Enterprise Adoption of Wearables: Smart glasses and wearable scanners are increasingly used in warehouses, field service, and manufacturing lines.

-

Battery and Power Innovations: Flexible batteries, solar charging, and energy harvesting are extending wearables’ operational life.

-

AI and On-Device Processing: Real-time decision-making is enabled via AI chips embedded in smartwatches and glasses.

-

Fashion-Tech Collaborations: Partnerships between tech firms and fashion brands are driving adoption through appealing design aesthetics.

Report Scope of Wearable Technology Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 109.63 Billion |

| Market Size by 2035 |

USD 353.70 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 13.9% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, Application, Region |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Google LLC; Apple Inc.; adidas AG.; Garmin Ltd.; Huawei Technologies Co., Ltd.; Nike, Inc.; Samsung Electronics Co., Ltd.; Sony Corporation; Xiaomi; Imagine Marketing Ltd. |

Market Driver: Consumer Shift Toward Preventive Healthcare and Fitness

One of the most powerful drivers of the wearable technology market is the consumer shift toward preventive healthcare and fitness. With rising awareness of chronic diseases such as diabetes, hypertension, and cardiovascular conditions, individuals are increasingly relying on wearables to monitor vital signs and physical activity. The ability to track metrics like heart rate, sleep patterns, blood oxygen levels, and stress is helping consumers proactively manage health and detect issues early.

Smartwatches from companies like Apple, Fitbit, and Garmin now offer features traditionally limited to clinical environments—such as ECG tracking and fall detection empowering users to take control of their wellbeing. Additionally, integration with mobile apps and cloud platforms allows seamless sharing of health data with physicians, enhancing continuity of care and supporting remote healthcare models.

Market Restraint: Concerns over Data Privacy and Device Accuracy

Despite its growth trajectory, the market is held back by persistent concerns over data privacy, security, and device accuracy. Wearables collect vast amounts of sensitive personal health and behavioral data, often without clear transparency on how that data is stored, processed, or shared. Consumers remain wary of potential misuse, especially when device data is linked to insurance decisions or employer monitoring.

Additionally, while wearable sensors have improved significantly, questions about clinical-grade accuracy persist, especially in non-laboratory settings. Discrepancies in step counts, heart rate variability, or blood oxygen saturation can undermine user trust. Without regulatory oversight or standardized performance benchmarks, some products may fail to meet user expectations, hindering wider adoption among risk-averse demographics.

Market Opportunity: Rise of Enterprise and Industrial Wearables

A major opportunity in this market lies in the rapid expansion of wearable adoption across enterprise and industrial sectors. From logistics workers using wrist-mounted barcode scanners to remote field technicians equipped with AR headsets for diagnostics, enterprises are leveraging wearables to improve safety, reduce errors, and boost productivity.

Smart helmet in construction, biometric wearables in defense, and exoskeletons for industrial lifting tasks are examples of enterprise use cases gaining traction. With 5G enabling low-latency video streaming and real-time analytics, wearables are becoming crucial components of digital workflows. As companies invest in digital twins and augmented maintenance, enterprise wearables offer a high-return growth segment.

Wearable Technology Market By Product Insights

Wrist-wear devices dominate the market, led by the widespread adoption of smartwatches and fitness bands. These devices combine health tracking, notifications, and increasingly sophisticated computing capabilities. Products like the Apple Watch Series 9, Fitbit Charge 6, and Samsung Galaxy Watch are integrated with ECG, sleep monitoring, fall detection, and contactless payment. Their affordability and convenience drive their popularity among a broad demographic.

Eyewear & headwear are the fastest-growing product segment, thanks to the rise of AR/VR headsets in both consumer and industrial settings. Devices like Meta Quest, Microsoft HoloLens, and Sony PlayStation VR2 are transforming gaming, remote collaboration, and medical training. The enterprise adoption of smart glasses in warehouses and telehealth further supports this segment’s expansion. Continued investment in lightweight optics, gesture control, and mixed reality content will accelerate market penetration.

Wearable Technology Market By Application Insights

Consumer electronics remain the largest application segment, with wearables serving lifestyle, entertainment, and wellness needs. From fitness trackers and audio wearables to smart rings and smart clothing, consumer adoption is driven by usability, brand loyalty, and design innovation. Companies also compete through ecosystem integration, with wearables syncing with phones, TVs, and smart home devices.

Healthcare is the fastest-growing application, accelerated by the rise of remote patient monitoring and personalized medicine. Wearables are used to manage chronic diseases, detect arrhythmias, and track rehabilitation progress. Clinical trials increasingly include wearable-generated metrics as endpoints. The growing need for cost-effective, scalable healthcare monitoring—especially for aging populations makes this a high-potential area for innovation and commercialization.

Wearable Technology Market By Regional Insights

North America leads the wearable technology market, driven by high consumer purchasing power, tech-savvy populations, and the presence of major players like Apple, Fitbit (Google), and Garmin. The U.S. has strong healthcare infrastructure integration, with many health insurers incentivizing wearable use for chronic disease management. Corporate wellness programs also promote wearable adoption for employee health tracking.

Moreover, robust venture capital support and strong IP protection encourage R&D and startup innovation. The region also benefits from advanced retail and e-commerce infrastructure, which boosts access and distribution of the latest wearable tech across diverse user segments.

Asia Pacific is the fastest-growing region, due to rising disposable incomes, tech innovation hubs, and mass smartphone adoption. China and India are key markets where local players like Huawei, Xiaomi, and Noise offer competitively priced wearables with increasingly advanced features. The region’s large millennial population is a significant driver of fitness and wellness-oriented wearables.

Japan and South Korea are also strong contributors, with investment in AR wearables, robotics, and aging population health solutions. Local innovation, government health initiatives, and rising health awareness are expected to fuel exponential growth, particularly in healthcare and enterprise applications.

Some of the prominent players in the wearable technology market include:

Wearable Technology Market Recent Developments

-

March 2025: Apple launched the Apple Watch Series 10, featuring a non-invasive glucose sensor and upgraded AI for mental health tracking.

-

February 2025: Meta unveiled the Quest Pro 2 AR headset targeting both enterprise collaboration and consumer gaming, with support for spatial computing.

-

January 2025: Xiaomi released its Smart Band 9 Pro, integrating NFC, ECG, and sleep apnea detection, targeted at emerging markets.

-

December 2024: Garmin announced a partnership with the Mayo Clinic to pilot its smartwatch as a remote cardiac monitoring tool for heart patients.

-

November 2024: Google added skin temperature and stress analysis to the Fitbit platform, powered by new AI algorithms.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the wearable technology market

By Product

- Wrist-Wear

- Eyewear & Headwear

- Footwear

- Neckwear

- Body-wear

- Others

By Application

- Consumer Electronics

- Healthcare

- Enterprise & Industrial Applications

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)