Wide Field Imaging Devices Market Size and Trends

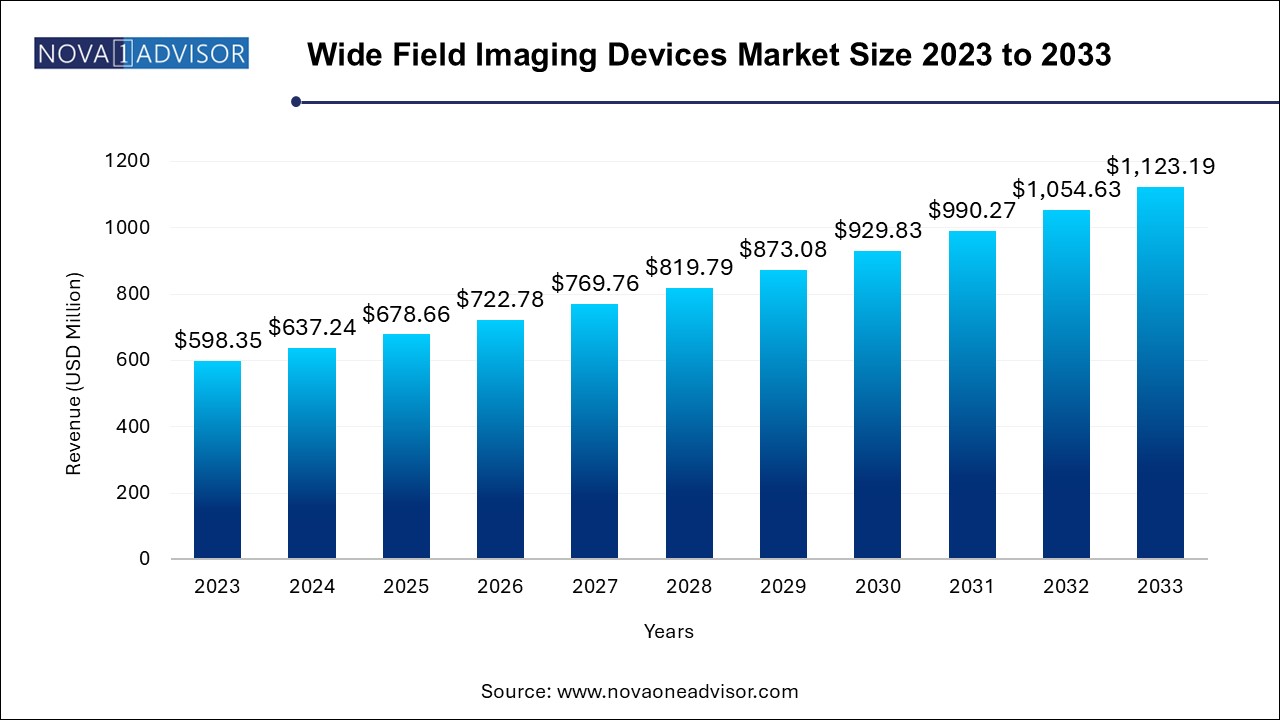

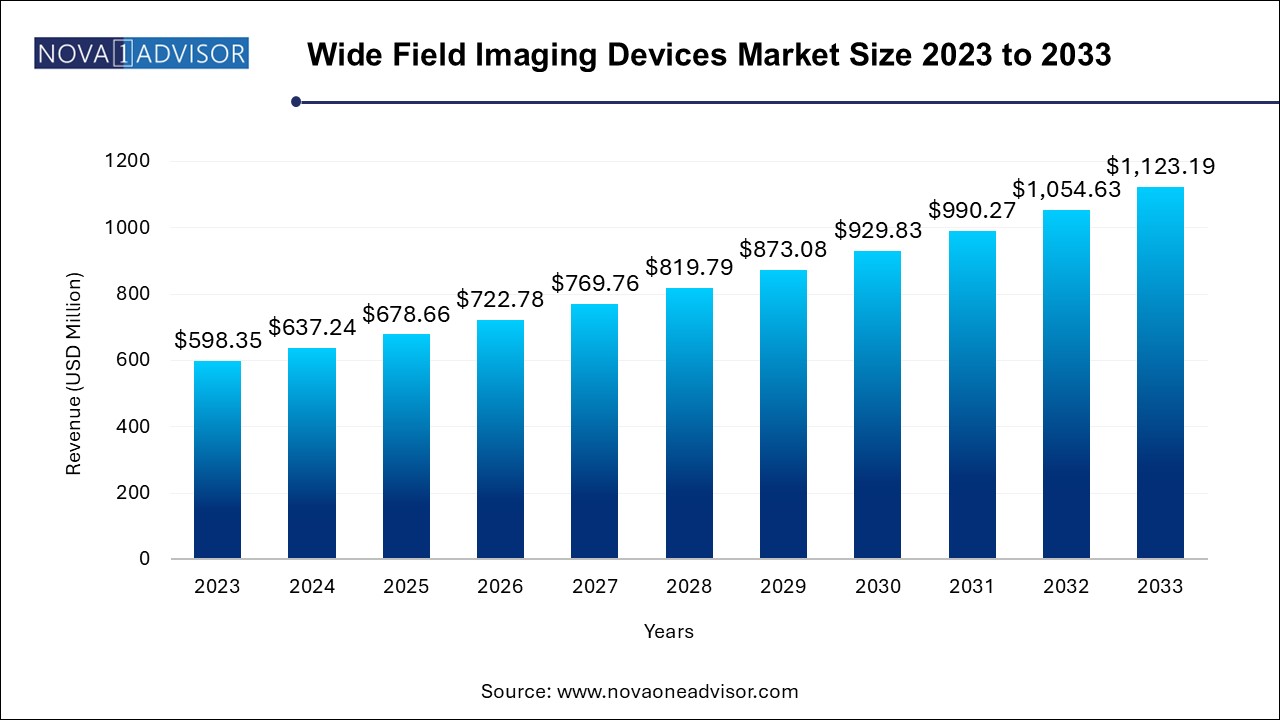

The wide field imaging devices market size was exhibited at USD 598.35 million in 2023 and is projected to hit around USD 1123.19 million by 2033, growing at a CAGR of 6.5% during the forecast period 2024 to 2033.

Wide Field Imaging Devices Market Key Takeaways:

- The diabetic retinopathy segment held the largest share of 25.2% in 2023 and is expected to grow at the fastest rate.

- The Retinopathy of Prematurity (ROP) segment is expected to experience a significant CAGR from 2024 to 2033.

- Tabletop wide field imaging devices held the largest share in 2023.

- Hand-held wide imaging devices are anticipated to experience a noteworthy CAGR during the forecast period.

- The hospitals segment held the largest share in 2023.

- The specialty clinics segment is projected to grow at the fastest CAGR from 2024 to 2033.

- North America held a significant revenue share in 2023.

Market Overview

The Global Wide Field Imaging (WFI) Devices Market is emerging as a critical frontier in ophthalmic diagnostics, particularly in addressing the increasing burden of retinal diseases. Wide field imaging devices are designed to capture high-resolution images of up to 200° of the retina in a single capture, providing a broader and more comprehensive view than traditional fundus cameras. This extended view of the retinal periphery allows for earlier detection and more accurate management of a wide spectrum of retinal and choroidal pathologies, making them indispensable in modern ophthalmology.

The growing prevalence of diabetic retinopathy, age-related macular degeneration, and other chronic ocular diseases is a significant driver of market growth. With an aging global population and the escalation of diabetes and hypertension, the demand for advanced retinal screening and imaging modalities is escalating at a rapid pace. In addition, the WFI market is experiencing a surge in technological innovation, where devices are being enhanced with features like ultra-widefield angiography, autofluorescence, and AI-driven diagnostic support.

These devices are not only confined to hospital settings but are increasingly penetrating specialty clinics and ambulatory surgical centers due to their ease of use, portability (in the case of hand-held models), and fast diagnostic output. As healthcare delivery becomes more patient-centric and preventive, the role of retinal imaging in systemic disease screening is expanding, opening new opportunities across both developed and developing economies.

Major Trends in the Market

-

Integration of Artificial Intelligence in Imaging: AI-powered algorithms are being embedded into WFI devices to assist in automated detection of retinal lesions and disease classification, improving diagnostic efficiency.

-

Rising Adoption of Hand-held Devices: Portable wide field imaging devices are gaining momentum, especially in rural and outreach programs where traditional tabletop models are impractical.

-

Increasing Use in Pediatrics and Neonatal Care: Wide field imaging for retinopathy of prematurity (ROP) is growing, driven by the need for non-invasive, rapid, and child-friendly diagnostic solutions.

-

Hybrid Imaging Platforms: Devices are being developed to combine fluorescein angiography, optical coherence tomography (OCT), and WFI capabilities into one system to support comprehensive diagnostics.

-

Shift Toward Outpatient and Specialty Clinics: The decentralization of eye care services is leading to greater procurement of compact and cost-effective WFI devices by clinics and ASCs.

-

Growing Role in Systemic Disease Management: Beyond ocular diseases, WFI is being used as a biomarker tool for cardiovascular, neurological, and metabolic disorders.

-

Software Upgrades and Cloud Integration: Real-time image sharing, storage, and teleophthalmology platforms are being integrated with WFI systems to enable remote consultation and long-term patient monitoring.

Report Scope of Wide Field Imaging Devices Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 637.24 Million |

| Market Size by 2033 |

USD 1123.19 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 6.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Application, Modality, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Key Companies Profiled |

Heidelberg Engineering Inc.; Optos; Carl Zeiss Meditec AG; iCare (CENTERVUE S.P.A.); Clarity Medical; MEDIBELL MEDICAL VISION TECHNOLOGIES LTD; Forus Health Pvt Ltd; oDocs Eye Care; Phoenix MICRON (Phoenix Technology Group, LLC); Epipole Ltd. |

Market Driver: Rising Prevalence of Retinal Diseases Globally

A key driver accelerating the wide field imaging devices market is the exponential increase in the global incidence of retinal diseases. Conditions such as diabetic retinopathy (DR), retinal vein occlusion (RVO), uveitis, and choroidal melanoma are becoming more common, particularly among the elderly and individuals with chronic systemic conditions. For instance, according to the International Diabetes Federation, over 530 million people worldwide are living with diabetes in 2024, a figure projected to grow significantly by 2040. Diabetic retinopathy affects nearly one-third of these individuals, making early and accurate screening vital.

Wide field imaging devices have demonstrated superior capability in detecting peripheral retinal lesions associated with DR and RVO, which traditional imaging methods may miss. Their ability to perform ultra-widefield fluorescein angiography helps visualize ischemic zones and neovascularization, enabling timely intervention. In tertiary care and community ophthalmology settings, the deployment of these systems is improving clinical outcomes, reducing vision loss, and facilitating mass screening programs.

Market Restraint: High Cost of Devices and Limited Reimbursement Coverage

Despite the clinical benefits, the high acquisition and operational costs of wide field imaging devices remain a significant challenge for many healthcare providers. These devices, especially those with integrated angiography or multimodal imaging capabilities, can cost anywhere between USD 50,000 to USD 150,000. For smaller clinics and healthcare systems in low-income countries, such capital expenditure is often unfeasible without government grants or partnerships.

In addition, reimbursement coverage for advanced retinal imaging procedures is not uniform across countries. In several developing markets, wide field imaging is still considered an advanced diagnostic and is not reimbursed under standard health insurance schemes, leading to out-of-pocket costs for patients. This restricts access and adoption, particularly in regions where the burden of retinal disease is ironically the highest.

Market Opportunity: Expansion of Teleophthalmology and Remote Diagnostics

The rapid rise of telemedicine is creating an exciting opportunity for the wide field imaging devices market. The COVID-19 pandemic demonstrated the value of remote diagnostic capabilities, prompting investments in teleophthalmology infrastructure across both public and private sectors. WFI devices, particularly portable and hand-held models, are being adapted for remote capture and cloud-based image transfer, enabling consultations between rural health centers and urban specialists.

For instance, in India, projects like the Aravind Eye Care tele-screening program have incorporated wide field imaging to reach underserved communities, screening thousands for diabetic retinopathy and other retinal disorders without requiring hospital visits. Similarly, in sub-Saharan Africa, NGOs are deploying solar-powered hand-held imaging units for neonatal ROP diagnosis in remote clinics. This trend, if supported by regulatory frameworks and digital health policies, has the potential to bridge healthcare disparities while simultaneously boosting market penetration.

Wide Field Imaging Devices Market By Application Insights

Diabetic Retinopathy (DR) remains the dominant application segment in the global wide field imaging devices market. The growing number of diabetes cases globally, particularly in Asia Pacific and North America, has heightened the need for annual retinal screenings. WFI devices offer the advantage of detecting peripheral ischemia, microaneurysms, and early neovascularization that traditional narrow-field systems may miss. The integration of ultra-widefield fluorescein angiography further enhances their value in DR management, as seen in large-scale screening programs in the U.S. and the U.K.

Conversely, uveitis is emerging as the fastest-growing application segment. This is due to increasing awareness and diagnosis of posterior uveitis, which often involves the peripheral retina and can be difficult to monitor with standard imaging. WFI enables comprehensive documentation of inflammation, chorioretinal lesions, and vasculitis. Moreover, with autoimmune diseases on the rise globally, especially in young adults, there is increasing clinical focus on early diagnosis of uveitis, further propelling demand for wide field retinal imaging in specialty ophthalmology centers.

Wide Field Imaging Devices Market By Modality Insights

Tabletop wide field imaging devices have long held the lion’s share in terms of revenue and installations. These systems, such as those from Optos and Zeiss, are standard in ophthalmology clinics and hospitals, offering high-resolution images, built-in angiography modules, and compatibility with electronic health records (EHR). Their stable platform allows for consistent image capture and ease of use during routine patient flow in busy practices. Furthermore, their integration with AI-based software for DR and AMD screening has increased their value proposition in developed markets.

On the other hand, hand-held WFI devices are experiencing the fastest growth due to their portability and increasing demand in remote screening and neonatal applications. Devices like RetCam are specifically designed for pediatric and infant imaging, such as diagnosing retinopathy of prematurity (ROP) in NICUs. NGOs and mobile eye clinics in Africa, Southeast Asia, and Latin America are also increasingly adopting these solutions. Their ability to capture quality images in non-traditional settings, coupled with reduced costs, is opening the market to new segments of users.

Wide Field Imaging Devices Market By End Use Insights

Hospitals continue to dominate the end-use landscape for wide field imaging devices due to their role as primary centers for comprehensive eye care, especially in tertiary settings. Hospitals often handle high volumes of complex cases such as retinal detachments, ROP, and uveitis. Their ability to afford high-end multimodal WFI systems and hire trained ophthalmologists positions them as major buyers. Additionally, these institutions frequently participate in research and clinical trials requiring advanced imaging technologies, further reinforcing their dominance.

Specialty clinics, however, are the fastest growing end-use segment. The trend toward decentralization of diagnostic services and the rise in private ophthalmology chains are driving this growth. In developed economies, many patients now prefer the convenience and speed of outpatient specialty clinics for routine eye checks, cataract assessments, and diabetic retinopathy screening. These clinics are investing in compact, AI-ready tabletop and hand-held devices to offer comprehensive services, driving a shift in market dynamics toward outpatient and ambulatory settings.

Wide Field Imaging Devices Market By Regional Insights

North America, led by the United States, dominates the global WFI devices market. This leadership is attributed to high awareness, routine screening programs for diabetic retinopathy, and extensive reimbursement coverage. Institutions like the American Academy of Ophthalmology (AAO) have long advocated for annual retinal screenings, which has led to widespread integration of WFI into ophthalmology practices. Additionally, leading manufacturers like Optos, ZEISS, and Eyenuk are headquartered or operate heavily in the U.S., ensuring steady product availability and innovation.

Clinical research and trials conducted in North America often require advanced imaging protocols, further boosting demand. Furthermore, Medicare and Medicaid programs, along with private insurers, frequently reimburse for wide field imaging, particularly for diabetic and pediatric populations. This policy landscape facilitates the adoption of high-end systems even among mid-sized practices.

Asia Pacific is witnessing the fastest market expansion due to growing diabetic populations, expanding healthcare access, and increasing government initiatives in eye care. Countries like India and China are particularly noteworthy for their sheer patient volumes. In India, public-private partnerships like the National Programme for Control of Blindness (NPCB) are integrating wide field imaging for early DR detection. Similarly, China’s Healthy China 2030 plan prioritizes chronic disease prevention, leading to investments in ophthalmology infrastructure.

Private hospital chains in the region are also investing in modern diagnostic tools to cater to urban populations. Meanwhile, teleophthalmology programs in rural and semi-urban regions are relying on hand-held WFI devices to reach underserved communities. As regional awareness grows and economic barriers reduce, Asia Pacific is expected to become a major growth engine for the industry over the next decade.

Some of the prominent players in the wide field imaging devices market include:

Wide Field Imaging Devices Market Recent Developments

-

March 2025: Optos announced the release of its Silverstone 2.0 device featuring ultra-widefield OCT capabilities and integrated AI-based lesion recognition.

-

January 2025: Phoenix Technology Group launched an upgraded version of the RetCam Envision system, enhancing image quality for neonatal and pediatric applications.

-

October 2024: ZEISS introduced a partnership with Eyenuk to embed AI diabetic retinopathy screening software into its Clarus WFI devices, aiming to support primary eye care providers.

-

August 2024: CenterVue received CE mark for its Eidon Smart UWF, a compact device designed for small clinics and telemedicine hubs in Europe and Asia.

-

May 2024: Nidek Co., Ltd. expanded its footprint in Southeast Asia by opening a dedicated WFI training and demo center in Kuala Lumpur, Malaysia.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the wide field imaging devices market

Application

- Diabetic Retinopathy

- Retinopathy Of Prematurity

- Choroidal Melanoma

- Retinal Vein Occlusion

- Hemoglobinopathy

- Uveitis

- Others

Modality

End-use

- Specialty Clinics

- Hospitals

- Ambulatory Surgical Centers

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)