Women’s Health App Market Size and Growth

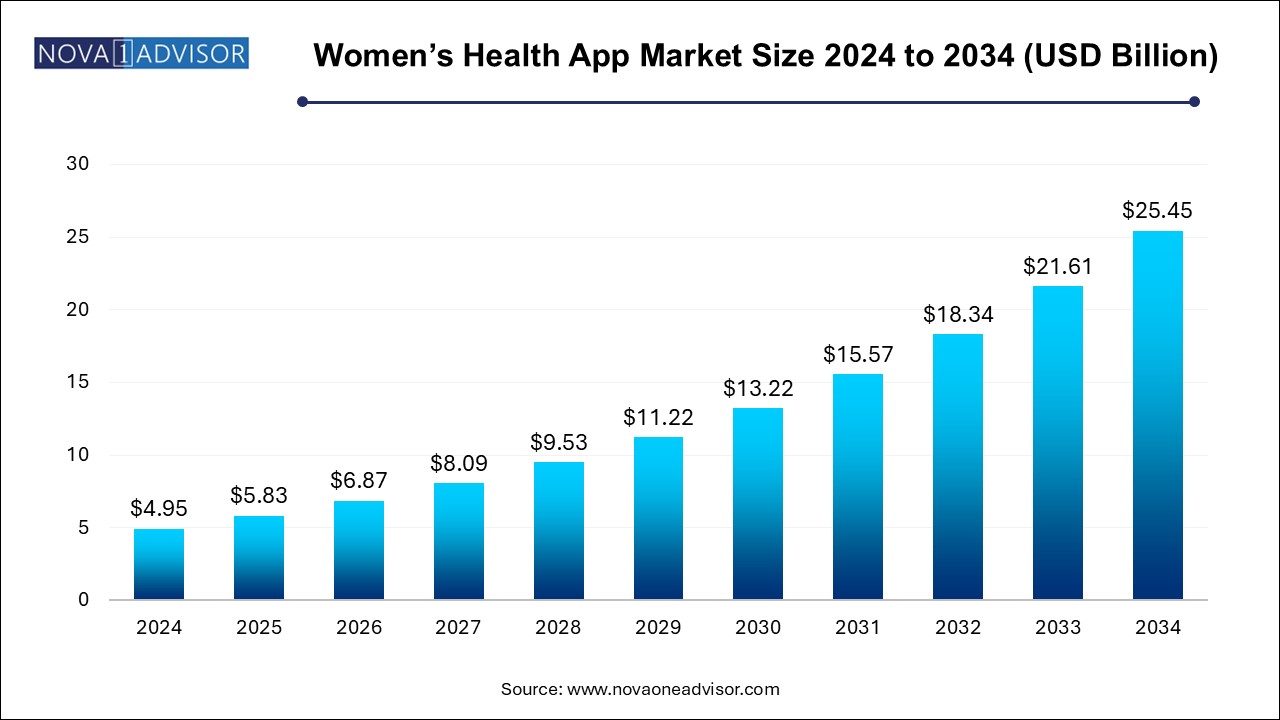

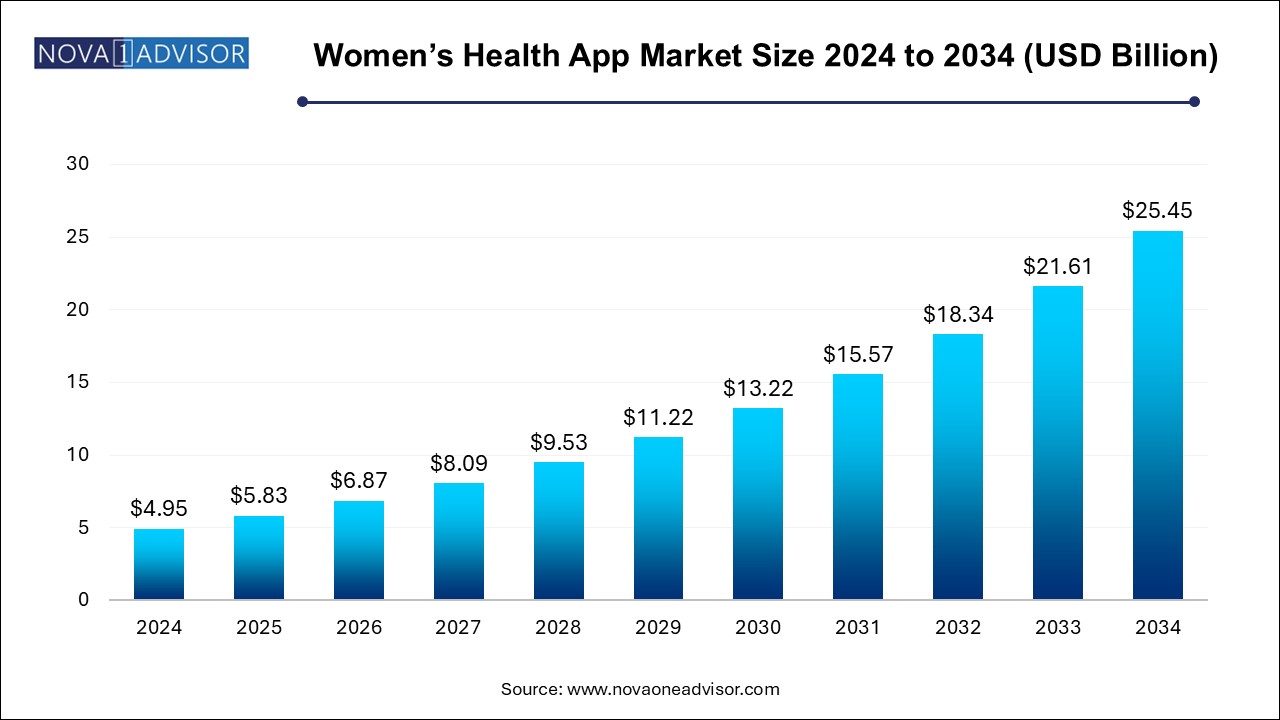

The women’s health app market size was exhibited at USD 4.95 billion in 2024 and is projected to hit around USD 25.45 billion by 2034, growing at a CAGR of 17.79% during the forecast period 2025 to 2034. The growth of the women’s health app market can be linked to the increased awareness of issue’s related to women’s health, growing demand for personalized treatment strategies and rising penetration of smartphones.

Women’s Health App Market Key Takeaways:

- Based on type, the menstrual health segment led the market with the largest revenue share of 37.68% in 2024.

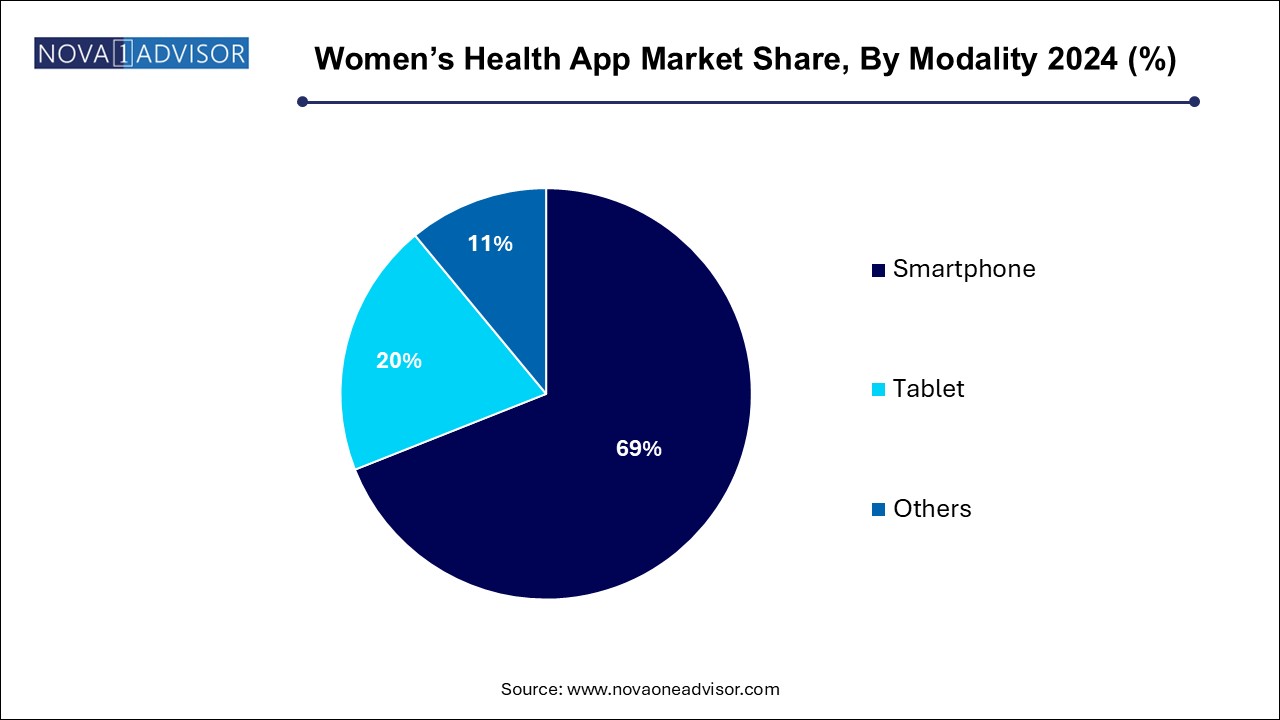

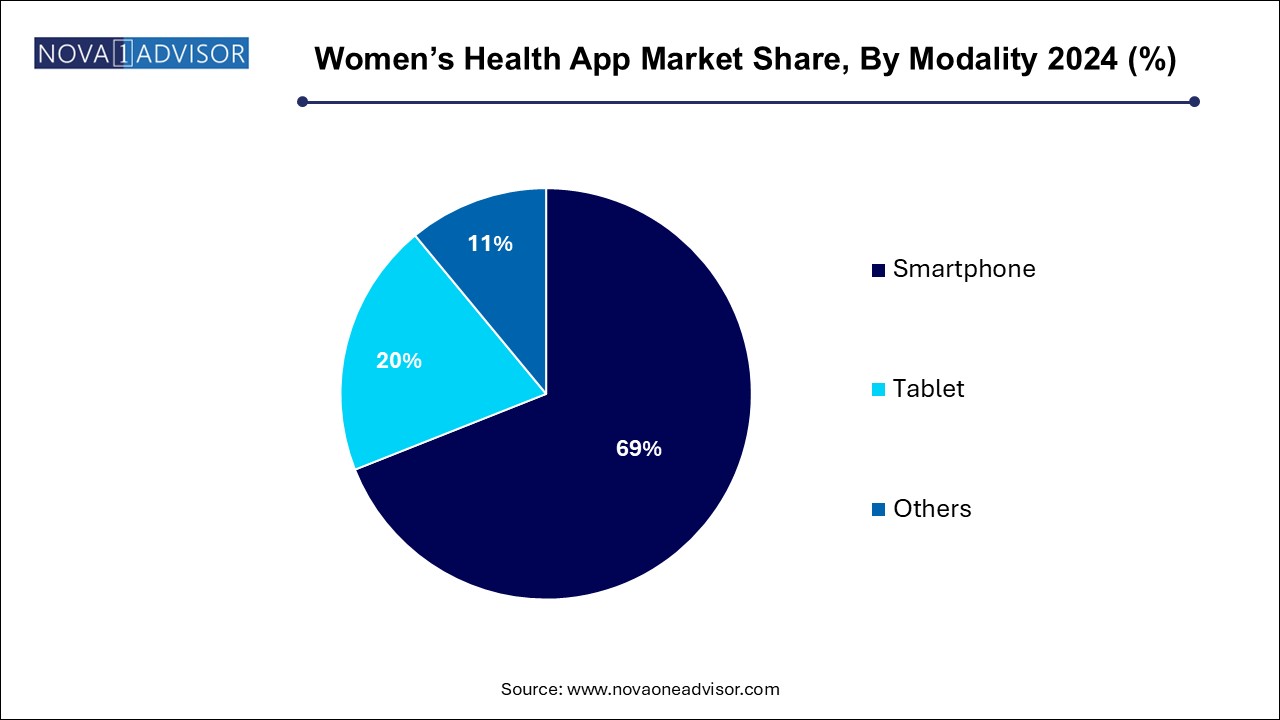

- Based on modality, the smartphone segment led the market with the largest revenue share of 69.0% in 2024.

- North America dominated the women’s health app market with the largest revenue share of 37.66% in 2024.

Market Overview

The Women’s Health App Market has emerged as a vital component of the broader digital health ecosystem, reflecting a powerful intersection of technology, wellness, and female-centric medical care. These mobile applications cater specifically to the health needs of women across different stages of life—from adolescence and fertility planning to pregnancy, postpartum, menopause, and chronic disease management. The proliferation of smartphones, rising health consciousness among women, and a growing emphasis on personalized healthcare are fueling the popularity of these apps globally.

Women's health apps serve diverse functions, such as menstrual cycle tracking, ovulation prediction, fitness monitoring, nutrition counseling, mental health support, pregnancy guidance, menopause symptom management, and chronic disease monitoring (such as PCOS, osteoporosis, and breast cancer). What sets this market apart is its deep engagement with users—offering real-time feedback, daily health reminders, and data integration with wearables like smartwatches and fitness bands.

Global healthcare systems are increasingly turning to preventive care models, where these apps play a pivotal role in collecting real-world data, facilitating early diagnosis, and supporting behavioral change. The ability of these apps to provide accessible, affordable, and user-centric care has made them especially valuable in underserved regions with limited access to gynecological care.

Several global events have also impacted market growth. The COVID-19 pandemic heightened awareness of remote health monitoring, leading to a surge in downloads and subscriptions of digital health tools. In parallel, social movements advocating for women’s health equity and mental well-being have empowered app developers to design inclusive platforms that address intersectional health needs.

The market is also attracting attention from healthcare providers, insurance companies, and pharmaceutical companies, as women's health apps evolve into platforms for patient engagement, medication adherence, clinical trial recruitment, and digital therapeutics. As the femtech industry matures, the Women’s Health App Market is expected to witness robust double-digit growth, revolutionizing how women interact with healthcare systems globally.

Major Trends in the Market

-

Rise of integrated platforms combining multiple features such as cycle tracking, mental health, fertility, and menopause management into a single app ecosystem.

-

Increased adoption of AI and machine learning for personalized insights, symptom prediction, and risk assessment based on user data.

-

Growing demand for data privacy and compliance with regulations like GDPR and HIPAA, leading to transparent data handling and user-controlled permissions.

-

Expansion of app-based telehealth services allowing women to consult healthcare professionals directly through in-app video calls or chats.

-

Emergence of culturally tailored health apps addressing the unique needs of women in different regions, ethnicities, and age groups.

-

Integration with wearable tech and IoT devices for real-time biometric monitoring and menstrual cycle-related biomarker analysis.

-

Focus on underserved segments such as menopause support, postpartum mental health, and chronic reproductive diseases.

-

Gamification of fitness and nutrition modules to enhance user engagement and adherence to wellness programs.

-

Growing investment from venture capital firms into femtech startups focusing on data-driven, user-centric women's health platforms.

Report Scope of Women’s Health App Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 5.83 Billion |

| Market Size by 2034 |

USD 25.45 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 17.79% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Modality, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Flo Health, Inc.; Clue; Apple Inc.; Glow, Inc.; Withings; Google, Inc.; Natural Cycles USA Corp; Wildflower Health; HelloBaby, Inc.; Ovia Health |

Key Market Driver: Increasing Awareness and Engagement in Women's Preventive Health

A primary driver for the Women’s Health App Market is the rising global awareness of preventive healthcare among women, particularly concerning reproductive health, hormonal balance, and chronic disease management. Historically, women’s health issues have been underdiagnosed and undertreated, especially in areas like endometriosis, PCOS, perimenopause, and postpartum depression. With greater access to smartphones and growing societal discourse on health equity, women are actively seeking tools that help them monitor and manage their well-being.

Health apps empower users to track menstrual cycles, detect irregularities, manage stress, and access evidence-based educational content. For example, apps like Clue, Flo, and Glow have popularized fertility tracking with smart notifications and data-driven insights. Furthermore, young women are increasingly adopting digital wellness tools to understand their bodies, reduce stigma around menstruation, and plan pregnancies. These behavioral shifts are not only boosting app downloads but also promoting long-term user retention, thereby driving steady market expansion.

Key Market Restraint: Data Privacy and Ethical Concerns

While women’s health apps offer immense potential, data privacy and security remain a significant restraint for market growth. These applications often collect sensitive personal health information, including menstrual cycles, sexual activity, pregnancy status, and emotional health metrics. Breaches or misuse of this data can have severe repercussions, particularly in regions where reproductive rights are under scrutiny or legally restricted.

Recent controversies involving unauthorized data sharing with third-party advertisers have raised alarms. As a result, many users are now more cautious about granting app permissions. Regulatory bodies are enforcing stricter guidelines, but discrepancies in international privacy laws create additional compliance burdens for developers. Building trust through transparent data practices, end-to-end encryption, and user-controlled consent models is now crucial for sustaining market credibility.

Key Market Opportunity: Expansion into Menopause and Midlife Health Management

An emerging opportunity within the market is the growing demand for menopause-related health management tools. While menstruation and fertility have traditionally been the focus of women’s health apps, the midlife and menopause phase has long been underserved. However, this is changing rapidly. Globally, over 1 billion women are expected to be in menopause by 2025, many of whom are seeking support for symptoms like hot flashes, mood swings, sleep disturbances, and hormonal changes.

Several startups and femtech innovators are addressing this gap with apps designed for peri-menopausal and post-menopausal women. These platforms offer personalized content, hormonal tracking, symptom journals, dietary tips, and teleconsultation features. Companies like Gennev, Lisa Health, and Elektra Health are pioneering this space, often collaborating with OB-GYNs, endocrinologists, and mental health professionals. As societal conversations around aging and women’s wellness become more open, this segment offers strong growth potential.

Women’s Health App Market By Type Insights

Based on type, the menstrual health segment led the market with the largest revenue share of 37.68% in 2024, accounting for the largest share due to its early adoption, wide user base, and critical role in reproductive health. Menstrual tracking apps have become mainstream tools among women aged 15 to 45, helping monitor ovulation, fertility windows, PMS symptoms, and hormonal changes. These apps are often integrated with wearable devices to offer temperature and heart rate-based fertility prediction, enhancing accuracy. As women become increasingly proactive about family planning and cycle health, demand for intelligent, data-backed apps continues to rise.

The pregnancy tracking and postpartum care segment is anticipated to grow at a considerable CAGR over the forecast period. These apps not only track menopause-related symptoms but also offer wellness plans addressing cognitive decline, bone density, cardiovascular health, and sexual well-being. The rise of “silver tech” and age-inclusive digital platforms has created a receptive market for menopause-focused innovations. In addition, employers and insurers are beginning to cover menopause health benefits, further accelerating adoption.

Women’s Health App Market Size By Type, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Fitness & Nutrition |

1.39 |

1.62 |

1.88 |

2.19 |

2.55 |

2.97 |

3.46 |

4.03 |

4.70 |

5.47 |

6.36 |

| Menstrual Health |

1.24 |

1.45 |

1.69 |

1.97 |

2.31 |

2.69 |

3.15 |

3.68 |

4.29 |

5.01 |

5.85 |

| Pregnancy Tracking & Postpartum Care |

0.89 |

1.06 |

1.25 |

1.48 |

1.75 |

2.08 |

2.46 |

2.91 |

3.45 |

4.08 |

4.84 |

| Menopause |

0.40 |

0.48 |

0.58 |

0.70 |

0.84 |

1.01 |

1.22 |

1.46 |

1.76 |

2.12 |

2.55 |

| Disease Management |

0.59 |

0.71 |

0.84 |

1.00 |

1.18 |

1.40 |

1.67 |

1.98 |

2.35 |

2.79 |

3.31 |

| Others |

0.45 |

0.53 |

0.63 |

0.75 |

0.90 |

1.07 |

1.27 |

1.51 |

1.80 |

2.14 |

2.55 |

Women’s Health App Market By Modality Insights

Based on modality, the smartphone segment led the market with the largest revenue share of 69.0% in 2024. primarily due to the widespread penetration of mobile devices, ease of access, and user-friendly interfaces. Nearly all leading apps are designed with smartphone optimization, offering biometric syncing, geolocation-based services (e.g., local clinics), push notifications, and cloud data storage. Mobile-first design has become essential, with app stores serving as the primary distribution channels. Additionally, smartphone cameras and sensors enable functionalities such as hydration tracking, pill reminders, and facial diagnostics (e.g., acne and skin health analysis).

Other segment is expected to grow at the fastest CAGR over the forecast period. especially in specialized healthcare and clinical research settings. Tablets offer larger screens and better visualization for health educators, OB-GYNs, and doulas using app-based coaching or consultation platforms. Hospitals and women’s wellness centers also utilize tablets for guided pregnancy classes, postpartum checklists, and patient intake surveys. While consumer usage is lower, institutional demand is on the rise, contributing to steady growth in this segment.

Women’s Health App Market By Regional Insights

North America is the dominant regional market for women’s health apps, underpinned by a combination of advanced digital infrastructure, health awareness, and progressive regulatory support for femtech innovation. The U.S. in particular accounts for a significant market share due to the high concentration of smartphone users, tech startups, venture capital activity, and proactive healthcare consumers. Leading players like Flo, Clue, and Apple Health are headquartered or heavily active in this region, supported by integration with mainstream insurance and employer wellness programs.

Moreover, the region’s strong advocacy for women’s health rights and public health education further propels adoption. Many health apps offer teleconsultation services with board-certified clinicians, mental health therapy, and access to community support—all in compliance with HIPAA regulations. With widespread user trust and commercial scalability, North America continues to lead in both innovation and revenue generation in the women’s health app space.

Asia Pacific is expected to grow at the fastest CAGR, driven by population growth, smartphone affordability, rising awareness about reproductive health, and government initiatives to improve maternal health outcomes. Countries like India, China, Japan, and South Korea are witnessing a digital health boom, supported by investments from both domestic players and international partnerships. Local developers are launching culturally tailored health apps that consider linguistic, dietary, and traditional medicine practices.

China’s large smartphone user base

China is anticipated to have a stronghold in the Asia Pacific women’s health app market. The huge female population in China and rising penetration of smartphones provides a massive user base and a booming market for these app manufacturers. Moreover, increased health awareness, growing emphasis on menstrual health, rising disposable incomes, surging number of women in the workforce and support from the government promoting digital health technologies are the factors contributing to the market growth.

Industry shifts

The women’s health app market is witnessing significant industrial shifts with the evolving needs of consumers, technological advancements and focus on personalizing experiences. Apps are being designed for offering highly tailored insights and recommendations based on the individual data over the simple tracking features. Integration of artificial intelligence and machine learning is helping in analyzing user data and pattern prediction. Telehealth services are being incorporated in these apps allowing users to connect with healthcare professionals remotely. Wearable devices are becoming a popular opinion. Many women’s health app users are integrating additional features such as stress monitoring and sleep monitoring understanding the interdependence of physical and mental health.

Furthermore, rising investments in the femtech industry is driving the development of more sophisticated women’s health apps with specialized features and enhanced security measures. Increased internet access, rising disposable incomes and penetration of smartphones in developing regions is accelerating the expansion in emerging markets.

Women’s Health App Market Size By Regional, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

1.73 |

2.03 |

2.38 |

2.78 |

3.26 |

3.82 |

4.47 |

5.23 |

6.13 |

7.17 |

8.40 |

| Europe |

1.34 |

1.56 |

1.83 |

2.14 |

2.50 |

2.92 |

3.41 |

3.99 |

4.66 |

5.44 |

6.36 |

| Asia Pacific |

1.09 |

1.31 |

1.58 |

1.90 |

2.29 |

2.75 |

3.31 |

3.97 |

4.77 |

5.73 |

6.87 |

| Latin America |

0.40 |

0.46 |

0.54 |

0.62 |

0.72 |

0.84 |

0.98 |

1.14 |

1.32 |

1.53 |

1.78 |

| Middle East and Africa (MEA) |

0.40 |

0.47 |

0.55 |

0.65 |

0.76 |

0.90 |

1.06 |

1.25 |

1.47 |

1.73 |

2.04 |

Some of the prominent players in the women’s health app market include:

Women’s Health App Market Recent Developments

- In March 2025, Sidekick Health, a leading digital health establishment, expanded women’s health portfolio with the launch of its latest prescription digital therapeutic (PDT), MENO! App through a new clinical study. The app is designed for fulfilling unmet needs in women undergoing menopause.

- In February 2025, Laiqa, a femtech start-up based in Gurugram, launched its innovative health app, LAIQA which targets women’s wellness. The app integrates latest AI technology with Ayurveda offering personalized insights on hormonal health and addressing health related issues like PCOS, thyroid disorders, sleep, stress, gut health and weight management. The app includes features like Cycle-Synced Wellness, expert-led support and personalized recommendations.

- In January 2025, Allara Health, a virtual women’s healthcare platform secured $26 million in Series B funding round, driving its overall raise to $38.5 million. The company plans on utilizing the funds for the U.S. expansion of its hormonal healthcare platform.

- In January 2025, the Federation of Obstetric and Gynaecological Societies (FOGSI) launched Arogya Sakhi, a free women-centric app developed for raising awareness on women’s health issues. The app is funded by UNICEF and will regularize circulation of information addressing issues related with cervical cancer, menopause, pregnancy and vaccinations.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the women’s health app market

Type

- Fitness & Nutrition

- Menstrual Health

- Pregnancy Tracking & Postpartum Care

- Menopause

- Disease Management

- Others

Modality

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)