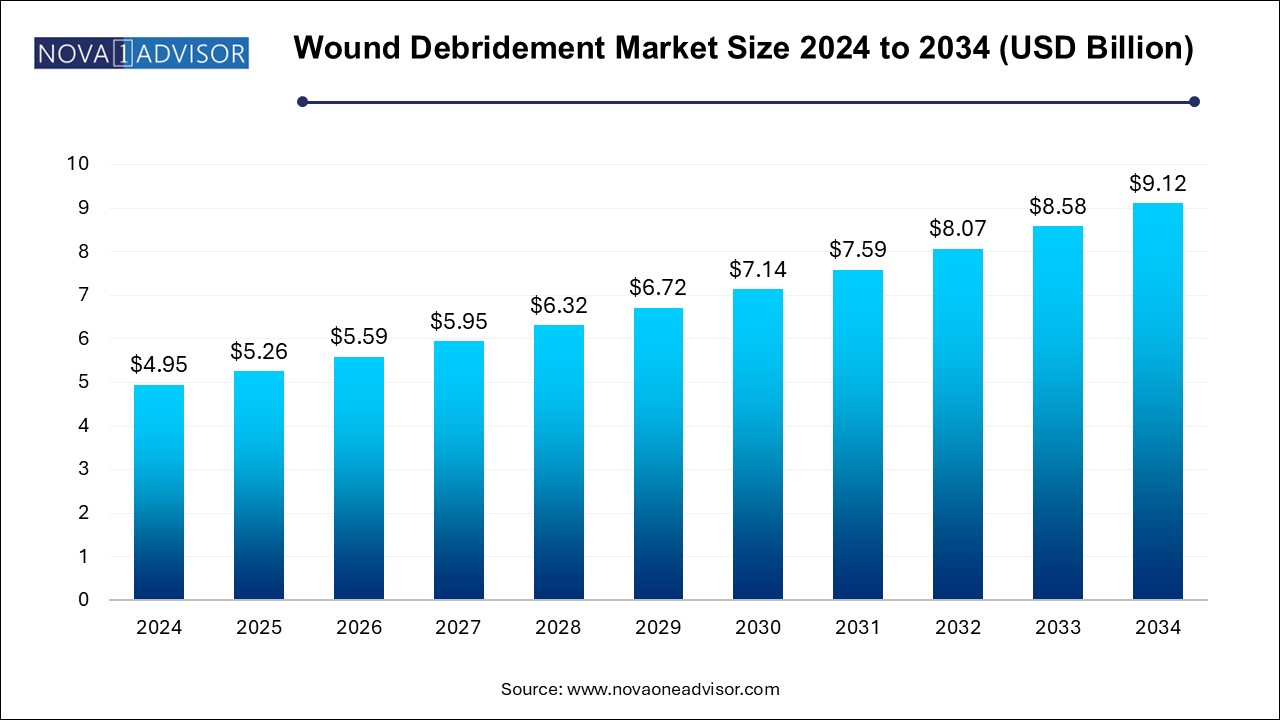

Wound Debridement Market Size and Growth

The wound debridement market size was exhibited at USD 4.95 billion in 2024 and is projected to hit around USD 9.12 billion by 2034, growing at a CAGR of 6.3% during the forecast period 2024 to 2034.

Wound Debridement Market Key Takeaways:

- Based on products, the medical gauze segment held the largest share of 22.73% in 2024.

- The gels segment is projected to impel at a growth rate of CAGR 5.2% during the forecast duration.

- The surgical wound debridement segment dominated the market in 2024 with a share of 26.99%.

- The autolytic wound debridement segment is expected to expand at the highest CAGR of 6.8% during the forecast period.

- The diabetic foot ulcers segment is anticipated to capture the largest market share of 32.96% in 2024.

- Based on end-use, the hospital segment dominated the wound debridement industry with a market share of 55.04% in 2024.

- The homecare segment is projected to witness the fastest growth rate at a CAGR of 6.8% during the forecast period

- Based on mode of purchase, the prescription segment dominated the wound debridement industry with a market share of 59.0% in 2024.

- The over-the-counter segment is projected to witness the fastest growth rate of CAGR 6.5% over the forecast of 2024-2034.

- Based on region, North America held the dominant market share of 38.0% in 2024.

- Asia Pacific is estimated to witness the fastest CAGR of 7.1% over the forecast period.

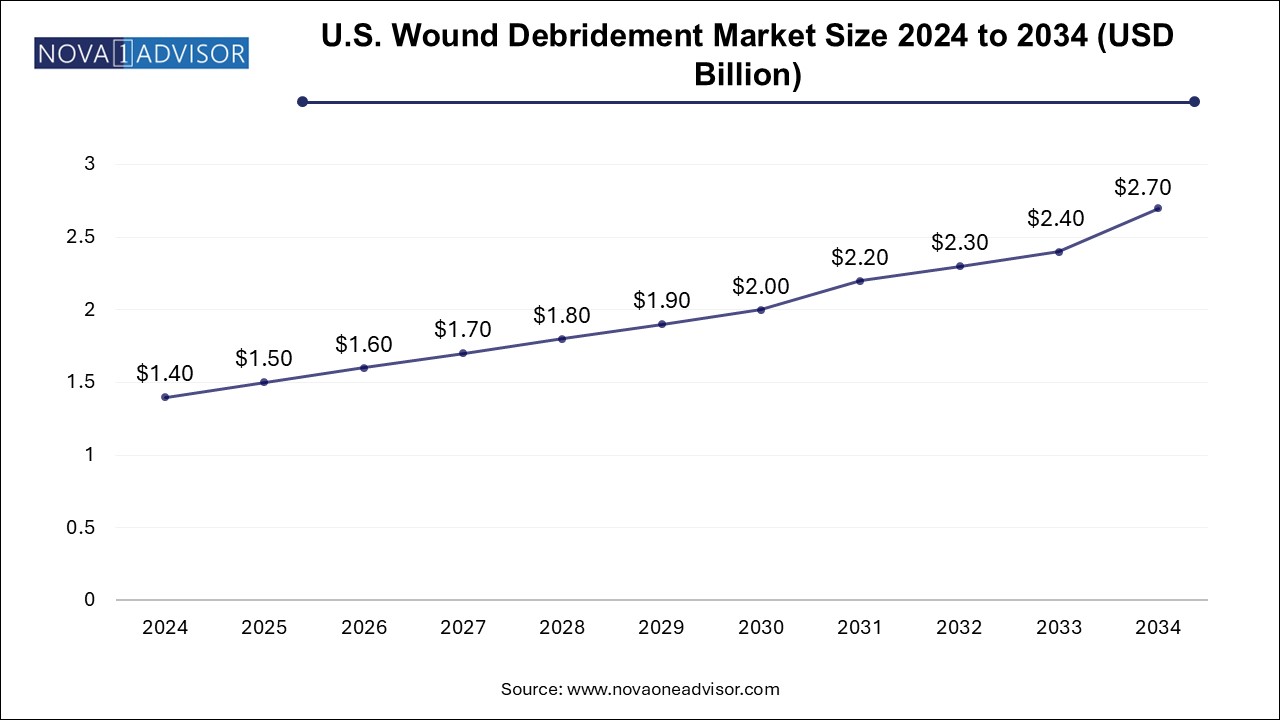

U. S. wound debridement market Size and Growth 2024 to 2034

The U.S. wound debridement market size is evaluated at USD 1.4 billion in 2024 and is projected to be worth around USD 2.7 million by 2034, growing at a CAGR of 6.15% from 2024 to 2034.

North America dominates the wound debridement market, with the United States leading in terms of technological advancement, reimbursement support, and a well-established wound care infrastructure. The region also has a high prevalence of diabetes, obesity, and aging populations, creating steady demand for advanced debridement products.

Asia-Pacific is the fastest-growing region, fueled by increasing healthcare expenditure, rising awareness, and government efforts to improve chronic disease management. Countries like China, India, and South Korea are investing in wound care training, expanding access to modern debridement technologies, and fostering public-private partnerships to enhance rural care delivery.

Report Scope of Wound Debridement Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 5.26 Billion |

| Market Size by 2034 |

USD 9.12 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 6.3% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Method, Wound type, End-use, Mode of Purchase, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled |

Coloplast Corp.; Medline Industries; Smith & Nephew; ConvaTec Group PLC; Integra LifeSciences; Molnlycke Health Care AB, B. Braun SE; Brightwake Ltd., Lohmann & Rauscher; 3M. |

Wound Debridement Market By Product Insights

Gels dominate the wound debridement market, driven by their non-invasive nature and growing use in autolytic and enzymatic debridement. Gels such as hydrogel-based products maintain a moist wound environment, support autolysis, and are easy to apply in both hospital and home settings. Their cost-effectiveness and minimal side effects make them a preferred choice for chronic wound management, especially in elderly and diabetic patients.

Ultrasonic devices are the fastest-growing segment, due to their ability to provide selective and effective debridement with minimal damage to healthy tissue. These devices use low-frequency ultrasound waves to remove necrotic tissue, reduce bacterial load, and stimulate healing. They are increasingly adopted in hospital wound clinics and are showing promise in outpatient and portable formats for broader accessibility.

Wound Debridement Market By Method Insights

Surgical debridement remains the dominant method, particularly for wounds with extensive necrotic tissue or infections requiring immediate intervention. This method is often employed in hospital and surgical settings, where rapid removal of devitalized tissue is necessary to prevent systemic complications. Despite being invasive, it offers precise control and quick results.

Autolytic debridement is the fastest-growing method, especially in homecare and outpatient environments. It relies on the body’s natural enzymes and moisture to break down necrotic tissue, typically facilitated by hydrogel or occlusive dressings. Its ease of use, low cost, and minimal discomfort make it appealing for long-term care and self-managed wound treatment.

Wound Debridement Market By Wound Type Insights

Diabetic foot ulcers dominate the wound type segment, as they require consistent debridement to manage infection risk and promote healing. With the increasing incidence of diabetes globally, this segment continues to grow, particularly in aging populations. The complexity and chronicity of DFUs make them a prime target for both advanced and routine debridement techniques.

Burn wounds are among the fastest-growing wound types, driven by the need for efficient removal of eschar and devitalized tissue to facilitate skin grafting and healing. Innovations in enzymatic and hydrosurgical debridement are improving burn care outcomes, particularly in specialized centers and military or trauma applications.

Wound Debridement Market By End-use Insights

Hospitals are the leading end-use segment, due to the availability of surgical infrastructure, wound care teams, and access to advanced debridement technologies. Hospitals handle acute wound cases, post-surgical wounds, and infected ulcers requiring complex, multi-disciplinary care.

Homecare is the fastest-growing end-use, as more patients manage chronic wounds from the comfort of their homes. The convenience, lower costs, and expansion of telehealth have encouraged patients and caregivers to adopt at-home debridement protocols with professional support via virtual consultations.

Wound Debridement Market By Mode Of Purchase Insights

Prescription-based wound debridement solutions dominate the market, especially for products like enzymatic agents and advanced dressings, which require clinical guidance and reimbursement approvals. Hospitals and clinics typically procure these through established supply chains.

Over-the-counter (OTC) products are growing rapidly, as more consumers seek autonomy in managing minor wounds and chronic ulcers. Hydrogel dressings, antimicrobial ointments, and enzymatic creams are now available in retail pharmacies and online platforms, expanding the reach of wound care products

Some of the prominent players in the wound debridement market include:

Recent Developments

-

In March 2025, Smith & Nephew launched a new line of enzymatic debridement gels for chronic wound management in outpatient settings.

-

In January 2025, Mölnlycke Health Care announced the expansion of its Exufiber Ag+ range, integrating antimicrobial silver for enhanced infection control.

-

In November 2024, ConvaTec unveiled a telehealth-compatible wound assessment platform in partnership with leading homecare agencies.

-

In October 2024, Derma Sciences (Integra LifeSciences) received FDA approval for a next-generation hydrogel product tailored for diabetic ulcers.

-

In September 2024, Coloplast introduced a portable ultrasonic debridement device for community wound clinics across Europe and North America.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the wound debridement market

By Product

- Gels

- Ointments & Creams

- Surgical Devices

- Medical Gauzes

- Ultrasonic Devices

- Others

By Method

- Autolytic

- Enzymatic

- Surgical

- Mechanical

- Others

By Wound Type

- Pressure Ulcers

- Diabetic Foot Ulcers

- Venous Leg Ulcers

- Burn Wounds

- Others

By End-use

- Hospitals

- Homecare

- Others

By Mode of Purchase

- Prescription

- Over The Counter

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)