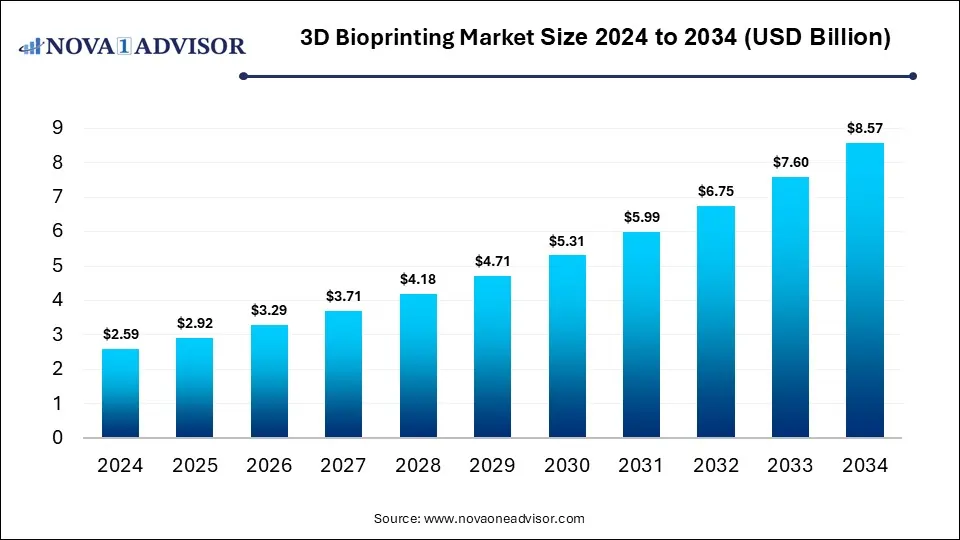

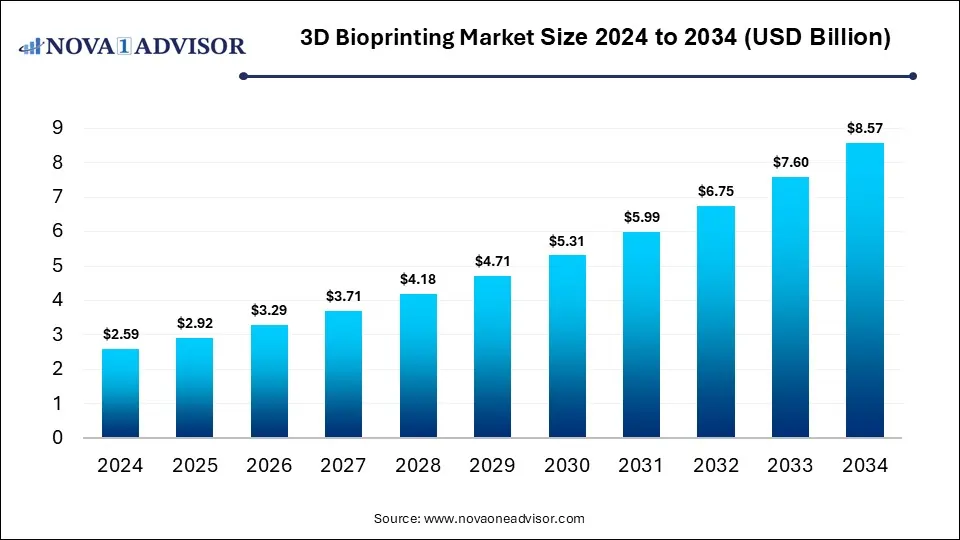

3D Bioprinting Market Size and Forecast 2025 to 2034

The global 3D bioprinting market size is calculated at USD 2.59 billion in 2024, grows to USD 2.92 billion in 2025, and is projected to reach around USD 8.57 billion by 2034, growing at a CAGR of 12.7% from 2025 to 2034. The market is expanding due to increasing applications in regenerative medicine and organ transplantation. Growing technological innovations and collaboration in healthcare research are also fueling its growth.

Key Takeaways

- Asia Pacific dominated the 3D bioprinting market with a revenue share in 2024.

- North America is expected to grow at the fastest CAGR in the market during the forecast period.

- By technology, the inkjet-based segment dominated the market with a revenue share in 2024.

- By technology, the magnetic levitation segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the medical segment led the market with the largest revenue share in 2024.

- By application, the tissue and organ generation subsegment is expected to grow at the fastest CAGR in the market during the forecast period.

How 3D Bioprinting Market Evolving?

3D bioprinting is an advanced additive manufacturing process that uses living cells, biomaterials, and growth factors to create tissue-like structures for medical and research applications. The 3D bioprinting market is evolving through innovations in bio-inks, microfabrication techniques, and hybrid printing systems that combine multiple materials for complex tissue creation. Rising applications in cosmetic testing, wound healing, and orthopedic implants are expanding its scope beyond organ regeneration. Academic-industry partnerships, government funding for biomedical research, and the emergence of startups focusing on making bioprinting a promising technology for diverse healthcare solutions.

What are the Key trends in the 3D Bioprinting Market in 2024?

- In June 2025, the University of Hawaii System partnered with the U.S. Army’s DEVCOM CBC to advance projects aimed at boosting soldier performance and survival using biomaterials and advanced manufacturing. The collaboration also focuses on supporting the U.S. Indo-Pacific Command in Hawaii through the use of organ-on-chip technology, repair solutions, and innovative manufacturing approaches.

- In April 2025, Black Drop Biodrucker GmbH joined forces with researchers from the NMI Natural and Medical Sciences Institute in Reutlingen and TU Darmstadt to create a novel bioink. This innovation is designed to improve nutrient delivery within printed tissues, advancing the effectiveness of bioprinted structures.

How Can AI Affect the 3D Bioprinting Market?

AI can significantly impact the market by optimizing printing processes, improving design accuracy, and predicting tissue growth patterns. It enables real-time monitoring and error detection, reducing material waste and enhancing reproducibility. AI-driven data analysis helps in developing patient-specific models and accelerating drug testing. Additionally, machine learning algorithms can refine bioink formulations and automate complex workflows, making bioprinting faster, more precise, and scalable, ultimately supporting personalized medicine and advanced healthcare solutions.

Report Scope of 3D Bioprinting Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.92 Billion |

| Market Size by 2034 |

USD 8.57 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 12.7% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Technology, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Inventia Life Science PTY LTD, EnvisionTEC, Inc., Regemat 3D S.L., Organovo Holdings, Inc., 3D Bioprinting Solutions, Poietis, Allevi, Vivax Bio, LLC, Cyfuse Biomedical K.K., Cellink Global |

Market Dynamics

Driver

Rising Demand for Organ and Tissue Transplants

The growing need for organ and tissue transplants drives the 3D bioprinting market as healthcare systems seek faster and safer alternatives to traditional procedures. Rising cases of chronic diseases, accidents, and age-related organ failure are fueling this demand. Bioprinting enables the development of functional tissue models for pre-clinical testing, reducing reliance on human donors. This shift not only accelerates research but also enhances the possibility of producing tissues on demand, supporting more efficient and timely treatment solutions.

- For Instance, In March 2024, researchers at the Catholic University of Korea successfully performed the world’s first transplant of a bioprinted artificial trachea. Created using adult stem cells to match the patient’s unique anatomy, this bioprinted organ marked a groundbreaking clinical milestone in personalized tissue replacement.

Restraint

High Cost of Equipment and Materials

The high cost of equipment and materials restrains the 3D bioprocessing market as it limits continuous experimentation and innovation. Many research institutes face budget constraints, making it difficult to upgrade to the latest printing systems or test diverse bioink combinations. The expensive nature of consumables also discourages routine use, slowing the pace of technological advancement. As a result, only a few organizations can fully explore the potential of bioprinting, creating uneven progress across the industry.

Opportunity

New Development of Bioinks

Emerging bioink innovations open new opportunities in the 3D bioprinting market by enabling the integration of smart materials, such as stimuli-responsive or conductive bioinks, that can mimic dynamic biological processes. These advanced formulations support the creation of more complex tissues, including to replicate. Additionally, sustainable and cost-effective bioink alternatives derived from natural polymers reduce reliance on expensive synthetic options, making bioprinting more accessible and commercially viable for broader healthcare use.

- For Instance, In February 2025, TheWell Bioscience partnered with REGEMAT 3D to distribute its innovative bioink, VitroINK®. This bioink allows direct mixing with cells and enables bioprinting without requiring crosslinking agents, UV light, or heat curing. By simplifying the process and supporting better cell growth and differentiation, VitroINK® offers significant potential for advancing regenerative medicine and tissue engineering applications.

Segmental Insights

How does the Inkjet-based Segment dominate the 3D Bioprinting Market in 2024?

In 2024, the inkjet-based segment dominated the market as it enabled non-contact, controlled deposition of living cells with minimal damage, ensuring higher cell viability. Its ability to create complex patterns with fine resolution made it ideal for producing intricate tissue models. Moreover, the widespread availability of modified inkjet printers at lower costs supported broader adoption in academic and clinical research, positioning this technology as a preferred choice for both experimental and practical bioprinting applications.

The magnetic levitation segment is projected to grow at the fastest CAGR as it offers a clean, label-free approach that reduces the use of external scaffolding materials and chemical agents. This technology supports faster assembly of tissue models while maintaining their structural integrity and biological relevance. Its potential to streamline workflows, lower contamination risks, and improve reproducibility makes it attractive for pharmaceutical research and personalized medicine, fueling its rapid expansion in the 3D bioprinting market.

3D Bioprinting Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Magnetic Levitation |

0.31 |

0.35 |

0.38 |

0.42 |

0.47 |

0.52 |

0.57 |

0.63 |

0.7 |

0.79 |

0.86 |

| Inkjet-based |

0.91 |

1.02 |

1.14 |

1.28 |

1.43 |

1.6 |

1.8 |

2.01 |

2.25 |

2.52 |

2.82 |

| Syringe-based |

0.72 |

0.82 |

0.93 |

1.06 |

1.2 |

1.37 |

1.55 |

1.76 |

2 |

2.26 |

2.57 |

| Laser-based |

0.47 |

0.53 |

0.61 |

0.69 |

0.79 |

0.89 |

1.02 |

1.16 |

1.32 |

1.5 |

1.71 |

| Others |

0.18 |

0.2 |

0.23 |

0.26 |

0.29 |

0.33 |

0.37 |

0.42 |

0.47 |

0.53 |

0.6 |

Why Did the Medical Segment Dominate the 3D Bioprinting Market in 2024?

In 2024, the medical segment led the market as it gained momentum in areas like wound healing, dental restoration, and orthopedic applications. This ability to create customized grafts, bone substitutes, and skin patches drove higher adoption in clinical practices. Moreover, the use of bioprinted models for pre-surgical simulations and training enhanced precision in complex procedures. These diverse and practical medical applications broadened its scope, positioning the segment as the primary revenue contributor during the year.

The tissue and organ generation subsegment is projected to grow at the fastest CAGR because of its expanding role in developing disease-specific models and accelerating drug discovery. Researchers are increasingly using bioprinted tissues to study complex conditions in a controlled environment, reducing reliance on animal testing. Furthermore, innovations in multi-material printing and microvascular printing. Networks are enhancing the functionality of printed tissues. These advancements not only broaden research applications but also pave the way for scalable, clinically relevant organ models.

3D Bioprinting Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Medical |

1.09 |

1.24 |

1.4 |

1.59 |

1.8 |

2.05 |

2.32 |

2.64 |

2.99 |

3.4 |

3.85 |

| Dental |

0.65 |

0.72 |

0.81 |

0.91 |

1.01 |

1.13 |

1.26 |

1.41 |

1.58 |

1.76 |

1.97 |

| Biosensors |

0.31 |

0.34 |

0.38 |

0.42 |

0.47 |

0.52 |

0.57 |

0.63 |

0.7 |

0.77 |

0.86 |

| Consumer/Personal Product Testing |

0.13 |

0.15 |

0.17 |

0.19 |

0.21 |

0.23 |

0.27 |

0.3 |

0.34 |

0.38 |

0.43 |

| Bioinks |

0.23 |

0.26 |

0.29 |

0.32 |

0.36 |

0.4 |

0.45 |

0.5 |

0.55 |

0.62 |

0.68 |

| Food And Animal Product |

0.18 |

0.21 |

0.24 |

0.28 |

0.33 |

0.38 |

0.44 |

0.5 |

0.58 |

0.67 |

0.77 |

Regional Insights

How is Asia-Pacific contributing to the Expansion of the 3D Bioprinting Market?

Asia-Pacific led the 3D bioprinting market in 2024 as the region saw a surge in clinical trials, academic research, and commercialization of advanced bioinks and printing systems. The presence of emerging startups alongside global players setting up local facilities accelerated technology adoption. Additionally, rising incidences of chronic diseases and trauma cases created a higher demand for innovative tissue models and implants. These factors, combined with competitive manufacturing capabilities, positioned Asia-Pacific as the top revenue-generating region in the market.

How is North America Accelerating the 3D Bioprinting Market?

North America is projected to grow at the fastest CAGR in the 3D bioprinting market as the region benefits from a well-established regulatory framework that supports clinical translation of bioprinted products. The presence of leading medical device companies expanding into bioprinting and the rising use of bioprinted models in cosmetic testing and toxicology studies are boosting demand. Moreover, the increasing focus on reducing animal testing through advanced tissue models is fueling rapid adoption and driving strong market growth.

3D Bioprinting Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

1.03 |

1.16 |

1.3 |

1.46 |

1.64 |

1.84 |

2.06 |

2.31 |

2.59 |

2.9 |

3.25 |

| Europe |

0.78 |

0.87 |

0.99 |

1.11 |

1.25 |

1.41 |

1.59 |

1.79 |

2.02 |

2.28 |

2.57 |

| Asia Pacific |

0.52 |

0.6 |

0.69 |

0.8 |

0.92 |

1.06 |

1.22 |

1.41 |

1.62 |

1.86 |

2.14 |

| Latin America |

0.13 |

0.15 |

0.16 |

0.19 |

0.21 |

0.24 |

0.27 |

0.3 |

0.34 |

0.38 |

0.43 |

| Middle East and Africa (MEA) |

0.13 |

0.14 |

0.15 |

0.15 |

0.16 |

0.16 |

0.17 |

0.17 |

0.17 |

0.18 |

0.17 |

Top Companies in the 3D Bioprinting Market

Recent Developments in the 3D Bioprinting Market

- In June 2025, researchers at the University of British Columbia (UBC) introduced a technology combining AI with 3D bioprinting to identify difficult-to-detect sperm and improve their growth in laboratory settings. This advancement offers new possibilities for treating male infertility, providing hope for men struggling to become parents.

- In April 2025, researchers at the National University of Singapore (NUS) combined AI with 3D bioprinting to create a novel approach for producing personalized gum grafts. This technique offers a less invasive alternative to conventional methods, which rely on harvesting tissue from the patient’s mouth a process often painful and limited by tissue availability.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the 3D Bioprinting Market.

By Technology

- Magnetic Levitation

- Inkjet-based

- Syringe-based

- Laser-based

- Others

By Application

-

- Tissue And Organ Generation

- Medical Pills

- Prosthetics And Implants

- Others

- Dental

- Biosensors

- Consumer/Personal Product Testing

- Bioinks

- Food And Animal Product

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)