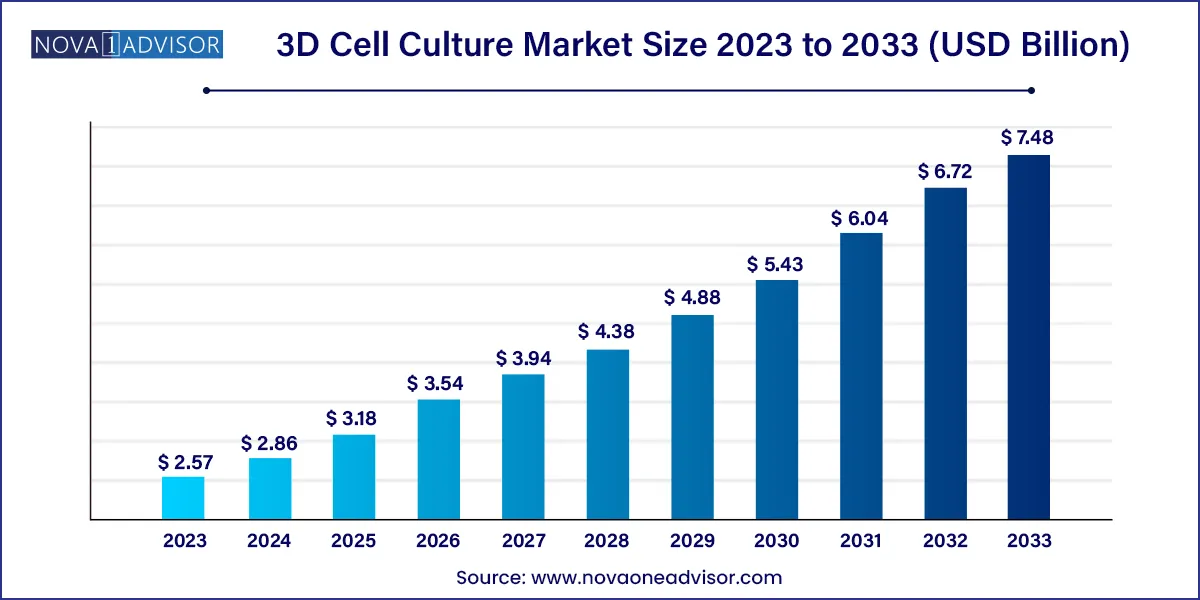

The global 3D cell culture market size was exhibited at USD 2.57 billion in 2023 and is projected to hit around USD 7.48 billion by 2033, growing at a CAGR of 11.27% during the forecast period 2024 to 2033.

Key Takeaways:

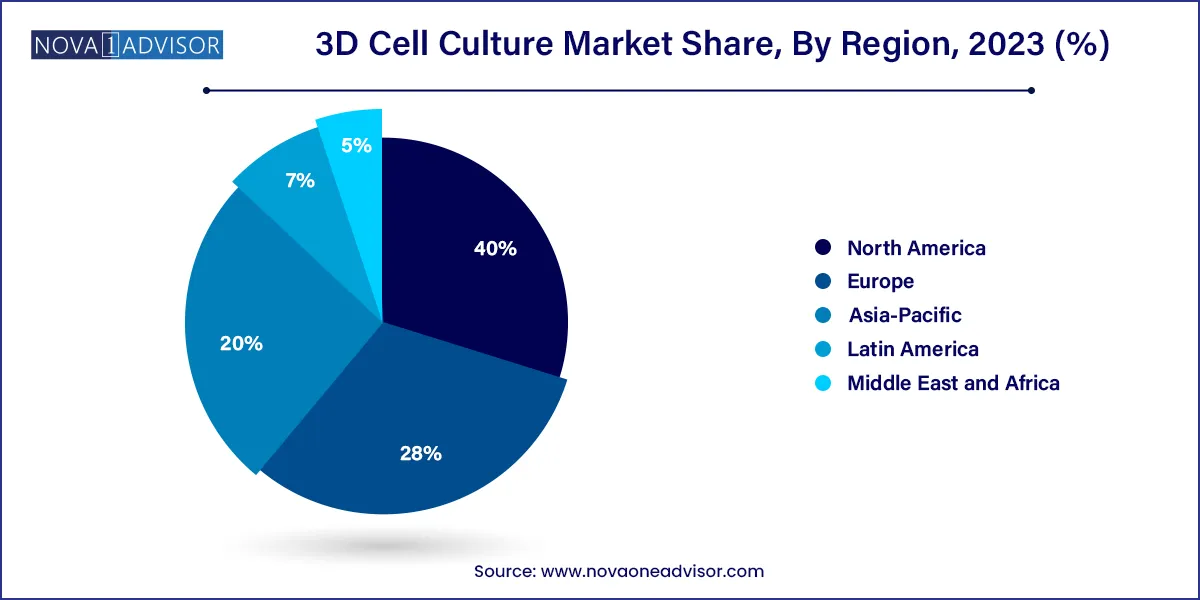

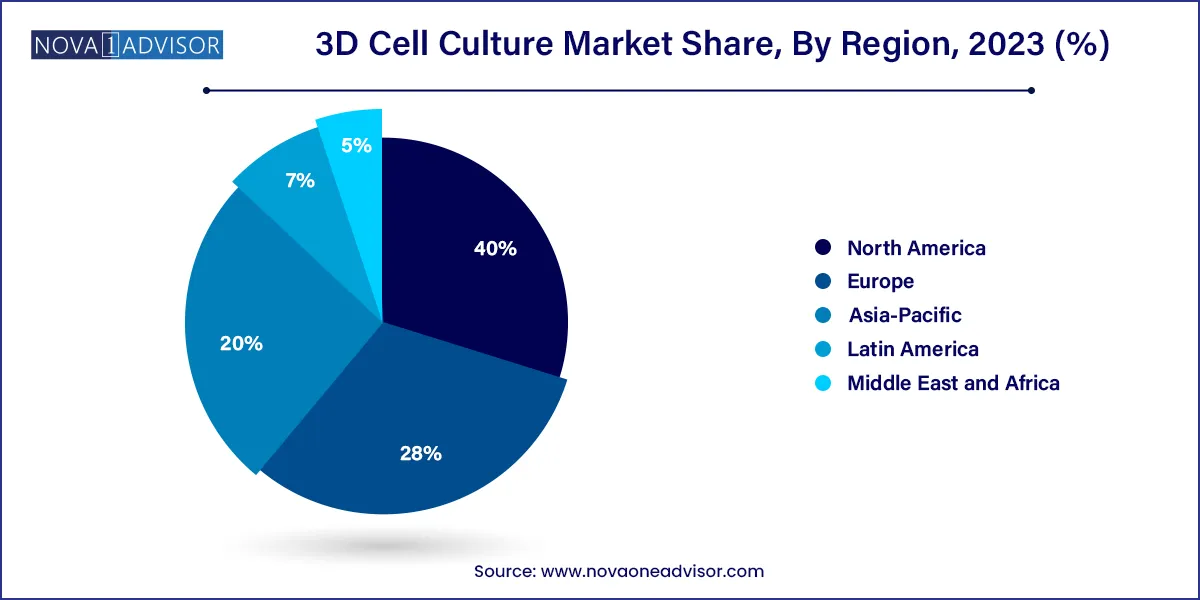

- North America dominated the market and accounted for a 40.0% share in 2023.

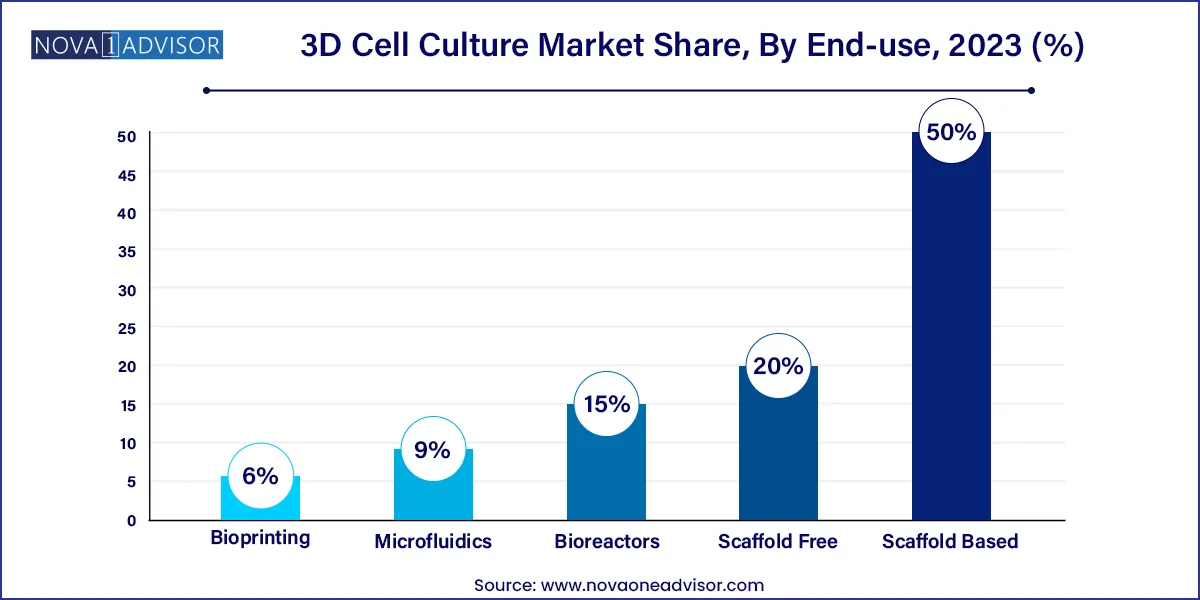

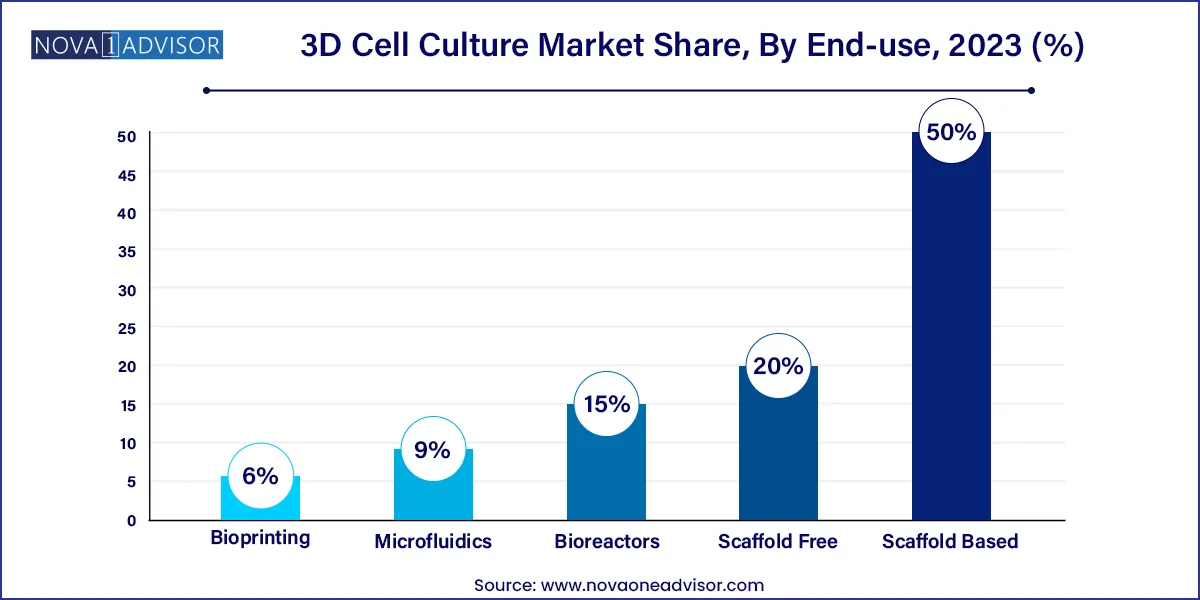

- The scaffold-based segment held the largest market share of 50.0% in 2023.

- The stem cell research & tissue engineering segment dominated the market with a share in 2023.

- The biopharmaceutical & pharmaceutical companies segment dominated the market with a share in 2023.

Market Overview

The 3D Cell Culture Market has emerged as a transformative force in biomedical science, reshaping how researchers model disease, evaluate therapeutics, and study cellular interactions. Unlike traditional 2D monolayer cultures, 3D cell cultures replicate the complex architecture, cell-to-cell communication, and microenvironment of in vivo tissue systems, thereby delivering more accurate data on cell physiology, pathology, and drug responses.

This transition is particularly crucial in oncology, stem cell biology, and tissue engineering, where cellular behavior is highly dependent on the spatial and biochemical context. The limitations of 2D culture models, such as altered gene expression, morphological distortion, and poor predictive power for human responses, have catalyzed the shift toward 3D models.

The market is supported by significant investments in drug discovery, organoid development, and regenerative medicine. Additionally, the growing emphasis on reducing animal testing and enhancing clinical translation has positioned 3D culture systems as both an ethical and scientific necessity. The integration of advanced technologies such as bioprinting, microfluidics, scaffold-free platforms, and organ-on-a-chip systems has expanded the scope of 3D cell culture from academic labs into commercial pharmaceutical pipelines.

With continuous innovation in biomaterials, matrix engineering, and imaging tools, the 3D cell culture market is set to experience robust growth over the coming decade, fundamentally altering preclinical research and personalized medicine.

Major Trends in the Market

-

Rapid adoption of organoid models in cancer, brain, and intestinal research, offering patient-derived 3D systems for precision medicine.

-

Widespread integration of 3D bioprinting for replicating tissues and screening drug responses in high-throughput formats.

-

Growing interest in microfluidic 3D systems (organ-on-chip) that mimic blood flow and mechanical stress for physiological accuracy.

-

Increased use of scaffold-free spheroid cultures for cost-effective, reproducible tumor modeling.

-

Emergence of magnetic levitation techniques enabling non-invasive and dynamic formation of cellular assemblies.

-

Customization of hydrogel matrices with specific ECM proteins to guide stem cell differentiation or disease modeling.

-

Advancements in imaging and real-time analysis platforms to monitor 3D culture growth and function.

-

Collaborative research between academia and industry accelerating commercialization of complex culture systems.

3D Cell Culture Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.86 Billion |

| Market Size by 2033 |

USD 7.48 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 11.27% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Technology, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc.; Merck KGaA, PromoCell GmbH; Lonza; Corning Incorporated; Avantor, Inc.; Tecan Trading AG; REPROCELL Inc.; CN Bio Innovations Ltd; Lena Biosciences. |

Key Market Driver: Growing Demand for Physiologically Relevant Drug Testing Models

A key driver propelling the 3D cell culture market is the increasing demand for physiologically relevant in vitro models in drug discovery and toxicity screening. The pharmaceutical industry suffers from high attrition rates, with many promising drug candidates failing in clinical trials due to inefficacy or unforeseen toxicity. Conventional 2D cultures often do not recapitulate the complexity of the human tissue microenvironment, leading to poor predictive outcomes.

In contrast, 3D cell cultures better mimic tissue architecture, gradient formation, and mechanical cues, resulting in more accurate assessment of drug penetration, efficacy, and cytotoxicity. For example, tumor spheroids derived from 3D models exhibit resistance to chemotherapeutics similar to solid tumors in the body, providing a more realistic testing ground. This ability to reduce the gap between preclinical models and human biology enhances decision-making in early drug pipelines, saving both time and cost.

Key Market Restraint: High Cost and Technical Complexity of 3D Systems

Despite their advantages, 3D culture systems come with inherent technical and financial challenges that impede widespread adoption. These include higher setup costs, increased need for specialized equipment, limited standardization, and longer optimization cycles. For example, bioprinting and organ-on-chip platforms require significant capital investment and skilled labor, making them less accessible to smaller academic institutions or early-stage biotech startups.

Furthermore, handling and analyzing 3D cultures demand more sophisticated imaging, processing, and data analysis techniques. Traditional microscopy methods often fall short in resolving layered cell structures, necessitating advanced confocal or 3D imaging systems. Variability in scaffold materials and hydrogel behavior can also lead to reproducibility issues, especially in multi-site or high-throughput studies.

Key Market Opportunity: Expansion of Personalized Medicine and Patient-Derived Organoids

The emergence of personalized medicine, with its focus on patient-specific treatment strategies, presents a significant opportunity for 3D cell culture technologies. Patient-derived organoids (PDOs), created by culturing biopsy tissues into 3D structures, are rapidly gaining traction in oncology and rare disease research. These mini-tissues retain the genetic, morphological, and histological features of the original tumor or organ, allowing for tailored drug screening and therapeutic decision-making.

For instance, colorectal, pancreatic, and breast cancer organoids have been used to test multiple chemotherapeutics in parallel, helping identify the most effective regimen for individual patients. Moreover, the ability to combine PDOs with CRISPR-based gene editing or immune cell co-culture expands their utility in studying genetic mutations and immune responses. As clinical demand for predictive, patient-specific models grows, 3D culture systems are poised to become central to translational research and personalized healthcare.

Segments Insights:

By Technology

Scaffold-based technologies dominate the market, primarily due to their versatility in supporting diverse cell types and simulating ECM properties. Hydrogels especially those derived from collagen, Matrigel, and synthetic polymers form the backbone of this segment. They enable cells to grow in three dimensions, maintain their phenotype, and interact with biochemical cues. Polymeric scaffolds and micropatterned plates offer spatial control and are widely used in tissue engineering applications.

Conversely, scaffold-free technologies are growing at the fastest rate, driven by their simplicity, cost-effectiveness, and high reproducibility. Hanging drop and ultra-low attachment (ULA) spheroid plates allow spontaneous aggregation of cells into spheroids, which are extensively used in cancer drug screening. Techniques like magnetic levitation further allow non-invasive manipulation of cell clusters, supporting dynamic studies in cellular biology. The reduced reliance on external matrices also simplifies regulatory compliance in therapeutic development.

By Application

Cancer research leads the application segment, reflecting the urgent need for better tumor models that recapitulate in vivo drug resistance, invasiveness, and tumor-stroma interactions. 3D tumor spheroids and PDOs have enabled more accurate screening of anticancer drugs and immunotherapeutics. These models are increasingly integrated into pharmaceutical workflows for understanding treatment responses and resistance mechanisms.

Stem cell research and tissue engineering are experiencing rapid growth, supported by global initiatives in regenerative medicine and organ replacement. 3D cultures provide the structural and mechanical cues necessary for stem cell differentiation into specific lineages like neurons, hepatocytes, or cardiomyocytes. Advanced hydrogel and microfluidic systems allow creation of biomimetic tissues and even vascularized constructs, making this segment one of the most dynamic areas of 3D cell culture.

By End Use

Biotechnology and pharmaceutical companies dominate the end-user landscape, as they employ 3D culture systems for drug discovery, toxicology, and biologics development. These firms invest heavily in technologies such as bioprinting, high-throughput screening-compatible 3D formats, and organ-on-chip platforms to streamline preclinical R&D and reduce clinical trial failure rates.

However, academic and research institutes are the fastest-growing user base, driven by global funding support for advanced biological modeling and translational research. Universities and public labs are increasingly adopting 3D systems for basic biology studies, disease modeling, and regenerative medicine. Their demand for customizable, exploratory, and cost-effective platforms supports innovation and knowledge transfer in the market.

By Regional Insights

North America leads the 3D cell culture market, fueled by a strong biotechnology ecosystem, high R&D spending, and rapid adoption of cutting-edge research technologies. The U.S., in particular, is home to numerous biotech startups, pharma giants, and academic research centers using 3D cultures in cancer biology, immunotherapy, and tissue engineering. Regulatory agencies such as the FDA have also promoted alternative testing models, further driving 3D adoption. Leading market players like Thermo Fisher Scientific, Corning, and 3D Biotek are headquartered in the region, creating a robust infrastructure for technology development and commercialization.

Asia-Pacific is emerging as the fastest-growing region, driven by expanding biomedical research capacity, increased government investment, and a surge in biopharmaceutical manufacturing. Countries like China, Japan, South Korea, and India are investing in translational research, personalized medicine, and advanced diagnostics. China’s national programs in stem cell science and precision oncology have created a fertile ground for 3D culture adoption, including organoid platforms and microfluidic systems. Additionally, the rise of contract research organizations (CROs) in Asia has led to increased outsourcing of 3D cell culture assays, supporting broader market penetration.

Recent Developments

-

In March 2025, Corning Incorporated launched an upgraded version of its Corning® Elplasia® 3D Spheroid Plates, aimed at improving uniformity in high-throughput drug screening.

-

Thermo Fisher Scientific announced in January 2025 the integration of Gibco™ Organoid Culture Media Kits for patient-derived 3D cultures used in oncology research.

-

In February 2025, MIMETAS BV, a leader in organ-on-chip technology, raised $50 million in Series C funding to expand its 3D tissue model platforms for disease modeling and drug discovery.

-

InSphero AG partnered with a major Asian pharmaceutical company in December 2024 to develop custom 3D pancreatic islet models for diabetes drug screening.

-

In November 2024, CELLINK (BICO Group) unveiled its next-generation BIO X6 Bioprinter, with multi-material and multi-cell printing capability, accelerating complex tissue engineering workflows.

Some of the prominent players in the 3D cell culture market include:

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- PromoCell GmbH

- Lonza

- Corning Incorporated

- Avantor, Inc.

- Tecan Trading AG

- REPROCELL Inc.

- CN Bio Innovations Ltd

- Lena Biosciences

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global 3D cell culture market.

Technology

-

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Base Scaffolds

-

- Hanging Drop Microplates

- Spheroid Microplates with ULA Coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

Application

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

End Use

- Biotechnology and Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)