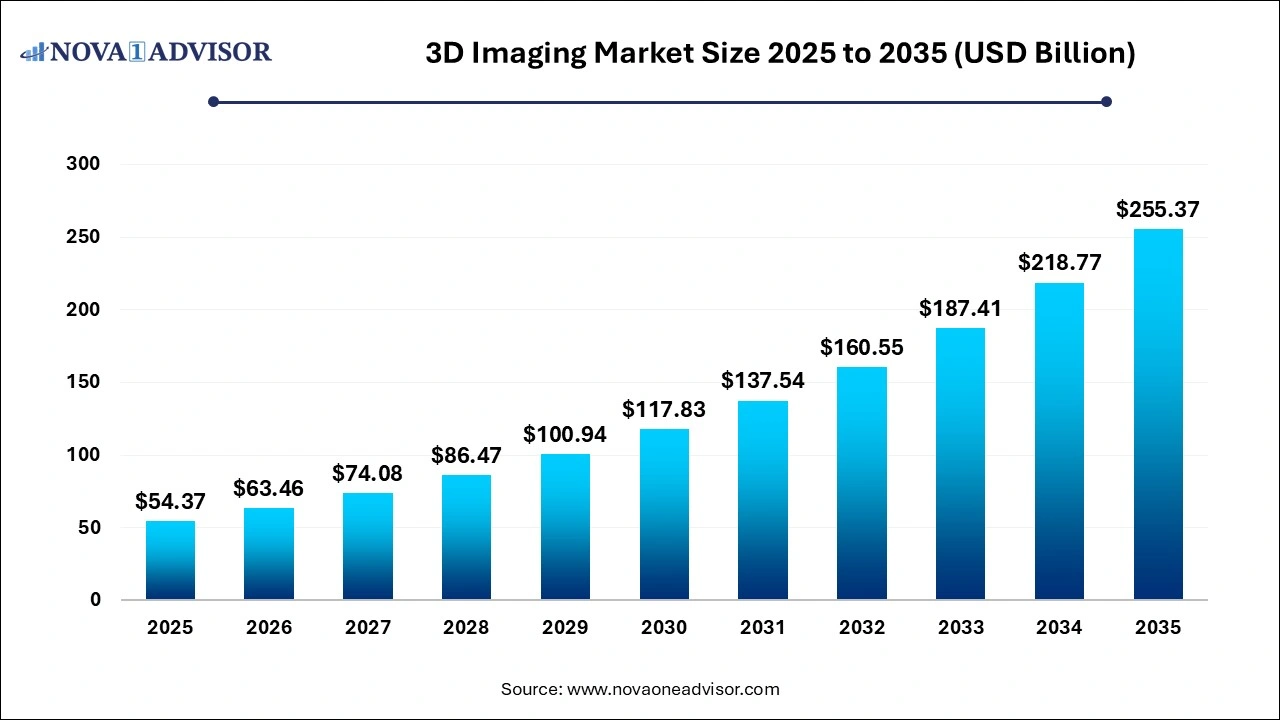

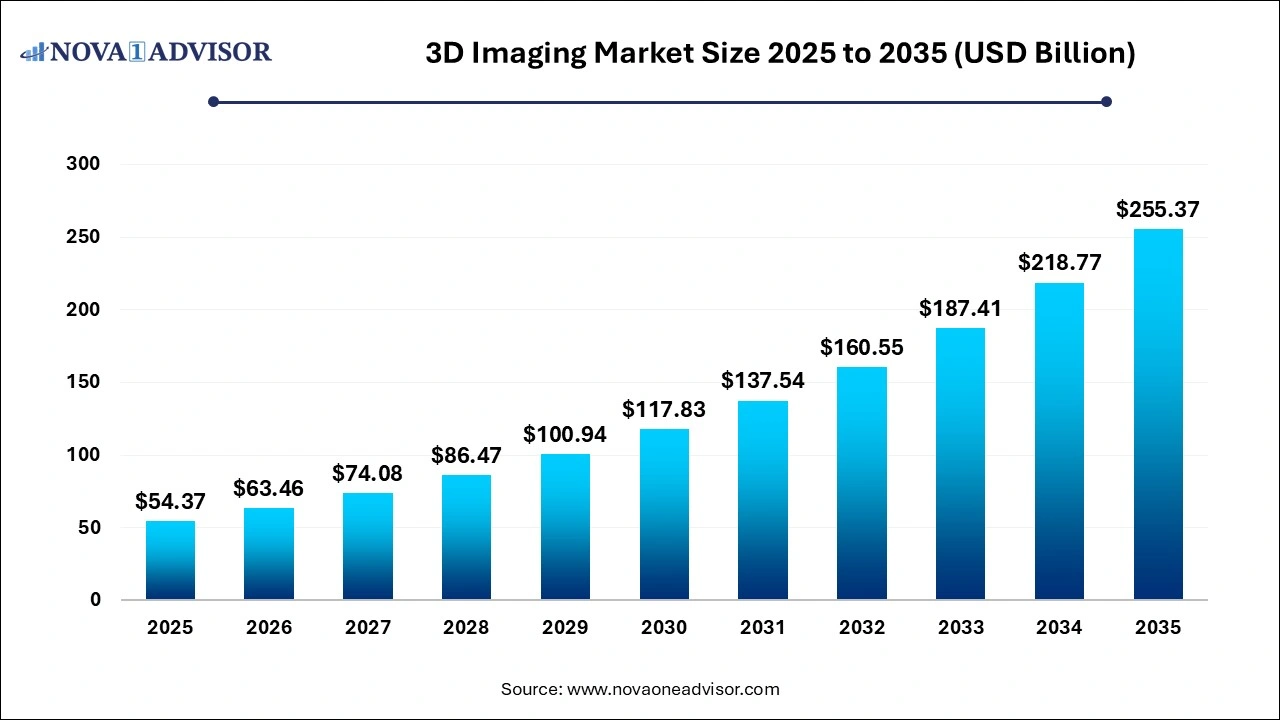

3D Imaging Market Size, Growth and Trends 2026 to 2035

The global 3D imaging market size was exhibited at USD 54.37 billion in 2025 and is projected to hit around USD 255.37 billion by 2035, growing at a CAGR of 16.73% during the forecast period 2026 to 2035.

Key Pointers:

- North America accounted for the highest revenue share of around 36.7% in 2025.

- Asia Pacific is anticipated to expand at the highest CAGR of 20.9% over the forecast period.

- By component, the hardware segment has held a revenue share of around 47% in 2025.

- By deployment, the on-premise segment has accounted for 76.5% of revenue share in 2025.

- By organization, the large enterprise segment has captured 56.6% revenue share in 2025.

- By end-use, the healthcare and life sciences segment has reached 58% revenue share in 2025.

3D Imaging Market Report Scope

| Report Coverage |

Details |

| Market Size in 2026 |

USD 63.46 Billion |

| Market Size in 2035 |

USD 255.37 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 16.73% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Component, By Deployment, By Application, By Deployment Mode, By End-Use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

General Electric, TomTec Imaging Systems GmbH, Planmeca Oy, Ajile Light Industry, Olympus Corporation, EOS Imaging, Siemens Healthcare GmbH, Intrasense, eCential Robotics, FARO, Koninklijke Philips N.V. |

3D Imaging Market Segment Insights

By Component Insights

How did the hardware segment dominate in the 3D imaging market?

The hardware segment is driven by the high unit value of advanced sensors and scanners. This segment generates substantial revenue by enabling the real-time data capture required for robotic guidance and complex medical visualization. Continuous innovation in 3D cameras and LiDAR technology ensures that hardware remains the primary recipient of capital investment across the healthcare and automotive sectors.

How did the software segment expect to grow at the fastest CAGR in the 3D imaging market during the forecast period?

The software segment is driven by the integration of AI and machine learning for superior diagnostic and industrial accuracy. The pivot toward cloud-based 3D solutions is democratizing access to high-fidelity rendering, allowing smaller enterprises to bypass heavy capital expenditure on hardware. As manufacturing shifts toward hyper-automation, sophisticated software platforms are becoming the critical intelligence layer for real-time machine vision and complex spatial reconstruction.

By Deployment Insights

How did the On-premise segment account for the largest share in the 3D imaging market?

The on-premise segment is driven by providing the high-performance computing power and localized control essential for mission-critical 3D rendering and simulation. For high-stakes sectors, such as healthcare and defense, this deployment mode is a prerequisite for ensuring regulatory compliance and the uncompromising security of sensitive diagnostic or tactical data.

How did the cloud segment expect to hold the fastest-growing 3D imaging market in the coming years?

The cloud segment is driven by democratizing access to AI-driven diagnostics and AR/VR integration, cloud platforms enable seamless global collaboration and real-time data processing across dispersed logistics and medical teams. The shift toward industry-specific solutions, such as AWS-hosted radiology tools, underscores a broader transition toward more agile, subscription-based infrastructure.

By Organization Insights

How did the large enterprise segment account for the largest share in the 3D imaging market?

The large enterprise segment is driven by embedding 3D imaging into large-scale production environments, particularly in EV prototyping and aerospace engineering, where they achieve superior quality control and operational productivity. Ultimately, the ability to manage and secure massive datasets in-house ensures that large-scale players remain the primary drivers of high-value 3D industrial applications.

How did the small and medium enterprises segment expect to hold the fastest-growing 3D imaging market in the coming years?

The small and medium enterprises segment is driven by leveraging these cost-effective technologies; smaller firms are integrating immersive 3D marketing and AEC visualization to compete effectively with larger players. Consequently, the shift toward flexible, subscription-based models is empowering SMEs to rapidly scale their digital workflows and customer engagement strategies.

By Application Insights

How did the 3D modelling segment account for the largest share in the 3D imaging market?

The 3D modelling segment is driven by the rising demand for immersive, simulation-based training in healthcare and high-fidelity content in the global entertainment industry. Furthermore, the strategic integration of modelling with geospatial GIS data is revolutionizing urban planning by enabling hyper-accurate digital twins of entire cities. Consequently, these versatile applications ensure that 3D modelling remains a mission-critical component for industries transitioning toward fully digitized and immersive operational workflows.

How did the 3D scanning segment expect to hold the fastest-growing 3D imaging market in the coming years?

The 3D scanning segment is driven by delivering high-velocity, real-time data accuracy that far exceeds traditional 2D systems. The convergence of AI-driven analysis and portable handheld technology has significantly condensed product development cycles in the automotive and customized healthcare sectors. As the market pivots toward integrated hardware-software ecosystems, companies are shifting from selling standalone devices to providing comprehensive end-to-end inspection and modeling services.

By End Use Insights

How did the healthcare and life science segment account for the largest share in the 3D imaging market?

The healthcare and life science segment is driven by the rapid growth of customized prosthetics and dental implants, facilitated by the integration of AI-driven diagnostics and cloud platforms, which are streamlining clinical workflows and improving patient outcomes.

How did the media and entertainment segment expect to hold the fastest-growing 3D imaging market in the coming years?

The 3D scanning segment is driven by hardware milestones like Apple’s 8K 3D imaging capabilities, and is redefining interactive gaming and cinematic experiences. By utilizing real-time rendering and 3D audio, creators are now able to construct hyper-realistic virtual environments that were previously unattainable. Consequently, this segment remains a primary catalyst for innovation, pushing the boundaries of spatial computing and digital storytelling.

North America accounted for the largest revenue share of over 36.7% in 2022 and is anticipated to retain its position over the forecast period. Factors such as the presence of major market vendors and the high adoption of advanced technologies are fueling the market growth in the region.

Asia Pacific is anticipated to expand at the highest CAGR of 20.9% over the forecast period. The growth of the regional market is mainly attributed to the growth in the healthcare, automation, media and entertainment, and the manufacturing sector. With the potential growth in the sectors, there have been increasing investments from Asia Pacific nations such as Japan, India, and China. The growing technological awareness and adoption in the region are also expected to fuel the market growth across the region over the forecast period.

Some of the prominent players in the 3D Imaging Market include:

- General Electric

- TomTec Imaging Systems GMBH

- PLANMECA OY

- Ajile Light Industry

- OLYMPUS CORPORATION

- EOS Imaging

- Siemens Healthcare GmbH

- INTRASENSE

- eCential Robotics

- FARO

- Koninklijke Philips N.V.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global 3D Imaging market.

By Component

- Software

- Hardware

- 3D Sensor

- 3D Display

- Others

- Services

By Organization

- Large Enterprises

- Small and Medium-sized Enterprises

By Deployment Mode

By Application

- Layout and Animation

- Image Reconstruction

- 3D Modelling

- 3D Scanning

- 3D Rendering

- Others

By End-Use

- Automotive and Transportation

- Manufacturing

- Healthcare and Life Sciences

- Architecture and Construction

- Media and Entertainment

- Security & Surveillance

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)