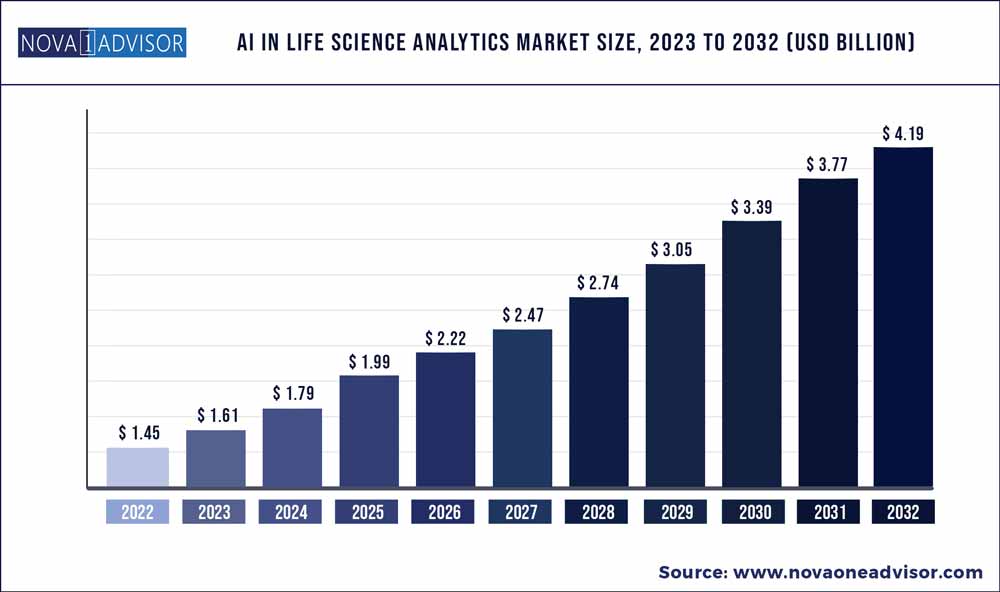

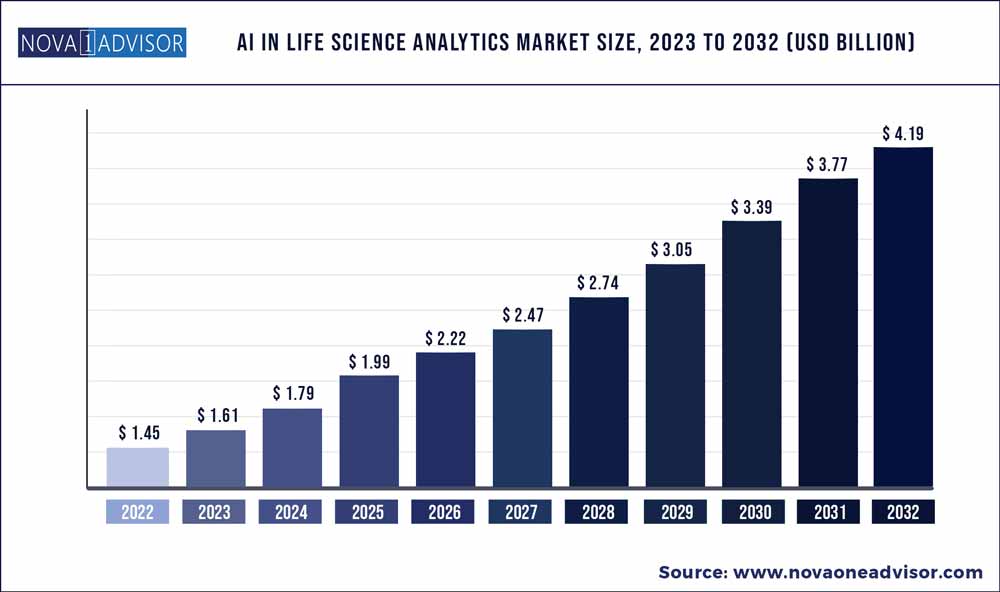

The global AI in life science analytics market size was exhibited at USD 1.45 billion in 2022 and is projected to hit around USD 4.19 billion by 2032, growing at a CAGR of 11.2% during the forecast period 2023 to 2032.

Key Pointers:

- In 2022, the service component segment dominated the market with a share of 37.11%.

- The cloud segment dominated the market with a revenue share of 50.19% in 2022

- By end-user, the pharmaceutical segment held the largest share of 46.10% in 2022.

- The sales and marketing segment held the largest share of 33.9% in 2022.

- North America dominated the market in 2022 with a revenue share of 50.17%.

- Asia Pacific is expected to witness the highest growth during the forecast period.

AI In Life Science Analytics Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 1.61 Billion

|

|

Market Size by 2032

|

USD 4.19 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 11.2%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Component, deployment, application, end-user, region

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

Indegene; Lexalytics; Databricks; SAS Institute Inc.; Sisense; IQVIA; IBM; Sorcero

|

The major factors contributing to the growth of the market is increased clinical trials, drug discovery, and growing focus on rare diseases. Furthermore, technological advancements in deep learning and artificial intelligence are also the prime reasons for expanding the market.

Rapid developments in artificial intelligence through the healthcare sector and increasing adoption of these tools in healthcare institutions in order to organize workflows is anticipated to be the key factor driving the growth of the market. Moreover, artificial intelligence is used to improve the supply chain, validate genetic targets and create novel compounds. The tools are used to enhance clinical trials and improve operational efficiencies while controlling the costs of the processes which is expected to positively contribute to the growth of the market.

Moreover, rising demand for correct and accurate diagnosis of diseases among the population is expected to drive the demand for the adoption of these models. Moreover, companies such as IBM, DeepMind and P1vital Products are working towards development of solutions for accurate diagnosis of diseases such as cancer, central nervous system disorders which is projected to boost the market growth. Moreover, through the use of AI models the drug discovery and development process can be fast tracked which is expected to contribute to the market growth.

COVID-19 pandemic has shown positive impact on adoption of technologically advanced tools in life sciences, thereby boosting the growth of the market. The amount of data generated every day by research and development is unfathomable; thus, AI plays an important role in interpreting data, assisting in the analysis and drawing of relevant information more quickly. AI offers reliable and big data in life science, assisting companies in revamping business models and streamlining biopharma manufacturing.

Component Insights

In 2022, the service component segment dominated the market with a share of 37.11%. The service segment is also anticipated to record the fastest growth during the forecast period. The primary factor driving the growth of the segment is an increase in the trend of outsourcing services. The majority of companies lack proper analytic components, which makes it difficult for them to perform better and more accurate analyses; thus, outsourcing is extremely crucial. The use of analytics requires experts for analyzing the large amounts of data generated, which drives the demand for AI in order to analyze the data accurately and effectively, thereby driving the growth of the segment during the forecast period.

AI is gaining trust in the analytics field because it is capable of providing fast, precise, and reliable data on which companies can rely. As a result, companies are more interested in investing in the integration of artificial intelligence algorithms into analytical solutions. The expansion of data analytics companies' services and growing technological collaborations are positively impacting the growth of the segment.

Deployment Insights

The cloud segment dominated the market with a revenue share of 50.19% in 2022 and is anticipated to grow at the fastest rate during the forecast period. Factors contributing to this growth are high penetration of the internet, development of cloud-based services, adoption of cloud technologies, and shift in preference toward cloud-based technologies from on-premise technologies owing to benefits provided by the former. In addition, cloud-based AI services are ideal for many organizations because they eliminate the need for large data centers, which require a significant investment. As a result, cloud-based AI is cost-effective, thereby demonstrating lucrative growth.

Cloud-based AI ensures smooth workloads and automates repetitive processes, increasing overall efficiency. The major advantage of cloud-based AI deployment is that the organization can cut down the costs associated with hardware administration and maintenance. Furthermore, by utilizing reliable real-time data, AI significantly improves seamless data management

End-user Insights

By end-user, the pharmaceutical segment held the largest share of 46.10% in 2022. Factors such as the increasing adoption of AI tools in the process of manufacturing, clinical trials, and drug discovery are some of the factors driving the growth of the segment. The use of these tools can fast-track the discovery of new molecules, and considerably reduce cycle times and costs while improving clinical outcomes. Moreover, through the use of AI tools, pharmaceutical manufacturers can identify quality control issues, and predict the proven bottlenecks, which are expected to further drive the adoption of this technology.

The biotechnology segment is anticipated to witness lucrative growth during the forecast period owing to the advantages offered by the incorporation of this technology, such as accelerated R&D, effective decision-making, analysis of homogenous databases, and cost-effectiveness. Moreover, through the integration of these tools, biotechnology firms can improve their organizational workflows in order to gain competitive advantages. Furthermore, machine learning is used for interpreting large genomic data sequences and genomic data sets, which is expected to drive the growth of the segment during the forecast period.

Application Insights

The sales and marketing segment held the largest share of 33.9% in 2022. The factors that boost the growth are the benefits provided by AI such as marketing automation, increased personalization, reduced errors, as well as smart and faster decision-making abilities. The demand for analytical solutions is constantly increasing, thus the competition is also high, so to cope with the competition major organization that provides solutions are implementing AI in the sales and marketing department. AI effectively analyses customer data and automates repetitive tasks by utilizing its advanced algorithms.

During the forecast period, the research and development segment is expected to grow at the fastest rate. The rising adoption of analytical solutions in drug development and clinical trials is one of the driving factors for growth. Leading companies are constantly investing in the development of new innovative drugs for the treatment of severe diseases such as cancer, diabetes, and other infectious diseases that necessitate extensive research and development. As a result, the segment is expected to expand at a lucrative rate in the coming years.

Regional Insights

North America dominated the market in 2022 with a revenue share of 50.17%. This growth is contributed by higher demand for AI technology, increased digital literacy as well as advancements in life science analytics in the region. Moreover, increasing initiatives undertaken by the governments and collaborations among government bodies and private players for the development of technological solutions are anticipated to drive market growth. Furthermore, the rapid adoption of the solutions by healthcare institutions in order to organize organizational workflows is anticipated to boost the market growth.

Asia Pacific is expected to witness the highest growth during the forecast period. The rising number of countries aiming to adopt AI-based tools and the extensive presence of biotech companies are the reasons that are fueling the growth of the market. Major players in Asia Pacific are more focused on the adoption of AI-based analytical tools to enhance operational efficiency, which also plays a crucial role in market growth.

Some of the prominent players in the AI In Life Science Analytics Market include:

- Indegene

- Lexalytics

- Databricks

- SAS Institute Inc.

- Sisense

- IQVIA

- IBM

- Sorcero

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global AI In Life Science Analytics market.

By Component

- Software

- Hardware

- Services

By Deployment

By Application

- Research and Development

- Sales and Marketing support

- Supply chain analytics

- Others

By End-user

- Medical Devices

- Pharmaceutical

- Biotechnology

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)