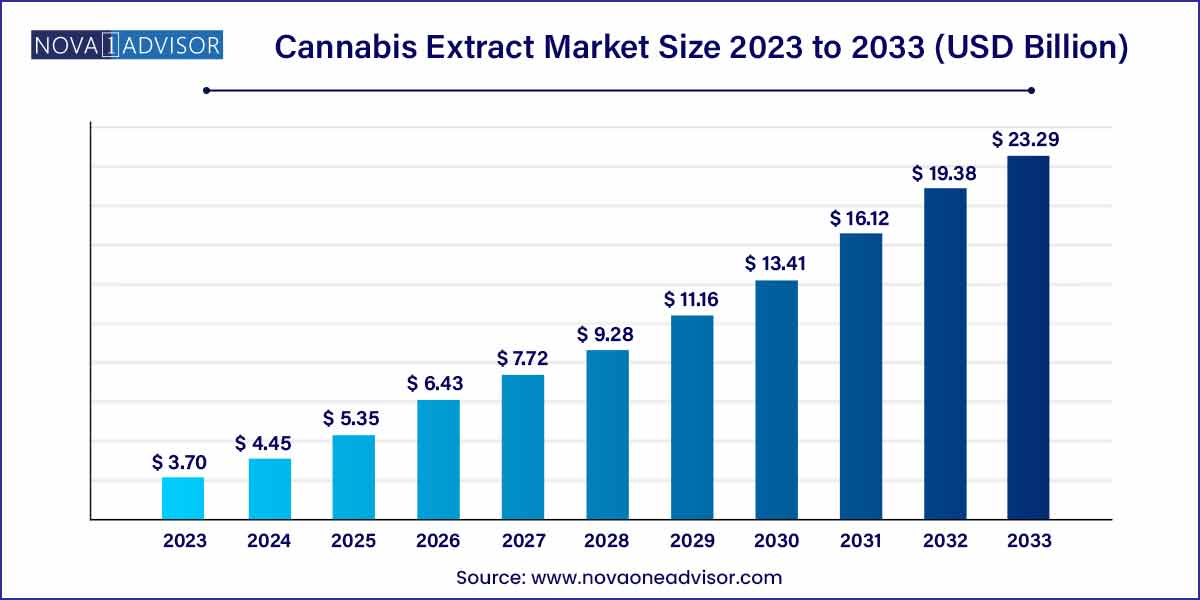

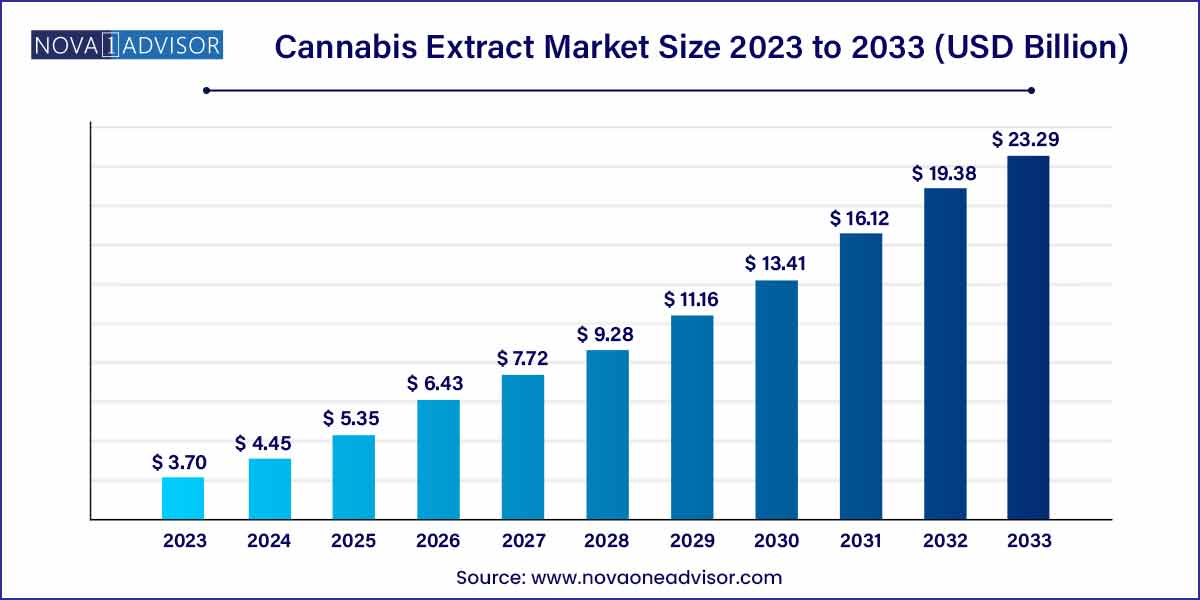

The global cannabis extract market size was exhibited at USD 3.70 billion in 2023 and is projected to hit around USD 23.29 billion by 2033, growing at a CAGR of 20.2% during the forecast period of 2024 to 2033.

Key Takeaways:

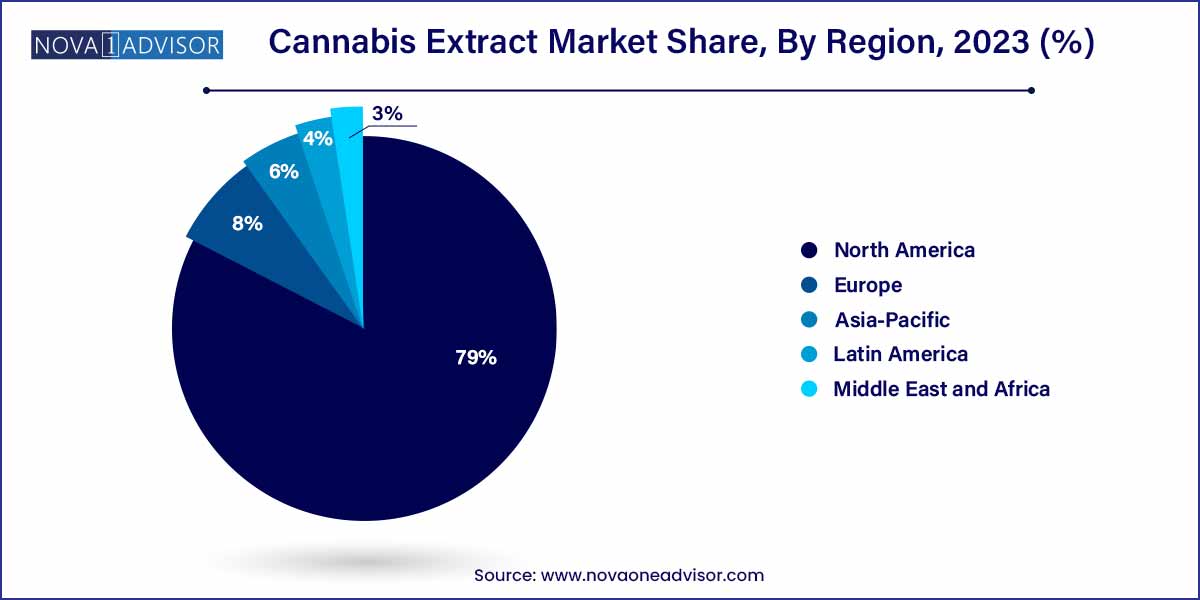

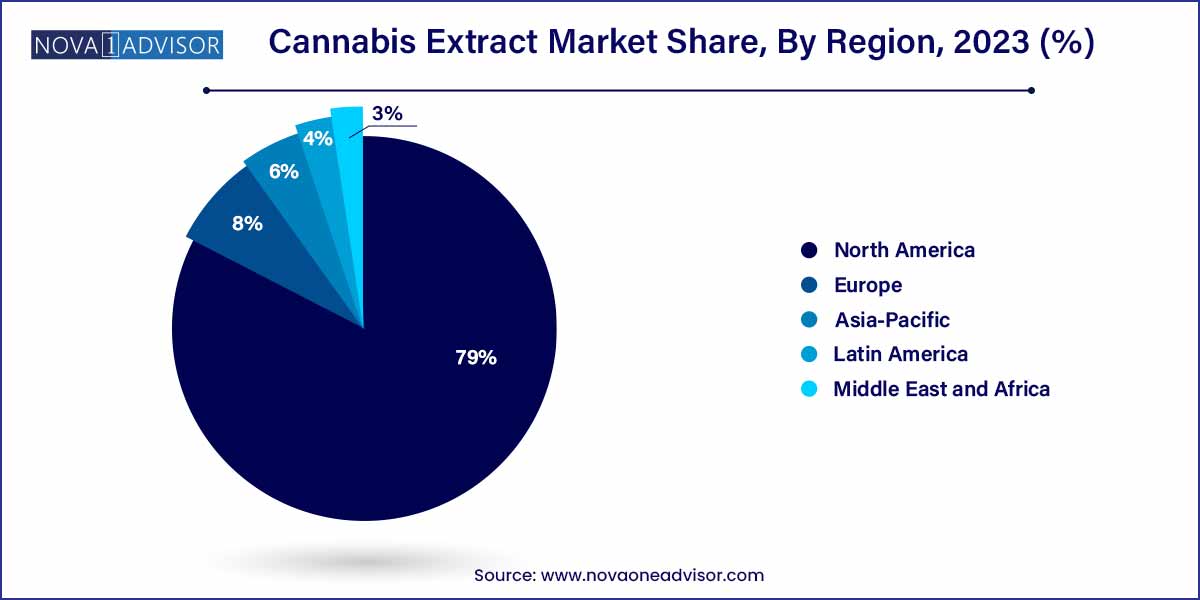

- North America accounted for a high revenue share of 79.0% in 2023.

- The oil sector held the largest revenue share of 62.8% in 2023 and is anticipated to register the fastest growth rate of 20.3%.

- Among them, marijuana held the highest revenue share of 83.5% in 2023 and is also expected to grow with the fastest CAGR value of 20.1% in the forecast period.

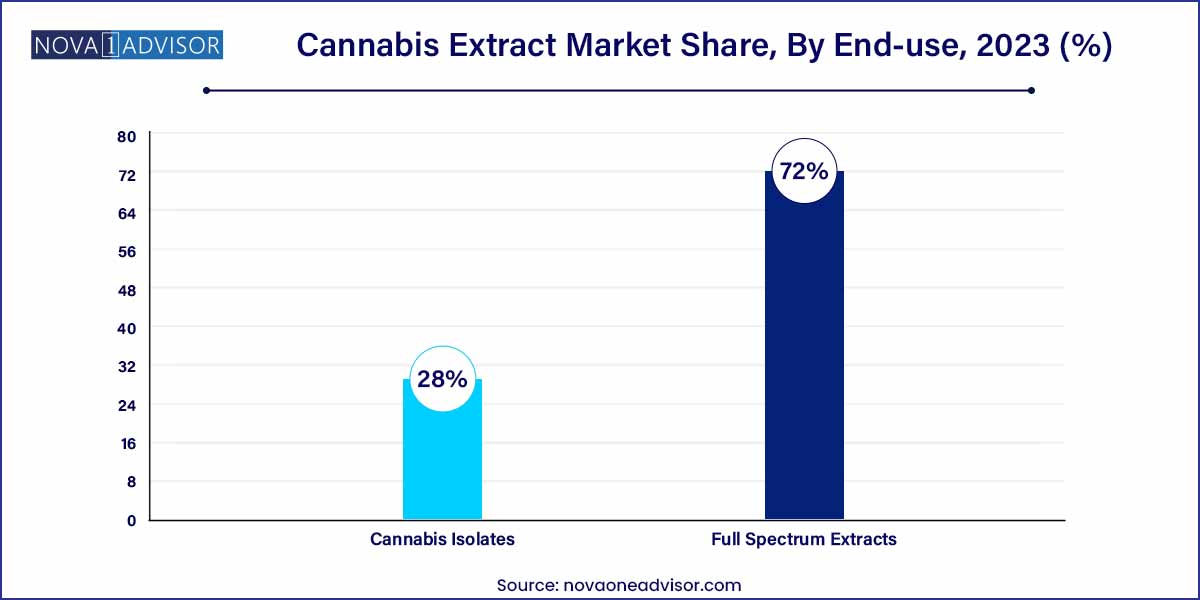

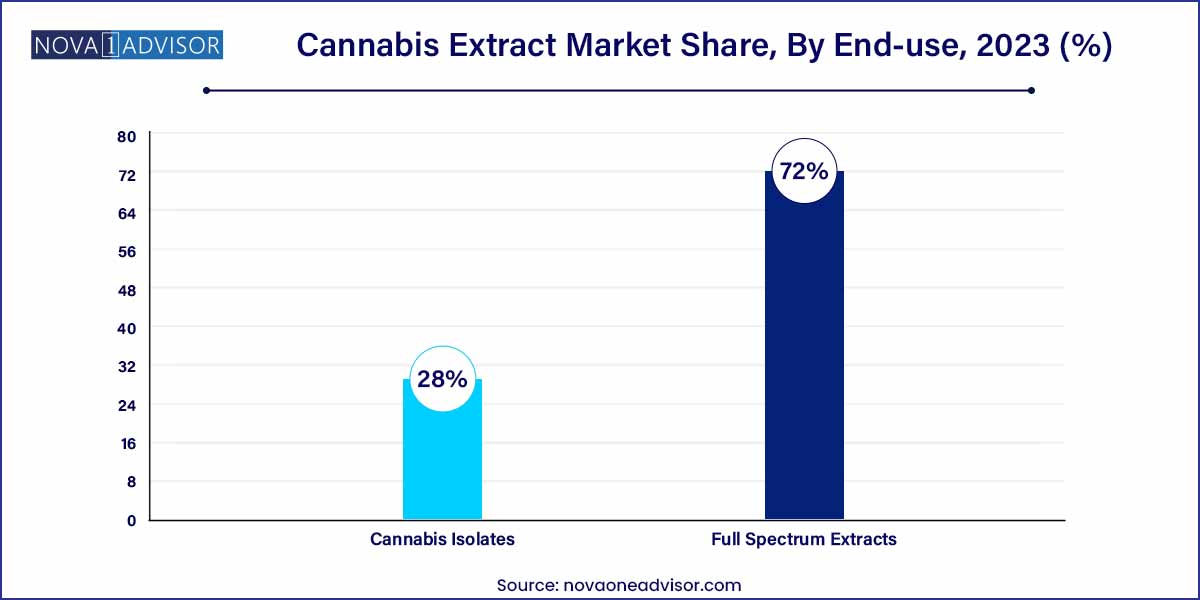

- The full-spectrum extract contains the entire range of cannabinoids taken from a cannabis plant. The segment held the largest share of 72.0% in 2023 and is anticipated to register the fastest growth rate of 21.0%.

Market Overview

The Cannabis Extract Market is emerging as a transformative segment within the global cannabis industry, characterized by its rapid expansion, increasing legal acceptance, and diversification into multiple end-use applications. Cannabis extracts refer to concentrated forms of the plant’s bioactive compounds—mainly cannabinoids like THC (tetrahydrocannabinol) and CBD (cannabidiol)—produced through solvent-based or solventless extraction processes. These extracts are the foundation of a wide range of product types, including oils, tinctures, edibles, topicals, and vape products.

This market’s growth is underpinned by the expanding legalization of cannabis for both medical and recreational purposes across several regions. Countries like Canada, parts of Europe, and an increasing number of U.S. states have allowed cannabis extracts to become legally available, driving consumer interest and accelerating product innovation. Additionally, growing awareness about the therapeutic potential of cannabinoids in treating conditions such as chronic pain, epilepsy, anxiety, and neurodegenerative diseases has fueled demand for high-purity, standardized extracts.

Beyond therapeutic use, cannabis extracts are also seeing surging interest for recreational consumption due to their ease of use, potency, and discreet nature. Unlike traditional cannabis flower products, extracts offer users the advantage of controlled dosing, minimal odor, and higher cannabinoid concentrations—features especially valued by health-conscious or first-time users. As consumer preferences evolve and R&D investments deepen, the extract market is well-positioned to lead the next wave of cannabis commercialization.

Major Trends in the Market

-

Surging Popularity of Full Spectrum Extracts: Consumers increasingly favor full spectrum products for their synergistic "entourage effect" compared to isolated compounds.

-

Growth in Personalized Cannabinoid Therapies: Tailored extracts targeting specific medical conditions, patient profiles, or genetic backgrounds are on the rise.

-

Integration of Blockchain for Supply Chain Transparency: Cannabis companies are adopting blockchain to enhance traceability and product authenticity.

-

Expansion of Hemp-Derived CBD Extracts: With regulatory clarity around hemp in many regions, CBD oils and tinctures derived from hemp are gaining mass appeal.

-

Shift Toward Eco-Friendly Extraction Techniques: COâ‚‚ and solventless extraction methods are becoming industry standards to meet consumer demand for natural, clean-label products.

-

Proliferation of Minor Cannabinoid-Based Extracts: Compounds like CBG, CBN, and THCV are entering the mainstream, supported by niche applications and early clinical findings.

-

Celebrity and Influencer Endorsements: Cannabis extract brands are leveraging endorsements from public figures to accelerate brand visibility and market trust.

-

Rise of Online Retail and Direct-to-Consumer Sales Channels: The digitalization of the cannabis industry is supporting extract market growth via subscription models and e-commerce.

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.70 Billion |

| Market Size by 2033 |

USD 23.29 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 20.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product Type, Extract Type, Sources, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Tikun Olam; CANOPY GROWTH CORPORATION; Tilray; Aurora Cannabis; The Cronos Group; Maricann Inc.; Organigram Holdings Inc.; Aphria Inc. |

Key Market Driver: Legalization and Policy Evolution

The leading driver for the cannabis extract market is the liberalization of laws and regulatory frameworks surrounding cannabis production, distribution, and consumption. Over the past decade, governments across North America, parts of Europe, and Latin America have moved to legalize medical and in several instances, recreational cannabis. These legislative shifts have unlocked new business models and legitimized consumer access to high-quality extracts, particularly oils and tinctures.

For instance, the 2018 Farm Bill in the United States catalyzed the growth of hemp-derived CBD by removing hemp from the list of controlled substances, triggering a cascade of product innovation in the wellness sector. Similarly, Canada’s Cannabis Act, which came into effect in October 2018, established one of the world’s most comprehensive regulatory models, allowing for extract sales under strict safety and labeling standards. As more countries and U.S. states modernize cannabis policy, the regulatory green light is expanding the extract market’s boundaries.

Key Market Restraint: Regulatory Inconsistencies and Stigma

Despite global advancements in cannabis policy, regulatory inconsistency and lingering social stigma remain significant restraints. Regulations vary dramatically between countries and even between states or provinces within a country leading to fragmented supply chains, uneven quality standards, and compliance challenges for manufacturers.

For example, while CBD is widely accepted in the U.S. and Europe, its legal status and marketing limitations differ based on its source (hemp vs. marijuana) and intended use (dietary supplement vs. drug). In Asia and parts of the Middle East, cannabis extracts remain largely prohibited, limiting international market penetration. Moreover, public perceptions in traditionally conservative regions still associate cannabis with recreational drug abuse, hampering acceptance of its legitimate medical use. These hurdles inhibit investor confidence, delay product launches, and slow down the expansion of retail networks.

Key Market Opportunity: Expansion of Medical Indications

One of the most promising opportunities for the cannabis extract market lies in the expansion of therapeutic applications across a broad range of chronic and complex conditions. Clinical trials and real-world evidence are increasingly supporting the use of cannabis-derived compounds for ailments beyond traditional pain or seizure management.

Emerging research suggests potential benefits of cannabinoids in managing neurodegenerative disorders like Parkinson’s and Alzheimer’s, autoimmune diseases like multiple sclerosis, and psychiatric disorders such as PTSD and depression. Furthermore, patient demand for alternatives to opioids for pain and anxiety management continues to rise, positioning cannabis extracts as a safer, non-addictive option.

Pharmaceutical companies are investing in cannabinoid-based drug formulations, and regulators are responding with dedicated pathways for approval exemplified by the FDA’s endorsement of Epidiolex, a CBD-based medication for epilepsy. As these therapeutic frontiers expand, the extract market stands to gain new demand from clinical and home-based care settings.

By Product Type Insights

Oils dominated the cannabis extract market due to their versatility, user-friendliness, and high concentration of cannabinoids. Cannabis oils are widely used across both medical and recreational verticals, offering easy dosing and rapid onset of action. They are typically consumed sublingually or used as a base for edibles and topical applications. Their shelf-stable nature and customizable cannabinoid profiles make them particularly attractive to both novice users and seasoned patients. Brands are increasingly producing oil formulations tailored to specific needs—such as sleep aid, pain relief, or mood enhancement—adding to the segment’s appeal.

On the other hand, tinctures are the fastest-growing product type, especially among health-conscious consumers and senior demographics. Tinctures allow for discreet and controlled administration, often coming with droppers that make dosage adjustment simple. Additionally, their alcohol- or glycerin-based composition ensures longer shelf life and enhanced bioavailability compared to some other delivery formats. As healthcare professionals become more comfortable recommending cannabis-based therapies, tinctures are gaining traction in clinical consultations due to their non-inhalation delivery and precision.

Source Insights

Marijuana-derived extracts dominate the market due to their broad cannabinoid profile, including high concentrations of THC. These extracts are typically used in recreational products and in medical formulations for conditions like cancer, PTSD, and severe pain—where THC’s analgesic and appetite-stimulating properties are highly valued. The established cultivation infrastructure for marijuana in legalized regions also contributes to the dominance of this segment.

Hemp is the fastest-growing source, particularly for CBD extracts. The non-psychoactive nature of hemp-derived cannabinoids makes them accessible to a broader consumer base and compliant with international trade regulations. With the U.S. Farm Bill and similar legislation in Europe, Asia, and Latin America enabling hemp cultivation, companies are rapidly scaling production and launching CBD-focused product lines targeting wellness and cosmetic industries.

Full spectrum extracts lead the market because they retain the complete range of cannabinoids, terpenes, and flavonoids present in the cannabis plant. These components work together to produce the entourage effect, wherein the combined compounds amplify each other’s therapeutic efficacy. Full spectrum extracts are increasingly preferred for conditions like anxiety, chronic pain, and inflammation where comprehensive endocannabinoid engagement is beneficial. As consumer understanding of cannabis pharmacology matures, demand for holistic, plant-based formulations continues to rise.

Cannabis isolates are witnessing faster growth, especially in the pharmaceutical and nutraceutical industries where purity, standardization, and dose specificity are critical. Isolates contain a single cannabinoid—typically CBD or THC—in pure crystalline or powdered form. Their near-100% purity ensures consistent potency and minimizes psychoactive or allergenic risks, which is essential for clinical trials and pediatric applications. As regulatory frameworks for cannabis-derived medicines solidify, isolates are increasingly adopted in capsule, tablet, and oral spray formulations.

By Regional Insights

North America holds the dominant position in the cannabis extract market, accounting for the largest revenue share due to its advanced legal landscape, mature consumer base, and active R&D environment. The United States and Canada have emerged as industry pacesetters. In the U.S., over 35 states have legalized medical cannabis, while several—including California, Colorado, and New York—permit recreational use. Canada’s federal legalization supports nationwide product distribution, offering brands a rare opportunity to operate at scale. Moreover, the presence of companies like Tilray, Aurora Cannabis, and Curaleaf ensures continuous innovation and investment in extraction technologies.

Asia-Pacific is the fastest-growing region, fueled by evolving legal frameworks, increasing investment, and rising health consciousness. Thailand became the first Southeast Asian nation to legalize medical cannabis, followed by progressive reforms in countries like South Korea, Japan (for research), and India (in Ayurvedic applications). The region’s vast population base and unmet medical needs present a lucrative frontier for CBD and non-psychoactive cannabinoid extracts. Furthermore, favorable climate conditions and low labor costs in countries like India and Vietnam are attracting global cultivators and extractors to establish local production hubs.

- Tikun Olam

- CANOPY GROWTH CORPORATION

- Tilray

- Aurora Cannabis

- The Cronos Group

- Maricann Inc

- Organigram Holdings Inc.

- The Cronos Group

- Aphria Inc

Recent Developments

-

March 2025: Tilray Brands Inc. announced the launch of a new full spectrum extract line targeting chronic pain and anxiety patients across Canadian provinces.

-

February 2025: Aurora Cannabis secured a strategic partnership with an Australian biotech company to co-develop cannabis isolate formulations for epilepsy.

-

January 2025: Canopy Growth Corporation expanded its hemp processing capacity in the U.S. Midwest to meet rising demand for CBD oil tinctures in wellness retail.

-

November 2024: Curaleaf Holdings launched an AI-driven dosage advisory app integrated with their tincture product line to aid first-time medical cannabis users.

-

October 2024: Charlotte’s Web Holdings entered a joint venture with a cosmetics firm to produce hemp-derived extracts for skincare applications in Europe.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global cannabis extract market.

Product Type

Extract Type

- Full Spectrum Extracts

- Cannabis Isolates

Sources

End-use

-

- Cancer

- Chronic Pain

- Depression and Anxiety

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer’s

- Post-Traumatic Stress Disorder (PTSD)

- Parkinson's

- Tourette’s

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)