DNA-encoded Library Market Size and Trends

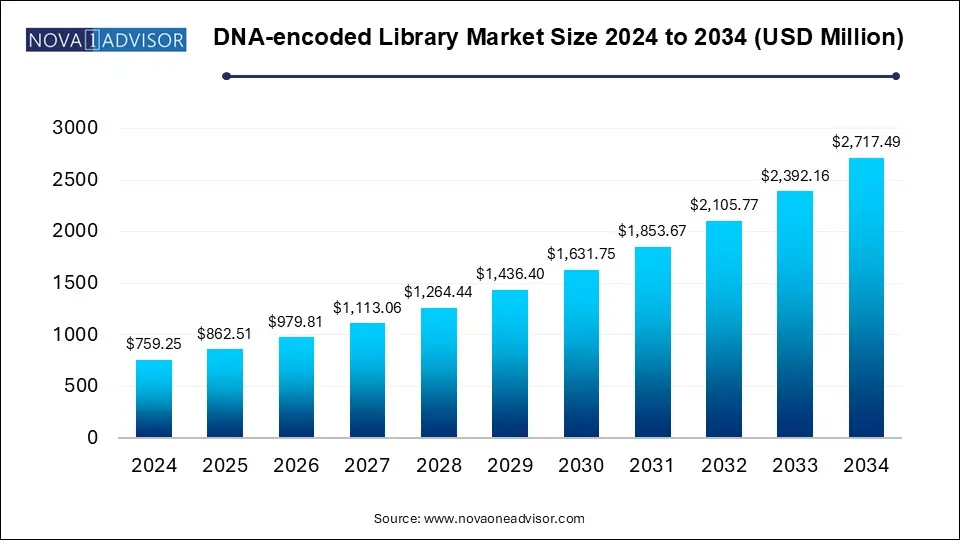

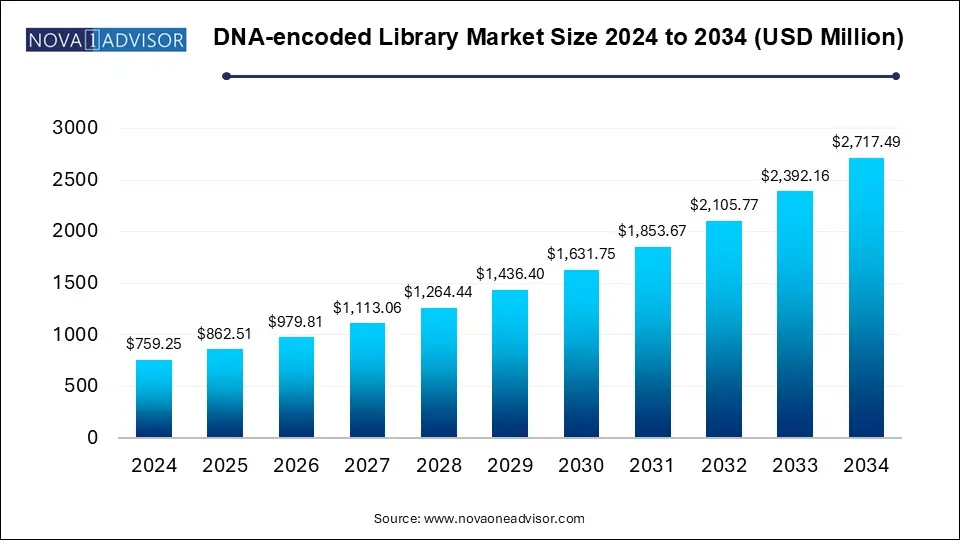

The DNA-encoded Library Market size was exhibited at USD 759.25 million in 2024 and is projected to hit around USD 2717.49 million by 2034, growing at a CAGR of 13.6% during the forecast period 2025 to 2034.

Key Takeaways:

- The services segment led the DNA-encoded library market in 2024

- The oncology segment held the largest revenue share of 39% in 2024

- The hit generation/identification segment dominated the market in 2024, with a share of 43%.

- Pharmaceutical and biotechnology companies accounted for the largest revenue share of 43% in 2024

Market Overview

The DNA-encoded library (DEL) market is redefining the landscape of drug discovery by offering a highly efficient, scalable, and cost-effective method to screen billions of small molecules in a single experiment. DEL technology, which links chemical compounds to unique DNA tags for identification and amplification, is revolutionizing hit identification and early-stage drug development processes. It combines the benefits of combinatorial chemistry and molecular biology to accelerate the identification of novel ligands with high affinity and specificity.

Traditionally, high-throughput screening (HTS) has been the standard approach for identifying active compounds, but it requires large sample volumes, expensive infrastructure, and manual labor. DEL circumvents these issues by encoding libraries of millions to billions of compounds with DNA barcodes, allowing simultaneous and massively parallel screening of drug-like molecules against biological targets. The technique significantly reduces cost, time, and labor while improving the precision of hit selection.

Pharmaceutical giants, contract research organizations (CROs), and biotech firms are rapidly adopting DEL to enrich their early-stage pipelines. Academic institutions and drug discovery consortia have also shown increased interest due to its potential in targeting previously undruggable proteins. With growing demand for innovative therapies and increasing R&D investments, the DNA-encoded library market is poised for robust growth through 2034.

Major Trends in the Market

- Expansion of DEL in Oncology Drug Discovery: DEL is extensively used in identifying oncology targets, where traditional screening often fails.

- AI and Machine Learning Integration: Companies are leveraging AI to optimize screening results and predict compound-target binding.

- Growth of Outsourced Screening Services: Rising adoption of CROs for DEL design and analysis to minimize in-house costs.

- Targeting Challenging Protein-Protein Interactions (PPIs): DEL is gaining popularity in tackling hard-to-drug targets like PPIs.

- Increase in Collaborations Between Pharma and Biotech: Companies like GSK and X-Chem are collaborating to co-develop DEL-based therapies.

- Miniaturization and Automation of Screening Platforms: Advances in microfluidics and automated systems enable more accurate DEL-based screenings.

- Rise in Academic Licensing Deals: Research institutes are licensing DEL platforms to biotech firms, supporting commercialization.

Report Scope of DNA-encoded Library Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 862.51 Million |

| Market Size by 2034 |

USD 2717.49 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 13.6% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product & Service, Therapeutic Area, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Merck KGaA; GenScript; Pharmaron; WuXi Biology; Aurigene Pharmaceutical Services; BOC Sciences; LGC Bioresearch Technologies; SPT Labtech Ltd; Life Chemicals; Charles River Laboratories |

Key Market Driver

Growing Need for Efficient Early-Stage Drug Discovery Tools

The main force propelling the DNA-encoded library market is the global demand for efficient and scalable early-stage drug discovery platforms. Traditional drug screening methods are labor-intensive and often fail to identify leads against challenging biological targets. DEL technology transforms this process by enabling simultaneous screening of millions to billions of compounds against a target protein. Moreover, the DNA barcoding system allows for unambiguous identification and quick amplification of binders using polymerase chain reaction (PCR). This significantly accelerates hit generation, enhances accuracy, and lowers costs—an ideal combination for pharmaceutical companies looking to shorten their development timelines and reduce attrition in clinical trials.

Key Market Restraint

Complexity in Data Analysis and Bioinformatics Integration

One of the major challenges facing the DEL market is the sheer complexity of sequencing data generated during high-throughput screening. Identifying relevant hits from millions of potential binders requires sophisticated bioinformatics tools and skilled data analysts. Interpretation of screening results must consider chemical structure-activity relationships (SAR), background noise, and potential off-target effects. Moreover, integration with cheminformatics and structural biology platforms is essential for downstream validation. These challenges create entry barriers for smaller firms and academic institutions lacking the computational infrastructure or bioinformatics expertise, thereby restraining widespread adoption.

Key Market Opportunity

Emergence of DEL in Personalized and Precision Medicine

As the pharmaceutical industry shifts toward personalized medicine, DNA-encoded libraries offer promising opportunities to discover patient-specific therapies. By integrating DEL technology with genomic data and disease-specific biomarkers, researchers can identify lead compounds that are more effective in genetically defined patient populations. This approach is particularly relevant in oncology, rare genetic disorders, and immunology, where standard treatments often fail. For example, patient-derived cell lines or disease-specific proteins can be screened against custom-built DELs to uncover unique therapeutic candidates. As the field of precision medicine expands, DEL has the potential to become a cornerstone in the development of highly tailored treatment regimens.

Segmental Analysis

Product & Service Outlook

Services dominated the DNA-encoded library market in 2024, primarily driven by rising outsourcing trends.

The design, synthesis, and screening services offered by specialized CROs and biotech firms have become highly sought after due to the technical sophistication required for DEL experiments. These service providers offer end-to-end solutions, including target selection, library synthesis, assay development, sequencing, and hit analysis. Companies such as WuXi AppTec and X-Chem have established themselves as leaders in this space by offering proprietary libraries and high-throughput platforms. The outsourcing of these services not only reduces capital expenditure for pharmaceutical firms but also shortens drug discovery timelines by leveraging the expertise of established providers.

Products, particularly kits & reagents, are emerging as the fastest-growing sub-segment.

As in-house capabilities for DEL screening grow among pharmaceutical companies and research institutes, the demand for standardized kits, reagents, and encoded libraries is rising. These products enable efficient and reproducible library preparation and screening. Pre-designed DEL kits reduce the time required for setup and are especially useful for pilot studies and academic research. Furthermore, modular kits are allowing customization, which broadens their application scope across therapeutic areas. The flexibility and growing affordability of these products make this sub-segment a lucrative growth avenue.

Therapeutic Area Outlook

Oncology accounted for the largest share in 2024, maintaining its dominance across applications.

Cancer drug discovery remains the focal point of DEL-based screening efforts. DEL technology is particularly effective in targeting kinase domains, transcription factors, and protein-protein interactions implicated in tumor progression and metastasis. The massive chemical diversity and precise screening capability of DEL platforms enable researchers to identify potent compounds for aggressive and rare cancers. Companies like GSK and AstraZeneca are already using DEL technology in their oncology pipelines, underscoring its critical role in this domain.

Neurological Diseases represent the fastest-growing therapeutic segment.

Neurological conditions, such as Alzheimer's, Parkinson’s, and Huntington’s disease, pose significant drug development challenges due to the complexity of brain chemistry and the blood-brain barrier. DEL is increasingly being utilized to discover ligands that can penetrate neural tissues and modulate neurological targets. Advances in CNS-targeted delivery systems and the availability of disease-relevant biomarkers are expanding the application of DEL in neurology. Collaborations between neuro-focused biotechs and DEL technology providers are paving the way for novel CNS therapeutics.

Application Outlook

Hit Generation / Identification was the leading application area in the market.

DEL’s primary value proposition lies in its ability to generate high-confidence hits rapidly and accurately. The vast chemical space encoded within DNA libraries allows for the exploration of novel scaffolds and binding motifs that traditional HTS may overlook. DEL screening can be performed in aqueous environments, making it suitable for a variety of protein targets including GPCRs, kinases, and enzymes. The process is also highly reproducible, enabling better hit triaging and prioritization for downstream development.

Hit Validation / Optimization is projected to grow at the fastest rate.

Following the identification of initial hits, validating and optimizing those candidates to improve potency, selectivity, and pharmacokinetic properties is critical. Recent advances in structure-guided design, artificial intelligence, and SAR analysis are being combined with DEL outputs to streamline this process. Moreover, hybrid workflows integrating DEL with cryo-EM and X-ray crystallography are enabling structure-based hit refinement, further boosting the potential of this segment.

End Use Outlook

Pharmaceutical & Biotechnology Companies were the leading end users of DEL technologies in 2024.

These organizations are the primary drivers of DEL adoption due to their emphasis on pipeline expansion and innovation. Companies are integrating DEL into their lead discovery platforms to improve efficiency and tackle undruggable targets. Large pharma firms are also investing in proprietary library creation and building in-house capabilities to gain long-term strategic advantages. Their ability to invest in infrastructure and computational tools gives them a competitive edge in utilizing DEL for high-value therapeutic areas.

Contract Research Organizations (CROs) are witnessing the fastest growth among end users.

With increasing demand for cost-effective and flexible drug discovery solutions, CROs are expanding their DEL capabilities to offer comprehensive discovery services. They cater to small- and mid-sized biotech firms and academic institutions that lack the infrastructure for large-scale DEL implementation. The growing number of partnerships and licensing deals between CROs and pharma clients underscores the momentum in this segment. CROs are also pushing boundaries by developing customized libraries and modular platforms for diverse research applications.

Regional Analysis

North America dominated the global DNA-encoded library market in 2024

The region’s leadership is attributed to its mature pharmaceutical ecosystem, presence of key market players, and high R&D expenditure. The United States, in particular, accounts for a majority of DEL-related research and collaborations. Companies like X-Chem, GSK, and HitGen have established robust operations in the U.S., and academic institutions such as Harvard and The Scripps Research Institute are driving innovations in DEL chemistry. Favorable regulatory support and funding from agencies like the NIH further strengthen the region’s position as a hub for DEL development.

Asia Pacific is emerging as the fastest-growing region in the DEL market

Countries like China, India, and South Korea are witnessing rapid growth due to increasing investments in biotechnology, government funding for life sciences, and expansion of CRO services. Chinese firms such as WuXi AppTec and HitGen are pioneering DEL research in the region, with extensive compound libraries and screening platforms. The cost advantages for R&D outsourcing and an expanding base of skilled researchers are accelerating market growth. Moreover, regional governments are initiating policies to promote domestic drug discovery, which bodes well for the adoption of DEL technology.

Some of The Prominent Players in The DNA-encoded Library Market Include:

- Merck KGaA

- GenScript

- Pharmaron

- WuXi Biology

- Aurigene Pharmaceutical Services

- BOC Sciences

- LGC Bioresearch Technologies

- SPT Labtech Ltd

- Life Chemicals

- Charles River Laboratories

Recent Developments

- In April 2025, WuXi AppTec announced the expansion of its DEL platform to over 100 billion compounds, significantly enhancing its screening capabilities for global clients.

- In February 2025, X-Chem entered into a new collaboration with Bayer to identify drug leads in oncology using its proprietary DEL screening platform.

- In January 2025, HitGen signed a licensing deal with Boston-based biotech startup NeuroVant to use its DEL libraries for neurological target discovery.

- In October 2024, GlaxoSmithKline (GSK) revealed that one of its DEL-derived oncology candidates entered Phase I clinical trials, marking a milestone in DEL-enabled drug development.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the DNA-encoded Library Market

By Product & Service

-

- Kits & Reagents

- Encoded Libraries

- Others

-

- Design & Synthesis Services

- Screening Services

- Others

By Therapeutic Area

- Oncology

- Infectious Diseases

- Cardiovascular Diseases

- Neurological Diseases

- Autoimmune Diseases

- Metabolic Diseases

- Others

By Application

- Hit Generation / Identification

- Hit to Lead

- Hit Validation / Optimization

- Others

By End Use

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)