India Clinical Trials Market Size and Research

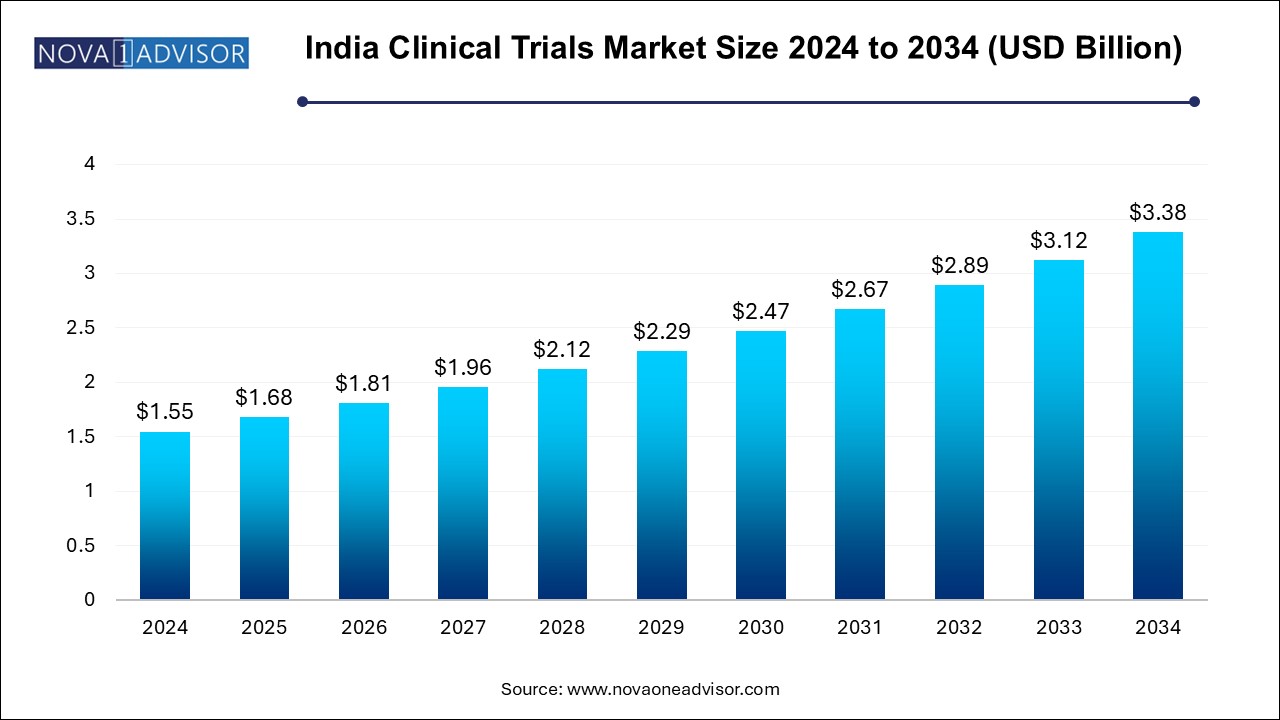

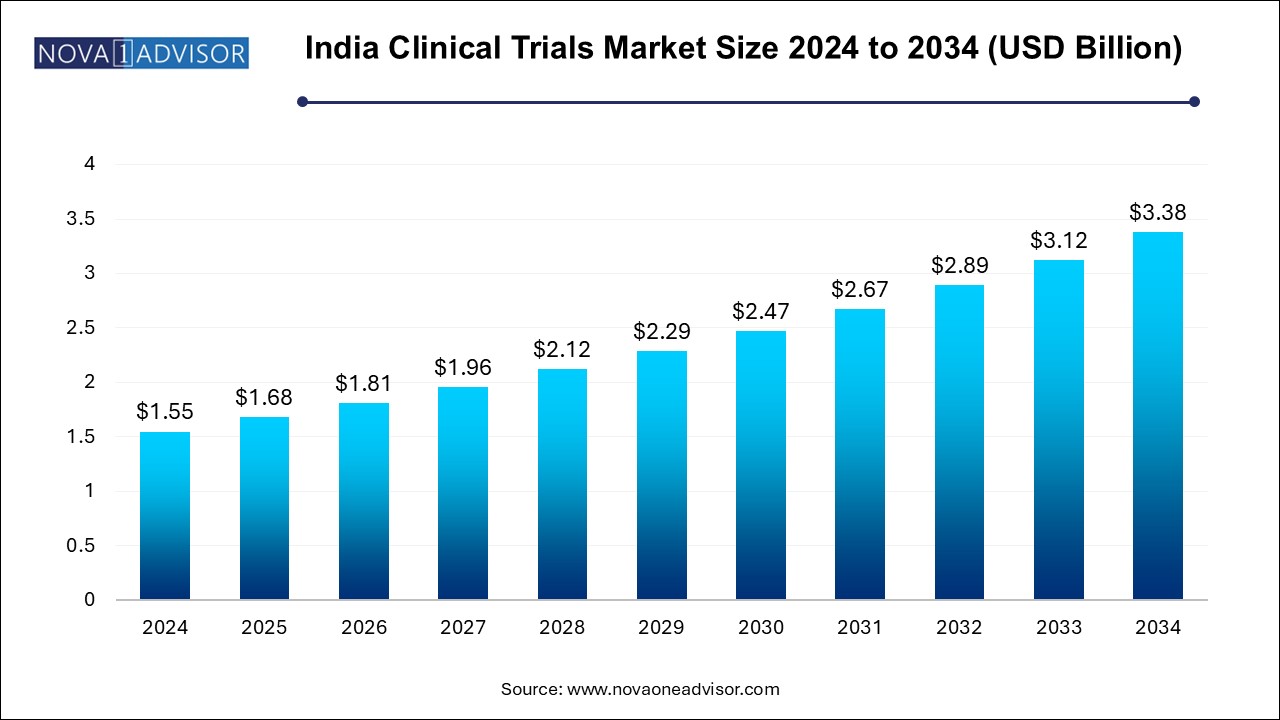

The India clinical trials market size was exhibited at USD 1.55 billion in 2024 and is projected to hit around USD 3.38 billion by 2034, growing at a CAGR of 8.1% during the forecast period 2024 to 2034. The growth of the India clinical trials market can be attributed to the diverse demographics, increased healthcare expenditure and rising adoption of digital solutions like electronic data capture (EDC) in clinical trials.

India Clinical Trials Market Key Takeaways:

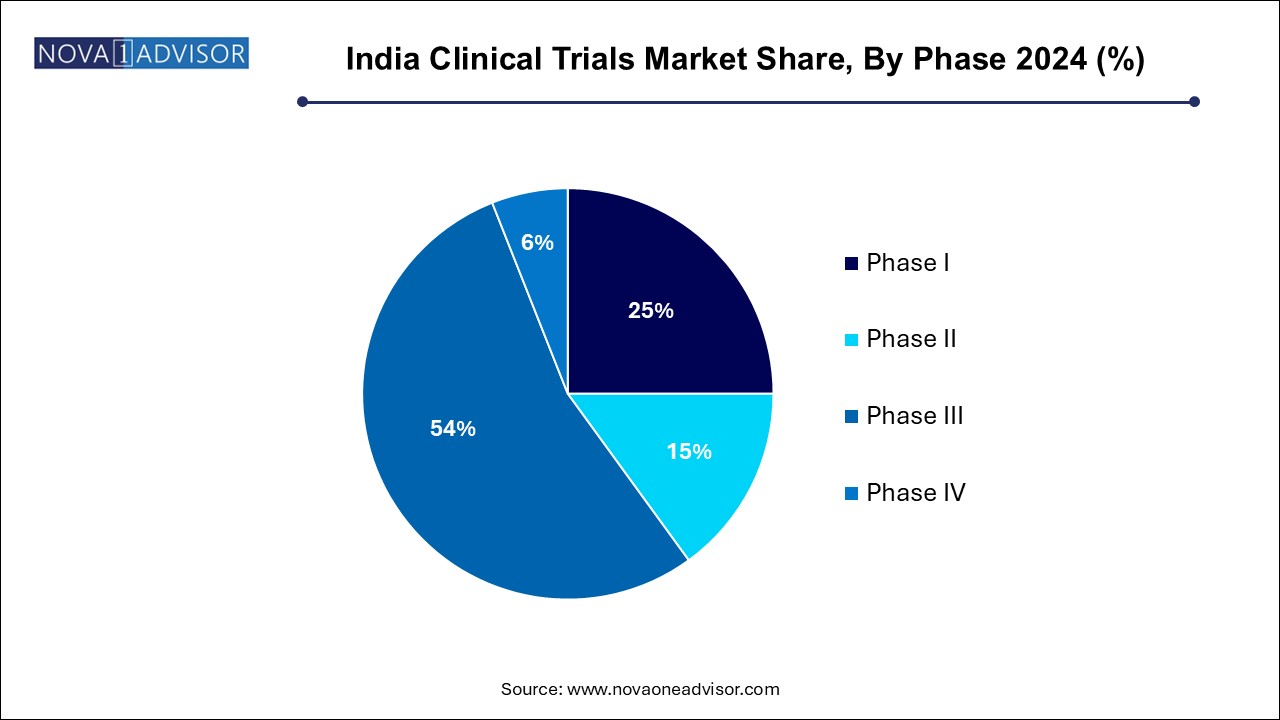

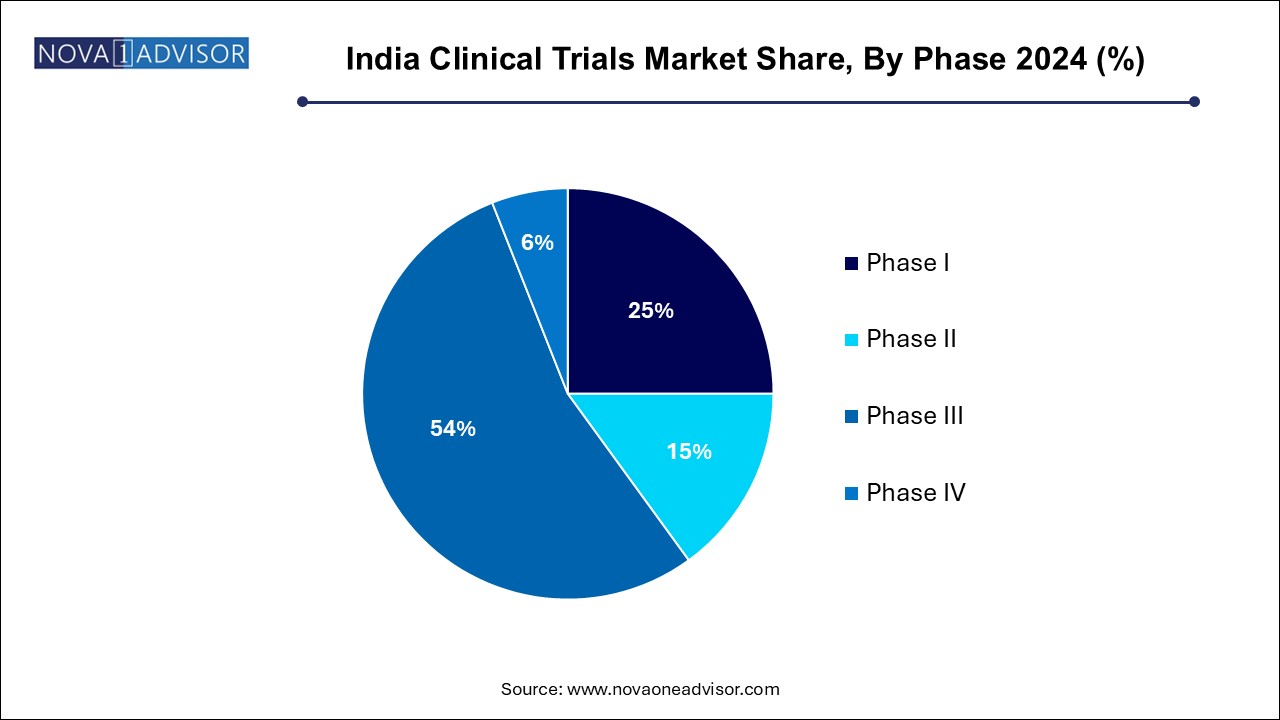

- The phase III segment dominated the India clinical trials industry, with a revenue share of 54.0% in 2024

- Phase I segment is projected to witness the fastest CAGR of 9.7% over the forecast period.

- The interventional trials segment dominated the market with the largest revenue share in 2024.

- The observational trials segment is projected to grow at the fastest CAGR over the forecast period

- The oncology segment dominated the market, with the largest revenue share in 2024

- The laboratory services segment dominated the market with the largest revenue share in 2024

- The pharmaceutical & biopharmaceutical companies segment dominated the market, with the largest revenue share in 2024

Market Overview

India’s clinical trials market is gaining unprecedented traction owing to its evolving pharmaceutical ecosystem, vast patient pool, and growing healthcare infrastructure. With a burgeoning population exceeding 1.4 billion, a growing burden of chronic diseases, and a medical workforce adept in English and global practices, India is rapidly becoming a hub for clinical research. The country's appeal as a preferred destination for clinical trials is further boosted by its cost advantages—clinical trials in India are significantly cheaper than those in developed nations like the U.S. or the U.K., while still maintaining scientific and ethical standards.

India has made considerable strides in aligning with international regulatory frameworks through regulatory reforms, such as the adoption of New Drugs and Clinical Trials Rules (NDCTR), 2019, introduced by the Central Drugs Standard Control Organization (CDSCO). This has streamlined the approval process, improved transparency, and accelerated the initiation of trials. Additionally, the Digital India initiative and increasing investments in healthcare IT are facilitating robust data management systems, which are essential for trial integrity and compliance.

Global pharmaceutical giants and Contract Research Organizations (CROs) are increasingly outsourcing their clinical research to India. A notable example is the collaboration between Pfizer and local CROs to conduct trials for novel therapies across therapeutic areas like oncology and metabolic disorders. This influx is complemented by a surge in indigenous drug development, as Indian pharmaceutical companies such as Dr. Reddy’s and Sun Pharma expand their R&D pipelines, necessitating extensive clinical evaluation within the country.

Major Trends in the Market

-

Decentralized Clinical Trials (DCTs): With the rise of telehealth and digital platforms, India is witnessing a shift towards decentralized trials that rely on remote monitoring and e-consent processes.

-

Increased Focus on Oncology Trials: A surge in cancer prevalence and investment in targeted therapies is driving a significant uptick in oncology-focused trials.

-

Artificial Intelligence (AI) in Trial Design and Recruitment: AI and machine learning tools are increasingly being used to streamline protocol design and optimize patient recruitment.

-

Adoption of Electronic Data Capture (EDC) and E-Clinical Solutions: Integration of digital tools is enhancing data accuracy and monitoring in real-time.

-

Emergence of Rare Disease Trials: Clinical research is expanding into rare and orphan diseases, backed by regulatory support and market incentives.

-

Patient-Centric Trial Approaches: Emphasis is being placed on improving participant engagement, retention, and education.

-

Rise in Adaptive Trials: These allow protocol modifications based on interim results, increasing trial efficiency and reducing costs.

Integration of artificial intelligence (AI) in the Indian clinical trials scenario is leading to accelerated and cost-effective drug development processes. Rising investments for adoption of digital technologies is driving the use of AI and machine learning tools for various applications in healthcare. AI algorithms can be applied for recruiting suitable candidates, optimizing clinical trial design, remote patient monitoring and for automating data analysis and management. Furthermore, AI can assist researchers and manufacturers for enhancing regulatory compliance with automation of documenting and reporting processes.

Report Scope of India Clinical Trials Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.68 Billion |

| Market Size by 2034 |

USD 3.38 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 8.1% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Phase, Study Design, Indication, Service Type, Sponsor |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

IQVIA.; Parexel International (MA) Corporation; Thermo Fisher Scientific Inc; Charles River Laboratories; ICON PLC; Aurigene Oncology.; Aragen Life Sciences Ltd.; Syneos Health.; SGS Société Générale de Surveillance SA; Syngene International Limited |

Key Market Driver

Regulatory Reforms Enhancing Trial Efficiency

India’s clinical trial landscape has been historically marred by bureaucratic delays and ethical controversies. However, the introduction of the NDCTR in 2019 transformed the market significantly. These rules have introduced fixed timelines for approvals, clarified sponsor responsibilities, and emphasized patient safety and compensation protocols. As a result, sponsors now experience more predictable regulatory pathways, which in turn, improves investor confidence. For example, the average trial approval timeline has been reduced to approximately 90 days, enabling quicker time-to-market for new therapies. These reforms are key to positioning India as a globally competitive clinical trial destination.

Key Market Restraint

Concerns Around Data Integrity and Compliance

Despite progress, apprehensions around data quality and protocol compliance still pose a challenge. Instances of deviation from Good Clinical Practices (GCP), coupled with concerns over ethical oversight in rural and semi-urban settings, have led to hesitation among some global sponsors. While regulatory bodies have implemented stricter monitoring frameworks, consistent enforcement across India’s diverse geographic and institutional landscape remains uneven. Furthermore, training gaps in clinical trial professionals and fragmented site infrastructure sometimes result in variability in trial execution.

Key Market Opportunity

Rising Demand for Personalized Medicine

India’s growing genetic research capabilities and increased adoption of genomic technologies open the door for trials in precision and personalized medicine. With a genetically diverse population, India offers a unique landscape to test targeted therapies. Companies like MedGenome and Mapmygenome are advancing genomic sequencing and analysis, which supports biomarker-based trials. As precision medicine gains momentum globally, India stands to benefit by becoming a preferred location for Phase II and III trials involving genomics-linked treatment pathways.

India Clinical Trials Market By Phase Insights

The phase III segment dominated the India clinical trials industry, with a revenue share of 54.0% in 2024, and is expected to retain its lead due to the extensive nature of efficacy and safety validation required at this stage. Phase III trials involve a large patient population and multiple study sites, often acting as the final step before regulatory submission. The high prevalence of non-communicable diseases such as cardiovascular conditions and cancer in India necessitates large-scale trials, which is well-suited for Phase III. Several Indian pharmaceutical companies also collaborate with global firms to conduct pivotal Phase III trials domestically, drawn by the country's population heterogeneity and regulatory benefits.

Phase I segment is projected to witness the fastest CAGR of 9.7% over the forecast period, Increased investment in preclinical R&D by both domestic and international sponsors is fueling demand for Phase I capabilities. Moreover, with enhanced regulatory clarity and improved infrastructure in urban research centers, more CROs and research hospitals are now capable of safely managing first-in-human trials. Initiatives like the Atal Innovation Mission and support from BIRAC (Biotechnology Industry Research Assistance Council) are further incentivizing early-phase research in biotech startups.

India Clinical Trials Market By Study Design Insights

Interventional trials segment accounted for the largest market share owing to their essential role in evaluating the safety and efficacy of new therapies. These trials form the foundation of most regulatory approvals, and given the diverse disease burden in India, interventional designs are widely deployed. From cardiovascular studies testing novel anticoagulants to vaccine trials including COVID-19 candidates, interventional frameworks remain the gold standard in the Indian context. Notably, the Serum Institute of India has conducted multiple interventional studies for vaccines in both pediatric and adult populations.

The observational trials segment is anticipated to witness lucrative growth over the forecast period. Rising regulatory focus on Real-World Evidence (RWE) and post-market surveillance is enabling better understanding of drugs and treatments in routine clinical practices as well as in monitoring long-term safety, efficacy and safety by identifying adverse events. India’s diverse demographics with a large patient pool, increasing chronic disease burden, feasibility and cost-effectiveness for conducting these trials, focus on strengthening regulatory frameworks and rising investments in R&D are the factors contributing to the market growth.

Expanded access trials segment is growing at a notable rate, albeit from a smaller base, driven by increased patient advocacy and awareness. These trials allow patients with severe or life-threatening conditions to access investigational treatments outside of standard trials. India’s regulatory framework now includes provisions for such access, especially in oncology and rare diseases. The growing number of advocacy groups and digital health forums are also aiding in connecting patients with physicians and sponsors to participate in these specialized studies.

India Clinical Trials Market By Indication Insights

Oncology dominated the India clinical trials market by indication, driven by the country’s rising cancer incidence and growing investments in cancer R&D. According to the National Cancer Registry, India records over 1.3 million new cancer cases annually. This prevalence, combined with government-backed cancer programs and advanced diagnostic capabilities, has led to a surge in trials focused on both solid tumors and hematologic malignancies. Companies such as AstraZeneca and Dr. Reddy’s Laboratories are actively conducting trials in breast cancer, leukemia, and lung cancer.

CNS conditions are emerging as the fastest-growing segment, propelled by rising awareness of neurological disorders like Parkinson’s and Alzheimer’s disease, which previously remained underdiagnosed. Technological advancements such as neuroimaging, genetic markers, and mobile monitoring devices are supporting better trial designs in this segment. Moreover, India’s growing geriatric population further underlines the need for neurodegenerative disorder trials, with several institutions including NIMHANS initiating investigator-led studies in cognitive disorders and mental health.

India Clinical Trials Market By Service Type Insights

The laboratory services segment accounted for the largest market share in 2024. The market growth is driven by the rising demand for clinical trials due to the large and diverse patient population, rising prevalence of chronic and lifestyle diseases, cost-effectiveness and globalization of clinical trials making India a hub for conduction of multi-center studies. Moreover, rising investments for expansion of healthcare infrastructure, growing emphasis on precision medicine, increased public awareness, skilled labor and surging number of laboratory services providers in India are bolstering the market growth. Rising innovations and adoption of advanced technologies such as automation in laboratories, integration of digital health tools and introduction of molecular diagnostics are further enhancing the accuracy and efficiency of laboratory services.

Patient recruitment services segment is anticipated to witness lucrative growth in the market. Timely enrolment of patients remains one of the most critical success factors in clinical research. India’s large treatment-naive patient population and improved access to rural healthcare networks make it a highly attractive destination for recruitment services. CROs like Syngene and Lambda Therapeutic Research specialize in rapid and ethical patient onboarding, aided by digital tools and site-based community outreach programs.

Clinical trial data management services segment is growing at a notable rate, benefiting from the digital transformation across the healthcare and pharmaceutical industries. Cloud-based data solutions, remote monitoring, and AI-powered data analytics are streamlining the collection and analysis of clinical trial information. Startups and tech-enabled CROs are leveraging these tools to offer real-time dashboards, minimizing delays and enhancing data quality. This segment is likely to witness exponential growth as India’s healthtech ecosystem matures further.

The pharmaceutical & biopharmaceutical companies segment dominated the market, with the largest revenue share in 2024, Global firms such as Roche and Novartis have entered into long-term partnerships with Indian research centers to explore innovative drug molecules. Meanwhile, Indian companies like Glenmark and Zydus Lifesciences are also increasing their in-house R&D and conducting trials to file for domestic and international regulatory submissions.

Medical device companies are seeing faster growth, largely due to the expanding medtech landscape and regulatory clarity from CDSCO regarding device trials. Devices related to cardiology, diagnostics, and diabetes management are particularly active in terms of clinical research. For instance, India has seen increased trials for wearable ECG monitors and smart glucometers, particularly in Tier 1 cities, where digital health adoption is higher.

Country-Level Analysis

India’s clinical trial ecosystem is centered around key metros including Mumbai, Delhi NCR, Bengaluru, Hyderabad, and Pune. These cities host leading academic research institutions, state-of-the-art hospitals, and globally accredited CROs. Bengaluru, often dubbed the biotech capital of India, is home to several research parks and innovation centers that facilitate early-phase trials. States like Gujarat and Maharashtra have proactively introduced biotech policies to attract clinical trial investments, offering tax incentives and infrastructure support.

Moreover, the Indian Council of Medical Research (ICMR) has launched national registries and guidelines to ensure transparency in trial conduct. Clinical Trials Registry - India (CTRI) has made it mandatory to register trials before initiation, which has improved public trust and research accountability. With initiatives like Ayushman Bharat Digital Mission (ABDM), the integration of patient records and electronic health data is expected to create more robust participant databases for future trials.

Some of the prominent players in the India clinical trials market include:

- IQVIA

- Parexel International (MA) Corporation

- Thermo Fisher Scientific Inc

- Charles River Laboratories

- ICON PLC

- Aurigene Oncology

- Aragen Life Sciences Ltd

- Syneos Health

- SGS Société Générale de Surveillance SA.

- Syngene International Limited.

India Clinical Trials Market Recent Developments

-

In May 2025, Bharat Biotech International Ltd, announced promising results in final Phase III clinical trials of its single-component oral cholera vaccine (OCV), Hillchol.

-

In April 2025, Shilpa Medicare, announced CDSCO’s Subject Expert Committee’s approval for its IND- Nor Ursodeoxycholic Acid Tablets 500 mg. The Committee has also approved grant for the marketing authorization of this IND for treating non-alcoholic fatty liver disease (NAFLD).

-

In November 2024, after three decades of extensive hard work and research, the drug Nafithromycin, marketed as Miqnaf and developed by Wockhardt Limited in collaboration with the Biotechnology Industry Research Assistance Council (BIRAC) was launched in India. The drug targets Community-Acquired Bacterial Pneumonia (CABP) which is caused by drug-resistant bacteria.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the India clinical trials market

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design

- Interventional Trials

- Observational Trials

- Expanded Access Trials

By Indication

-

- Rheumatoid Arthritis

- Multiple Sclerosis

- Osteoarthritis

- Irritable Bowel Syndrome (IBS)

- Others

-

- Blood Cancer

- Solid Tumors

- Other

-

- Epilepsy

- Parkinson's Disease (PD)

- Huntington's Disease

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Muscle Regeneration

- Others

- Diabetes

- Obesity

- Cardiovascular

- Others

By Service Type

- Protocol Designing

- Site Identification

- Patient Recruitment

- Laboratory Services

- Bioanalytical Testing Services

- Clinical Trial Data Management Services

- Others

By Sponsor

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Others