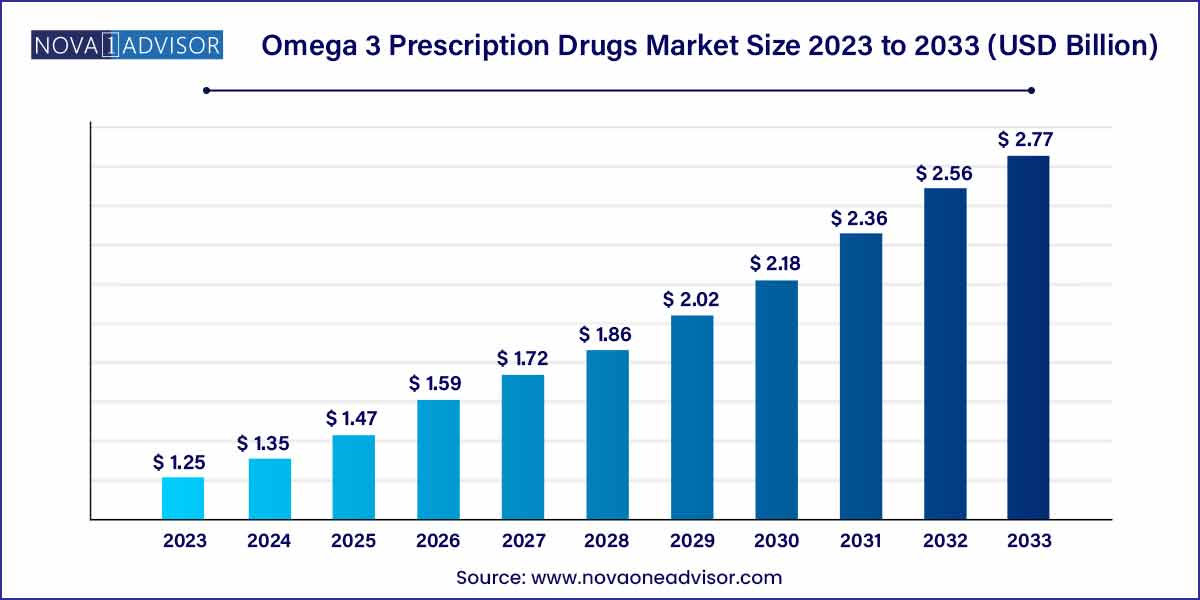

The global omega 3 prescription drugs market size was estimated at USD 1.25 billion in 2023, is expected to surpass around USD 2.77 billion by 2033, and is poised to grow at a compound annual growth rate (CAGR) of 8.29% during the forecast period of 2024 to 2033.

Key Takeaways:

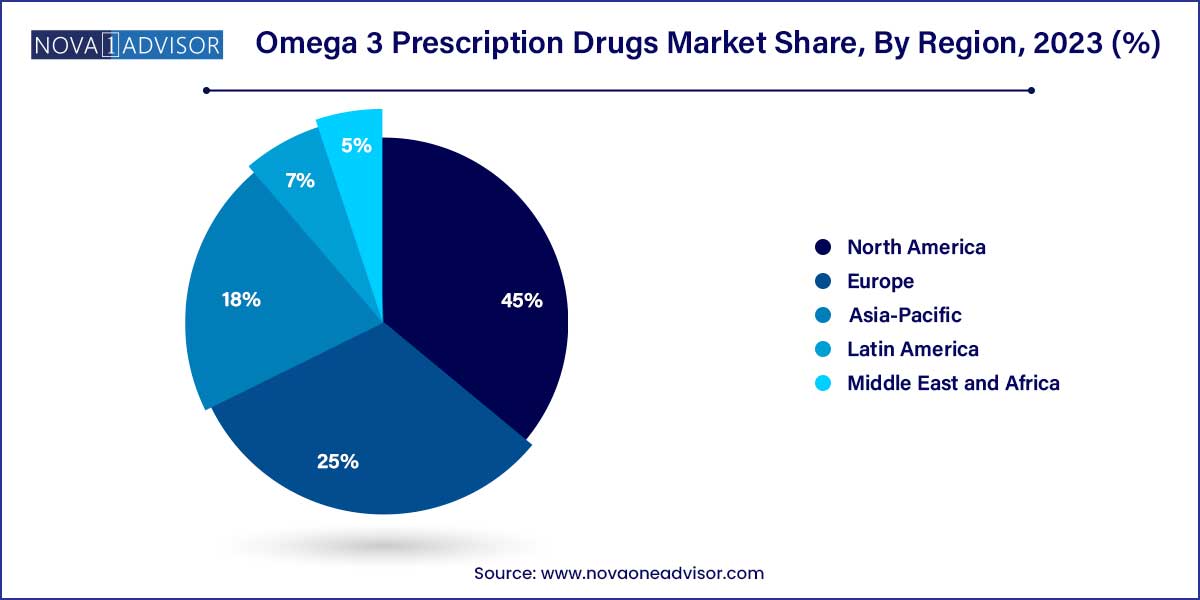

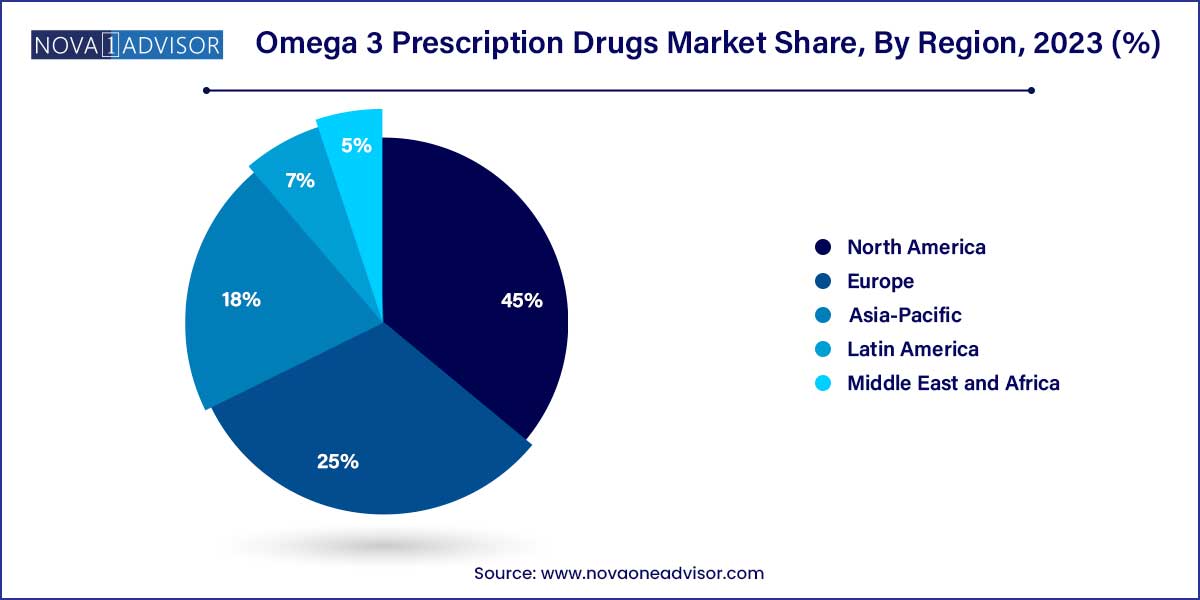

- North America dominated the global industry in 2023 and accounted for the maximum share of more than 45.0% of the global revenue.

- The Vascepa drug segment dominated the global industry in 2023 and accounted for the largest share of more than 45.60% of the overall revenue

- The hypertriglyceridemia application segment dominated the industry in 2023 and accounted for the largest revenue share of more than 85.45%.

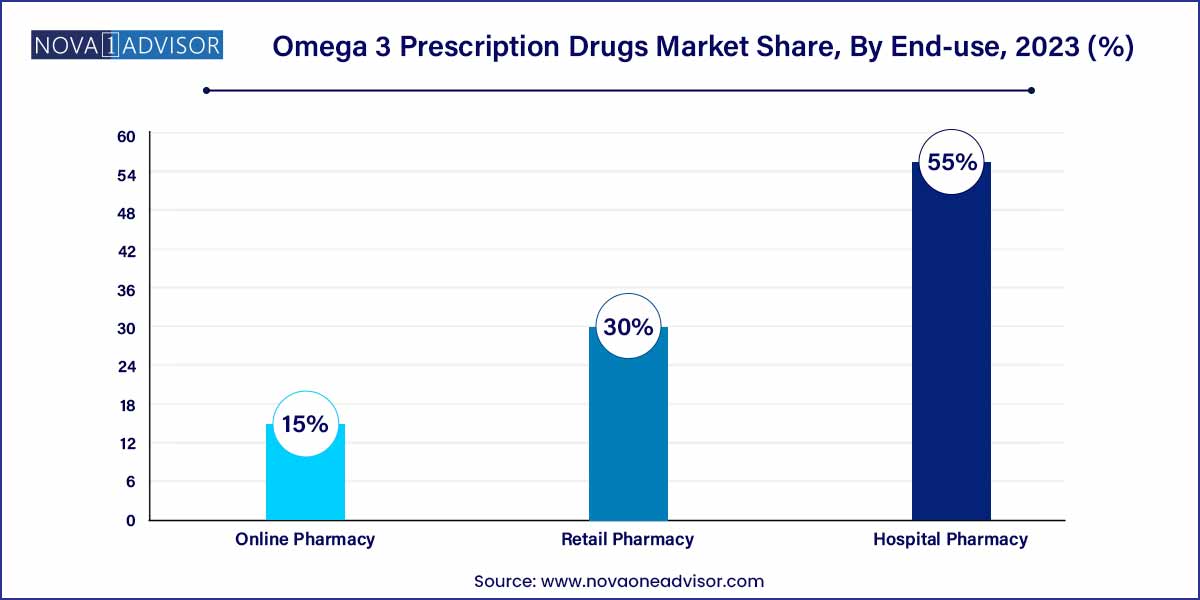

- The retail pharmacy distribution channel segment dominated the industry in 2023 and accounted for the largest share of more than 55.0% of the overall revenue.

Market Overview

The Omega 3 prescription drugs market is emerging as a pivotal segment of the broader pharmaceutical and nutraceutical industries. These drugs are specially formulated omega-3 fatty acids, primarily consisting of eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA), that have demonstrated efficacy in treating specific medical conditions such as hypertriglyceridemia and cardiovascular diseases. Unlike dietary supplements, prescription omega-3 drugs undergo stringent clinical testing and are approved by regulatory bodies like the U.S. Food and Drug Administration (FDA), making them reliable therapeutic options for high-risk patient populations.

With increasing awareness around cardiovascular health and the rising prevalence of hyperlipidemia worldwide, the demand for safe and effective lipid-lowering therapies has surged. Omega-3 prescription drugs like Vascepa (icosapent ethyl) and Lovaza (omega-3-acid ethyl esters) have gained significant traction as they offer cardiovascular benefits without the side effects commonly associated with traditional statins. These drugs are not only utilized as monotherapy in some patients but are also prescribed as adjuncts to statins in high-risk individuals.

Recent guidelines by organizations such as the American Heart Association (AHA) endorsing the use of omega-3 prescription drugs in specific patient groups have further bolstered the market's credibility and adoption. Additionally, innovation in drug delivery mechanisms and pharmaceutical formulations has enabled better bioavailability and patient compliance, enhancing market expansion.

Major Trends in the Market

-

Increased physician endorsement of omega-3 prescription drugs as adjunct therapy with statins.

-

Growing preference for EPA-only formulations (e.g., Vascepa) over combined EPA/DHA products due to superior cardiovascular outcomes.

-

Rise in clinical trials assessing the broader therapeutic impact of omega-3 drugs in neurological and inflammatory diseases.

-

Increased FDA approvals and patent extensions encouraging further R&D investment.

-

Growth in telemedicine and e-pharmacies boosting access to prescription-based therapies.

-

Integration of digital tools to monitor lipid levels and therapy adherence among patients on omega-3 prescription regimens.

-

Greater penetration in emerging economies through strategic licensing and distribution agreements.

Omega 3 Prescription Drugs Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.25 Billion |

| Market Size by 2033 |

USD 2.77 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 8.29% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Drug, Application, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Abbott; Amarin Pharmaceuticals Ireland Ltd.; GSK plc; Natrapharm, Inc. (Patriot Pharmaceutical Corp.); Viatris Inc.; Grupo Ferrer Internacional, S.A.; Camber Pharmaceuticals, Inc.; Dr. Reddy’s Laboratories Ltd.; Zydus Group; Hikma Pharmaceuticals PLC. |

By Drug Insights

Vascepa, a highly purified EPA-only omega-3 drug, dominated the global market owing to its unparalleled clinical backing and cardiovascular risk reduction profile. Developed by Amarin Corporation, Vascepa gained FDA approval for cardiovascular risk reduction in statin-treated patients with elevated triglyceride levels in December 2019. This approval significantly boosted its market appeal, particularly in the U.S. The robust data from the REDUCE-IT trial led to widespread physician confidence in Vascepa, positioning it as a first-line therapy alongside statins in high-risk patients.

In contrast, the "Others" segment, comprising new and region-specific omega-3 formulations, is growing rapidly. This includes drugs under development or those approved for limited indications in specific countries. Biopharmaceutical companies in Japan, South Korea, and Europe are focusing on niche EPA/DHA blends that cater to specific patient needs. Moreover, innovations in controlled-release and combination therapies are expected to add momentum to this segment's growth.

By Application Insights

Hypertriglyceridemia is the primary indication for omega-3 prescription drugs and hence dominates the market. As a condition marked by elevated triglyceride levels, it significantly increases the risk of coronary heart disease and pancreatitis. Physicians globally prescribe omega-3 drugs as a non-statin option or in combination therapy to manage triglyceride levels effectively. The condition’s growing incidence, especially among the aging population and individuals with obesity or type 2 diabetes, continues to fuel this segment.

The "Others" segment, which includes therapeutic areas such as non-alcoholic fatty liver disease (NAFLD), rheumatoid arthritis, and neurodegenerative disorders, is expanding steadily. While still in its nascent stages, increasing research interest in the anti-inflammatory and neuroprotective properties of EPA and DHA is driving this expansion. Several clinical trials are underway exploring their use in Alzheimer’s disease and depression, hinting at potential future label expansions.

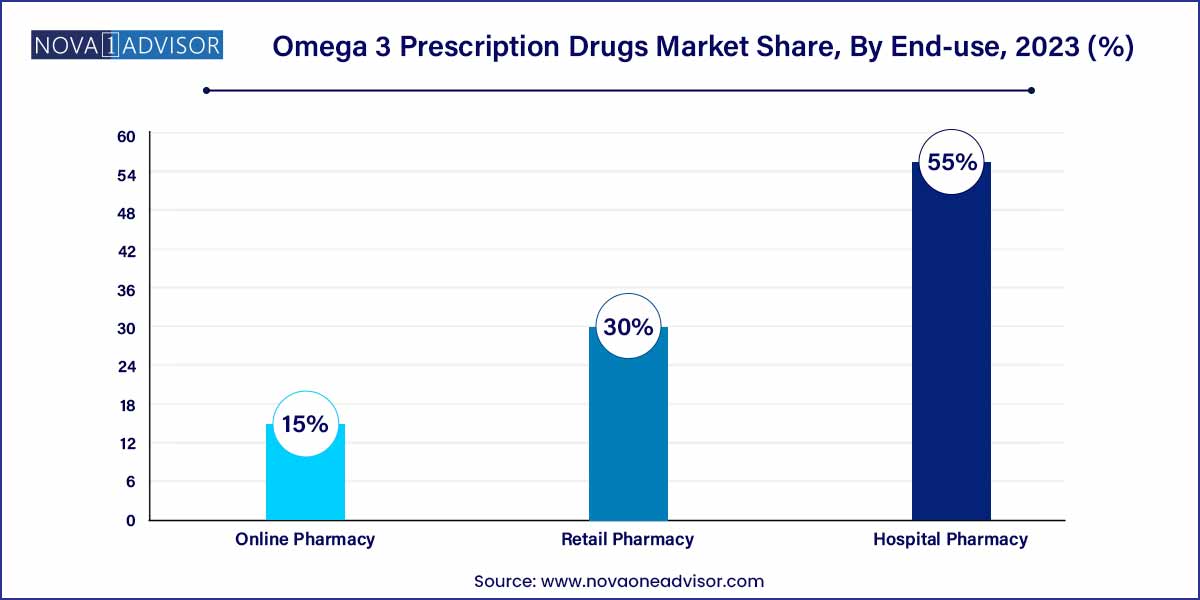

By Distribution Channel Insights

Hospital pharmacies remain the dominant distribution channel for omega-3 prescription drugs due to the acute nature of the conditions treated and the need for physician oversight. Prescription drugs, especially those approved for cardiovascular risk mitigation, are typically dispensed through institutional pharmacies associated with tertiary care hospitals or cardiology clinics. These facilities ensure the right dosage and patient monitoring, enhancing compliance and outcomes.

On the other hand, online pharmacies are witnessing the fastest growth, especially in developed countries. The shift toward telemedicine, accelerated by the COVID-19 pandemic, has made it easier for patients to receive prescriptions and fulfill them via digital platforms. Additionally, e-pharmacies offer the convenience of home delivery, prescription reminders, and even subscription models for long-term therapies, all of which contribute to rising sales through this channel.

By Regional Insights

North America, particularly the United States, dominates the global Omega 3 prescription drugs market. The region benefits from a high prevalence of cardiovascular diseases, favorable reimbursement policies, and proactive guidelines from agencies like the FDA and AHA. The U.S. accounts for the lion’s share of global Vascepa sales, driven by robust marketing, clinical trust, and insurance support. Furthermore, the presence of leading pharmaceutical firms and ongoing R&D investments continue to fuel innovation and market maturity in the region.

The Asia-Pacific region is the fastest growing market, owing to its rapidly increasing burden of hyperlipidemia and cardiovascular ailments. Countries such as India, China, and South Korea are witnessing lifestyle transitions, leading to higher incidences of metabolic disorders. Government initiatives promoting cardiovascular health, increasing awareness among patients, and expanding healthcare infrastructure contribute to market growth. Moreover, regional pharmaceutical companies are beginning to manufacture or license omega-3 drugs for local use, further accelerating the pace of market expansion.

Some of the prominent players in the Omega 3 prescription drugs market include:

- Abbott

- Amarin Pharmaceuticals Ireland Ltd.

- GSK plc (GlaxoSmithKline plc)

- Natrapharm, Inc. (Patriot Pharmaceutical Corp.)

- Viatris, Inc.

- Grupo Ferrer Internacional, S.A.

- Camber Pharmaceuticals, Inc.

- Dr. Reddy’s Laboratories Ltd.

- Zydus Group

- Hikma Pharmaceuticals PLC

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global omega 3 prescription drugs market.

Drug

Application Type

- Hypertriglyceridemia

- Others

Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)