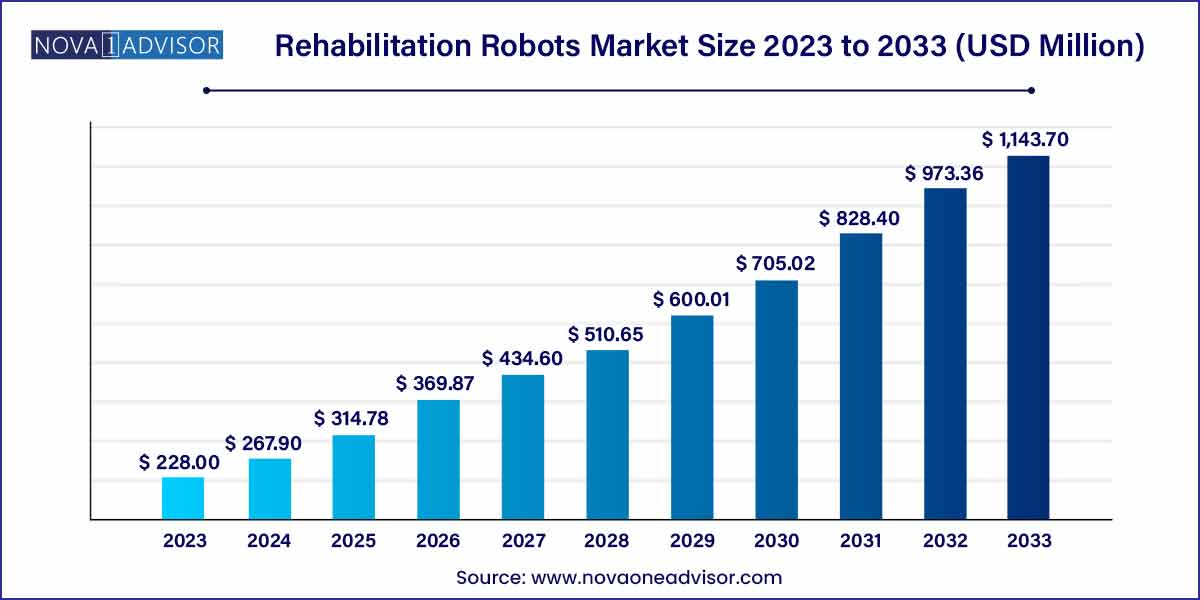

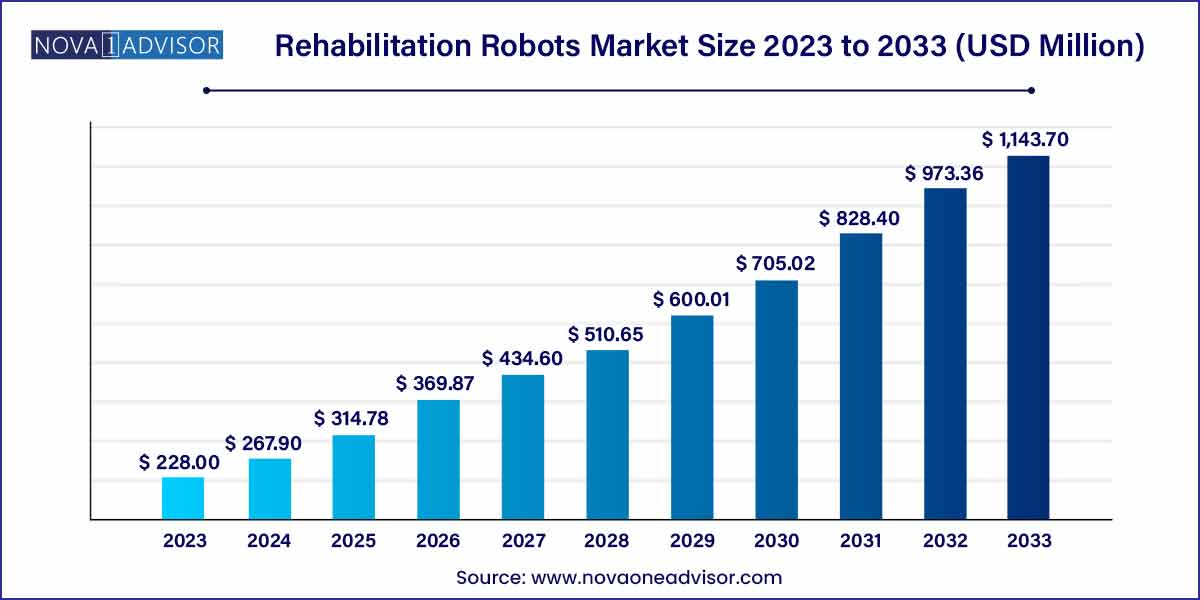

The global rehabilitation robots market size was exhibited at USD 228.00 million in 2023 and is projected to hit around USD 1,143.70 million by 2033, growing at a CAGR of 17.5% during the forecast period of 2024 to 2033.

Key Takeaways:

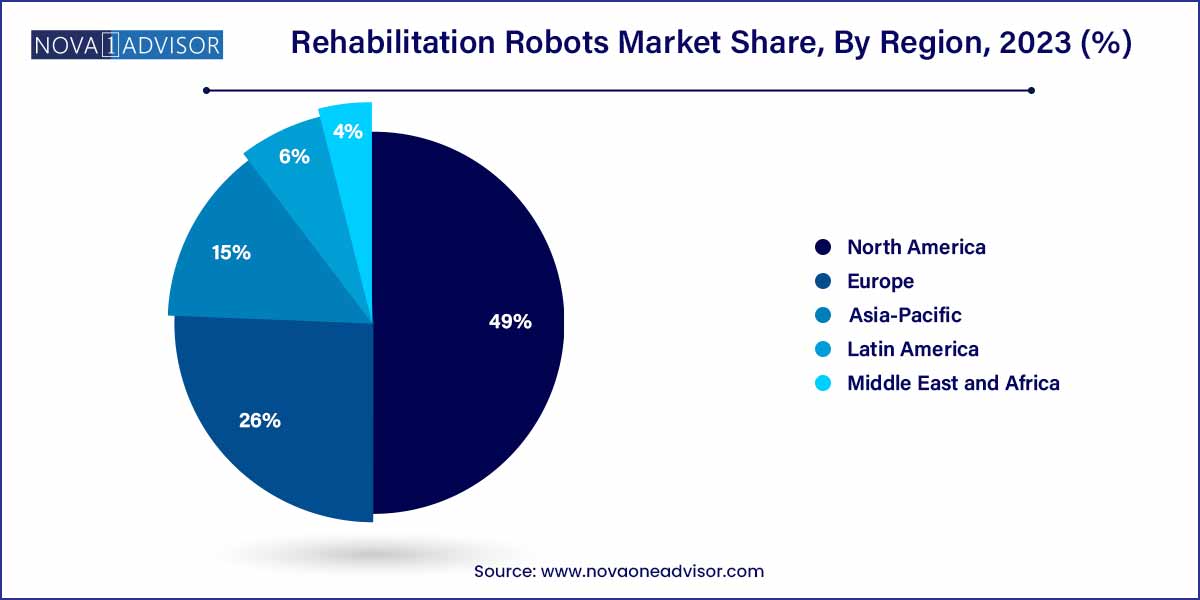

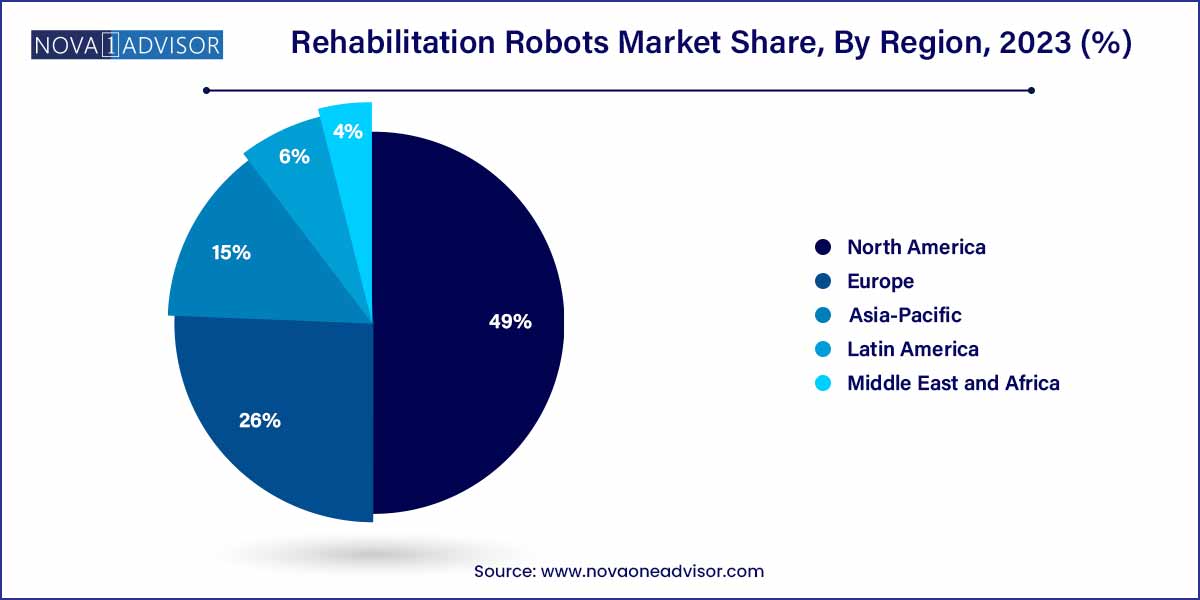

- North America dominated the rehabilitation robots industry in 2023 and accounted for the largest revenue share of 49.0%.

- Exoskeleton held the largest revenue share of 58.5% in 2023.

- Based on end-use, the hospitals & clinics segment held the largest revenue share at 47.0% in 2023.

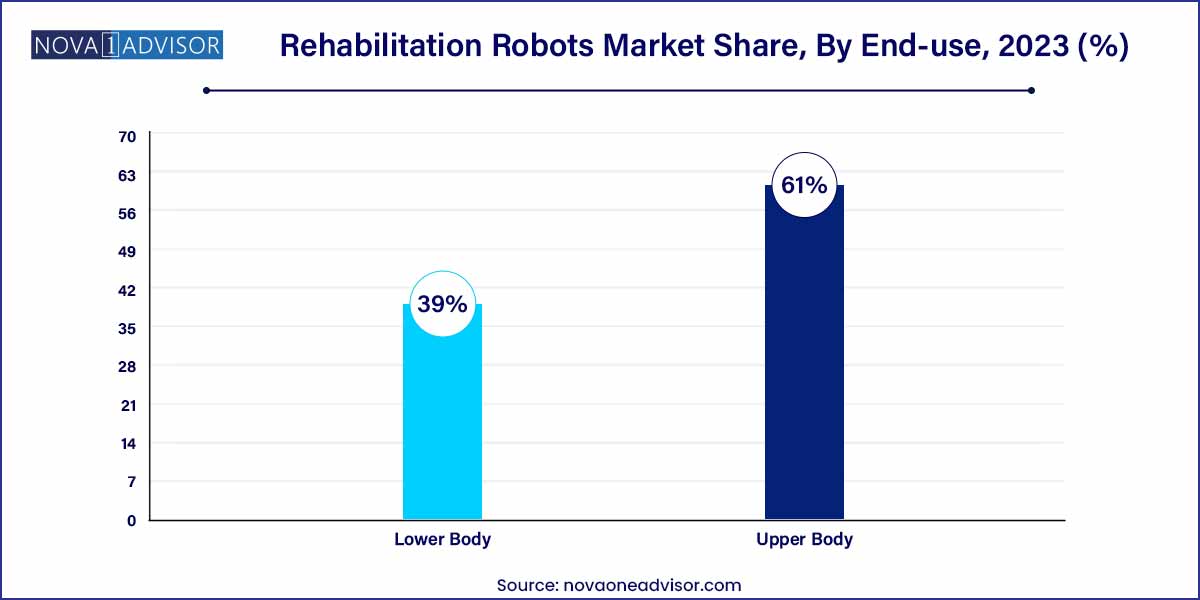

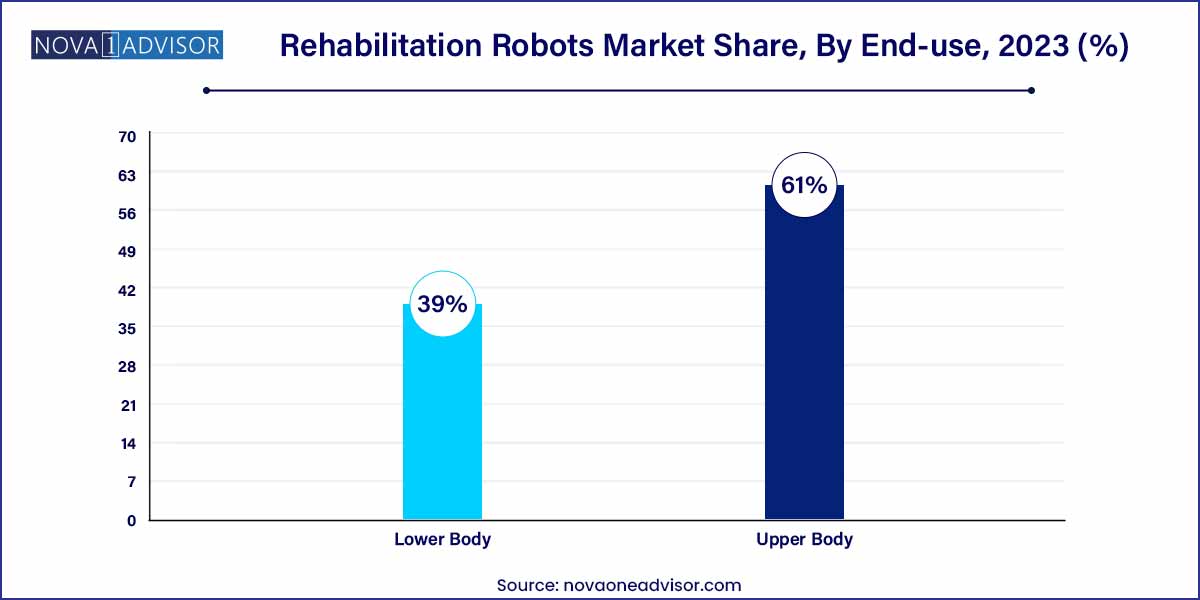

- The lower body extremity held the largest share of 61.0% in 2023.

Market Overview

The Rehabilitation Robots Market has emerged as a transformative segment within the global healthcare and robotics industries. These robots are designed to assist patients in recovering motor functions and mobility lost due to injury, surgery, stroke, or chronic illnesses such as Parkinson’s disease or multiple sclerosis. Rehabilitation robots operate either autonomously or under therapist supervision to support repetitive, precise, and measurable therapeutic exercises.

As the global population ages and neurological disorders increase, the need for innovative, efficient rehabilitation solutions is more critical than ever. Traditional physical therapy, though effective, can be labor-intensive, inconsistent in quality, and subject to availability of skilled professionals. Rehabilitation robots, on the other hand, provide consistent, quantifiable therapy sessions with real-time feedback. They also reduce the physical burden on caregivers and physiotherapists while offering patients a more engaging recovery process.

This market’s growth is driven by rising healthcare expenditure, increasing demand for personalized and home-based rehabilitation, and technological breakthroughs in robotics, artificial intelligence (AI), and human-machine interaction. From wearable robotic exoskeletons helping paraplegic patients walk to robotic arms facilitating stroke recovery, the applications are varied and growing rapidly.

The COVID-19 pandemic further accelerated the shift toward robotic-assisted rehabilitation, especially as healthcare facilities struggled with staffing shortages and remote care delivery. Post-pandemic, this momentum continues, supported by government initiatives, increasing R&D investments, and growing public awareness.

Major Trends in the Market

-

Integration of Artificial Intelligence and Machine Learning: Smart algorithms are enabling rehabilitation robots to adapt to patient progress and personalize therapy.

-

Expansion of Home-Based Rehabilitation Robots: Portable and user-friendly devices are being developed for home use, enabling continuous recovery outside clinical settings.

-

Wearable Exoskeletons Gaining Ground: Exoskeletons are increasingly used in spinal cord injuries and stroke rehab to restore lower limb movement.

-

Robotic Telerehabilitation Platforms: Remote-controlled robotic therapy, often integrated with cloud-based platforms, is gaining popularity for remote patient monitoring.

-

Gamification and Virtual Reality Integration: Robotics with gamified interfaces and VR elements enhance user engagement and motivation during recovery.

-

Public-Private Partnerships for Assistive Technology: Governments are investing in rehabilitation tech via research grants, especially for elderly and veterans' care.

-

Decline in Component Costs: As sensors, actuators, and processors become cheaper and more powerful, more affordable rehabilitation robots are entering the market.

-

Focus on Pediatric Rehabilitation Robotics: Specialized robots designed for children are being developed to address motor impairments in early development stages.

Rehabilitation Robots Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 228.00 Million |

| Market Size by 2033 |

USD 1,143.70 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 17.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Extremity, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

TYROMOTION GMBH; Life Science Robotics ApS; Hocoma AG (DIH International Ltd.); Rex Bionics Ltd; Kinova Inc.; Rehab-Robotics Company Limited; ReWalk Robotics Ltd; Ekso Bionics Holdings Inc.; Cyberdyne Inc.; Bionik Laboratories Corporation. |

Key Market Driver: Rising Incidence of Stroke and Neurological Disorders

The most significant driver of the rehabilitation robots market is the global rise in stroke and neurological disorders, which are primary contributors to long-term disability. According to the World Stroke Organization, over 12 million people suffer strokes each year globally, with around half experiencing lasting mobility challenges. Similarly, Parkinson’s disease affects more than 10 million people worldwide and requires ongoing motor rehabilitation.

Rehabilitation robots offer scalable, efficient, and quantifiable solutions for these patients. Unlike conventional therapy, which may vary based on therapist skill or fatigue, robotic-assisted rehabilitation ensures precision, repeatability, and consistent intensity—factors critical to neuroplasticity and functional recovery. Hospitals and rehabilitation centers are increasingly investing in robotic systems for stroke wards and neuro rehab units. For instance, robots like the ArmeoPower and Lokomat by Hocoma have become staples in many neurorehabilitation facilities due to their proven effectiveness.

Key Market Restraint: High Initial Investment and Maintenance Cost

While the clinical efficacy of rehabilitation robots is well recognized, high capital and maintenance costs remain a significant barrier, especially for small- and medium-sized healthcare institutions. These systems can range from tens of thousands to several hundred thousand dollars, depending on complexity, functionality, and brand.

Beyond procurement, costs associated with software upgrades, staff training, and system servicing can strain hospital budgets. In lower-income regions or in developing economies, such investments may not be feasible without government support or insurance reimbursement. Additionally, since reimbursement policies for robotic rehabilitation are still inconsistent across regions, institutions may hesitate to adopt these technologies at scale.

Key Market Opportunity: Growth in Home-Based Robotic Rehabilitation

As healthcare systems shift toward decentralized and patient-centric care, home-based robotic rehabilitation is emerging as a major opportunity. Patients recovering from surgery, stroke, or trauma often face logistical and financial challenges when commuting to clinics multiple times a week. Home-use rehabilitation robots offer a solution by enabling consistent therapy from the comfort of one's residence.

Companies are now designing lightweight, easy-to-use robots integrated with mobile apps and cloud platforms to track progress and offer virtual therapist consultations. For example, products like ReStore from ReWalk Robotics or Neofect’s Smart Glove allow patients to perform therapy at home while maintaining data connectivity with clinicians. As remote care models become more mainstream, homecare robotics is poised to be a lucrative and scalable segment.

By Type Insights

Therapy robots dominated the type segment in the rehabilitation robots market, accounting for the largest share due to their widespread use in clinical rehabilitation for stroke, brain injury, and musculoskeletal disorders. These robots assist with repetitive motor tasks, especially for upper and lower limb movement, and often integrate AI for personalized therapy sessions. Devices like MIT-Manus and ArmeoSpring have demonstrated excellent clinical outcomes, making them a cornerstone in neuro-rehabilitation practices.

Exoskeletons are the fastest-growing segment, driven by their utility in restoring mobility in patients with spinal cord injuries, multiple sclerosis, and post-stroke conditions. Wearable exoskeletons not only assist movement but also enable patients to practice natural gait patterns, enhancing muscle memory. Lightweight designs, battery-powered units, and growing adoption in military and rehabilitation centers are fueling this segment’s rapid growth. Exoskeletons like EksoNR and ReWalk Personal 6.0 are finding increasing applications in both clinical and home settings.

By End-use Insights

Lower body rehabilitation robots dominated the extremity segment, primarily due to the high incidence of mobility impairments caused by stroke, spinal injuries, and surgeries such as hip or knee replacements. These robots often target gait training, balance improvement, and muscle reactivation. Systems such as Lokomat or EksoNR help patients practice coordinated walking in a safe, controlled environment. The demand is particularly strong in inpatient settings, where early mobilization is a recovery priority.

Upper body rehabilitation robots are the fastest-growing, driven by rising demand for devices that restore arm, hand, and shoulder mobility—especially post-stroke. These robots are used for fine motor skill improvement, strength training, and hand-eye coordination. Devices like HandyRehab or ArmeoSenso support rehabilitation for patients with traumatic brain injury or neurological degeneration. With increased research focus on occupational rehabilitation and dexterity recovery, this segment is projected to gain strong momentum.

By Extremity Insights

Lower body rehabilitation robots dominated the extremity segment, primarily due to the high incidence of mobility impairments caused by stroke, spinal injuries, and surgeries such as hip or knee replacements. These robots often target gait training, balance improvement, and muscle reactivation. Systems such as Lokomat or EksoNR help patients practice coordinated walking in a safe, controlled environment. The demand is particularly strong in inpatient settings, where early mobilization is a recovery priority.

Upper body rehabilitation robots are the fastest-growing, driven by rising demand for devices that restore arm, hand, and shoulder mobility—especially post-stroke. These robots are used for fine motor skill improvement, strength training, and hand-eye coordination. Devices like HandyRehab or ArmeoSenso support rehabilitation for patients with traumatic brain injury or neurological degeneration. With increased research focus on occupational rehabilitation and dexterity recovery, this segment is projected to gain strong momentum.

By Regional Insights

North America dominates the global rehabilitation robots market, largely due to its robust healthcare infrastructure, high adoption of cutting-edge medical technologies, and supportive reimbursement environment. The U.S. is a frontrunner, with top-tier hospitals integrating robotic systems into rehabilitation departments. Federal initiatives, such as the U.S. Department of Veterans Affairs investing in exoskeleton programs for spinal cord injury veterans, further propel the market. Additionally, the presence of key companies like ReWalk Robotics, Ekso Bionics, and Myomo ensures continuous innovation and availability.

Asia-Pacific is the fastest-growing region, driven by a rapidly aging population, rising stroke incidence, and healthcare modernization. Countries like China, Japan, and South Korea are investing heavily in robotic healthcare systems. For example, Japan’s government has funded rehabilitation robot development as part of its strategy to cope with labor shortages in eldercare. India is also seeing start-up activity and government interest in affordable, AI-driven assistive technologies. As local production increases and prices fall, accessibility will continue to improve, further fueling growth.

Some of the prominent players in the rehabilitation robots market include:

- Tyromotion GmbH

- Life Science Robotics ApS

- Hocoma AG (DIH International Ltd.)

- Rex Bionics Ltd

- Kinova Inc.

- Rehab-Robotics Company Limited

- ReWalk Robotics Ltd

- Ekso Bionics Holdings Inc.

- Cyberdyne Inc.

- Bionik Laboratories Corporation

Recent Developments

-

March 2025: Ekso Bionics launched an upgraded version of its EksoNR exoskeleton with advanced AI features for real-time gait pattern adaptation and enhanced rehabilitation analytics.

-

January 2025: ReWalk Robotics received CE mark approval for its ReStore Exo-Suit, enabling wider adoption in Europe for stroke and multiple sclerosis patients.

-

December 2024: Honda Robotics announced a pilot program with a Japanese senior care chain to deploy Walking Assist Devices in assisted living centers.

-

October 2024: Myomo, Inc. expanded its MyoPro powered arm brace into select Middle Eastern countries through a distribution agreement with a local rehab solutions provider.

-

August 2024: Cyberdyne Inc. secured a strategic partnership with India’s AIIMS hospitals to integrate its HAL (Hybrid Assistive Limb) system into stroke recovery programs.

-

June 2024: Hocoma launched a VR-compatible version of its ArmeoSenso, providing immersive gaming-based rehabilitation exercises to improve therapy engagement.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global rehabilitation robots market.

Type

- Therapy Robots

- Exoskeleton

Extremity

End-use

- Hospitals & Clinics

- Senior care facilities

- Homecare Settings

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)