Smart Implantable Pumps Market Size and Trends

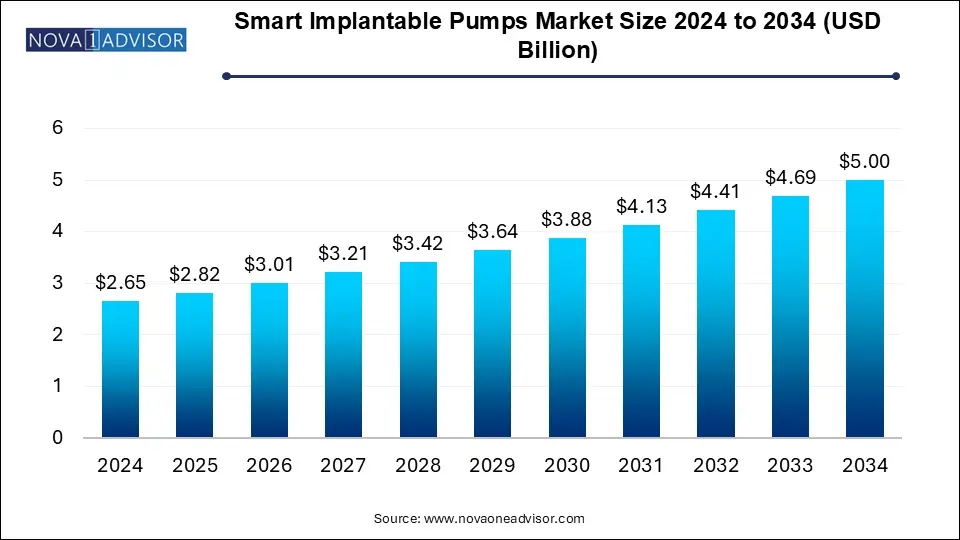

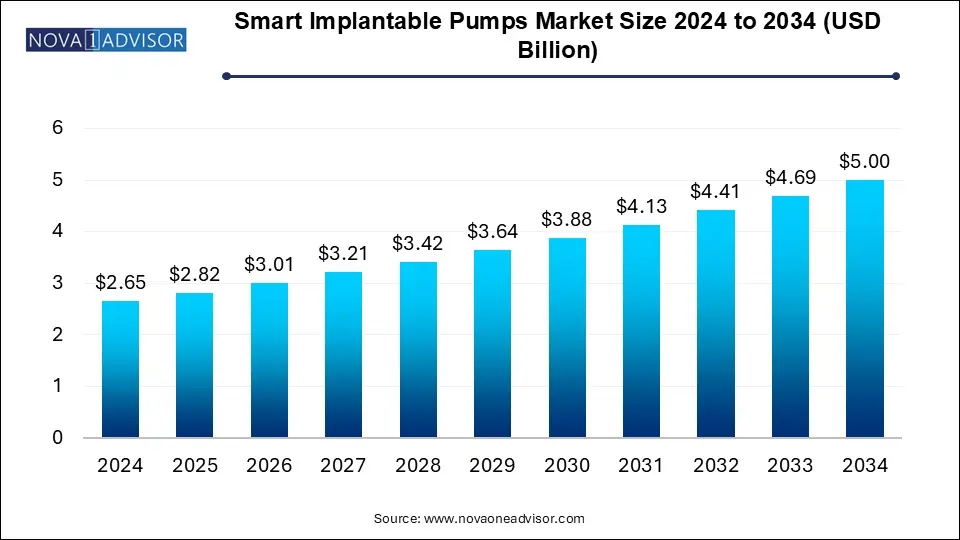

The global smart implantable pumps market was valued at USD 2.65 billion in 2024 and is projected to reach USD 5.00 billion by 2034, registering a CAGR of 6.65% from 2025 to 2034. The global smart implantable pumps market growth is attributed to the increasing adoption of smart implantable pumps and increase the patient’s compliance.

Smart Implantable Pumps Market Key Takeaways

- By region, North America dominated the market share in 2024.

- By region, Asia Pacific is expected to grow fastest during the forecast period.

- By type insights, the micropumps segment dominated the smart implantable pumps market in 2024.

- By type insights, the perfusion pumps segment is expected to grow fastest during the forecast period.

- By application insights, the cardiovascular segment dominated the market growth in 2024.

- By application insights, the pain control segment is expected to grow fastest during the forecast period.

- By end-user insights, the hospitals segment dominated the market share in 2024.

- By end-user insights, the ambulatory surgery centers segment is anticipated to grow the fastest during the forecast period.

Report Scope of Smart Implantable Pumps Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.82 Billion |

| Market Size by 2034 |

USD 5.00 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 6.56% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Type, By Application, By End User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Abbott , Medtronic , Intarcia Therapeutics , FLOWONIX MEDICAL INC , Cognos Therapeutics, Inc. , Flowonix Medical , Cognos Therapeutic , Baxter , Pfizer Inc , Smiths Group Plc, Johnson & Johnson Services. |

Smart Implantable Pumps Market Overview

The smart implantable pumps market deals with advanced drug delivery devices or systems that are implanted beneath the skin. This technology is used for the administration of slow doses of drugs in patients suffering from chronic diseases, including heart, pain, diabetes, cancer, and brain-related issues. The global market is driven by factors such as favorable reimbursement policies for smart pumps, increasing healthcare spending, increasing geriatric population, and increasing prevalence of chronic diseases.

Smart implantable pumps have various benefits over conventional drug delivery devices including ease of administration, minimal side effects, and target drug delivery, which drives the smart implantable pumps market growth. In addition, getting regulatory clearances from organizations such as the EMA and FDA and increasing preference towards home healthcare to cut down on hospital expenses and stays. These are the major drivers expected to enhance the market growth during the forecast period.

Major Trends Contributing to Market Expansion

- Education and awareness: As medical professionals and patients become more aware of the benefits of smart implanted pumps, their adoption is increasing rapidly, which drives market growth.

- Strategic collaborations and partnerships: Healthcare providers and research centers can work together to improve innovative solutions that will help smart implantable pumps gain popularity in the smart implantable pumps market.

- Good payment policies: The increasing use of advanced medical devices, like smart implantable pumps, is driven by payment regimens and favorable insurance, which are further expected to drive market growth.

Technological advancements create market opportunities

The adoption of advanced technology in smart implantable pumps is improving patient care. Innovations such as precision drug delivery systems, real-time data monitoring, and wireless communication are enhancing treatment outcomes. These smart pumps enable healthcare providers to ensure optimal drug administration, adjust treatment as required, and monitor patients remotely. These pumps improve patient compliance and reduce hospital visits with enhanced capabilities such as better battery life and automated adjustments. In addition, the preference towards personalized treatment plans and increasing demand for minimally invasive procedures are also major opportunities to further revolutionize the growth of the smart implantable pumps market.

High cost associated with the products hampers market demand

Smart implantable pumps are often associated with high manufacturing costs, such as maintenance, surgical implantation, and device procurement. The cost of these devices may create a major challenge to adoption, especially in healthcare systems with limited reimbursement challenges and financial resources. In addition, healthcare decision-makers and payers may hamper the cost-effectiveness of smart implantable pumps, which may further be expected to restrain the growth of the smart implantable market.

Segment Insights

Smart Implantable Pumps Market By type insights

The micropumps segment dominated the smart implantable pumps market in 2024. Micropumps can control the directions and flow rates to proceed with diverse biomedical applications, like delivering the necessary fluids for many biological reactions and drug infusion into animals or human bodies. Whereas the perfusion pumps segment is expected to grow fastest during the forecast period. Perfusion pumps play an important role in healthcare industries by facilitating controlled and accurate administration of medications and fluids. Perfusion pumps offer precise control over the dosage and flow rate.

Smart Implantable Pumps Market By Application Insights

The cardiovascular segment dominated the smart implantable pumps market in 2024. The segment growth in the market is attributed to the increasing prevalence of heart failure and shortage of heart donors and the rise in the prevalence of cardiovascular diseases across the globe. In addition, the pain control segment is expected to grow fastest during the forecast period. The segment growth in the market is driven by the increasing prevalence of chronic diseases such as spasticity and pain among hospitalized patients.

Smart Implantable Pumps Market By End-use Insights

The hospital segments dominated the smart implantable pumps market in 2024. The segment growth in the market is attributed to the increase in number of hospital visits and expanding base of hospitals due to increasing prevalence of chronic diseases. In addition, the ambulatory surgery centers segment is expected to grow fastest during the forecast period. Ambulatory surgery centers (ASCs) are improving and focused on providing surgical care without the need for the patient to stay in the hospital, which drives the segment growth.

Smart Implantable Pumps Market By Regional Insights

North America dominated the smart implantable pumps market in 2024. The market growth in the region is attributed to the growing adoption of smart implantable pumps, increasing emphasis on patient monitoring and data logging, rising cases of diabetes and cancer, and increasing prevalence of cardiovascular diseases. The U.S. and Canada are dominating countries driving the market growth.

- For instance, in October 2024, Ascensia Diabetes Care announced the launch of the Eversense 365 CGM system from Senseonics in the U.S. Eversense 365, an implantable continuous glucose monitor (CGM), is indicated for people with type 1 and type 2 diabetes aged 18 years and older.

Asia Pacific Market Trends

Asia Pacific is expected to grow fastest during the forecast period. The smart implantable pumps market growth in the region is attributed to the growing awareness about technologically advanced devices, increasing healthcare expenditure, increasing prevalence of chronic diseases and rising aging population. China, India, Japan, and South Korea are the fastest growing countries driving the market growth.

Some of The Prominent Players in The Smart Implantable Pumps Market Include:

- Abbott

- Medtronic

- Intarcia Therapeutics

- FLOWONIX MEDICAL INC

- Cognos Therapeutics, Inc.

- Flowonix Medical

- Cognos Therapeutic

- Baxter

- Pfizer Inc

- Smiths Group Plc

- Johnson & Johnson Services.

Smart Implantable Pumps Market Recent Innovations

- In August 2024, Abbott announced that the U.S. Food and Drug Administration (FDA) has approved a change to its label that will help patients who receive a HeartMate 3™ left ventricular assist device experience superior clinical outcomes.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Smart Implantable Pumps Market

By Type

- Micro Pumps

- Perfusion Pumps

By Application

- Cardiovascular

- Pain Control

- Others

By End User

- Hospitals

- Ambulatory Surgery Centers

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)