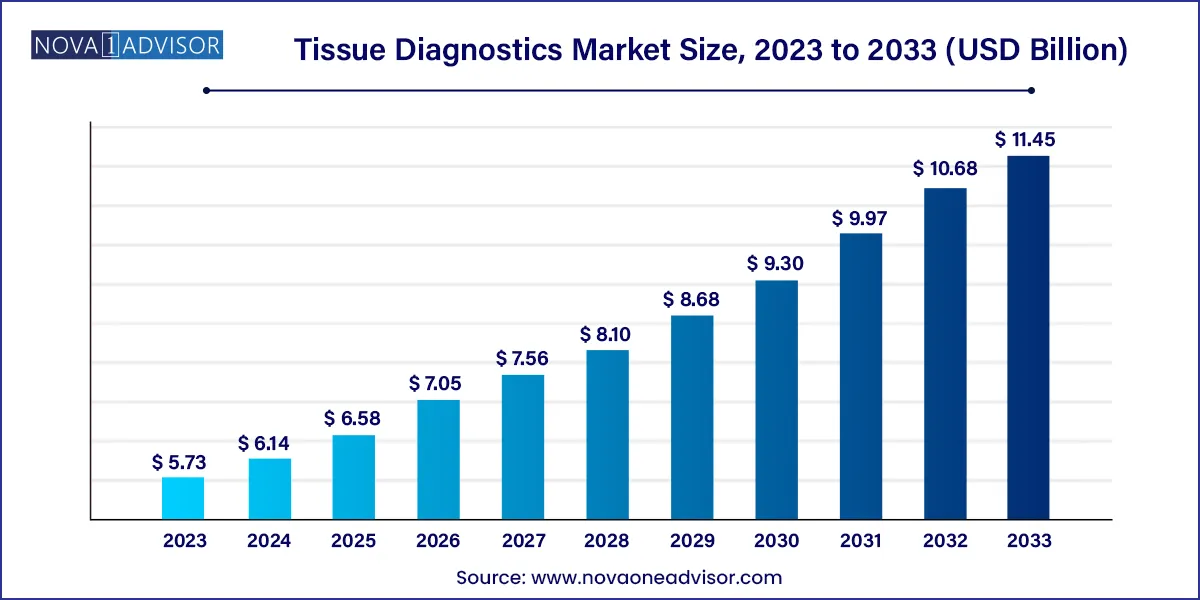

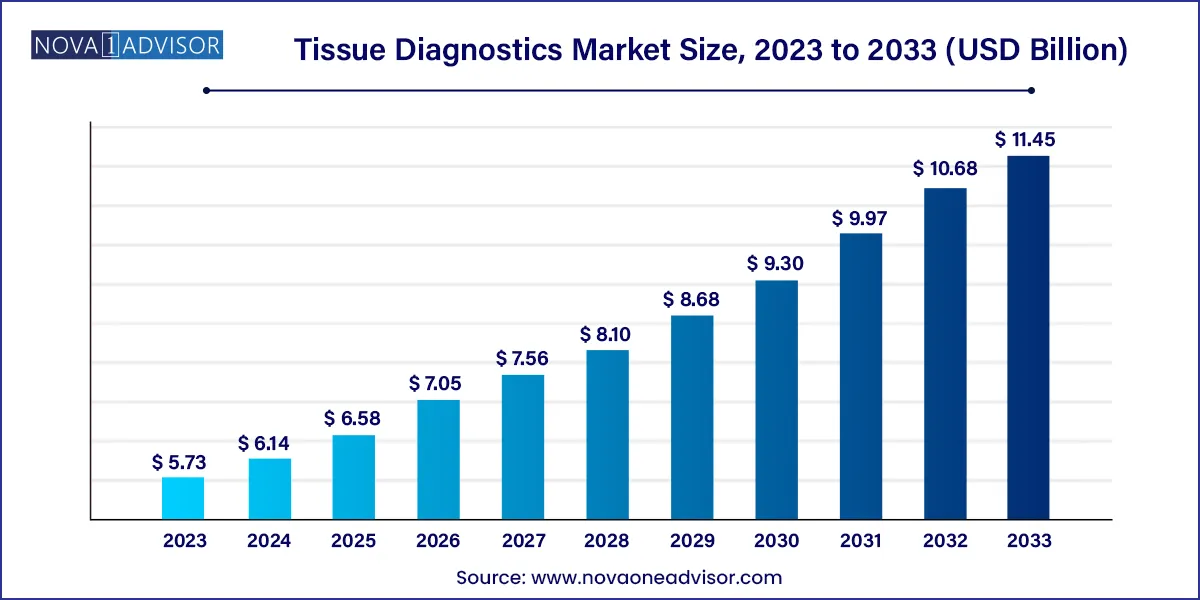

The global tissue diagnostics market size was valued at USD 5.73 billion in 2023 and is projected to surpass around USD 11.45 billion by 2033, registering a CAGR of 7.16% over the forecast period of 2024 to 2033.

Key Takeaways:

- North America dominated the tissue diagnostics market with a share of 46.87% in 2023.

- Asia Pacific region is estimated to witness a lucrative growth rate during the forecast period.

- The Immunohistochemistry (IHC) is widely applied in clinical research and development of cancer diagnostics and therapeutics, resulting in the largest revenue share of 29.76% in 2023.

- Digital pathology & workflow is estimated to witness the fastest CAGR during the forecast period.

- The breast cancer segment led the tissue diagnostics market in 2023 with a revenue share of 51.15%.

- The prostate cancer segment is expected to grow at the fastest CAGR during the forecast period.

- The Hospitals dominated the tissue diagnostics industry in 2023 with a revenue share of 44.67%.

Market Overview

The tissue diagnostics market plays a vital role in modern medical science, particularly in oncology, where it serves as a cornerstone for the accurate diagnosis, prognosis, and therapeutic guidance of cancer and other tissue-related pathologies. It encompasses a broad array of technologies, instruments, consumables, and software solutions used to analyze tissue samples typically collected via biopsies in both clinical and research settings.

Driven by the global rise in cancer incidence, coupled with increasing awareness about early detection and personalized medicine, the demand for tissue diagnostics has surged across hospitals, research laboratories, and pharmaceutical companies. Cancer types such as breast cancer, prostate cancer, and non-small cell lung cancer represent major application areas, with breast cancer diagnostics alone commanding a significant market share due to widespread screening programs.

Technologies like immunohistochemistry (IHC) and in situ hybridization (ISH) are foundational in tissue analysis, aiding in visualizing specific antigens and gene expressions within a tissue section. These tools provide oncologists with detailed molecular insights critical for tailored therapeutic strategies. Simultaneously, digital pathology and AI-enabled image analysis are transforming the traditional workflow by improving diagnostic accuracy, efficiency, and remote accessibility.

In addition to diagnostics, the tissue diagnostics market supports drug discovery and development, where it facilitates the identification of novel biomarkers and therapeutic targets. Contract Research Organizations (CROs) and pharmaceutical companies are extensively deploying tissue diagnostic platforms to enhance clinical trials, particularly in oncology, rare diseases, and immune disorders.

As the healthcare ecosystem becomes more digital and personalized, the tissue diagnostics market is evolving rapidly, integrating new technologies and embracing interoperability with electronic health records (EHRs), laboratory information systems (LIS), and data analytics tools. The future of this market lies in a synergistic combination of pathology, genomics, and data science, enabling precision diagnostics at scale.

Major Trends in the Market

-

Shift toward automation and digitization of tissue diagnostics workflows to reduce error rates and improve turnaround times.

-

Increased adoption of AI and machine learning in digital pathology for image-based predictive diagnostics and anomaly detection.

-

Integration of tissue diagnostics with molecular testing and genomic profiling to enable comprehensive personalized care strategies.

-

Rising preference for multiplexing techniques, allowing simultaneous detection of multiple biomarkers from a single tissue sample.

-

Growing number of biomarker-driven clinical trials, fueling the demand for tissue diagnostics in pharmaceutical R&D pipelines.

-

Expansion of slide scanning and cloud-based storage solutions, promoting remote pathology consultations and telemedicine integration.

-

Emergence of companion diagnostics partnerships, particularly in oncology drug development and targeted therapy approvals.

-

Rising investments in tissue microarrays and staining automation systems to facilitate high-throughput laboratory environments.

Tissue Diagnostics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 6.14 Billion |

| Market Size by 2033 |

USD 11.45 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.16% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Technology, application, end-use, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

F. Hoffmann-La Roche Ltd.; Abbott Laboratories; Thermo Fisher Scientific Inc.; Siemens, Danaher; bioMérieux SA; QIAGEN; BD; Merck KGaA; GE Healthcare; BioGenex; Cell Signaling Technology, Inc.; Bio SB; DiaGenic ASA; Agilent Technologies |

Market Driver: Rising Global Burden of Cancer

The most prominent driver of the tissue diagnostics market is the growing global burden of cancer. According to WHO, cancer is among the leading causes of death worldwide, with the number of cases projected to rise significantly in the next decade. Early detection and accurate histopathological evaluation are critical for reducing cancer mortality and enabling timely interventions.

Tissue diagnostics plays a central role in confirming cancer types, grading tumors, and determining hormone receptor status or gene expressions key inputs for treatment planning. Techniques such as IHC are used to identify HER2 status in breast cancer, while ISH techniques help detect EGFR or ALK gene rearrangements in lung cancer. As new targeted therapies continue to emerge, the demand for precise, tissue-based companion diagnostics grows in tandem, making tissue diagnostics a fundamental pillar in modern oncology care.

Market Restraint: High Cost and Technical Complexity

Despite its clinical value, the high cost and technical complexity of tissue diagnostics systems pose a barrier to widespread adoption, particularly in resource-limited settings. The market is characterized by sophisticated instruments like automated tissue processors, slide scanners, and staining systems, many of which require substantial capital investment and regular maintenance.

Additionally, advanced techniques such as ISH and digital pathology demand highly trained personnel, complex software integration, and stringent quality control. For small laboratories or hospitals in developing countries, these factors can hinder implementation and limit access to high-end tissue diagnostics capabilities. Moreover, regulatory challenges and reimbursement uncertainties further complicate the market landscape, affecting investment and innovation cycles.

Market Opportunity: Integration of AI in Digital Pathology

A major opportunity lies in the integration of artificial intelligence (AI) with digital pathology, transforming the way tissue diagnostics is conducted and interpreted. Digital pathology enables the digitization of entire slide images, which can be stored, shared, and analyzed electronically. When combined with AI-powered algorithms, these images can be scanned for tumor regions, morphological anomalies, or even molecular markers with unparalleled accuracy.

AI tools are particularly valuable in settings facing a shortage of experienced pathologists, enabling faster diagnosis with reduced human error. Furthermore, AI can assist in quantitative analysis, image scoring, and prognostic prediction—adding significant clinical and research value. Companies are already piloting AI-based pathology platforms for prostate cancer grading, breast cancer lymph node metastasis detection, and melanoma classification. The opportunity lies in scaling these innovations and integrating them with broader diagnostic and clinical decision-making ecosystems.

Tissue Diagnostics Market By Technology Insights

Immunohistochemistry (IHC) dominated the market, representing the most widely used method for detecting antigens in tissue sections. IHC remains the gold standard for identifying protein expressions relevant to cancer subtyping, such as hormone receptors in breast cancer (ER, PR) or PD-L1 in immuno-oncology. The wide application range, robust protocols, and compatibility with automation have made IHC the backbone of tissue diagnostics in both clinical and research settings. Leading companies such as Roche and Agilent offer IHC platforms and reagents designed for high-throughput pathology labs, supporting scalability and standardization.

Digital Pathology and Workflow is the fastest-growing segment, owing to the growing demand for remote diagnostics, real-time consultations, and high-resolution image analysis. Within this segment, whole slide imaging (WSI) and image analysis informatics are witnessing rapid adoption. Hospitals and reference labs are increasingly investing in slide scanners and AI-enabled software to optimize pathologist workflow and decision support. For instance, Philips’ IntelliSite Pathology Solution and Leica’s Aperio AT2 scanner offer end-to-end digital workflow integration, allowing for seamless LIS connectivity and collaborative diagnosis across geographies.

Tissue Diagnostics Market By Application Insights

Breast cancer diagnostics dominated the market, due to the high prevalence, public screening initiatives, and rich biomarker landscape associated with this cancer type. Tissue diagnostics in breast cancer involves a combination of H&E staining, IHC for ER/PR/HER2, and occasionally, ISH for gene amplification analysis. These tools guide treatment decisions around hormone therapy and HER2-targeted drugs like trastuzumab. Additionally, tissue diagnostics plays a role in monitoring disease progression, resistance, and recurrence—further solidifying its market dominance.

Non-small cell lung cancer (NSCLC) is the fastest-growing application, reflecting the rising incidence and increasing use of precision medicine in this domain. Molecular profiling in NSCLC often requires ISH to detect EGFR, ALK, or ROS1 alterations, followed by IHC for PD-L1 scoring. As new immunotherapies and TKIs (tyrosine kinase inhibitors) gain approval, the need for accurate, tissue-based diagnostics in lung cancer becomes even more essential. The growing number of companion diagnostics and clinical trials targeting NSCLC continues to drive demand for sophisticated histopathology tools and personalized diagnostic protocols.

Tissue Diagnostics Market By End-use Insights

Hospitals are the leading end-users of tissue diagnostics, driven by the need for immediate, on-site histopathological services for clinical decision-making. Large academic medical centers and cancer institutes maintain comprehensive pathology labs equipped with advanced staining, scanning, and analysis technologies. Their integration with surgical oncology and radiology departments ensures a continuous flow of biopsy samples for diagnosis, prognosis, and intraoperative consultation.

Pharmaceutical and biotechnology companies represent the fastest-growing end-user segment, largely due to the growing reliance on tissue biomarkers in drug development and clinical trials. These organizations employ tissue diagnostics for patient stratification, biomarker validation, and regulatory submissions. With increasing focus on precision oncology, pharma companies are investing in companion diagnostic co-development and tissue microarray platforms to support early-phase and late-stage trials.

Tissue Diagnostics Market By Regional Insights

North America dominates the tissue diagnostics market, with the United States leading in both revenue and innovation. The region's well-established healthcare infrastructure, extensive cancer screening programs, and early adoption of digital pathology contribute to its leadership position. Key academic centers, such as the Mayo Clinic and MD Anderson Cancer Center, have invested heavily in digital pathology systems and AI-enhanced diagnostics, setting benchmarks for clinical practice. Moreover, supportive reimbursement frameworks for diagnostic tests and high public awareness around cancer screening bolster demand for tissue-based diagnostics.

Asia-Pacific is the fastest-growing regional market, fueled by rising cancer incidence, increasing investments in healthcare infrastructure, and growing adoption of precision medicine. Countries like China, India, and South Korea are witnessing rapid growth in cancer diagnostic facilities, supported by both public and private initiatives. The expansion of oncology-focused hospitals, partnerships with Western diagnostic firms, and local manufacturing of pathology instruments and consumables have accelerated regional market penetration. Additionally, governments in this region are investing in AI research and digital health, laying the foundation for a technology-driven diagnostics future.

Tissue Diagnostics Market Top Key Companies:

- F. Hoffmann-La Roche Ltd.

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Siemens

- Danaher

- bioMérieux SA

- QIAGEN

- BD

- Merck KGaA

- GE Healthcare

- BioGenex

- Cell Signaling Technology, Inc.

- Bio SB

- DiaGenic ASA

- Agilent Technologies

Recent Developments

-

In March 2025, Roche Diagnostics announced FDA approval for its latest companion diagnostic test using IHC technology, designed to identify patients eligible for a novel PD-L1 checkpoint inhibitor in non-small cell lung cancer.

-

In January 2025, Philips launched an AI-powered image analysis module for breast cancer histopathology within its IntelliSite Pathology platform, aimed at improving diagnostic confidence and consistency across multi-site hospitals.

-

In December 2024, Agilent Technologies expanded its tissue diagnostics portfolio by acquiring a biotechnology startup specializing in RNA-ISH probes for rare cancer types, enabling broader diagnostic capabilities.

-

In October 2024, Leica Biosystems collaborated with Microsoft to integrate cloud-based AI tools into its digital pathology systems, focusing on automated grading of prostate and colorectal cancer biopsies.

-

In August 2024, Thermo Fisher Scientific unveiled its next-generation tissue staining system, featuring predictive maintenance, remote calibration, and multi-protocol automation to cater to high-throughput labs.

Tissue Diagnostics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Tissue Diagnostics market.

By Technology

-

- Immunohistochemistry

- Instruments

- Slide Staining Systems

- Tissue Microarrays

- Tissue Processing Systems

- Slide Scanners

- Other Products

- Consumables

- Antibodies

- Reagents

- Kits

- In Situ Hybridization

- Instruments

- Consumables

- Software

- Primary & Special Staining

- Digital Pathology and Workflow

- Whole Slide Imaging

- Image Analysis Informatics

- Information Management System Storage & Communication

- Anatomic Pathology

- Instruments

- Microtomes & Cryostat Microtomes

- Tissue Processors

- Automatic Strainers

- Other Products

- Consumables

- Reagents & Antibodies

- Probes & Kits

- Others

By Application

- Breast Cancer

- Non-small Cell Lung Cancer

- Prostate Cancer

- Gastric Cancer

- Other Cancers

By End-use

- Hospitals

- Research Laboratories

- Pharmaceutical Organizations

- Contract Research Organizations (CROs)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)