UAE Health Check-up Market Size and Research

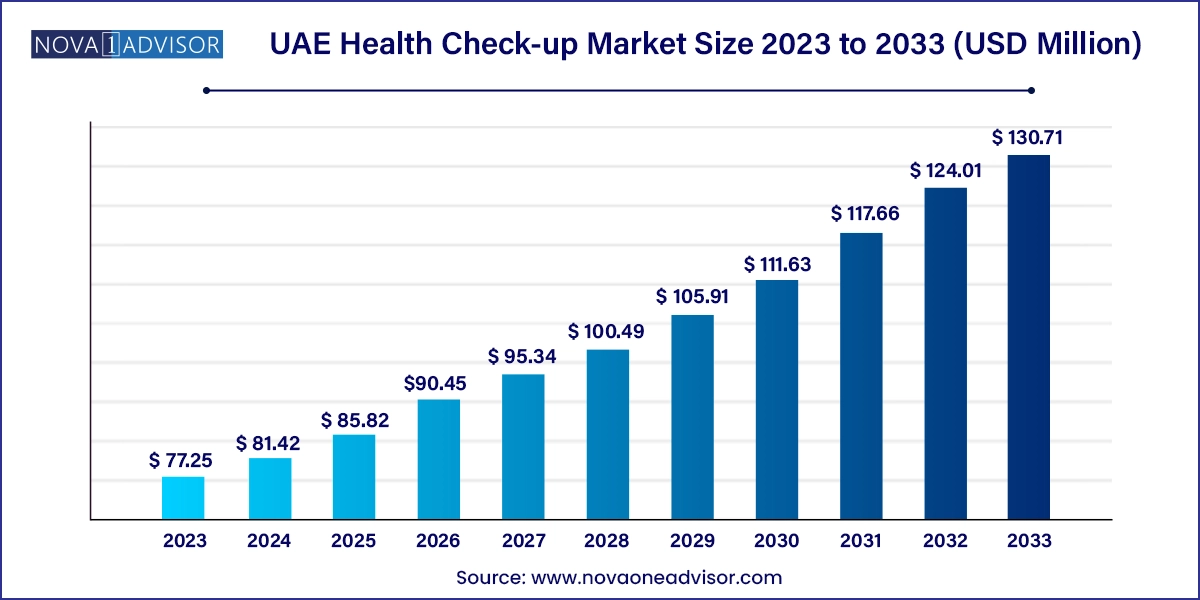

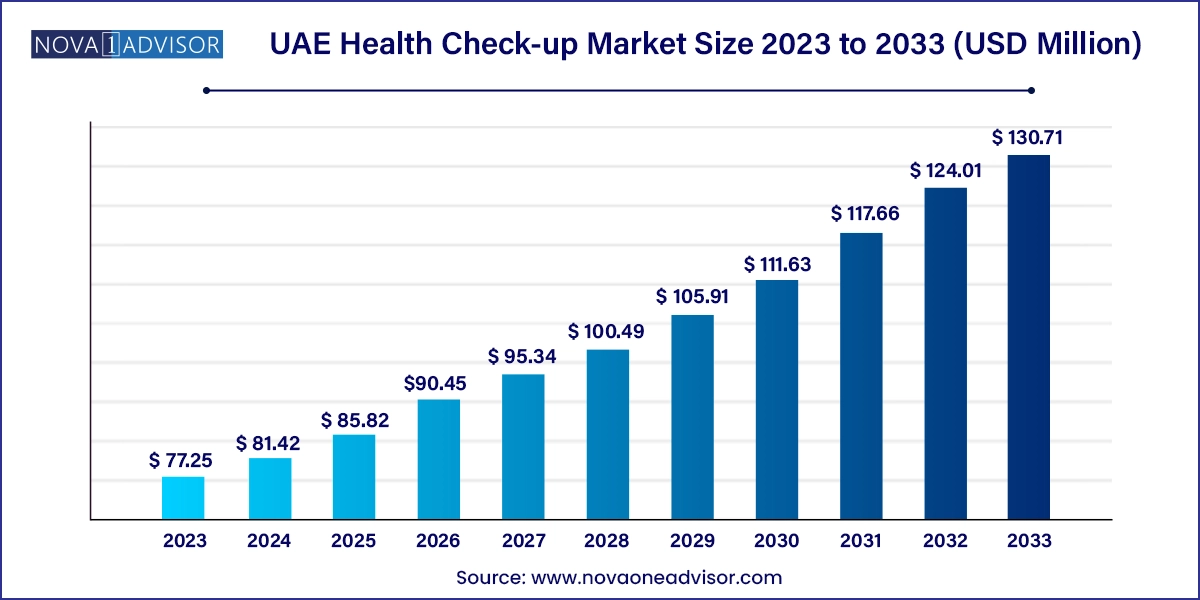

The UAE health check-up market size was exhibited at USD 77.25 million in 2023 and is projected to hit around USD 130.71 million by 2033, growing at a CAGR of 5.4% during the forecast period 2024 to 2033.

UAE Health Check-up Market Key Takeaways:

- The general health check-up type segment led the UAE health check-up market and accounted for 36.6% of the revenue in 2023.

- The specialized health check-up type segment is projected to witness a fastest growth rate of 5.8% over the forecast period.

- The blood glucose test segment led the UAE health check-up market and accounted for 21.7% of the revenue in 2023.

- Tumor Marker segment is projected to witness fastest growth rate over the forecast period.

- The blood, urine, body fluid tests segment led the UAE health check-up market and accounted for 55.4% of the revenue in 2023 .

- Cardiovascular diseases led the UAE health check-up market and accounted for 28.4% of the revenue in 2023.

- The hospital-based laboratories segment led the UAE health check-up market and accounted for 57.8% of the revenue in 2023.

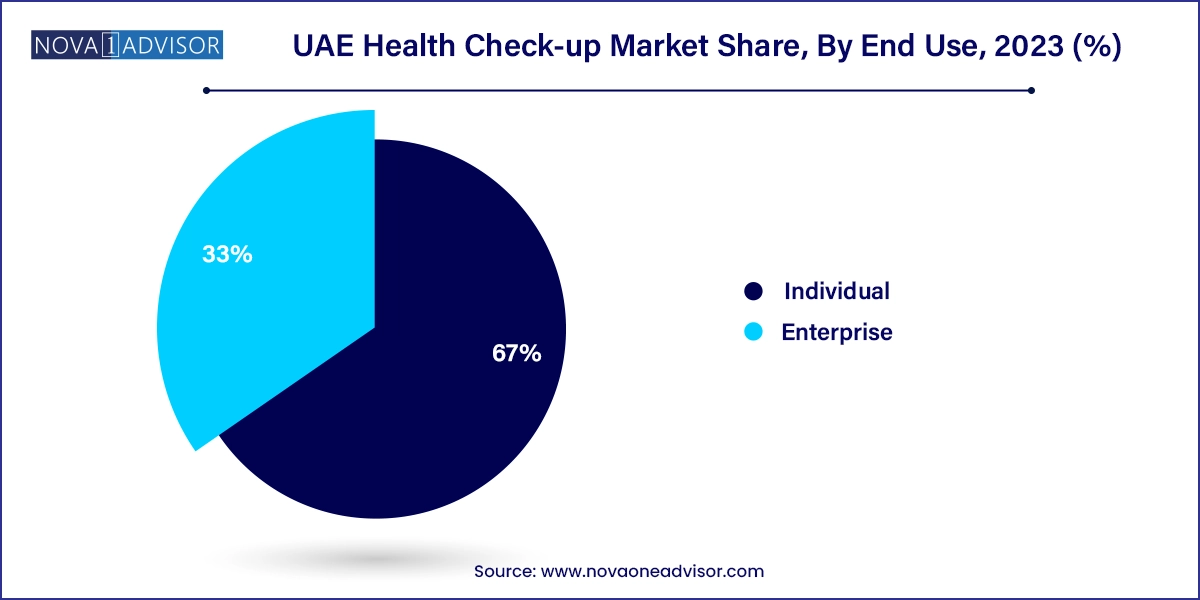

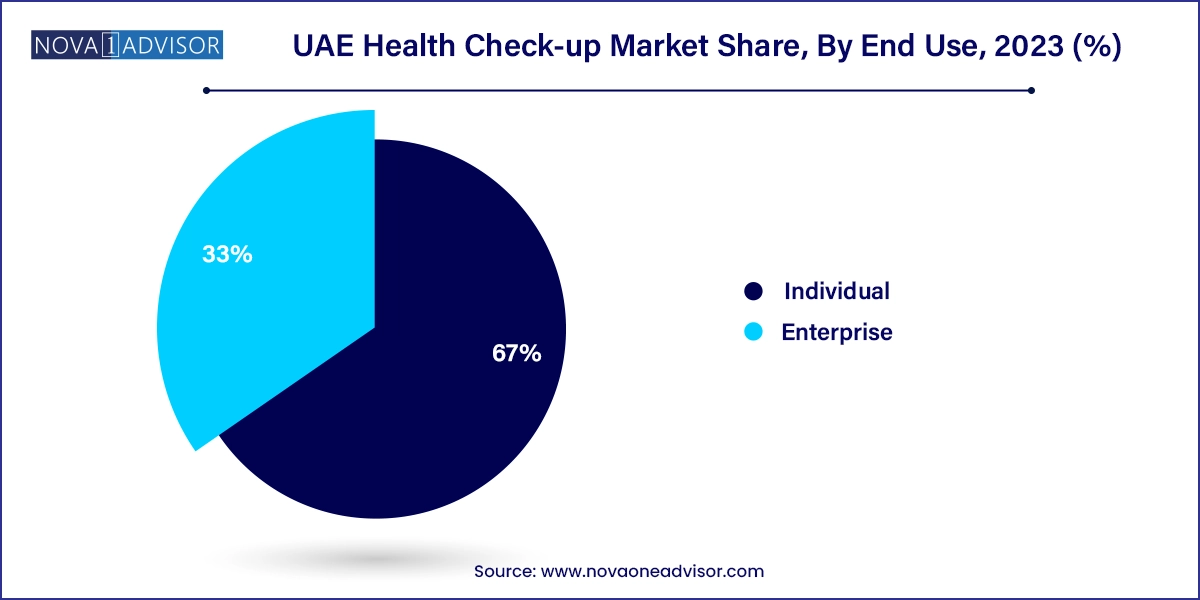

- Individual end use segment led the UAE health check-up market with a share of 67.0% in 2023.

- Enterprise end-use segment is projected to witness the fastest growth rate over the forecast period.

Market Overview

The United Arab Emirates (UAE) health check-up market is experiencing robust growth, driven by a confluence of demographic shifts, lifestyle-related diseases, and a national commitment to preventive healthcare. As the country moves toward a vision of healthcare sustainability, health check-ups have become a cornerstone of wellness strategies for both individuals and corporations. The demand is particularly high for full-body screenings, lifestyle disease assessments, specialized diagnostics, and wellness evaluations, owing to rising awareness among residents and expatriates alike.

Home to a large working-age expatriate population and a steadily growing base of citizens with access to comprehensive healthcare, the UAE has positioned preventive medicine as a key public health priority. Initiatives like the Dubai Health Strategy 2021 and Abu Dhabi’s SEHA preventative programs highlight the national push to reduce the disease burden through early detection and screening. Additionally, employers in the private and public sectors are increasingly integrating employee wellness packages and check-ups into HR policies.

The emergence of smart diagnostics, AI-driven labs, and mobile health services are further enhancing access and efficiency. Both international and regional healthcare groups are investing in advanced laboratory infrastructure and rolling out consumer-centric health check-up services across Dubai, Abu Dhabi, Sharjah, and other emirates. As chronic diseases such as diabetes, cardiovascular conditions, and obesity continue to rise, the demand for structured and recurring health check-up packages is expected to grow significantly, shaping the UAE’s future of value-based care.

Major Trends in the Market

-

Preventive Health Culture Expansion: A shift from illness-based care to wellness-based proactive health management is rapidly taking hold.

-

Corporate Wellness Integration: Employers are investing in annual health check-ups for staff as part of productivity and engagement strategies.

-

Technology-enabled Diagnostics: Use of digital platforms, AI, and home sample collection for delivering streamlined, personalized health check-ups.

-

Insurance-backed Preventive Plans: Insurers increasingly provide coverage or discounts for check-ups to manage long-term chronic disease costs.

-

Specialized Screening Demand: Rising interest in specialized diagnostic panels like cancer biomarkers, fertility testing, and vitamin profiling.

-

Growth of Standalone Diagnostic Chains: Independent diagnostic providers are expanding rapidly with a focus on customer-centric check-up packages.

-

Increased Health Screening for Visa & Regulatory Compliance: Mandatory health checks for expatriate visa renewals and residency applications sustain base demand.

Report Scope of UAE Health Check-up Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 81.42 Million |

| Market Size by 2033 |

USD 130.71 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 5.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Test, Test Technique, Application, Service Provider, End use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

UAE |

| Key Companies Profiled |

Quest Diagnostics Incorporated; Laboratory Corporation of America Holdings; SYNLAB International GmbH;OPKO Health Inc.; Eurofins Scientific; UNILABS; Sonic Healthcare Limited; ARUP Laboratories; Q2 Solutions |

Key Market Driver

Rising Prevalence of Chronic and Lifestyle-related Diseases

A central driver of the UAE health check-up market is the increasing prevalence of chronic lifestyle-related illnesses, notably diabetes, cardiovascular disease, obesity, and metabolic disorders. The UAE has one of the highest diabetes prevalence rates globally, with over 15% of the adult population affected, according to the International Diabetes Federation. Obesity and hypertension also remain critical concerns, largely due to sedentary lifestyles, high-calorie diets, and urban stress.

Routine and preventive health check-ups enable early diagnosis and risk profiling, thus playing a pivotal role in reducing long-term complications. National awareness campaigns such as Weqaya (Abu Dhabi) and Live Healthy Dubai have emphasized screening and wellness check-ups, particularly targeting young adults, middle-aged professionals, and high-risk groups. The growing availability of personalized preventive packages encourages frequent testing, empowering patients and reducing pressure on tertiary care systems.

Key Market Restraint

High Cost of Comprehensive Check-up Packages in Private Sector

One of the key restraints in the market is the relatively high out-of-pocket cost of health check-ups in the private sector, especially for those not covered under comprehensive insurance plans. While basic screening services may be accessible, more advanced and specialized check-up panels particularly those involving MRI, genetic testing, or cancer biomarkers remain expensive for a significant portion of the expatriate and uninsured population.

This pricing challenge is compounded by the fragmented nature of insurance coverage for preventive care in the UAE. Although insurers are moving toward integrated preventive health offerings, many plans still exclude full check-ups unless mandated by employer schemes or specific medical necessity. The lack of pricing standardization across providers also leads to wide cost discrepancies, causing hesitancy among consumers to opt for proactive screenings.

Key Market Opportunity

Digital Health Integration and At-Home Diagnostics

An emerging opportunity lies in the rapid digitalization of diagnostic services and the growth of home-based health check-ups. The pandemic accelerated consumer openness to telemedicine, mobile labs, and remote diagnostics. Now, leading labs and health platforms in the UAE are offering online booking, sample collection at home, digital report delivery, and even virtual follow-up consultations as part of their health check-up packages.

This trend particularly appeals to tech-savvy millennials, working professionals, and elderly individuals with mobility issues. Digital solutions not only enhance user experience but also improve engagement, compliance, and repeat business. As AI tools are integrated into diagnostics especially in imaging and biochemistry interpretation at-home diagnostics could become a mainstay of the UAE’s health check-up market, enhancing accessibility and affordability.

UAE Health Check-up Market By Type Insights

Preventive health check-ups are the dominant type in the UAE health check-up market, reflecting the region's healthcare strategy that emphasizes early detection and wellness. These check-ups usually include full-body screening panels, blood profiling, and evaluations aimed at identifying risk factors for chronic diseases. Both citizens and long-term expatriates increasingly view annual health check-ups as essential, supported by corporate and insurance partners. Preventive check-ups are also promoted by national health initiatives and are offered across hospitals, diagnostics labs, and corporate wellness programs.

Specialized health check-ups represent the fastest-growing segment. Tailored packages focusing on women's health, cardiac health, cancer markers, fertility profiling, and hormonal testing are gaining significant traction. These packages are commonly availed by high-income individuals, executives, and patients with a family history of illness. Clinics in Dubai and Abu Dhabi are designing lifestyle-based and age-specific diagnostics panels, offering premium packages that combine lab work, imaging, and consultation under one roof.

UAE Health Check-up Market By Test Insights

Blood glucose tests are the most commonly conducted test type in the UAE due to the country’s high diabetes burden. Regular screening for fasting blood sugar and HbA1c is standard in most health check-up packages and often serves as the entry point for broader metabolic and cardiovascular evaluations. Clinics, insurance providers, and government wellness programs ensure that these tests are easily accessible, even at basic primary care levels. Almost every individual over 30 years of age undergoes routine glucose monitoring in the UAE.

The cardiac biomarkers segment is the fastest-growing test category, driven by the increasing incidence of heart disease and preventive cardiac care awareness. Biomarkers like troponin, BNP, CRP, and lipid profiles are being incorporated into mid-to-premium check-up packages. These tests are increasingly used not only for symptomatic cases but also for early risk stratification among working-age adults, athletes, and senior citizens. Given the country’s focus on lifestyle transformation, cardiac evaluations are becoming integral to comprehensive health check-up programs.

UAE Health Check-up Market By Test Technique Insights

Blood, urine, and body fluid tests dominate the UAE health check-up market in terms of test technique. These serve as the core of virtually all screening programs, offering insights into a broad range of conditions metabolic, hepatic, renal, endocrine, and hematologic. These tests are non-invasive, affordable, and can be processed quickly, making them ideal for routine and preventive care.

Imaging-based tests, including X-rays, ultrasounds, CT, and MRI, are witnessing rapid growth. Imaging is vital for organ-level screening, cancer detection, cardiovascular diagnostics, and musculoskeletal evaluations. Clinics offering premium packages frequently bundle imaging diagnostics with lab-based panels. Full-body scans, especially MRI and CT, are increasingly used as preventive tools for busy professionals and individuals with lifestyle-related risks, contributing to higher ticket sizes for health check-ups.

UAE Health Check-up Market By Application Insights

Metabolic disorders, including diabetes, prediabetes, obesity, and dyslipidemia, remain the leading application segment for health check-ups in the UAE. With a high prevalence of sedentary lifestyles and carbohydrate-heavy diets, the country faces a significant burden of undiagnosed and untreated metabolic conditions. Routine health check-ups are essential for early detection, glycemic monitoring, and intervention planning. Glucose profiling, lipid panels, liver function, and HbA1c tests are central to most packages offered by private labs and hospitals.

Cardiovascular disease screening is the fastest-growing application area. The growing incidence of heart disease, combined with stress, obesity, and smoking among younger adults, has prompted an increase in cardiac-specific check-ups. Programs now include ECG, ECHO, treadmill tests, and advanced cardiac biomarkers. Corporate wellness plans and executive health check-ups commonly include comprehensive heart assessments to identify early risks and improve productivity outcomes.

UAE Health Check-up Market By Service Provider Insights

Hospital-based laboratories continue to lead in market share due to their integration with primary and secondary care services. Government hospitals, such as those operated by SEHA and DHA, along with private multispecialty hospitals like Mediclinic and NMC, offer check-up services tied to broader patient care programs. These labs benefit from trusted reputations, insurance integration, and in-house physician consultation services that add value to the screening experience.

Standalone laboratories are growing fastest, driven by consumer demand for convenience, pricing flexibility, and digital interfaces. Brands like Aster, Life Diagnostics, and Medcare Labs have expanded into this segment aggressively. These labs operate collection centers across cities, offer at-home sample collection, and cater to both individual and enterprise clients. As customer loyalty in diagnostics is often influenced by turnaround time and digital experience, standalone players are disrupting traditional models with tech-enabled services.

UAE Health Check-up Market By End Use Insights

Individual consumers, particularly those paying out of pocket, dominate the UAE health check-up market. High levels of health literacy, awareness campaigns, and easy access to private providers encourage people to invest in their health through periodic check-ups. Many high-income individuals and wellness-conscious expatriates proactively opt for customized packages ranging from basic to premium. Women’s wellness and fertility panels, in particular, are highly sought after among the individual segment.

However, the enterprise segment, especially in the private corporate sector, is growing rapidly. Companies are embedding health check-ups into annual employee benefits, partly motivated by regulatory compliance and also to reduce absenteeism and improve workforce wellness. Insurance partners collaborate with corporate clients to deliver tailored programs at scale. Government employers and health insurers are also supporting employee screenings for early risk identification and chronic disease management.

Country-Level Analysis

Across the UAE, the health check-up landscape reflects the broader healthcare modernization goals of the country. In Dubai, the Dubai Health Authority (DHA) regulates and promotes preventive services across public and private hospitals. Private health groups like Aster DM Healthcare and Medcare offer a wide range of customized wellness packages through digital booking platforms and in-person centers.

In Abu Dhabi, SEHA and private players operate check-up services that often double as entry points for other specialties. Abu Dhabi also has strong occupational health programs tied to industry regulations, ensuring mandatory health checks for large sectors like oil, aviation, and logistics.

Emirates such as Sharjah, Ajman, and Ras Al Khaimah are witnessing increased investments in diagnostic centers to cater to rising middle-income populations. Cross-border medical tourists from GCC countries also contribute to the market, particularly for premium check-up packages bundled with wellness tourism services.

Some of the prominent players in the UAE health check-up market include:

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings

- SYNLAB International GmbH

- OPKO Health, Inc.

- Eurofins Scientific

- UNILABS

- Sonic Healthcare Limited

- ARUP Laboratories

- Q2 Solutions

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the UAE health check-up market

Type

- General Health Check-up

- Preventive Health Check-up

- Specialized Health Check-up

- Routine & Wellness Health Check-up

Test

- Blood Glucose Test

- Kidney Function Test

- Bone Profile Test

- Electrolytes Test

- Liver Function Test

- Lipid Profile Test

- Special Biochemistry

- Cardiac Biomarkers

- Hormones & Vitamins

- Tumor Markers

- Others

Test Technique

- Blood, urine, body fluid tests

- Imaging based tests (Xray, CT, US, MRI)

- Non-Imaging Tests (eg: ECG, CPET, NCS, EMG, EEG)

Application

- Cardiovascular Diseases

- Metabolic Disorders

- Cancer

- Inflammatory Conditions

- Musculoskeletal Disorders

- Neurological Conditions

- Others

Service Provider

- Hospital-Based Laboratories

- Central Laboratories

- Standalone Laboratories

End Use

-

- Private (Corporate) Sector

- Government Sector

- Insurance

-

- Out of Pocket- Direct Payment for Health Check

- Individual Health Insurance Plan