U.S. Cord Blood Banking Services Market Size and Trends

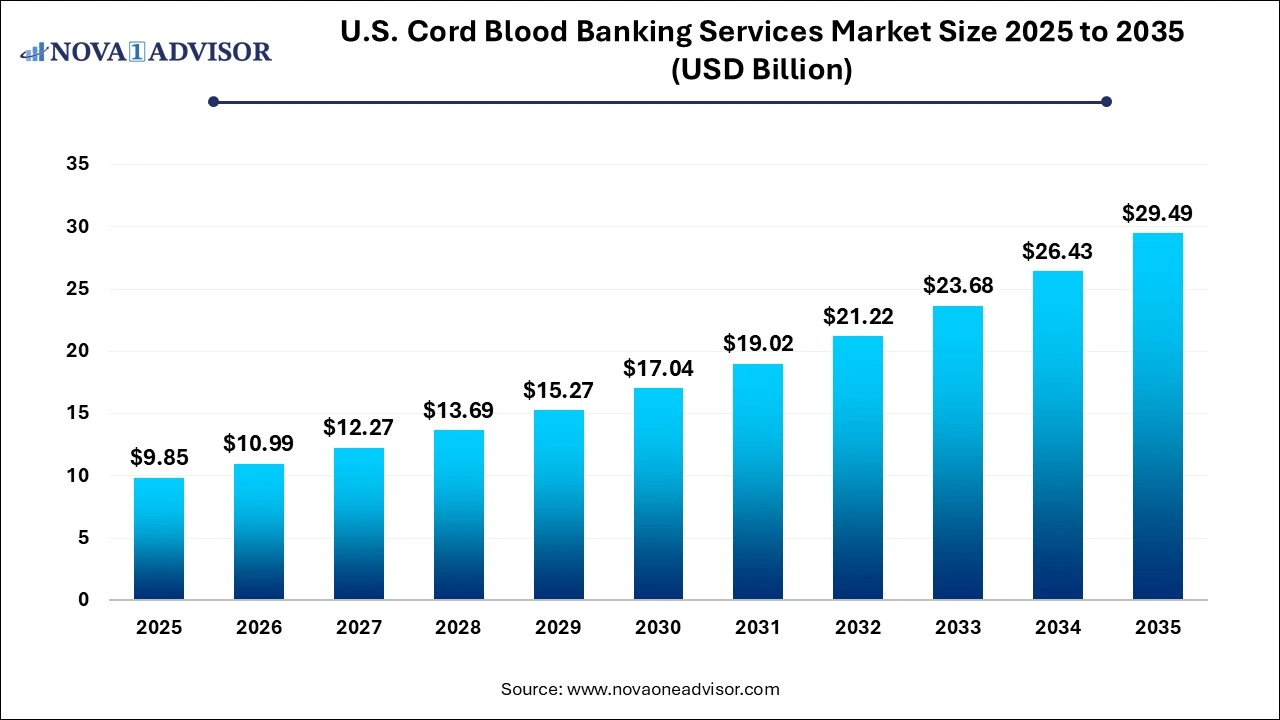

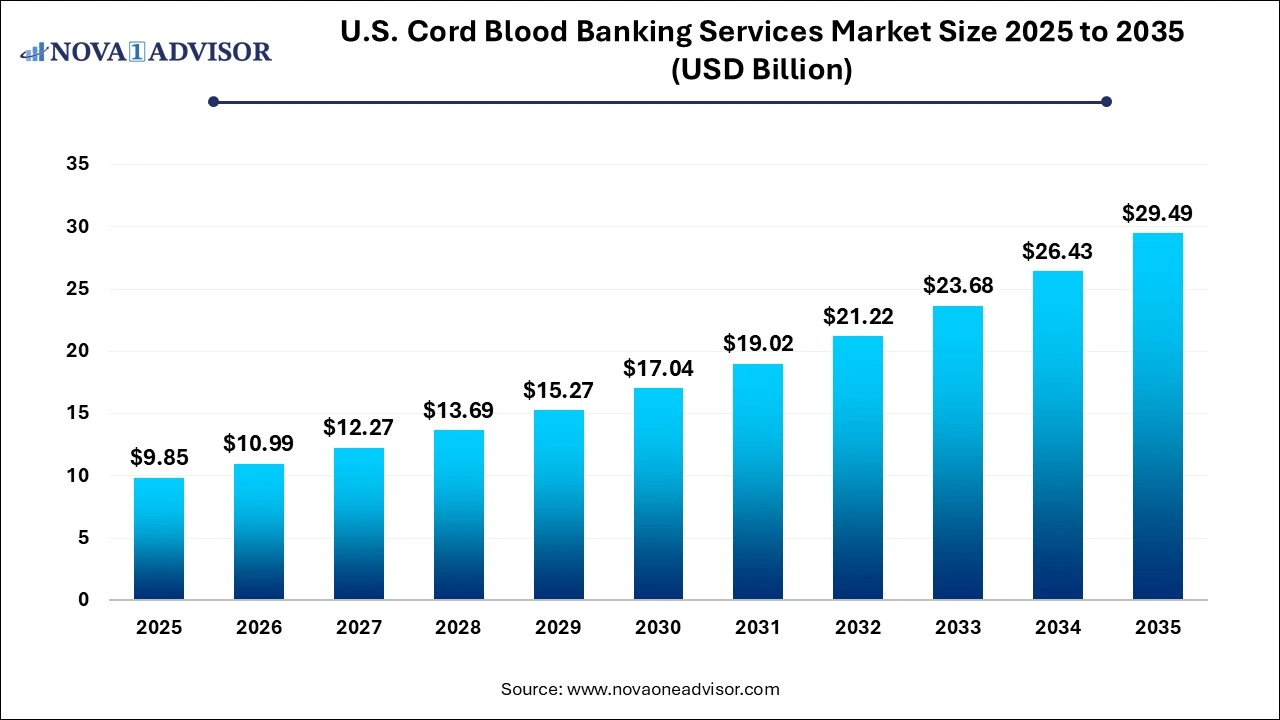

The U.S. cord blood banking services market size was valued at USD 9.85 billion in 2025 and is expected to be worth around USD 29.49 billion by 2035, growing at a CAGR of 11.59% during the forecast period from 2026 to 2035. Technological advancement and rising consumer awareness drive the U.S. cord blood banking services market.

U.S. Cord Blood Banking Services Market Key Takeaways:

- By bank type insight, the private bank's segment dominated the market in 2025.

- By bank type insight, the hybrid banking segment is expected to grow fastest during the forecast period.

- By component insight, the cord blood segment dominated the market in 2025.

- By component insight, the cord tissue segment is expected to grow fastest during the forecast period.

U.S. Cord Blood Banking Services Market Overview

The growth of the U.S. market for cord blood banking services is perhaps due to the increasing applications of cord blood and stem cells for managing hereditary disorders and chronic diseases. Increased awareness of collective availability of service providers, increased health coverage, and so on aspects of growth. The United States has a mature market, with higher consumer spending and competitive pricing. The application of umbilical cord blood in chronic illnesses, such as those relating to bone marrow disorders, growth-inhibiting cancer, blood diseases, liver pathologies, and immunodeficiency syndromes, could generate driving demand for these collections. This effect will considerably benefit the market in the coming years.

The growing incidence of cancers combined with the evolution of stem cell therapy is likely to create a further positive boom for the industry. The U.S. cord blood banking services industry is expected to sustain consistent growth with increased awareness of advances in technology and diversified service offerings.

Growth Factors

- Further establishment of stem cell therapy for the treatment of cancers, autoimmune diseases, and hematological disorders.

- Rising personalized medicine, with private parents choosing private cord blood banking.

- An enrolment by governments and regulations favoring the market landscape of such banking

Report Scope of U.S. Cord Blood Banking Services Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 10.99 Billion |

| Market Size by 2035 |

USD 29.49 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 11.59% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Bank Type, Component, States |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

California Cryobank, StemCyte Inc., Cryo-Cell International Inc., Lifeforce Cryobank Sciences Inc., Stem Cell Cryobank Inc., Norton Healthcare Viacord, MiracleCord Inc., New Jersey Cord Blood Bank, Carter BloodCare. |

Driver

Growing Awareness and Medical Advancements Fuel Cord Blood Banking Market

The cord blood banking market is on the rise due to increasing awareness of stem cell therapy and its possible life-saving applications. Public awareness campaigns, educational programs, and professional health practitioners' guidance are crucial in affirming the benefits of cord blood stem cells for therapeutic use in autoimmune disorders, cancers, and hematological diseases. The need for cord blood banking services stems from the very fact that these therapies are being recognized by the medical community. The growing field of personalized medicine is also acting as a catalyst for demand since parents tend to consider their child's cord blood as a valuable biological resource that could tailor interventions in case their child ever gets sick. This is valid since there are accelerating studies on regenerative medicine that make the services more promising in the eyes of society. All of the above contribute to the growth of the cord blood banking market.

Opportunity

Technological Advancements Creating Opportunities in Cord Blood Banking

Emerging technologies are revolutionizing cord blood banking, advancing both the processing and storage of stem cells, as well as their therapeutic uses. Increasingly automated processing facilities save time and resources; cryopreservation techniques ensure long-term storage and cell viability maintenance. Quality control systems assure consistency in processing. There is a growing trend toward the use of cord blood stem cells for hematopoietic stem cell transplantation as treatments for blood disorders and malignancies, as well as for some immune disorders. Research is also focusing on the roles of cord blood stem cells in regenerative medicine and tissue repair, as well as gene therapy. While cord tissue banking where mesenchymal stem cells (MSCs) are abundant is gaining popularity for its regenerative potential and easy availability, newer techniques that proliferate cord blood stem cells are increasing their accessibility to potential uses.

Restraint

Cost Challenges in Cord Blood Banking

The cord blood banking industry has witnessed huge challenges regarding cost. These are worst in price-sensitive regions. Private banks have implications of high upfront and ongoing costs with respect to collection, processing, cryopreservation, and even annual storage. It generally turns out to be a very costly venture for most families. The reality of financial load discourages many in very poor economies and among those who do not have much disposable income. Public banks also make their cord blood collection services free. However, they face many sustainability and funding challenges, as well as the diversity of their donors. Private banks do allow exclusive access to stored cord blood. However, that privilege comes at a cost, which, unfortunately, excludes a large part of the population. Complex maintenance and storage requirements call for specialized equipment, trained staff, and meticulous monitoring, and this adds to the cost.

Segment Analysis

U.S. Cord Blood Banking Services Market By Bank Type Analysis

The private banks segment dominated the market as it has a very large customer base and advanced marketing strategies. They provide premium services and advanced facilities with personalized care that attracts all classes of customers. Higher costs resulting from cord blood collection and retention add to their revenue. They charge exorbitant fees for the specialized processing and associated long-term storage and enhanced service options through which private banks entrap customers in search of dependable, high-quality offerings. The hybrid banking segment is expected to witness a rapid surge in growth and combine the features of public and private cord blood banking, offering different benefits such as donation and family banking. This model is proving to be more popular among private banks and focuses on StemCyte, Celebration Stem Cell Centre, Core 23 BioBank, and New Jersey Cord Blood Bank, promoting the global accessibility of cord blood transplants along with offering more personalized banking services. The merging of public-private systems is what is mainly driving the growth of the hybrid bank.

U.S. Cord Blood Banking Services Market By Component Analysis

The cord blood segment covers the bulk of the U.S. market for cord blood banking services due to the rising demand for umbilical cord blood applications in regenerative medical biology and treatment of chronic diseases. Contributing factors include the increasing numbers of umbilical cord blood providers and the number of births in the U.S. The fastest growth for the cord tissue segment is expected due to progress in research about its applications in Parkinson’s disease, multiple sclerosis, Type 1 diabetes, rheumatoid arthritis, and even cerebral palsy. Awareness of tissue storage benefits is expected to spur further market expansion.

Some of the prominent players in the U.S. cord blood banking services market include:

U.S. Cord Blood Banking Services Market Recent developments

- In March 2025, Abu Dhabi Biobank introduces private cord blood banking services, providing affordable, accessible, and local storage options for expectant families to preserve their newborns' stem cells.

In January 2025, Cryo-Cell International, the world's first cord blood bank, approved a quarterly cash dividend of $0.25 per share, payable on February 28, 2025.

- In September 2025, Cordlife Group was approved to resume cord blood banking activities in Singapore, enhancing its processing and storage facility with enhanced operational protocols and advanced laboratory monitoring systems.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. cord blood banking services market

By Bank Type Scope

By Component Scope

- Cord Blood

- Cord Tissue

- Placenta