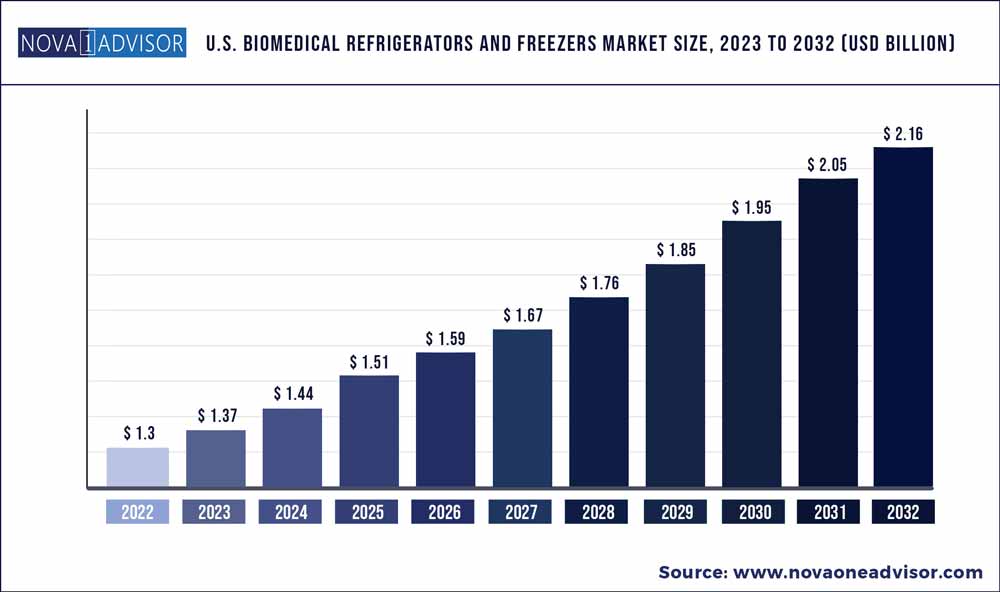

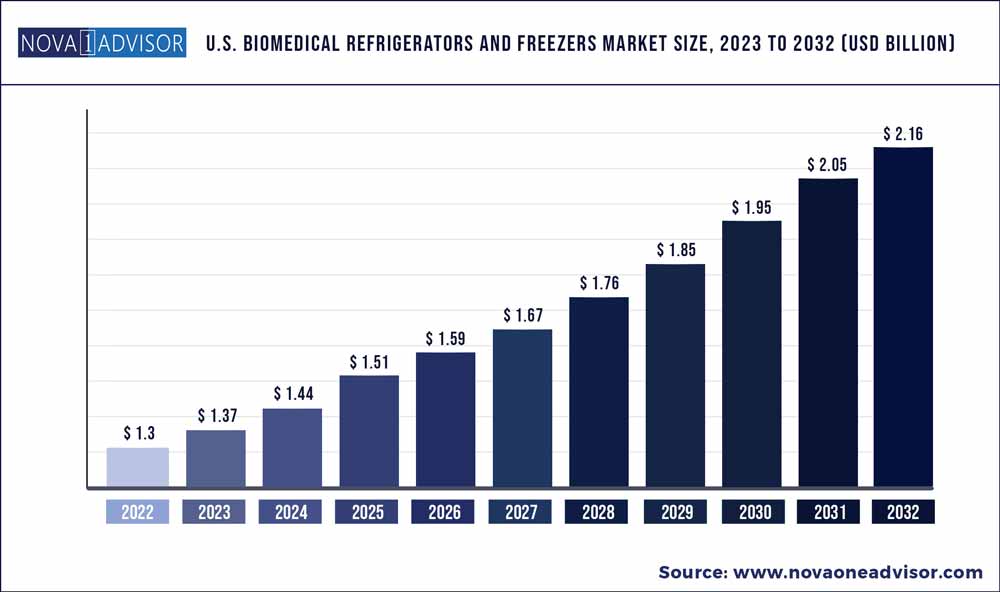

The U.S. biomedical refrigerators and freezers market size was exhibited at USD 1.3 billion in 2022 and is projected to hit around USD 2.16 billion by 2032, growing at a CAGR of 5.19% during the forecast period 2023 to 2032.

Key Pointers:

- U.S. biomedical refrigerators and freezers market size from blood bank refrigerators is projected to record more than 5.19% CAGR through 2032.

- The research labs segment is expected to hold a 9.4% share of U.S. biomedical refrigerators and freezers industry by 2032.

- U.S. biomedical refrigerators and freezers market size from hospitals end-use segment is anticipated to register more than 4.9% CAGR up to 2032.

Report Scope of the U.S. Biomedical Refrigerators and Freezers Market

The U.S. government is increasing its focus on conducting advanced clinical trials and research activities to promote the country’s healthcare sector. As per ClinicalTrials.gov database, the website registered more than 21,000 studies by the U.S. in 2022 alone. R&D expenditure on drug development is determined by several factors. These include projected earnings from the new drug, government policies, drug development cost, parameters influencing the drug’s demand & supply, and others. Consequently, the rising number of clinic trials will drive U.S. biomedical refrigerators and freezers market growth over the forecast timeframe.

Several technological innovations are being introduced in the production of biomedical fridges and freezers. Many reputed enterprises operating in biomedical refrigerators and freezers market are concentrating on developing novel products to fit diverse requirements. For instance, Thermo Fisher Scientific introduced a TSX Series high-performance freezers and refrigerators equipped with features that support sample sustainability and protection. Such improvements are also expected to contribute to industry growth.

However, the high purchase and maintenance costs related to biomedical refrigerators and freezers might deter the market progress. These appliances, along with their service charges, are expensive. Biomedical refrigerators and freezers are generally in the price range of USD 5,000 and USD 24,000. These expenses can make them unaffordable for small healthcare institutions. The systems are also required to operate at a constant low temperature, which raises the maintenance and electricity costs. Integration of upgraded technologies makes the product more expensive, further impeding U.S. biomedical refrigerators and freezers market expansion.

U.S. biomedical refrigerators and freezers market size from blood bank refrigerators is projected to record more than 5.19% CAGR through 2032. Rising number of blood transfusions across the nation has raised the demand for refrigeration solutions in blood banks. The number of road accidents is also increasing every year, which often leads to severe injuries and high casualties. Rising number of surgical procedures to treat a wide range of chronic disorders is also contributing to the large-scale adoption of blood bank refrigerators and freezers across the United States.

The research labs segment is expected to hold a 9% share of U.S. biomedical refrigerators and freezers industry by 2032. The technologically advanced healthcare system in the region has prompted the launch of various R&D initiatives to produce advanced vaccines and medicines. There is also a growing need for reliable and sensitive temperature-control mechanisms in research labs. Having these mechanisms can help clinicians maintain and control the temperature and quality of their samples, which will drive the usage of biomedical refrigerators and freezers in research laboratories across the U.S.

U.S. biomedical refrigerators and freezers market size from hospitals end-use segment is anticipated to register more than 4.9% CAGR up to 2032. The demand for technologically advanced equipment has also urged hospitals and medical centers to shift away from traditional medical devices. These factors will promote the installation of biomedical refrigerators and freezers across hospitals.

U.S. Biomedical Refrigerators and Freezers Market Segmentation