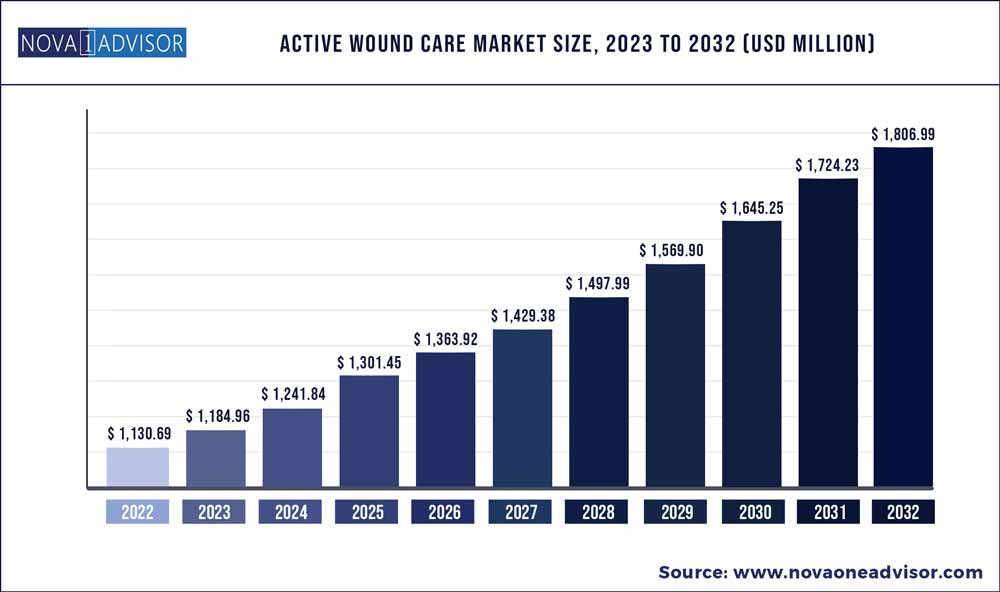

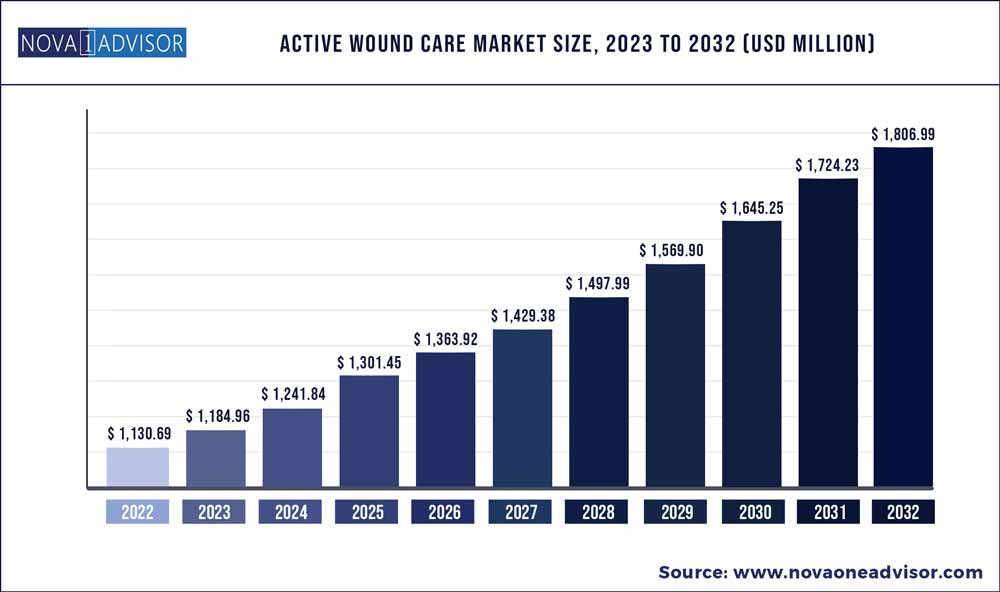

The global active wound care market size was exhibited at USD 1,130.69 million in 2022 and is projected to hit around USD 1,806.99 million by 2032, growing at a CAGR of 4.8% during the forecast period 2023 to 2032.

Key Pointers:

- The biomaterials segment accounted for the maximum share of 45.19% of the global revenue in 2022

- The skin-substitutes segment is expected to witness the fastest CAGR of 5.39%.

- The synthetic segment is anticipated to witness the fastest CAGR of 5.11% over the forecast period.

- The chronic wounds segment dominated the market for active wound care and held the largest revenue share of 61.8% in 2022

- The acute wounds segment is expected to witness a considerable CAGR of 4.3% during the forecast period.

- The hospital segment dominated the market for active wound care and held the largest revenue share of 46.8% in 2022

- The home healthcare segment is expected to witness the fastest CAGR of 5.6% during the forecast period.

- North America dominated the active wound care market and accounted for a revenue share of 46.9% in 2022

- Asia Pacific, the market for active wound care is estimated to witness the highest CAGR of 5.6% over the forecast period.

Active wound care Market Report Scope

The market is primarily driven by technology advancements, an ageing population, difficulties associated with inadequate traditional wound healing procedures, government initiatives, and an urgent need for faster and safer chronic wound treatment. Moreover, rising prevalence of several lifestyle conditions that lead to chronic wounds, such as diabetic foot ulcer, venous leg ulcer, and pressure ulcer, is expected to drive the expansion of the market in the coming years.

For instance, chronic wounds impact around 5.7 million people in the U.S., according to recent estimates published in NCBI. Besides, some chronic lesions, such as diabetic ulcers, can necessitate amputation. The Independent Diabetes Trust in the United Kingdom claimed in its report (2019) that each year, around 115,000 people get diabetic foot ulcers and 278,000 people are treated for venous leg ulcers in the U.K. As a result, these ulcers take an average of 200 days to cure. Thus, the rising prevalence of chronic and acute wounds is expected to increase the demand for active wound care products.

Furthermore, benefits such as reducing the length of hospital stay to minimize surgical healthcare costs, as well as a growing preference for products that improve therapeutic results, are boosting demand for active wound care products. In addition, the rising economic cost burden of chronic wounds, as well as prolonged treatment duration and the inefficiency of wound dressings and devices in treating chronic wounds, might have resulted in increased unmet needs. This presents a huge opportunity for players to enter the market for active wound care by launching new products based on regenerative technologies, to reduce overall treatment duration and cost. This, combined with effective treatment outcomes for chronic wound patients, will drive demand for innovative active wound care treatment options.

Advanced growth factors and biological skin substitutes are well-known and scientifically established in the treatment of both acute and chronic wounds. Key players are currently attempting to strengthen their global presence by introducing new bioactive products to the market for active wound care. For instance, in July 2019, Angelini ACRAF S.p.A., introduced a new active wound cleanser. Similarly, in February 2019, Axio Biosolutions released MaxioCel which contains chitosan and is intended to treat chronic wounds. Further, in January 2019, the US FDA approved Platform Wound Dressing (PWD) by Applied Tissue Technologies LLC. Besides, in April 2018, MTF Biologics (previously known as Musculoskeletal Transplant Foundation) launched AminoBand Viable Membrane at the Wound Healing Society (WHS) meeting in the U.S. As a result of such launches coupled with rising spending on research and development activities and by key players, the market is expected to witness significant growth in the near term.

The COVID-19, had a negative impact on the market for active wound care, mainly owing to the cancellation or delay of elective surgeries. However, the rising adoption of telehealth and virtual consultations has helped the market regain post-COVID-19 pandemic. For instance, the Wound Pros provides a telemedicine platform that allows wound care teams and patients to communicate securely. It has also recently introduced "RITA," a new diagnostic and wound assessment application. Furthermore, according to several research studies, telemedicine options are a cost-effective way to improve wound care outcomes, growing patient compliance, and satisfaction. In addition to this, insurance policies have also started covering telehealth. Thus, owing to the aforementioned factors, the market for active wound care is anticipated to gain a significant growth rate in the post-pandemic period.

North America dominated the active wound care market and accounted for a revenue share of 45.9% in 2022 and is expected to witness a considerable growth rate over the forecast period. There is a rising demand for advanced treatment options, owing to the increasing prevalence of wounds, rising economic cost burden, and growing efforts by the government to reduce the overall treatment duration. These factors have led to the growing number of regulatory approvals for active wound care products including skin substitutes and growth factors in the U.S. This, along with suitable reimbursement policies in the region, are factors responsible for regional dominance.

In the Asia Pacific, the market for active wound care is estimated to witness the highest CAGR of 5.6% over the forecast period. This can be attributed to rising changing lifestyles leading to an increase in the incidence of chronic diseases and the presence of a large population base. For instance, in 2017, Diabetic Foot Ulcers (DFUs) account for roughly 80% of all non-traumatic amputations in India, according to a research paper published in Value in Health (the official journal of the International Society for Pharmacoeconomics and Outcomes Research, Inc.). Furthermore, patients with a history of DFU had a 40% higher 10-year mortality rate than those without. Such developments are projected to boost demand for active wound care products as an increasing number of patients uses these products to enhance patient treatment results. Furthermore, medical tourism in this region is increasing which is increasing the number of surgeries performed. Additionally, the increasing focus of the major players in the emerging Asian countries and government support is further driving the growth of the market for active wound care in this region.

Some of the prominent players in the Active wound care Market include:

- Smith & Nephew

- MiMedx

- Tissue Regenix

- Organogenesis Inc.

- Acell Inc.

- Integra Life Sciences

- Solsys Medical

- Osiris Therapeutics Inc.

- Cytori Therapeutics Inc.

- Human BioSciences

- Wright Medical Group N.V.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global active wound care market.

By Product

- Biomaterials

- Skin-substitutes

- Biological Skin-substitute

- Allograft

- Xenograft

- Others

- Synthetic Skin-substitute

- Growth Factors

By Application

- Chronic Wounds

- Diabetic foot ulcers

- Pressure ulcers

- Venous leg ulcers

- Other chronic wounds

- Acute Wounds

- Surgical & traumatic wounds

- Burns

By End-use

- Hospitals

- Specialty Clinics

- Home Healthcare

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)