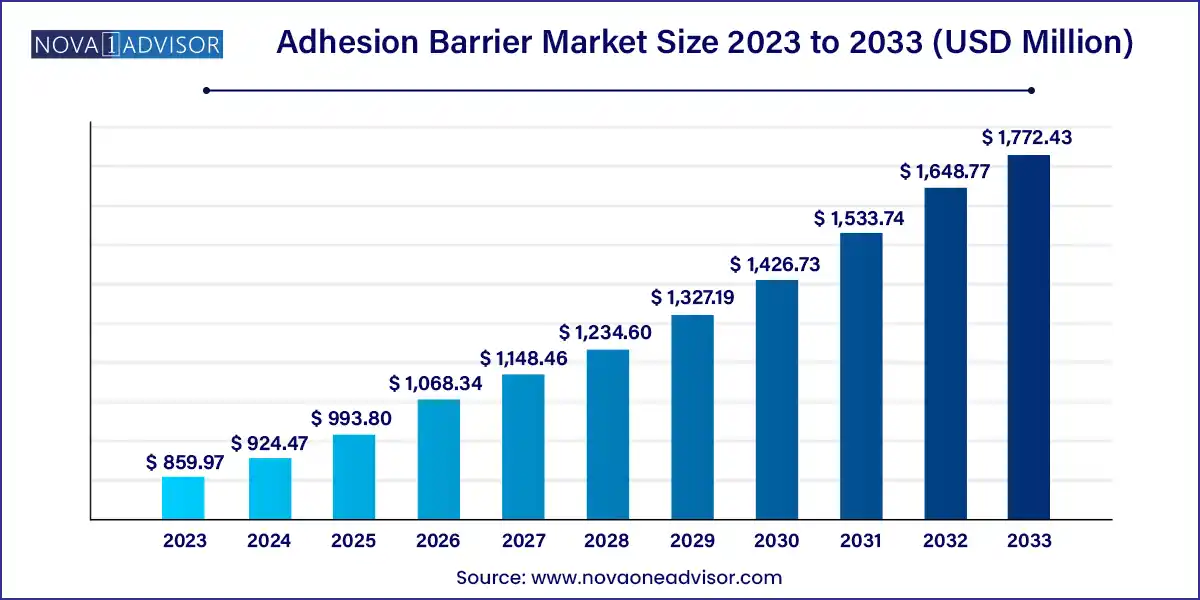

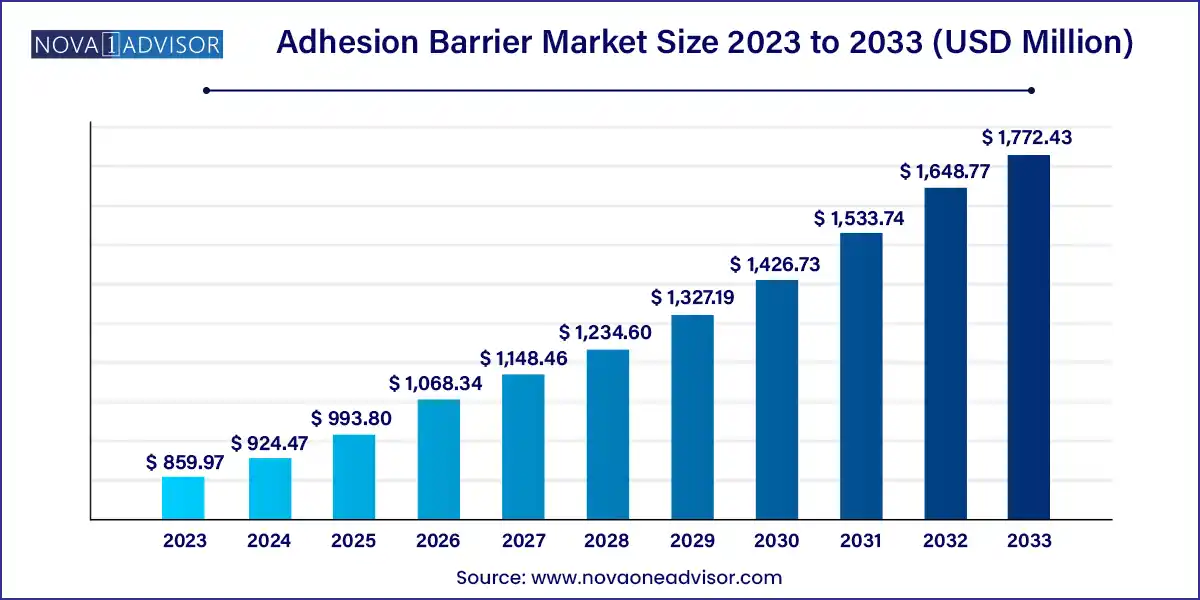

The global adhesion barrier market size was exhibited at USD 859.97 million in 2023 and is projected to hit around USD 1,772.43 million by 2033, growing at a CAGR of 7.5% during the forecast period 2024 to 2033.

Key Takeaways:

- North America region dominated the adhesion barrier market and accounted for the largest revenue share in 2023.

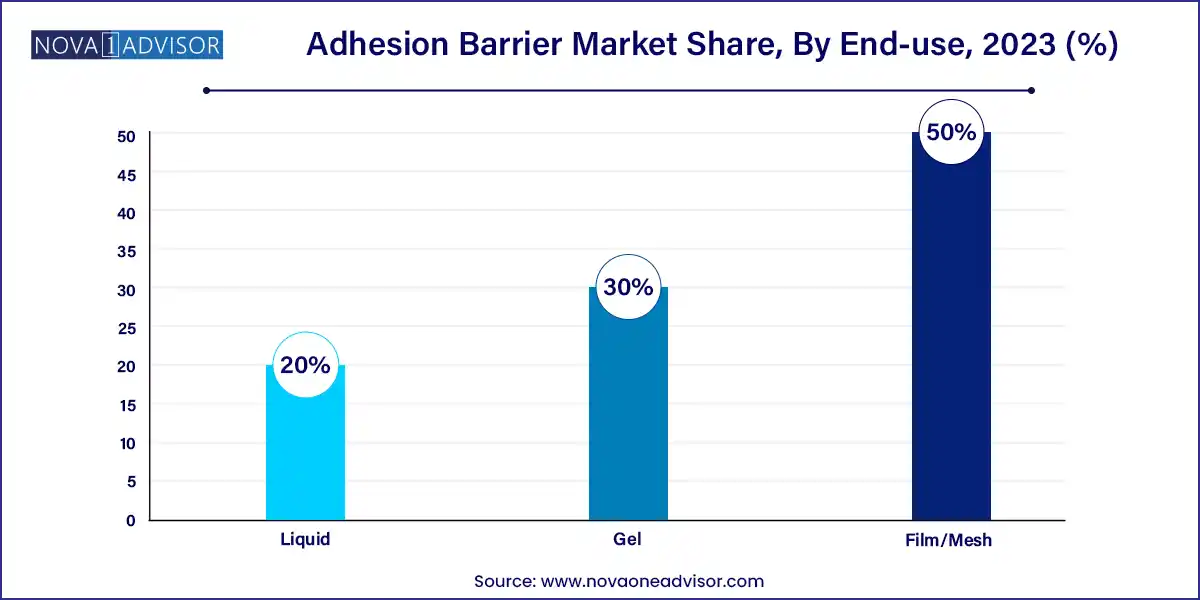

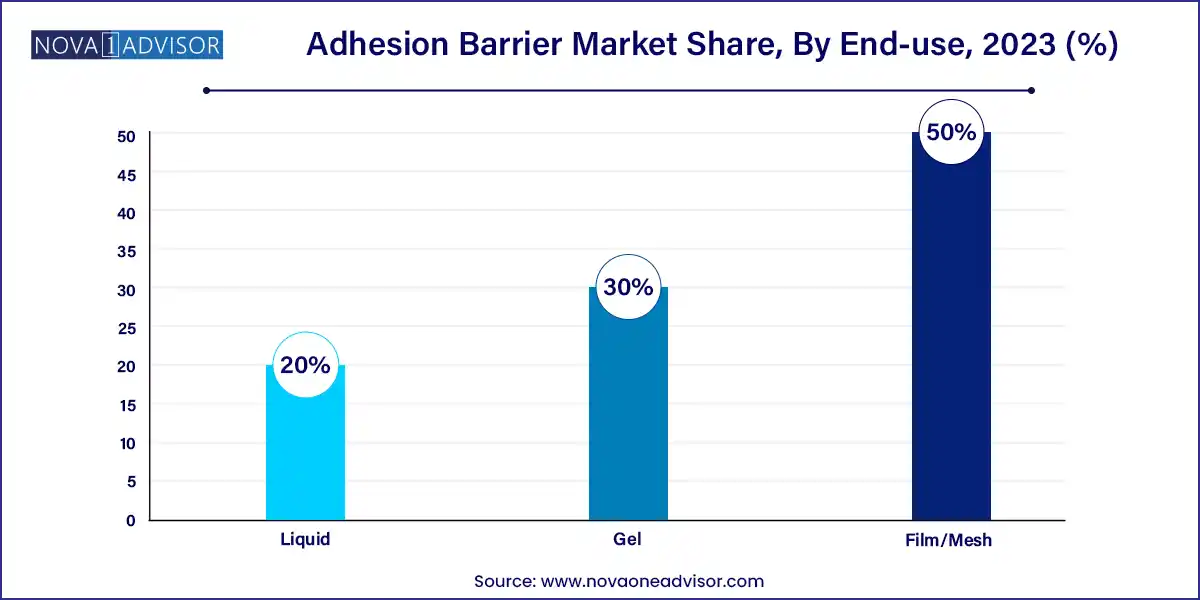

- The film/mesh segment dominated the market and accounted for the largest market share in 2023 and is expected to maintain its dominance during the forecast period.

- The cardiovascular surgeries segment dominated the market and is expected to grow at the fastest CAGR during the forecast period.

Market Overview

The Adhesion Barrier Market plays a vital role in post-surgical recovery by preventing the formation of internal scar tissue, commonly referred to as adhesions. These fibrous bands can form between tissues and organs following surgery, leading to complications such as chronic pain, infertility, or intestinal obstruction. Adhesion barriers are bioresorbable materials applied during surgery to separate tissues and prevent these adhesions.

Adhesion prevention is crucial in surgeries involving the abdominal cavity, gynecological interventions, orthopedic procedures, and cardiovascular operations. With the growing number of surgeries globally, particularly in aging populations and individuals with chronic conditions, the demand for effective adhesion prevention solutions is rising.

The adhesion barrier industry is largely driven by innovation in biomaterials, increasing awareness among surgeons, and the shift toward minimally invasive surgeries, where tissue handling can still result in adhesions. Products are available in various formulations films, gels, and liquids and are derived from both synthetic and natural sources. These include compounds like hyaluronic acid, regenerated cellulose, and collagen, each suited to specific surgical applications.

As surgical outcomes and quality of life post-operation gain more focus in value-based healthcare systems, adhesion barriers are being integrated into routine surgical protocols, not just in high-risk procedures but as a preventive standard.

Major Trends in the Market

-

Surge in Laparoscopic and Minimally Invasive Surgeries: Increasing usage of adhesion barriers in keyhole procedures where tissue approximation can still cause adhesions.

-

R&D in Bioresorbable Polymers: Development of smarter materials that degrade safely and offer sustained separation for optimal healing.

-

Preference for Gel-Based and Sprayable Adhesion Barriers: Easy application in hard-to-reach anatomical regions boosts their adoption.

-

Regulatory Approvals for Expanded Indications: Broader FDA and CE-mark approvals are enabling use in newer surgical categories.

-

Clinical Evidence Driving Product Uptake: Surgeons are more inclined to use products with proven real-world outcomes.

-

Global Health Infrastructure Investment: Particularly in Asia-Pacific and Latin America, expanding access to advanced surgical adjuncts.

-

Combination Therapies: Adhesion barriers integrated with hemostatic agents to deliver multifunctional benefits.

-

Sustainability Initiatives: Shift towards biodegradable and ethically sourced biological materials.

Adhesion Barrier Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 924.47 Million |

| Market Size by 2033 |

USD 1,772.43 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 7.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Formulation, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Sanofi S.A.; Becton Dickinson and Company; Baxter International, Inc.; Johnson & Johnson; Anika Therapeutic, Inc.; FzioMed, Inc; Mast Biosurgery, Inc.; Innocoll Holdings PLC; Atrium Medical Corporation (A part of Getinge Group). |

Market Driver: Increasing Surgical Volume and Postoperative Complication Awareness

A leading driver of the adhesion barrier market is the rising number of surgical procedures globally, driven by aging populations, improved healthcare access, and growing elective surgery rates. Each surgical event carries the inherent risk of adhesion formation, which can lead to severe complications and increased hospitalization or reoperation costs.

The adoption of adhesion barriers is also propelled by a greater understanding of the economic and clinical burden of adhesions. For instance, adhesions account for over 30% of readmissions following abdominal surgeries. This has led hospitals and surgeons to proactively use barriers to reduce future liabilities and improve recovery outcomes.

Market Restraint: Limited Reimbursement and Cost-Sensitivity in Developing Markets

Despite clear clinical benefits, the cost of adhesion barrier products can be a barrier to widespread use, particularly in lower-income healthcare systems. Many reimbursement models, especially in emerging economies, do not cover surgical adjuncts unless deemed essential. This forces hospitals to make budget-based decisions, often prioritizing life-saving equipment or drugs over preventive solutions.

Furthermore, adoption depends heavily on the surgeon’s preference and familiarity with the product, and training gaps in smaller healthcare facilities may reduce usage rates. This cost-sensitivity and knowledge gap continue to limit growth in regions without comprehensive surgical protocols.

Market Opportunity: Integration into Enhanced Recovery After Surgery (ERAS) Protocols

A promising opportunity for the adhesion barrier market lies in integration with ERAS (Enhanced Recovery After Surgery) pathways. These clinical protocols aim to reduce recovery time, minimize complications, and shorten hospital stays. Adhesion barriers align with these goals by preventing postoperative issues that could delay discharge or require secondary interventions.

As ERAS protocols become global standards in colorectal, gynecological, and orthopedic surgeries, the inclusion of adhesion prevention as a routine step opens up vast potential for product adoption, especially when backed by cost-effectiveness studies and hospital outcome benchmarks.

Segments Insights

By Product Insights

Synthetic adhesion barriers dominate the market, particularly those based on hyaluronic acid, regenerated cellulose, and polyethylene glycol. These materials are biocompatible, non-immunogenic, and offer predictable degradation timelines. Products like Seprafilm (by Baxter) and Interceed (by Ethicon) are widely used across abdominal and pelvic surgeries for their ease of application and proven efficacy.

Natural adhesion barriers are gaining momentum, especially collagen and fibrin-based formulations. These materials are preferred in cardiovascular and neurosurgical settings due to their hemostatic properties and compatibility with delicate tissues. As interest in regenerative medicine and bio-based products increases, this segment is expected to grow rapidly, particularly in biologically sensitive procedures.

Film/mesh-based formulations lead the market, primarily used in laparotomy procedures where the surgical field is open and accessible. These products provide a physical barrier that remains in place for several days post-surgery, preventing adjacent tissues from adhering as they heal. They are especially common in gynecological and abdominal surgeries.

Gel formulations are the fastest-growing, thanks to their ability to be sprayed or applied to irregular anatomical surfaces via laparoscopic ports. Gels are ideal for minimally invasive surgeries, where access and maneuverability are limited. Their versatility, combined with ease of application, is making them the formulation of choice in orthopedic, urological, and thoracic surgeries.

By Application Insights

Gynecological surgeries account for the largest share, with barriers used extensively to prevent infertility-related complications and chronic pelvic pain. Conditions like endometriosis, uterine fibroids, and cesarean sections carry high adhesion risks, making prophylactic use of barriers common practice.

Orthopedic surgeries are the fastest-growing application area, particularly in joint replacements and spinal surgeries. Adhesion barriers are being evaluated for their role in preventing soft tissue tethering and nerve entrapment post-operation, which can affect mobility and recovery. The segment is also driven by the rising number of sports-related and geriatric orthopedic procedures.

By Regional Insights

North America leads the global adhesion barrier market, driven by high surgical volumes, established ERAS protocols, and strong reimbursement infrastructure. The U.S. is a major hub for surgical innovation, with top hospitals adopting preventive products to improve patient outcomes and meet pay-for-performance targets. Companies like Baxter, Integra, and J&J operate large-scale production and distribution networks here.

Asia-Pacific is the fastest-growing region, with countries like India, China, and South Korea ramping up surgical infrastructure investments. Rising medical tourism, the expansion of private hospitals, and increased adoption of minimally invasive surgeries are fueling demand for advanced surgical products like adhesion barriers. Additionally, government policies aimed at improving rural surgical access are creating new demand channels.

Some of the prominent players in the adhesion barrier market include:

- Sanofi S.A.

- Becton Dickinson and Company

- Baxter International, Inc.

- Johnson & Johnson

- Anika Therapeutic, Inc.

- FzioMed, Inc,

- Mast Biosurgery, Inc.,

- Innocoll Holdings PLC

- Atrium Medical Corporation (A part of Getinge Group).

Recent Developments

-

Baxter International (April 2025): Announced the launch of a next-generation hyaluronic acid-based gel barrier for laparoscopic surgeries in Europe.

-

Integra LifeSciences (March 2025): Expanded its neurosurgical adhesion barrier product line with a new collagen-based film approved in the U.S.

-

Anika Therapeutics (February 2025): Initiated Phase III trials for an adhesion prevention gel targeting spinal surgeries.

-

FzioMed (January 2025): Received regulatory approval in South Korea for its bioresorbable barrier used in gynecological procedures.

-

Sanofi (December 2024): Entered a co-development deal with a biotech startup focused on dual-action hemostatic and anti-adhesion membranes.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global adhesion barrier market.

Adhesion Barrier Product

- Synthetic Adhesion Barriers

-

- Hyaluronic acid

- Regenerated cellulose

- Polyethylene glycol

- Others

- Natural Adhesion Barriers

-

- Collagen & Protein

- Fibrin

Adhesion Barrier Formulation

Adhesion Barrier Application

-

- Synthetic Adhesion Barriers

- Natural Adhesion Barriers

- Abdominal General Surgeries

-

- Synthetic Adhesion Barriers

- Natural Adhesion Barriers

-

- Synthetic Adhesion Barriers

- Natural Adhesion Barriers

-

- Synthetic Adhesion Barriers

- Natural Adhesion Barriers

-

- Synthetic Adhesion Barriers

- Natural Adhesion Barriers

-

- Synthetic Adhesion Barriers

- Natural Adhesion Barriers

-

- Synthetic Adhesion Barriers

- Natural Adhesion Barriers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)